Key Insights

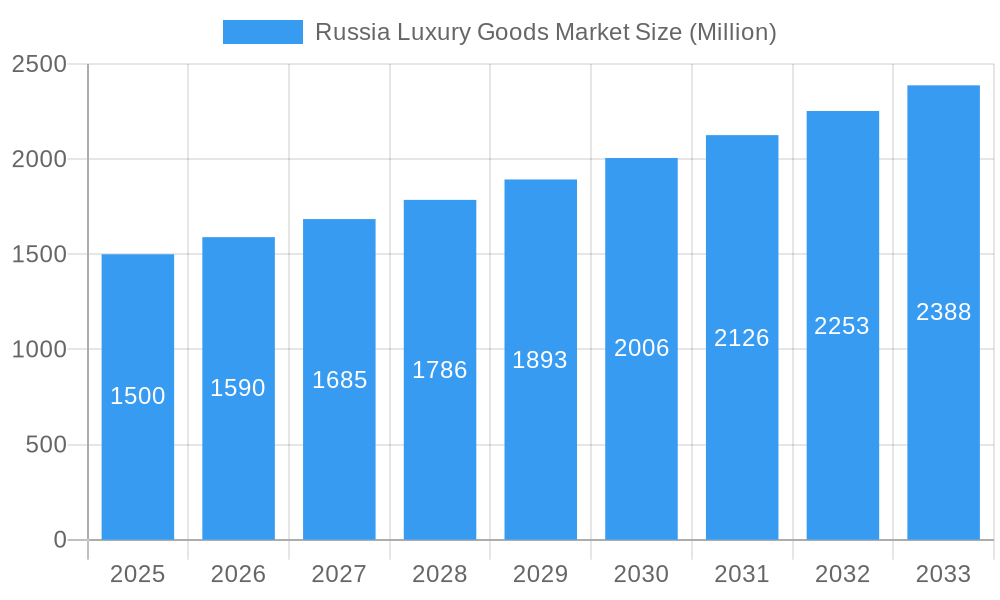

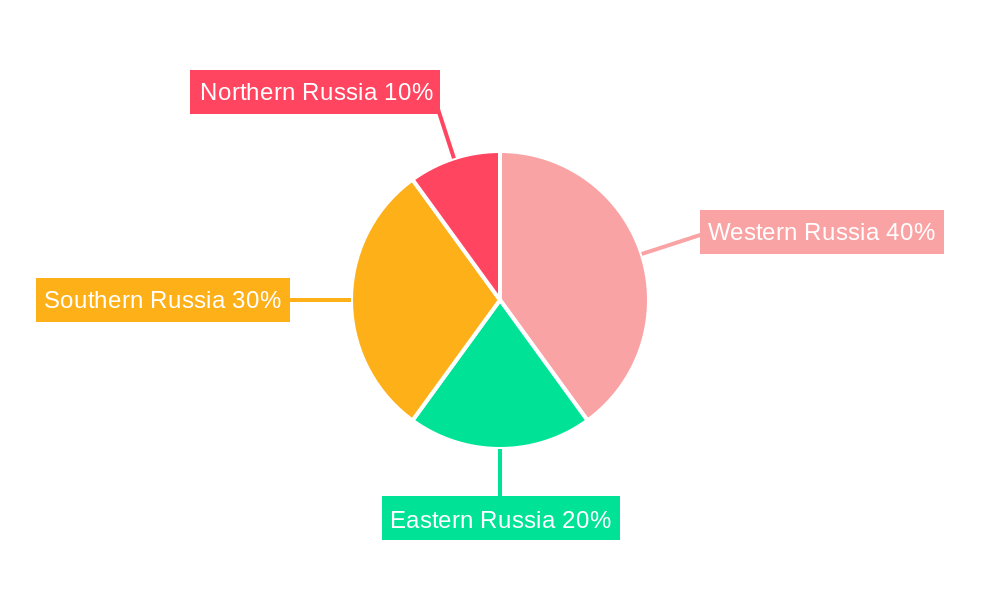

The Russia luxury goods market, projected at 2.59 billion in 2025, is poised for significant expansion with a CAGR of 2.81% from 2025 to 2033. Key growth drivers include a growing affluent population with increased disposable income and a rising demand for premium brands and experiences among younger demographics. The proliferation of e-commerce and the development of luxury retail infrastructure in major Russian cities further bolster market growth. While geopolitical factors present challenges, the inherent resilience of the luxury sector, particularly for established international brands, remains a key characteristic. The market is segmented by product type, including apparel, footwear, jewelry, watches, bags, and accessories, and by distribution channel, such as single-brand and multi-brand stores, and online retail. Leading international luxury houses maintain a strong presence, complemented by the emergence of domestic brands catering to local tastes. Regional growth is expected to be more pronounced in Western and Southern Russia due to higher concentrations of wealth and tourism.

Russia Luxury Goods Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, though susceptible to economic volatility, currency fluctuations, and evolving consumer preferences. However, the long-term outlook is positive, driven by rising consumer affluence and the enduring allure of luxury goods. Diverse product segments and expanding online channels contribute to market resilience and adaptation to consumer behavior. Strategic collaborations and innovative marketing will be crucial for navigating market complexities and capitalizing on opportunities. The ongoing enhancement of Russia's luxury retail landscape, with an emphasis on personalized customer experiences and digital engagement, will shape future market trajectories.

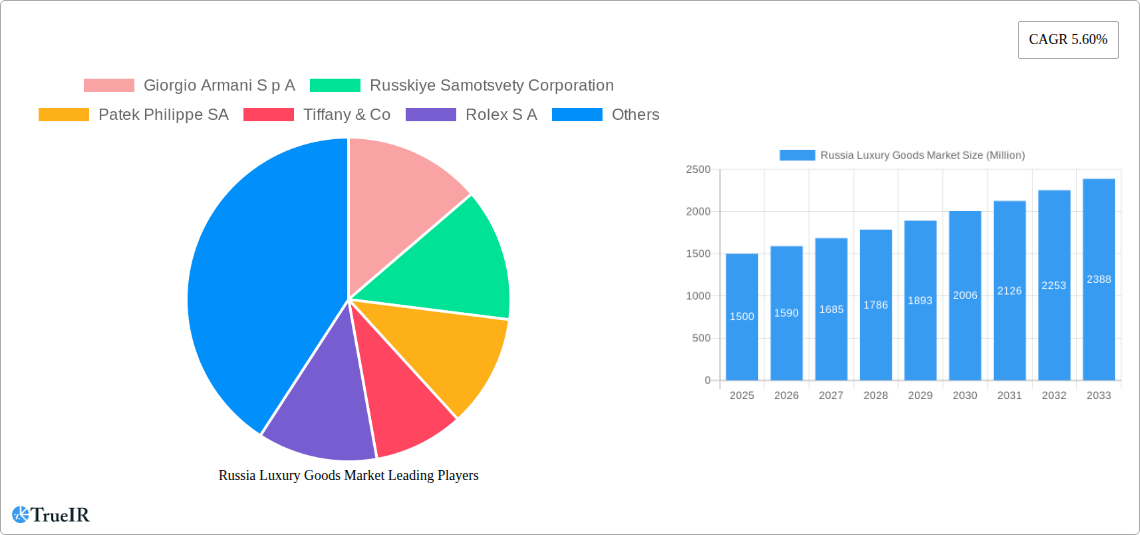

Russia Luxury Goods Market Company Market Share

This comprehensive report offers deep insights into the Russia luxury goods market, providing critical data for stakeholders, investors, and strategic planners. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, the report utilizes extensive data and expert analysis to identify market trends, growth catalysts, and significant challenges. The market is forecast to reach substantial value by 2033, presenting considerable opportunities for both established and emerging players.

Russia Luxury Goods Market Market Structure & Competitive Landscape

The Russian luxury goods market exhibits a moderately concentrated structure, with several key players dominating specific segments. The market's concentration ratio (CR4) is estimated at xx%, indicating the presence of several significant players alongside a multitude of smaller niche brands. Innovation is a crucial driver, with companies continuously introducing new designs, materials, and technologies to attract discerning consumers. Government regulations concerning import duties, labeling requirements, and consumer protection significantly impact market dynamics. Product substitutes, including more affordable alternatives and counterfeits, pose an ongoing challenge. The end-user segmentation is primarily driven by demographics, affluence, and lifestyle preferences, with a focus on high-net-worth individuals and younger, aspirational consumers.

Mergers and acquisitions (M&A) activity within the luxury goods sector has been relatively moderate in recent years, with a total M&A volume estimated at xx Million in 2024. Key drivers behind M&A activity include expansion into new product categories, access to new distribution channels, and strengthening of brand portfolios.

Russia Luxury Goods Market Market Trends & Opportunities

The Russia luxury goods market is projected to experience robust growth over the forecast period, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors. Rising disposable incomes among affluent consumers are driving increased demand for luxury goods. Technological advancements in areas like e-commerce, personalized marketing, and supply chain management are reshaping the market landscape. Changing consumer preferences, including a growing preference for sustainable and ethically sourced luxury products, present both opportunities and challenges. Competitive dynamics are intense, with established global brands competing alongside domestic players. Market penetration rates are expected to increase substantially, driven by rising brand awareness and accessibility. The luxury goods market in Russia is segmented into several distinct product categories:

Dominant Markets & Segments in Russia Luxury Goods Market

Moscow and St. Petersburg remain the dominant markets for luxury goods in Russia, accounting for a significant portion of overall sales. However, growth is also observed in other major cities across the country.

By Product Type:

- Jewelry: This segment is expected to show the fastest growth. The strong local tradition of craftsmanship and the growing purchasing power of the middle class are key drivers.

- Watches: High demand for Swiss and other premium watches drives this segment.

- Clothing & Apparel: High-end fashion labels are seeing increased demand from younger, affluent buyers.

- Bags: Luxury handbags and accessories maintain their popularity with a significant market share.

By Distribution Channel:

- Single-Brand Stores: Flagship stores remain crucial for brand building and high-end customer experience.

- Multi-Brand Stores: These stores provide a broad choice for consumers and often offer a convenient shopping environment.

- Online Stores: This channel is expanding rapidly and is expected to significantly contribute to future growth, particularly in reaching a younger demographic.

Key Growth Drivers:

- Expanding Affluent Class: The number of high-net-worth individuals in Russia is increasing, driving demand for luxury goods.

- Government Initiatives: Government policies that support domestic luxury brands and attract foreign investment contribute to growth.

- Improving Infrastructure: Improvements in logistics and infrastructure facilitate a smoother movement of goods.

Russia Luxury Goods Market Product Analysis

The Russian luxury goods market is characterized by a wide range of products, encompassing high-end apparel, footwear, jewelry, watches, and accessories. Innovation is a critical element, with brands constantly introducing new designs, materials, and technologies to meet consumer demands and maintain a competitive edge. The use of high-quality materials, advanced manufacturing processes, and unique design elements is crucial in achieving competitive advantages.

Key Drivers, Barriers & Challenges in Russia Luxury Goods Market

Key Drivers:

- Increasing Disposable Incomes: Rising affluence among the Russian population is a key driver of market growth.

- E-commerce Growth: The burgeoning e-commerce sector is facilitating broader access to luxury goods.

- Government Support: Government initiatives to support the luxury goods sector create positive momentum.

Challenges and Restraints:

- Economic Volatility: Fluctuations in the Russian economy pose a significant challenge to the sector.

- Geopolitical Instability: International sanctions and geopolitical tensions influence the market.

- Counterfeit Goods: The prevalence of counterfeit luxury goods impacts sales of genuine products. This leads to an estimated xx Million annual loss for the market.

Growth Drivers in the Russia Luxury Goods Market Market

The key drivers of growth in the Russia luxury goods market include the increasing disposable incomes of the affluent population, the growing popularity of e-commerce, government initiatives to support the luxury goods sector, and a desire for status symbols among the rising middle class. The expansion of the luxury retail infrastructure and a larger number of high net worth individuals are also important factors in accelerating growth.

Challenges Impacting Russia Luxury Goods Market Growth

The major challenges facing the Russia luxury goods market include economic volatility, geopolitical instability, currency fluctuations, the prevalence of counterfeit goods, and the impact of international sanctions. These factors contribute to uncertainty and can significantly hinder market expansion.

Key Players Shaping the Russia Luxury Goods Market Market

- Giorgio Armani S p A

- Russkiye Samotsvety Corporation

- Patek Philippe SA

- Tiffany & Co

- Rolex S A

- Estee Lauder

- EssilorLuxottica SA

- Fossile Group

- Nika Watches Jewelry

- Sokolov Jewelry

Significant Russia Luxury Goods Market Industry Milestones

- 2020: & Other Stories opened its first store in Russia, expanding access to a range of luxury goods.

- 2021: Alrosa consolidated its jewelry production and launched its first online store, aiming to improve transparency and combat fraud.

- 2021: Sokolov planned a dual listing in New York and Moscow in 2023, signaling expansion plans.

Future Outlook for Russia Luxury Goods Market Market

The Russia luxury goods market is poised for continued growth, driven by increasing affluence, evolving consumer preferences, and the expansion of e-commerce. Strategic opportunities exist for brands that can effectively adapt to changing market dynamics, leverage technological advancements, and address the unique challenges of the Russian market. The market's potential is considerable, with significant growth prospects across various product categories and distribution channels.

Russia Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing & Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russia Luxury Goods Market Segmentation By Geography

- 1. Russia

Russia Luxury Goods Market Regional Market Share

Geographic Coverage of Russia Luxury Goods Market

Russia Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Consumer's Willingness to Spend on Luxury Grooming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing & Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Russkiye Samotsvety Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Patek Philippe SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tiffany & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rolex S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Estee Lauder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EssilorLuxottica SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fossile Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nika Watches Jewelry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sokolov Jewelry*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Russia Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Russia Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Russia Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Russia Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Goods Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the Russia Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Russkiye Samotsvety Corporation, Patek Philippe SA, Tiffany & Co, Rolex S A, Estee Lauder, EssilorLuxottica SA, Fossile Group, Nika Watches Jewelry, Sokolov Jewelry*List Not Exhaustive.

3. What are the main segments of the Russia Luxury Goods Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Consumer's Willingness to Spend on Luxury Grooming.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

In 2021, The Russian company Alrosa completed the consolidation of its jewelry production and launched its first online jewelry store. The company's goal is to promote origin-guaranteed Russian diamonds, improve the user's experience, and combat fraud in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Russia Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence