Key Insights

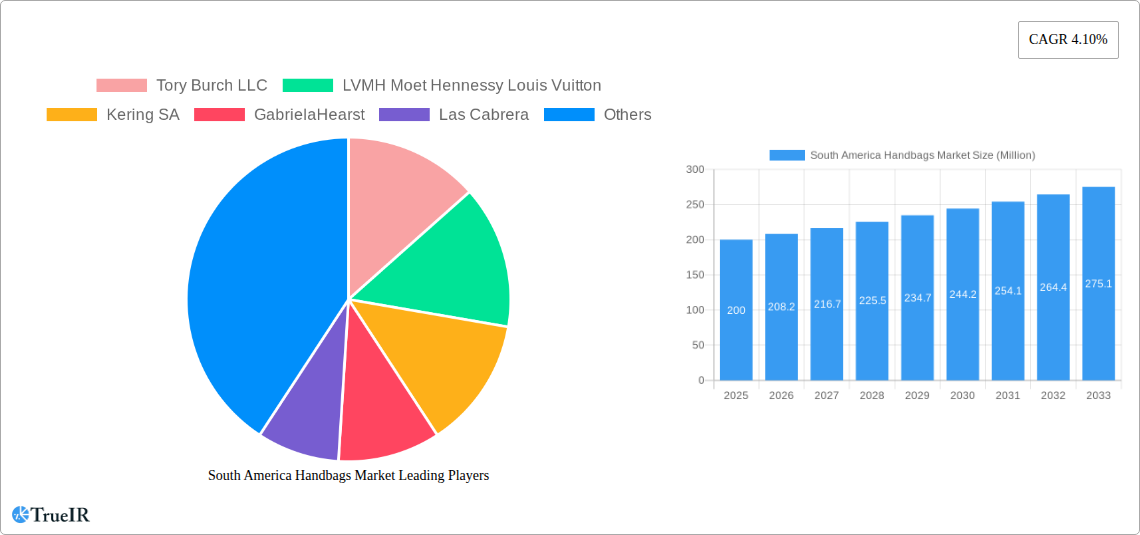

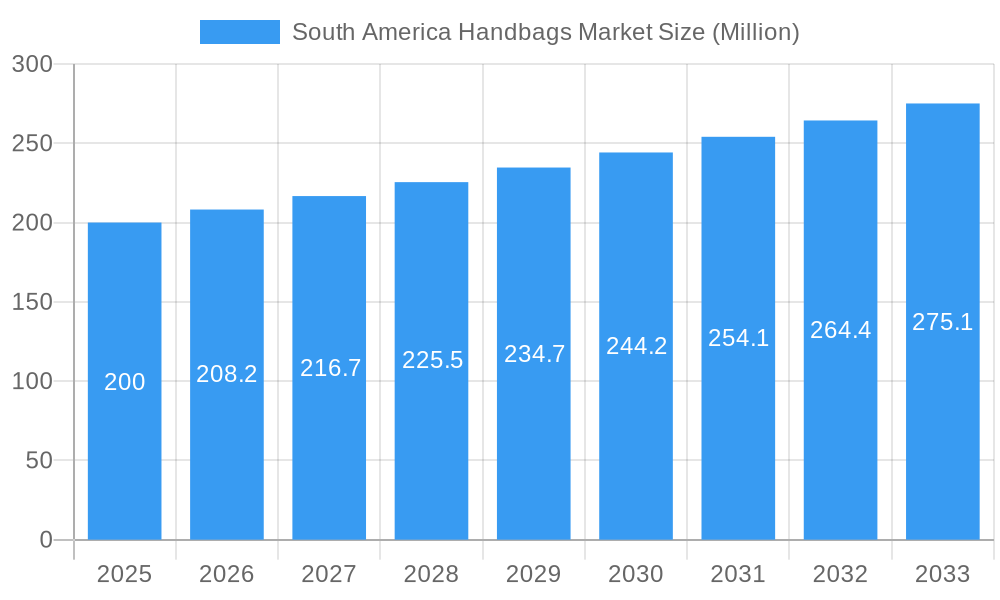

The South American handbags market, valued at approximately $XX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes, particularly within the burgeoning middle class of Brazil and Argentina, are driving increased consumer spending on luxury and fashion accessories. The influence of social media and fashion trends further stimulates demand, particularly among younger demographics. The market is segmented by type (satchels, clutches, tote bags, sling bags, and others) and distribution channel (online and offline stores). The preference for specific bag styles may vary across regions within South America, with certain designs enjoying greater popularity in Brazil compared to Argentina, for instance. While the presence of established international brands like Tory Burch, Michael Kors, and luxury conglomerates like LVMH and Kering, contributes to market sophistication, the growth of local and regional brands like Las Cabrera and Colombian Label Co. reflects a growing demand for unique, regionally-inspired designs. This blend of international and local brands fosters healthy competition and caters to a diverse range of consumer preferences and price points.

South America Handbags Market Market Size (In Million)

The market faces challenges such as economic volatility in some South American countries, which can affect consumer spending. Furthermore, fluctuations in currency exchange rates can impact the pricing and profitability of imported handbags. Despite these restraints, the long-term outlook remains positive. The continued expansion of e-commerce platforms is expected to facilitate market access and boost sales, particularly in more remote areas. Additionally, innovative product designs, collaborations between international and local brands, and strategic marketing campaigns targeting specific demographics can further accelerate market growth. The market's segmentation offers opportunities for targeted marketing and product development, allowing brands to cater to niche preferences and maximize market share.

South America Handbags Market Company Market Share

South America Handbags Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the South America handbags market, offering invaluable insights for businesses, investors, and industry stakeholders. Leveraging extensive research and data analysis covering the period 2019-2033, this report unveils the market's structure, competitive landscape, dominant segments, and future outlook. With a focus on key trends and growth drivers, this report is an essential resource for navigating the complexities of this burgeoning market. The market is expected to reach xx Million by 2033.

South America Handbags Market Structure & Competitive Landscape

The South America handbags market exhibits a moderately concentrated structure, with a handful of global luxury brands and several prominent local players vying for market share. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating a relatively competitive landscape. Innovation plays a significant role, with brands constantly introducing new designs, materials, and technologies to appeal to diverse consumer preferences. Regulatory frameworks, including those related to product safety and labeling, impact market operations. The presence of substitute products, such as imitation leather handbags, adds further complexity. The market is segmented by end-user, catering to various demographics and income levels. Recent years have witnessed a moderate level of mergers and acquisitions (M&A) activity, with xx M&A deals recorded between 2019 and 2024, primarily focused on expanding market reach and strengthening brand portfolios.

- Market Concentration: CR4 estimated at xx% in 2024.

- Innovation Drivers: New materials, designs, and technological advancements.

- Regulatory Impacts: Product safety standards and labeling regulations.

- Product Substitutes: Imitation leather and other affordable alternatives.

- End-User Segmentation: Differentiated offerings targeting various income levels and demographics.

- M&A Trends: xx M&A deals between 2019 and 2024.

South America Handbags Market Trends & Opportunities

The South America handbags market experienced significant growth between 2019 and 2024, with a Compound Annual Growth Rate (CAGR) of xx%. This growth is propelled by rising disposable incomes, increased urbanization, and a growing preference for fashion accessories among consumers. Technological advancements, such as e-commerce platforms and personalized marketing strategies, are transforming market dynamics. Consumer preferences are evolving towards sustainable and ethically sourced products. The market exhibits strong competitive dynamics, with brands investing heavily in marketing and product differentiation. Market penetration rates vary across different segments and regions, with higher penetration observed in urban areas compared to rural regions. The forecast period (2025-2033) anticipates continued growth, driven by factors such as increasing tourism, the expansion of the middle class, and evolving fashion trends.

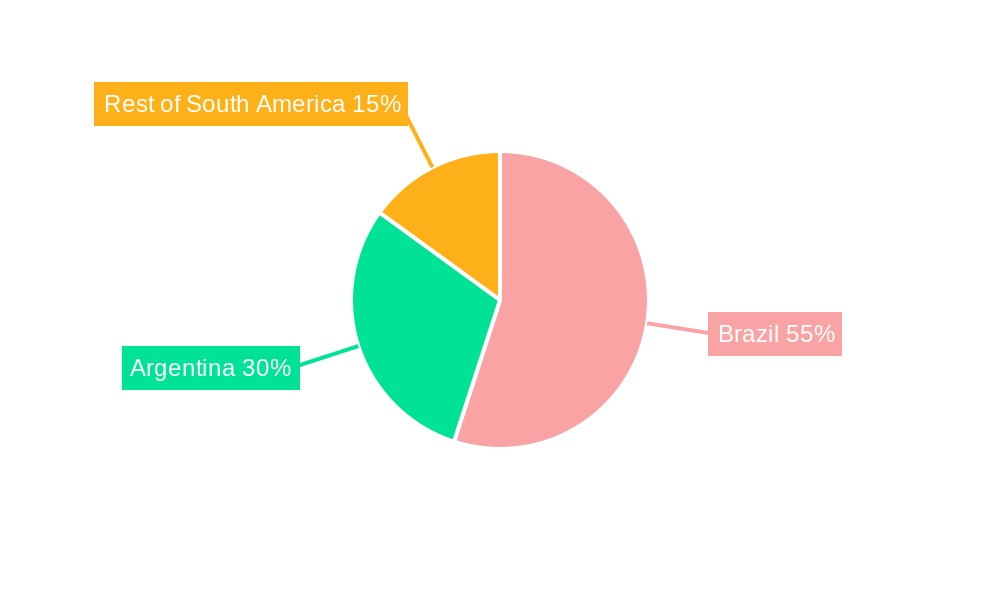

Dominant Markets & Segments in South America Handbags Market

The Brazilian market dominates the South American handbags market, accounting for approximately xx% of total revenue in 2024. This dominance is attributed to its large population, high disposable incomes in urban centers, and strong fashion consciousness. Other major markets include Colombia, Argentina, and Peru.

By Type: The Tote Bag segment holds the largest market share, followed by Satchels and Sling Bags. Growth in the Others category (including backpacks, clutches etc.) is anticipated.

By Distribution Channel: Offline stores continue to be the dominant distribution channel, due to the preference for physical examination and immediate possession. However, Online Stores are witnessing robust growth, driven by increased internet penetration and the convenience of online shopping.

- Key Growth Drivers (Brazil): Large consumer base, growing middle class, strong fashion industry, favorable infrastructure in major urban centers.

- Key Growth Drivers (Colombia): Rising disposable incomes, increasing demand for luxury goods, expanding e-commerce sector.

- Key Growth Drivers (Argentina): Growing fashion awareness, increasing tourism, and a relatively well-developed retail sector.

South America Handbags Market Product Analysis

Product innovation is a key differentiator in the South America handbags market. Brands are constantly introducing new designs, using diverse materials (leather, vegan leather, textiles), incorporating technological features (RFID blocking, smart features), and focusing on sustainability. The focus is on achieving a balance between functionality, aesthetic appeal, and affordability to cater to the diverse demands of the target consumer base. The market fit is influenced by trends such as minimalism, maximalism, and ethnic-inspired designs.

Key Drivers, Barriers & Challenges in South America Handbags Market

Key Drivers: Rising disposable incomes, increasing fashion consciousness, expanding e-commerce, technological advancements in materials and design, government support for the fashion industry in certain countries.

Key Challenges: Intense competition from both international and local brands, fluctuations in currency exchange rates, supply chain disruptions impacting the availability of raw materials, regulatory complexities related to import/export, counterfeit products, and socio-economic instability in some regions. The impact of these challenges is estimated to reduce market growth by an average of xx% annually in the forecast period.

Growth Drivers in the South America Handbags Market

The South America handbags market is fueled by rising disposable incomes, a burgeoning middle class, and increased urbanization. E-commerce expansion and technological innovations further enhance market growth.

Challenges Impacting South America Handbags Market Growth

Economic volatility, supply chain disruptions, and intense competition pose significant challenges. Regulatory hurdles and counterfeiting activities also negatively influence market growth.

Key Players Shaping the South America Handbags Market Market

- Tory Burch LLC

- LVMH Moet Hennessy Louis Vuitton

- Kering SA

- Gabriela Hearst

- Las Cabrera

- Colombian Label Co

- Carla Busso

- Catarina Mina Brand

- Michael Kors (USA) Inc

- Prada Holding SpA

Significant South America Handbags Market Industry Milestones

- January 2022: LVMH opened a second Dior store in São Paulo, Brazil, expanding its luxury handbag offerings.

- April 2021: Balenciaga (Kering Group) launched its first South American store in São Paulo, marking a significant entry into the regional market.

Future Outlook for South America Handbags Market Market

The South America handbags market is poised for continued growth, driven by the expansion of e-commerce, increasing fashion awareness, and the rise of new luxury brands. Strategic partnerships, innovative product launches, and targeted marketing campaigns will be crucial for success. The market's potential remains significant, with opportunities for both established players and new entrants.

South America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distribution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Handbags Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Handbags Market Regional Market Share

Geographic Coverage of South America Handbags Market

South America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Popularity of Leather Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Tory Burch LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 LVMH Moet Hennessy Louis Vuitton

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kering SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GabrielaHearst

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Las Cabrera

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Colombian Label Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Carla Busso*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Catarina Mina Brand

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Michael Kors (USA) Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Prada Holding SpA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Tory Burch LLC

List of Figures

- Figure 1: South America Handbags Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: South America Handbags Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: South America Handbags Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Handbags Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the South America Handbags Market?

Key companies in the market include Tory Burch LLC, LVMH Moet Hennessy Louis Vuitton, Kering SA, GabrielaHearst, Las Cabrera, Colombian Label Co, Carla Busso*List Not Exhaustive, Catarina Mina Brand, Michael Kors (USA) Inc, Prada Holding SpA.

3. What are the main segments of the South America Handbags Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Popularity of Leather Handbags.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In January 2022, LVMH opened a second Dior store in Shops Jardins Shopping Center in São Paulo, Brazil. The store features ready-to-wear, handbags, small leather goods, exotic leathers, jewelry, footwear, accessories, and sunglasses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Handbags Market?

To stay informed about further developments, trends, and reports in the South America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence