Key Insights

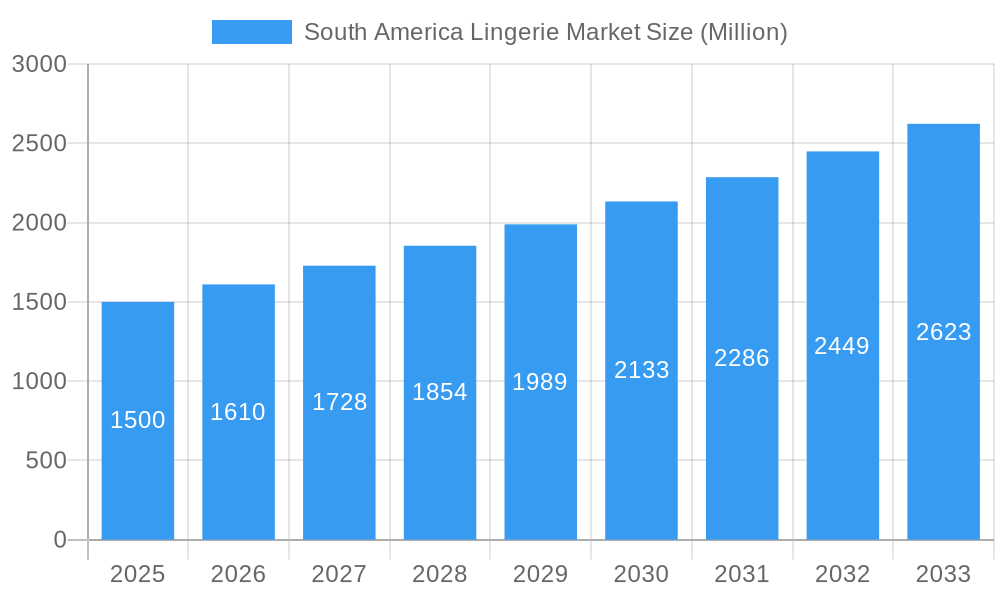

The South American lingerie market is poised for significant expansion, projected to reach $40.09 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6% from 2025. This growth trajectory is underpinned by several influential factors. Increasing disposable incomes, especially within the expanding middle class in key economies like Brazil and Argentina, are driving higher consumer expenditure on apparel and personal care items, including lingerie. Concurrently, evolving societal attitudes towards body positivity and self-expression are fostering a greater demand for a wide array of lingerie styles and sizes. The proliferation of e-commerce is also a critical enabler, enhancing product and brand accessibility for consumers across the continent. A growing preference for comfort and functionality in lingerie, alongside an emerging trend towards sustainable and ethically sourced materials, are further key market drivers. Potential challenges include economic instability in select South American nations and currency exchange rate fluctuations.

South America Lingerie Market Market Size (In Billion)

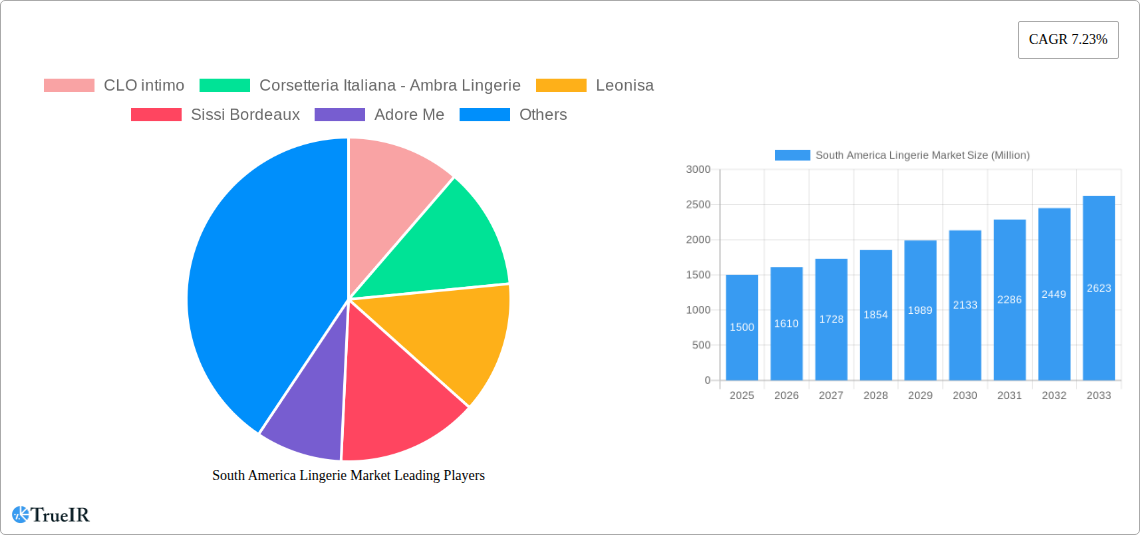

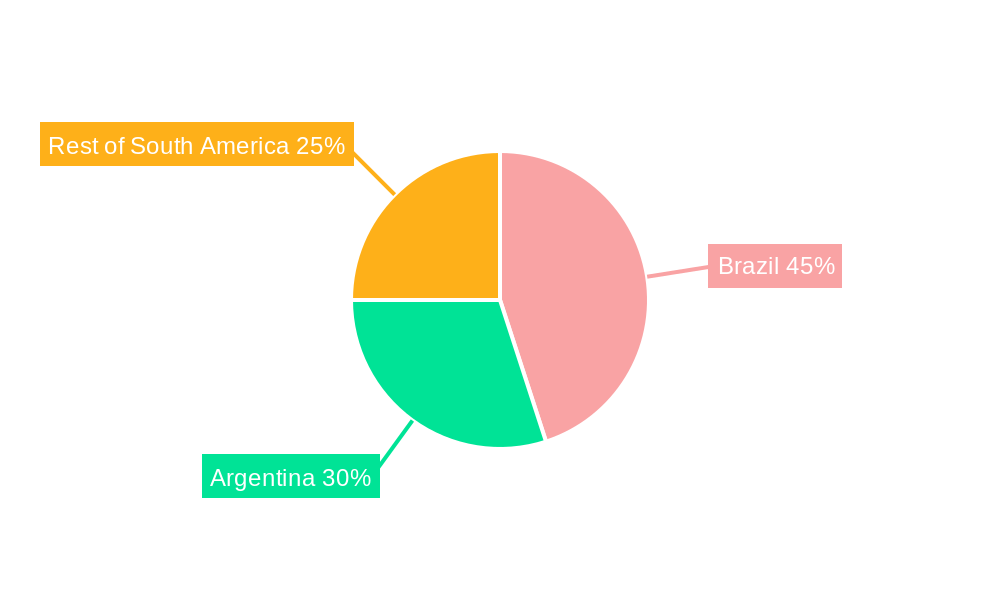

Market segmentation highlights diverse product categories and distribution channels. Brassieres and briefs represent the dominant product segments, addressing core consumer needs. Online retail channels are experiencing accelerated growth, driven by their inherent convenience and accessibility, presenting a competitive challenge to established channels such as supermarkets and specialty stores. Leading players in the South American lingerie market, including global entities like Victoria's Secret & Co. and Groupe Chantelle, and regional leaders such as CLO intimo and Leonisa, are actively engaged in competitive strategies. These include product innovation, robust branding, and strategic distribution to secure market share. The forecast period (2025-2033) anticipates sustained market development, offering opportunities for adaptable companies that can effectively respond to shifting consumer preferences and navigate regional market complexities. Brazil and Argentina are anticipated to continue as the primary contributors to market value, owing to their substantial populations and robust consumer spending. The "Rest of South America" segment is also expected to grow, albeit potentially at a more measured pace due to diverse economic conditions.

South America Lingerie Market Company Market Share

South America Lingerie Market: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Lingerie Market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and growth opportunities within this dynamic sector. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

South America Lingerie Market Structure & Competitive Landscape

The South American lingerie market exhibits a moderately concentrated structure, with a handful of major players dominating alongside numerous smaller, regional brands. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating the presence of both established international and successful local players. Innovation is a key driver, with companies focusing on new materials, designs, and technologies to appeal to evolving consumer preferences. Regulatory impacts, particularly concerning labeling and safety standards, vary across countries and influence market dynamics. Product substitutes, such as loungewear and athleisure apparel, pose a competitive threat, demanding continuous innovation and brand differentiation. The market is segmented by end-users based on demographics, lifestyle, and purchasing power. M&A activity remains relatively low, with a recorded xx number of deals in the past five years, mainly involving smaller players consolidating market share. This landscape creates both opportunities and challenges for new entrants and established players, requiring careful strategic navigation.

South America Lingerie Market Market Trends & Opportunities

The South American lingerie market is experiencing significant growth, driven by rising disposable incomes, increasing fashion awareness, and a growing preference for comfort and style. The market size, estimated at xx Million in 2025, is projected to expand at a CAGR of xx% between 2025 and 2033, reaching xx Million. Technological advancements, such as the use of sustainable materials and e-commerce platforms, are reshaping consumer preferences and driving market penetration. Consumer preferences are shifting towards comfort, inclusivity, and ethically sourced products. The increasing adoption of online retail channels offers significant growth potential, although challenges around logistics and digital infrastructure remain. Competitive dynamics are influenced by the interplay between international brands and local players, with established players focusing on brand loyalty and diversification strategies while local brands capitalize on regional preferences and cost advantages.

Dominant Markets & Segments in South America Lingerie Market

The Brazilian market is the dominant segment in South America, accounting for approximately xx% of the total market value in 2025. This dominance stems from its large population, higher disposable incomes compared to other South American countries, and a robust fashion industry. Other significant markets include Colombia, Argentina, and Peru.

By Product Type:

- Brassieres: This segment remains the largest, driven by diverse style preferences and functional needs.

- Briefs: This segment enjoys strong growth, fueled by increasing demand for comfortable and fashionable underwear.

- Other Product Types: This category includes shapewear, sleepwear, and other related items, exhibiting a steady growth trajectory.

By Distribution Channel:

- Online Retail Stores: This channel is experiencing rapid expansion, offering convenience and wider product selections.

- Specialty Stores: These stores cater to specific customer needs and offer personalized shopping experiences.

- Supermarkets/Hypermarkets: This channel offers convenience and value for price-sensitive consumers.

- Other Distribution Channels: Direct-to-consumer sales and pop-up shops are gaining traction.

Growth drivers include improving infrastructure, particularly in e-commerce logistics, supportive government policies promoting local manufacturing, and increasing urbanization, which influences consumer behavior and retail expansion.

South America Lingerie Market Product Analysis

The South American lingerie market showcases a diverse range of products, from basic everyday underwear to sophisticated designer pieces. Technological advancements are evident in the incorporation of innovative fabrics like breathable, sustainable materials and smart technologies for comfort and health monitoring. Key competitive advantages include brand recognition, product quality, design innovation, and effective marketing strategies. The market's diverse product offerings cater to varied consumer preferences and lifestyles, from functional everyday wear to fashionable and occasion-specific pieces. The focus is shifting towards inclusivity and sustainability, reflecting changing consumer expectations.

Key Drivers, Barriers & Challenges in South America Lingerie Market

Key Drivers:

Rising disposable incomes, particularly in urban areas, are fueling demand. Growing awareness of fashion trends and personal style influences purchasing decisions. E-commerce platforms are expanding market reach.

Key Challenges and Restraints:

Economic volatility in certain South American countries can impact consumer spending. Supply chain disruptions can affect product availability and pricing. Intense competition from both international and domestic brands poses a significant challenge. Varying regulations across different countries increase complexities in market entry and operation. These factors affect profitability and growth for market players.

Growth Drivers in the South America Lingerie Market Market

Key growth drivers include the rising disposable income of the middle class, increasing fashion consciousness, a growing preference for comfort and convenience, and the expanding e-commerce market. The rise of social media and influencer marketing plays a critical role in shaping consumer choices and driving demand.

Challenges Impacting South America Lingerie Market Growth

Economic instability in certain regions, fluctuating currency exchange rates, and supply chain complexities represent significant challenges. Stringent regulations and import duties in some countries increase operational costs. Competition from both established international brands and local players further intensifies the market dynamics.

Key Players Shaping the South America Lingerie Market Market

- CLO intimo

- Corsetteria Italiana - Ambra Lingerie

- Leonisa

- Sissi Bordeaux

- Adore Me

- Catalogo SAC

- Victoria's Secret & Co

- Carmel

- Groupe Chantelle

- AEO Inc

- Lili Pink

- PVH Corp

- List Not Exhaustive

Significant South America Lingerie Market Industry Milestones

- July 2022: Aerie (American Eagle Outfitters) launches Smoothez, an inclusive underwear line for people with disabilities.

- March 2022: Lais Ribeiro debuts Victoria's Secret's Love & Lemons lingerie spring campaign.

- January 2021: AEO Inc. announces the expansion of its Aerie lingerie line with 50 new locations.

Future Outlook for South America Lingerie Market Market

The South American lingerie market is poised for continued growth, driven by increasing disposable incomes, evolving consumer preferences, and technological advancements. Strategic opportunities lie in leveraging e-commerce platforms, focusing on sustainable and ethical production, and catering to the diverse needs of the growing middle class. The market's potential for expansion is significant, offering attractive returns for investors and growth opportunities for businesses.

South America Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Columbia

- 3.4. Rest of South America

South America Lingerie Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Columbia

- 4. Rest of South America

South America Lingerie Market Regional Market Share

Geographic Coverage of South America Lingerie Market

South America Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Increased Online Retail Adoption Facilitated Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Columbia

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Columbia

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Brassiere

- 6.1.2. Briefs

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Columbia

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Brassiere

- 7.1.2. Briefs

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Columbia

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Columbia South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Brassiere

- 8.1.2. Briefs

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Columbia

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of South America South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Brassiere

- 9.1.2. Briefs

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Columbia

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 CLO intimo

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Corsetteria Italiana - Ambra Lingerie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Leonisa

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sissi Bordeaux

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Adore Me

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Catalogo SAC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Victoria's Secret & Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Carmel

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Groupe Chantelle

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AEO Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lili Pink

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PVH Corp *List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 CLO intimo

List of Figures

- Figure 1: South America Lingerie Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Lingerie Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Lingerie Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the South America Lingerie Market?

Key companies in the market include CLO intimo, Corsetteria Italiana - Ambra Lingerie, Leonisa, Sissi Bordeaux, Adore Me, Catalogo SAC, Victoria's Secret & Co, Carmel, Groupe Chantelle, AEO Inc, Lili Pink, PVH Corp *List Not Exhaustive.

3. What are the main segments of the South America Lingerie Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.09 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Increased Online Retail Adoption Facilitated Market Growth.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

In July 2022, Aerie, an American Eagle Outfitters brand, has announced the release of Smoothez, a new underwear line designed exclusively for persons with disabilities of various body shapes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Lingerie Market?

To stay informed about further developments, trends, and reports in the South America Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence