Key Insights

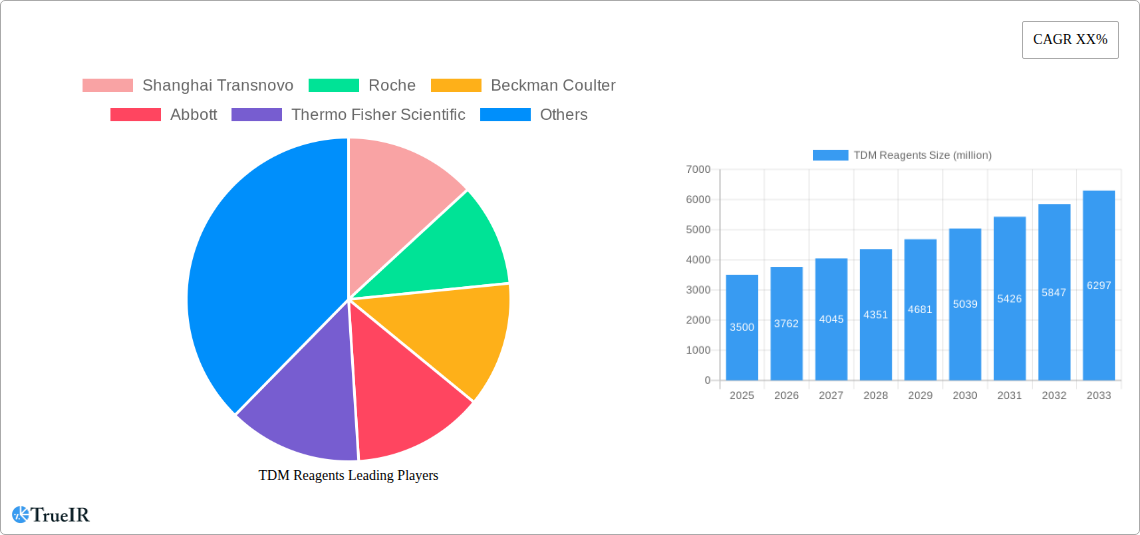

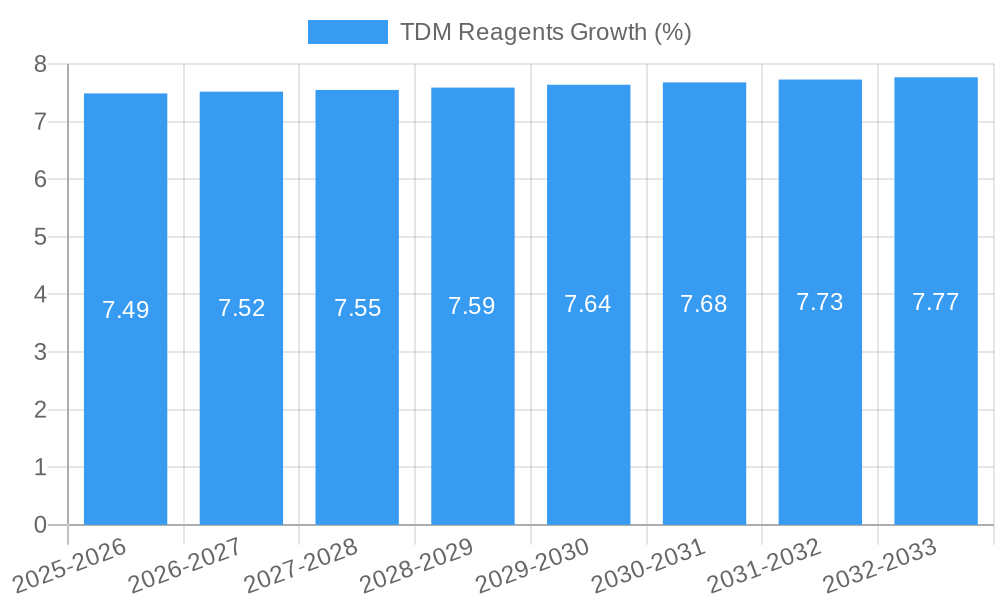

The global TDM Reagents market is poised for substantial growth, projected to reach a market size of approximately $3,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust expansion is primarily driven by the increasing prevalence of chronic diseases, the growing demand for personalized medicine, and advancements in diagnostic technologies. TDM reagents play a critical role in therapeutic drug monitoring, enabling healthcare professionals to optimize drug dosages for individual patients, thereby improving treatment efficacy and minimizing adverse drug reactions. The clinical application segment is expected to dominate the market, fueled by the widespread use of TDM in managing conditions like epilepsy, infections, and cardiovascular diseases. Furthermore, the expansion of research and development activities in the pharmaceutical sector, particularly in drug discovery and development, will contribute to the sustained demand for TDM reagents in drug research applications.

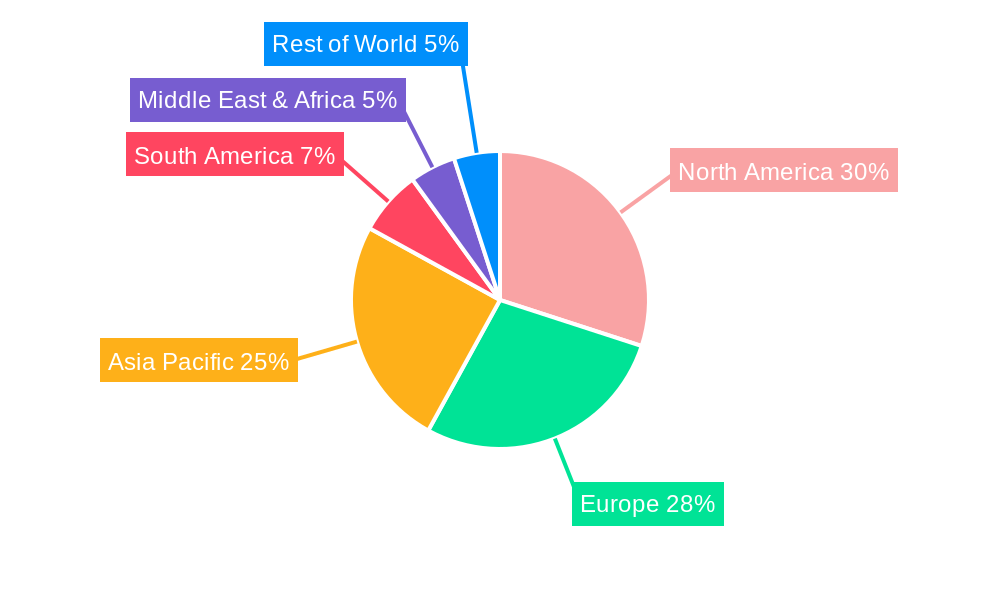

The market landscape for TDM reagents is characterized by a dynamic interplay of technological innovation and strategic collaborations. Key market trends include the development of more sensitive and specific reagents, the integration of automation in TDM testing, and the increasing adoption of point-of-care diagnostic solutions. However, certain restraints, such as the high cost of advanced diagnostic equipment and stringent regulatory hurdles for new product approvals, could moderate the growth trajectory. Geographically, North America and Europe currently hold significant market shares due to well-established healthcare infrastructures and a high adoption rate of advanced diagnostic tools. The Asia Pacific region, however, presents the most significant growth potential, driven by a rapidly expanding patient base, increasing healthcare expenditure, and growing awareness of the benefits of personalized pharmacotherapy. Leading companies such as Roche, Abbott, and Thermo Fisher Scientific are at the forefront, investing heavily in R&D to introduce innovative TDM reagent solutions and expand their market presence globally.

TDM Reagents Market Report: Navigating a Dynamic Landscape for Enhanced Therapeutic Drug Monitoring

This comprehensive report offers an in-depth analysis of the global TDM Reagents market, providing critical insights into its structure, trends, and future trajectory. Leveraging high-volume keywords such as "Therapeutic Drug Monitoring Reagents," "TDM Diagnostics," "Clinical Chemistry Reagents," and "Drug Metabolism Testing," this report is meticulously crafted for optimal SEO performance and maximum engagement with industry stakeholders, including researchers, diagnostic manufacturers, pharmaceutical companies, and healthcare providers. The study encompasses a detailed examination of market dynamics from 2019 to 2033, with a base year of 2025, and an extensive forecast period.

TDM Reagents Market Structure & Competitive Landscape

The global TDM Reagents market exhibits a moderately concentrated structure, driven by significant investments in research and development and stringent regulatory frameworks. Innovation remains a key differentiator, with companies continuously striving to enhance reagent sensitivity, specificity, and ease of use for a wider array of therapeutic drugs. Regulatory impacts, particularly from bodies like the FDA and EMA, are paramount, influencing product development, market entry strategies, and quality control standards. The market's competitive intensity is shaped by the presence of established global players and emerging niche providers. Product substitutes, such as alternative diagnostic methodologies, exert a moderate influence, though the specificity and established protocols of TDM reagents ensure their continued relevance. End-user segmentation reveals a dominant healthcare sector, followed by drug research entities and other specialized applications. Merger and acquisition (M&A) activities are a significant trend, with an estimated volume of over 10 major deals annually in the historical period, driven by a desire for market consolidation, portfolio expansion, and synergistic technological integration. The concentration ratio among the top five players stands at approximately 65%, indicating a substantial but not entirely saturated market.

TDM Reagents Market Trends & Opportunities

The global TDM Reagents market is poised for substantial growth, projected to expand from an estimated XX million in 2024 to over XX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is fueled by a confluence of technological advancements, shifting consumer preferences towards personalized medicine, and evolving healthcare policies that prioritize patient safety and treatment efficacy. The increasing prevalence of chronic diseases and the continuous development of new targeted therapies are directly driving the demand for routine and specialized TDM testing. Technological shifts are characterized by the development of more sensitive and specific immunoassays and chromatographic techniques, enabling the accurate quantification of a broader range of drugs and their metabolites at lower concentrations. The advent of automation and point-of-care testing solutions is further enhancing accessibility and reducing turnaround times, thereby improving patient outcomes. Consumer preferences are increasingly leaning towards precision medicine, where TDM plays a crucial role in optimizing drug dosages for individual patients, minimizing adverse drug reactions, and improving therapeutic responses. This personalized approach is a significant market penetration driver, encouraging wider adoption of TDM diagnostics. Competitive dynamics are intensifying, with key players focusing on innovation, strategic partnerships, and geographical expansion to capture market share. The growing awareness among healthcare professionals and patients about the benefits of TDM in managing complex drug regimens represents a significant opportunity for market expansion. Furthermore, the rising demand for infectious disease monitoring and oncology drug monitoring is creating new avenues for TDM reagent manufacturers. The market penetration rate for TDM reagents in developed economies is high, estimated at over XX%, while emerging economies present considerable untapped potential for growth.

Dominant Markets & Segments in TDM Reagents

The Clinical application segment stands as the dominant force within the TDM Reagents market, accounting for an estimated XX% of the total market share in 2024 and projected to maintain its leadership position through 2033. This dominance is underpinned by the critical role of TDM in optimizing patient care, ensuring therapeutic efficacy, and mitigating toxicity for a vast array of prescription medications. Within this segment, the sub-segment of Photometry reagents demonstrates significant market penetration, driven by its cost-effectiveness, established protocols, and widespread availability in clinical laboratories. The Electrochemistry segment, while currently smaller, is exhibiting rapid growth due to its high specificity, sensitivity, and potential for miniaturization, making it increasingly attractive for advanced diagnostic applications.

Key Growth Drivers in the Dominant Clinical Application Segment:

- Increasing Burden of Chronic Diseases: The rising global incidence of conditions such as cardiovascular diseases, diabetes, and epilepsy necessitates continuous monitoring of drug levels to ensure optimal treatment outcomes.

- Expanding Pharmaceutical Pipeline: The continuous development of new drugs, particularly biologics and targeted therapies, creates a growing need for specialized TDM reagents to monitor their efficacy and safety.

- Focus on Patient Safety and Personalized Medicine: Healthcare systems worldwide are prioritizing patient safety by minimizing adverse drug reactions and tailoring treatment regimens to individual patient profiles, directly boosting TDM utilization.

- Technological Advancements in Immunoassays and Chromatography: Innovations leading to higher sensitivity, specificity, and faster assay times are expanding the scope of drugs that can be effectively monitored through TDM.

- Growing Adoption of Automated Diagnostic Platforms: The integration of TDM reagents with automated analyzers in clinical laboratories enhances throughput, reduces manual errors, and improves overall laboratory efficiency.

Regional Dominance: North America currently holds the largest market share due to a well-established healthcare infrastructure, high adoption rates of advanced diagnostic technologies, and robust reimbursement policies for TDM testing. However, the Asia-Pacific region is emerging as a significant growth hotspot, driven by rapid healthcare expansion, increasing disposable incomes, and a growing awareness of personalized medicine approaches.

TDM Reagents Product Analysis

TDM Reagents are at the forefront of diagnostic innovation, enabling precise therapeutic drug monitoring that is critical for patient safety and treatment efficacy. Product innovations are focused on enhancing reagent sensitivity and specificity for a wider range of therapeutic drugs and their active metabolites, including immunosuppressants, anti-epileptics, and cardiovascular drugs. The competitive advantages of these reagents lie in their ability to provide rapid, accurate, and cost-effective results, often integrated with automated immunoassay analyzers and liquid chromatography-mass spectrometry (LC-MS) systems. Advancements in antibody development and assay design are crucial, leading to improved signal-to-noise ratios and reduced cross-reactivity. The market fit of these products is directly linked to their ability to support personalized medicine approaches, allowing clinicians to optimize drug dosages and minimize adverse effects.

Key Drivers, Barriers & Challenges in TDM Reagents

Key Drivers Propelling the TDM Reagents Market:

- Technological Advancements: The development of highly sensitive immunoassays, coupled with the increasing adoption of LC-MS, allows for the precise quantification of a broader spectrum of drugs, including complex biologics and small molecules.

- Growing Prevalence of Chronic Diseases: The escalating burden of conditions like cancer, cardiovascular diseases, and neurological disorders necessitates precise drug management, driving demand for TDM.

- Shift Towards Personalized Medicine: The imperative to tailor drug dosages to individual patient genetics and metabolism fuels the adoption of TDM for optimized therapeutic outcomes.

- Increasing Healthcare Expenditure: Higher investments in healthcare infrastructure and diagnostic technologies, particularly in emerging economies, create a favorable environment for TDM reagent market growth.

- Regulatory Support and Guidelines: Evolving guidelines that emphasize patient safety and effective drug therapy encourage the routine use of TDM.

Challenges Impacting TDM Reagents Growth:

- Regulatory Hurdles and Compliance: Navigating diverse and stringent regulatory requirements across different regions can be time-consuming and costly for manufacturers.

- Supply Chain Disruptions: Global supply chain volatilities, including raw material shortages and logistical challenges, can impact production volumes and lead times, with an estimated XX% increase in production costs during periods of disruption.

- Reimbursement Policies and Cost Pressures: Inconsistent reimbursement policies and pressure to reduce healthcare costs can limit the adoption of TDM testing in certain markets.

- Competition from Alternative Testing Methods: While TDM remains crucial, the emergence of advanced genetic and phenotypic testing methodologies presents indirect competition.

- Limited Awareness in Certain Geographies: In under-developed regions, a lack of awareness regarding the benefits of TDM among healthcare professionals and patients can hinder market penetration.

Growth Drivers in the TDM Reagents Market

The TDM Reagents market is propelled by several key growth drivers. Technologically, the continuous innovation in immunoassay platforms and the increasing integration of LC-MS in clinical laboratories are expanding the utility of TDM. Economically, rising healthcare expenditure globally, coupled with increasing patient access to sophisticated diagnostics, fuels demand. Regulatory bodies, by emphasizing patient safety and the need for therapeutic drug efficacy, indirectly promote the adoption of TDM. Specific examples include the development of reagents for monitoring novel biologics used in oncology and autoimmune diseases.

Challenges Impacting TDM Reagents Growth

Several challenges impact the growth of the TDM Reagents market. Regulatory complexities, with varying approval processes and quality standards across different countries, can create significant barriers. Supply chain issues, from raw material sourcing to finished product distribution, pose a constant threat, potentially leading to an estimated XX% increase in lead times during peak disruptions. Competitive pressures from both established players and emerging diagnostics companies necessitate continuous innovation and cost-efficiency. Furthermore, the cost of implementing and maintaining TDM testing, including reagent expenses, can be a restraint in resource-limited settings.

Key Players Shaping the TDM Reagents Market

- Shanghai Transnovo

- Roche

- Beckman Coulter

- Abbott

- Thermo Fisher Scientific

- Siemens Healthineers

- Bio-Rad Laboratories

- bioMerieux

- Chromsystems Instruments

- Randox Laboratories

- Sekisui Medical

- Biotree

- Chromai

- Beijing Diagreat Biotechnologies

- Purspec

- Calibra

- SCIEX

- Shimadzu

- ARK Diagnostics

Significant TDM Reagents Industry Milestones

- 2019: Launch of novel TDM reagents for monitoring anti-cancer biologics by leading manufacturers, expanding the therapeutic reach of TDM.

- 2020: Increased focus on TDM for immunosuppressants due to organ transplantation advancements.

- 2021: Significant investment in R&D for point-of-care TDM solutions to improve patient accessibility.

- 2022: Emergence of AI-driven data analysis for TDM results, enabling more precise treatment adjustments.

- 2023: Strategic collaborations between reagent manufacturers and automated analyzer providers to enhance workflow integration.

- 2024: Expansion of TDM reagent portfolios to include monitoring of novel psychiatric and neurological drugs.

- 2025 (Estimated): Anticipated launch of next-generation TDM reagents with enhanced multiplexing capabilities.

- 2026-2030 (Forecast): Expected market penetration of TDM reagents for monitoring novel gene therapies and personalized cancer vaccines.

- 2031-2033 (Forecast): Growing adoption of TDM in veterinary medicine and specialized research applications.

Future Outlook for TDM Reagents Market

The future outlook for the TDM Reagents market is exceptionally promising, driven by the accelerating trend towards personalized medicine and the increasing complexity of pharmaceutical treatments. Strategic opportunities lie in expanding TDM applications to novel drug classes, including gene therapies and advanced biologics. The development of highly automated, user-friendly TDM solutions and the integration of real-time data analytics will further enhance market penetration. Furthermore, the growing healthcare infrastructure in emerging economies presents significant untapped market potential for established and innovative TDM reagent providers. The continuous drive for improved patient outcomes and reduced healthcare costs will remain central to the sustained growth of this vital diagnostic sector.

TDM Reagents Segmentation

-

1. Application

- 1.1. Clinical

- 1.2. Drug Research

- 1.3. Others

-

2. Types

- 2.1. Photometry

- 2.2. Colorimetry

- 2.3. Electrochemistry

- 2.4. Others

TDM Reagents Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

TDM Reagents REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clinical

- 5.1.2. Drug Research

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Photometry

- 5.2.2. Colorimetry

- 5.2.3. Electrochemistry

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clinical

- 6.1.2. Drug Research

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Photometry

- 6.2.2. Colorimetry

- 6.2.3. Electrochemistry

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clinical

- 7.1.2. Drug Research

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Photometry

- 7.2.2. Colorimetry

- 7.2.3. Electrochemistry

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clinical

- 8.1.2. Drug Research

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Photometry

- 8.2.2. Colorimetry

- 8.2.3. Electrochemistry

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clinical

- 9.1.2. Drug Research

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Photometry

- 9.2.2. Colorimetry

- 9.2.3. Electrochemistry

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific TDM Reagents Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clinical

- 10.1.2. Drug Research

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Photometry

- 10.2.2. Colorimetry

- 10.2.3. Electrochemistry

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shanghai Transnovo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Roche

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beckman Coulter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bio-Rad Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 bioMerieux

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chromsystems Instruments

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Randox Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sekisui Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Biotree

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chromai

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Beijing Diagreat Biotechnologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Purspec

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Calibra

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SCIEX

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shimadzu

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 ARK Diagnostics

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Shanghai Transnovo

List of Figures

- Figure 1: Global TDM Reagents Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America TDM Reagents Revenue (million), by Application 2024 & 2032

- Figure 3: North America TDM Reagents Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America TDM Reagents Revenue (million), by Types 2024 & 2032

- Figure 5: North America TDM Reagents Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America TDM Reagents Revenue (million), by Country 2024 & 2032

- Figure 7: North America TDM Reagents Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America TDM Reagents Revenue (million), by Application 2024 & 2032

- Figure 9: South America TDM Reagents Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America TDM Reagents Revenue (million), by Types 2024 & 2032

- Figure 11: South America TDM Reagents Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America TDM Reagents Revenue (million), by Country 2024 & 2032

- Figure 13: South America TDM Reagents Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe TDM Reagents Revenue (million), by Application 2024 & 2032

- Figure 15: Europe TDM Reagents Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe TDM Reagents Revenue (million), by Types 2024 & 2032

- Figure 17: Europe TDM Reagents Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe TDM Reagents Revenue (million), by Country 2024 & 2032

- Figure 19: Europe TDM Reagents Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa TDM Reagents Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa TDM Reagents Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa TDM Reagents Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa TDM Reagents Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa TDM Reagents Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa TDM Reagents Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific TDM Reagents Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific TDM Reagents Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific TDM Reagents Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific TDM Reagents Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific TDM Reagents Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific TDM Reagents Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global TDM Reagents Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global TDM Reagents Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global TDM Reagents Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global TDM Reagents Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global TDM Reagents Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global TDM Reagents Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global TDM Reagents Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global TDM Reagents Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global TDM Reagents Revenue million Forecast, by Country 2019 & 2032

- Table 41: China TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific TDM Reagents Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TDM Reagents?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the TDM Reagents?

Key companies in the market include Shanghai Transnovo, Roche, Beckman Coulter, Abbott, Thermo Fisher Scientific, Siemens Healthineers, Bio-Rad Laboratories, bioMerieux, Chromsystems Instruments, Randox Laboratories, Sekisui Medical, Biotree, Chromai, Beijing Diagreat Biotechnologies, Purspec, Calibra, SCIEX, Shimadzu, ARK Diagnostics.

3. What are the main segments of the TDM Reagents?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TDM Reagents," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TDM Reagents report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TDM Reagents?

To stay informed about further developments, trends, and reports in the TDM Reagents, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence