Key Insights

The United Kingdom luxury goods market, projected at £18.08 billion in 2025, is set for considerable expansion, forecasting a compound annual growth rate (CAGR) of 2.29% from 2025 to 2033. This growth trajectory is underpinned by several key drivers: a burgeoning affluent demographic with elevated disposable income; the UK's established prominence as a global epicentre for luxury retail, attracting a diverse consumer base; the burgeoning e-commerce landscape and sophisticated omnichannel strategies enhancing product accessibility; and a discernible shift towards experiential luxury and personalized services.

United Kingdom Luxury Goods Market Market Size (In Billion)

Despite promising growth, the market navigates headwinds. Economic volatility, inflationary pressures, and geopolitical uncertainties may impact consumer expenditure. The pervasive issue of counterfeit goods presents a substantial risk to brand integrity and revenue. Brands must meticulously balance exclusivity with digital adaptation, prioritizing robust online brand protection and exceptional customer journeys. Market segmentation highlights consistent demand in apparel and accessories, with notable growth potential in jewelry and watches reflecting evolving consumer tastes. The definitive trend towards digital channels underscores the imperative of a strong online presence for all market participants.

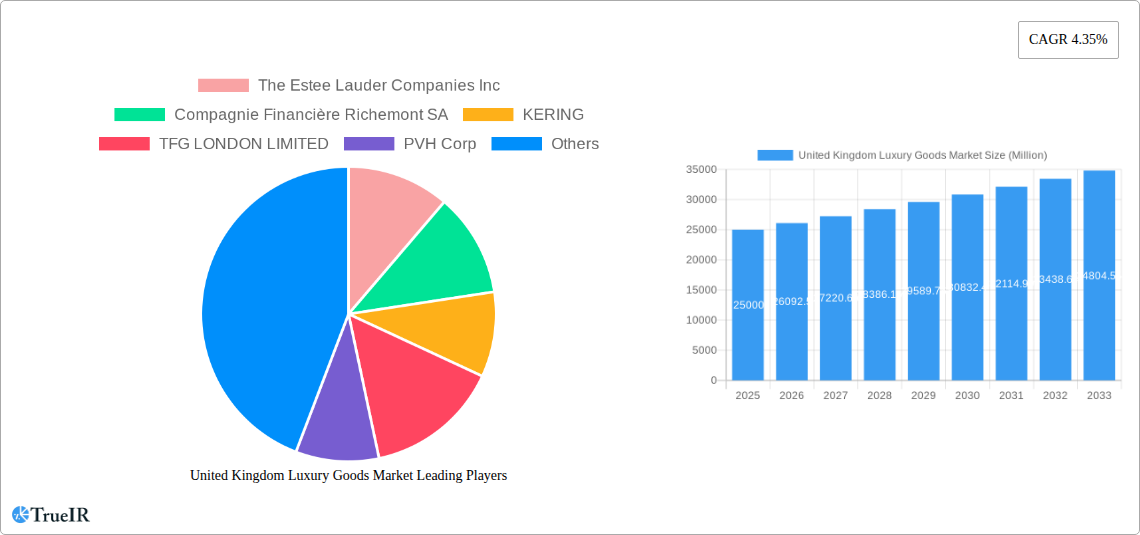

United Kingdom Luxury Goods Market Company Market Share

United Kingdom Luxury Goods Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the United Kingdom luxury goods market, offering invaluable insights for businesses, investors, and industry professionals. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. We forecast market trends from 2025 to 2033, analyzing historical data from 2019 to 2024. This report leverages high-impact keywords to ensure maximum visibility in online searches.

United Kingdom Luxury Goods Market Market Structure & Competitive Landscape

The UK luxury goods market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Key players include The Estée Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL, and CHANEL.

- Innovation Drivers: Technological advancements in materials, manufacturing, and personalized experiences are driving innovation. Sustainability initiatives, such as Burberry's commitment to sustainable materials, are also gaining prominence.

- Regulatory Impacts: Brexit and evolving trade regulations impact import/export dynamics and pricing. Consumer protection laws influence product safety and labeling.

- Product Substitutes: The market faces competition from mid-range brands offering comparable aesthetics at lower price points. This pressure is especially felt in the clothing and apparel segment.

- End-User Segmentation: The market caters to diverse demographics, including high-net-worth individuals, younger luxury consumers, and tourists. Market segmentation by age, income, and lifestyle is crucial for targeted marketing.

- M&A Trends: The past five years have witnessed xx Million in M&A activity, primarily driven by consolidation efforts among smaller players and expansion into new product categories. Future M&A activity is expected to focus on brands with strong digital presence and sustainable practices.

United Kingdom Luxury Goods Market Market Trends & Opportunities

The UK luxury goods market is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Growth is fueled by several factors:

- Rising Disposable Incomes: Increased affluence among high-net-worth individuals and the growing middle class fuels demand for luxury goods.

- E-commerce Expansion: The online luxury market is experiencing rapid growth, driven by improved digital infrastructure and increased consumer adoption of online shopping platforms.

- Experiential Retail: Luxury brands are increasingly focusing on creating immersive brand experiences to engage consumers beyond mere transactions.

- Personalization and Customization: Consumers are demanding personalized experiences and customized products, prompting brands to offer tailored services and bespoke items.

- Sustainability and Ethical Sourcing: Growing consumer awareness of environmental and social issues is driving demand for ethically sourced and sustainable luxury goods.

- Shifting Consumer Preferences: Younger generations are shaping preferences towards unique styles, functionality and sustainability, leading to innovation in designs and materials.

Market penetration rates vary significantly across segments, with online sales showing the highest growth, while traditional channels maintain relevance among older luxury consumers.

Dominant Markets & Segments in United Kingdom Luxury Goods Market

The London region dominates the UK luxury goods market, accounting for xx% of total revenue in 2024. Within product segments, Clothing and Apparel, followed by Bags and Watches, remain the most significant revenue generators.

By Type:

- Clothing and Apparel: Dominates the market due to high demand for designer clothing and premium fabrics. Growth driven by evolving fashion trends and increasing consumer spending on apparel.

- Bags: Strong growth potential driven by demand for designer handbags and luggage. High-end brands leverage brand heritage and craftsmanship to maintain market share.

- Watches: High-value segment characterized by strong brand loyalty and increasing demand for smart watches with luxury features.

- Jewelry: Sustained demand from affluent customers, but growth impacted by economic fluctuations. Growth in eco-conscious materials expected.

- Footwear: Growth closely linked to apparel trends. Increased demand for premium and comfortable footwear.

- Other Accessories: Includes scarves, sunglasses, belts, and other fashion accessories, contributing steadily to market revenue.

By Distribution Channel:

- Single-brand Stores: Maintain strong brand identity and control over customer experience.

- Multi-brand Stores: Offer a wider selection of brands and cater to diverse consumer preferences.

- Online Stores: Show rapid growth driven by increased digital penetration and convenience.

- Other Distribution Channels: Includes department stores, pop-up shops, and wholesale distribution.

Key Growth Drivers:

- Strong Tourism: London's position as a global tourism hub drives demand for luxury goods among international visitors.

- High Consumer Confidence: A robust economy and high consumer confidence foster spending on luxury items.

- Strong Brand Equity: Established luxury brands benefit from high brand recognition and loyalty.

United Kingdom Luxury Goods Market Product Analysis

The UK luxury goods market showcases continuous innovation, with brands focusing on technological integration, sustainability, and personalization. Advancements in materials science have produced lighter, more durable, and environmentally friendly products. Digital technologies enhance the customer experience through personalized recommendations, virtual try-on tools, and immersive retail experiences. Brands are increasingly emphasizing storytelling and brand heritage to create emotional connections with consumers.

Key Drivers, Barriers & Challenges in United Kingdom Luxury Goods Market

Key Drivers:

- Rising disposable incomes fuel demand for luxury goods.

- Technological advancements enable personalized experiences and sustainable production.

- Government initiatives promoting tourism and luxury retail further boost growth.

Key Challenges:

- Economic uncertainty: Economic downturns can significantly impact consumer spending on luxury goods.

- Supply chain disruptions: Global supply chain issues can increase costs and delay product delivery.

- Intense competition: The market's competitive landscape demands continuous innovation and strategic agility.

- Counterfeit products: The prevalence of counterfeit goods undermines brand authenticity and impacts revenue. The estimated financial loss due to counterfeits in 2024 is xx Million.

Growth Drivers in the United Kingdom Luxury Goods Market Market

The UK luxury market is propelled by a combination of economic prosperity, evolving consumer preferences, and technological advancements. Rising disposable incomes among high-net-worth individuals drive demand, while evolving consumer preferences towards sustainable and personalized products drive innovation. Technological advancements in e-commerce and immersive retail experiences enhance brand engagement and sales.

Challenges Impacting United Kingdom Luxury Goods Market Growth

Significant challenges include economic uncertainty impacting consumer spending, supply chain vulnerabilities leading to increased costs and delays, and intensifying competition requiring continuous innovation. The rise of counterfeit goods poses a serious threat to brand authenticity and revenue generation.

Key Players Shaping the United Kingdom Luxury Goods Market Market

- The Estée Lauder Companies Inc

- Compagnie Financière Richemont SA

- KERING

- TFG LONDON LIMITED

- PVH Corp

- Ralph Lauren Corporation

- L'OREAL

- LVMH Moët Hennessy Louis Vuitton

- MAX MARA SRL

- CHANEL

Significant United Kingdom Luxury Goods Market Industry Milestones

- September 2021: Estée Lauder launched a new collection of luxury perfumes featuring ScentCapture Fragrance Extender technology, extending fragrance longevity.

- April 2020: Burberry released a sustainable collection made from cutting-edge materials, demonstrating commitment to environmental responsibility.

- January 2020: Versace opened a new flagship store in London, expanding its retail presence in the UK market.

Future Outlook for United Kingdom Luxury Goods Market Market

The UK luxury goods market is poised for sustained growth driven by increasing affluence, technological innovation, and evolving consumer preferences. Strategic opportunities exist in personalized experiences, sustainable luxury, and leveraging e-commerce to expand market reach. The market's potential is significant, with substantial growth projected in the coming years.

United Kingdom Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

United Kingdom Luxury Goods Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Luxury Goods Market Regional Market Share

Geographic Coverage of United Kingdom Luxury Goods Market

United Kingdom Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Beauty and Personal Care Products

- 3.4. Market Trends

- 3.4.1. Rising Affinity for Vegan Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KERING

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TFG LONDON LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PVH Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ralph Lauren Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'OREAL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LVMH Moët Hennessy Louis Vuitton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAX MARA SRL*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CHANEL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: United Kingdom Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: United Kingdom Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: United Kingdom Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Luxury Goods Market?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the United Kingdom Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL*List Not Exhaustive, CHANEL.

3. What are the main segments of the United Kingdom Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Natural and Organic Formulations.

6. What are the notable trends driving market growth?

Rising Affinity for Vegan Leather Goods.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Beauty and Personal Care Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Estée Lauder launched a new collection of luxury perfumes, featuring the brand's exclusive technology - ScentCapture Fragrance Extender which allows the fragrance to last for aroundnd 12 hours after a single application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Luxury Goods Market?

To stay informed about further developments, trends, and reports in the United Kingdom Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence