Key Insights

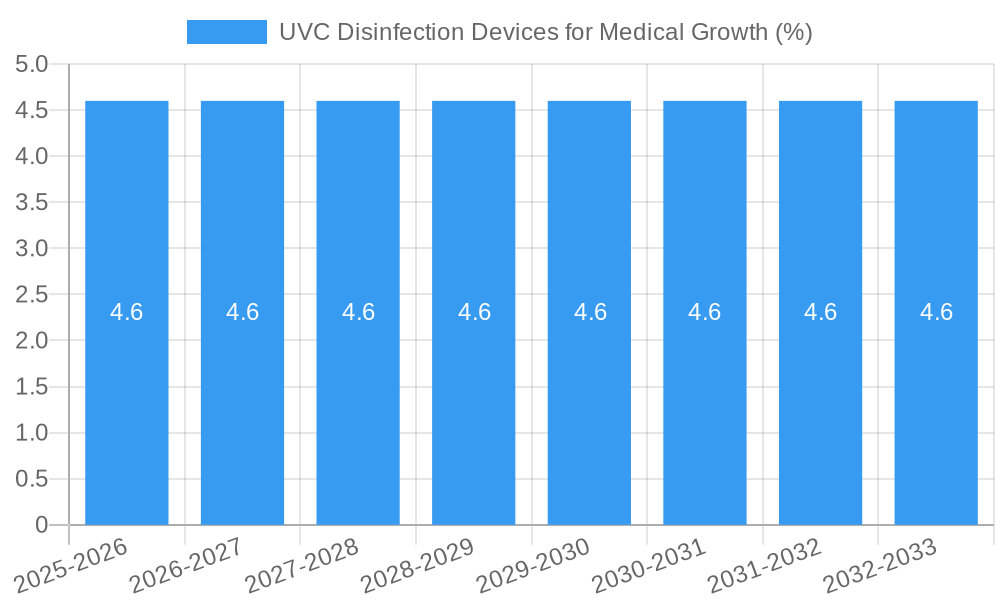

The global UVC Disinfection Devices for Medical market is poised for significant growth, projected to reach approximately $9 million by 2025 and expand further at a Compound Annual Growth Rate (CAGR) of 4.6% through 2033. This upward trajectory is primarily fueled by an increasing global emphasis on infection control and prevention, especially in healthcare settings. The COVID-19 pandemic has undeniably accelerated the adoption of UVC disinfection technologies as a critical tool in combating the spread of infectious diseases, leading to heightened demand from hospitals and clinics. Furthermore, advancements in UVC technology, including the development of more efficient and safer devices like UVC disinfection robots and advanced UVC lamps, are continuously expanding the market's potential. The growing awareness among healthcare providers and institutions about the efficacy of UVC in eliminating a broad spectrum of pathogens, including bacteria, viruses, and fungi, acts as a strong catalyst for market expansion.

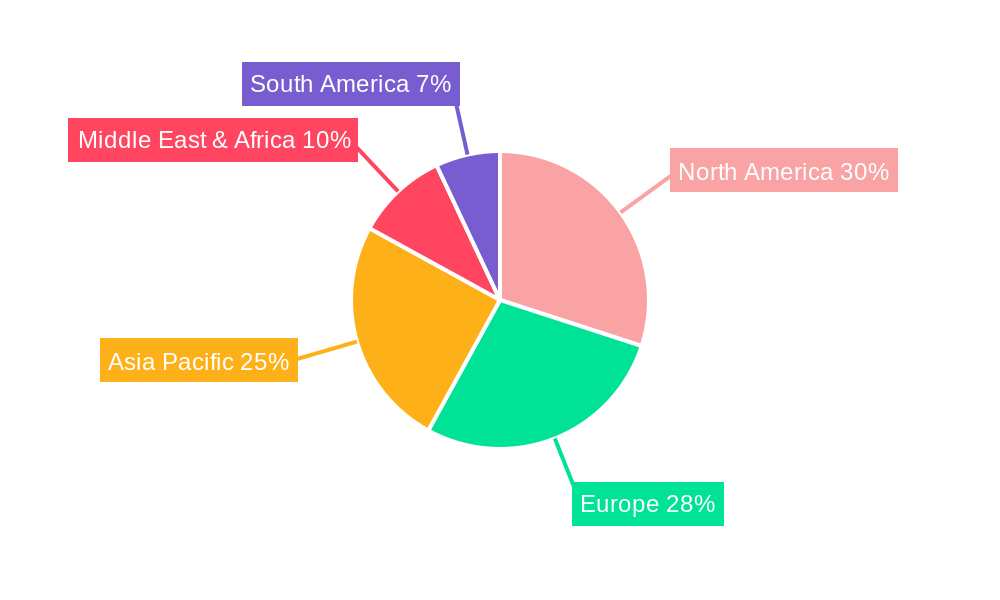

Looking ahead, the market is expected to be driven by the continuous innovation in UVC device types and applications. The diversification of UVC disinfection solutions, ranging from portable UVC boxes for smaller medical equipment to autonomous disinfection robots capable of sanitizing entire hospital rooms, caters to a wider array of healthcare needs. While the market is robust, potential restraints may include the initial investment cost of advanced UVC systems and the need for proper training and adherence to safety protocols during operation. However, the long-term benefits of enhanced patient safety, reduced healthcare-associated infections (HAIs), and improved operational efficiency are expected to outweigh these challenges. Regionally, North America and Europe are anticipated to remain dominant markets due to strong healthcare infrastructure and proactive adoption of advanced medical technologies. Asia Pacific, with its rapidly expanding healthcare sector and increasing investments in public health, is projected to exhibit the highest growth rate.

Here is a dynamic, SEO-optimized report description for UVC Disinfection Devices for Medical, designed for immediate use and enhanced search visibility.

UVC Disinfection Devices for Medical: Market Analysis, Trends, and Forecast 2019–2033

This comprehensive report offers an in-depth analysis of the global UVC Disinfection Devices for Medical market, providing critical insights into its structure, competitive landscape, current trends, and future trajectory. Driven by an escalating need for advanced infection control solutions in healthcare settings, the market is witnessing rapid innovation and expansion. This study covers the historical period from 2019 to 2024, with the base and estimated year set at 2025, and projects growth through to 2033. We explore market dynamics, key player strategies, dominant segments, and future opportunities, making it an essential resource for manufacturers, suppliers, investors, and healthcare professionals navigating this vital sector. The market size is projected to reach approximately $5,000 million by 2025, with a robust CAGR of 12.5% anticipated over the forecast period.

UVC Disinfection Devices for Medical Market Structure & Competitive Landscape

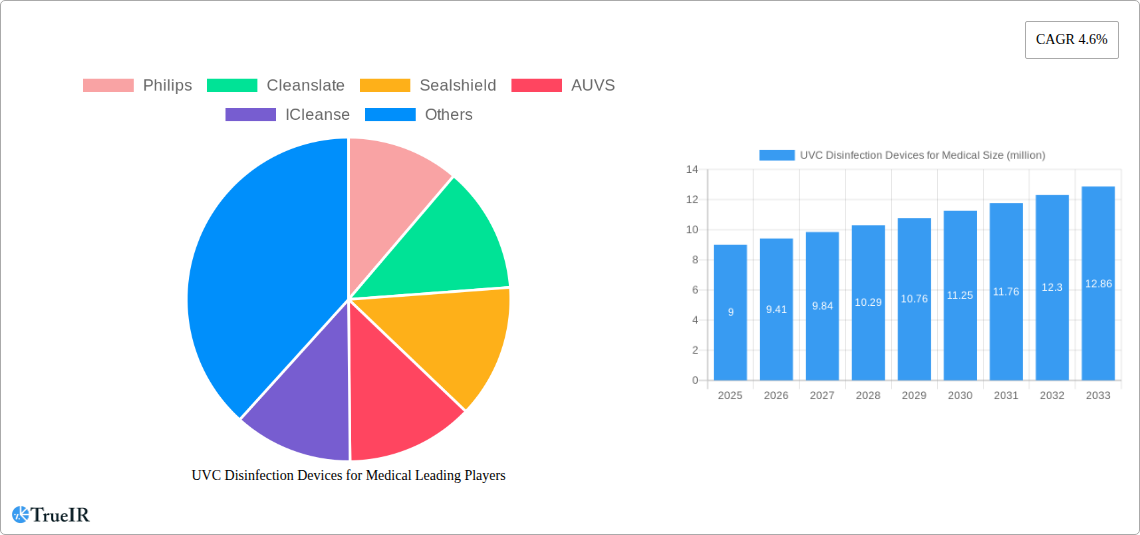

The UVC Disinfection Devices for Medical market is characterized by a moderate to high concentration ratio, with a few key players holding significant market share, while numerous smaller companies compete in niche segments. Innovation drivers are primarily focused on enhancing disinfection efficacy, improving device portability and usability, and developing integrated smart technologies. Regulatory impacts, such as evolving healthcare facility standards and government initiatives for infection prevention, play a crucial role in shaping market entry and product development. Product substitutes include traditional chemical disinfectants and other UV-based technologies, though UVC offers distinct advantages in speed and chemical-free operation. The end-user segmentation is dominated by hospitals, followed by clinics. Mergers and acquisition (M&A) trends are on the rise as larger companies seek to consolidate their market position and acquire innovative technologies. Approximately 15 M&A deals were observed in the historical period, signaling increasing consolidation. The market’s ongoing growth is intrinsically linked to its ability to adapt to these dynamic forces.

UVC Disinfection Devices for Medical Market Trends & Opportunities

The global UVC Disinfection Devices for Medical market is experiencing significant growth, projected to reach approximately $15,000 million by 2033. This expansion is fueled by a heightened global awareness of infectious diseases and the critical need for effective sterilization in healthcare environments. Technological shifts are central to this growth, with advancements in lamp efficiency, device automation, and the integration of AI for intelligent disinfection protocols. The market penetration rate for UVC devices in hospitals is currently estimated at 35%, with substantial room for further adoption. Consumer preferences are increasingly leaning towards non-chemical, rapid disinfection methods, making UVC solutions highly attractive. Competitive dynamics are intensifying, with companies like Philips, Xenex, and Tru-D SmartUVC leading the charge in innovation and market reach. Opportunities abound for companies focusing on developing cost-effective, user-friendly, and highly efficient UVC devices, particularly for ambulatory surgical centers and long-term care facilities, which represent emerging segments with significant growth potential. The market is also seeing increased investment in robotic UVC disinfection, offering autonomous and comprehensive room sterilization, further driving market penetration and setting new benchmarks for healthcare hygiene. The estimated market size for 2025 is $5,000 million, growing at a CAGR of 12.5%.

Dominant Markets & Segments in UVC Disinfection Devices for Medical

The Hospital segment stands as the dominant market force within the UVC Disinfection Devices for Medical sector, driven by the sheer volume of patient interactions, the critical need for stringent infection control, and substantial healthcare infrastructure investments. This segment is expected to account for over 60% of the total market revenue. Key growth drivers include the increasing prevalence of hospital-acquired infections (HAIs), stringent regulatory compliance mandates from bodies like the CDC and WHO, and the adoption of advanced technologies to ensure patient safety.

Application:

- Hospital: The primary market, characterized by high demand for comprehensive room, equipment, and surface disinfection. Growth is spurred by the need to combat multidrug-resistant organisms (MDROs).

- Clinic: A rapidly growing segment, driven by increasing outpatients and the need for efficient disinfection between procedures to maintain patient throughput and safety.

- Others: Encompasses laboratories, pharmaceutical manufacturing, and dental practices, which are adopting UVC technology for specialized sterilization needs.

Types:

- UVC Disinfection Robot: This sub-segment is witnessing exponential growth due to its ability to autonomously disinfect entire rooms, reaching inaccessible areas and reducing manual labor. Estimated growth in this category is 15% annually.

- UVC Disinfection Lamp: Traditional and widely adopted, these lamps are crucial for surface and air disinfection, with ongoing innovations focused on efficacy and safety features.

- UVC Disinfection Box: Ideal for smaller medical instruments and personal protective equipment (PPE), these boxes offer contained and targeted disinfection solutions.

- Others: Includes specialized UVC disinfection solutions for specific medical equipment.

Geographically, North America and Europe are the leading markets, owing to robust healthcare systems, higher healthcare spending, and proactive adoption of advanced medical technologies. Asia-Pacific is emerging as a significant growth region due to rapid healthcare infrastructure development and increasing awareness of infection control.

UVC Disinfection Devices for Medical Product Analysis

Product innovation in the UVC Disinfection Devices for Medical market is characterized by a focus on increased efficacy, faster disinfection cycles, enhanced safety features, and greater portability. Companies are developing devices with advanced sensor technology to ensure optimal UVC dosage and coverage, minimizing exposure risks. The integration of smart capabilities, including app-based control, real-time monitoring, and data logging for compliance, provides a significant competitive advantage. Key applications range from whole-room disinfection by robots to targeted sterilization of instruments and surfaces using lamps and boxes. Competitive advantages are being carved out by devices that offer a superior combination of germicidal efficacy, ease of use, rapid deployment, and cost-effectiveness for healthcare facilities.

Key Drivers, Barriers & Challenges in UVC Disinfection Devices for Medical

Key Drivers: The market is propelled by the escalating global burden of infectious diseases and the persistent threat of hospital-acquired infections (HAIs), driving the demand for advanced, chemical-free disinfection solutions. Technological advancements in UVC-LED technology offer improved efficiency, longevity, and miniaturization of devices. Favorable government policies and increasing healthcare expenditure worldwide also play a crucial role.

Barriers & Challenges: Despite robust growth, the market faces challenges including the initial high cost of advanced UVC devices, which can be a barrier for smaller healthcare facilities. Stringent regulatory approvals and the need for comprehensive validation of disinfection efficacy can slow down market penetration. Public perception and concerns regarding potential health risks associated with UVC exposure, if not managed with proper safety protocols, can also pose a restraint. Supply chain disruptions for critical components, particularly semiconductors, can impact production capacity, with an estimated impact of 5-10% on production timelines.

Growth Drivers in the UVC Disinfection Devices for Medical Market

The growth of the UVC Disinfection Devices for Medical market is primarily driven by the urgent and continuous need for effective infection control in healthcare settings globally. The rising incidence of healthcare-associated infections (HAIs), coupled with the emergence of novel pathogens and antibiotic-resistant bacteria, necessitates superior sterilization methods beyond traditional chemical disinfectants. Technological innovations, particularly in the development of more efficient and safer UVC-LEDs and automated robotic systems, are making UVC disinfection more accessible and effective. Government initiatives and healthcare policy shifts that prioritize patient safety and infection prevention further boost adoption.

Challenges Impacting UVC Disinfection Devices for Medical Growth

Challenges impacting the growth of the UVC Disinfection Devices for Medical market include the significant upfront capital investment required for advanced UVC systems, posing a barrier for smaller healthcare providers with limited budgets. The process of obtaining regulatory approvals and ensuring compliance with evolving international standards can be complex and time-consuming. Furthermore, educating healthcare staff and the public about the safe and effective use of UVC technology, and addressing any residual concerns about UV exposure, remains an ongoing effort. Supply chain vulnerabilities for key components, estimated to impact production by up to 10%, can also create delays and increase costs.

Key Players Shaping the UVC Disinfection Devices for Medical Market

- Philips

- Cleanslate

- Sealshield

- AUVS

- ICleanse

- American Ultraviolet

- Della Group Corporation

- INTERmedic

- KOVER Srl

- LIGHT PROGRESS

- Lumalier

- Steriliz LLC

- UVC Solutions Ltd

- Uvsmart

- Xenex

- Shanghai Huifeng Medical Instrument

- Tru-D SmartUVC

- UVD Robots

Significant UVC Disinfection Devices for Medical Industry Milestones

- 2019: Introduction of advanced UVC-LED disinfection devices offering targeted sterilization.

- 2020: Significant surge in demand for UVC disinfection robots due to the global pandemic, leading to rapid product development and adoption.

- 2021: Launch of smart UVC devices with integrated sensors and data logging for enhanced compliance and efficiency.

- 2022: Increased investment in research and development for automated UVC disinfection solutions for various healthcare settings.

- 2023: Growing market focus on sustainability and energy-efficient UVC disinfection technologies.

Future Outlook for UVC Disinfection Devices for Medical Market

The future outlook for the UVC Disinfection Devices for Medical market is exceptionally strong, driven by an unyielding demand for advanced infection control and continuous technological innovation. The anticipated market size is projected to reach $15,000 million by 2033. Strategic opportunities lie in the development of more affordable, user-friendly, and intelligent UVC solutions tailored for a wider range of healthcare applications, including home healthcare and specialized medical facilities. The integration of AI and IoT for predictive maintenance and optimized disinfection schedules will further enhance market appeal. As global health concerns persist, UVC disinfection is poised to become an indispensable component of modern healthcare infrastructure, ensuring safer environments for patients and staff alike.

UVC Disinfection Devices for Medical Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. UVC Disinfection Box

- 2.2. UVC Disinfection Lamp

- 2.3. UVC Disinfection Robot

- 2.4. Others

UVC Disinfection Devices for Medical Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UVC Disinfection Devices for Medical REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. UVC Disinfection Box

- 5.2.2. UVC Disinfection Lamp

- 5.2.3. UVC Disinfection Robot

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. UVC Disinfection Box

- 6.2.2. UVC Disinfection Lamp

- 6.2.3. UVC Disinfection Robot

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. UVC Disinfection Box

- 7.2.2. UVC Disinfection Lamp

- 7.2.3. UVC Disinfection Robot

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. UVC Disinfection Box

- 8.2.2. UVC Disinfection Lamp

- 8.2.3. UVC Disinfection Robot

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. UVC Disinfection Box

- 9.2.2. UVC Disinfection Lamp

- 9.2.3. UVC Disinfection Robot

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific UVC Disinfection Devices for Medical Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. UVC Disinfection Box

- 10.2.2. UVC Disinfection Lamp

- 10.2.3. UVC Disinfection Robot

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Philips

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cleanslate

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sealshield

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AUVS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ICleanse

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American Ultraviolet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Della Group Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 INTERmedic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KOVER Srl

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LIGHT PROGRESS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lumalier

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Steriliz LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UVC Solutions Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Uvsmart

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Xenex

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Shanghai Huifeng Medical Instrument

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tru-D SmartUVC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 UVD Robots

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Philips

List of Figures

- Figure 1: Global UVC Disinfection Devices for Medical Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global UVC Disinfection Devices for Medical Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America UVC Disinfection Devices for Medical Revenue (million), by Application 2024 & 2032

- Figure 4: North America UVC Disinfection Devices for Medical Volume (K), by Application 2024 & 2032

- Figure 5: North America UVC Disinfection Devices for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America UVC Disinfection Devices for Medical Volume Share (%), by Application 2024 & 2032

- Figure 7: North America UVC Disinfection Devices for Medical Revenue (million), by Types 2024 & 2032

- Figure 8: North America UVC Disinfection Devices for Medical Volume (K), by Types 2024 & 2032

- Figure 9: North America UVC Disinfection Devices for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America UVC Disinfection Devices for Medical Volume Share (%), by Types 2024 & 2032

- Figure 11: North America UVC Disinfection Devices for Medical Revenue (million), by Country 2024 & 2032

- Figure 12: North America UVC Disinfection Devices for Medical Volume (K), by Country 2024 & 2032

- Figure 13: North America UVC Disinfection Devices for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America UVC Disinfection Devices for Medical Volume Share (%), by Country 2024 & 2032

- Figure 15: South America UVC Disinfection Devices for Medical Revenue (million), by Application 2024 & 2032

- Figure 16: South America UVC Disinfection Devices for Medical Volume (K), by Application 2024 & 2032

- Figure 17: South America UVC Disinfection Devices for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America UVC Disinfection Devices for Medical Volume Share (%), by Application 2024 & 2032

- Figure 19: South America UVC Disinfection Devices for Medical Revenue (million), by Types 2024 & 2032

- Figure 20: South America UVC Disinfection Devices for Medical Volume (K), by Types 2024 & 2032

- Figure 21: South America UVC Disinfection Devices for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America UVC Disinfection Devices for Medical Volume Share (%), by Types 2024 & 2032

- Figure 23: South America UVC Disinfection Devices for Medical Revenue (million), by Country 2024 & 2032

- Figure 24: South America UVC Disinfection Devices for Medical Volume (K), by Country 2024 & 2032

- Figure 25: South America UVC Disinfection Devices for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America UVC Disinfection Devices for Medical Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe UVC Disinfection Devices for Medical Revenue (million), by Application 2024 & 2032

- Figure 28: Europe UVC Disinfection Devices for Medical Volume (K), by Application 2024 & 2032

- Figure 29: Europe UVC Disinfection Devices for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe UVC Disinfection Devices for Medical Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe UVC Disinfection Devices for Medical Revenue (million), by Types 2024 & 2032

- Figure 32: Europe UVC Disinfection Devices for Medical Volume (K), by Types 2024 & 2032

- Figure 33: Europe UVC Disinfection Devices for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe UVC Disinfection Devices for Medical Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe UVC Disinfection Devices for Medical Revenue (million), by Country 2024 & 2032

- Figure 36: Europe UVC Disinfection Devices for Medical Volume (K), by Country 2024 & 2032

- Figure 37: Europe UVC Disinfection Devices for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe UVC Disinfection Devices for Medical Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa UVC Disinfection Devices for Medical Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa UVC Disinfection Devices for Medical Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa UVC Disinfection Devices for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa UVC Disinfection Devices for Medical Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa UVC Disinfection Devices for Medical Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa UVC Disinfection Devices for Medical Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa UVC Disinfection Devices for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa UVC Disinfection Devices for Medical Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa UVC Disinfection Devices for Medical Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa UVC Disinfection Devices for Medical Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa UVC Disinfection Devices for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa UVC Disinfection Devices for Medical Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific UVC Disinfection Devices for Medical Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific UVC Disinfection Devices for Medical Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific UVC Disinfection Devices for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific UVC Disinfection Devices for Medical Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific UVC Disinfection Devices for Medical Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific UVC Disinfection Devices for Medical Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific UVC Disinfection Devices for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific UVC Disinfection Devices for Medical Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific UVC Disinfection Devices for Medical Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific UVC Disinfection Devices for Medical Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific UVC Disinfection Devices for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific UVC Disinfection Devices for Medical Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global UVC Disinfection Devices for Medical Volume K Forecast, by Region 2019 & 2032

- Table 3: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 5: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 7: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global UVC Disinfection Devices for Medical Volume K Forecast, by Region 2019 & 2032

- Table 9: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 11: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 13: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global UVC Disinfection Devices for Medical Volume K Forecast, by Country 2019 & 2032

- Table 15: United States UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 23: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 25: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global UVC Disinfection Devices for Medical Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 35: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 37: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global UVC Disinfection Devices for Medical Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 59: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 61: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global UVC Disinfection Devices for Medical Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global UVC Disinfection Devices for Medical Volume K Forecast, by Application 2019 & 2032

- Table 77: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global UVC Disinfection Devices for Medical Volume K Forecast, by Types 2019 & 2032

- Table 79: Global UVC Disinfection Devices for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global UVC Disinfection Devices for Medical Volume K Forecast, by Country 2019 & 2032

- Table 81: China UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific UVC Disinfection Devices for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific UVC Disinfection Devices for Medical Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UVC Disinfection Devices for Medical?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the UVC Disinfection Devices for Medical?

Key companies in the market include Philips, Cleanslate, Sealshield, AUVS, ICleanse, American Ultraviolet, Della Group Corporation, INTERmedic, KOVER Srl, LIGHT PROGRESS, Lumalier, Steriliz LLC, UVC Solutions Ltd, Uvsmart, Xenex, Shanghai Huifeng Medical Instrument, Tru-D SmartUVC, UVD Robots.

3. What are the main segments of the UVC Disinfection Devices for Medical?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 9 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UVC Disinfection Devices for Medical," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UVC Disinfection Devices for Medical report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UVC Disinfection Devices for Medical?

To stay informed about further developments, trends, and reports in the UVC Disinfection Devices for Medical, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence