Key Insights

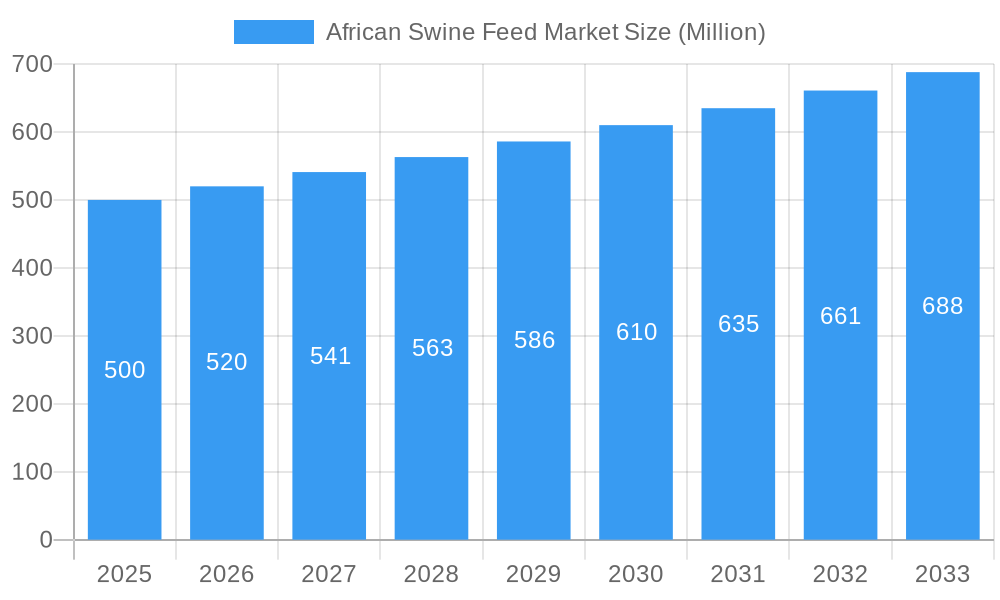

The African swine feed market, valued at approximately $4.32 billion in 2025, is projected for substantial growth at a compound annual growth rate (CAGR) of 3.9% from 2025 to 2033. Key growth drivers include escalating pork demand in Africa, propelled by population increases and rising disposable incomes. Concurrently, the modernization of swine farming, encompassing intensive practices and enhanced feed management, further fuels market expansion. The market is segmented by ingredients (cereals, oilseed meal, oils, molasses) and supplements (antibiotics, vitamins, antioxidants), with cereals anticipated to lead due to their economic viability and nutritional benefits. Growing emphasis on animal health and welfare is also increasing demand for premium feed additives like vitamins and antioxidants, driving the adoption of advanced feed formulations. Prominent players such as Serfco Feeds and Cargill are actively expanding production and innovating feed solutions for African swine farmers.

African Swine Feed Market Market Size (In Billion)

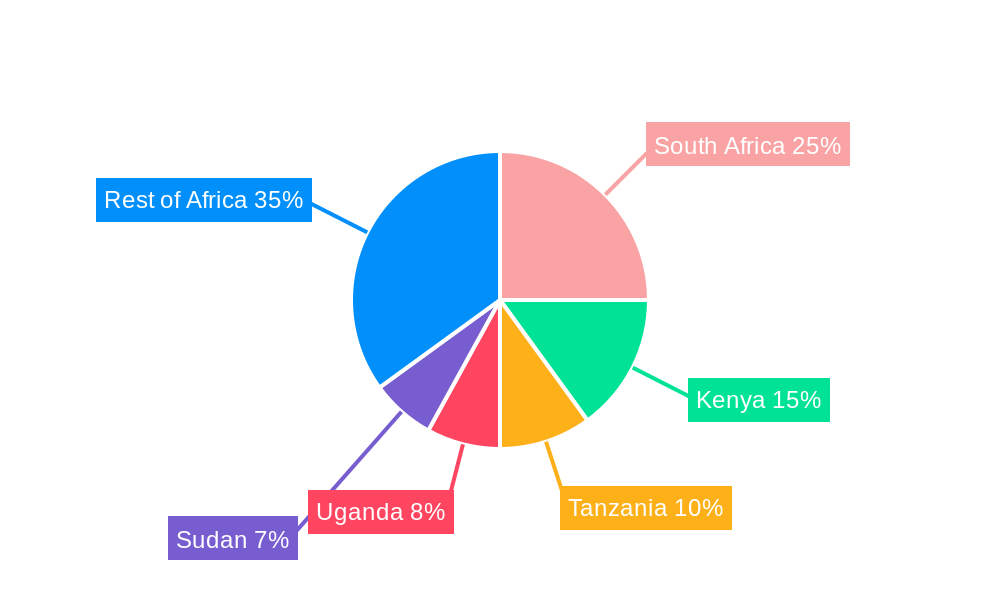

Market constraints include raw material price volatility, particularly for cereals and oilseeds, impacting feed costs. Logistical hurdles and underdeveloped infrastructure in certain African regions can impede efficient feed distribution and create supply chain disruptions. Developing local feed production and improving infrastructure are vital for sustained growth. Significant market segments include South Africa, Kenya, and Tanzania. Future expansion hinges on overcoming these challenges and leveraging opportunities from rising pork demand and evolving swine farming practices across the continent. A focus on sustainable, efficient feed production and R&D for region-specific feed solutions will be crucial for realizing the market's full potential.

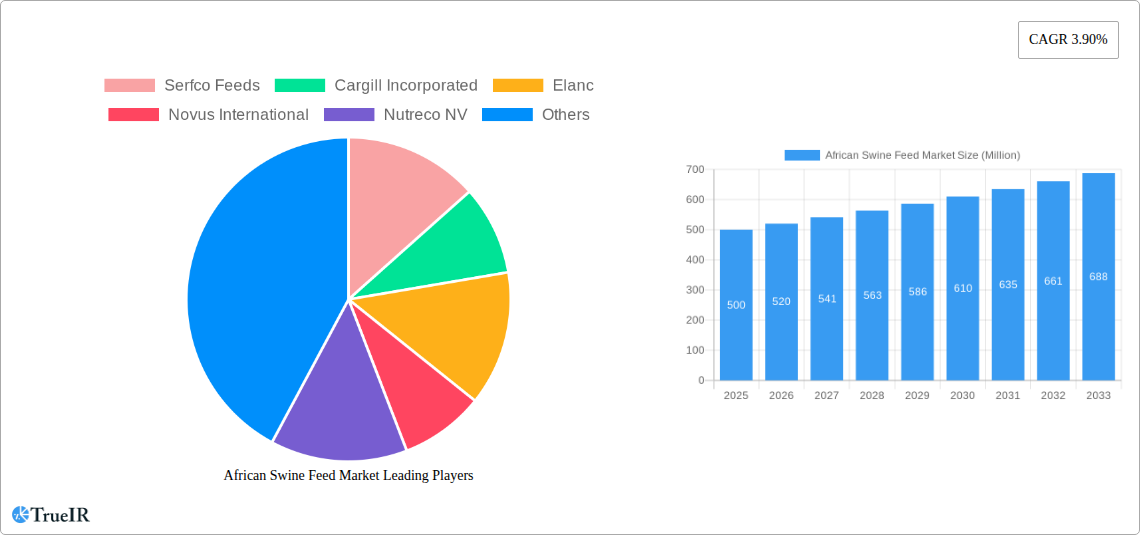

African Swine Feed Market Company Market Share

African Swine Feed Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the African swine feed market, offering invaluable insights for industry stakeholders seeking to capitalize on significant growth opportunities. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive primary and secondary research to deliver a detailed understanding of market size, segmentation, competitive dynamics, and future trends. The market is projected to reach xx Million by 2033, demonstrating substantial growth potential.

African Swine Feed Market Structure & Competitive Landscape

The African swine feed market exhibits a moderately concentrated structure, with key players like Cargill Incorporated, Nutreco NV, and Alltech Inc. holding significant market share. However, the market is also characterized by the presence of numerous smaller, regional players, particularly in niche segments. The market concentration ratio (CR4) is estimated at xx% in 2025.

Innovation Drivers: Technological advancements in feed formulation, including the use of precision nutrition and novel feed additives, are driving market innovation.

Regulatory Impacts: Government regulations regarding feed safety and animal health significantly impact market dynamics. Variations in regulations across African nations create both opportunities and challenges for market participants.

Product Substitutes: While limited, alternative protein sources and feed ingredients are emerging as potential substitutes, exerting subtle pressure on the market.

End-User Segmentation: The market is primarily segmented based on swine farm size (smallholder vs. large-scale commercial farms), influencing feed demand patterns and product specifications.

M&A Trends: The number of mergers and acquisitions in the African swine feed sector has been relatively low in recent years (estimated at xx deals between 2019-2024), but consolidation is anticipated to increase as larger players seek to expand their market presence.

African Swine Feed Market Market Trends & Opportunities

The African swine feed market is experiencing robust growth, driven by factors such as rising pork consumption, increasing investment in swine farming, and favorable government policies promoting livestock production. The market's CAGR from 2025 to 2033 is estimated at xx%. This growth is unevenly distributed across the continent, with certain regions showing higher penetration rates than others. Technological shifts, such as the adoption of automated feed mixing and delivery systems, are improving efficiency and reducing costs within the industry. Consumer preference for high-quality pork is translating into increased demand for premium swine feeds with enhanced nutritional profiles. Intense competition among major players is further driving innovation and improving the overall quality and affordability of swine feed. The market is expected to witness a significant increase in the demand for specialized feeds tailored to specific swine breeds and production stages.

Dominant Markets & Segments in African Swine Feed Market

Leading Regions/Countries: While data varies across the continent due to reporting inconsistencies, xx and xx are currently considered leading regions due to high swine production and investment.

Dominant Segments:

By Ingredient: Cereals (specifically maize and sorghum) constitute the largest segment by ingredient, due to availability and cost-effectiveness. However, the Oilseed meal segment is experiencing notable growth as a protein source.

By Supplement: The Vitamins and Antioxidants segments are experiencing relatively high growth, reflecting the increasing focus on improving animal health and feed efficiency.

Key Growth Drivers (by segment):

- Cereals: Favorable climatic conditions in key agricultural regions and government support for grain production.

- Oilseed Meal: Growing awareness of the benefits of sustainable and high-protein feed ingredients.

- Vitamins: Increased focus on animal health and disease prevention.

- Antioxidants: Demand for enhancing feed stability and nutritional value.

The dominance of specific segments is significantly influenced by factors such as local agricultural production, import costs, and consumer preferences for specific pork quality characteristics.

African Swine Feed Market Product Analysis

Significant innovation focuses on developing specialized feed formulations tailored to different swine breeds and production phases, such as starter, grower, and finisher feeds. These formulations incorporate optimized nutrient ratios and functional additives to maximize growth rates, improve feed efficiency, and enhance overall animal health and welfare. Technological advancements, like the use of advanced feed processing techniques and novel feed ingredients, are enhancing the nutritional value and palatability of swine feeds, leading to a competitive advantage for producers offering premium products.

Key Drivers, Barriers & Challenges in African Swine Feed Market

Key Drivers: Growing demand for pork, increasing investment in commercial swine farming, improving infrastructure in key agricultural regions, and government initiatives promoting livestock production are key drivers. Technological advancements are enhancing efficiency and reducing costs.

Key Challenges: Fluctuations in raw material prices, infrastructural limitations affecting feed distribution, inconsistent regulatory frameworks across different African countries, and competition from substitute protein sources are significant challenges. Disease outbreaks and their impact on swine production pose substantial risks. These challenges have an estimated xx Million negative impact annually on the market.

Growth Drivers in the African Swine Feed Market Market

The market's expansion is driven by increased demand for pork, spurred by a growing population and rising incomes. Government support for the agricultural sector, including investments in infrastructure and technology, further stimulates growth. Additionally, the adoption of advanced feed formulation techniques and improved feed efficiency are significant growth catalysts.

Challenges Impacting African Swine Feed Market Growth

Significant challenges include volatile raw material prices, logistical hurdles hindering efficient feed distribution, and inconsistent regulatory frameworks across various African countries. These factors constrain market expansion and necessitate strategic adjustments from market players. Disease outbreaks, particularly African Swine Fever, pose a significant threat.

Key Players Shaping the African Swine Feed Market Market

Significant African Swine Feed Market Industry Milestones

- 2021: Launch of a new feed formulation by Cargill incorporating locally sourced ingredients.

- 2022: Investment by Nutreco in a new feed mill in xx, boosting production capacity.

- 2023: Implementation of a new feed quality control program by Alltech.

- 2024: A major outbreak of African Swine Fever impacting production in several regions.

Future Outlook for African Swine Feed Market Market

The African swine feed market is poised for continued growth, driven by escalating pork demand, technological progress, and supportive government policies. Strategic partnerships, investment in research and development, and expansion into underserved markets present lucrative opportunities for market players. Addressing challenges related to raw material price volatility, disease outbreaks, and infrastructure limitations is crucial for sustaining long-term growth.

African Swine Feed Market Segmentation

-

1. Ingredient

- 1.1. Cereals

- 1.2. Cereals By Product

- 1.3. Oilseed Meal

- 1.4. Molasses

- 1.5. Other Ingredients

-

2. Supplement

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Enzymes

- 2.5. Acidifiers

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Rest of South Africa

African Swine Feed Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Rest of South Africa

African Swine Feed Market Regional Market Share

Geographic Coverage of African Swine Feed Market

African Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Rising Swine Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Cereals

- 5.1.2. Cereals By Product

- 5.1.3. Oilseed Meal

- 5.1.4. Molasses

- 5.1.5. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Supplement

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Enzymes

- 5.2.5. Acidifiers

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Rest of South Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Rest of South Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Cereals

- 6.1.2. Cereals By Product

- 6.1.3. Oilseed Meal

- 6.1.4. Molasses

- 6.1.5. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Supplement

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Enzymes

- 6.2.5. Acidifiers

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Rest of South Africa

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. Egypt African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Cereals

- 7.1.2. Cereals By Product

- 7.1.3. Oilseed Meal

- 7.1.4. Molasses

- 7.1.5. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Supplement

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Enzymes

- 7.2.5. Acidifiers

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Rest of South Africa

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Rest of South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Cereals

- 8.1.2. Cereals By Product

- 8.1.3. Oilseed Meal

- 8.1.4. Molasses

- 8.1.5. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Supplement

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Enzymes

- 8.2.5. Acidifiers

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Rest of South Africa

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Serfco Feeds

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cargill Incorporated

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elanc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Novus International

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nutreco NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Alltech Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Novafeeds

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemin Industries Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Serfco Feeds

List of Figures

- Figure 1: African Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: African Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 2: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 3: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: African Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 7: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 10: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 11: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 14: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 15: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Swine Feed Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the African Swine Feed Market?

Key companies in the market include Serfco Feeds, Cargill Incorporated, Elanc, Novus International, Nutreco NV, Alltech Inc, Novafeeds, Kemin Industries Inc.

3. What are the main segments of the African Swine Feed Market?

The market segments include Ingredient, Supplement, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Rising Swine Production Drives the Market.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Swine Feed Market?

To stay informed about further developments, trends, and reports in the African Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence