Key Insights

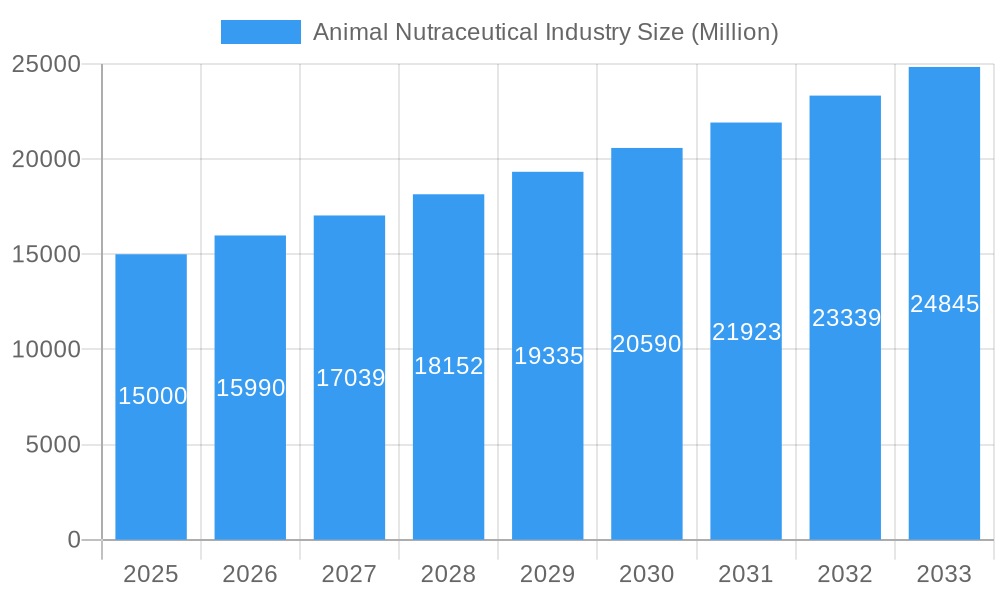

The global animal nutraceutical market is experiencing robust growth, projected to reach a significant value within the forecast period (2025-2033). A CAGR of 6.20% indicates a consistently expanding market driven by several key factors. Increasing pet ownership worldwide, coupled with a rising awareness of pet health and wellness, fuels demand for products enhancing animal immunity, digestion, and overall well-being. The growing humanization of pets, leading pet owners to seek premium and specialized nutrition, further contributes to market expansion. This trend is evident across various segments, including milk bioactives, omega-3 fatty acids, probiotics, proteins and peptides, and vitamins and minerals, catering to specific animal health needs. The market is also segmented by pet type (cats, dogs, and others) and distribution channels (convenience stores, online channels, specialty stores, supermarkets/hypermarkets, and others), showcasing diverse avenues for market penetration. Major players like ADM, Nestle (Purina), and Mars Incorporated are driving innovation and expanding product portfolios, solidifying their market positions. While potential restraints like fluctuating raw material prices and stringent regulatory approvals exist, the overall market outlook remains positive, underpinned by consistent consumer demand and ongoing technological advancements in animal nutrition.

Animal Nutraceutical Industry Market Size (In Billion)

The market's segmentation offers diverse growth opportunities. The increasing popularity of functional foods and supplements for pets is pushing the demand for specialized nutraceuticals, such as those addressing joint health, cognitive function, and allergy management. Online channels are experiencing rapid growth, reflecting evolving consumer preferences and providing convenient access to a wider range of products. Geographical variations in market penetration exist, with developed economies currently dominating, yet emerging markets present substantial untapped potential fueled by increasing pet ownership and rising disposable incomes. Future growth will be shaped by continuous innovation in product formulations, expanding distribution networks, and an evolving understanding of animal nutritional needs. Strategic partnerships and mergers and acquisitions are expected to further reshape the competitive landscape.

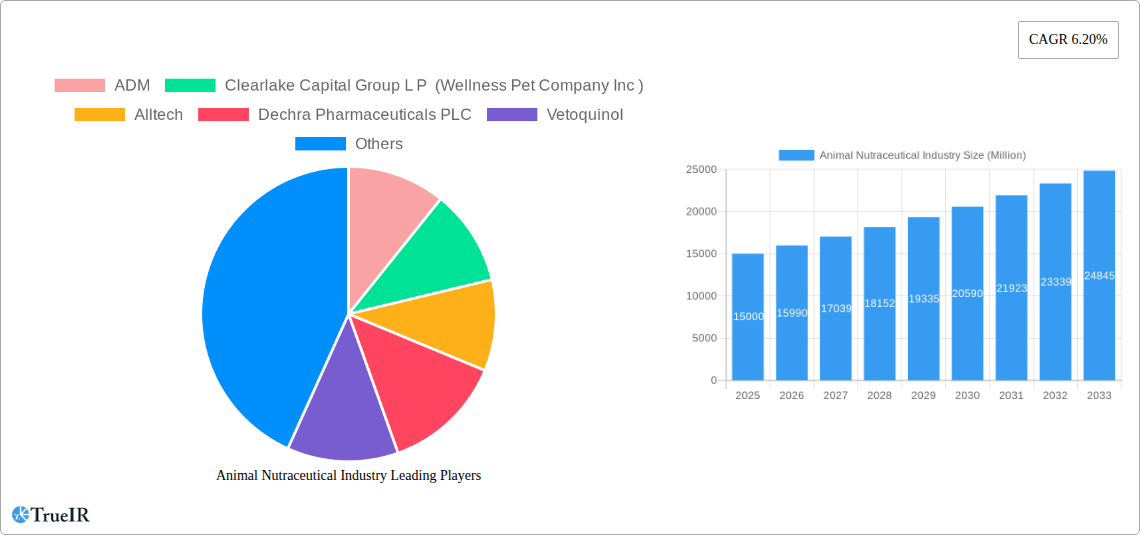

Animal Nutraceutical Industry Company Market Share

Animal Nutraceutical Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global animal nutraceutical industry, encompassing market size, trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. The market is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Animal Nutraceutical Industry Market Structure & Competitive Landscape

The animal nutraceutical market is characterized by a moderately concentrated structure, with several multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for the industry is estimated at xx, indicating a moderately competitive landscape. Key players include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, and Virbac. Innovation is a crucial driver, with companies continuously developing new products to cater to evolving pet owner preferences and address specific health concerns. Regulatory frameworks vary across regions, impacting product approvals and market access. Product substitutes, such as traditional veterinary medicines, exist, but the growing awareness of the benefits of nutraceuticals is fueling market growth.

- Market Concentration: Moderately concentrated, with a HHI of xx.

- Innovation Drivers: Development of novel functional ingredients, targeted formulations, and improved delivery systems.

- Regulatory Impacts: Varying regulations across geographies impact market entry and product approval processes.

- Product Substitutes: Traditional veterinary medicines pose some level of competition.

- End-User Segmentation: Dominated by dogs and cats, with growing demand from other companion animals.

- M&A Trends: Increasing M&A activity reflects the industry's consolidation and expansion trends. The volume of M&A deals in the last five years is estimated at xx.

Animal Nutraceutical Industry Market Trends & Opportunities

The animal nutraceutical market is experiencing robust and dynamic growth, fueled by a confluence of evolving consumer attitudes and technological progress. The profound trend of pet humanization, coupled with a global surge in pet ownership, is a primary catalyst for market expansion. Modern pet parents increasingly view their animals as integral family members, leading to a heightened emphasis on their health and well-being. This translates into a soaring demand for premium pet food formulations and specialized supplements designed to optimize animal vitality. Concurrently, significant advancements in ingredient sourcing, sophisticated formulation techniques, and innovative delivery methods are paving the way for the development of more potent, targeted, and user-friendly products. The digital landscape is also playing a pivotal role, with the online sales channel witnessing exponential growth, reflecting shifting consumer purchasing habits and providing unparalleled access to a diverse array of specialized products. The competitive arena is characterized by a relentless pursuit of innovation, strategic brand building, and the expansion of robust distribution networks.

- Market Size Growth: The global animal nutraceutical market is projected to reach an impressive $XX Billion by 2033, showcasing a substantial upward trajectory from an estimated $XX Billion in 2024.

- Technological Shifts: Cutting-edge advancements in areas such as precision ingredient extraction, advanced encapsulation technologies, and the development of targeted delivery systems are significantly enhancing the efficacy and bioavailability of nutraceutical products.

- Consumer Preferences: A pronounced shift in consumer demand towards premium, naturally derived, and functional nutraceutical products specifically formulated to address various health and wellness needs is a key growth driver.

- Competitive Dynamics: The market is marked by intense competition, with established industry leaders and agile emerging companies vying for market share through continuous product differentiation, strategic branding, and aggressive market penetration strategies.

Dominant Markets & Segments in Animal Nutraceutical Industry

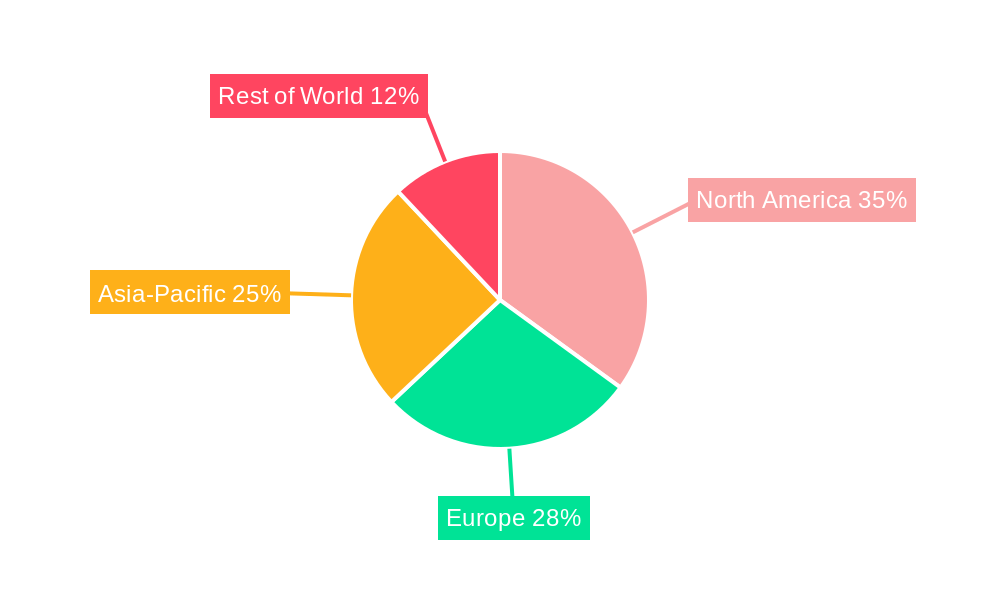

North America currently commands the largest share of the global animal nutraceutical market, closely followed by the European region. Within product segments, vitamins and minerals consistently lead in market share, owing to widespread consumer understanding of their fundamental roles in maintaining animal health. Probiotics are also experiencing significant growth due to increasing awareness of their benefits for gut health and immunity. Dogs represent the most substantial end-user segment, driving a significant portion of demand, with cats following closely. The primary distribution channels are dominated by supermarkets/hypermarkets and specialized pet stores, offering convenient access for consumers.

- Key Growth Drivers:

- North America: Characterized by exceptionally high pet ownership rates, robust consumer spending on pet healthcare, and well-established, efficient distribution networks.

- Europe: Fueled by a rising trend in pet ownership, growing consumer consciousness regarding optimal pet nutrition, and stringent regulatory frameworks that ensure high product quality and safety standards.

- Vitamins & Minerals: Their well-established and widely recognized health benefits, coupled with their seamless integration into a vast array of pet food and supplement products, solidify their dominant position.

- Probiotics: Mounting scientific evidence substantiating their critical role in promoting digestive health and bolstering the immune system is driving increasing adoption and demand.

- Dogs: As the largest pet population segment globally, dogs are the primary drivers of demand for specialized nutraceutical products tailored to their unique health requirements.

- Supermarkets/Hypermarkets: Their extensive retail footprint and unparalleled convenience for pet owners make them a crucial distribution channel for a wide range of animal nutraceutical products.

Animal Nutraceutical Industry Product Analysis

The animal nutraceutical landscape is witnessing an exciting wave of product innovation. This includes the development of functional foods with superior bioavailability, precisely targeted formulations designed to address specific health conditions (such as joint health, cognitive function, or immune support), and the introduction of user-friendly delivery systems like palatable chewable tablets, convenient liquids, and even topical applications. These innovations are primarily focused on meeting specialized pet health needs while simultaneously enhancing palatability to ensure consistent pet acceptance. A key competitive advantage in this segment is derived from the successful integration of demonstrable efficacy, superior palatability, and effortless delivery systems. Continuous advancements in sophisticated ingredient extraction methodologies and cutting-edge formulation processes are consistently elevating the quality, potency, and overall effectiveness of these products.

Key Drivers, Barriers & Challenges in Animal Nutraceutical Industry

Key Drivers: The sustained growth of the animal nutraceutical industry is propelled by several powerful factors: the continuously expanding global pet population, an increase in discretionary income among pet owners, heightened consumer awareness and education regarding the benefits of preventative pet healthcare, and significant technological advancements in product formulation, ingredient efficacy, and innovative delivery systems. Furthermore, supportive government initiatives aimed at promoting animal welfare and public health also contribute positively to market expansion.

Barriers & Challenges: The industry faces several significant hurdles that can impede growth. These include navigating complex and stringent regulatory approval processes for new products, susceptibility to fluctuating raw material prices which can impact production costs, and intense competition among a growing number of established and emerging players. Additionally, ongoing consumer concerns and a need for greater education regarding the verifiable efficacy and long-term safety of certain nutraceutical products can pose challenges. Unforeseen supply chain disruptions can also lead to production delays and elevated operational costs. The estimated impact of persistent supply chain issues on overall market growth is approximately xx%.

Growth Drivers in the Animal Nutraceutical Industry Market

Technological advancements leading to better product formulations and delivery methods, increasing pet ownership, rising consumer awareness of animal health, and favorable government regulations contribute significantly to the growth of the animal nutraceutical market. Increased disposable income further fuels this trend.

Challenges Impacting Animal Nutraceutical Industry Growth

The animal nutraceutical industry is navigating a complex terrain shaped by persistent challenges. Stringent regulatory frameworks governing product approvals can lead to extended market entry timelines. Fluctuations in raw material prices, often exacerbated by supply chain vulnerabilities, directly impact manufacturing costs and profitability. The market is also characterized by intense competition among a diverse array of players, necessitating continuous innovation and strategic differentiation. Moreover, consumer skepticism and a demand for transparent, evidence-based efficacy and safety data for nutraceutical products remain critical factors influencing market adoption and overall growth.

Key Players Shaping the Animal Nutraceutical Industry Market

- ADM

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- Alltech

- Dechra Pharmaceuticals PLC

- Vetoquinol

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- Nutramax Laboratories Inc

- Virbac

Significant Animal Nutraceutical Industry Industry Milestones

- April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific, boosting product innovation in the region.

- April 2023: Vafo Praha, s.r.o. expanded its Scandinavian presence by acquiring a majority stake in Lupus Foder AB.

- May 2023: Virbac expanded its reach in the Czech Republic and Slovakia by acquiring its distributor, GS Partners, establishing its 35th subsidiary.

Future Outlook for Animal Nutraceutical Industry Market

The animal nutraceutical market is poised for continued growth, driven by increasing pet ownership, rising consumer spending on pet health, and ongoing technological innovations. Strategic partnerships, product diversification, and expansion into emerging markets will present significant opportunities for market players. The market's future is bright, with substantial potential for expansion and further market penetration.

Animal Nutraceutical Industry Segmentation

-

1. Sub Product

- 1.1. Milk Bioactives

- 1.2. Omega-3 Fatty Acids

- 1.3. Probiotics

- 1.4. Proteins and Peptides

- 1.5. Vitamins and Minerals

- 1.6. Other Nutraceuticals

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Animal Nutraceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Nutraceutical Industry Regional Market Share

Geographic Coverage of Animal Nutraceutical Industry

Animal Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Milk Bioactives

- 5.1.2. Omega-3 Fatty Acids

- 5.1.3. Probiotics

- 5.1.4. Proteins and Peptides

- 5.1.5. Vitamins and Minerals

- 5.1.6. Other Nutraceuticals

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. North America Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 6.1.1. Milk Bioactives

- 6.1.2. Omega-3 Fatty Acids

- 6.1.3. Probiotics

- 6.1.4. Proteins and Peptides

- 6.1.5. Vitamins and Minerals

- 6.1.6. Other Nutraceuticals

- 6.2. Market Analysis, Insights and Forecast - by Pets

- 6.2.1. Cats

- 6.2.2. Dogs

- 6.2.3. Other Pets

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Channel

- 6.3.3. Specialty Stores

- 6.3.4. Supermarkets/Hypermarkets

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Sub Product

- 7. South America Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 7.1.1. Milk Bioactives

- 7.1.2. Omega-3 Fatty Acids

- 7.1.3. Probiotics

- 7.1.4. Proteins and Peptides

- 7.1.5. Vitamins and Minerals

- 7.1.6. Other Nutraceuticals

- 7.2. Market Analysis, Insights and Forecast - by Pets

- 7.2.1. Cats

- 7.2.2. Dogs

- 7.2.3. Other Pets

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Channel

- 7.3.3. Specialty Stores

- 7.3.4. Supermarkets/Hypermarkets

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Sub Product

- 8. Europe Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 8.1.1. Milk Bioactives

- 8.1.2. Omega-3 Fatty Acids

- 8.1.3. Probiotics

- 8.1.4. Proteins and Peptides

- 8.1.5. Vitamins and Minerals

- 8.1.6. Other Nutraceuticals

- 8.2. Market Analysis, Insights and Forecast - by Pets

- 8.2.1. Cats

- 8.2.2. Dogs

- 8.2.3. Other Pets

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Channel

- 8.3.3. Specialty Stores

- 8.3.4. Supermarkets/Hypermarkets

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Sub Product

- 9. Middle East & Africa Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 9.1.1. Milk Bioactives

- 9.1.2. Omega-3 Fatty Acids

- 9.1.3. Probiotics

- 9.1.4. Proteins and Peptides

- 9.1.5. Vitamins and Minerals

- 9.1.6. Other Nutraceuticals

- 9.2. Market Analysis, Insights and Forecast - by Pets

- 9.2.1. Cats

- 9.2.2. Dogs

- 9.2.3. Other Pets

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Channel

- 9.3.3. Specialty Stores

- 9.3.4. Supermarkets/Hypermarkets

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Sub Product

- 10. Asia Pacific Animal Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 10.1.1. Milk Bioactives

- 10.1.2. Omega-3 Fatty Acids

- 10.1.3. Probiotics

- 10.1.4. Proteins and Peptides

- 10.1.5. Vitamins and Minerals

- 10.1.6. Other Nutraceuticals

- 10.2. Market Analysis, Insights and Forecast - by Pets

- 10.2.1. Cats

- 10.2.2. Dogs

- 10.2.3. Other Pets

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Channel

- 10.3.3. Specialty Stores

- 10.3.4. Supermarkets/Hypermarkets

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Sub Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alltech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dechra Pharmaceuticals PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nestle (Purina)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vafo Praha s r o

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nutramax Laboratories Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Animal Nutraceutical Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 3: North America Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 4: North America Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 5: North America Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 6: North America Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 11: South America Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 12: South America Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 13: South America Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 14: South America Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 19: Europe Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 20: Europe Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 21: Europe Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 22: Europe Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Europe Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 27: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 28: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 29: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 30: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Sub Product 2025 & 2033

- Figure 35: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Sub Product 2025 & 2033

- Figure 36: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Pets 2025 & 2033

- Figure 37: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Pets 2025 & 2033

- Figure 38: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Animal Nutraceutical Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Animal Nutraceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 2: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 3: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 6: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 7: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 13: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 14: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 20: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 21: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 33: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 34: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 43: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Pets 2020 & 2033

- Table 44: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Animal Nutraceutical Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Animal Nutraceutical Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Nutraceutical Industry?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the Animal Nutraceutical Industry?

Key companies in the market include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, Virba.

3. What are the main segments of the Animal Nutraceutical Industry?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, which became Virbac's 35th subsidiary. This new subsidiary allows Virbac to expand its presence more in these countries.April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.April 2023: Vafo Praha, s.r.o. partnered with the Swedish wholesaler of pet food products, Lupus Foder AB. Under this partnership, VAFO got the majority stake in Lupus Foder, thus expanding its position in Scandinavia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Animal Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence