Key Insights

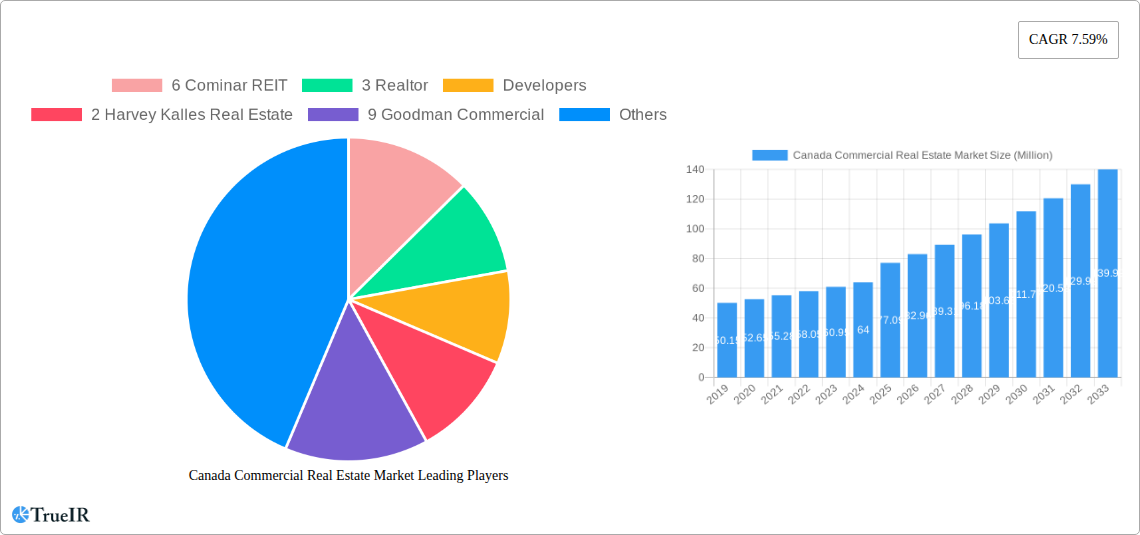

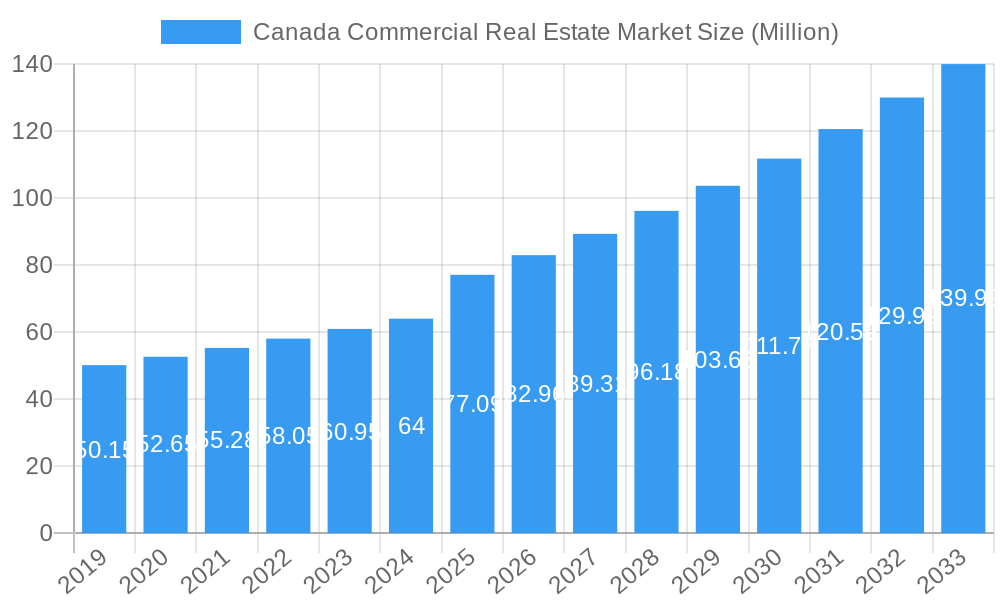

The Canadian Commercial Real Estate (CRE) market is poised for significant expansion, projected to reach an estimated market size of approximately CAD 77.09 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.59% through 2033. This growth is fueled by a confluence of dynamic economic factors, including increasing foreign investment, robust population growth driving demand for office and multi-family spaces, and a steady recovery in sectors like retail and hospitality. The industrial segment, particularly logistics and warehousing, is experiencing a surge driven by e-commerce expansion and supply chain optimization. Key urban centers such as Toronto, Vancouver, and Montreal are leading this charge, attracting substantial investment and development. The market is characterized by a diverse range of participants, from established REITs and developers to emerging startups and brokerage firms, all vying for a share of the expanding CRE landscape. This competitive environment fosters innovation in property management, sustainability initiatives, and the adoption of proptech solutions, further propelling market dynamism.

Canada Commercial Real Estate Market Market Size (In Million)

Despite the optimistic outlook, the Canadian CRE market faces certain headwinds that could temper growth. Rising interest rates and inflation present a significant restrain, potentially impacting investment appetite and increasing the cost of capital for new developments and acquisitions. Furthermore, evolving work-from-home policies continue to shape the demand for traditional office spaces, necessitating adaptation and re-imagining of these assets to incorporate flexible work arrangements and enhanced amenities. Regulatory changes and environmental, social, and governance (ESG) compliance requirements also add layers of complexity for market players. However, these challenges are also fostering new opportunities. The demand for sustainable and energy-efficient buildings is on the rise, presenting a significant trend for developers and investors focused on the future. The resilience of the industrial sector, coupled with the sustained demand for multi-family housing, provides a strong foundation for continued market buoyancy. Strategic investment in high-growth segments and adaptation to evolving tenant needs will be critical for success in this vibrant Canadian CRE market.

Canada Commercial Real Estate Market Company Market Share

This comprehensive report provides an unparalleled deep dive into the dynamic Canada Commercial Real Estate Market. Leveraging high-volume keywords such as "Canadian commercial property," "office space Toronto," "industrial real estate Vancouver," "multi-family housing Canada," "retail market trends," and "investment opportunities Canada," this analysis is meticulously crafted to enhance SEO rankings and engage a broad spectrum of industry professionals, including investors, developers, brokers, and corporate real estate decision-makers. With a study period spanning 2019 to 2033, a base year of 2025, and a detailed forecast period from 2025 to 2033, this report offers actionable insights and strategic foresight into one of North America's most robust property markets.

Canada Commercial Real Estate Market Market Structure & Competitive Landscape

The Canada Commercial Real Estate Market exhibits a moderately concentrated structure, characterized by the presence of established institutional investors and a growing number of agile developers and specialized firms. Key innovation drivers include the adoption of proptech for enhanced building management, sustainable development practices to meet ESG mandates, and flexible workspace solutions responding to evolving tenant demands. Regulatory impacts, while varying by province, generally focus on zoning laws, environmental standards, and tenant protection, influencing development feasibility and operational costs. Product substitutes are emerging in the form of co-working spaces and conversion of underutilized traditional assets, pushing market players to innovate. End-user segmentation reveals strong demand in the industrial and multi-family sectors, driven by e-commerce growth and housing shortages respectively. The office segment is undergoing a transformation driven by hybrid work models, while retail continues its adaptation to omnichannel strategies. Mergers & Acquisitions (M&A) trends are notable, with a 15% increase in deal volume observed in the historical period (2019-2024) as larger entities seek consolidation and scale. Concentration ratios for the top five players in specific segments, such as industrial and office, hover around 35-40%, indicating room for smaller players and niche specialization.

Canada Commercial Real Estate Market Market Trends & Opportunities

The Canada Commercial Real Estate Market is poised for significant growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by a confluence of favorable economic conditions, demographic shifts, and evolving business needs. Technological advancements are revolutionizing how commercial spaces are designed, managed, and utilized. The integration of Artificial Intelligence (AI) in building operations, smart technologies for energy efficiency, and data analytics for tenant behavior prediction are becoming standard. Consumer preferences are shifting towards amenity-rich, sustainable, and well-connected workspaces and residential units, driving demand for modern, high-quality developments.

The industrial sector is experiencing unprecedented demand, propelled by the relentless growth of e-commerce, necessitating modern logistics and warehousing facilities. This has led to a substantial increase in development pipelines and rental rates. The multi-family sector continues its upward trajectory, driven by a persistent housing affordability crisis and a growing preference for rental accommodations, particularly in urban centers. Rental growth in this segment is projected to outpace inflation.

The office market, while facing headwinds from hybrid work, is seeing a bifurcation. Premium, well-located, and amenity-rich office spaces are performing strongly, attracting tenants seeking collaborative environments and employee well-being features. Older, less desirable stock is facing vacancy challenges, creating opportunities for redevelopment and repurposing. The retail sector is increasingly focusing on experiential retail, omnichannel integration, and well-curated tenant mixes in dominant shopping centers and urban high streets.

Market penetration rates for sustainable building certifications are rising, with a target of over 60% of new developments achieving LEED or similar accreditations by 2030. Opportunities abound in the redevelopment of underutilized retail or office assets into mixed-use properties, addressing diverse market needs. Furthermore, the increasing emphasis on ESG (Environmental, Social, and Governance) factors presents significant opportunities for investors and developers focused on sustainable and socially responsible real estate. The Canadian government's commitment to infrastructure development, particularly in major urban centers, will further stimulate commercial real estate activity.

Dominant Markets & Segments in Canada Commercial Real Estate Market

The Canada Commercial Real Estate Market is characterized by the dominance of key urban centers and specific property segments, each driven by unique growth catalysts. Toronto consistently leads in transaction volumes and development activity across most sectors, owing to its status as a major financial hub, diverse economy, and significant population growth. Its robust infrastructure, including extensive public transit networks and international connectivity, underpins its appeal for all commercial property types.

- Office: While facing adaptation challenges, premium office spaces in Toronto and Vancouver remain highly sought after for their prestige and accessibility. Key growth drivers include demand for modern, collaborative workspaces and the flight-to-quality trend.

- Retail: Dominant retail markets are concentrated in Toronto, Vancouver, and Montreal, where consumer spending power is highest. Growth drivers include the evolution towards experiential retail, omnichannel integration, and the development of mixed-use lifestyle centers.

- Industrial: This segment is experiencing explosive growth nationwide, with Toronto, Vancouver, and Calgary leading in demand for logistics and distribution facilities. Key growth drivers include e-commerce expansion, supply chain resilience initiatives, and government investment in infrastructure.

- Multi-family: Toronto, Vancouver, and Montreal are the primary hubs for multi-family investment and development due to high population density and escalating housing costs. Policies supporting rental housing development and increasing urbanization are key growth factors.

- Hospitality: Toronto, Vancouver, and major tourist destinations see the most significant activity. Post-pandemic recovery, international tourism, and business travel are crucial growth drivers.

Montreal and Calgary are emerging as significant secondary markets, offering attractive investment opportunities with robust economic bases and growing populations, particularly in the industrial and multi-family sectors. The Rest of Canada, while offering diversified opportunities, often sees more localized demand patterns influenced by specific industry strengths (e.g., resource sectors in Alberta and Saskatchewan). Government policies promoting urban intensification, foreign investment incentives, and infrastructure upgrades are critical for sustained growth across all key cities.

Canada Commercial Real Estate Market Product Analysis

The Canada Commercial Real Estate Market is witnessing a significant evolution in product offerings, driven by technological advancements and changing end-user demands. Innovations are centered around creating smarter, more sustainable, and adaptable spaces. This includes the integration of Building Information Modeling (BIM) throughout the lifecycle of a property, IoT sensors for real-time environmental monitoring and energy optimization, and sophisticated property management software. Competitive advantages are increasingly derived from a building's ability to offer flexible lease terms, integrated technology solutions, and a focus on occupant well-being. Applications range from highly efficient, automated logistics centers in the industrial segment to amenity-rich, community-focused multi-family developments and adaptive office spaces designed to foster collaboration and hybrid work models.

Key Drivers, Barriers & Challenges in Canada Commercial Real Estate Market

Key Drivers:

- Economic Growth: A stable and growing Canadian economy fuels demand across all commercial real estate segments.

- Population Growth: Robust immigration and natural population increase drive demand for housing (multi-family) and supporting retail and services.

- E-commerce Expansion: The continued surge in online retail necessitates significant growth in industrial and logistics facilities.

- Urbanization: Concentrated population growth in major cities increases demand for all property types.

- Government Investment: Infrastructure projects and supportive policies for development stimulate market activity.

Key Barriers & Challenges:

- Interest Rate Hikes: Higher borrowing costs can dampen investment activity and development feasibility, impacting deal volumes.

- Construction Costs: Escalating material and labor costs can delay or halt projects, impacting supply. For example, a projected 7% increase in construction input costs year-over-year is a significant constraint.

- Regulatory Hurdles: Complex and varying zoning laws, permitting processes, and municipal approvals can create significant delays and increase project expenses.

- Supply Chain Disruptions: Ongoing global supply chain issues can lead to material shortages and project delays, adding uncertainty.

- Economic Uncertainty: Potential recessions or significant economic downturns can reduce tenant demand and investor confidence.

Growth Drivers in the Canada Commercial Real Estate Market Market

The Canada Commercial Real Estate Market is propelled by several interconnected factors. Technological integration is a significant driver, with proptech solutions enhancing operational efficiency and tenant experience. Economic stability and projected GDP growth foster investor confidence and tenant demand. Demographic shifts, particularly continued urbanization and immigration, ensure sustained demand for residential and commercial spaces. Government initiatives focused on infrastructure development, housing affordability, and sustainable building practices create a favorable environment for growth. For instance, planned public transit expansions in major cities directly stimulate demand for office, retail, and multi-family properties in transit-oriented developments.

Challenges Impacting Canada Commercial Real Estate Market Growth

Several challenges pose restraints to the Canada Commercial Real Estate Market. Rising interest rates and tighter credit conditions present a significant headwind for investment and development financing. Labor shortages and escalating costs within the construction industry continue to impact project timelines and profitability. Regulatory complexities across different municipalities and provinces can lead to protracted approval processes and increased project risk. Furthermore, global economic volatility and potential recessions can lead to reduced corporate expansion plans and lower consumer spending, impacting leasing demand and rental income across various segments. Supply chain disruptions, while improving, still pose a risk for material availability and cost.

Key Players Shaping the Canada Commercial Real Estate Market Market

- Cominar REIT

- Realtor

- Developers

- Harvey Kalles Real Estate

- Goodman Commercial

- Amacon

- Pinnacle International

- Brookfield Global Integrated Solutions

- Real Estate Brokerage Firms

- Manulife Real Estate

- Redev Properties*

- Allied REIT**

- WestBank Corp

- Onni Group

- Knights Bridge Development Corp

- Dream Office REIT

- Other Companies (startups associations etc )

- Relogix

- TAG Developments

- Chard Development

- Hausway

- Maxwell Realty*

- Anthem Properties Group Limited

Significant Canada Commercial Real Estate Market Industry Milestones

- June 2023: Prologis, Inc. and Blackstone announced a definitive agreement for Prologis to acquire nearly 14 million square feet of industrial properties from opportunistic real estate funds affiliated with Blackstone for USD 3.1 billion, funded by cash. The acquisition price represents an approximately 4% cap rate in the first year and a 5.75% cap rate when adjusting to today's market rents. This deal underscored the strong investor appetite and valuation trends in the Canadian industrial sector.

- May 2023: An experiential real estate investment trust, VICI Properties Inc., announced that it had signed agreements to buy the real estate assets of Century Casinos, Inc.'s Century Downs Racetrack and Casino in Calgary, Alberta, Century Casino St. Albert in Edmonton, Alberta, and Century Casino St. Albert in St. Albert, Alberta, for a total purchase price of USD 164.7 million. This move demonstrates both their continued drive to grow abroad and their faith in the Canadian gaming industry. They are also excited to assist Century's asset monetization strategy, which will open up new opportunities for their cooperation. This acquisition highlighted the growing diversification within the real estate investment landscape and specific opportunities within the entertainment and hospitality sector.

Future Outlook for Canada Commercial Real Estate Market Market

The Canada Commercial Real Estate Market is projected for sustained and robust growth through the forecast period of 2025–2033. Strategic opportunities lie in the continued expansion of the industrial and multi-family sectors, driven by structural economic trends like e-commerce and urbanization. The office market will continue its transformation, favoring premium, flexible, and sustainable spaces. Emerging opportunities include the adaptive reuse of older assets, the development of green buildings, and the integration of advanced proptech solutions. The market's resilience, coupled with ongoing investment in infrastructure and a favorable immigration policy, positions Canada as an attractive destination for real estate investment. Investors and developers who can navigate evolving tenant needs and embrace sustainable practices are set to benefit significantly from the market's long-term potential.

Canada Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial

- 1.4. Multi-family

- 1.5. Hospitality

-

2. Key Cities

- 2.1. Toronto

- 2.2. Vancouver

- 2.3. Calgary

- 2.4. Ottawa

- 2.5. Montreal

- 2.6. Edmonton

- 2.7. Rest of Canada

Canada Commercial Real Estate Market Segmentation By Geography

- 1. Canada

Canada Commercial Real Estate Market Regional Market Share

Geographic Coverage of Canada Commercial Real Estate Market

Canada Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing

- 3.3. Market Restrains

- 3.3.1. High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Evolution of retail sector driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Multi-family

- 5.1.5. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Toronto

- 5.2.2. Vancouver

- 5.2.3. Calgary

- 5.2.4. Ottawa

- 5.2.5. Montreal

- 5.2.6. Edmonton

- 5.2.7. Rest of Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 Cominar REIT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Realtor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Developers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Harvey Kalles Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 9 Goodman Commercial

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3 Amacon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 4 Pinnacle International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Brookfield Global Integrated Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Real Estate Brokerage Firms

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 Manulife Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 10 Redev Properties*

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Allied REIT**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 2 WestBank Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 1 Onni Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 6 Knights Bridge Development Corp

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Dream Office REIT

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Other Companies (startups associations etc )

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 2 Relogix

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 8 TAG Developments

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 7 Chard Development

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 4 Hausway

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 3 Maxwell Realty*

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 5 Anthem Properties Group Limited

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 6 Cominar REIT

List of Figures

- Figure 1: Canada Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Canada Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Canada Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Real Estate Market?

The projected CAGR is approximately 7.59%.

2. Which companies are prominent players in the Canada Commercial Real Estate Market?

Key companies in the market include 6 Cominar REIT, 3 Realtor, Developers, 2 Harvey Kalles Real Estate, 9 Goodman Commercial, 3 Amacon, 4 Pinnacle International, 1 Brookfield Global Integrated Solutions, Real Estate Brokerage Firms, 1 Manulife Real Estate, 10 Redev Properties*, 7 Allied REIT**List Not Exhaustive, 2 WestBank Corp, 1 Onni Group, 6 Knights Bridge Development Corp, 5 Dream Office REIT, Other Companies (startups associations etc ), 2 Relogix, 8 TAG Developments, 7 Chard Development, 4 Hausway, 3 Maxwell Realty*, 5 Anthem Properties Group Limited.

3. What are the main segments of the Canada Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing.

6. What are the notable trends driving market growth?

Evolution of retail sector driving the market.

7. Are there any restraints impacting market growth?

High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

June 2023: Prologis, Inc. and Blackstone announced a definitive agreement for Prologis to acquire nearly 14 million square feet of industrial properties from opportunistic real estate funds affiliated with Blackstone for USD 3.1 billion, funded by cash. The acquisition price represents an approximately 4% cap rate in the first year and a 5.75% cap rate when adjusting to today's market rents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence