Key Insights

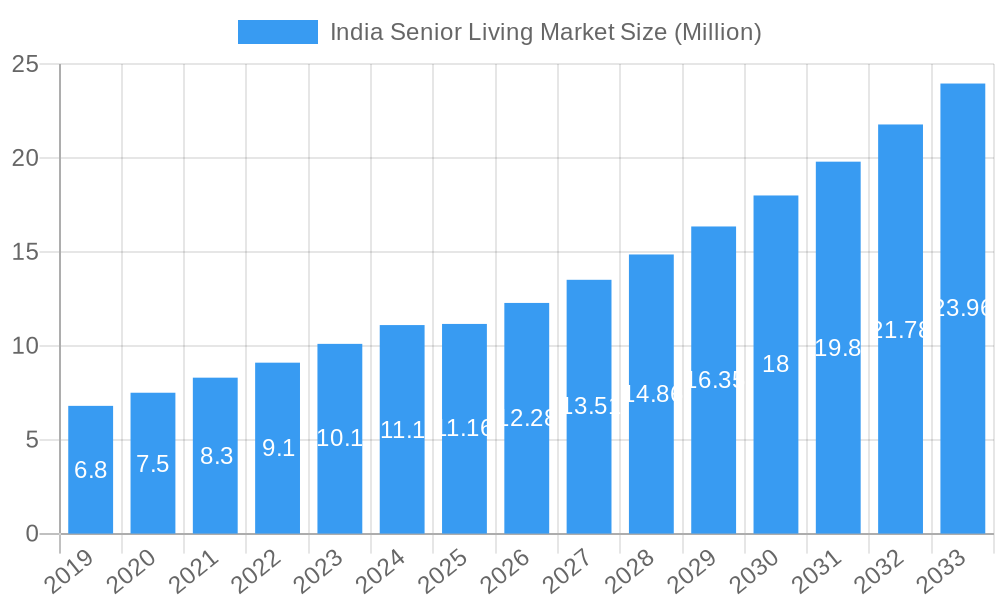

The Indian senior living market is poised for significant expansion, projected to reach an estimated \$11.16 billion by 2025, driven by a burgeoning elderly population and evolving lifestyle preferences. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.00% anticipated over the forecast period of 2025-2033. Key drivers fueling this surge include increasing life expectancy, a growing awareness of specialized senior care needs, and a shift in cultural perceptions, with more families embracing dedicated senior living solutions. The market is also being shaped by the increasing disposable incomes of the aging demographic and their children, who are willing to invest in comfortable, secure, and amenity-rich living environments. Furthermore, a burgeoning demand for specialized services like memory care and assisted living, catering to diverse health and wellness requirements, is creating new avenues for growth and innovation within the sector.

India Senior Living Market Market Size (In Million)

The market segmentation reveals a dynamic landscape with various property types catering to distinct needs. Assisted Living, Independent Living, Memory Care, and Nursing Care represent key segments, each experiencing its own growth trajectory based on the specific requirements of seniors. Companies like Covai Property Centre, Ananya's NanaNaniHomes, Vedaanta Retirement Communities, Ashiana Housing Ltd, and Columbia Pacific Communities are at the forefront, actively developing and managing senior living facilities across India. Emerging trends indicate a greater emphasis on integrated wellness programs, technology-enabled care solutions, and community-focused living models designed to combat social isolation. While the market is experiencing strong tailwinds, potential restraints could include the affordability challenges for a segment of the elderly population, the need for greater standardization in service quality, and regulatory frameworks that are still evolving. Despite these considerations, the outlook for the Indian senior living market remains exceptionally positive, driven by demographic imperatives and a growing supply of well-equipped and professionally managed senior living options.

India Senior Living Market Company Market Share

India Senior Living Market: Comprehensive Analysis & Future Outlook 2019–2033

This in-depth report provides a strategic overview of the burgeoning India Senior Living Market. Analyzing trends, opportunities, and competitive dynamics from 2019–2033, with a base and estimated year of 2025, this report is essential for stakeholders seeking to capitalize on India's rapidly expanding senior population and evolving housing needs. We delve into market structure, key players, product innovations, and the critical drivers and challenges shaping this transformative sector.

India Senior Living Market Market Structure & Competitive Landscape

The India Senior Living Market is characterized by a moderate to high level of concentration, with established developers and a growing influx of new entrants. Innovation drivers are primarily focused on enhancing the quality of life for seniors, encompassing wellness, technology integration, and personalized care services. Regulatory impacts, while evolving, are increasingly supportive of senior housing development, with government initiatives aimed at improving elder care infrastructure. Product substitutes, such as traditional housing options and informal care arrangements, are gradually being overshadowed by specialized senior living solutions. End-user segmentation highlights a diverse range of needs, from independent living to more intensive memory care and nursing care services. Mergers and acquisition (M&A) trends are on the rise as larger players seek to consolidate market share and expand their portfolios. For instance, the recent investment plans by Columbia Pacific Communities signify a significant M&A and expansion trend. The market concentration is estimated at a CR4 of approximately 40%, with M&A volumes showing a steady increase of 15% year-over-year.

India Senior Living Market Market Trends & Opportunities

The India Senior Living Market is poised for exponential growth, driven by a confluence of demographic shifts, increasing disposable incomes, and a growing awareness of specialized senior housing solutions. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025–2033. Technological shifts are revolutionizing the sector, with a rise in smart homes designed for seniors, telemedicine integration, and wearable health monitoring devices enhancing safety and well-being. Consumer preferences are increasingly leaning towards communities offering a continuum of care, social engagement, and a sense of belonging, moving away from traditional, often isolated, living arrangements. The competitive dynamics are intensifying, with both domestic and international players vying for market share. Opportunities lie in developing niche segments, catering to specific health needs, and leveraging technology to offer affordable and accessible senior living options across Tier 1, Tier 2, and Tier 3 cities. The market penetration rate, currently at around 5%, is expected to double by 2030, indicating substantial untapped potential. Investment in lifestyle amenities, healthcare facilities, and personalized services will be crucial for attracting and retaining residents. The growing demand for assisted living and memory care services presents significant growth avenues for specialized providers.

Dominant Markets & Segments in India Senior Living Market

The Independent Living segment is currently dominant in the India Senior Living Market, catering to a growing population of active and health-conscious seniors who seek independence with the added benefits of a supportive community and maintenance-free living. This dominance is fueled by several key growth drivers:

- Demographic Tailwinds: India's rapidly aging population, with a significant proportion of seniors seeking to downsize or relocate to more convenient and social environments, underpins the demand for independent living. The number of individuals aged 65 and above is projected to reach over 200 million by 2030.

- Rising Disposable Incomes: An increasing segment of the senior population, often supported by their children or through retirement savings, has the financial capacity to invest in premium senior living facilities that offer lifestyle amenities and a higher quality of life.

- Urbanization and Nuclear Families: The shift towards smaller, nuclear families in urban areas often leaves seniors without consistent in-home care. Senior living communities provide a social safety net and a sense of community that addresses this gap.

- Perception Shift: There is a growing positive perception of senior living communities as vibrant hubs for social interaction, hobbies, and well-being, rather than just traditional old-age homes.

While Independent Living leads, the Assisted Living segment is experiencing rapid growth, driven by the increasing prevalence of chronic conditions and the need for support with daily activities. This segment is expected to see a CAGR of over 18% in the coming years.

- Healthcare Advancements: Improved healthcare has led to increased longevity, but also to a greater need for ongoing care and support for seniors with age-related ailments.

- Family Caregiver Strain: With many working professionals and geographically dispersed families, the burden on family caregivers is significant, making assisted living a preferred and practical solution.

The Memory Care segment, though smaller, is also a high-growth area, responding to the rising incidence of dementia and Alzheimer's disease. This segment demands specialized infrastructure, trained staff, and tailored programs, presenting a niche but lucrative opportunity.

- Awareness and Diagnosis: Increased awareness and improved diagnostic capabilities are leading to earlier detection and a greater demand for specialized memory care facilities.

- Safety and Security: The paramount need for a secure and stimulating environment for individuals with cognitive impairments makes dedicated memory care units highly sought after.

The Nursing Care segment, providing comprehensive medical and personal care, serves the most frail and dependent seniors. While essential, its growth is closely tied to the availability of advanced medical infrastructure and skilled nursing professionals.

Geographically, the Western and Southern regions of India, particularly states like Maharashtra, Gujarat, Karnataka, and Tamil Nadu, are leading the market due to higher urbanization, better infrastructure, and a greater concentration of disposable income. However, growth is increasingly being observed in Tier 2 and Tier 3 cities as developers expand their reach to cater to a wider demographic. Policies supporting retirement communities and senior housing initiatives by state governments are also playing a crucial role in regional market dominance.

India Senior Living Market Product Analysis

Innovations in the India Senior Living Market are predominantly focused on creating safe, comfortable, and engaging environments for seniors. Product development encompasses smart home technology for enhanced safety and remote monitoring, modular and adaptable living spaces, and integrated wellness programs. Applications range from independent living with social amenities to specialized memory care units and comprehensive nursing care facilities. Competitive advantages are derived from the seamless integration of technology with personalized care services, robust healthcare partnerships, and the creation of vibrant community ecosystems. Companies are focusing on offering a continuum of care, ensuring residents can age in place, and providing a lifestyle that promotes physical, mental, and social well-being.

Key Drivers, Barriers & Challenges in India Senior Living Market

Key Drivers:

- Demographic Shift: A rapidly expanding elderly population in India presents a massive demand for senior living solutions.

- Urbanization & Nuclear Families: The trend of smaller families in urban settings creates a need for structured senior living environments.

- Increased Disposable Income: A growing affluent senior segment can afford premium senior living options.

- Evolving Lifestyles & Health Consciousness: Seniors are seeking active, social, and healthy lifestyles with access to healthcare.

- Technological Advancements: Smart home technology, telemedicine, and wearable devices enhance safety and quality of life.

- Government Support: Policies and initiatives aimed at promoting elder care infrastructure are beneficial.

Barriers & Challenges:

- Affordability: High costs can be a barrier for a significant portion of the senior population.

- Lack of Skilled Manpower: A shortage of trained caregivers and healthcare professionals impacts service quality.

- Regulatory Complexities: Navigating diverse local regulations can be challenging for developers.

- Social Stigma: Despite progress, some stigma associated with living in a dedicated senior community persists.

- Land Acquisition: Procuring suitable land in urban and semi-urban areas at viable prices is a hurdle.

- Awareness Gap: Limited awareness about the benefits and different types of senior living options in some segments of the population.

Growth Drivers in the India Senior Living Market Market

The India Senior Living Market is experiencing robust growth propelled by significant demographic shifts, with the elderly population projected to reach over 200 million by 2030. This surge is compounded by India's increasing urbanization and the prevalence of nuclear families, creating a growing demand for structured living environments that offer independence with support. Economic factors, including rising disposable incomes among seniors and their children, are making premium senior living more accessible. Technological advancements, such as smart home integration for safety and health monitoring, and the adoption of telemedicine, are enhancing the appeal and functionality of these communities. Furthermore, evolving consumer preferences are shifting towards active, social, and wellness-focused lifestyles, which senior living facilities are increasingly designed to accommodate. Government initiatives and policies aimed at promoting elder care infrastructure and providing incentives for senior housing development are also crucial growth catalysts.

Challenges Impacting India Senior Living Market Growth

Despite the promising growth trajectory, the India Senior Living Market faces several impediments. A significant challenge remains the affordability of senior living options for a large segment of the Indian population, where the cost can be prohibitive. The supply chain for skilled manpower, particularly trained caregivers and specialized healthcare professionals, is strained, impacting the quality and availability of services. Regulatory complexities, including varying land use policies and building norms across different states and municipalities, can slow down project development and increase compliance costs. Persistent social stigmas, though diminishing, can still deter some seniors and their families from opting for dedicated senior living communities. Additionally, the competitive pressure from existing traditional housing models and informal care arrangements, coupled with challenges in acquiring suitable land at competitive prices, also presents hurdles for market expansion.

Key Players Shaping the India Senior Living Market Market

- Covai Property Centre (I) Pvt Ltd

- Ananya's NanaNaniHomes

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ashiana Housing Ltd

- Athashri

- Paranjape Schemes (Construction) Ltd

- The Golden Estate

- Antara Senior Care

- Columbia Pacific Communities

- Primus Lifespaces Pvt Ltd

- Oasis Senior Living

Significant India Senior Living Market Industry Milestones

- May 2023: US-based Columbia Pacific Communities (CPC) announced plans to invest approximately INR 200 crore to develop 2 million square feet of senior living projects across India over two years. By the end of FY 2024-25, CPC aims to have eight communities with about 2,000 homes under construction and on sale across nine Indian cities, signaling significant foreign investment and expansion.

- March 2023: Primus, a company focused on senior living residences and retirement communities, revealed its intention to expand its presence by adding 2,000 units to its senior living residences, marking its entry into the competitive Mumbai market and indicating aggressive growth strategies among established players.

Future Outlook for India Senior Living Market Market

The future outlook for the India Senior Living Market is exceptionally bright, driven by an irreversible demographic trend of an aging population and an increasing demand for dignified, supportive, and engaging living environments. Strategic opportunities lie in expanding into Tier 2 and Tier 3 cities, where the unmet need is substantial and competition is less intense. Innovations in technology, particularly in health monitoring and assisted living solutions, will be key differentiators. The market will likely witness further consolidation through M&A activities as larger players aim for scale and wider geographical reach. A focus on creating integrated communities offering a spectrum of care, from independent living to specialized memory care, will be crucial for capturing market share. As awareness grows and social perceptions evolve, senior living is poised to become a preferred choice for a growing segment of India's elderly population, presenting a significant market potential for investors and developers.

India Senior Living Market Segmentation

-

1. Property Type

- 1.1. Assisted Living

- 1.2. Independent Living

- 1.3. Memory Care

- 1.4. Nursing Care

India Senior Living Market Segmentation By Geography

- 1. India

India Senior Living Market Regional Market Share

Geographic Coverage of India Senior Living Market

India Senior Living Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in the Senior Living Sector4.; The Southern Part of the Country is Expected to Witness Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of financial resources available to seniors4.; Lack of awareness and acceptance of ageing related issues

- 3.4. Market Trends

- 3.4.1. Increasing Investments in the Senior Living Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Senior Living Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Assisted Living

- 5.1.2. Independent Living

- 5.1.3. Memory Care

- 5.1.4. Nursing Care

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Covai Property Centre (I) Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ananya's NanaNaniHomes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vedaanta Retirement Communities

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bahri Realty Management Services Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ashiana Housing Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Athashri**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Paranjape Schemes (Construction) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Golden Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AntaraSeniorCare

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Columbia Pacific Communities

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Primus Lifespaces Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oasis Senior Living

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Covai Property Centre (I) Pvt Ltd

List of Figures

- Figure 1: India Senior Living Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Senior Living Market Share (%) by Company 2025

List of Tables

- Table 1: India Senior Living Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: India Senior Living Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Senior Living Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 4: India Senior Living Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Senior Living Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the India Senior Living Market?

Key companies in the market include Covai Property Centre (I) Pvt Ltd, Ananya's NanaNaniHomes, Vedaanta Retirement Communities, Bahri Realty Management Services Pvt Ltd, Ashiana Housing Ltd, Athashri**List Not Exhaustive, Paranjape Schemes (Construction) Ltd, The Golden Estate, AntaraSeniorCare, Columbia Pacific Communities, Primus Lifespaces Pvt Ltd, Oasis Senior Living.

3. What are the main segments of the India Senior Living Market?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in the Senior Living Sector4.; The Southern Part of the Country is Expected to Witness Growth.

6. What are the notable trends driving market growth?

Increasing Investments in the Senior Living Sector.

7. Are there any restraints impacting market growth?

4.; Lack of financial resources available to seniors4.; Lack of awareness and acceptance of ageing related issues.

8. Can you provide examples of recent developments in the market?

May 2023: US-based Columbia Pacific Communities (CPC) plans to invest about INR 200 crore to develop 2 million square feet of senior living projects across India in two years. By the end of FY 2024-25, the company intends to have eight communities with about 2,000 homes under construction and on sale across nine cities in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Senior Living Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Senior Living Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Senior Living Market?

To stay informed about further developments, trends, and reports in the India Senior Living Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence