Key Insights

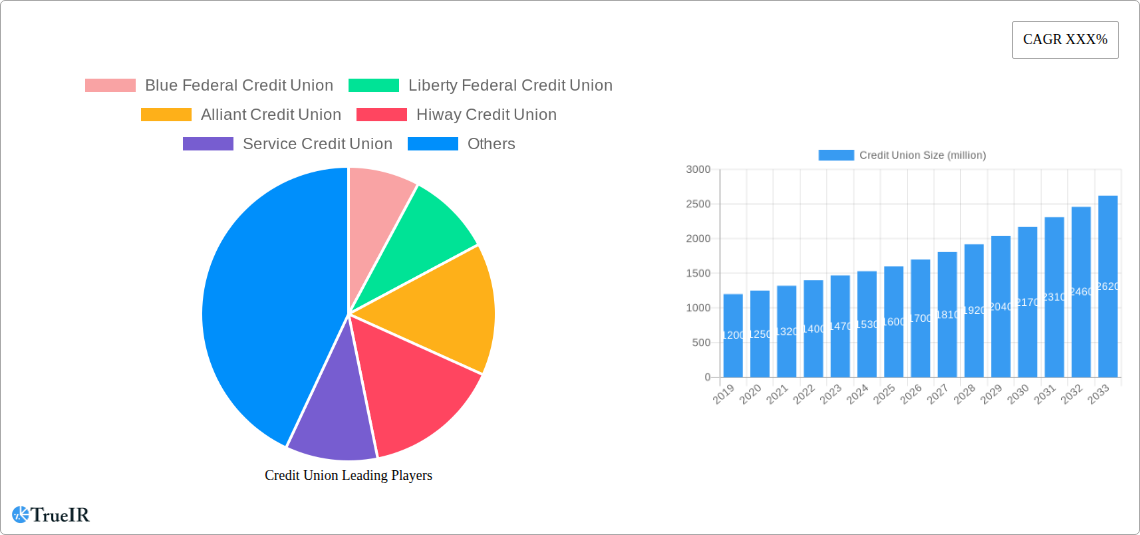

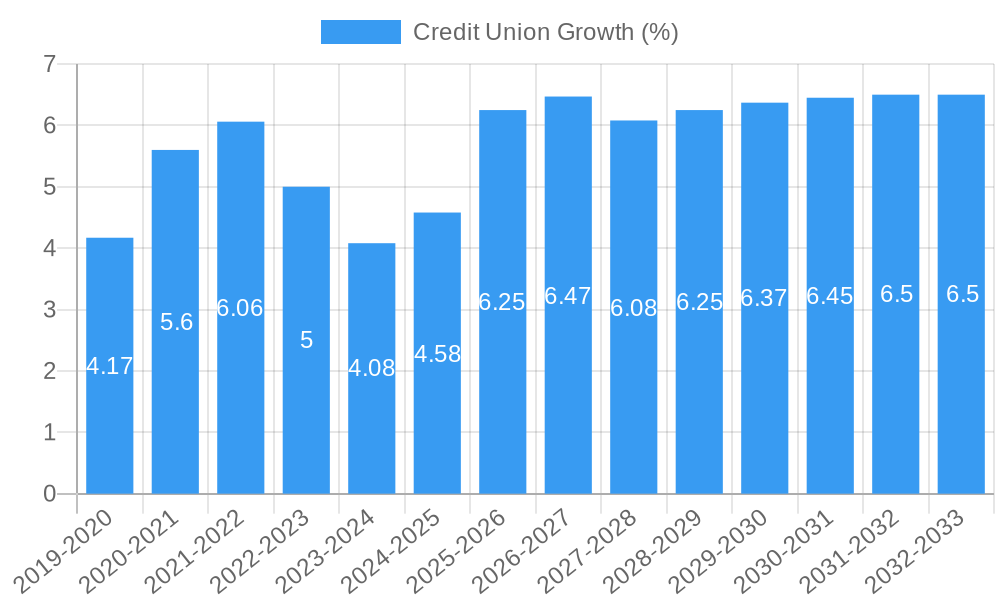

The global credit union market is poised for robust expansion, driven by increasing consumer preference for personalized financial services and community-focused institutions. With an estimated market size of approximately USD 1.5 trillion and a projected Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033, the sector is set to witness significant value appreciation, reaching an estimated USD 2.5 trillion by the end of the forecast period. Key growth drivers include the ongoing digital transformation within credit unions, offering enhanced online and mobile banking experiences that rival traditional banks. Furthermore, a growing awareness of credit unions' member-centric approach, lower fees, and competitive interest rates is attracting both individuals and businesses. The 'Personal' application segment, encompassing savings and checking accounts, credit and debit cards, and personal loans, is expected to remain the dominant force, fueled by consistent demand for everyday financial products.

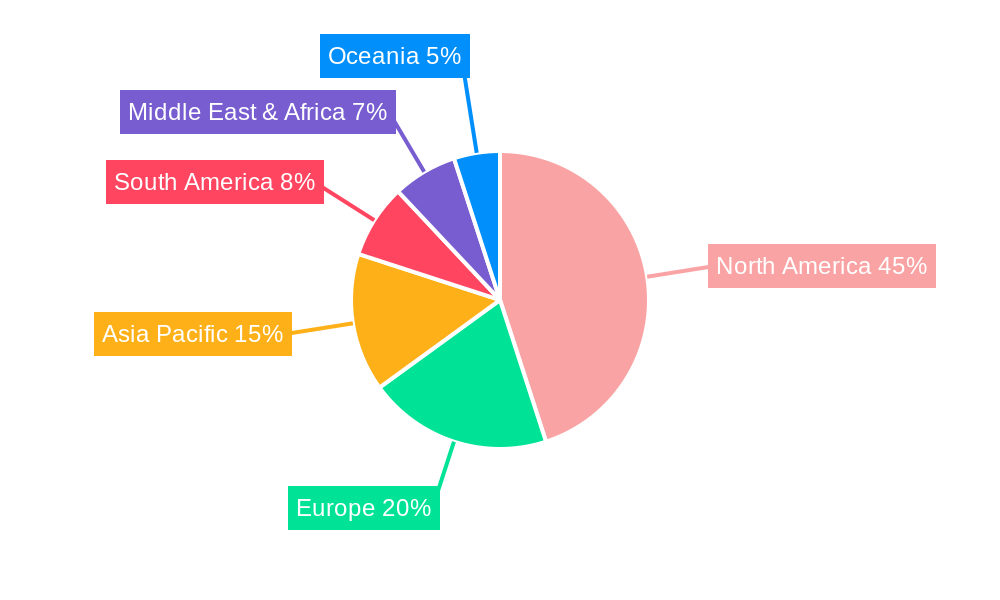

The market is further propelled by a favorable regulatory environment in many regions, supporting credit union growth and stability. Emerging trends such as the integration of advanced fintech solutions, personalized financial advisory services, and a focus on financial inclusion are shaping the competitive landscape. While the market demonstrates strong growth potential, certain restraints, such as intense competition from large incumbent banks and neobanks, and the cost of technological upgrades, need to be strategically managed. The 'Business' segment, encompassing business loans and other financial services tailored for small and medium-sized enterprises, is anticipated to exhibit higher growth rates, reflecting the increasing need for accessible and flexible financing for entrepreneurial ventures. Geographically, North America, with its mature credit union ecosystem, is expected to hold a significant market share, while the Asia Pacific region presents substantial untapped potential for future expansion.

Comprehensive Credit Union Market Analysis: 2019-2033

This in-depth report provides a dynamic, SEO-optimized analysis of the global credit union market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers invaluable insights into market structure, trends, dominant segments, product innovations, key drivers, barriers, and the competitive landscape.

Credit Union Market Structure & Competitive Landscape

The credit union market is characterized by moderate to high concentration, with a significant portion of assets held by a few large national institutions. Innovation drivers are increasingly focused on digital transformation, member experience enhancement, and the integration of advanced financial technologies. Regulatory impacts, while generally supportive of the cooperative model, continue to evolve, influencing operational strategies and compliance costs. Product substitutes, primarily from traditional banks and emerging FinTech companies, pose a constant competitive challenge. End-user segmentation spans personal banking, small and medium-sized businesses, and specialized sponsorship opportunities. Mergers and acquisitions (M&A) activity remains a key trend, with approximately 20-30 significant M&A transactions projected annually during the forecast period, consolidating market share and expanding operational reach. For instance, the top 10 credit unions by asset size, which collectively hold over $2.5 trillion, demonstrate a notable concentration ratio.

Credit Union Market Trends & Opportunities

The global credit union market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2033. This expansion is fueled by a significant shift towards digital banking solutions, with online and mobile banking penetration expected to exceed 85% of the member base by 2028. Consumer preferences are increasingly leaning towards personalized financial advice, ethical banking practices, and community-focused institutions, all core tenets of the credit union model. Technological advancements such as AI-powered chatbots for customer service, blockchain for secure transaction processing, and advanced data analytics for risk assessment are transforming operational efficiencies and member engagement. The competitive dynamics are intensifying, with credit unions actively differentiating themselves through superior member service, competitive rates, and a strong emphasis on financial literacy programs. Opportunities lie in expanding digital offerings, fostering strategic partnerships with FinTech firms, and catering to underserved demographic segments. The market penetration rate for credit union services is projected to reach 30% in developed economies by 2030.

Dominant Markets & Segments in Credit Union

The Personal application segment is demonstrably the dominant force within the credit union market, accounting for an estimated 70% of all transactions and member relationships. Within this segment, Savings and Checking Accounts represent the bedrock, with an estimated $4.2 trillion in combined deposits held by credit unions nationally. Credit and Debit Cards also exhibit strong growth, with annual transaction volumes exceeding $1.5 trillion. Personal Loans are another significant contributor, with an estimated $800 billion in outstanding loan balances. Key growth drivers in this segment include the continued demand for accessible and affordable financial products, particularly for younger generations, and the increasing reliance on digital channels for account management and transactions.

The Business segment, while smaller, is experiencing accelerated growth, with an estimated CAGR of 7% due to credit unions focusing on serving small and medium-sized enterprises (SMEs). Sponsorships, though a niche segment, play a vital role in community engagement and brand building for credit unions, often supporting local events and non-profit organizations. Infrastructure development in digital banking platforms and the implementation of robust cybersecurity measures are critical for sustained growth across all segments. Furthermore, supportive government policies aimed at promoting financial inclusion and supporting community-based financial institutions are creating a favorable environment for expansion.

Credit Union Product Analysis

Credit unions are continuously innovating their product portfolios to remain competitive and meet evolving member needs. Key product innovations include the introduction of enhanced digital onboarding processes, contactless payment solutions, and personalized budgeting tools integrated into mobile banking applications. The application of AI in fraud detection and personalized loan offerings is a significant competitive advantage. Furthermore, credit unions are developing specialized loan products for small businesses and first-time homebuyers, demonstrating strong market fit and a commitment to community economic development. These advancements are crucial for attracting and retaining members in a rapidly changing financial landscape.

Key Drivers, Barriers & Challenges in Credit Union

Key Drivers:

- Technological Advancements: The adoption of digital banking, mobile apps, and AI is enhancing member experience and operational efficiency.

- Economic Stability: Favorable interest rate environments and robust economic conditions generally boost demand for loans and financial services.

- Policy Support: Government initiatives promoting financial inclusion and community reinvestment provide a conducive operating environment.

- Member-Centric Approach: The inherent focus on member well-being and community benefit resonates strongly with a growing segment of consumers.

Key Barriers & Challenges:

- Regulatory Hurdles: Evolving compliance requirements and capital reserve mandates can increase operational costs. Approximately 10-15% of operational expenditure can be attributed to compliance.

- Competitive Pressures: Intense competition from large national banks and agile FinTech companies requires continuous adaptation and investment.

- Digital Transformation Costs: Significant upfront investment is required to upgrade IT infrastructure and develop sophisticated digital platforms.

- Talent Acquisition: Attracting and retaining skilled personnel in areas like cybersecurity and data analytics can be challenging.

Growth Drivers in the Credit Union Market

Key growth drivers in the credit union market are predominantly technological, economic, and regulatory in nature. The ongoing digital transformation, exemplified by the widespread adoption of mobile banking and AI-driven personalized services, is a significant catalyst. Economically, periods of stable interest rates and a growing economy encourage borrowing and saving, directly benefiting credit union operations. Regulatory frameworks that encourage financial inclusion and provide support for cooperative financial institutions also play a crucial role. For example, initiatives like the Community Reinvestment Act in the United States indirectly foster an environment where credit unions can thrive.

Challenges Impacting Credit Union Growth

Several barriers and restraints are impacting credit union growth. Regulatory complexities, including evolving data privacy laws and capital adequacy requirements, can impose significant compliance costs, estimated at 15% of total operating expenses for smaller credit unions. Supply chain issues, particularly in the context of technology procurement and upgrades, can lead to delays and increased costs. Furthermore, intense competitive pressures from large banks offering extensive resources and FinTech companies with rapid innovation cycles necessitate substantial investment in technology and marketing to maintain market share. Quantifiable impacts include increased operational expenditure and potential loss of market share if adaptation is slow.

Key Players Shaping the Credit Union Market

- Blue Federal Credit Union

- Liberty Federal Credit Union

- Alliant Credit Union

- Hiway Credit Union

- Service Credit Union

- First Tech Federal Credit Union

- Navy Federal Credit Union

- Global Credit Union

- Empeople Credit Union

- Pentagon Federal Credit Union

- BCU

- State Employees' Credit Union

- Patelco Credit Union

- Manchester Credit Union

- United Federal Credit Union

- Together Credit Union

- Suncoast Credit Union

- Veridian Credit Union

- VyStar Credit Union

- Sound Credit Union

- Wright-Patt Credit Union

- OneAZ Credit Union

- Redwood Credit Union

- Delta Community Credit Union

- SAFE Credit Union

- Visions Federal Credit Union

- Florida Credit Union

- Idaho Central Credit Union

- Travis Credit Union

- PenFed Credit Union

- BECU

- Digital Federal Credit Union

- Golden 1 Credit Union

- Alaska USA Federal Credit Union

- America First Credit Union

Significant Credit Union Industry Milestones

- 2019: Increased focus on cybersecurity measures following data breaches in the broader financial sector.

- 2020: Rapid adoption of digital services and remote work capabilities due to the global pandemic.

- 2021: Expansion of contactless payment options and peer-to-peer (P2P) transfer services.

- 2022: Heightened investment in AI and machine learning for personalized member experiences and fraud detection.

- 2023: Growing emphasis on Environmental, Social, and Governance (ESG) initiatives within credit union operations.

- 2024: Introduction of more flexible loan products to address economic uncertainties and inflationary pressures.

Future Outlook for Credit Union Market

The future outlook for the credit union market is exceptionally positive, characterized by sustained growth and strategic expansion. Key growth catalysts include the continued digital revolution, with an anticipated $6 trillion in digital transaction volume by 2030, and an increasing consumer demand for ethical and community-focused financial services. Strategic opportunities lie in leveraging data analytics for hyper-personalized offerings, forging partnerships with FinTech innovators to enhance service delivery, and expanding services to underserved populations and small businesses. The market potential is significant, with projections indicating a substantial increase in market share as consumers increasingly favor the member-centric model over traditional banking.

Credit Union Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Business

- 1.3. Sponsorship

-

2. Type

- 2.1. Savings and Checking Accounts

- 2.2. Credit and Debit Cards

- 2.3. Personal and Business Loans

- 2.4. Others

Credit Union Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Credit Union REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Credit Union Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Business

- 5.1.3. Sponsorship

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Savings and Checking Accounts

- 5.2.2. Credit and Debit Cards

- 5.2.3. Personal and Business Loans

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Credit Union Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Business

- 6.1.3. Sponsorship

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Savings and Checking Accounts

- 6.2.2. Credit and Debit Cards

- 6.2.3. Personal and Business Loans

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Credit Union Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Business

- 7.1.3. Sponsorship

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Savings and Checking Accounts

- 7.2.2. Credit and Debit Cards

- 7.2.3. Personal and Business Loans

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Credit Union Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Business

- 8.1.3. Sponsorship

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Savings and Checking Accounts

- 8.2.2. Credit and Debit Cards

- 8.2.3. Personal and Business Loans

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Credit Union Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Business

- 9.1.3. Sponsorship

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Savings and Checking Accounts

- 9.2.2. Credit and Debit Cards

- 9.2.3. Personal and Business Loans

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Credit Union Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Business

- 10.1.3. Sponsorship

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Savings and Checking Accounts

- 10.2.2. Credit and Debit Cards

- 10.2.3. Personal and Business Loans

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Blue Federal Credit Union

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liberty Federal Credit Union

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alliant Credit Union

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hiway Credit Union

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Service Credit Union

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 First Tech Federal Credit Union

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Navy Federal Credit Union

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Global Credit Union

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Empeople Credit Union

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pentagon Federal Credit Union

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BCU

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 State Employees' Credit Union

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Patelco Credit Union

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Manchester Credit Union

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 United Federal Credit Union

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Together Credit Union

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Suncoast Credit Union

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Veridian Credit Union

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 VyStar Credit Union

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Sound Credit Union

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Wright-Patt Credit Union

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 OneAZ Credit Union

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Redwood Credit Union

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Delta Community Credit Union

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 SAFE Credit Union

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Visions Federal Credit Union

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Florida Credit Union

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Idaho Central Credit Union

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Travis Credit Union

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 PenFed Credit Union

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 BECU

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Digital Federal Credit Union

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Golden 1 Credit Union

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Alaska USA Federal Credit Union

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 America First Credit Union

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.1 Blue Federal Credit Union

List of Figures

- Figure 1: Global Credit Union Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Credit Union Revenue (million), by Application 2024 & 2032

- Figure 3: North America Credit Union Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Credit Union Revenue (million), by Type 2024 & 2032

- Figure 5: North America Credit Union Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Credit Union Revenue (million), by Country 2024 & 2032

- Figure 7: North America Credit Union Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Credit Union Revenue (million), by Application 2024 & 2032

- Figure 9: South America Credit Union Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Credit Union Revenue (million), by Type 2024 & 2032

- Figure 11: South America Credit Union Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Credit Union Revenue (million), by Country 2024 & 2032

- Figure 13: South America Credit Union Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Credit Union Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Credit Union Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Credit Union Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Credit Union Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Credit Union Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Credit Union Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Credit Union Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Credit Union Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Credit Union Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Credit Union Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Credit Union Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Credit Union Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Credit Union Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Credit Union Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Credit Union Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Credit Union Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Credit Union Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Credit Union Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Credit Union Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Credit Union Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Credit Union Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Credit Union Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Credit Union Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Credit Union Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Credit Union Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Credit Union Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Credit Union Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Credit Union Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Credit Union Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Credit Union?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Credit Union?

Key companies in the market include Blue Federal Credit Union, Liberty Federal Credit Union, Alliant Credit Union, Hiway Credit Union, Service Credit Union, First Tech Federal Credit Union, Navy Federal Credit Union, Global Credit Union, Empeople Credit Union, Pentagon Federal Credit Union, BCU, State Employees' Credit Union, Patelco Credit Union, Manchester Credit Union, United Federal Credit Union, Together Credit Union, Suncoast Credit Union, Veridian Credit Union, VyStar Credit Union, Sound Credit Union, Wright-Patt Credit Union, OneAZ Credit Union, Redwood Credit Union, Delta Community Credit Union, SAFE Credit Union, Visions Federal Credit Union, Florida Credit Union, Idaho Central Credit Union, Travis Credit Union, PenFed Credit Union, BECU, Digital Federal Credit Union, Golden 1 Credit Union, Alaska USA Federal Credit Union, America First Credit Union.

3. What are the main segments of the Credit Union?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Credit Union," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Credit Union report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Credit Union?

To stay informed about further developments, trends, and reports in the Credit Union, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence