Key Insights

The Financial Advisory Services market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 8.9% from 2025 to 2033. This robust growth is propelled by escalating wealth management demands from high-net-worth individuals and the increasing complexity of financial regulations, both driving the need for expert financial counsel. Concurrently, the widespread adoption of digital platforms and fintech innovations is improving industry accessibility and operational efficiency, thereby broadening the client base. The market is segmented by service type (e.g., investment management, retirement planning, tax advisory), client type (individuals, corporations, institutions), and geographical region. Leading organizations including Bank of America, Goldman Sachs, JP Morgan Chase, and Deloitte are strategically utilizing their extensive networks and deep expertise to secure substantial market share. Intense competition characterizes the landscape, with firms consistently innovating to deliver personalized and high-value services.

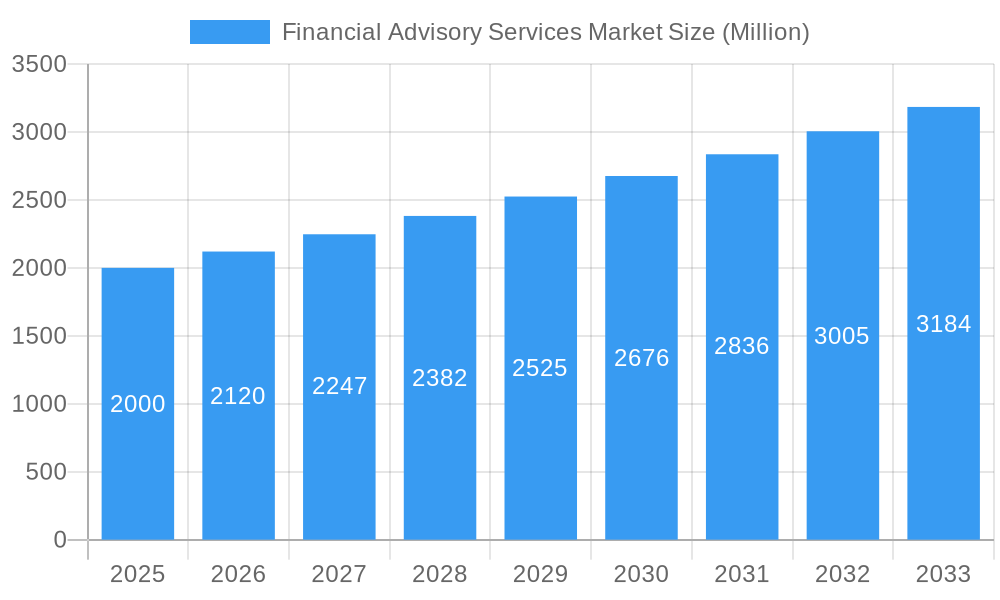

Financial Advisory Services Market Market Size (In Billion)

Key market trends are shaping its growth trajectory. The rising prominence of sustainable and responsible investing is influencing investment strategies, while technological advancements such as artificial intelligence and machine learning are optimizing processes and enhancing analytical capabilities. Conversely, evolving regulatory landscapes and economic uncertainties present potential challenges. Global market fluctuations and stringent compliance mandates may impact profitability and growth rates. Despite these factors, the long-term outlook remains optimistic, underpinned by the persistent requirement for professional financial guidance in an increasingly complex and interconnected global economy. The market size is estimated at $134.87 billion in the base year 2025, with considerable growth anticipated throughout the forecast period. Detailed segmentation will uncover specific growth opportunities within specialized market niches.

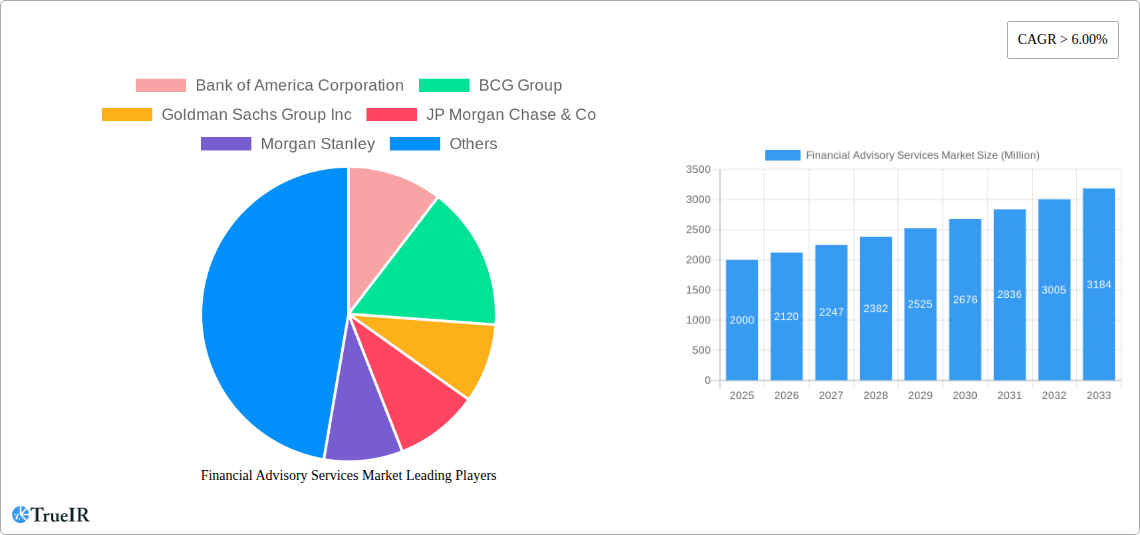

Financial Advisory Services Market Company Market Share

Financial Advisory Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Financial Advisory Services Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report unveils the market's current state and projects its future trajectory, offering crucial data-driven projections. The market is estimated to reach xx Million by 2025 and is poised for substantial growth over the forecast period.

Financial Advisory Services Market Market Structure & Competitive Landscape

The Financial Advisory Services market exhibits a moderately concentrated structure, with several multinational giants dominating the landscape. Key players such as Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, PwC, and Wells Fargo & Co. (list not exhaustive) compete fiercely, driving innovation and shaping market dynamics. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately consolidated market.

- Market Concentration: The top 5 players hold an estimated xx% market share, while the remaining share is distributed among numerous smaller firms and niche players.

- Innovation Drivers: Technological advancements, such as AI-powered portfolio management tools and robo-advisors, are significant drivers of innovation. The increasing demand for personalized financial planning and wealth management solutions fuels this development.

- Regulatory Impacts: Stringent regulations, particularly those concerning data privacy and client confidentiality, significantly impact market operations. Compliance costs and evolving regulatory landscapes present challenges and opportunities for market players.

- Product Substitutes: The availability of online investment platforms and self-directed investing tools presents a level of substitution, although the demand for personalized, expert advice persists.

- End-User Segmentation: The market is segmented by individual investors, institutional clients (corporations, endowments, etc.), and high-net-worth individuals (HNWIs). Each segment presents distinct needs and opportunities.

- M&A Trends: The sector has witnessed a consistent volume of mergers and acquisitions (M&A) activity in recent years, with an estimated xx Million in M&A deals completed in 2024. This trend is projected to continue, driven by strategic expansion and consolidation efforts.

Financial Advisory Services Market Market Trends & Opportunities

The Financial Advisory Services market is experiencing robust growth, driven by several key factors. Market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, fueled by increased wealth accumulation, growing demand for sophisticated financial planning, and the rise of technology-driven solutions. The market penetration rate for digital advisory services is currently at xx%, and is predicted to reach xx% by 2033.

Technological advancements, such as Artificial Intelligence (AI) and Machine Learning (ML), are transforming the industry, enabling personalized advice, automated portfolio management, and more efficient risk assessment. Consumer preferences are shifting toward digitally enabled services, demanding convenience and transparency. Intensifying competition is pushing firms to enhance service offerings, explore new technologies, and expand into underserved markets.

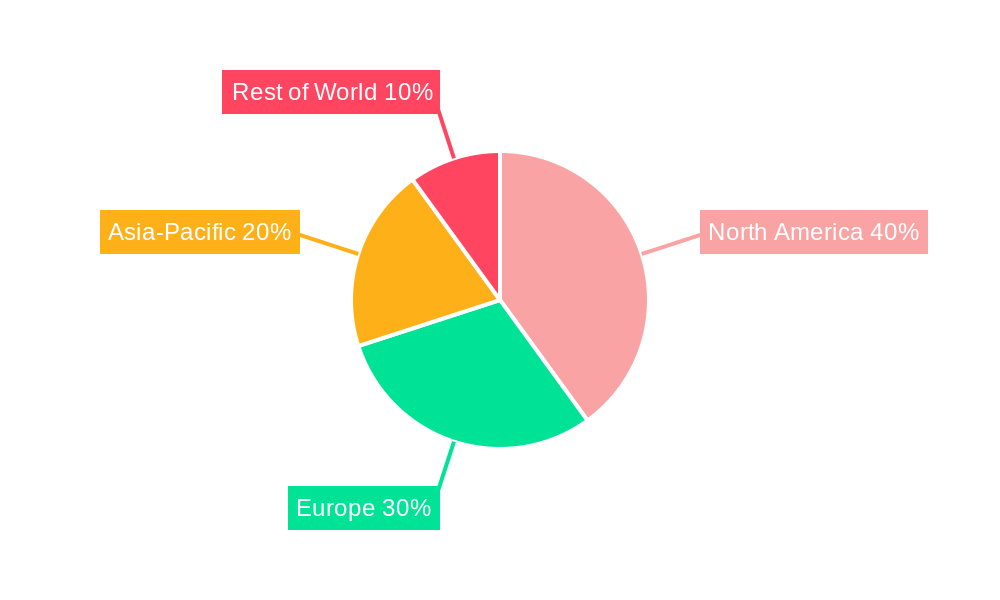

Dominant Markets & Segments in Financial Advisory Services Market

The North American region currently dominates the Financial Advisory Services market, accounting for an estimated xx% of the global market share in 2024. This dominance is attributable to a confluence of factors:

- Robust Economic Growth: The strong economic performance in North America fuels wealth creation and demand for sophisticated financial advice.

- Highly Developed Financial Infrastructure: Mature financial markets and a well-established regulatory framework provide a supportive environment for the industry.

- High Adoption of Technology: Early adoption of fintech solutions and a tech-savvy population contribute to market expansion.

- Increased Awareness: Growing financial literacy and an understanding of the benefits of professional financial advice contribute to market growth.

- Regulatory Landscape: A relatively stable and predictable regulatory environment fosters investment and market expansion.

Other regions, such as Europe and Asia-Pacific, are also exhibiting substantial growth potential. Rapid economic expansion in these areas and increasing financial awareness among the population drive market development.

Financial Advisory Services Market Product Analysis

The Financial Advisory Services market encompasses a range of products, including wealth management, investment advisory, retirement planning, tax planning, and estate planning services. Technological advancements have led to the introduction of robo-advisors, AI-powered portfolio management tools, and personalized financial planning platforms. These innovations enhance efficiency, provide cost-effective solutions, and expand access to financial advisory services for a wider range of clients. The competitive advantage is increasingly determined by the ability to leverage technology, provide personalized solutions, and build strong client relationships.

Key Drivers, Barriers & Challenges in Financial Advisory Services Market

Key Drivers:

- Increasing disposable incomes and wealth accumulation drive the demand for financial advisory services.

- Growing awareness of the benefits of professional financial planning fuels market expansion.

- Technological advancements enable greater efficiency, personalization, and cost-effectiveness.

- Favorable regulatory environments support market growth and investment.

Key Challenges:

- Stringent regulatory compliance creates substantial costs and complexity for businesses.

- Intense competition among established firms and the emergence of fintech disruptors exert pressure on margins.

- Data privacy and cybersecurity concerns pose significant risks and require robust mitigation strategies. A data breach could cost a firm an estimated xx Million in remediation.

- Maintaining client trust and addressing concerns around conflicts of interest is paramount.

Growth Drivers in the Financial Advisory Services Market Market

Several factors are propelling growth in the Financial Advisory Services market. These include: rising disposable incomes, increased awareness of the value of professional financial advice, advancements in financial technology (fintech), and favorable regulatory conditions in several key markets. The growing complexity of financial markets also drives demand for expert guidance.

Challenges Impacting Financial Advisory Services Market Growth

The growth of the Financial Advisory Services market faces challenges such as stringent regulatory compliance, intense competition from both established players and new fintech entrants, and concerns over data security and privacy. These factors can impact profitability and limit market expansion.

Key Players Shaping the Financial Advisory Services Market Market

Significant Financial Advisory Services Market Industry Milestones

- February 2023: Morgan Stanley Investment Management secured full control of Morgan Stanley Huaxin Funds in China, signifying a major strategic expansion in the Asian market.

- February 2023: Boston Consulting Group appointed Axel Weber, former president of Germany's central bank and UBS chairman, as a senior advisor, strengthening its expertise in financial services.

Future Outlook for Financial Advisory Services Market Market

The Financial Advisory Services market is poised for continued expansion, driven by technological innovation, evolving consumer preferences, and the persistent need for expert financial guidance. Strategic opportunities exist for firms that can leverage technology effectively, personalize services, and build strong client relationships. The market's future growth will be significantly influenced by advancements in AI, big data analytics, and the expansion of digital financial platforms. The market presents significant potential for both established players and innovative newcomers.

Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Financial Advisory Services Market Regional Market Share

Geographic Coverage of Financial Advisory Services Market

Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Majority of Revenues generated from United states

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Corporate Finance

- 6.1.2. Accounting Advisory

- 6.1.3. Tax Advisory

- 6.1.4. Transaction Services

- 6.1.5. Risk Management

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small & Medium-Sized Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. Bfsi

- 6.3.2. It And Telecom

- 6.3.3. Manufacturing

- 6.3.4. Retail And E-Commerce

- 6.3.5. Public Sector

- 6.3.6. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Corporate Finance

- 7.1.2. Accounting Advisory

- 7.1.3. Tax Advisory

- 7.1.4. Transaction Services

- 7.1.5. Risk Management

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small & Medium-Sized Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. Bfsi

- 7.3.2. It And Telecom

- 7.3.3. Manufacturing

- 7.3.4. Retail And E-Commerce

- 7.3.5. Public Sector

- 7.3.6. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Corporate Finance

- 8.1.2. Accounting Advisory

- 8.1.3. Tax Advisory

- 8.1.4. Transaction Services

- 8.1.5. Risk Management

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small & Medium-Sized Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. Bfsi

- 8.3.2. It And Telecom

- 8.3.3. Manufacturing

- 8.3.4. Retail And E-Commerce

- 8.3.5. Public Sector

- 8.3.6. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Corporate Finance

- 9.1.2. Accounting Advisory

- 9.1.3. Tax Advisory

- 9.1.4. Transaction Services

- 9.1.5. Risk Management

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small & Medium-Sized Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. Bfsi

- 9.3.2. It And Telecom

- 9.3.3. Manufacturing

- 9.3.4. Retail And E-Commerce

- 9.3.5. Public Sector

- 9.3.6. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Corporate Finance

- 10.1.2. Accounting Advisory

- 10.1.3. Tax Advisory

- 10.1.4. Transaction Services

- 10.1.5. Risk Management

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small & Medium-Sized Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. Bfsi

- 10.3.2. It And Telecom

- 10.3.3. Manufacturing

- 10.3.4. Retail And E-Commerce

- 10.3.5. Public Sector

- 10.3.6. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BCG Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JP Morgan Chase & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Morgan Stanley

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Deloitte

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EY Financial Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KPMG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pwc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wells Fargo & Co**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Financial Advisory Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 5: North America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 7: North America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 8: North America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 13: Europe Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 15: Europe Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 16: Europe Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 23: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 24: Asia Pacific Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 29: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 31: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 32: Middle East and Africa Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Financial Advisory Services Market Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Financial Advisory Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Financial Advisory Services Market Revenue (billion), by Organization Size 2025 & 2033

- Figure 37: South America Financial Advisory Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: South America Financial Advisory Services Market Revenue (billion), by Industry Vertical 2025 & 2033

- Figure 39: South America Financial Advisory Services Market Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: South America Financial Advisory Services Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Financial Advisory Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Global Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: USA Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 14: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: UK Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 24: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 25: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Australia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: India Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 34: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 35: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Egypt Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: UAE Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 42: Global Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 43: Global Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Argentina Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Colombia Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of South America Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Advisory Services Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Financial Advisory Services Market?

Key companies in the market include Bank of America Corporation, BCG Group, Goldman Sachs Group Inc, JP Morgan Chase & Co, Morgan Stanley, Deloitte, EY Financial Services, KPMG, Pwc, Wells Fargo & Co**List Not Exhaustive.

3. What are the main segments of the Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.87 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Majority of Revenues generated from United states.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Morgan Stanley Investment Management announced that it had received approval from the China Securities Regulatory Commission (CSRC) to take a full controlling stake in Morgan Stanley Huaxin Funds, marking a key strategic advancement for the company's broader footprint in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence