Key Insights

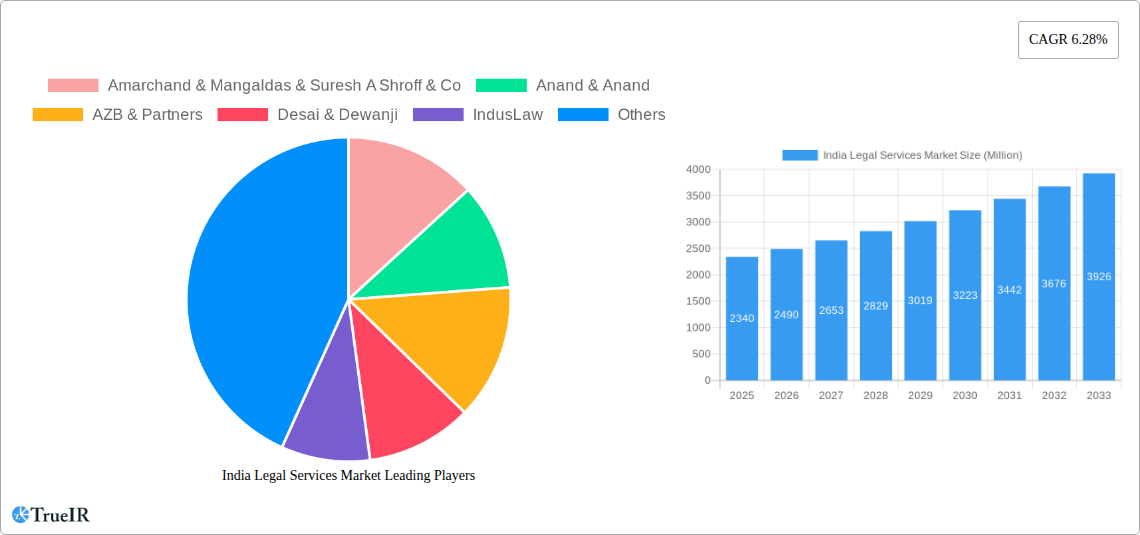

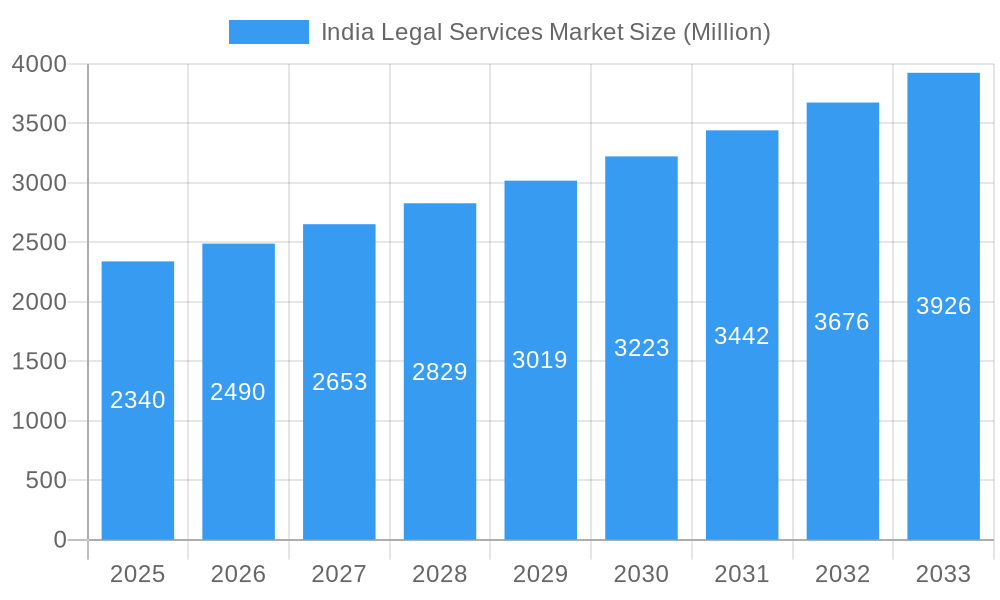

The India Legal Services Market, valued at $2.34 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.28% from 2025 to 2033. This expansion is driven by several key factors. Firstly, India's burgeoning economy and increasing foreign direct investment (FDI) fuel demand for legal expertise across diverse sectors, including corporate law, intellectual property, and dispute resolution. Secondly, the rise of technology and legal tech solutions is streamlining processes, improving efficiency, and expanding access to legal services, particularly in underserved regions. The growing awareness of legal rights among individuals and businesses further contributes to market growth. However, challenges remain, including a shortage of skilled legal professionals, particularly in specialized areas, and the need for further modernization of the legal infrastructure. Competition amongst established firms like Amarchand & Mangaldas & Suresh A Shroff & Co, Anand & Anand, AZB & Partners, and others, as well as emerging players, is fierce, necessitating continuous innovation and strategic partnerships. The market is segmented by practice area (e.g., corporate, IP, litigation), client type (e.g., corporations, individuals), and geographic location.

India Legal Services Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, driven by sustained economic growth, evolving legal frameworks, and increasing sophistication of legal needs. While regulatory hurdles and infrastructure limitations pose challenges, the overall outlook remains positive. The market's trajectory will be shaped by the government's initiatives to promote ease of doing business, the adoption of advanced technologies, and the development of legal talent. The substantial and increasing complexity of business transactions and disputes, coupled with a growing middle class with increased legal awareness, will guarantee sustained demand.

India Legal Services Market Company Market Share

India Legal Services Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India Legal Services Market, offering invaluable insights for investors, legal professionals, and industry stakeholders. With a comprehensive analysis spanning the period 2019-2033, including a detailed forecast from 2025-2033 and a base year of 2025, this report unveils the market's structure, competitive landscape, growth drivers, and future potential. The report leverages extensive data and analysis to illuminate key trends and opportunities within this rapidly evolving sector. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

India Legal Services Market: Market Structure & Competitive Landscape

The Indian legal services market exhibits a concentrated structure, with a few large firms dominating the landscape. However, a significant number of smaller firms and boutiques also contribute to the overall market size. The top players, including Amarchand & Mangaldas & Suresh A Shroff & Co, Anand & Anand, AZB & Partners, Desai & Dewanji, IndusLaw, J Sagar Associates, Khaitan & Co, Lakshmikumaran & Sridharan (L&S), S&R Associates, and Talwar Thakore and Associates (list not exhaustive), compete intensely for high-profile clients and major corporate transactions. Market concentration is estimated at xx% in 2025, indicating a relatively consolidated market.

- Innovation Drivers: Technological advancements, such as AI-powered legal research tools and e-discovery platforms, are driving innovation.

- Regulatory Impacts: Changes in government regulations and policies significantly impact the market, especially in areas like data privacy and intellectual property.

- Product Substitutes: The rise of legal tech solutions and online legal service platforms presents a degree of substitution, albeit limited for complex legal matters.

- End-User Segmentation: The market is segmented by client type (corporates, individuals, government), legal service type (litigation, advisory, transactional), and geographical location (metro vs. non-metro).

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx major deals recorded between 2019 and 2024. This trend is expected to continue, driven by firms seeking to expand their service offerings and geographic reach.

India Legal Services Market: Market Trends & Opportunities

The Indian legal services market is experiencing robust growth, driven by several key factors. The increasing complexity of business transactions, coupled with a growing awareness of legal rights and regulations, fuels demand for specialized legal expertise. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of specialized legal services in non-metro areas is increasing but still lags behind the metro regions. Technological advancements, particularly in legal tech, represent a significant opportunity for firms to improve efficiency and enhance client service. However, challenges such as high costs, limited access to legal services in rural areas, and a shortage of skilled professionals need to be addressed. The changing consumer preferences towards digital solutions and transparent fee structures also shape market dynamics. Competitive pressures necessitate continuous innovation and strategic partnerships.

Dominant Markets & Segments in India Legal Services Market

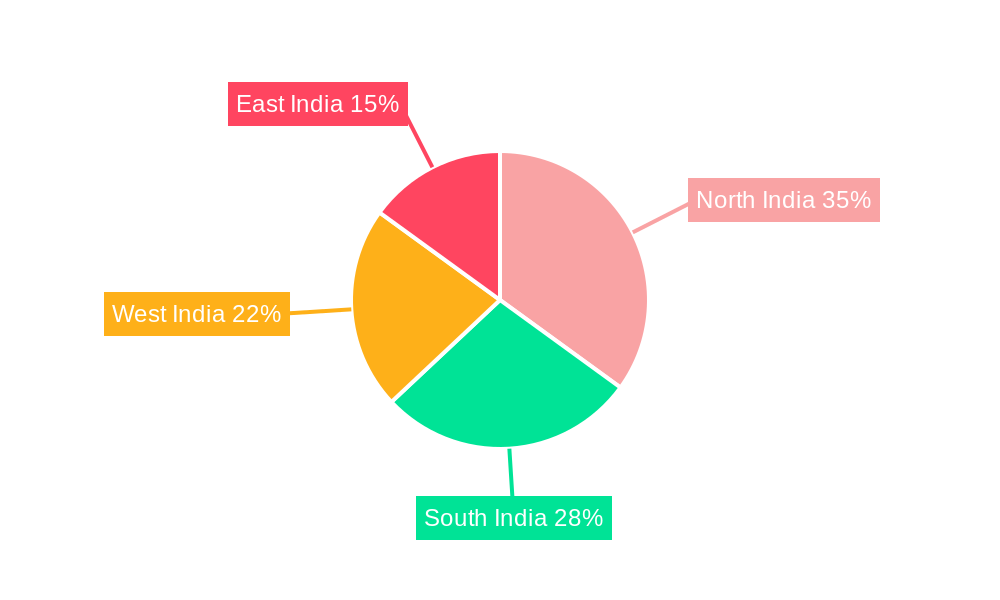

The major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai dominate the Indian legal services market, owing to the concentration of major corporations and legal institutions. The corporate segment is the largest contributor to market revenue, driven by the growing number of multinational companies and domestic conglomerates operating in India.

Key Growth Drivers for Metropolitan Areas:

- Well-established legal infrastructure.

- Large pool of skilled legal professionals.

- High concentration of corporate clients.

- Favorable regulatory environment.

Detailed Analysis: Mumbai and Delhi account for approximately xx% of the total market revenue, owing to their position as major financial and commercial centers. Other major cities like Bangalore and Chennai are also witnessing significant growth due to the burgeoning IT and manufacturing sectors, respectively.

India Legal Services Market: Product Analysis

The Indian legal services market offers a broad spectrum of services, encompassing litigation, corporate advisory, intellectual property rights management, dispute resolution, and regulatory compliance. Technological advancements are driving innovation, with the introduction of AI-powered legal research tools, e-discovery platforms, and contract management systems. These solutions enhance efficiency, reduce costs, and improve the quality of legal services. The market also witnesses increasing adoption of alternative dispute resolution (ADR) methods, such as arbitration and mediation. The competitive advantage often lies in specialized expertise, strong client relationships, and effective use of technology.

Key Drivers, Barriers & Challenges in India Legal Services Market

Key Drivers: The rapid economic growth of India, increasing foreign direct investment, and the expanding regulatory landscape are major drivers, creating high demand for legal services. The government's initiatives to promote ease of doing business also contribute positively. Technological advancements in legal tech are streamlining processes and enhancing efficiency.

Challenges: Regulatory complexities, particularly in areas like data protection and intellectual property, pose a challenge. A shortage of skilled legal professionals, especially in specialized areas, limits market expansion. Intense competition from both established and new entrants creates pressure on pricing and profitability. Supply chain issues, such as access to technology and infrastructure in certain areas, remain a concern. The impact is estimated to be a xx% reduction in market growth annually.

Growth Drivers in the India Legal Services Market

Technological advancements, particularly in legal tech, are significantly boosting efficiency and innovation. The burgeoning economy and increasing FDI attract significant legal work. Government regulations and policies related to ease of doing business have a positive impact. The rising awareness among individuals and businesses about legal rights is leading to increased demand.

Challenges Impacting India Legal Services Market Growth

Regulatory complexities, especially in sectors like data protection and environmental law, create hurdles. The availability of skilled legal professionals remains a constraint, especially in specialized areas. Competition from established and emerging players exerts pressure on pricing and profitability. Supply chain challenges in accessing technology and infrastructure in remote areas hamper growth.

Key Players Shaping the India Legal Services Market

- Amarchand & Mangaldas & Suresh A Shroff & Co

- Anand & Anand

- AZB & Partners

- Desai & Dewanji

- IndusLaw

- J Sagar Associates

- Khaitan & Co

- Lakshmikumaran & Sridharan (L&S)

- S&R Associates

- Talwar Thakore and Associates (List Not Exhaustive)

Significant India Legal Services Market Industry Milestones

- June 2023: AZB & Partners expands to Chennai, adding a seasoned corporate lawyer.

- February 2023: Anand and Anand launches a Digital Group focused on emerging technologies like AI and blockchain.

Future Outlook for India Legal Services Market

The Indian legal services market is poised for continued expansion, driven by sustained economic growth, increasing foreign investment, and the growing complexity of business transactions. Strategic opportunities exist for firms to leverage technology, expand into underserved markets, and develop specialized expertise. The market's potential remains substantial, with significant scope for growth in both the corporate and individual segments.

India Legal Services Market Segmentation

-

1. End User

- 1.1. Legal Aid Consumers

- 1.2. Private Consumers

- 1.3. SMEs

- 1.4. Charities

- 1.5. Large Businesses

- 1.6. Government

-

2. Application

- 2.1. Corporate, Financial, and Commercial Law

- 2.2. Personal Injury

- 2.3. Commercial and Residential Property

- 2.4. Wills, Trusts, and Probate

- 2.5. Family Law

- 2.6. Employment Law

- 2.7. Criminal Law

-

3. Service

- 3.1. Representation

- 3.2. Taxation

- 3.3. Litigation

- 3.4. Bankruptcy

- 3.5. Advice

- 3.6. Notarial Activities

- 3.7. Research

India Legal Services Market Segmentation By Geography

- 1. India

India Legal Services Market Regional Market Share

Geographic Coverage of India Legal Services Market

India Legal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Complexities In Laws And Regulations; Technological Advancements in Legal Tech Services

- 3.3. Market Restrains

- 3.3.1. Growing Complexities In Laws And Regulations; Technological Advancements in Legal Tech Services

- 3.4. Market Trends

- 3.4.1. Increasing Number of Pre-litigation Cases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Legal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Legal Aid Consumers

- 5.1.2. Private Consumers

- 5.1.3. SMEs

- 5.1.4. Charities

- 5.1.5. Large Businesses

- 5.1.6. Government

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Corporate, Financial, and Commercial Law

- 5.2.2. Personal Injury

- 5.2.3. Commercial and Residential Property

- 5.2.4. Wills, Trusts, and Probate

- 5.2.5. Family Law

- 5.2.6. Employment Law

- 5.2.7. Criminal Law

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Representation

- 5.3.2. Taxation

- 5.3.3. Litigation

- 5.3.4. Bankruptcy

- 5.3.5. Advice

- 5.3.6. Notarial Activities

- 5.3.7. Research

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amarchand & Mangaldas & Suresh A Shroff & Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Anand & Anand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AZB & Partners

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Desai & Dewanji

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IndusLaw

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 J Sagar Associates

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Khaitan & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lakshmikumaran & Sridharan (L&S)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 S&R Associates

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Talwar Thakore and Associates**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amarchand & Mangaldas & Suresh A Shroff & Co

List of Figures

- Figure 1: India Legal Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Legal Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: India Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 3: India Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: India Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: India Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 7: India Legal Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Legal Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Legal Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: India Legal Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: India Legal Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: India Legal Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: India Legal Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: India Legal Services Market Volume Billion Forecast, by Service 2020 & 2033

- Table 15: India Legal Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Legal Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Legal Services Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the India Legal Services Market?

Key companies in the market include Amarchand & Mangaldas & Suresh A Shroff & Co, Anand & Anand, AZB & Partners, Desai & Dewanji, IndusLaw, J Sagar Associates, Khaitan & Co, Lakshmikumaran & Sridharan (L&S), S&R Associates, Talwar Thakore and Associates**List Not Exhaustive.

3. What are the main segments of the India Legal Services Market?

The market segments include End User, Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Complexities In Laws And Regulations; Technological Advancements in Legal Tech Services.

6. What are the notable trends driving market growth?

Increasing Number of Pre-litigation Cases.

7. Are there any restraints impacting market growth?

Growing Complexities In Laws And Regulations; Technological Advancements in Legal Tech Services.

8. Can you provide examples of recent developments in the market?

June 2023: AZB & Partners, a Mumbai-based law firm, announced its expansion with the opening of a new office in Chennai. The firm received a significant boost with the addition of Aarthi Sivanandh, a seasoned corporate lawyer who previously worked with J Sagar Associates (JSA) in Chennai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Legal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Legal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Legal Services Market?

To stay informed about further developments, trends, and reports in the India Legal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence