Key Insights

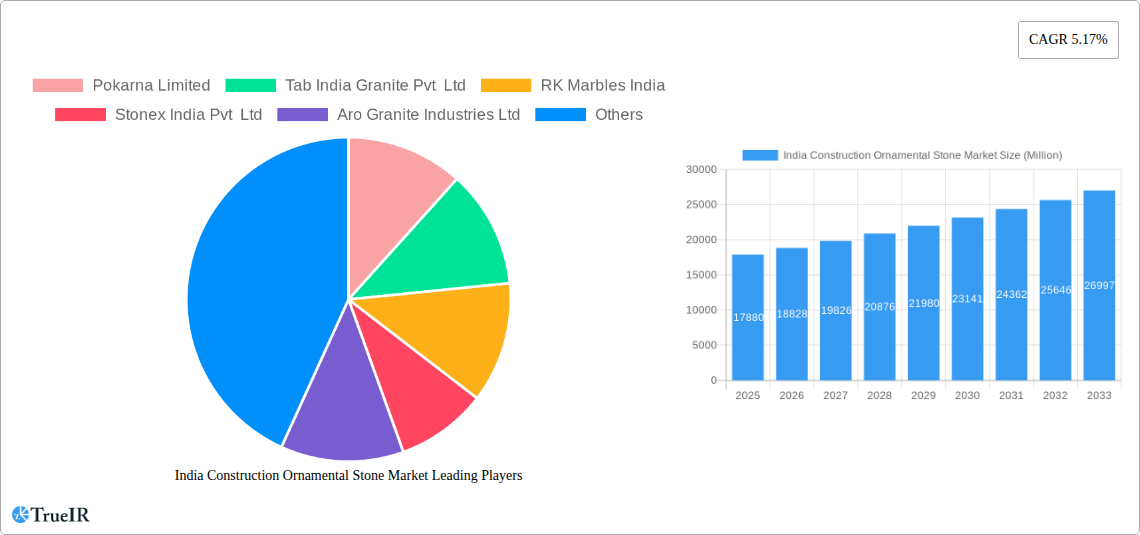

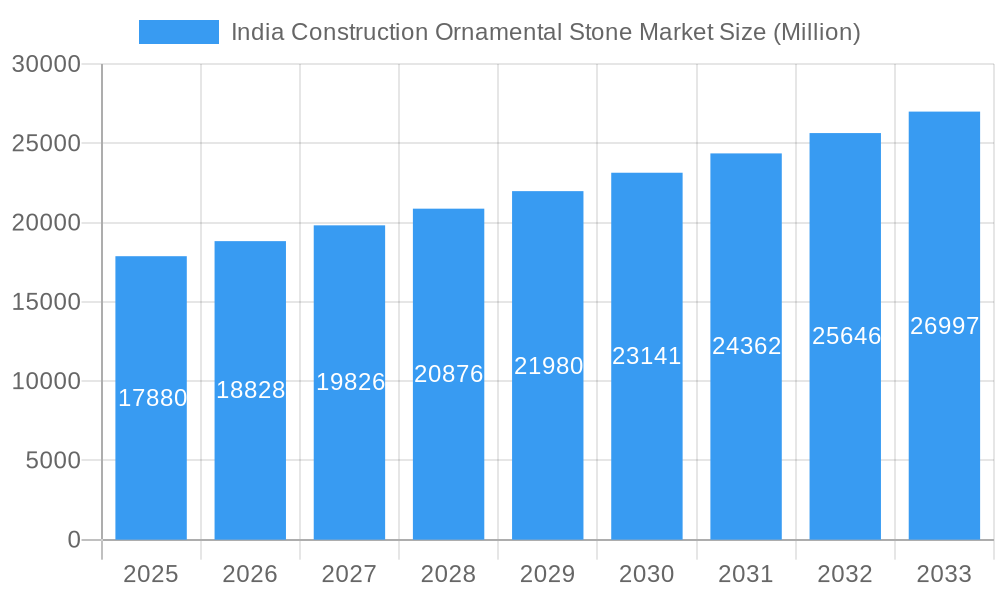

The India Construction Ornamental Stone Market, valued at $17.88 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.17% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector in India, particularly in residential and commercial real estate, is a primary driver. Increasing urbanization and rising disposable incomes are boosting demand for aesthetically pleasing and durable building materials, making ornamental stones a popular choice. Government initiatives promoting infrastructure development further contribute to market growth. Furthermore, the growing preference for natural and sustainable materials in construction aligns with the eco-conscious trends, further propelling the demand for ornamental stones. However, challenges such as price volatility of raw materials and potential supply chain disruptions could act as restraints. The market is segmented based on stone type (e.g., granite, marble, sandstone), application (e.g., flooring, cladding, countertops), and region. Key players like Pokarna Limited, Tab India Granite Pvt Ltd, and others are actively shaping the market landscape through innovation and expansion.

India Construction Ornamental Stone Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, although the pace might vary slightly based on economic conditions and government policies. The market's resilience is underpinned by the long-term growth prospects of the Indian construction sector and the enduring appeal of ornamental stones in architectural and interior design. Competitive dynamics are likely to intensify with both existing players investing in capacity expansion and new entrants exploring opportunities. Strategies such as product diversification, improved supply chain management, and targeted marketing towards specific customer segments will be critical for sustained success in this dynamic market.

India Construction Ornamental Stone Market Company Market Share

India Construction Ornamental Stone Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the India Construction Ornamental Stone Market, offering invaluable insights for investors, industry professionals, and strategic planners. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period. This report delves into market segmentation, competitive dynamics, growth drivers, challenges, and future prospects, providing a 360-degree view of this burgeoning sector.

India Construction Ornamental Stone Market Structure & Competitive Landscape

The Indian construction ornamental stone market is characterized by a moderately fragmented structure with a Herfindahl-Hirschman Index (HHI) of xx, indicating the presence of both large established players and several smaller regional operators. The market concentration is expected to increase slightly by 2033 due to consolidation and strategic acquisitions. Key innovation drivers include the adoption of advanced processing technologies, the introduction of new designs and materials (e.g., engineered stone), and the growing emphasis on sustainability. Regulatory factors such as environmental regulations and building codes significantly impact the market. Product substitutes, such as engineered stone and ceramic tiles, pose competitive pressure, although natural stone's inherent aesthetic appeal maintains its demand.

End-user segmentation comprises residential, commercial, and infrastructure projects. The residential segment is a major driver of market growth, fueled by rising urbanization and disposable incomes. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, primarily driven by companies seeking to expand their product portfolios and geographic reach. The average deal size was approximately xx Million.

India Construction Ornamental Stone Market Market Trends & Opportunities

The Indian construction ornamental stone market is experiencing significant growth, driven by a combination of factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025. This growth is fueled by a surge in construction activity across residential, commercial, and infrastructure sectors, supported by government initiatives promoting infrastructure development (e.g., Smart Cities Mission). Technological advancements, such as the use of CNC machining for precise stone cutting and polishing, have improved efficiency and product quality. Consumer preferences are shifting towards sustainable and eco-friendly materials, driving demand for locally sourced and ethically produced stone. Furthermore, the increasing adoption of engineered stones and the growing popularity of unique designs and intricate stonework offer exciting opportunities for market expansion. The market penetration rate for ornamental stone in new construction is currently estimated at xx%, with considerable scope for further growth in both urban and rural areas.

Dominant Markets & Segments in India Construction Ornamental Stone Market

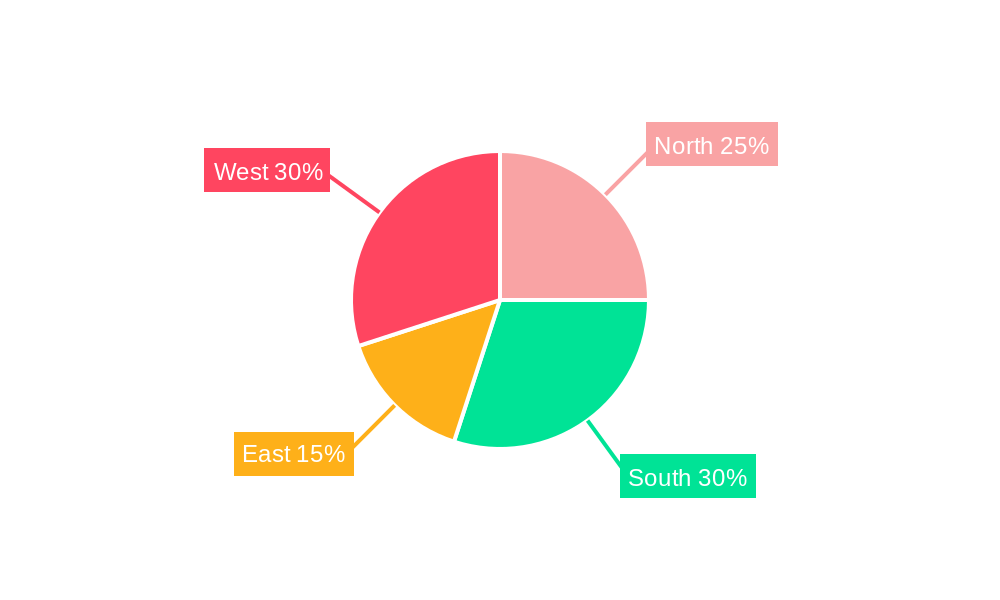

The most dominant market segment is the residential construction sector, accounting for xx% of the overall market share in 2024. Key growth drivers in this segment include rising urbanization, increasing disposable incomes, and a growing preference for aesthetically pleasing homes. The Southern and Western regions of India are currently the most dominant geographically, owing to higher construction activity and strong demand.

Key Growth Drivers for Residential Segment:

- Increasing urbanization and population growth.

- Rising disposable incomes and improved living standards.

- Growing preference for aesthetically appealing homes and premium finishes.

- Government initiatives promoting affordable housing.

Key Growth Drivers for Infrastructure Segment:

- Massive infrastructure projects undertaken by the government (e.g., highways, metro rail).

- Strong government focus on infrastructure development.

- Increasing government spending on public infrastructure projects.

The dominance of these regions stems from factors like the presence of established quarries, skilled labor, and a robust construction industry. The commercial and infrastructure sectors are also showing promising growth trajectories, albeit at a slower pace than the residential sector.

India Construction Ornamental Stone Market Product Analysis

The Indian market offers a diverse range of ornamental stones, including granite, marble, sandstone, and slate, each with unique properties and applications. Technological advancements in stone processing, such as water jet cutting and polishing techniques, have led to more precise and intricate designs. Furthermore, the introduction of engineered stones (like quartz and sintered stone) has broadened the choices and created a competitive landscape. Engineered stones offer superior durability and stain resistance, but natural stones continue to command a premium market segment due to their inherent aesthetic qualities and perceived prestige.

Key Drivers, Barriers & Challenges in India Construction Ornamental Stone Market

Key Drivers: The market is primarily driven by robust growth in the construction industry, particularly in residential and infrastructure sectors, fueled by government initiatives like the Smart Cities Mission and the National Infrastructure Pipeline. Additionally, rising disposable incomes, increased urbanization, and changing consumer preferences towards premium building materials contribute to market expansion. Technological advancements in stone processing and design further enhance the appeal and application of ornamental stones.

Key Challenges: The ornamental stone market faces challenges like the volatile price fluctuations of raw materials, especially imported ones. Supply chain disruptions and logistics bottlenecks can also impact market stability. Environmental regulations and concerns regarding sustainable sourcing and waste management pose significant hurdles. Furthermore, intense competition from substitute materials like engineered stones and ceramic tiles presents a challenge for natural stone producers. The overall impact of these challenges is estimated to be a reduction in the market CAGR by approximately xx% if left unaddressed.

Growth Drivers in the India Construction Ornamental Stone Market Market

The primary growth drivers include increasing government spending on infrastructure projects, the burgeoning real estate sector, and rising disposable incomes leading to higher demand for aesthetically pleasing homes. Technological advancements in stone processing and design are also fueling the market’s expansion. The growing preference for sustainable and eco-friendly construction materials provides additional impetus for growth.

Challenges Impacting India Construction Ornamental Stone Market Growth

Significant challenges include fluctuating raw material prices, supply chain disruptions, and stringent environmental regulations. Competition from substitute materials, coupled with high transportation costs, further limits market expansion. Addressing these challenges necessitates proactive strategies for sustainable sourcing, efficient logistics, and innovative product development.

Key Players Shaping the India Construction Ornamental Stone Market Market

- Pokarna Limited

- Tab India Granite Pvt Ltd

- RK Marbles India

- Stonex India Pvt Ltd

- Aro Granite Industries Ltd

- A-Class Marble India Pvt Ltd

- Inani Marbles and Industries Ltd

- Asian Granito India Ltd

- Bhandari Marble Group

- Marble City Company (List Not Exhaustive)

Significant India Construction Ornamental Stone Market Industry Milestones

- February 2024: The India Design 2024 event showcased a marble brand's "Harmony in Duality" collection, highlighting the use of pastel Brazilian coastal marble and lush green quartz, influencing design trends and showcasing material innovation.

- February 2024: AGL's partnership with Ogilvy India for a brand campaign signifies increased marketing efforts to penetrate the home decor market and highlights the growing importance of brand building in the sector.

Future Outlook for India Construction Ornamental Stone Market Market

The Indian construction ornamental stone market is poised for sustained growth over the forecast period. Continued infrastructure development, robust real estate activity, and rising consumer demand for premium building materials will drive market expansion. Strategic opportunities exist for companies focusing on sustainable sourcing, technological innovation, and effective branding to capture market share. The market's potential is significant, driven by India's rapid economic growth and urbanization trends.

India Construction Ornamental Stone Market Segmentation

-

1. Type

- 1.1. Marble

- 1.2. Granite

- 1.3. Sandstone

- 1.4. Onyx

- 1.5. Quartzite

- 1.6. Slate

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Application

- 3.1. Flooring

- 3.2. Cladding

-

4. Distribution Channel

- 4.1. Direct Sales

- 4.2. Retail Stores

- 4.3. Online Retail

India Construction Ornamental Stone Market Segmentation By Geography

- 1. India

India Construction Ornamental Stone Market Regional Market Share

Geographic Coverage of India Construction Ornamental Stone Market

India Construction Ornamental Stone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry

- 3.3. Market Restrains

- 3.3.1. Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry

- 3.4. Market Trends

- 3.4.1. Indian Residential Real Estate is Driving the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Ornamental Stone Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Marble

- 5.1.2. Granite

- 5.1.3. Sandstone

- 5.1.4. Onyx

- 5.1.5. Quartzite

- 5.1.6. Slate

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Flooring

- 5.3.2. Cladding

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Direct Sales

- 5.4.2. Retail Stores

- 5.4.3. Online Retail

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pokarna Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tab India Granite Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RK Marbles India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stonex India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aro Granite Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A-Class Marble India Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inani Marbles and Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Asian Granito India Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bhandari Marble Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marble City Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pokarna Limited

List of Figures

- Figure 1: India Construction Ornamental Stone Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Construction Ornamental Stone Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Ornamental Stone Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Construction Ornamental Stone Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Construction Ornamental Stone Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: India Construction Ornamental Stone Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: India Construction Ornamental Stone Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Construction Ornamental Stone Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Construction Ornamental Stone Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: India Construction Ornamental Stone Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: India Construction Ornamental Stone Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Construction Ornamental Stone Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: India Construction Ornamental Stone Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: India Construction Ornamental Stone Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: India Construction Ornamental Stone Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: India Construction Ornamental Stone Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: India Construction Ornamental Stone Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: India Construction Ornamental Stone Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: India Construction Ornamental Stone Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: India Construction Ornamental Stone Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: India Construction Ornamental Stone Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Construction Ornamental Stone Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Ornamental Stone Market?

The projected CAGR is approximately 5.17%.

2. Which companies are prominent players in the India Construction Ornamental Stone Market?

Key companies in the market include Pokarna Limited, Tab India Granite Pvt Ltd, RK Marbles India, Stonex India Pvt Ltd, Aro Granite Industries Ltd, A-Class Marble India Pvt Ltd, Inani Marbles and Industries Ltd, Asian Granito India Ltd, Bhandari Marble Group, Marble City Company**List Not Exhaustive.

3. What are the main segments of the India Construction Ornamental Stone Market?

The market segments include Type, End User, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry.

6. What are the notable trends driving market growth?

Indian Residential Real Estate is Driving the Market Studied.

7. Are there any restraints impacting market growth?

Rapid Urbanization Leads to Increased Demand; Rapid Growth in the Real Estate Industry.

8. Can you provide examples of recent developments in the market?

February 2024: The prestigious India Design 2024 event featured a marble brand showcasing collections themed 'Harmony in Duality,' blending Yin-Yang concepts with Amazonian elements using pastel Brazilian coastal marble and lush green quartz from the rainforestFebruary 2024: AGL, a prominent player in the Indian tiles, engineered marble, quartz, and bathware industry, announced its partnership with Ogilvy India for a dynamic brand campaign. Through this collaboration, AGL seeks to reshape narratives in the constantly evolving home decor landscape. It aims to penetrate the home decor market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Ornamental Stone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Ornamental Stone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Ornamental Stone Market?

To stay informed about further developments, trends, and reports in the India Construction Ornamental Stone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence