Key Insights

The global Healthcare IT Outsourcing market is poised for substantial expansion, fueled by the increasing adoption of cloud solutions, escalating demand for advanced healthcare data management, and the imperative for cost optimization within healthcare entities. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.9%, expanding from an estimated market size of $40 billion in the base year 2025. Key growth drivers include outsourcing by both payers and providers, with healthcare provider systems, biopharmaceutical companies, and clinical research organizations forming significant end-user segments. Leading industry players such as Infosys, Allscripts, Wipro, and Accenture highlight the market's maturity and competitive nature. While North America currently leads, driven by its robust technological infrastructure and high healthcare spending, the Asia-Pacific region is anticipated to experience accelerated growth, propelled by increased healthcare investments and digital transformation initiatives in economies like India and China. Emerging challenges include data security, regulatory compliance complexities, and system integration hurdles.

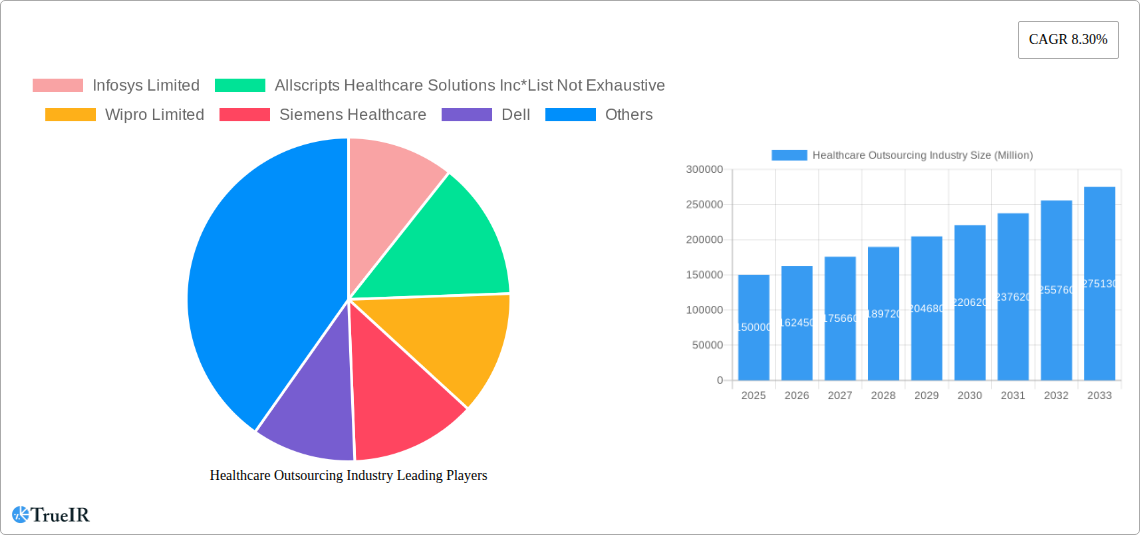

Healthcare Outsourcing Industry Market Size (In Billion)

Despite these challenges, the long-term outlook for the Healthcare IT Outsourcing market is highly positive. The growing volume and complexity of healthcare data necessitate outsourced solutions for efficient management and insightful analysis. The transition to value-based care models further amplifies the demand for specialized IT services, enabling healthcare providers to enhance patient outcomes while managing costs effectively. Technological advancements, particularly in artificial intelligence and machine learning, are expected to catalyze innovation and unlock new market opportunities. The continuous expansion of telehealth and remote patient monitoring further strengthens the growth trajectory for HCIT outsourcing firms. Companies specializing in data analytics, cybersecurity, and cloud migration are strategically positioned to capitalize on these evolving trends. Based on the projected CAGR and anticipated market expansion, a sustained and significant increase in market value is expected throughout the forecast period.

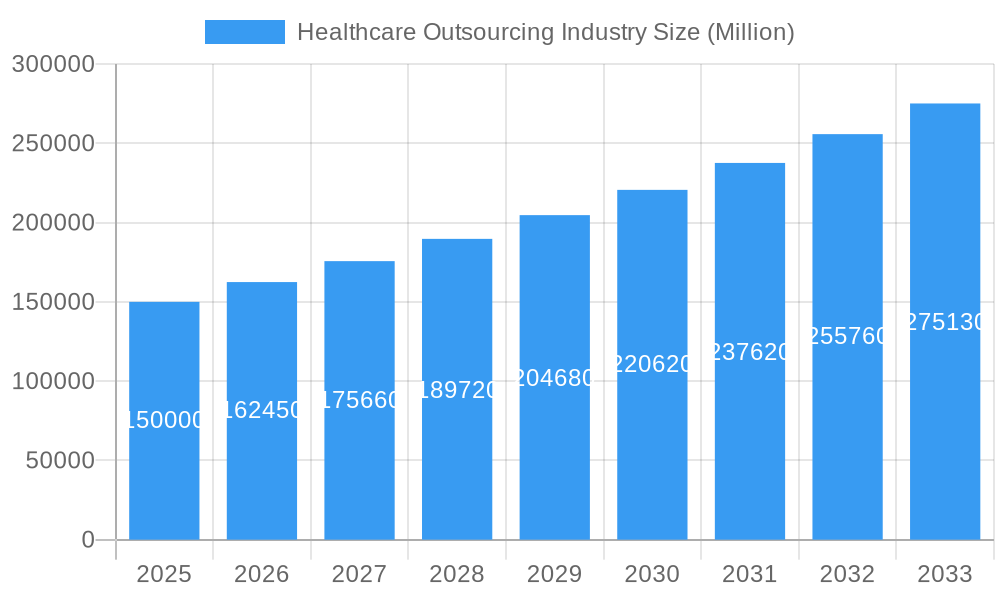

Healthcare Outsourcing Industry Company Market Share

Healthcare Outsourcing Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Healthcare Outsourcing Industry, projecting a market valued at $XX Million by 2033. Leveraging a robust methodology and incorporating key industry developments, this report offers invaluable insights for stakeholders across the healthcare ecosystem. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024.

Healthcare Outsourcing Industry Market Structure & Competitive Landscape

The Healthcare Outsourcing market exhibits a moderately concentrated structure, with a handful of large players like Infosys Limited, Wipro Limited, Accenture, International Business Machines, and Oracle holding significant market share. However, the presence of numerous smaller niche players prevents absolute dominance. The industry is characterized by continuous innovation driven by technological advancements, particularly in areas like AI, cloud computing, and data analytics. Stringent regulatory frameworks, including HIPAA compliance in the US and GDPR in Europe, heavily influence market dynamics. Product substitutes, such as in-house IT departments, exist but are often less cost-effective or efficient.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: The historical period (2019-2024) witnessed xx major mergers and acquisitions, driven primarily by consolidation efforts and technological synergy. The value of these transactions totaled approximately $xx Million.

- End-User Segmentation: The market caters to diverse end users, including Healthcare Provider Systems, Biopharmaceutical companies, Clinical Research Organizations (CROs), and Payers, each with unique outsourcing needs.

- Innovation Drivers: Advancements in AI, machine learning, cloud computing, and big data analytics are driving continuous innovation and increased outsourcing.

Healthcare Outsourcing Industry Market Trends & Opportunities

The global healthcare outsourcing market is experiencing robust growth, driven by escalating healthcare expenditures, the increasing adoption of electronic health records (EHRs), and the rising demand for advanced analytical capabilities. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a value of $XX Million by 2033. This growth is fueled by several factors:

- Technological advancements, such as the increasing adoption of cloud-based solutions and AI-powered diagnostics, are transforming the healthcare landscape, creating new opportunities for outsourcing.

- The growing need for cost optimization and efficiency improvements is pushing healthcare organizations to leverage outsourcing services for non-core functions.

- A rise in the adoption of telemedicine and remote patient monitoring solutions is driving the demand for specialized IT infrastructure and support services, enhancing outsourcing opportunities.

- The increasing complexity of regulatory requirements is further driving the outsourcing of compliance and regulatory functions.

- Shifts in consumer preferences, including a desire for personalized care and enhanced convenience, influence the adoption of tech-enabled solutions and outsourced services.

Market penetration rates vary across segments, with the highest penetration observed in the Provider HCIT outsourcing segment, followed by Payer HCIT outsourcing.

Dominant Markets & Segments in Healthcare Outsourcing Industry

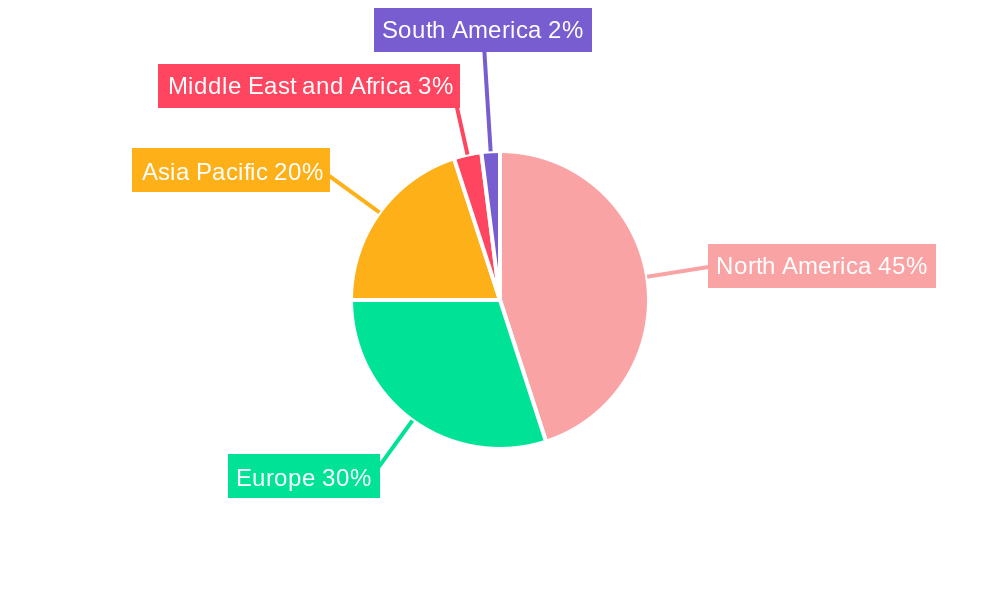

The North American region dominates the healthcare outsourcing market, driven by factors including robust healthcare infrastructure, advanced technological adoption, and a high concentration of major players. Within North America, the United States holds the largest market share. However, other regions like Europe and Asia-Pacific are demonstrating significant growth potential, fueled by increasing government support for digital health initiatives and rising healthcare expenditures.

Key Growth Drivers:

- Developed Healthcare Infrastructure: Advanced IT infrastructure and a skilled workforce in North America contribute significantly to market dominance.

- Favorable Regulatory Environment: While stringent, regulatory frameworks in the US and Europe promote innovation and market growth by pushing demand for compliance-related outsourcing services.

- High Healthcare Expenditures: Increased spending on healthcare fuels demand for cost-effective outsourcing solutions.

Segment Analysis: The Provider HCIT outsourcing segment is currently the most dominant, but the Biopharmaceutical and Clinical Research Organization (CRO) segments are expected to witness the fastest growth rates during the forecast period.

Healthcare Outsourcing Industry Product Analysis

The healthcare outsourcing market offers a diverse range of services, including IT outsourcing, business process outsourcing (BPO), and knowledge process outsourcing (KPO). Key product innovations focus on cloud-based solutions, AI-powered analytics, and specialized services tailored to the needs of specific healthcare segments. Competitive advantages stem from expertise, technology adoption, and cost-effectiveness, with players seeking to differentiate through specialized services and strong client relationships. The market is witnessing a shift towards integrated solutions that combine various services to provide comprehensive support.

Key Drivers, Barriers & Challenges in Healthcare Outsourcing Industry

Key Drivers: Technological advancements in AI, cloud computing, and big data analytics; increasing healthcare costs and the need for efficiency; growing demand for specialized services like data analytics and cybersecurity; government initiatives promoting digital health.

Challenges: Stringent regulatory compliance requirements (HIPAA, GDPR); data security and privacy concerns; managing vendor relationships and ensuring quality of service; potential supply chain disruptions, especially during pandemics; and intense competition. The impact of these challenges can be quantified by the potential loss of revenue and market share due to delayed projects or breaches in security, potentially impacting millions of dollars annually for affected companies.

Growth Drivers in the Healthcare Outsourcing Industry Market

The market is propelled by technological advancements, rising healthcare costs and the need for cost optimization, growing demand for specialized services like data analytics and cybersecurity, and supportive government policies.

Challenges Impacting Healthcare Outsourcing Industry Growth

Significant challenges include stringent regulatory compliance, concerns surrounding data security and privacy, difficulties in managing vendor relationships, potential supply chain disruptions, and fierce competition. These hurdles can collectively impact millions of dollars in potential revenue annually.

Key Players Shaping the Healthcare Outsourcing Industry Market

- Infosys Limited

- Allscripts Healthcare Solutions Inc

- Wipro Limited

- Siemens Healthcare

- Dell

- Accenture

- International Business Machines

- Koninklijke Philips NV

- Tata Consultancy Services

- Oracle

- Accretive Health

Significant Healthcare Outsourcing Industry Milestones

- February 2022: Clinixir Company Limited selected Oracle's clinical research and pharmacovigilance solutions, demonstrating growing demand for cloud-based eClinical platforms.

- January 2022: IBM's sale of its Watson Health data and analytics assets to Francisco Partners highlights ongoing consolidation and strategic shifts within the market.

Future Outlook for Healthcare Outsourcing Industry Market

The healthcare outsourcing market is poised for continued growth, driven by technological innovation, increasing demand for specialized services, and favorable regulatory environments. Strategic partnerships, expansion into emerging markets, and investments in advanced technologies will be key to success for players in this dynamic market. The market is expected to witness significant growth opportunities in areas like AI-powered diagnostics, telemedicine, and personalized medicine.

Healthcare Outsourcing Industry Segmentation

-

1. Type

-

1.1. Payers HCIT Outsourcing

- 1.1.1. Hospital Information System (HIS)

- 1.1.2. Laboratory Information System (LIS)

- 1.1.3. Radiology Information System (RIS)

- 1.1.4. Electronic Medical Records (EMR)

- 1.1.5. Other Types

-

1.2. Providers HCIT Outsourcing

- 1.2.1. Revenue Cycle Management (RCM) System

- 1.2.2. Healthcare Analytics

-

1.1. Payers HCIT Outsourcing

-

2. End User

- 2.1. Healthcare Provider System

- 2.2. Biopharmaceutical Industry

- 2.3. Clinical Research Organization

- 2.4. Other End Users

Healthcare Outsourcing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Healthcare Outsourcing Industry Regional Market Share

Geographic Coverage of Healthcare Outsourcing Industry

Healthcare Outsourcing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Lack of Infrastructure or Funding Needed for Better and Secure IT Facilities; Increased Patient-centric and Value-based Approaches in Healthcare; Shortage of In-house

- 3.2.2 Trained IT Professionals; Government Focus on Introducing IT in Healthcare

- 3.3. Market Restrains

- 3.3.1. Threat to Data Security and Confidentiality; Lack of Standard Platform; Shortcomings in Performance as Compared to Expectations

- 3.4. Market Trends

- 3.4.1. Payers Healthcare IT Outsourcing Segment is Expected to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Payers HCIT Outsourcing

- 5.1.1.1. Hospital Information System (HIS)

- 5.1.1.2. Laboratory Information System (LIS)

- 5.1.1.3. Radiology Information System (RIS)

- 5.1.1.4. Electronic Medical Records (EMR)

- 5.1.1.5. Other Types

- 5.1.2. Providers HCIT Outsourcing

- 5.1.2.1. Revenue Cycle Management (RCM) System

- 5.1.2.2. Healthcare Analytics

- 5.1.1. Payers HCIT Outsourcing

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare Provider System

- 5.2.2. Biopharmaceutical Industry

- 5.2.3. Clinical Research Organization

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Payers HCIT Outsourcing

- 6.1.1.1. Hospital Information System (HIS)

- 6.1.1.2. Laboratory Information System (LIS)

- 6.1.1.3. Radiology Information System (RIS)

- 6.1.1.4. Electronic Medical Records (EMR)

- 6.1.1.5. Other Types

- 6.1.2. Providers HCIT Outsourcing

- 6.1.2.1. Revenue Cycle Management (RCM) System

- 6.1.2.2. Healthcare Analytics

- 6.1.1. Payers HCIT Outsourcing

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Healthcare Provider System

- 6.2.2. Biopharmaceutical Industry

- 6.2.3. Clinical Research Organization

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Payers HCIT Outsourcing

- 7.1.1.1. Hospital Information System (HIS)

- 7.1.1.2. Laboratory Information System (LIS)

- 7.1.1.3. Radiology Information System (RIS)

- 7.1.1.4. Electronic Medical Records (EMR)

- 7.1.1.5. Other Types

- 7.1.2. Providers HCIT Outsourcing

- 7.1.2.1. Revenue Cycle Management (RCM) System

- 7.1.2.2. Healthcare Analytics

- 7.1.1. Payers HCIT Outsourcing

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Healthcare Provider System

- 7.2.2. Biopharmaceutical Industry

- 7.2.3. Clinical Research Organization

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Payers HCIT Outsourcing

- 8.1.1.1. Hospital Information System (HIS)

- 8.1.1.2. Laboratory Information System (LIS)

- 8.1.1.3. Radiology Information System (RIS)

- 8.1.1.4. Electronic Medical Records (EMR)

- 8.1.1.5. Other Types

- 8.1.2. Providers HCIT Outsourcing

- 8.1.2.1. Revenue Cycle Management (RCM) System

- 8.1.2.2. Healthcare Analytics

- 8.1.1. Payers HCIT Outsourcing

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Healthcare Provider System

- 8.2.2. Biopharmaceutical Industry

- 8.2.3. Clinical Research Organization

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Payers HCIT Outsourcing

- 9.1.1.1. Hospital Information System (HIS)

- 9.1.1.2. Laboratory Information System (LIS)

- 9.1.1.3. Radiology Information System (RIS)

- 9.1.1.4. Electronic Medical Records (EMR)

- 9.1.1.5. Other Types

- 9.1.2. Providers HCIT Outsourcing

- 9.1.2.1. Revenue Cycle Management (RCM) System

- 9.1.2.2. Healthcare Analytics

- 9.1.1. Payers HCIT Outsourcing

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Healthcare Provider System

- 9.2.2. Biopharmaceutical Industry

- 9.2.3. Clinical Research Organization

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Healthcare Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Payers HCIT Outsourcing

- 10.1.1.1. Hospital Information System (HIS)

- 10.1.1.2. Laboratory Information System (LIS)

- 10.1.1.3. Radiology Information System (RIS)

- 10.1.1.4. Electronic Medical Records (EMR)

- 10.1.1.5. Other Types

- 10.1.2. Providers HCIT Outsourcing

- 10.1.2.1. Revenue Cycle Management (RCM) System

- 10.1.2.2. Healthcare Analytics

- 10.1.1. Payers HCIT Outsourcing

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Healthcare Provider System

- 10.2.2. Biopharmaceutical Industry

- 10.2.3. Clinical Research Organization

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infosys Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Allscripts Healthcare Solutions Inc*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wipro Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dell

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accenture

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Business Machines

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tata Consultancy Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accretive Health

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Infosys Limited

List of Figures

- Figure 1: Global Healthcare Outsourcing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Healthcare Outsourcing Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Healthcare Outsourcing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Healthcare Outsourcing Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Healthcare Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Healthcare Outsourcing Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Healthcare Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Healthcare Outsourcing Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Healthcare Outsourcing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Healthcare Outsourcing Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Healthcare Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Healthcare Outsourcing Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Healthcare Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Healthcare Outsourcing Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Healthcare Outsourcing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Healthcare Outsourcing Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Healthcare Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Healthcare Outsourcing Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Healthcare Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Healthcare Outsourcing Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East and Africa Healthcare Outsourcing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Healthcare Outsourcing Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Middle East and Africa Healthcare Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Healthcare Outsourcing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Healthcare Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Healthcare Outsourcing Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: South America Healthcare Outsourcing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Healthcare Outsourcing Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: South America Healthcare Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Healthcare Outsourcing Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Healthcare Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 21: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Healthcare Outsourcing Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 36: Global Healthcare Outsourcing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Healthcare Outsourcing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Outsourcing Industry?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Healthcare Outsourcing Industry?

Key companies in the market include Infosys Limited, Allscripts Healthcare Solutions Inc*List Not Exhaustive, Wipro Limited, Siemens Healthcare, Dell, Accenture, International Business Machines, Koninklijke Philips NV, Tata Consultancy Services, Oracle, Accretive Health.

3. What are the main segments of the Healthcare Outsourcing Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 40 billion as of 2022.

5. What are some drivers contributing to market growth?

Lack of Infrastructure or Funding Needed for Better and Secure IT Facilities; Increased Patient-centric and Value-based Approaches in Healthcare; Shortage of In-house. Trained IT Professionals; Government Focus on Introducing IT in Healthcare.

6. What are the notable trends driving market growth?

Payers Healthcare IT Outsourcing Segment is Expected to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Threat to Data Security and Confidentiality; Lack of Standard Platform; Shortcomings in Performance as Compared to Expectations.

8. Can you provide examples of recent developments in the market?

In February 2022 Clinixir Company Limited selected Oracle's innovative clinical research and pharmacovigilance solutions as its eClinical platform. Clinixir chose the Oracle Health Sciences Clinical One Cloud Service for its comprehensive, end-to-end technology capabilities and breadth of applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Outsourcing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Outsourcing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Outsourcing Industry?

To stay informed about further developments, trends, and reports in the Healthcare Outsourcing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence