Key Insights

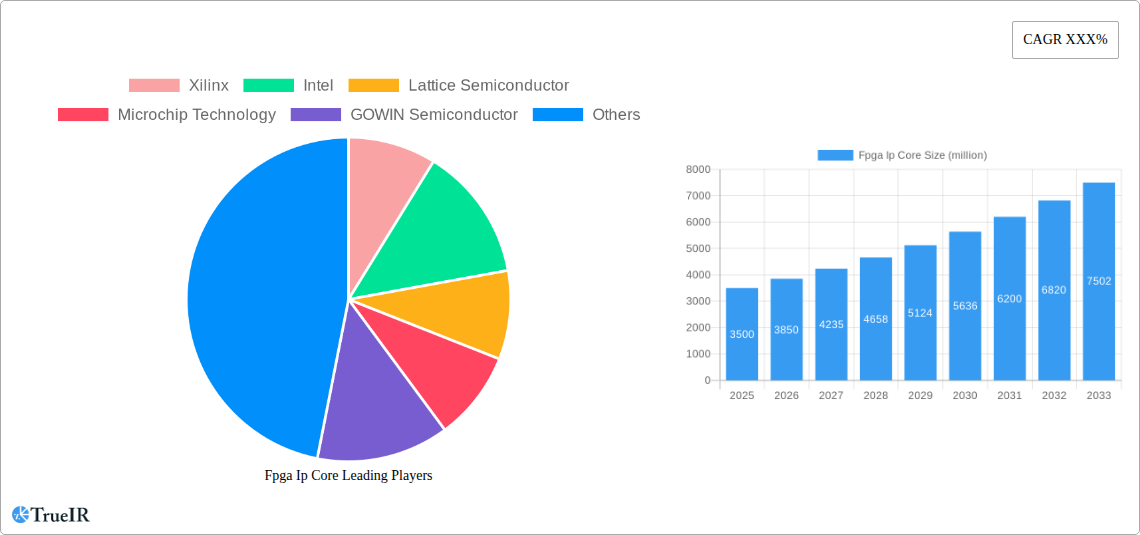

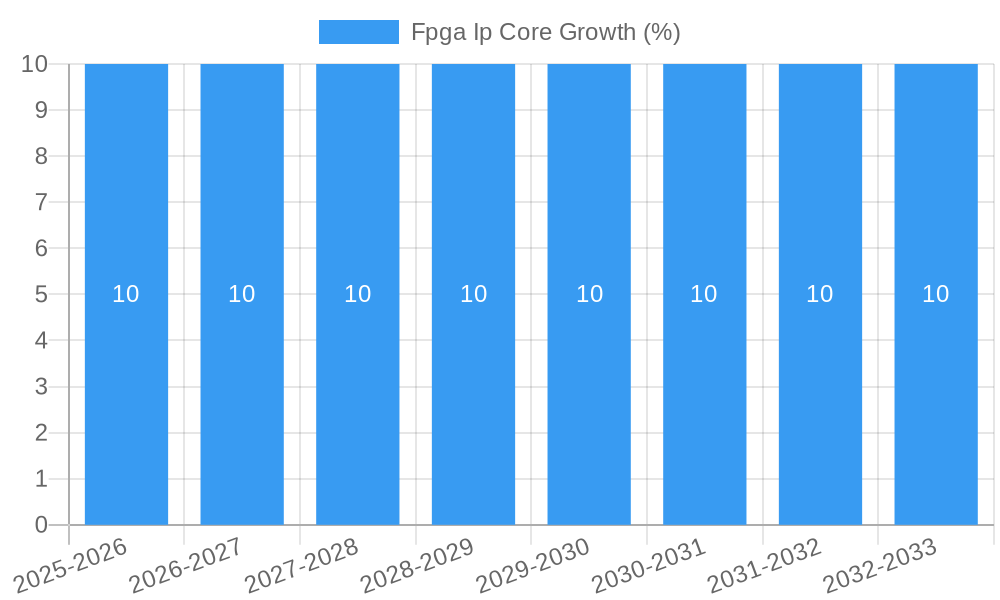

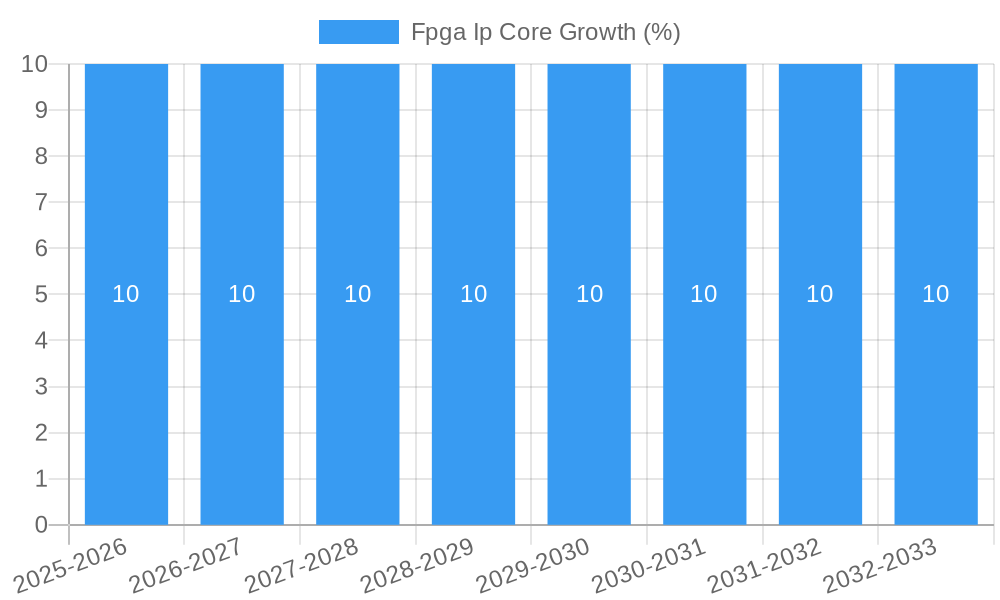

The FPGA IP Core market is poised for significant expansion, driven by the escalating demand for high-performance, customizable hardware solutions across a multitude of industries. With a projected market size of approximately $3,500 million and an anticipated Compound Annual Growth Rate (CAGR) of around 10-12% from 2025 to 2033, this sector demonstrates robust momentum. The primary growth drivers include the rapid advancements in telecommunications infrastructure, particularly the rollout of 5G networks, which necessitate sophisticated processing capabilities. Furthermore, the burgeoning adoption of industrial automation and control systems in manufacturing, logistics, and energy sectors, coupled with the increasing complexity and data demands of networking and data centers, are fueling the need for flexible and efficient FPGA IP Cores. The market's trajectory suggests a strong preference for Soft IP Cores due to their adaptability and cost-effectiveness, though Hard IP Cores will continue to dominate high-performance, specialized applications.

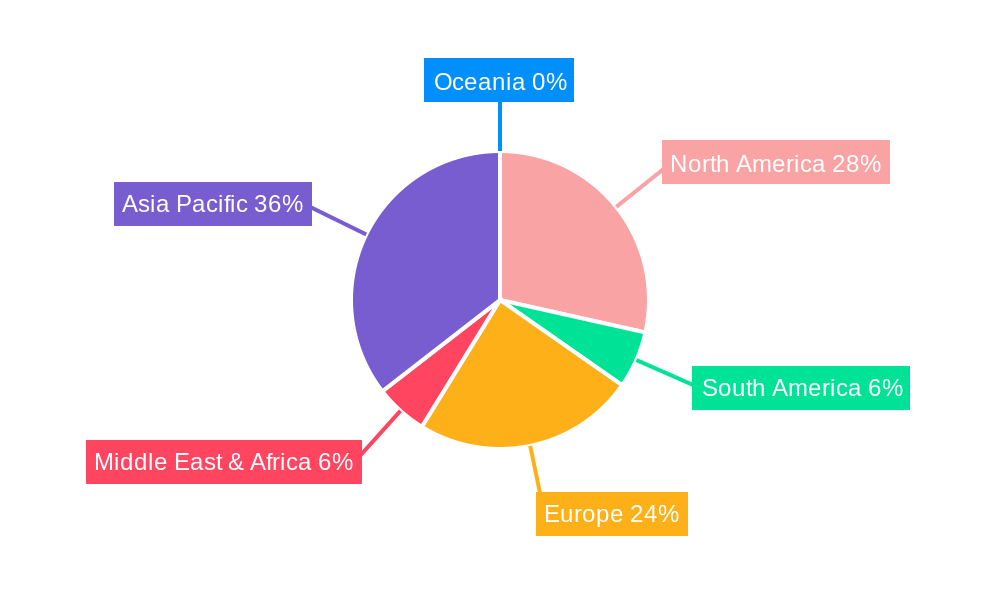

Emerging trends like the integration of AI and machine learning capabilities directly into FPGA designs, the growing utilization of FPGA IP Cores in edge computing, and the increasing emphasis on power efficiency are shaping the competitive landscape. While the market is generally robust, potential restraints such as the specialized skill set required for FPGA development and the initial setup costs for certain applications could pose challenges. However, the continuous innovation from key players like Xilinx, Intel, and Lattice Semiconductor, coupled with the expansion of regional markets, particularly in Asia Pacific with China and India leading the charge, indicates a sustained period of growth and opportunity. The increasing adoption across diverse applications, from consumer electronics to automotive, further solidifies the FPGA IP Core market's critical role in enabling next-generation technological advancements.

Here is a dynamic, SEO-optimized report description for FPGA IP Cores, incorporating high-volume keywords and structured for clarity and immediate insight.

FPGA IP Core Market: Growth, Trends, and Competitive Landscape 2019–2033

This comprehensive report offers an in-depth analysis of the global FPGA IP Core market, projected to reach several million dollars by 2033. We delve into the intricate market structure, dynamic competitive landscape, evolving trends, and key opportunities that are shaping the future of this critical semiconductor segment. With a study period spanning from 2019 to 2033, including a base year of 2025 and an estimated year also of 2025, this report provides robust historical context and precise future projections for the forecast period (2025–2033). Understand the strategic implications of market concentration, innovation drivers, regulatory impacts, product substitutes, end-user segmentation, and M&A trends. Gain critical insights into market size growth, technological shifts, consumer preferences, and competitive dynamics.

FPGA IP Core Market Structure & Competitive Landscape

The FPGA IP Core market exhibits a moderately concentrated structure, with a significant share held by key players such as Xilinx, Intel, Lattice Semiconductor, Microchip Technology, GOWIN Semiconductor, Menta, QuickLogic, and Achronix. Innovation drivers are primarily fueled by the increasing demand for high-performance computing, advancements in AI and machine learning, and the growing adoption of FPGAs in telecommunications, networking, and industrial automation. Regulatory impacts, while generally supportive of technological advancement, can influence market access and compliance standards. Product substitutes, such as ASICs and GPUs, present a competitive challenge, though FPGA IP cores offer distinct advantages in flexibility and time-to-market. End-user segmentation highlights the dominance of telecommunications, networking, and data centers, followed by industrial automation and control. Mergers and acquisitions (M&A) trends are actively shaping the landscape, with an estimated xx major M&A deals valued in the millions of dollars occurring annually. Concentration ratios are expected to remain stable, with a few large players dominating the high-end segment, while niche players cater to specific application requirements.

FPGA IP Core Market Trends & Opportunities

The FPGA IP Core market is experiencing robust growth, driven by the insatiable demand for customizable and reconfigurable hardware acceleration across a multitude of industries. Market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching several million dollars. Technological shifts are central to this expansion, with advancements in process nodes leading to smaller, more power-efficient FPGA devices and increasingly sophisticated IP cores. The development of specialized IP cores for artificial intelligence, machine learning inference, high-speed networking (e.g., 400G Ethernet, PCIe Gen 5), and edge computing is a significant trend. Consumer preferences, particularly from system designers and engineers, are leaning towards readily available, high-quality IP cores that accelerate development cycles and reduce design complexity. Competitive dynamics are characterized by intense innovation, with companies continuously enhancing their IP portfolios and offering integrated solutions. Opportunities abound in emerging applications such as autonomous driving, advanced medical imaging, and secure data processing, where the unique capabilities of FPGAs and their associated IP cores are indispensable. The increasing prevalence of edge AI deployments further fuels the demand for efficient and adaptable hardware acceleration.

Dominant Markets & Segments in FPGA IP Core

The Telecommunications, Networking and Data Centers segment currently represents the largest and fastest-growing market for FPGA IP Cores. This dominance is driven by several key growth factors.

- Infrastructure Upgrades: The relentless global expansion and upgrade of telecommunications infrastructure, including 5G deployment and the evolution towards 6G, necessitates high-performance, low-latency processing capabilities that FPGA IP cores excel at providing for functions like baseband processing, packet forwarding, and network acceleration.

- Data Center Expansion: The exponential growth in data generation and consumption fuels the demand for more efficient data center operations. FPGA IP cores are crucial for accelerating critical workloads in data centers, including analytics, AI/ML inferencing, encryption/decryption, and high-speed network interfaces, leading to significant energy savings and performance gains.

- High-Speed Connectivity: The increasing demand for higher bandwidth and faster data transfer speeds in networking applications, such as 400GbE and beyond, makes FPGA IP cores indispensable for implementing complex network functions and protocols.

- Programmability and Flexibility: The inherent programmability of FPGAs allows for rapid adaptation to evolving standards and new applications within the telecommunications and networking sectors, a critical advantage over fixed-function ASICs.

Within the Type segmentation, Hard IP Core and Firm IP (Semi-Hard IP) Core are witnessing substantial growth, particularly for performance-critical applications within these dominant segments.

- Hard IP Core Dominance: For applications demanding maximum performance, minimal power consumption, and predictable timing, such as high-frequency trading or ultra-low latency networking, Hard IP cores, which are pre-verified and mapped to specific FPGA fabric structures, offer significant advantages. The market for these highly optimized cores is projected to grow by xx% annually.

- Firm IP (Semi-Hard IP) Core Growth: Firm IP cores strike a balance between the performance of Hard IP and the flexibility of Soft IP. They are typically pre-placed and routed, offering faster integration and better performance than Soft IP, making them increasingly popular for complex designs in networking and industrial applications. Their market share is expected to increase by xx% over the forecast period.

- Soft IP Core Niche: While Soft IP cores offer the highest degree of flexibility and portability across different FPGA architectures, their performance and power efficiency are generally lower. They continue to hold a strong position in R&D, prototyping, and less performance-intensive applications.

The Industrial Automation and Control segment is also a significant contributor, driven by the increasing adoption of Industry 4.0 technologies, smart manufacturing, and the need for real-time control systems, robotics, and vision processing, where FPGA IP cores enable custom acceleration and deterministic operation.

FPGA IP Core Product Analysis

FPGA IP cores are at the forefront of semiconductor innovation, enabling custom hardware acceleration for a vast array of applications. Product innovations are characterized by the development of highly specialized cores for AI/ML inference, advanced signal processing, high-speed networking, and embedded vision. Competitive advantages stem from their reconfigurability, enabling rapid design iteration and adaptation to evolving industry standards, unlike fixed-function ASICs. This flexibility, combined with increasing performance densities and power efficiencies of modern FPGAs, makes FPGA IP cores essential for applications in telecommunications, data centers, industrial automation, and automotive.

Key Drivers, Barriers & Challenges in FPGA IP Core

Key Drivers: The FPGA IP core market is propelled by the burgeoning demand for custom hardware acceleration in AI/ML, 5G networks, and data centers. Technological advancements in FPGA architectures, leading to higher performance and lower power consumption, are significant drivers. The increasing complexity of modern SoCs and the need for accelerated development cycles, where pre-verified IP cores significantly reduce design time and risk, are also crucial factors. Furthermore, government initiatives promoting domestic semiconductor manufacturing and R&D further bolster market growth.

Barriers & Challenges: Supply chain disruptions, particularly the global semiconductor shortage experienced in recent years, have impacted the availability and pricing of FPGAs, indirectly affecting the IP core market. Intense competition from ASIC solutions, especially for high-volume, cost-sensitive applications, and the inherent learning curve associated with FPGA design and integration present challenges. Regulatory hurdles related to intellectual property protection and export controls can also create complexities for global market participants.

Growth Drivers in the FPGA IP Core Market

Key growth drivers for the FPGA IP Core market include the rapid expansion of Artificial Intelligence and Machine Learning, necessitating custom hardware accelerators for inference and training. The ongoing global deployment of 5G infrastructure and the development of next-generation wireless technologies are creating immense demand for high-performance, low-latency processing solutions. Furthermore, the continuous growth of data centers and the increasing need for efficient data processing, analytics, and network acceleration are significant economic catalysts. Regulatory support for domestic semiconductor innovation and advanced manufacturing also contributes positively.

Challenges Impacting FPGA IP Core Growth

Regulatory complexities in international trade and IP protection can pose significant barriers to growth. Supply chain issues, including the availability of advanced FPGA devices and components, continue to be a concern. Intense competitive pressures from ASICs for certain high-volume applications and the inherent design complexity and associated talent requirements for FPGA development also present challenges. Overcoming these hurdles requires strategic partnerships, robust supply chain management, and continuous efforts in design tool development and education.

Key Players Shaping the FPGA IP Core Market

- Xilinx

- Intel

- Lattice Semiconductor

- Microchip Technology

- GOWIN Semiconductor

- Menta

- QuickLogic

- Achronix

Significant FPGA IP Core Industry Milestones

- 2019: Introduction of new AI-optimized IP cores by major FPGA vendors, boosting machine learning capabilities.

- 2020: Increased focus on soft IP cores for broader accessibility and development flexibility.

- 2021: Significant advancements in high-speed networking IP cores to support 400GbE and beyond.

- 2022: Emergence of specialized IP cores for edge AI and IoT applications.

- 2023: Enhanced security IP cores become a key offering due to growing cybersecurity concerns.

- 2024: Innovations in RISC-V based IP cores for greater customization and open architecture.

Future Outlook for FPGA IP Core Market

The future outlook for the FPGA IP Core market is exceptionally bright, driven by ongoing technological advancements and the expanding application landscape. The persistent demand for accelerated computing in AI/ML, 5G/6G telecommunications, and advanced data analytics will continue to fuel growth. Strategic opportunities lie in developing specialized IP cores for emerging fields like autonomous driving, quantum computing interfaces, and advanced robotics. The market is poised for significant expansion as FPGAs and their integrated IP cores become increasingly integral to overcoming the computational challenges of next-generation technologies, offering unparalleled flexibility and performance.

Fpga Ip Core Segmentation

-

1. Application

- 1.1. Telecommunications

- 1.2. Networking and Data Centers

- 1.3. Industrial Automation and Control

- 1.4. Other

-

2. Type

- 2.1. Hard IP Core

- 2.2. Firm IP (Semi-Hard IP) Core

- 2.3. Soft IP Core

Fpga Ip Core Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fpga Ip Core REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Telecommunications

- 5.1.2. Networking and Data Centers

- 5.1.3. Industrial Automation and Control

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hard IP Core

- 5.2.2. Firm IP (Semi-Hard IP) Core

- 5.2.3. Soft IP Core

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Telecommunications

- 6.1.2. Networking and Data Centers

- 6.1.3. Industrial Automation and Control

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hard IP Core

- 6.2.2. Firm IP (Semi-Hard IP) Core

- 6.2.3. Soft IP Core

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Telecommunications

- 7.1.2. Networking and Data Centers

- 7.1.3. Industrial Automation and Control

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hard IP Core

- 7.2.2. Firm IP (Semi-Hard IP) Core

- 7.2.3. Soft IP Core

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Telecommunications

- 8.1.2. Networking and Data Centers

- 8.1.3. Industrial Automation and Control

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hard IP Core

- 8.2.2. Firm IP (Semi-Hard IP) Core

- 8.2.3. Soft IP Core

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Telecommunications

- 9.1.2. Networking and Data Centers

- 9.1.3. Industrial Automation and Control

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hard IP Core

- 9.2.2. Firm IP (Semi-Hard IP) Core

- 9.2.3. Soft IP Core

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fpga Ip Core Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Telecommunications

- 10.1.2. Networking and Data Centers

- 10.1.3. Industrial Automation and Control

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hard IP Core

- 10.2.2. Firm IP (Semi-Hard IP) Core

- 10.2.3. Soft IP Core

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Xilinx

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lattice Semiconductor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microchip Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GOWIN Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Menta

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 QuickLogic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Achronix

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Xilinx

List of Figures

- Figure 1: Global Fpga Ip Core Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fpga Ip Core Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fpga Ip Core Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fpga Ip Core Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fpga Ip Core Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fpga Ip Core Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fpga Ip Core Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fpga Ip Core Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fpga Ip Core Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fpga Ip Core Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fpga Ip Core Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fpga Ip Core Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fpga Ip Core Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fpga Ip Core Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fpga Ip Core Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fpga Ip Core Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fpga Ip Core Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fpga Ip Core Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fpga Ip Core Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fpga Ip Core Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fpga Ip Core Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fpga Ip Core Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fpga Ip Core Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fpga Ip Core Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fpga Ip Core Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fpga Ip Core Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fpga Ip Core Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fpga Ip Core Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fpga Ip Core Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fpga Ip Core Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fpga Ip Core Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fpga Ip Core Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fpga Ip Core Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fpga Ip Core Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fpga Ip Core Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fpga Ip Core Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fpga Ip Core Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fpga Ip Core Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fpga Ip Core Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fpga Ip Core Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fpga Ip Core Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fpga Ip Core?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Fpga Ip Core?

Key companies in the market include Xilinx, Intel, Lattice Semiconductor, Microchip Technology, GOWIN Semiconductor, Menta, QuickLogic, Achronix.

3. What are the main segments of the Fpga Ip Core?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fpga Ip Core," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fpga Ip Core report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fpga Ip Core?

To stay informed about further developments, trends, and reports in the Fpga Ip Core, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence