Key Insights

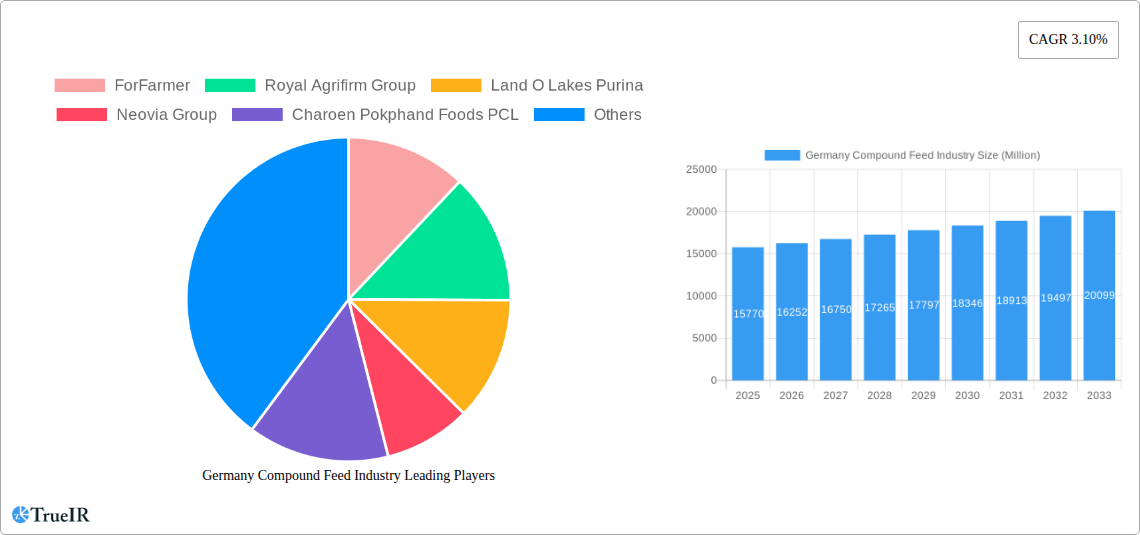

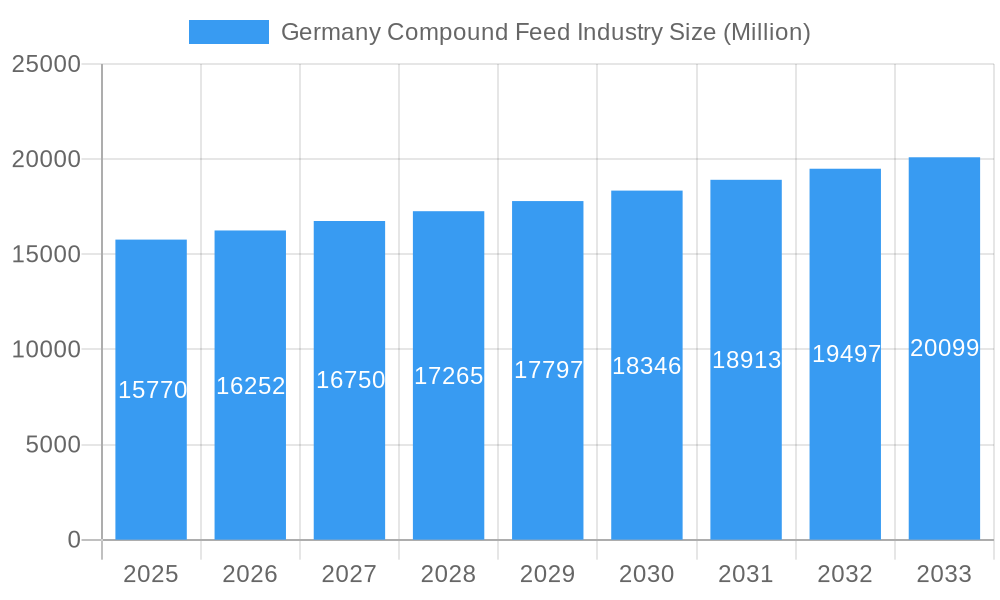

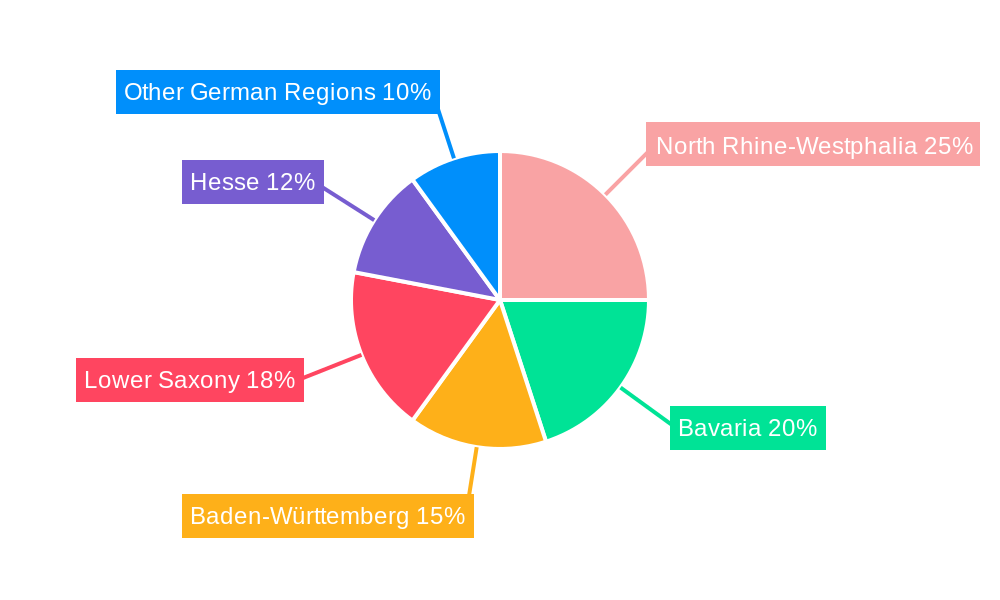

The German compound feed market, valued at €15.77 billion in 2025, exhibits a steady growth trajectory, projected to expand at a CAGR of 3.10% from 2025 to 2033. This growth is driven by several factors. Increasing demand for animal protein, particularly poultry and swine, fuels the need for efficient and nutritious compound feed. The rising adoption of advanced feeding technologies and precision livestock farming practices further contributes to market expansion. Germany's robust agricultural sector and focus on sustainable farming methods also play a crucial role. While regulatory changes concerning feed composition and environmental sustainability present some challenges, the overall market outlook remains positive. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, others) and ingredient (cereals, cakes & meals, by-products, supplements). Poultry and swine segments are likely to witness the most significant growth, propelled by increasing consumer demand for meat. Major players like ForFarmer, Royal Agrifirm Group, and Land O Lakes Purina dominate the market, leveraging their extensive distribution networks and technological advancements to maintain a competitive edge. Regional variations exist, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse representing key market areas reflecting higher livestock density and agricultural activity.

Germany Compound Feed Industry Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and regional players. The market is experiencing consolidation as larger companies acquire smaller ones to expand their market share and product portfolio. Innovation in feed formulation, focusing on improved digestibility, enhanced nutrient utilization, and reduced environmental impact, is a key trend. The growing consumer awareness of animal welfare and sustainable food production practices is also influencing the market, leading to a demand for more ethically and environmentally responsible feed solutions. This necessitates strategic investments in research and development to create innovative and sustainable feed products. Furthermore, fluctuations in raw material prices and evolving government regulations will continue to influence market dynamics throughout the forecast period.

Germany Compound Feed Industry Company Market Share

Germany Compound Feed Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Germany compound feed industry, covering market size, segmentation, competitive landscape, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is essential for businesses, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market.

Germany Compound Feed Industry Market Structure & Competitive Landscape

The German compound feed industry exhibits a moderately concentrated market structure, with the top 10 players commanding approximately xx% of the market share in 2024. Key players include ForFarmer, Royal Agrifirm Group, Land O Lakes Purina, Neovia Group, Charoen Pokphand Foods PCL, Nuscience Group, Nutreco NV, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds, and Trouw Nutrition Deutschland GmbH. Innovation, particularly in sustainable and specialized feed formulations, is a major driver, fueled by increasing consumer demand for high-quality animal products and a growing focus on animal welfare. Stringent EU regulations regarding feed composition and safety significantly impact industry operations. Product substitutes, such as home-mixed feeds, pose a competitive threat, though their market share remains relatively small (estimated at xx%). The industry witnesses regular M&A activity, with an estimated xx Million Euro in deal value recorded during 2019-2024. End-user segmentation is primarily driven by animal type (ruminants, poultry, swine, aquaculture, and others), influencing product formulation and market demand.

- Market Concentration: Top 10 players hold approximately xx% market share (2024).

- Innovation Drivers: Sustainable feed formulations, specialized diets for enhanced animal health and productivity.

- Regulatory Impacts: Stringent EU regulations on feed composition, safety, and traceability.

- Product Substitutes: Home-mixed feeds, with a limited market share (estimated at xx%).

- End-User Segmentation: Ruminants, poultry, swine, aquaculture, and other animal types.

- M&A Trends: xx Million Euro in deal value (2019-2024).

Germany Compound Feed Industry Market Trends & Opportunities

The German compound feed market is poised for steady growth, with a projected CAGR of xx% from 2025 to 2033, driven by increasing demand for animal protein and technological advancements in feed formulation. Market size is estimated at xx Million Euro in 2025, expanding to xx Million Euro by 2033. Technological shifts, such as the incorporation of precision feeding technologies and data analytics for optimized feed management, are transforming industry practices. Consumer preferences are shifting towards sustainably produced animal products, influencing the demand for organic and environmentally friendly feed ingredients. Intense competition compels continuous innovation and efficiency improvements among market players. Market penetration of specialized feed solutions, such as those designed for specific animal breeds or health conditions, is growing steadily, with a projected penetration rate of xx% by 2033. Emerging trends like insect-based proteins and alternative feed sources present significant growth opportunities.

Dominant Markets & Segments in Germany Compound Feed Industry

The poultry segment continues to be the dominant force in the German compound feed market, representing a substantial portion of the total volume in 2024, estimated at approximately 45-50%. Following closely is the swine segment, projected to account for 30-35%, while the ruminant segment makes up a significant 20-25%. In terms of ingredient categories, cereals remain the cornerstone, holding the largest market share at an estimated 50-55%, driven by their widespread availability and cost-effectiveness. This is followed by cakes & meals, contributing around 20-25%, and various by-products which represent approximately 15-20% of the market share. The aquaculture segment, though smaller, is showing promising growth potential.

Key Growth Drivers for Dominant Segments:

- Poultry: Sustained high demand for poultry meat and eggs, bolstered by highly efficient farming practices and a favorable production cost structure, continues to fuel robust growth in this segment. Innovations in feed formulations aimed at improving feed conversion ratios further enhance its appeal.

- Swine: A strong and consistent domestic demand for pork, coupled with significant export opportunities, underpins the expansion of the swine feed market. While susceptible to global market price fluctuations, the overall trend remains positive, supported by a focus on lean meat production and improved animal health.

- Cereals: The inherent advantage of broad availability and relative cost-effectiveness solidifies cereals' position as a dominant feed ingredient. However, the industry is actively exploring strategies to mitigate the impact of increasing price volatility, which can influence profitability and necessitate strategic sourcing and hedging.

Detailed Market Analysis: The preeminence of poultry and swine in the German compound feed landscape is a direct reflection of high per capita consumption of these animal proteins within Germany and across the wider European Union. The substantial contribution of cereals underscores their historical and ongoing role as a fundamental feed component. In response to growing concerns about supply chain resilience and price fluctuations, the industry is actively investing in research and development to identify and integrate alternative feed ingredients. The aquaculture segment is poised for accelerated growth, driven by a growing consumer preference for sustainably sourced seafood and a rising awareness of its health benefits.

Germany Compound Feed Industry Product Analysis

Product innovations focus on optimizing feed formulations for improved animal health, productivity, and reduced environmental impact. This includes utilizing advanced feed additives, such as enzymes and probiotics, to enhance nutrient digestibility and minimize waste. Formulations tailored to specific animal species and life stages are gaining traction, catering to evolving consumer demand for high-quality and sustainably produced animal products. The competitive advantage lies in developing innovative, cost-effective, and environmentally sustainable feed solutions while adhering to increasingly stringent regulatory requirements.

Key Drivers, Barriers & Challenges in Germany Compound Feed Industry

Key Drivers: The German compound feed industry is propelled by several key factors. The persistent and growing global demand for animal protein remains a primary driver. Technological advancements in feed formulation, including precision nutrition and the use of novel ingredients, are enhancing efficiency and product quality. Furthermore, an increasing emphasis on animal welfare and sustainability across the entire value chain is stimulating innovation and the adoption of eco-friendly practices. Specifically, the continued expansion of the highly efficient poultry sector and the rising demand for high-quality, sustainably produced pork are significant contributors to market growth. Supportive government policies and initiatives promoting sustainable agricultural practices also play a crucial role in fostering innovation and market expansion.

Key Challenges: The industry faces significant hurdles that impact profitability and growth. Fluctuating raw material prices, particularly for key commodities like cereals and protein meals, create considerable price volatility and exert substantial pressure on profit margins. Stringent regulatory frameworks governing feed composition, safety standards, and environmental impact necessitate continuous investment in compliance, research, and quality control, thereby increasing operational costs. Intense competition among established players and new entrants demands constant innovation, operational efficiency improvements, and a focus on delivering added value to customers to maintain and expand market share. Moreover, supply chain disruptions, exacerbated by global events such as pandemics, geopolitical instability, and climate change-related weather patterns, pose a significant threat to the consistent availability and predictable pricing of essential feed ingredients. These cumulative factors are estimated to lead to a 5-10% reduction in profit margins due to price volatility and the ongoing costs associated with regulatory compliance.

Growth Drivers in the Germany Compound Feed Industry Market

The growth of the German compound feed industry is propelled by rising consumer demand for animal protein, the continuous improvement of livestock farming techniques, and stringent regulations promoting animal welfare and environmental sustainability. Technological advancements in feed formulations, particularly using precision feeding technologies and data analytics for optimized feed management, significantly contribute to improved efficiency and reduced waste.

Challenges Impacting Germany Compound Feed Industry Growth

The growth trajectory of the German compound feed industry is significantly influenced by a confluence of challenges. Chief among these are the ever-fluctuating prices of key raw materials, with a particular sensitivity to the cost of cereals and oilseeds, which directly impacts production costs. The increasing financial burden of regulatory compliance, encompassing stringent safety, environmental, and animal welfare standards, necessitates substantial ongoing investment. Furthermore, the intense competitive landscape, characterized by both domestic and international players, compels companies to operate at peak efficiency and foster continuous innovation to retain market position. Amplifying these challenges are persistent supply chain vulnerabilities, which create uncertainty regarding the reliable availability and stable pricing of crucial ingredients, often stemming from global logistical issues or geopolitical events. Collectively, these factors exert considerable pressure on profit margins and can impede the industry's overall growth potential and its ability to respond swiftly to market demands.

Key Players Shaping the Germany Compound Feed Industry Market

- ForFarmer

- Royal Agrifirm Group

- Land O Lakes Purina

- Neovia Group

- Charoen Pokphand Foods PCL

- Nuscience Group

- Nutreco NV

- Alltech Inc

- Archer Daniels Midland

- Cargill Inc

- Kent Feeds

- Trouw Nutrition Deutschland GmbH

Significant Germany Compound Feed Industry Industry Milestones

- November 2022: BASF significantly bolstered its feed enzyme production capabilities with the expansion of its plant in Ludwigshafen. This strategic investment enhanced the supply of key enzymes such as Natuphos E, Natugrain TS, and Natupulse TS. The increased capacity strengthens the market's access to high-quality feed additives, crucial for improving feed digestibility, nutrient utilization, and ultimately, the economic efficiency of animal production. This move reinforces BASF's commitment to sustainable animal nutrition and supports the industry's drive for enhanced performance and reduced environmental footprint.

- May 2021: ForFarmers introduced "ForFaser," an innovative fiber-rich feed component specifically designed for swine. This product launch represents a significant step in catering to evolving consumer preferences for more sustainable and ethically produced food. ForFaser aligns with the growing demand for feed solutions that support improved animal welfare, gut health, and a reduced reliance on traditional feed ingredients, positioning ForFarmers as a leader in sustainable feed innovation.

Future Outlook for Germany Compound Feed Industry Market

The German compound feed industry is poised for continued and robust growth in the coming years. This positive outlook is underpinned by several key trends: ongoing technological advancements in feed formulation and production processes, a steadfast focus on sustainability across the entire agricultural value chain, and the consistently rising global demand for animal protein. Emerging strategic opportunities lie in the development of novel feed formulations leveraging alternative protein sources, such as insect protein and plant-based alternatives, and the widespread adoption of precision feeding technologies that optimize nutrient delivery and minimize waste. The market's future success will be critically dependent on its ability to effectively navigate and address persistent challenges, notably the volatility of raw material prices and the increasing demands of regulatory compliance. Embracing innovation, prioritizing sustainable practices, and fostering resilient supply chains will be paramount for sustained growth and competitiveness in the evolving German compound feed industry.

Germany Compound Feed Industry Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-Products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

Germany Compound Feed Industry Segmentation By Geography

- 1. Germany

Germany Compound Feed Industry Regional Market Share

Geographic Coverage of Germany Compound Feed Industry

Germany Compound Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Consumer Preference Towards Meat and Other Animal Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Compound Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-Products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ForFarmer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Agrifirm Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Land O Lakes Purina

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neovia Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Charoen Pokphand Foods PCL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nuscience Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nutreco NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alltech Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Archer Daniels Midland

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kent Feeds

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Trouw Nutrition Deutschland GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 ForFarmer

List of Figures

- Figure 1: Germany Compound Feed Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Compound Feed Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Compound Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Germany Compound Feed Industry Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Germany Compound Feed Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Compound Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Germany Compound Feed Industry Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Germany Compound Feed Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Compound Feed Industry?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Germany Compound Feed Industry?

Key companies in the market include ForFarmer, Royal Agrifirm Group, Land O Lakes Purina, Neovia Group, Charoen Pokphand Foods PCL, Nuscience Grou, Nutreco NV, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds, Trouw Nutrition Deutschland GmbH.

3. What are the main segments of the Germany Compound Feed Industry?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Growing Consumer Preference Towards Meat and Other Animal Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: BASF expanded the production capacity of feed enzyme plants in Ludwigshafen, Germany. The expansion of the existing plant enables BASF to meet the growing global demand from customers for a reliable, high-quality supply of the BASF feed enzymes Natuphos E (phytase), Natugrain TS (xylanase and glucanase), and the recently launched Natupulse TS (mannanase).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Compound Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Compound Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Compound Feed Industry?

To stay informed about further developments, trends, and reports in the Germany Compound Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence