Key Insights

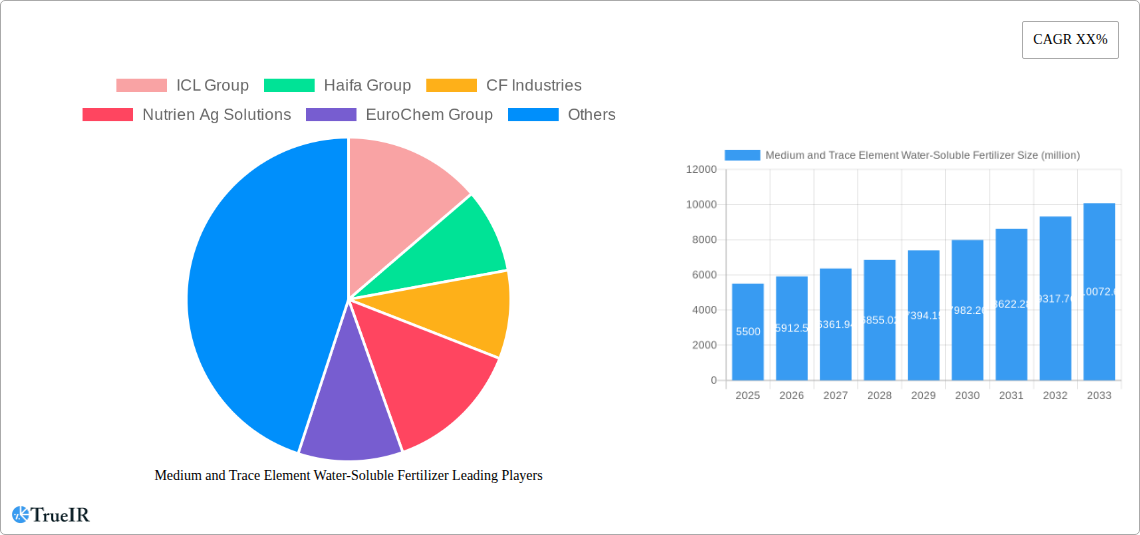

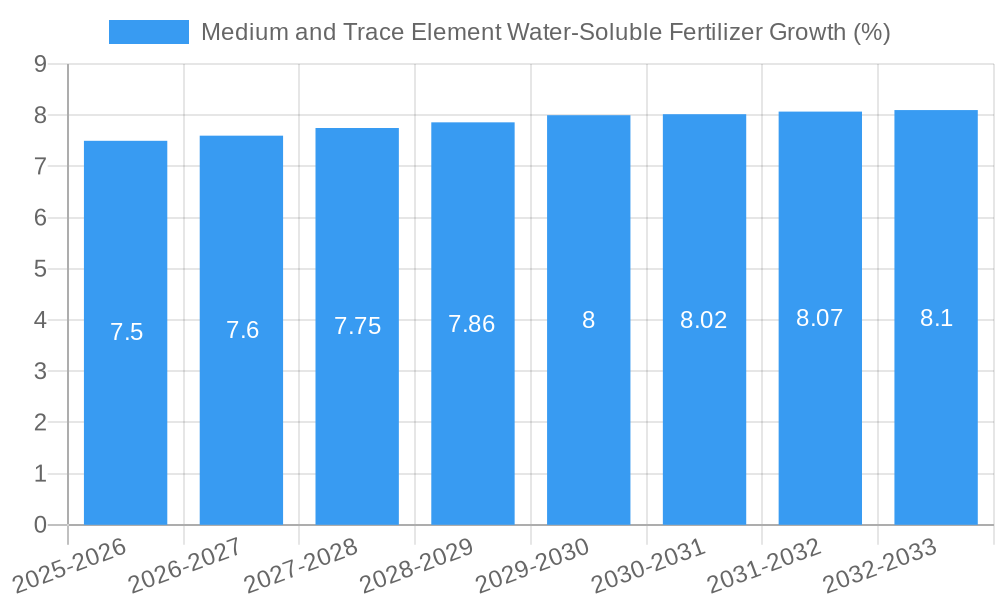

The global market for Medium and Trace Element Water-Soluble Fertilizers is experiencing robust expansion, driven by a critical need to enhance crop yields and quality in the face of increasing food demand and declining arable land. With an estimated market size of approximately USD 5,500 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This sustained growth is propelled by several key factors, including the rising adoption of precision agriculture techniques, the growing awareness among farmers about the importance of balanced plant nutrition beyond NPK, and the increasing prevalence of soil deficiencies that limit crop productivity. Water-soluble fertilizers, in particular, offer superior nutrient delivery efficiency and are well-suited for modern irrigation systems like fertigation, minimizing nutrient loss and environmental impact. The demand is further amplified by government initiatives promoting sustainable agricultural practices and the need to improve the nutritional value of food products to combat micronutrient deficiencies in human populations.

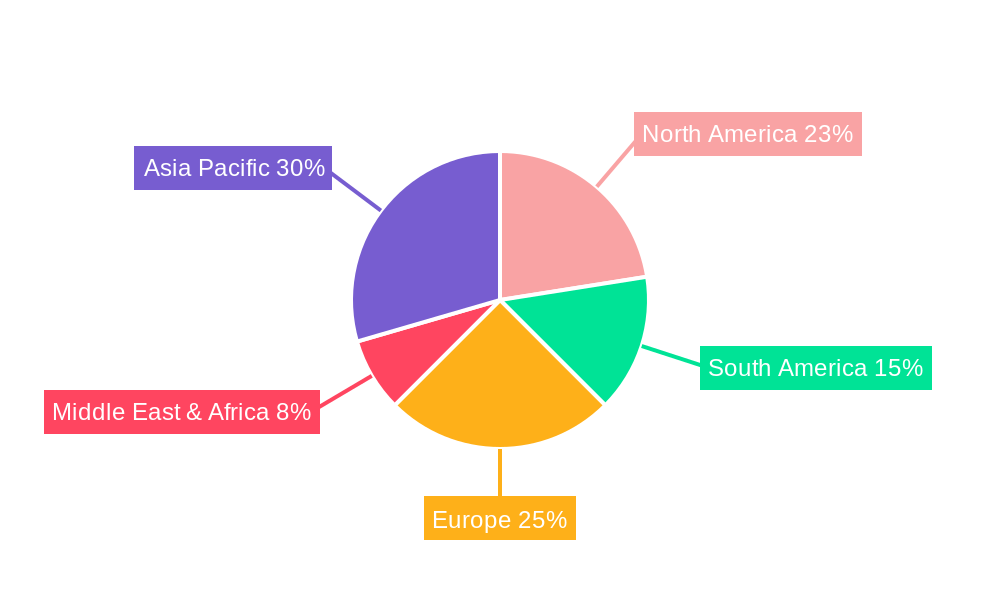

The market segmentation reveals distinct growth opportunities across various applications and types. Food crops, oil crops, and vegetables represent significant application segments, with increasing emphasis on specialized nutrient formulations tailored to specific crop requirements and growth stages. The "Others" segment, likely encompassing specialty crops and horticultural applications, is also poised for substantial growth. In terms of product types, both solid and liquid water-soluble fertilizers are witnessing strong demand, with liquid formulations gaining traction due to their ease of application and rapid nutrient uptake. Geographically, the Asia Pacific region, led by China and India, is anticipated to be a dominant market, fueled by its large agricultural base, increasing adoption of advanced farming technologies, and supportive government policies. North America and Europe also represent significant markets, driven by a mature agricultural sector focused on efficiency and sustainability. Key players like ICL Group, Haifa Group, CF Industries, and Nutrien Ag Solutions are actively investing in research and development, expanding their product portfolios, and strengthening their distribution networks to capture market share in this dynamic and expanding industry.

Medium and Trace Element Water-Soluble Fertilizer Market Structure & Competitive Landscape

The global medium and trace element water-soluble fertilizer market is characterized by a moderate to high concentration, with a significant market share held by a few key global players, including ICL Group, Haifa Group, CF Industries, Nutrien Ag Solutions, EuroChem Group, and Yara International ASA. These entities leverage extensive R&D capabilities, established distribution networks, and strong brand recognition to maintain their competitive edge. Innovation drivers are primarily focused on enhancing nutrient uptake efficiency, developing specialized formulations for specific crops and soil conditions, and promoting sustainable agricultural practices. The regulatory landscape, while varying by region, increasingly favors fertilizers that minimize environmental impact and comply with stringent quality standards. Product substitutes, such as granular fertilizers and organic nutrient sources, exist but often lack the precise application and rapid nutrient delivery offered by water-soluble formulations. End-user segmentation is diverse, with significant demand stemming from food crops, oil crops, and vegetables. Merger and acquisition (M&A) trends, while not dominant, are observed as companies seek to expand their product portfolios, geographic reach, and technological expertise. For instance, the market has witnessed M&A activity totaling an estimated 1,500 million in deal values over the historical period, indicating consolidation and strategic expansion within the industry.

Medium and Trace Element Water-Soluble Fertilizer Market Trends & Opportunities

The medium and trace element water-soluble fertilizer market is poised for robust growth, driven by a confluence of factors that are reshaping agricultural practices worldwide. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period of 2025–2033, escalating from an estimated market size of 35,000 million in the base year of 2025. This expansion is fueled by the escalating global demand for food production to feed a burgeoning population, which necessitates enhanced crop yields and improved nutritional content. Precision agriculture techniques are gaining traction, leading farmers to adopt more efficient and targeted fertilization methods, where water-soluble fertilizers excel due to their rapid absorption and minimal wastage. Technological shifts are a significant trend, with continuous advancements in fertilizer formulations focusing on enhanced bioavailability of micronutrients, reduced environmental footprint, and improved solubility for various irrigation systems, including drip irrigation and foliar application. Consumer preferences are also evolving, with an increasing emphasis on healthier, more nutritious food products, which directly influences the demand for fertilizers that contribute to better crop quality. The competitive dynamics are intensifying, as established players invest heavily in R&D and market penetration, while new entrants with innovative technologies are emerging, particularly from regions like Asia. The market penetration rate for water-soluble fertilizers, while varying by crop and region, is steadily increasing as awareness of their benefits grows. Opportunities abound for manufacturers who can offer sustainable, cost-effective, and highly efficient nutrient solutions tailored to specific agricultural needs. The increasing adoption of modern farming techniques, coupled with government initiatives promoting sustainable agriculture and food security, are expected to further accelerate market growth. The development of specialized water-soluble fertilizers for high-value crops, organic farming, and hydroponic systems represents a significant untapped potential. Furthermore, the growing awareness among farmers about the detrimental effects of nutrient deficiencies on crop health and yield is a key catalyst for the increased adoption of trace element fertilizers. The market penetration in developed economies is already substantial, with significant growth opportunities emerging in developing regions where agricultural modernization is underway and the adoption of advanced farming inputs is on the rise. The drive towards reducing fertilizer runoff and improving nutrient use efficiency is a paramount concern for environmentalists and policymakers, further bolstering the appeal of water-soluble fertilizers that can be applied precisely and efficiently, minimizing waste and environmental impact.

Dominant Markets & Segments in Medium and Trace Element Water-Soluble Fertilizer

The global medium and trace element water-soluble fertilizer market demonstrates clear regional dominance and segment leadership, driven by a complex interplay of agricultural practices, economic development, and environmental regulations. Asia Pacific, particularly China and India, currently represents the largest market in terms of both volume and value. This dominance is attributed to the vast agricultural landmass, the substantial population requiring food security, and the increasing adoption of modern farming technologies, including precision irrigation and advanced fertilization methods. Government support for agricultural modernization and food production further bolsters this region's lead. Within this region, Food Crops constitute the most dominant application segment, accounting for an estimated 55% of the total market share. Cereals, pulses, and fruits grown for mass consumption necessitate efficient nutrient delivery to maximize yields and ensure adequate food supply. Vegetables emerge as another significant and rapidly growing application segment, driven by increasing consumer demand for fresh produce and the higher nutritional value sought in these crops. The value of this segment is estimated to reach 18,000 million by 2025.

The Types segmentation reveals a dynamic landscape where Solid Fertilizer currently holds a larger market share due to established manufacturing processes and wider availability. However, Liquid Fertilizer is experiencing a faster growth rate, propelled by its ease of application through irrigation systems, precise dosing capabilities, and enhanced nutrient absorption by plants, particularly in high-value crops and controlled environments like greenhouses. The market share of liquid fertilizers is projected to grow at a CAGR of 8.5% over the forecast period.

Key growth drivers in the dominant Asia Pacific region include substantial investments in agricultural infrastructure, including advanced irrigation systems and smart farming technologies. Supportive government policies aimed at increasing agricultural productivity and ensuring food security, alongside subsidies for advanced fertilizers, significantly contribute to market expansion. The rapid industrialization and economic growth in several Asian countries have also led to increased disposable incomes, fostering demand for higher quality food produce, which in turn drives the need for superior fertilization solutions. Furthermore, the presence of major manufacturing hubs for fertilizers in countries like China contributes to competitive pricing and product availability. The increasing adoption of drip and sprinkler irrigation systems, especially in water-scarce regions, is a critical enabler for the widespread use of water-soluble fertilizers.

Medium and Trace Element Water-Soluble Fertilizer Product Analysis

Product innovations in the medium and trace element water-soluble fertilizer market are centered on enhancing nutrient solubility, increasing nutrient use efficiency, and minimizing environmental impact. Manufacturers are developing highly concentrated formulas that dissolve rapidly and completely, preventing clogging in irrigation systems. Advanced formulations often include chelated micronutrients, which improve their availability to plants under various soil pH conditions. Competitive advantages are derived from products offering tailored solutions for specific crop needs, addressing deficiencies of essential elements like zinc, iron, manganese, and copper, which are crucial for plant growth and disease resistance.

Key Drivers, Barriers & Challenges in Medium and Trace Element Water-Soluble Fertilizer

The medium and trace element water-soluble fertilizer market is propelled by several key drivers, including the global imperative for increased food production to meet the demands of a growing population. Technological advancements in precision agriculture and fertigation systems are enabling more efficient nutrient application, driving demand for water-soluble formulations. Furthermore, growing awareness among farmers about the critical role of micronutrients in enhancing crop yield and quality is a significant growth factor.

Key challenges impacting the market include the relatively higher cost of water-soluble fertilizers compared to conventional granular fertilizers, which can be a barrier for small-holder farmers in developing economies. Supply chain disruptions, volatile raw material prices, and stringent regulatory approvals for new formulations also pose significant hurdles. Competitive pressures from established players and the emergence of innovative, albeit sometimes unproven, new entrants add complexity to the market landscape.

Growth Drivers in the Medium and Trace Element Water-Soluble Fertilizer Market

The primary growth drivers for the medium and trace element water-soluble fertilizer market are the escalating global food demand, necessitating higher crop yields and improved quality. Technological advancements in precision agriculture and fertigation are enabling more efficient and targeted nutrient delivery, favoring water-soluble formulations. Growing farmer awareness regarding the crucial role of micronutrients in plant health and productivity further fuels demand. Government initiatives promoting sustainable agricultural practices and food security also contribute significantly to market expansion by incentivizing the adoption of advanced fertilizer solutions.

Challenges Impacting Medium and Trace Element Water-Soluble Fertilizer Growth

Challenges impacting the growth of the medium and trace element water-soluble fertilizer market include the comparatively higher price point of these advanced fertilizers, which can pose affordability issues for farmers in price-sensitive markets. Supply chain complexities and fluctuations in the cost of raw materials can lead to price volatility and impact profitability. Navigating diverse and evolving regulatory frameworks across different regions, including registration processes and environmental compliance standards, presents a continuous challenge. Intense competition among a growing number of players, including both established giants and emerging innovators, also exerts downward pressure on pricing and margins.

Key Players Shaping the Medium and Trace Element Water-Soluble Fertilizer Market

- ICL Group

- Haifa Group

- CF Industries

- Nutrien Ag Solutions

- EuroChem Group

- Yara International ASA

- Grupa Azoty Group

- Xiangcheng Jiahe Biological Technology

- Shandong Dove Agriculture

- Qingdao Haidel

- Liaoning Tianhe Agricultural Technology

- Qingdao Shengao Biotechnology

- Shanghai Harvmore Eco-Tech

Significant Medium and Trace Element Water-Soluble Fertilizer Industry Milestones

- 2019: Introduction of advanced slow-release micronutrient formulations for enhanced nutrient availability.

- 2020: Increased focus on developing water-soluble fertilizers tailored for hydroponic and vertical farming systems.

- 2021: Significant investments in R&D for bio-enhanced water-soluble fertilizers, incorporating beneficial microbes.

- 2022: Expansion of production capacities by major players to meet rising global demand.

- 2023: Growing trend of product customization and bespoke fertilizer solutions for specific regional crops and soil conditions.

- 2024: Enhanced emphasis on sustainable sourcing of raw materials and eco-friendly packaging.

Future Outlook for Medium and Trace Element Water-Soluble Fertilizer Market

The future outlook for the medium and trace element water-soluble fertilizer market is exceptionally bright, driven by an unwavering global demand for enhanced food security and agricultural productivity. The persistent trend towards precision agriculture and efficient resource management will continue to favor water-soluble fertilizers, particularly those designed for fertigation. Continued innovation in nanotechnology for improved nutrient delivery and the development of bio-stimulant integrated fertilizers will further enhance crop health and yield. Emerging markets in Africa and Southeast Asia are expected to witness substantial growth as agricultural practices modernize. Strategic partnerships and ongoing research into optimizing nutrient uptake and minimizing environmental impact will shape the competitive landscape, leading to a more sustainable and efficient agricultural future. The market is projected to reach 75,000 million by 2033.

Medium and Trace Element Water-Soluble Fertilizer Segmentation

-

1. Application

- 1.1. Food Crops

- 1.2. Oil Crops

- 1.3. Vegetables

- 1.4. Others

-

2. Types

- 2.1. Solid Fertilizer

- 2.2. Liquid Fertilizer

Medium and Trace Element Water-Soluble Fertilizer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medium and Trace Element Water-Soluble Fertilizer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Crops

- 5.1.2. Oil Crops

- 5.1.3. Vegetables

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Solid Fertilizer

- 5.2.2. Liquid Fertilizer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Crops

- 6.1.2. Oil Crops

- 6.1.3. Vegetables

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Solid Fertilizer

- 6.2.2. Liquid Fertilizer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Crops

- 7.1.2. Oil Crops

- 7.1.3. Vegetables

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Solid Fertilizer

- 7.2.2. Liquid Fertilizer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Crops

- 8.1.2. Oil Crops

- 8.1.3. Vegetables

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Solid Fertilizer

- 8.2.2. Liquid Fertilizer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Crops

- 9.1.2. Oil Crops

- 9.1.3. Vegetables

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Solid Fertilizer

- 9.2.2. Liquid Fertilizer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Crops

- 10.1.2. Oil Crops

- 10.1.3. Vegetables

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Solid Fertilizer

- 10.2.2. Liquid Fertilizer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ICL Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haifa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CF Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nutrien Ag Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EuroChem Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yara International ASA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grupa Azoty Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xiangcheng Jiahe Biological Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shandong Dove Agriculture

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qingdao Haidel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Liaoning Tianhe Agricultural Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qingdao Shengao Biotechnology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanghai Harvmore Eco-Tech

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ICL Group

List of Figures

- Figure 1: Global Medium and Trace Element Water-Soluble Fertilizer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Medium and Trace Element Water-Soluble Fertilizer Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Application 2024 & 2032

- Figure 4: North America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Application 2024 & 2032

- Figure 5: North America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Types 2024 & 2032

- Figure 8: North America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Types 2024 & 2032

- Figure 9: North America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Country 2024 & 2032

- Figure 12: North America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Country 2024 & 2032

- Figure 13: North America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Application 2024 & 2032

- Figure 16: South America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Application 2024 & 2032

- Figure 17: South America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Types 2024 & 2032

- Figure 20: South America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Types 2024 & 2032

- Figure 21: South America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Country 2024 & 2032

- Figure 24: South America Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Country 2024 & 2032

- Figure 25: South America Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Application 2024 & 2032

- Figure 29: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Types 2024 & 2032

- Figure 33: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Country 2024 & 2032

- Figure 37: Europe Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Medium and Trace Element Water-Soluble Fertilizer Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Medium and Trace Element Water-Soluble Fertilizer Volume K Forecast, by Country 2019 & 2032

- Table 81: China Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Medium and Trace Element Water-Soluble Fertilizer Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medium and Trace Element Water-Soluble Fertilizer?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medium and Trace Element Water-Soluble Fertilizer?

Key companies in the market include ICL Group, Haifa Group, CF Industries, Nutrien Ag Solutions, EuroChem Group, Yara International ASA, Grupa Azoty Group, Xiangcheng Jiahe Biological Technology, Shandong Dove Agriculture, Qingdao Haidel, Liaoning Tianhe Agricultural Technology, Qingdao Shengao Biotechnology, Shanghai Harvmore Eco-Tech.

3. What are the main segments of the Medium and Trace Element Water-Soluble Fertilizer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medium and Trace Element Water-Soluble Fertilizer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medium and Trace Element Water-Soluble Fertilizer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medium and Trace Element Water-Soluble Fertilizer?

To stay informed about further developments, trends, and reports in the Medium and Trace Element Water-Soluble Fertilizer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence