Key Insights

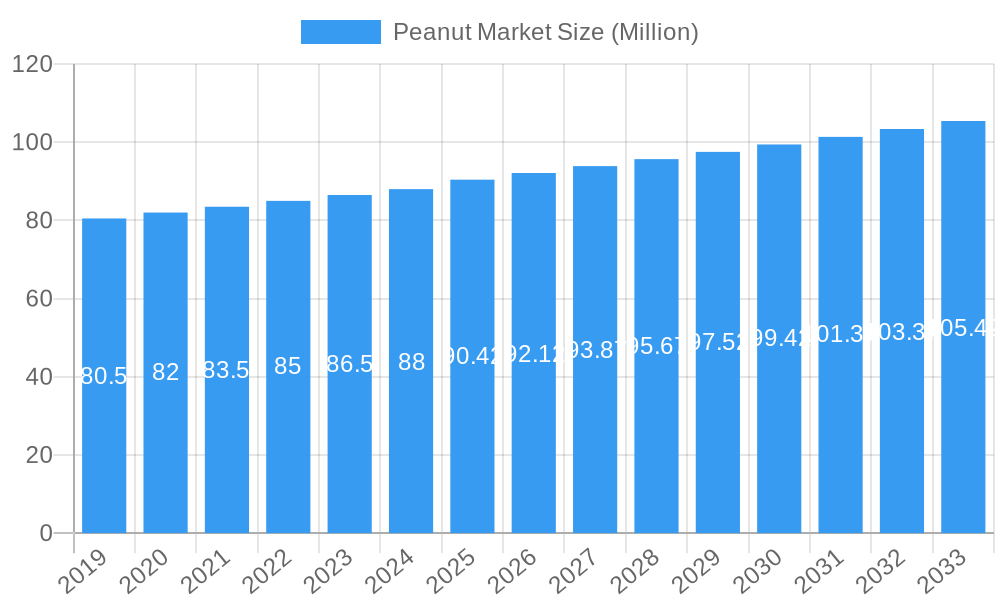

The global Peanut Market is poised for steady growth, with an estimated market size of USD 90.42 million and a projected Compound Annual Growth Rate (CAGR) of 2.60% from 2019 to 2033. This sustained expansion is underpinned by robust demand from various end-use industries, including food and beverage, confectionery, and the rapidly growing snack sector. Key drivers for this market are the increasing consumer preference for plant-based protein sources, the versatility of peanuts in culinary applications, and their recognized health benefits, such as being rich in healthy fats and antioxidants. Furthermore, advancements in cultivation techniques and a growing emphasis on sustainable farming practices are expected to bolster production and supply chain efficiency, contributing to the market's upward trajectory. The market's performance will be significantly influenced by the production and consumption analyses across major regions, with particular attention to import and export dynamics that shape global trade flows.

Peanut Market Market Size (In Million)

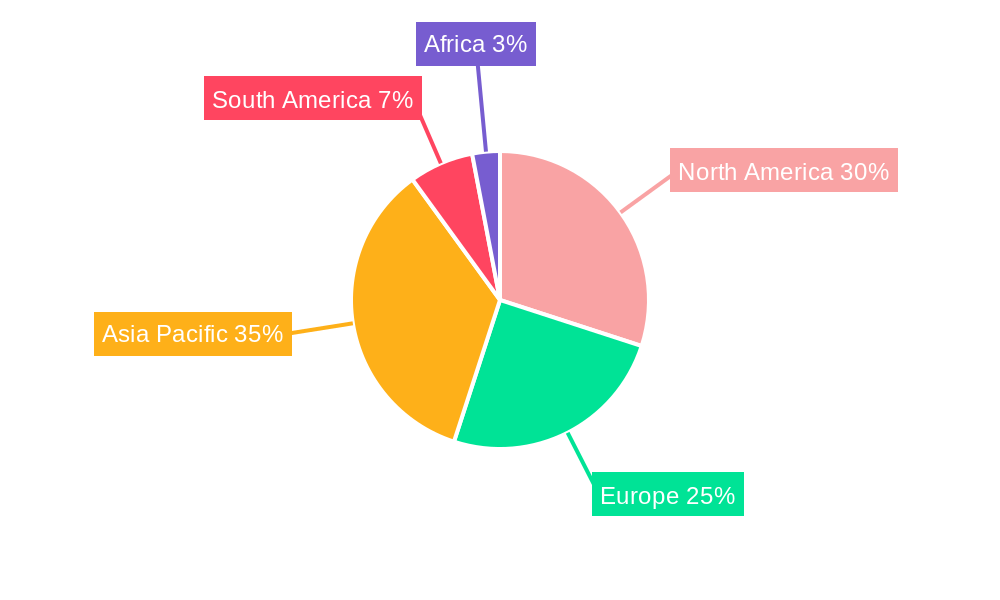

While the market exhibits positive growth, certain restraints could influence its pace. These may include the volatility in raw material prices due to climate-related factors affecting peanut harvests, and evolving consumer dietary trends that might favor alternative nuts and seeds. However, the inherent nutritional value and affordability of peanuts are expected to mitigate these challenges. Emerging trends like the demand for roasted and flavored peanuts, as well as the development of peanut-based ingredients for specialized dietary needs (e.g., gluten-free, vegan), are creating new avenues for market penetration and revenue generation. The competitive landscape features major players such as Archer Daniels Midland Company and Cargill Incorporated, whose strategic initiatives in sourcing, processing, and product innovation will be crucial in navigating market dynamics and capturing growth opportunities across key geographical segments like North America, Europe, Asia Pacific, South America, and Africa.

Peanut Market Company Market Share

Peanut Market: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global Peanut Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. With a Study Period from 2019 to 2033, a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, this report offers unparalleled insights into market structure, trends, dominant segments, product innovations, key players, and future outlook. Delving into the Historical Period of 2019–2024, we provide a robust foundation for understanding market evolution and forecasting future trajectories. This report is designed for immediate use without further modification.

Peanut Market Market Structure & Competitive Landscape

The global Peanut Market exhibits a moderately concentrated structure, with key players such as Archer Daniels Midland Company, Cargill Incorporated, Conagra Brands, Inc., J.M. Smucker Company, and Hormel Foods Corporation dominating significant market shares. These industry giants leverage their extensive distribution networks, robust R&D capabilities, and established brand recognition to maintain a competitive edge. Innovation drivers within the market include the development of healthier peanut varieties, advancements in processing technologies for enhanced shelf-life and functionality, and the growing demand for plant-based protein alternatives. Regulatory impacts, particularly concerning food safety standards and trade policies, play a crucial role in shaping market entry and operational strategies. While direct product substitutes are limited for traditional peanut consumption, alternative snacks and protein sources pose indirect competitive pressures. End-user segmentation is diverse, encompassing food manufacturers, snack producers, agricultural cooperatives, and the retail sector. Merger and acquisition (M&A) trends, while not consistently high in volume, are strategically driven by companies seeking to expand their product portfolios, geographical reach, or access to raw materials. For instance, acquisitions focused on specialty peanut butter brands or companies with advanced processing capabilities are anticipated to continue. The market's competitive landscape is characterized by a balance between established conglomerates and emerging niche players, with a constant focus on product differentiation and cost optimization.

Peanut Market Market Trends & Opportunities

The Peanut Market is poised for significant growth, projected to reach an estimated market size of XX Million by 2033, driven by a compound annual growth rate (CAGR) of XX%. This expansion is fueled by a confluence of evolving consumer preferences, technological advancements, and burgeoning market opportunities. Consumers are increasingly seeking healthier snack options and plant-based protein sources, positioning peanuts as a highly desirable commodity. This trend is particularly evident in developed economies, where awareness of the nutritional benefits of peanuts, such as their high protein, healthy fat, and fiber content, is growing. The demand for value-added peanut products, including artisanal peanut butters with diverse flavor profiles, peanut flour, and peanut oil for culinary and cosmetic applications, is also on the rise.

Technological shifts are playing a pivotal role in enhancing production efficiency and product quality. Innovations in agricultural practices, such as precision farming and the development of disease-resistant peanut varieties, are contributing to increased yields and reduced input costs for farmers. Furthermore, advancements in food processing technologies are enabling the creation of innovative peanut-based ingredients and finished products that cater to specific dietary needs, such as low-sodium or allergen-free options. The market penetration rate for peanuts is expected to further deepen as these innovative products become more accessible and appealing to a wider consumer base.

Competitive dynamics are characterized by strategic alliances, product differentiation, and a focus on sustainability. Companies are increasingly investing in vertical integration to secure their supply chains and ensure the quality of their raw materials. The growing global demand for plant-based food products presents a substantial opportunity for the peanut sector, as peanuts are a versatile ingredient that can be incorporated into a wide array of savory and sweet applications. Emerging markets, particularly in Asia and Africa, are expected to contribute significantly to market growth due to their expanding middle classes and increasing disposable incomes, leading to a greater demand for protein-rich foods. The development of novel applications for peanuts, beyond traditional food consumption, such as in biofuels or pharmaceuticals, could unlock further growth avenues. The market's resilience, coupled with its adaptability to evolving consumer demands, positions it for sustained and robust expansion in the coming years.

Dominant Markets & Segments in Peanut Market

The Peanut Market's dominance is shaped by a complex interplay of production, consumption, trade, and pricing dynamics, with specific regions and segments exhibiting pronounced leadership.

Production Analysis:

Asia, particularly China and India, remains the undisputed leader in global peanut production. These regions benefit from favorable climatic conditions, extensive arable land, and a large, established agricultural workforce.

- Key Growth Drivers: Traditional farming practices, government support for agricultural output, and substantial domestic demand contribute to their production prowess. India's recent development of high-yielding, drought-tolerant 'Spanish type' high oleic peanuts is a significant advancement, aiming to boost farmer incomes and export opportunities.

- Detailed Analysis: China's production, while vast, faces increasing pressure from environmental concerns and a shift towards higher-value crops. India, on the other hand, is actively focusing on improving seed quality and farmer education to enhance productivity and competitiveness. The production segment is characterized by a large number of smallholder farmers, with increasing adoption of mechanization and improved agronomic practices to boost yields.

Consumption Analysis:

North America and Europe lead in per capita peanut consumption, driven by a strong consumer preference for peanut butter, snacks, and peanut-derived ingredients in processed foods. Asia also represents a substantial consumption market due to its large population.

- Key Growth Drivers: Rising health consciousness, the popularity of plant-based diets, and the versatility of peanuts as an ingredient in diverse food applications are significant drivers.

- Detailed Analysis: The demand for healthy snacks and convenient food options continues to fuel consumption in developed markets. In emerging economies, the increasing availability of affordable peanut products and growing awareness of their nutritional benefits are driving consumption growth.

Import Market Analysis (Value & Volume):

The import market for peanuts is dominated by countries with significant processing industries and demand that outstrips domestic production. China, the European Union, and the United States are major importers.

- Key Growth Drivers: Demand from the confectionery, bakery, and snack food industries, coupled with supply gaps, dictates import volumes and values. China's authorization of 47 Brazilian peanut companies to export in October 2022 signals a significant shift, opening a new supply avenue and potentially impacting global import dynamics.

- Detailed Analysis: The value of imports is influenced by global commodity prices, currency fluctuations, and trade agreements. Countries often import specific types of peanuts based on their processing requirements and consumer preferences.

Export Market Analysis (Value & Volume):

The United States, Argentina, India, and Brazil are the leading peanut exporters globally. These nations possess the production capacity and infrastructure to supply international markets.

- Key Growth Drivers: Export competitiveness is determined by production costs, quality standards, and access to global trade routes. India's efforts to develop new peanut lines are strategically aimed at enhancing its export competitiveness.

- Detailed Analysis: Export volumes are susceptible to weather patterns, government policies, and international trade disputes. Companies often engage in long-term supply contracts to ensure market stability.

Price Trend Analysis:

Peanut prices are highly volatile, influenced by global supply and demand, weather conditions, input costs (fertilizers, labor), and speculative trading. The base year of 2025 is expected to see prices influenced by ongoing supply chain adjustments and geopolitical factors.

- Key Growth Drivers: Climatic events like droughts or excessive rainfall can drastically impact yields and, consequently, prices. Government subsidies and trade policies also play a role in price stabilization or fluctuation.

- Detailed Analysis: Price trends are closely monitored by producers, processors, and traders to make informed decisions regarding planting, purchasing, and inventory management.

Peanut Market Product Analysis

The Peanut Market is witnessing a surge in product innovations driven by evolving consumer demands for healthier, more convenient, and specialized offerings. Innovations span from improved peanut varieties with enhanced nutritional profiles and pest resistance to novel processing techniques that extend shelf-life and create unique textures. Applications are diversifying beyond traditional peanut butter and snacks to include functional food ingredients, plant-based meat alternatives, and even cosmetic formulations. Competitive advantages are being forged through the development of high-oleic peanuts, offering improved oxidative stability and health benefits, and the creation of allergen-friendly peanut products. Technological advancements in roasting, grinding, and extrusion are enabling manufacturers to cater to niche markets and create premium products, further expanding the market's reach and profitability.

Key Drivers, Barriers & Challenges in Peanut Market

The Peanut Market is propelled by several key drivers, including increasing consumer demand for plant-based protein and healthy snacks, driven by growing health consciousness globally. Technological advancements in agriculture and processing are enhancing yields and product quality. Government initiatives supporting agricultural development and favorable trade policies also act as significant drivers.

However, the market faces significant challenges and restraints. Fluctuations in global commodity prices due to unpredictable weather patterns and geopolitical instability pose a major risk to profitability. Stringent food safety regulations and varying international standards create barriers to market entry for some producers. Supply chain disruptions, influenced by logistics, transportation costs, and labor shortages, can impact the availability and affordability of peanuts. Furthermore, the presence of alternative protein sources and snack options creates competitive pressures.

Growth Drivers in the Peanut Market Market

The Peanut Market is experiencing robust growth driven by several critical factors. A primary driver is the escalating global demand for plant-based protein sources and healthy snack alternatives, fueled by increasing consumer awareness of health and wellness. Technological innovations in agricultural practices, including precision farming and the development of drought- and disease-resistant peanut varieties, are enhancing crop yields and quality. Supportive government policies in key producing nations, aimed at boosting agricultural output and facilitating trade, also contribute significantly to market expansion. Furthermore, the versatility of peanuts as an ingredient in a wide array of food products, from confectionery and baked goods to savory dishes and dairy alternatives, opens up diverse market opportunities.

Challenges Impacting Peanut Market Growth

Despite its strong growth trajectory, the Peanut Market is susceptible to several challenges. Volatile weather patterns and climate change can lead to unpredictable yields, impacting supply and price stability. Regulatory complexities and evolving food safety standards across different regions can pose hurdles for exporters. Supply chain vulnerabilities, including transportation costs, logistics issues, and potential labor shortages, can disrupt the flow of goods and increase operational expenses. Moreover, the competitive landscape is intensifying with the emergence of alternative protein sources and snack options, requiring continuous innovation and differentiation.

Key Players Shaping the Peanut Market Market

- Archer Daniels Midland Company

- Cargill Incorporated

- Conagra Brands, Inc.

- J.M. Smucker Company

- Hormel Foods Corporation

Significant Peanut Market Industry Milestones

- October 2022: General Administration of Customs of China (GACC) granted authorization to 47 Brazilian peanut companies to export to China, significantly opening up the Chinese import market for Brazilian peanuts.

- September 2022: India's first 'Spanish type' high oleic peanut was developed by researchers at ICRISAT in partnership with the Junagadh Agricultural University. This innovation is highly beneficial, offering advantages over 'Virginia-type' varieties with its high yield, drought tolerance, and resistance to foliar diseases, poised to increase farmer income and boost Indian peanut exports.

- May 2022: The Government of Andhra Pradesh in India fixed subsidized peanut seed rates at ₹51.48 (0.64 USD) per kg and initiated registration for farmers to access these subsidized seeds, supporting domestic production and farmer welfare.

Future Outlook for Peanut Market Market

The Peanut Market is projected to witness sustained growth, driven by an increasing global appetite for plant-based nutrition and healthy snacking. Strategic opportunities lie in the development of value-added products tailored to specific dietary needs and preferences, such as low-sodium, organic, or allergen-free peanut-based offerings. Emerging markets in Asia and Africa represent significant untapped potential due to their burgeoning middle classes and increasing disposable incomes. Continued investment in agricultural R&D to develop climate-resilient and higher-yielding peanut varieties will be crucial for ensuring supply stability and competitiveness. Furthermore, exploring novel applications for peanuts in functional foods, alternative proteins, and even industrial uses could unlock substantial market expansion and innovation in the coming years.

Peanut Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Peanut Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Ukraine

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Indonesia

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Africa

- 5.1. Nigeria

- 5.2. Tanzania

Peanut Market Regional Market Share

Geographic Coverage of Peanut Market

Peanut Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand in the International Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Peanut Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Peanut Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Peanut Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Peanut Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Peanut Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Peanut Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Archer Daniels Midland Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Conagra Brands Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 J.M. Smucker Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hormel Foods Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Archer Daniels Midland Company

List of Figures

- Figure 1: Global Peanut Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Peanut Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Peanut Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Peanut Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Peanut Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Peanut Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Peanut Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Peanut Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Peanut Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Peanut Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Peanut Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Peanut Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Peanut Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Peanut Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: Europe Peanut Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Peanut Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Peanut Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Peanut Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Peanut Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Peanut Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Peanut Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Peanut Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Peanut Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Peanut Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Peanut Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Peanut Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Peanut Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Peanut Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Peanut Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Peanut Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Peanut Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Peanut Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Peanut Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Peanut Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Peanut Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Peanut Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Peanut Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Peanut Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: South America Peanut Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Peanut Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: South America Peanut Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Peanut Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Peanut Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Peanut Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Peanut Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Peanut Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Peanut Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Peanut Market Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Peanut Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Africa Peanut Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Africa Peanut Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Africa Peanut Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Africa Peanut Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Africa Peanut Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Africa Peanut Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Africa Peanut Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Africa Peanut Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Africa Peanut Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Africa Peanut Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Africa Peanut Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Africa Peanut Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Peanut Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Peanut Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 16: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 20: Global Peanut Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Ukraine Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 27: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 31: Global Peanut Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: China Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: India Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Indonesia Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 36: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 37: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 40: Global Peanut Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Brazil Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Argentina Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Global Peanut Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 44: Global Peanut Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 45: Global Peanut Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 46: Global Peanut Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 47: Global Peanut Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 48: Global Peanut Market Revenue Million Forecast, by Country 2020 & 2033

- Table 49: Nigeria Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Tanzania Peanut Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peanut Market?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Peanut Market?

Key companies in the market include Archer Daniels Midland Company , Cargill Incorporated , Conagra Brands, Inc., J.M. Smucker Company , Hormel Foods Corporation.

3. What are the main segments of the Peanut Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Increasing Demand in the International Market.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

October 2022: General Administration of Customs of China (GACC) granted authorization to 47 Brazilian peanut companies to export to China. Through this, China opens the import market for peanuts from Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peanut Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peanut Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peanut Market?

To stay informed about further developments, trends, and reports in the Peanut Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence