Key Insights

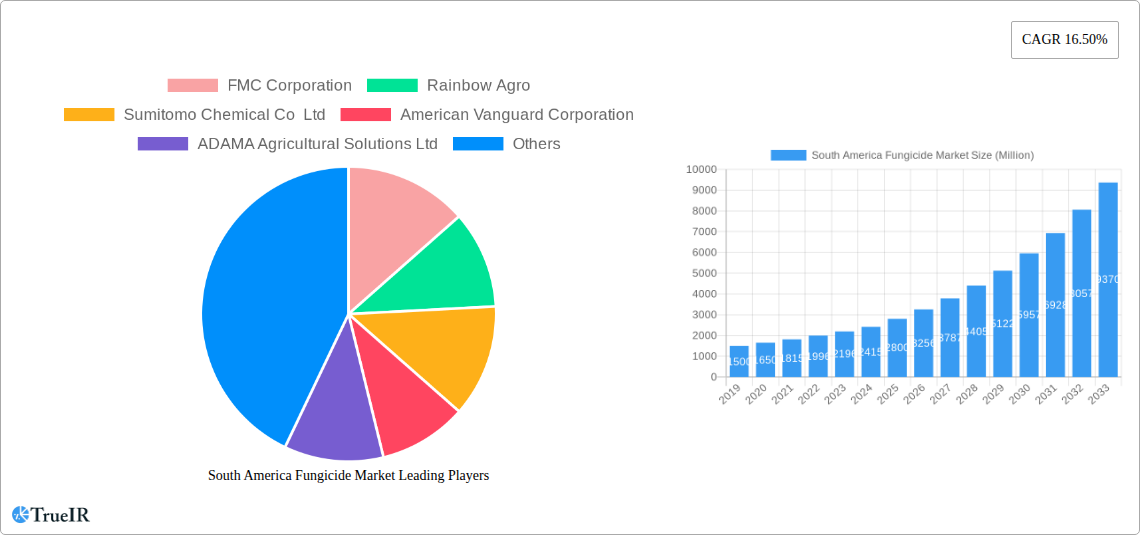

The South American fungicide market is poised for robust expansion, projecting a remarkable CAGR of 16.50% to reach an estimated market size of $2,800 million by 2025. This significant growth is primarily propelled by the escalating demand for enhanced crop yields and quality to meet the region's growing population and global food export needs. Key drivers include the increasing adoption of advanced agricultural practices, particularly those focused on disease management for high-value crops such as fruits, vegetables, and commercial crops. Furthermore, the imperative to minimize post-harvest losses, a perennial challenge in the region, fuels the demand for effective fungicidal solutions. The expanding cultivated land area, coupled with governmental initiatives supporting agricultural modernization and sustainable farming, also contributes to this upward trajectory.

South America Fungicide Market Market Size (In Billion)

The market segmentation reveals a diverse application landscape, with Chemigation and Foliar applications emerging as dominant methods due to their efficiency in delivering active ingredients directly to plants and soil. Seed Treatment is also gaining traction as a preventative measure, reducing the need for extensive spraying later in the crop cycle. In terms of crop types, Commercial Crops, Fruits & Vegetables, and Grains & Cereals represent the largest segments, reflecting the agricultural backbone of South America. The market is further shaped by key trends such as the rising preference for bio-fungicides and integrated pest management (IPM) strategies, driven by increasing environmental consciousness and regulatory pressures. However, the market faces restraints including the high cost of advanced fungicide formulations, the presence of counterfeit products, and the complex regulatory frameworks in certain countries. Despite these challenges, the innovative product pipelines of major players and the strategic partnerships being forged are expected to mitigate these limitations and sustain market growth.

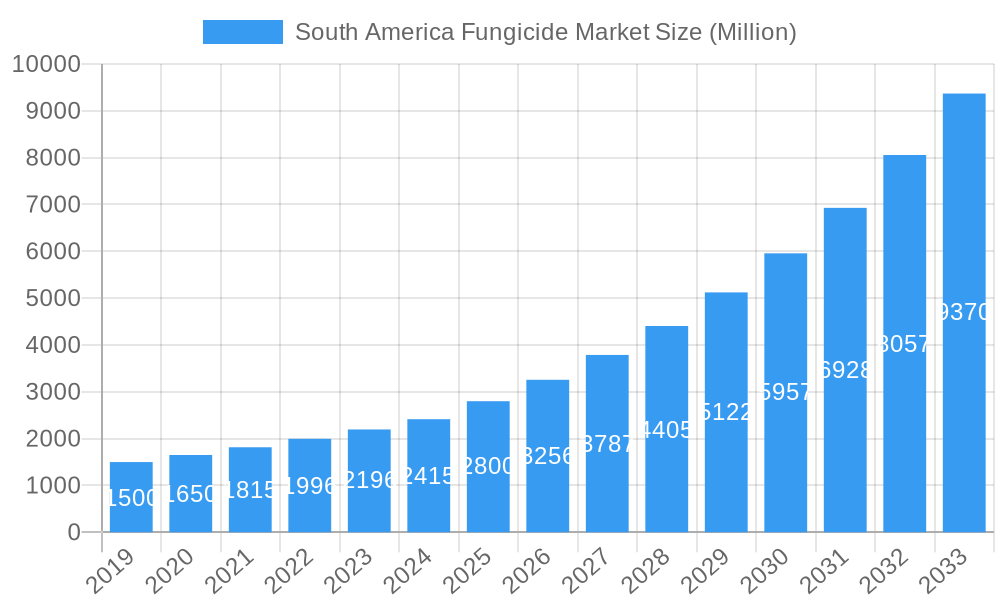

South America Fungicide Market Company Market Share

This in-depth report provides a definitive analysis of the South America Fungicide Market, offering critical insights into market dynamics, trends, and future projections from 2019 to 2033. Covering a market size estimated to reach xx Million by 2025, and projected to grow at a robust CAGR of xx% during the forecast period (2025–2033), this study is essential for stakeholders seeking to understand and capitalize on the evolving agricultural landscape in the region.

South America Fungicide Market Market Structure & Competitive Landscape

The South America Fungicide Market exhibits a moderately concentrated structure, with key players like FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limited, Syngenta Group, Corteva Agriscience, and BASF SE dominating market share. Innovation drivers are primarily fueled by the need for advanced crop protection solutions to combat evolving fungal diseases and enhance crop yields amidst increasing demand for food security. Regulatory frameworks, while evolving, present both opportunities and challenges, influencing product approvals and market access. The presence of viable product substitutes necessitates continuous R&D to maintain competitive advantage. End-user segmentation highlights the significant role of commercial crops and fruits & vegetables, while M&A trends indicate a strategic consolidation phase, aimed at expanding product portfolios and market reach. For instance, the South America Fungicide Market has witnessed several strategic partnerships and acquisitions aimed at consolidating market presence and technological capabilities. Quantitative analysis reveals an estimated M&A volume of xx Million in the historical period (2019–2024), indicative of active consolidation efforts.

South America Fungicide Market Market Trends & Opportunities

The South America Fungicide Market is poised for significant expansion, driven by a confluence of factors including growing agricultural output, increasing pest and disease pressure, and the adoption of advanced farming practices. The market size is projected to reach xx Million by the base year 2025, with substantial growth anticipated through 2033. Technological shifts are central to this growth, with a discernible move towards more targeted, eco-friendly fungicide formulations and integrated pest management (IPM) strategies. Consumer preferences are increasingly leaning towards sustainable agriculture, creating opportunities for biological fungicides and products with reduced environmental impact. Competitive dynamics are intensifying, compelling market players to focus on product differentiation, efficacy, and cost-effectiveness. The penetration rate of modern fungicides is steadily increasing across major South American economies, reflecting a heightened awareness of disease management and its impact on farm profitability. Opportunities abound for companies that can innovate with next-generation fungicides, offer comprehensive crop protection solutions, and adapt to the unique agricultural needs of diverse South American agro-climatic zones. The projected CAGR of xx% over the forecast period underscores the substantial growth trajectory of this vital market.

Dominant Markets & Segments in South America Fungicide Market

The South America Fungicide Market is characterized by a dynamic interplay of dominant regions and key segments. Brazil emerges as a leading country within the South American fungicide market, owing to its vast agricultural land, extensive cultivation of high-value crops like soybeans, corn, and sugarcane, and increasing adoption of modern agricultural technologies. Argentinian and Colombian markets also present significant growth opportunities.

Dominant Application Modes:

- Foliar Application: This remains the most prevalent application mode, accounting for a substantial market share due to its efficacy in treating existing fungal infections on plant leaves and stems.

- Seed Treatment: Gaining significant traction due to its proactive approach in protecting seedlings from soil-borne pathogens, thereby improving germination rates and early plant vigor.

- Soil Treatment: Crucial for managing soil-borne fungal diseases that affect root systems, especially in extensive row cropping.

- Chemigation: An emerging application mode, offering efficient delivery of fungicides through irrigation systems, particularly in regions with advanced irrigation infrastructure.

- Fumigation: Primarily used for specific soil or stored product pest control, with niche but important applications.

Dominant Crop Types:

- Grains & Cereals: Soybeans, corn, and wheat are major crops driving demand for fungicides due to their susceptibility to diseases like rusts, blights, and mildews, especially in extensive farming operations.

- Commercial Crops: This broad category includes vital crops like coffee, cocoa, and tobacco, which are susceptible to a range of fungal diseases requiring specialized fungicide treatments.

- Fruits & Vegetables: A high-value segment where disease management is critical for marketability and profitability, encompassing a wide array of produce like tomatoes, grapes, bananas, and citrus fruits.

- Turf & Ornamental: This segment, while smaller, is important for maintaining aesthetic appeal and health in managed landscapes, golf courses, and nurseries.

- Pulses & Oilseeds: Crops like beans, lentils, and sunflower are significant in specific regions, requiring effective disease control to ensure yield and quality.

Growth drivers in these dominant segments are powered by government policies supporting agricultural modernization, increasing farm incomes, the need to mitigate crop losses due to climate change-induced disease outbreaks, and the ongoing demand for high-quality agricultural produce in both domestic and international markets. Infrastructure development, particularly in logistics and storage, also plays a pivotal role in ensuring the timely availability and effective deployment of fungicides.

South America Fungicide Market Product Analysis

Product innovation in the South America Fungicide Market is characterized by the development of broad-spectrum fungicides with enhanced efficacy against resistant strains, alongside a growing emphasis on selective and targeted action. Companies are investing in novel active ingredients and advanced formulation technologies to improve product performance, reduce application rates, and minimize environmental impact. For instance, the introduction of Corteva Agriscience's Haviza™ Active signifies a move towards specialized solutions for critical diseases like Asian soybean rot. Competitive advantages are being built on improved biological efficacy, favorable residue profiles, and integrated pest management compatibility, ensuring market fit and addressing the evolving needs of South American farmers seeking sustainable and profitable crop protection.

Key Drivers, Barriers & Challenges in South America Fungicide Market

Key Drivers:

- Growing Demand for Food Security: The increasing global population necessitates higher agricultural output, driving the demand for effective crop protection solutions like fungicides.

- Climate Change Impacts: Shifting weather patterns are contributing to increased prevalence and severity of fungal diseases, prompting greater fungicide adoption.

- Technological Advancements: Development of more efficient, targeted, and eco-friendly fungicide formulations enhances their appeal and effectiveness.

- Government Initiatives & Subsidies: Policies promoting modern agriculture and crop insurance programs encourage investment in advanced crop protection.

- Increasing Awareness Among Farmers: Greater understanding of the economic benefits of disease management leads to higher fungicide usage.

Key Barriers & Challenges:

- Regulatory Hurdles: Stringent and varied regulatory approval processes across different South American countries can delay market entry and increase R&D costs.

- Fungal Resistance Development: Over-reliance on certain fungicide classes can lead to resistance, necessitating continuous innovation and rotation strategies.

- Supply Chain Disruptions: Logistical challenges, import/export complexities, and economic volatility can impact the availability and pricing of fungicides.

- Cost of Advanced Fungicides: High-value, innovative products may be less accessible to smallholder farmers due to cost constraints.

- Environmental Concerns: Growing scrutiny over the environmental impact of synthetic pesticides necessitates the development and adoption of sustainable alternatives.

Growth Drivers in the South America Fungicide Market Market

The South America Fungicide Market is propelled by several key growth drivers. Technologically, the continuous development of novel active ingredients and advanced formulations offering enhanced efficacy against a broader spectrum of fungal pathogens is crucial. Economically, the growing demand for agricultural commodities, coupled with increasing farm incomes in major producing nations, encourages farmers to invest more in crop protection. Policy-driven factors, such as government support for sustainable agriculture and initiatives aimed at boosting agricultural productivity, also play a significant role. For example, specific trade agreements that facilitate agricultural exports can indirectly fuel demand for effective disease management tools. The proactive introduction of innovative products, such as ADAMA's Prothioconazole-based solutions, directly addresses emerging market needs.

Challenges Impacting South America Fungicide Market Growth

Challenges impacting the South America Fungicide Market include the increasing complexity and variability of regulatory landscapes across the continent, which can hinder product launches and market penetration. Supply chain issues, exacerbated by geopolitical factors and infrastructure limitations in certain regions, can lead to availability concerns and price fluctuations. Competitive pressures from established global players and emerging local manufacturers demand constant innovation and cost management. Furthermore, the growing concern regarding fungicide resistance necessitates a shift towards integrated pest management (IPM) strategies and a more judicious use of chemical inputs. The estimated impact of regulatory delays on new product introductions is approximately xx% of projected revenue.

Key Players Shaping the South America Fungicide Market Market

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co Ltd

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- BASF SE

Significant South America Fungicide Market Industry Milestones

- February 2023: ADAMA opened a new multi-purpose facility in Brazil, enhancing its capacity to deliver Prothioconazole-based products globally and introducing innovative items to the Brazilian market.

- January 2023: Bayer formed a new partnership with Oerth Bio to advance crop protection technology and develop more eco-friendly crop protection solutions.

- October 2022: Corteva Agriscience introduced Haviza™ Active, a new fungicide brand in its pipeline, offering farmers in South America an alternative for managing Asian soybean rot and expanding its picolinamide active class.

Future Outlook for South America Fungicide Market Market

The future outlook for the South America Fungicide Market is exceptionally promising, driven by a sustained demand for enhanced agricultural productivity and resilience. Strategic opportunities lie in the development and adoption of precision agriculture techniques, integrated pest management solutions, and bio-fungicides that align with the growing global emphasis on sustainability. The market is expected to witness continued innovation in product formulation and delivery systems, catering to specific crop and regional needs. Investments in R&D for combating fungicide resistance and developing more environmentally benign alternatives will be critical for long-term success. The projected growth suggests a robust market expansion, making it an attractive landscape for both established corporations and innovative startups.

South America Fungicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

South America Fungicide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Fungicide Market Regional Market Share

Geographic Coverage of South America Fungicide Market

South America Fungicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fungicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rainbow Agro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Chemical Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Vanguard Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADAMA Agricultural Solutions Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limite

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Syngenta Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: South America Fungicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Fungicide Market Share (%) by Company 2025

List of Tables

- Table 1: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 2: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 3: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 4: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 5: South America Fungicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 7: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 8: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 9: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 10: South America Fungicide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Brazil South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Argentina South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Chile South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Colombia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Peru South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Venezuela South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Ecuador South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Bolivia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Paraguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Uruguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fungicide Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the South America Fungicide Market?

Key companies in the market include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Fungicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

February 2023: ADAMA opened a new multi-purpose facility in Brazil. With this factory, the company will be able to deliver all the Prothioconazole-based products in its pipeline to the global market and achieve its objective of introducing a number of innovative items to the Brazilian market in the upcoming years.January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.October 2022: HavizaTM Active was the newest fungicide brand added to Corteva Agriscience's strong innovation pipeline. The product is an alternative for farmers in South America to manage Asian soybean rot. The company broadened its active class of picolinamide through this innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fungicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fungicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fungicide Market?

To stay informed about further developments, trends, and reports in the South America Fungicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence