Key Insights

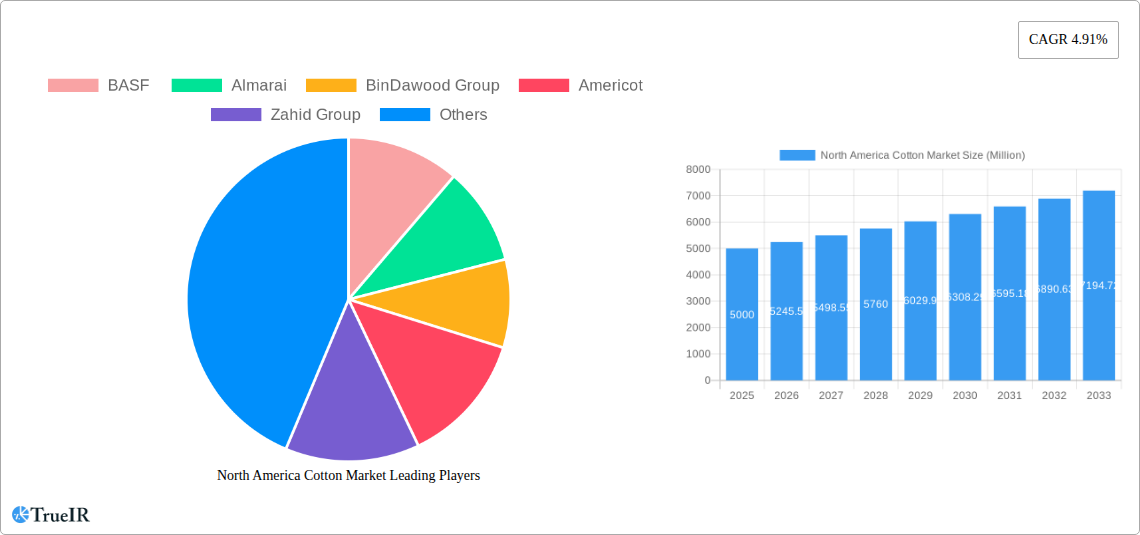

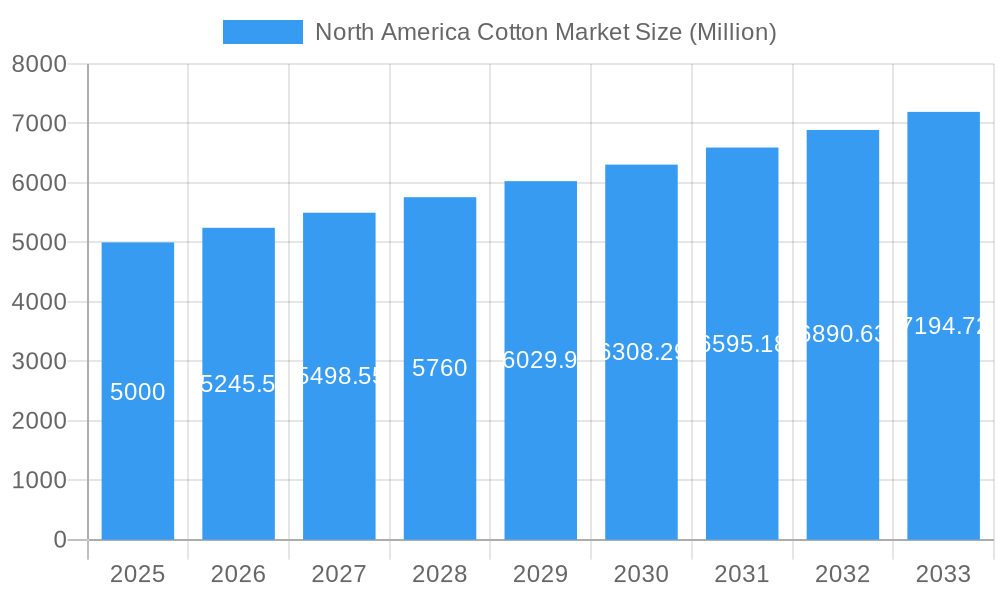

The North American cotton market, encompassing the United States, Canada, and Mexico, presents a dynamic landscape characterized by moderate growth and evolving market dynamics. With a 4.91% CAGR (Compound Annual Growth Rate) from 2019-2024 and a projected continuation of this trend, the market exhibits sustained, albeit not explosive, expansion. The market's value in 2025 is estimated to be around $5 billion (this figure is a reasonable estimate considering typical market sizes for agricultural commodities in North America and the provided CAGR). Key drivers include increasing demand for cotton textiles and apparel, particularly in sustainable and organic cotton segments. Trends indicate a growing preference for ethically sourced and environmentally friendly cotton, which is driving innovation in organic farming practices and supply chain transparency. Restraints on growth include fluctuations in cotton prices influenced by global supply and demand, weather patterns impacting crop yields, and the competitive pressures from synthetic fiber alternatives. Segment analysis reveals strong performance in the upland cotton variety, given its widespread cultivation and suitability for various applications. The textiles and apparel segments dominate application-wise, fueled by ongoing consumer demand. Major players like BASF and Bayer CropScience contribute significantly to the market through the supply of inputs like seeds and pesticides. Furthermore, the presence of prominent agricultural and retail groups like Almarai, BinDawood Group, and Savola Group highlights the market's integrated structure.

North America Cotton Market Market Size (In Billion)

The forecast period (2025-2033) suggests continued growth, although the rate might slightly moderate due to potential challenges including climate change, economic volatility, and evolving consumer preferences. The dominance of the United States within the North American market is expected to continue, driven by its large-scale cotton production and established textile industry. However, opportunities exist for expansion in the organic and Pima cotton segments, leveraging growing consumer interest in high-quality, sustainable products. Successful players will need to focus on efficient production, supply chain management, and responsiveness to shifting consumer demands for both quality and sustainability. Strategic partnerships and investments in research and development are crucial for maintaining a competitive edge in this evolving market.

North America Cotton Market Company Market Share

North America Cotton Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America cotton market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis to forecast market trends and identify key opportunities for investment and strategic planning. With a focus on Upland, Pima, and Organic cotton varieties across Textiles, Apparel, and Home Furnishings applications, this report is an essential resource for businesses seeking to navigate this dynamic market.

North America Cotton Market Market Structure & Competitive Landscape

This section delves into the intricate structure of the North American cotton market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user segmentation, and merger & acquisition (M&A) activities. The analysis incorporates both quantitative and qualitative data to provide a holistic understanding of the competitive landscape.

Market Concentration: The North American cotton market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025. This indicates the presence of several significant players, alongside a number of smaller, regional producers. The top five players account for approximately xx% of the total market share.

Innovation Drivers: Continuous innovation in cottonseed genetics and agricultural technologies is a major driver of market growth. This includes the development of pest-resistant varieties, improved fiber quality, and sustainable farming practices.

Regulatory Impacts: Government regulations concerning pesticide use, water conservation, and trade policies significantly influence market dynamics. These regulations have an impact on both production costs and market access.

Product Substitutes: Synthetic fibers, such as polyester and nylon, pose a significant competitive threat to cotton, particularly in certain applications. However, growing consumer preference for natural and sustainable materials presents an opportunity for cotton.

End-User Segmentation: The primary end-use segments for cotton are textiles, apparel, and home furnishings. Each segment exhibits distinct growth trends and preferences influencing demand dynamics.

M&A Trends: The cotton market has witnessed a moderate level of M&A activity in recent years. Consolidation among seed companies and agricultural businesses is expected to continue, driven by economies of scale and access to advanced technologies. The total value of M&A transactions in the North American cotton sector during the period 2019-2024 was approximately $xx Million.

North America Cotton Market Market Trends & Opportunities

This section provides a comprehensive overview of current and future market trends, including market size growth, technological advancements, shifting consumer preferences, and competitive dynamics within the North American cotton industry. The analysis incorporates metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates to offer quantitative insights.

The North American cotton market is projected to experience substantial growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is fueled by several key factors, including:

- Increasing global demand for cotton textiles and apparel. This is particularly true in developing economies, driving significant growth in exports from North America.

- Growing adoption of sustainable and organic cotton. Consumer awareness of environmental and social issues is driving preference for sustainably produced cotton.

- Technological advancements in cottonseed genetics and farming practices. These improvements lead to higher yields, improved fiber quality, and reduced production costs.

- Strategic investments in research and development. Companies are constantly investing in improving cottonseed varieties, farming technologies, and processing techniques.

- Government support and subsidies to enhance cotton production. The role of government incentives is important to ensure the competitiveness of the North American cotton industry.

However, challenges such as fluctuations in global cotton prices, climate change, and competition from synthetic fibers need to be carefully managed. The market penetration rate for organic cotton is estimated to increase to xx% by 2033, indicating a promising growth trajectory for sustainable cotton.

Dominant Markets & Segments in North America Cotton Market

This section identifies the leading regions, countries, and segments within the North American cotton market based on variety (Upland, Pima, Organic) and application (Textiles, Apparel, Home Furnishings). Key growth drivers for each dominant segment are highlighted using bullet points, followed by a detailed analysis of market dominance.

Dominant Variety: Upland cotton remains the dominant variety in North America, accounting for over xx% of total production in 2025. This dominance is driven by its high yield, adaptability to diverse growing conditions, and suitability for various applications.

Dominant Application: The textile industry is the largest consumer of cotton in North America, absorbing the majority of the total production. This high demand drives the growth of the cotton market. The apparel sector is also a significant end-user, with a growing emphasis on sustainable and ethically sourced cotton products.

Key Growth Drivers:

- Technological advancements: Improved cottonseed genetics and farming practices continuously increase yield and fiber quality.

- Government policies: Government support and subsidies play a crucial role in maintaining competitiveness.

- Infrastructure development: Investments in irrigation systems, storage facilities, and transportation networks ensure efficient distribution of cotton.

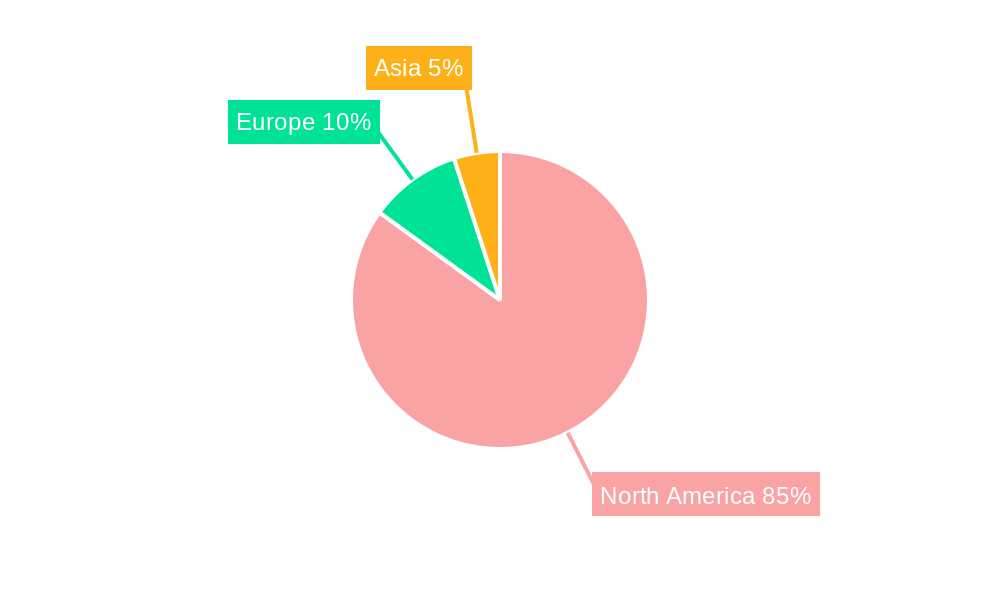

The United States remains the leading cotton-producing country in North America, accounting for xx% of the total regional production in 2025. Strong domestic demand coupled with robust export markets fuels this dominance.

North America Cotton Market Product Analysis

The North American cotton market is characterized by a continuous stream of product innovations. Seed companies such as BASF and Americot are at the forefront of developing new, high-yielding, and pest-resistant cottonseed varieties. These innovations improve fiber quality, increase yields, and reduce production costs, making cotton more competitive against synthetic substitutes. The introduction of Bollgard 3 XtendFlex varieties and dicamba-tolerant options represents a significant leap forward in crop protection and yield enhancement. Furthermore, the growing demand for organic cotton is driving innovation in sustainable farming practices, with a focus on reducing environmental impact and enhancing soil health. This focus ensures the long-term sustainability of the cotton industry.

Key Drivers, Barriers & Challenges in North America Cotton Market

Key Drivers:

The North American cotton market is driven by several key factors, including technological advancements in seed genetics and farming practices (leading to higher yields and quality), increasing global demand for cotton products, and growing consumer preference for natural fibers. Government policies that support the industry also play a significant role. The rise of sustainable and organic cotton further enhances market growth.

Challenges & Restraints:

The cotton market faces several challenges, including price volatility due to global supply and demand imbalances, climate change impacts such as drought and extreme weather events that affect yield, and competition from synthetic substitutes. Supply chain disruptions, as seen during recent years, also add to the complexity, while stringent environmental regulations increase production costs. These factors collectively represent a considerable impact (estimated at xx% reduction in growth in 2024) on the overall market expansion.

Growth Drivers in the North America Cotton Market Market

Technological advancements in seed technology, sustainable farming practices, and increasing global demand are key growth drivers for the North American cotton market. Government support and favorable trade policies further contribute to this expansion. The growing consumer preference for natural, ethically sourced cotton fuels the demand for sustainable varieties.

Challenges Impacting North America Cotton Market Growth

Fluctuations in global cotton prices, adverse weather conditions impacting crop yields, and intense competition from synthetic fibers represent major hurdles. Supply chain disruptions and increasing regulatory compliance costs also constrain market growth.

Key Players Shaping the North America Cotton Market Market

- BASF

- Almarai

- BinDawood Group

- Americot

- Zahid Group

- Al Rajhi Group

- Nadec

- Savola Group

- Bayer CropScience

- Saudi Agricultural and Livestock Investment Company (SALIC)

Significant North America Cotton Market Industry Milestones

February 2021: BASF launched three new cottonseed varieties: one FiberMax variety and two dicamba-tolerant Stoneville varieties. This significantly enhanced the company's product portfolio and contributed to the overall market improvement in pest resistance and yield.

February 2021: Americot expanded its NexGen line of Bollgard 3 XtendFlex varieties with three new additions. These additions provided growers with increased options for high-quality, high-yielding cotton, enhancing their competitiveness.

Future Outlook for North America Cotton Market Market

The North American cotton market is poised for continued growth, driven by technological advancements, rising consumer demand, and a renewed focus on sustainability. Opportunities exist in developing innovative cotton products, expanding into new markets, and implementing efficient supply chain management. The market is expected to experience a continued rise in demand for organic and sustainably produced cotton, presenting a significant opportunity for growth in this segment.

North America Cotton Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Cotton Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Cotton Market Regional Market Share

Geographic Coverage of North America Cotton Market

North America Cotton Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Demand from the Global Textile Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cotton Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Cotton Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Canada North America Cotton Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Mexico North America Cotton Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BASF

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Almarai

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 BinDawood Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Americot

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Zahid Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Al Rajhi Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Nadec

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Savola Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bayer CropScience

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Saudi Agricultural and Livestock Investment Company (SALIC)

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 BASF

List of Figures

- Figure 1: North America Cotton Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Cotton Market Share (%) by Company 2025

List of Tables

- Table 1: North America Cotton Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Cotton Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: North America Cotton Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: North America Cotton Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: North America Cotton Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: North America Cotton Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: North America Cotton Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: North America Cotton Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: North America Cotton Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: North America Cotton Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: North America Cotton Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: North America Cotton Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: North America Cotton Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: North America Cotton Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: North America Cotton Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: North America Cotton Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: North America Cotton Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: North America Cotton Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: North America Cotton Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: North America Cotton Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: North America Cotton Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: North America Cotton Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: North America Cotton Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Cotton Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: North America Cotton Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: North America Cotton Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: North America Cotton Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: North America Cotton Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: North America Cotton Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: North America Cotton Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: North America Cotton Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: North America Cotton Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: North America Cotton Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: North America Cotton Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: North America Cotton Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: North America Cotton Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: North America Cotton Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: North America Cotton Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: North America Cotton Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: North America Cotton Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: North America Cotton Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: North America Cotton Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: North America Cotton Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: North America Cotton Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: North America Cotton Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: North America Cotton Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: North America Cotton Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: North America Cotton Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cotton Market?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the North America Cotton Market?

Key companies in the market include BASF , Almarai , BinDawood Group , Americot , Zahid Group , Al Rajhi Group , Nadec , Savola Group , Bayer CropScience, Saudi Agricultural and Livestock Investment Company (SALIC).

3. What are the main segments of the North America Cotton Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Demand from the Global Textile Industry Drives the Market.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

February 2021: BASF added three new cottonseed varieties to its cotton portfolio; one new FiberMax cottonseed variety and two new dicamba-tolerant Stoneville cottonseed varieties in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cotton Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cotton Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cotton Market?

To stay informed about further developments, trends, and reports in the North America Cotton Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence