Key Insights

The North America fertilizer market, valued at approximately $63.76 billion in 2025, is projected for robust expansion with a compound annual growth rate (CAGR) of 5.13% from 2025 to 2033. This growth is propelled by escalating demand for food and feed crops, necessitating enhanced fertilizer application for sustained yields. Technological advancements in nutrient delivery systems, such as fertigation, are optimizing crop productivity and resource management, driving market expansion. Government initiatives promoting sustainable agriculture and advanced fertilizer technologies further bolster growth. However, market expansion is tempered by raw material price volatility, environmental concerns, and stringent regulations. The market is segmented by fertilizer type (straight, conventional, specialty), application mode (fertigation, foliar, soil), and crop type (horticultural, turf & ornamental). Key players, including Wilbur-Ellis Company LLC, Haifa Group, and Nutrien Ltd, are strategically innovating, merging, and expanding to capture market share amid intense competition.

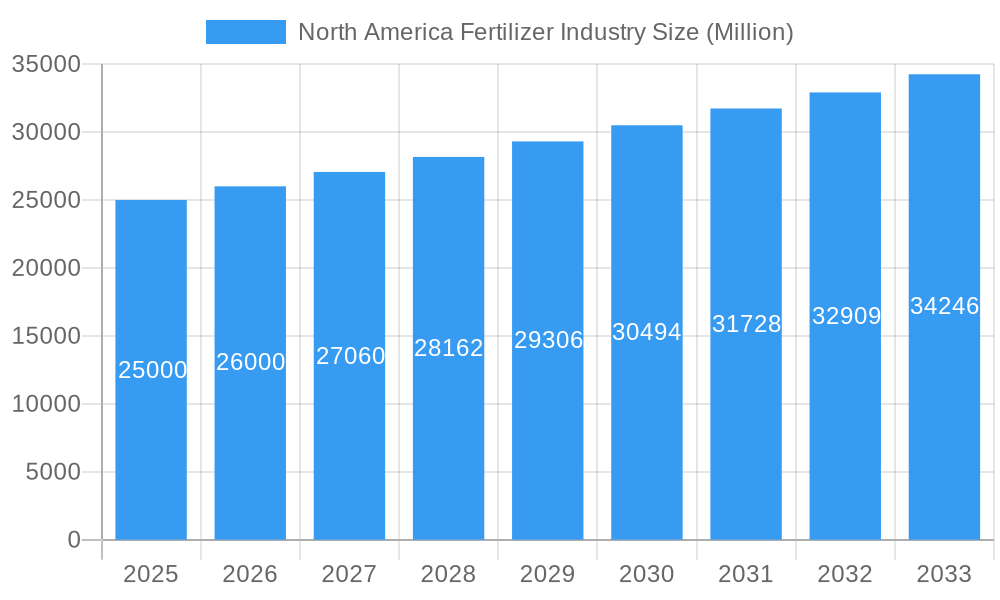

North America Fertilizer Industry Market Size (In Billion)

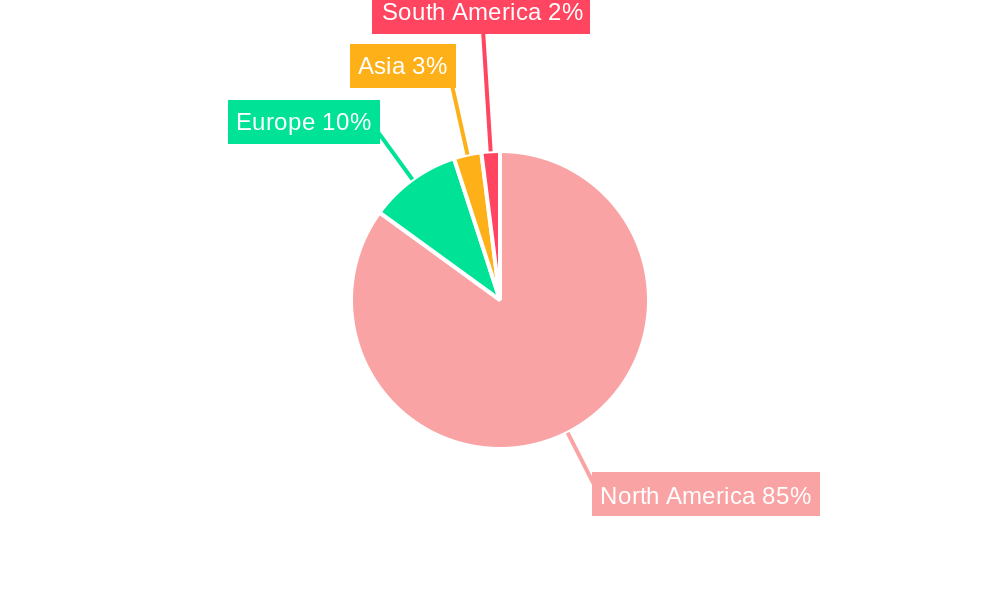

Geographically, the United States leads the North America fertilizer market, followed by Canada and Mexico. The "Rest of North America" segment offers emerging growth prospects influenced by regional agricultural policies and economic development. The forecast period (2025-2033) anticipates continued trend adherence, although external factors like extreme weather or economic downturns may impact market trajectory. A comprehensive understanding of these drivers, restraints, and regional dynamics is vital for informed stakeholder decision-making in this competitive landscape.

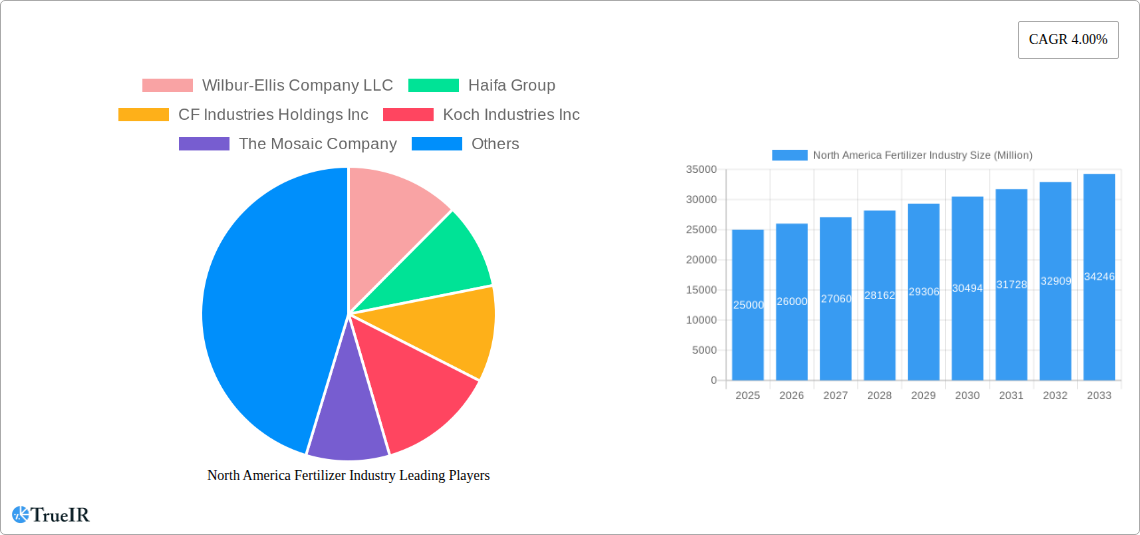

North America Fertilizer Industry Company Market Share

North America Fertilizer Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America fertilizer industry, covering market trends, competitive dynamics, and future growth prospects from 2019 to 2033. With a focus on key segments including straight, conventional, and specialty fertilizers, across various application modes (fertigation, foliar, soil) and crop types (horticultural, turf & ornamental), this report is essential for industry professionals, investors, and researchers seeking a detailed understanding of this dynamic market. The report leverages extensive data analysis to project a robust forecast, using 2025 as the base year and encompassing the historical period (2019-2024) and forecast period (2025-2033).

North America Fertilizer Industry Market Structure & Competitive Landscape

The North America fertilizer market exhibits a moderately concentrated structure, with several major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation in fertilizer technology, particularly in slow-release and specialty formulations, drives competition. Stringent environmental regulations regarding nutrient runoff and carbon emissions exert significant pressure on producers, pushing for sustainable solutions. The availability of substitutes, such as organic fertilizers and improved farming practices, further influences market dynamics. End-user segmentation is largely driven by crop type, with significant demand from the corn, soybean, and wheat sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million USD in deal volume during 2019-2024. Key M&A trends include vertical integration and expansion into specialty fertilizer segments.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Development of slow-release and specialty fertilizers.

- Regulatory Impacts: Stringent environmental regulations on nutrient runoff and carbon emissions.

- Product Substitutes: Organic fertilizers and improved farming practices.

- End-User Segmentation: Corn, soybean, wheat, horticultural crops, turf & ornamental.

- M&A Trends: Vertical integration and expansion into specialty fertilizer segments; estimated xx Million USD in deal volume (2019-2024).

North America Fertilizer Industry Market Trends & Opportunities

The North American fertilizer market is projected to experience robust growth throughout the forecast period (2025-2033). The market size is estimated at xx Million USD in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by increasing demand for food and feed, driven by population growth and changing dietary habits. Technological advancements, such as precision agriculture techniques and the development of more efficient fertilizer formulations, are further enhancing market expansion. Consumer preference for sustainably produced crops is creating opportunities for organic and bio-based fertilizers. Intense competition among major players is resulting in price pressures, but also driving innovation and efficiency improvements. Market penetration rates of specialty fertilizers are expected to increase significantly as farmers adopt precision application methods.

Dominant Markets & Segments in North America Fertilizer Industry

The United States constitutes the largest market within North America, driven by its extensive agricultural sector and high crop yields. Within the various segments:

- Type: Straight fertilizers dominate the market due to their cost-effectiveness and widespread application. However, specialty fertilizers are experiencing rapid growth, driven by increasing demand for higher crop yields and efficient nutrient management.

- Form: Conventional granular fertilizers hold the largest share, but liquid fertilizers are gaining traction due to ease of application and precision in fertigation.

- Application Mode: Soil application remains dominant, but fertigation and foliar application are gaining popularity due to improved efficiency and reduced environmental impact.

- Crop Type: Horticultural crops and turf & ornamental sectors demonstrate strong growth potential due to the increasing demand for high-quality produce and aesthetically pleasing landscapes.

Key Growth Drivers:

- United States: Large agricultural sector, high crop yields, and technological advancements in farming practices.

- Canada: Growing demand for horticultural crops and increasing investment in precision agriculture.

- Mexico: Expanding agricultural sector and government support for agricultural modernization.

- Specialty Fertilizers: Increasing demand for higher crop yields and improved nutrient use efficiency.

- Fertigation: Growing adoption for improved fertilizer efficiency and reduced environmental impact.

North America Fertilizer Industry Product Analysis

The North American fertilizer market showcases a wide range of products, from traditional granular fertilizers to advanced slow-release and specialty formulations. Technological advancements are focused on improving nutrient use efficiency, reducing environmental impact, and enhancing crop yields. Slow-release fertilizers are gaining popularity due to their ability to provide nutrients over an extended period, minimizing nutrient loss and maximizing crop uptake. Specialty fertilizers are tailored to specific crop needs and soil conditions, further optimizing crop growth and yield. The competitive advantage lies in developing sustainable and efficient fertilizer products that meet the evolving needs of farmers and environmental regulations.

Key Drivers, Barriers & Challenges in North America Fertilizer Industry

Key Drivers:

- Growing global food demand: Increasing population and changing diets drive the need for increased crop production.

- Technological advancements: Precision agriculture and improved fertilizer formulations increase efficiency.

- Government support for agricultural modernization: Policies and subsidies promote the adoption of advanced farming techniques.

Challenges:

- Supply chain disruptions: Fluctuations in raw material prices and logistical challenges impact fertilizer production and distribution. The impact is estimated at a xx Million USD loss in revenue in 2024.

- Environmental regulations: Stringent regulations on nutrient runoff and greenhouse gas emissions increase production costs.

- Price volatility: Fluctuations in energy and raw material prices impact fertilizer profitability.

Growth Drivers in the North America Fertilizer Industry Market

The North American fertilizer market is propelled by a confluence of factors, including increasing global food demand, technological advancements in precision agriculture, and government support for sustainable agricultural practices. Rising consumer preference for sustainably produced food also presents a significant growth driver for environmentally friendly fertilizers.

Challenges Impacting North America Fertilizer Industry Growth

Significant challenges include supply chain disruptions that cause price volatility, stringent environmental regulations that increase production costs, and intense competition amongst existing players. These hurdles need strategic solutions for sustainable growth.

Key Players Shaping the North America Fertilizer Industry Market

- Wilbur-Ellis Company LLC

- Haifa Group

- CF Industries Holdings Inc

- Koch Industries Inc

- The Mosaic Company

- The Andersons Inc

- Yara International AS

- Nutrien Ltd

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

Significant North America Fertilizer Industry Industry Milestones

- August 2022: Koch invested around USD 30 Million in the Kansas nitrogen plant to increase UAN production by 35,000 tons per year.

- October 2022: The Andersons acquired the assets of Mote Farm Service, Inc., expanding its retail network.

- January 2023: ICL partnered with General Mills to supply specialty phosphate solutions, focusing on international expansion.

Future Outlook for North America Fertilizer Industry Market

The North America fertilizer market is poised for continued growth, driven by increasing demand for food and feed, advancements in fertilizer technology, and the adoption of sustainable agricultural practices. Strategic opportunities exist in developing innovative, efficient, and environmentally friendly fertilizer solutions, catering to the evolving needs of farmers and consumers. The market is expected to witness increased consolidation and strategic partnerships, shaping a more efficient and sustainable future.

North America Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Fertilizer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fertilizer Industry Regional Market Share

Geographic Coverage of North America Fertilizer Industry

North America Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wilbur-Ellis Company LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haifa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CF Industries Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koch Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mosaic Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Andersons Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nutrien Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ICL Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sociedad Quimica y Minera de Chile SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Wilbur-Ellis Company LLC

List of Figures

- Figure 1: North America Fertilizer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Fertilizer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Fertilizer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fertilizer Industry?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the North America Fertilizer Industry?

Key companies in the market include Wilbur-Ellis Company LLC, Haifa Group, CF Industries Holdings Inc, Koch Industries Inc, The Mosaic Company, The Andersons Inc, Yara International AS, Nutrien Ltd, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the North America Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.October 2022: The Andersons entered into an agreement to acquire the assets of Mote Farm Service, Inc. to expand thier retail farm center network.August 2022: Koch invested around USD 30 million in the Kansas nitrogen plant to increase UAN production by 35,000 tons per year to meet growing UAN demand across western Kansas and eastern Colorado.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fertilizer Industry?

To stay informed about further developments, trends, and reports in the North America Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence