Key Insights

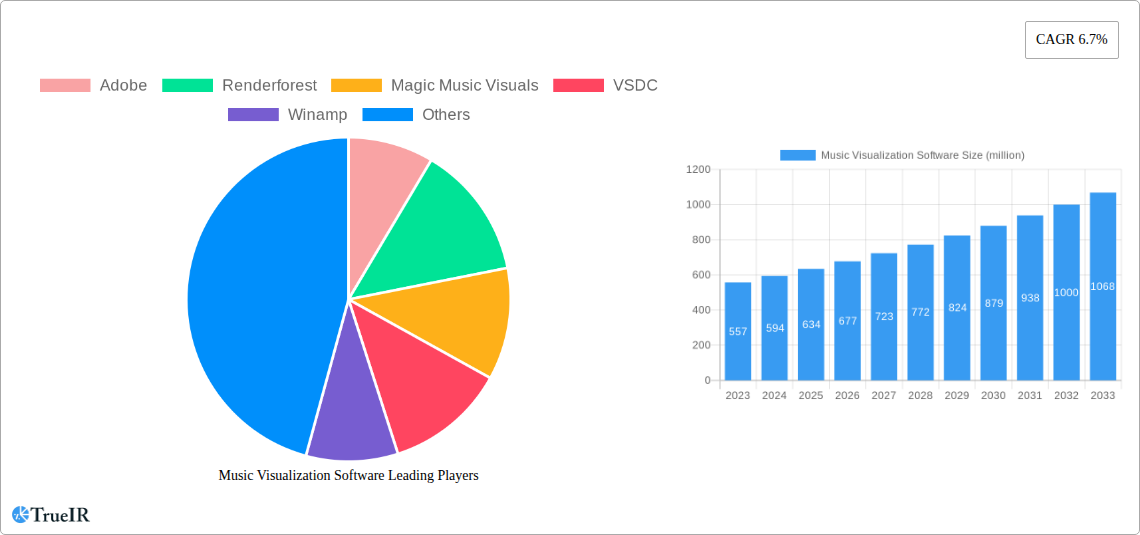

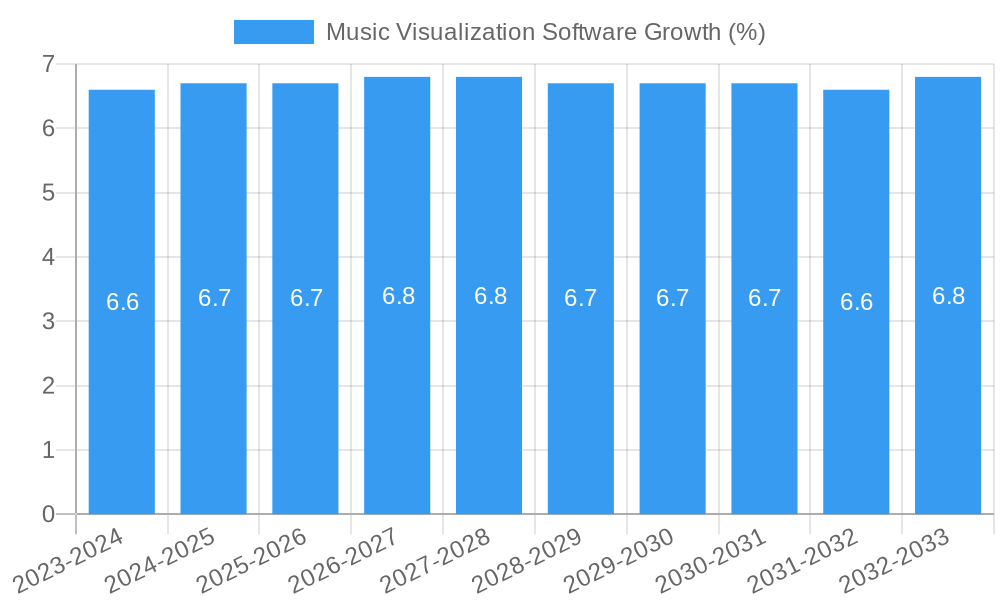

The global Music Visualization Software market is poised for robust growth, projected to reach a significant valuation by 2033. Driven by the increasing demand for engaging visual content across social media, live performances, and digital streaming platforms, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.7% from its current estimated market size of $557 million. This growth is fueled by advancements in AI-powered visualization tools, greater accessibility through cloud-based solutions, and the rising popularity of personalized content creation. The software empowers artists, content creators, and businesses to translate audio into captivating visual experiences, enhancing audience engagement and brand storytelling. Small and Medium-sized Enterprises (SMEs) represent a crucial segment, leveraging these tools for cost-effective marketing and promotional activities, while large enterprises adopt sophisticated solutions for high-impact campaigns and professional productions.

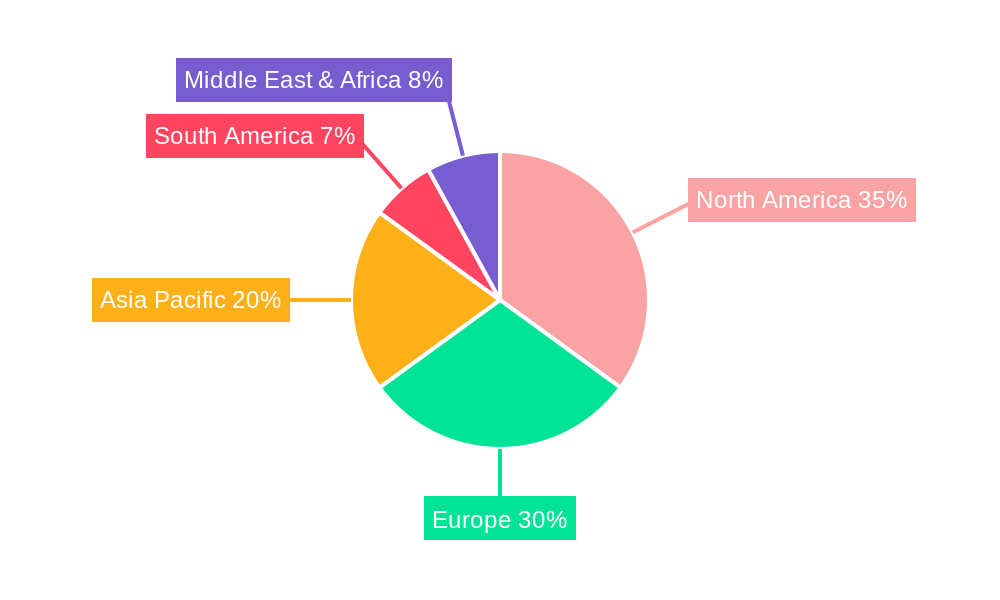

The market dynamics are further shaped by emerging trends such as the integration of real-time data into visualizations, the growing adoption of virtual reality (VR) and augmented reality (AR) for immersive experiences, and the increasing demand for user-friendly, drag-and-drop interfaces. Key players are focusing on developing innovative features, expanding their service offerings, and forging strategic partnerships to capture market share. While the market benefits from widespread digital adoption and a surge in content creation, potential restraints include the high initial cost of advanced software for some users and the complexity associated with mastering intricate visualization techniques. However, the increasing availability of freemium models and subscription-based services is democratizing access, ensuring continued expansion across diverse user bases. Geographically, North America and Europe are expected to lead market adoption due to their mature digital infrastructure and high consumer spending on entertainment and digital content, with Asia Pacific showing rapid growth potential driven by a burgeoning creator economy.

This comprehensive report delves into the dynamic music visualization software market, offering in-depth analysis of its structure, trends, and future trajectory. Covering the study period of 2019–2033, with a base year of 2025 and an estimated year of 2025, this report provides actionable insights for businesses seeking to leverage this rapidly evolving technology. We project a significant market size growth from XX million in 2024 to over XX million by 2033, exhibiting a robust CAGR of XX%. This report is essential for SMEs and Large Enterprises across various industries, offering strategic guidance for both Cloud Based and On-premises solutions.

Music Visualization Software Market Structure & Competitive Landscape

The music visualization software market, valued at approximately XX million in the base year 2025, exhibits a moderately consolidated structure. Innovation drivers are primarily fueled by advancements in AI-driven generative art, real-time audio processing capabilities, and the increasing demand for personalized visual experiences. Regulatory impacts are currently minimal, though evolving data privacy laws could influence user-generated content features. Product substitutes, such as manual video editing software and static graphic design tools, are being increasingly outperformed by dedicated music visualization platforms due to their automation and dynamic capabilities. End-user segmentation reveals strong adoption among independent musicians, content creators, gaming companies, and live event producers. Mergers and acquisitions (M&A) are expected to play a crucial role in market consolidation, with an estimated XX M&A deals anticipated between 2025 and 2033, valued at over XX million. Key players like Adobe and Renderforest are actively investing in R&D, while emerging startups are focusing on niche applications and affordability. The competitive landscape is characterized by a blend of established software giants and agile, specialized providers.

- Market Concentration: Moderate, with key players holding significant market share.

- Innovation Drivers: AI, real-time processing, personalization, VR/AR integration.

- Regulatory Impacts: Minimal to moderate, with potential for data privacy considerations.

- Product Substitutes: Manual editing tools, static design software.

- End-User Segmentation: Musicians, content creators, gaming, live events, marketing.

- M&A Trends: Expected to increase for market consolidation and technology acquisition.

Music Visualization Software Market Trends & Opportunities

The music visualization software market is poised for remarkable expansion, driven by a confluence of technological advancements and evolving consumer preferences. The projected market size is expected to surge from approximately XX million in 2024 to over XX million by 2033, indicating a healthy CAGR of XX% over the forecast period. This growth is underpinned by a significant increase in digital content creation, the proliferation of streaming platforms, and the growing demand for immersive audio-visual experiences across social media, live performances, and virtual events. Technological shifts are particularly impactful, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing the creation of sophisticated and responsive visualizers. These technologies enable dynamic, real-time generation of visuals that perfectly sync with music, offering a more engaging and personalized experience. Furthermore, the rise of cloud-based solutions is democratizing access to powerful visualization tools, lowering the barrier to entry for independent artists and small to medium-sized enterprises (SMEs).

Consumer preferences are increasingly leaning towards unique and customizable visual content that enhances the emotional impact of music. This is driving demand for software that offers intuitive interfaces, a wide array of creative presets, and the ability to incorporate brand elements and custom graphics. The competitive dynamics are intensifying, with established players like Adobe and Renderforest continuously enhancing their offerings, while innovative startups like Magic Music Visuals and Videobolt are carving out niches with specialized features and pricing models. The market penetration rate for music visualization software is expected to grow from XX% in 2024 to XX% by 2033, highlighting its increasing indispensability in the digital media landscape. Opportunities abound for software providers that can deliver powerful yet accessible tools, foster user communities, and integrate with emerging platforms and technologies such as augmented reality (AR) and virtual reality (VR). The demand for interactive and user-generated visualizers also presents a significant growth avenue.

Dominant Markets & Segments in Music Visualization Software

The music visualization software market is experiencing robust growth across various regions and segments, with a clear dominance emerging in key areas. Globally, North America is projected to remain the leading region, driven by its strong digital media ecosystem, high adoption rates of creative software, and a thriving music industry. Within North America, the United States stands out as the dominant country, boasting a significant concentration of content creators, music production studios, and technology innovators. The country's advanced technological infrastructure, supportive government policies for the creative industries, and substantial consumer spending on digital entertainment further solidify its leading position.

Analyzing segments, Cloud Based solutions are rapidly outpacing their On-premises counterparts in terms of growth and market penetration. This shift is attributed to the inherent advantages of cloud technology, including scalability, accessibility from anywhere, and subscription-based pricing models that are attractive to a broader user base, particularly SMEs. Cloud-based platforms offer continuous updates, reduced hardware dependency, and collaborative features, making them ideal for the dynamic needs of modern content creation.

- Leading Region: North America

- Key Growth Drivers in North America:

- High adoption of creative software and digital content creation tools.

- Thriving music industry and live event scene.

- Presence of major technology companies and startups.

- Strong consumer demand for visually engaging music experiences.

- Key Growth Drivers in North America:

- Dominant Country: United States

- Key Growth Drivers in the United States:

- Well-developed digital infrastructure.

- Government support for creative industries.

- Large pool of freelance artists and content creators.

- Significant investment in AR/VR technologies.

- Key Growth Drivers in the United States:

- Dominant Segment by Type: Cloud Based

- Key Growth Drivers for Cloud Based Solutions:

- Scalability and flexibility for diverse user needs.

- Cost-effectiveness through subscription models.

- Enhanced accessibility and remote collaboration capabilities.

- Continuous updates and feature enhancements.

- Key Growth Drivers for Cloud Based Solutions:

- Dominant Segment by Application: SMEs

- Key Growth Drivers for SMEs:

- Democratization of high-quality visualizer creation tools.

- Increased need for engaging social media content.

- Affordable pricing models of cloud-based solutions.

- User-friendly interfaces enabling quick learning curves.

- Key Growth Drivers for SMEs:

While Large Enterprises also represent a significant market, their adoption patterns often involve more customized, enterprise-grade solutions and integrations, contributing to sustained, albeit less explosive, growth compared to the rapidly expanding SME sector.

Music Visualization Software Product Analysis

The music visualization software market is witnessing a surge in product innovations centered around AI-powered dynamic content generation, real-time responsiveness to audio cues, and enhanced customization options. Advancements include sophisticated algorithms that translate musical nuances into complex visual patterns, creating unique and immersive experiences. Applications span from professional music production and live event enhancements to social media content creation and brand marketing. Competitive advantages lie in offering intuitive user interfaces, extensive libraries of customizable templates, seamless integration with popular DAWs and video editing suites, and the ability to generate high-resolution outputs. Technological advancements are enabling more realistic textures, intricate animations, and personalized visual styles, catering to a diverse range of artistic visions and client requirements.

Key Drivers, Barriers & Challenges in Music Visualization Software

The music visualization software market is propelled by several key drivers. Technological advancements, particularly in AI and real-time rendering, enable more sophisticated and responsive visuals. The increasing demand for engaging video content across social media platforms and streaming services is a significant economic driver. Furthermore, the growing accessibility of these tools, often through affordable subscription models, empowers a wider range of creators, from independent artists to SMEs. Policy-driven initiatives supporting the digital creative economy also contribute to market growth.

However, the market faces several challenges. High initial development costs for cutting-edge features can be a barrier for smaller companies. The intense competitive landscape, with numerous established and emerging players, necessitates continuous innovation and aggressive marketing strategies. Regulatory complexities surrounding intellectual property and copyright for AI-generated content, while not fully realized, represent a potential future hurdle. Supply chain issues, though less direct for software, can impact the availability of necessary hardware for rendering high-fidelity visualizations.

Growth Drivers in the Music Visualization Software Market

Key growth drivers in the music visualization software market are primarily technological, economic, and user-centric. The continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) algorithms allows for increasingly complex, dynamic, and personalized visual outputs that react in real-time to musical elements. Economically, the explosion of online content creation and the demand for engaging visual accompaniments on platforms like YouTube, TikTok, and Instagram fuel the need for accessible and powerful visualization tools. Furthermore, the rise of the creator economy and the increasing importance of visual branding for artists and businesses alike necessitate compelling visualizers. Policy-driven support for digital arts and creative industries also provides a conducive environment for market expansion.

Challenges Impacting Music Visualization Software Growth

Challenges impacting the growth of the music visualization software market include the steep learning curve associated with highly advanced features, which can deter some casual users. The intense competitive pressure from numerous software providers, both established and emerging, forces continuous innovation and can lead to price wars, impacting profit margins. Regulatory complexities surrounding copyright and intellectual property rights for AI-generated visuals, while still developing, present an evolving challenge that could influence content creation and licensing. Furthermore, ensuring seamless compatibility across diverse operating systems and hardware configurations remains an ongoing technical challenge for developers.

Key Players Shaping the Music Visualization Software Market

- Adobe

- Renderforest

- Magic Music Visuals

- VSDC

- Winamp

- Media Monkey (Ventis Media)

- Videobolt

- VideoLAN

- PotPlayer

- SongRender

- Veed

- Trapp

- VSXu

- SoundSpectrum

- Sonic Visualiser

Significant Music Visualization Software Industry Milestones

- 2019: Launch of advanced AI-driven visualizers offering real-time audio analysis.

- 2020: Increased adoption of cloud-based music visualization platforms by independent artists.

- 2021: Integration of VR/AR capabilities into select music visualization software, enhancing immersive experiences.

- 2022: Emergence of user-friendly, template-based visualizer creation tools targeting SMEs.

- 2023: Significant advancements in GPU rendering for faster, high-fidelity visual generation.

- 2024 (Q1-Q4): Growing demand for customizable brand integration within music visuals for marketing campaigns.

- 2025 (Projected): Further development of AI models for hyper-personalized visual experiences and increased focus on live-streaming integrations.

Future Outlook for Music Visualization Software Market

- 2019: Launch of advanced AI-driven visualizers offering real-time audio analysis.

- 2020: Increased adoption of cloud-based music visualization platforms by independent artists.

- 2021: Integration of VR/AR capabilities into select music visualization software, enhancing immersive experiences.

- 2022: Emergence of user-friendly, template-based visualizer creation tools targeting SMEs.

- 2023: Significant advancements in GPU rendering for faster, high-fidelity visual generation.

- 2024 (Q1-Q4): Growing demand for customizable brand integration within music visuals for marketing campaigns.

- 2025 (Projected): Further development of AI models for hyper-personalized visual experiences and increased focus on live-streaming integrations.

Future Outlook for Music Visualization Software Market

The future outlook for the music visualization software market is exceptionally bright, characterized by sustained growth and exciting technological integration. The market is expected to be driven by escalating demand for immersive and interactive digital content, further fueled by advancements in AI, AR, and VR. Strategic opportunities lie in developing highly personalized visualizers that adapt to individual user preferences and in expanding integration with emerging metaverse platforms and decentralized content distribution networks. The continued democratization of powerful creative tools will empower a broader spectrum of users, ensuring robust market penetration and a vibrant ecosystem of visual artists and innovators. The market's potential for innovation remains vast, promising an exciting future for creative expression through music visualization.

Music Visualization Software Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Type

- 2.1. Cloud Based

- 2.2. On-premises

Music Visualization Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Music Visualization Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud Based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud Based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud Based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud Based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud Based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Music Visualization Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud Based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adobe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renderforest

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Magic Music Visuals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VSDC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Winamp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Media Monkey (Ventis Media)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Videobolt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 VideoLAN

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PotPlayer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SongRender

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Veed

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Trapp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 VSXu

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SoundSpectrum

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sonic Visualiser

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Adobe

List of Figures

- Figure 1: Global Music Visualization Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Music Visualization Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Music Visualization Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Music Visualization Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Music Visualization Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Music Visualization Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Music Visualization Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Music Visualization Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Music Visualization Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Music Visualization Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Music Visualization Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Music Visualization Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Music Visualization Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Music Visualization Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Music Visualization Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Music Visualization Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Music Visualization Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Music Visualization Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Music Visualization Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Music Visualization Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Music Visualization Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Music Visualization Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Music Visualization Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Music Visualization Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Music Visualization Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Music Visualization Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Music Visualization Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Music Visualization Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Music Visualization Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Music Visualization Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Music Visualization Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Music Visualization Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Music Visualization Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Music Visualization Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Music Visualization Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Music Visualization Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Music Visualization Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Music Visualization Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Music Visualization Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Music Visualization Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Music Visualization Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Visualization Software?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Music Visualization Software?

Key companies in the market include Adobe, Renderforest, Magic Music Visuals, VSDC, Winamp, Media Monkey (Ventis Media), Videobolt, VideoLAN, PotPlayer, SongRender, Veed, Trapp, VSXu, SoundSpectrum, Sonic Visualiser.

3. What are the main segments of the Music Visualization Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 557 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Visualization Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Visualization Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Visualization Software?

To stay informed about further developments, trends, and reports in the Music Visualization Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence