Key Insights

The global Silica Market is poised for robust expansion, projected to reach a significant USD 5,822 million in 2025 and exhibiting a compelling Compound Annual Growth Rate (CAGR) of 7.8% throughout the forecast period of 2025-2033. This impressive growth trajectory is underpinned by a confluence of potent drivers, including the escalating demand from the agriculture sector for enhanced soil conditioning and crop protection, the burgeoning use of silica in advanced cosmetic formulations for improved texture and efficacy, and its critical role in the automotive industry for tire performance and lightweighting initiatives. Furthermore, the electronics sector's insatiable appetite for high-purity silica in semiconductors and advanced materials is a substantial contributor to this upward trend. Emerging applications in areas like advanced construction materials and specialized industrial coatings are also expected to fuel market dynamics, presenting significant opportunities for innovation and market penetration.

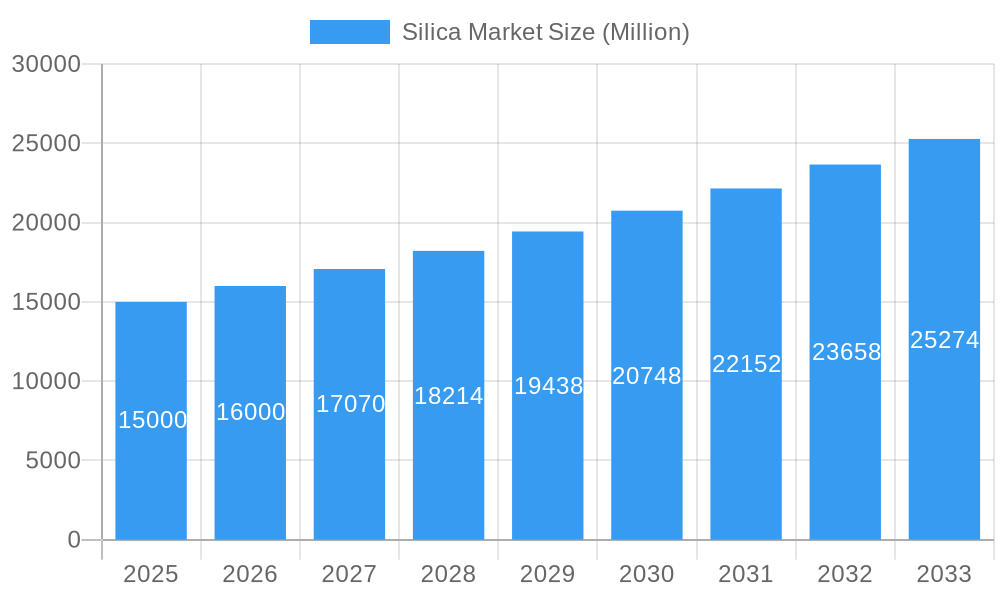

Silica Market Market Size (In Billion)

The market's expansion, however, is not without its considerations. While growth is strong, certain restraints such as the fluctuating raw material costs and stringent environmental regulations concerning silica production and disposal may present challenges for market participants. Despite these hurdles, the prevailing trends indicate a clear shift towards high-performance and sustainable silica grades, driven by increasing consumer and regulatory preferences. Key players like Madhu Silica Pvt Ltd, Evonik Industries AG, and Tosoh Silica Corporation are actively investing in research and development to cater to these evolving demands, focusing on product differentiation and capacity expansion. The Asia Pacific region, particularly China and India, is expected to lead this growth due to rapid industrialization and increasing end-user demand across various sectors. North America and Europe also represent substantial markets, driven by technological advancements and a strong focus on specialty silica applications.

Silica Market Company Market Share

Global Silica Market Report: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides an exhaustive analysis of the global silica market, encompassing a detailed examination of its structure, competitive landscape, emerging trends, growth opportunities, dominant segments, product innovations, key drivers, barriers, and future outlook. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this report utilizes high-volume keywords and strategic SEO optimization to deliver unparalleled insights for industry stakeholders.

Silica Market Market Structure & Competitive Landscape

The global silica market exhibits a moderately concentrated structure, driven by a few key players with significant market share, alongside a growing number of specialized manufacturers. Innovation is a primary driver, fueled by continuous research and development in advanced silica grades and applications, particularly in high-performance materials for sectors like automotive and electronics. Regulatory landscapes, while generally supportive of industrial growth, can influence production standards and product approvals, impacting market entry and competition. Product substitutes, though present in some niche applications, face challenges in matching the versatility and performance characteristics of silica. The end-user industry segmentation reveals diverse demand patterns, with automotive, electronics, and industrial applications forming the core. Mergers and acquisitions (M&A) activity, while not overtly dominant, plays a role in market consolidation and strategic expansion, with reported volumes in the tens of millions of dollars annually. Understanding these dynamics is crucial for navigating the evolving silica industry.

- Market Concentration: Dominated by a mix of multinational corporations and regional specialists.

- Innovation Drivers: Advancements in precipitated silica, fumed silica, and silica gel for enhanced performance.

- Regulatory Impacts: Environmental regulations and product safety standards influencing manufacturing processes.

- Product Substitutes: Limited in high-performance applications, but present in certain bulk uses.

- End-User Segmentation: Diverse applications across multiple industries, driving varied demand.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and geographic reach.

Silica Market Market Trends & Opportunities

The silica market is poised for substantial growth, with an estimated market size projected to reach over $15,000 million by 2033. This expansion is underpinned by a compound annual growth rate (CAGR) of approximately 6.5% over the forecast period (2025-2033). Technological shifts are pivotal, with increasing demand for high-purity and specialized silica grades driving innovation in manufacturing processes. Consumer preferences are indirectly influencing the market, with a growing emphasis on sustainable and high-performance products in end-user industries. For instance, the automotive sector's shift towards fuel-efficient and durable tires directly boosts the demand for advanced silica fillers that reduce rolling resistance and enhance wear properties. The electronics industry's constant innovation in miniaturization and performance requires specialized silica for insulation, passivation, and thermal management applications. The silica market is also witnessing opportunities in emerging economies, where industrialization and infrastructure development are creating new avenues for silica consumption. Furthermore, the growing adoption of silica in personal care products, due to its exfoliating and thickening properties, represents another significant growth avenue. The continuous development of novel applications, such as in battery technologies and advanced composites, promises to further diversify and expand the global silica market.

- Market Size Growth: Projected to surpass $15,000 million by 2033.

- CAGR: Approximately 6.5% from 2025 to 2033.

- Technological Shifts: Focus on advanced silica grades and sustainable manufacturing.

- Consumer Preferences: Driving demand for high-performance and eco-friendly products.

- Competitive Dynamics: Intensified by innovation and strategic partnerships.

- Market Penetration: Increasing across diverse end-user industries.

Dominant Markets & Segments in Silica Market

The global silica market is characterized by distinct regional dominance and the significant contribution of specific end-user industries. Asia-Pacific stands out as the leading region, driven by robust manufacturing capabilities, rapid industrialization, and a burgeoning automotive and electronics sector. Countries like China and India are major consumers and producers of silica, owing to their expansive industrial bases and favorable government policies supporting manufacturing growth. The Automotive end-user industry is a dominant segment, with precipitated silica playing a crucial role as a reinforcing filler in tires, improving fuel efficiency, traction, and durability. The demand is further fueled by increasing vehicle production and stringent emission standards that necessitate advanced tire technologies. The Electronics segment also represents a significant and rapidly growing market for silica, particularly fumed silica and colloidal silica, used in semiconductors, printed circuit boards, and displays for their insulating, abrasive, and thickening properties. Emerging applications in renewable energy components, like solar panels, are further boosting demand.

The Agriculture sector utilizes silica for its benefits in soil conditioning and as a carrier for pesticides and fertilizers, contributing to crop yield and protection. The Cosmetics industry employs silica in formulations for its mattifying, thickening, and exfoliating properties, driving demand for high-purity grades.

- Dominant Region: Asia-Pacific, driven by industrial growth and manufacturing hubs.

- Key Countries: China and India, major consumers and producers.

- Dominant End-User Industry: Automotive, with significant contributions from Electronics.

- Growth Drivers (Automotive): Increasing vehicle production, fuel efficiency mandates, tire technology advancements.

- Growth Drivers (Electronics): Miniaturization, advanced material requirements, growth in semiconductors and displays.

- Growth Drivers (Agriculture): Soil health improvement, enhanced nutrient delivery, crop protection.

- Growth Drivers (Cosmetics): Demand for innovative personal care products, natural ingredients.

Silica Market Product Analysis

The silica market is defined by a range of innovative products, including precipitated silica, fumed silica, and silica gel, each offering distinct properties and applications. Precipitated silica has seen advancements in surface modification for improved dispersion and compatibility with polymers, enhancing its use in tires and rubber goods. Fumed silica continues to evolve with controlled particle size and surface area for applications in rheology control, anti-caking, and advanced coatings. Silica gel finds new applications in chromatography, desiccants, and as catalyst supports. The competitive advantage of these products lies in their versatility, cost-effectiveness, and the ability to be tailored for specific performance requirements across diverse industries, from enhancing tire performance to providing crucial functionalities in electronics and pharmaceuticals.

Key Drivers, Barriers & Challenges in Silica Market

The silica market is propelled by several key drivers, including the increasing demand from the automotive industry for fuel-efficient tires, the growing electronics sector's need for advanced materials, and the expanding applications in personal care and industrial sectors. Technological advancements in silica production and application are also significant growth catalysts. For example, the development of highly dispersible silica for green tires directly addresses environmental concerns and fuel economy regulations.

However, the silica market faces challenges such as volatile raw material prices, particularly for silicon dioxide sources, and increasing environmental regulations concerning mining and manufacturing processes. Supply chain disruptions and logistical complexities can also impact market stability, especially in a globalized economy. Competitive pressures from alternative materials in some applications and the need for continuous investment in research and development to maintain a competitive edge are also significant considerations for market participants.

- Key Drivers: Automotive demand, electronics growth, personal care applications, technological innovation.

- Barriers & Challenges: Raw material price volatility, environmental regulations, supply chain disruptions, competitive pressures.

Growth Drivers in the Silica Market Market

Key drivers fueling the silica market growth include the robust demand from the automotive sector for tire applications that enhance fuel efficiency and safety, driven by stringent emissions standards. The burgeoning electronics industry's requirement for high-performance silica in semiconductors, displays, and insulation materials is another significant contributor. Furthermore, the expanding use of silica in personal care products, such as cosmetics and toothpaste, for its functional properties, alongside its established role in agriculture as a soil conditioner and in industrial applications like coatings and adhesives, collectively fuels market expansion. Technological advancements in silica synthesis, leading to tailored properties for specialized applications, and favorable government initiatives promoting sustainable materials also act as crucial growth catalysts.

Challenges Impacting Silica Market Growth

Several challenges impact the growth of the silica market. Fluctuations in the prices of key raw materials, such as quartz and chemical precursors, can lead to increased production costs and affect profitability. Stringent environmental regulations concerning mining operations, chemical processing, and waste management necessitate significant investment in compliance, potentially increasing operational expenses. Supply chain vulnerabilities, exacerbated by geopolitical factors and logistical constraints, can disrupt the availability of raw materials and the distribution of finished products. Intense competition from both established players and emerging manufacturers, as well as the development of alternative materials in certain applications, also exerts pressure on market growth and pricing.

Key Players Shaping the Silica Market Market

- Madhu Silica Pvt Ltd

- AMS Applied Material Solutions

- Solvay

- Covia Holdings LLC

- Evonik Industries AG

- PPG Industries Inc

- QUECHEN

- W R Grace & Co -Conn

- Denka Company Limited

- Tosoh Silica Corporation

- Anten Chemical Co Ltd

Significant Silica Market Industry Milestones

- October 2021: PPG Industries Inc. entered into a strategic agreement with Oriental Silicas Corporation (OSC) to expand its sales capabilities and introduce innovative products in the Asia-Pacific tire market.

- May 2021: Evonik Industries developed Ultrasil 4000 GR, a new active filler for the tire industry, enhancing winter tire safety and performance.

- March 2021: Bridgestone, ARLANXEO, and Solvay announced the launch of TECHSYN, a new tire technology platform focused on strength and environmental performance.

Future Outlook for Silica Market Market

The future outlook for the silica market is exceptionally promising, driven by ongoing innovation and expanding applications. The relentless pursuit of high-performance materials in key sectors like automotive and electronics will continue to be a primary growth catalyst. Strategic collaborations and acquisitions are expected to shape the competitive landscape, fostering consolidation and technological advancements. Emerging applications in advanced battery technologies, sustainable packaging, and specialized pharmaceutical excipients present significant untapped potential. Furthermore, the growing global emphasis on sustainability and circular economy principles will likely spur the development of eco-friendly silica production methods and bio-based silica alternatives, ensuring the global silica market remains dynamic and poised for sustained growth in the coming decade.

Silica Market Segmentation

-

1. End-user Industry

- 1.1. Agriculture

- 1.2. Cosmetics

- 1.3. Automotive

- 1.4. Electronics

- 1.5. Other End-user Industries

Silica Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silica Market Regional Market Share

Geographic Coverage of Silica Market

Silica Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Automotive Industry; Others

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automobile Industry is Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silica Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Agriculture

- 5.1.2. Cosmetics

- 5.1.3. Automotive

- 5.1.4. Electronics

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Silica Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Agriculture

- 6.1.2. Cosmetics

- 6.1.3. Automotive

- 6.1.4. Electronics

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Silica Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Agriculture

- 7.1.2. Cosmetics

- 7.1.3. Automotive

- 7.1.4. Electronics

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Silica Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Agriculture

- 8.1.2. Cosmetics

- 8.1.3. Automotive

- 8.1.4. Electronics

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Silica Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Agriculture

- 9.1.2. Cosmetics

- 9.1.3. Automotive

- 9.1.4. Electronics

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Silica Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Agriculture

- 10.1.2. Cosmetics

- 10.1.3. Automotive

- 10.1.4. Electronics

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Madhu Silica Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMS Applied Material Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Covia Holdings LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PPG Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 QUECHEN

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 W R Grace & Co -Conn *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Denka Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tosoh Silica Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Anten Chemical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Madhu Silica Pvt Ltd

List of Figures

- Figure 1: Global Silica Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Asia Pacific Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Silica Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Silica Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Silica Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Silica Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Silica Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Silica Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: China Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: India Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Japan Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Korea Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United States Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Canada Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Germany Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Brazil Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Argentina Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Silica Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Silica Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Silica Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silica Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Silica Market?

Key companies in the market include Madhu Silica Pvt Ltd, AMS Applied Material Solutions, Solvay, Covia Holdings LLC, Evonik Industries AG, PPG Industries Inc, QUECHEN, W R Grace & Co -Conn *List Not Exhaustive, Denka Company Limited, Tosoh Silica Corporation, Anten Chemical Co Ltd.

3. What are the main segments of the Silica Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Automotive Industry; Others.

6. What are the notable trends driving market growth?

Automobile Industry is Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

In October 2021, PPG Industries Inc. entered into a strategic agreement with Oriental Silicas Corporation (OSC). OSC of Greater China is the sales representative for select grades of PPG silica products used by tire manufacturers in the Asia-Pacific region. This helped the company to expand service capabilities and introduce innovative products in the Asia-Pacific market for new and existing tire customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silica Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silica Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silica Market?

To stay informed about further developments, trends, and reports in the Silica Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence