Key Insights

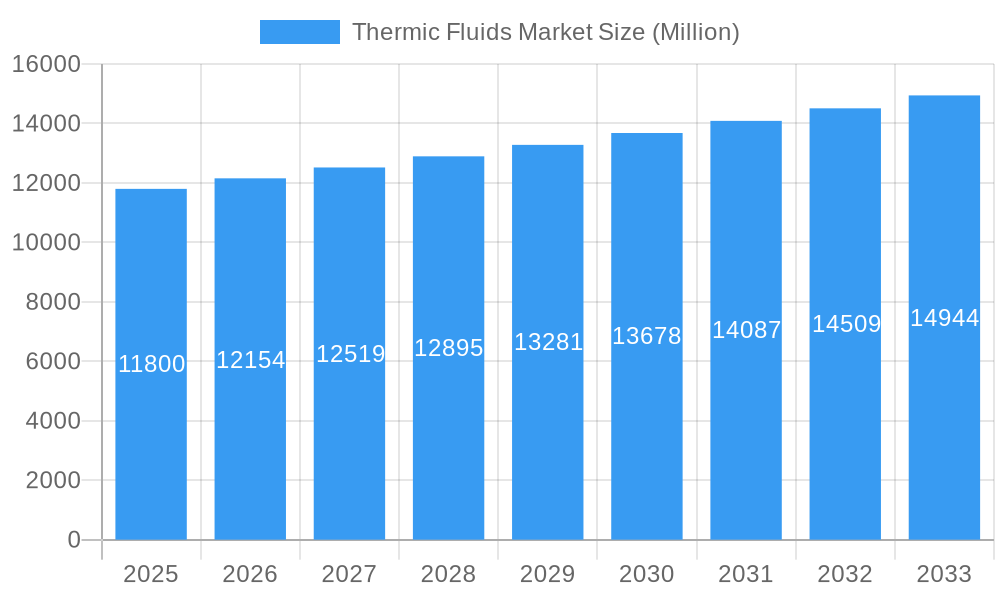

The global Thermic Fluids Market is poised for significant expansion, projected to reach $11.8 billion by 2025. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 3% from 2019 to 2033, indicating a robust and sustained demand for efficient heat transfer solutions. The market's dynamism is driven by the increasing adoption of thermic fluids across a multitude of industrial applications, from food and beverage processing and chemical manufacturing to pharmaceuticals and the burgeoning oil and gas sector. Notably, the Concentrated Solar Power (CSP) industry is emerging as a pivotal growth engine, leveraging thermic fluids for effective thermal energy storage and electricity generation. The demand is further fueled by evolving industrial processes that necessitate precise temperature control and enhanced operational efficiency.

Thermic Fluids Market Market Size (In Billion)

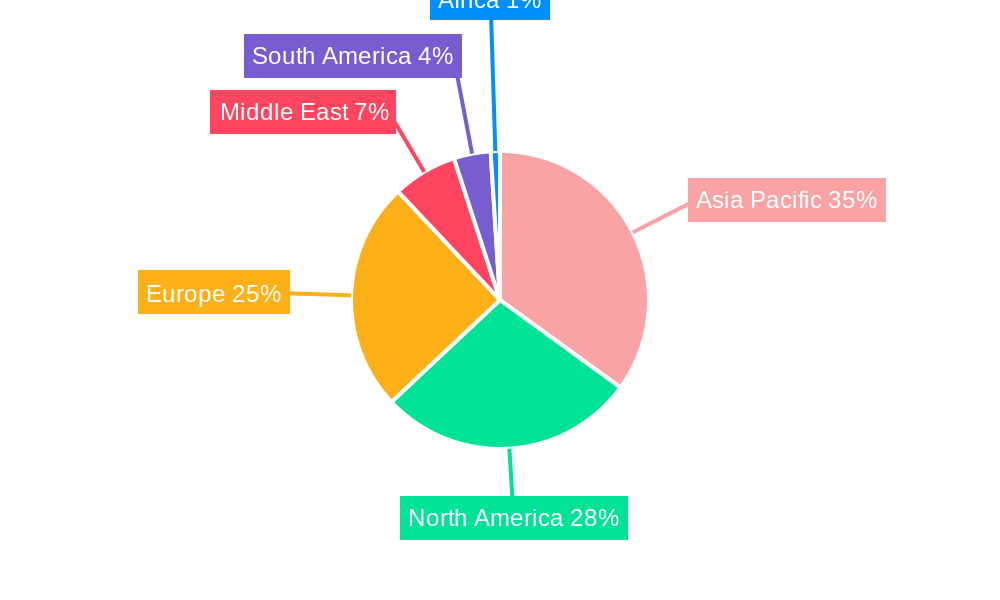

Key market restraints such as fluctuating raw material prices and the stringent environmental regulations surrounding certain fluid types are being strategically addressed through innovation in fluid composition and a growing preference for eco-friendly alternatives. The market segmentation reveals a strong presence of Mineral Oils, Silicon, and Aromatics, alongside a rising interest in Glycols and Other Types, reflecting the diverse performance requirements of end-users. Geographically, Asia Pacific is anticipated to lead market expansion, driven by rapid industrialization and infrastructure development in countries like China and India. North America and Europe remain substantial markets, characterized by mature industries and a focus on upgrading existing facilities with advanced thermic fluid systems. Leading companies like BP plc, Dow, Exxon Mobil Corporation, and Shell plc are actively investing in research and development to introduce advanced, sustainable, and high-performance thermic fluid solutions, ensuring the market's continued upward trajectory.

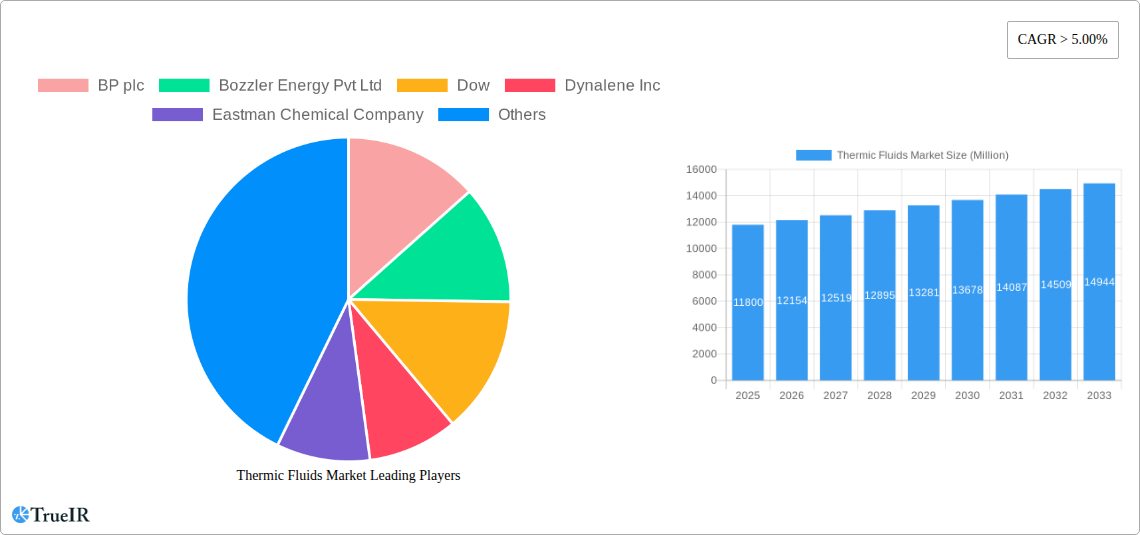

Thermic Fluids Market Company Market Share

Thermic Fluids Market: Comprehensive Analysis and Future Projections (2019–2033)

Dive into the intricate workings of the global Thermic Fluids Market with this exhaustive report. Covering the period from 2019 to 2033, with a deep dive into the Base Year of 2025 and an expansive Forecast Period of 2025–2033, this analysis provides unparalleled insights into market dynamics, growth opportunities, and competitive strategies. The report examines key segments, including Mineral Oils, Silicon and Aromatics, Glycols, and Other Types, alongside critical end-user industries such as Food and Beverage, Chemical, Pharmaceutical, Oil and Gas, and Concentrated Solar Power. With an estimated market size poised to reach billions, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving thermic fluids landscape.

Thermic Fluids Market Market Structure & Competitive Landscape

The thermic fluids market exhibits a moderate to high concentration, driven by the presence of established global players and a growing number of specialized manufacturers. Innovation is a key differentiator, with companies investing heavily in developing high-performance, environmentally friendly, and cost-effective heat transfer fluids. Regulatory impacts are increasingly shaping the market, pushing for sustainable alternatives and stringent safety standards. Product substitutes, while present in certain niche applications, are largely outcompeted by the specialized properties of thermic fluids. The end-user segmentation highlights the diverse applications across various industries, with the chemical and oil & gas sectors being major consumers. Merger and acquisition (M&A) trends are evident as larger entities seek to consolidate market share and expand their product portfolios. The market is characterized by a blend of strategic alliances and targeted acquisitions aimed at enhancing technological capabilities and market reach. Quantitative data on concentration ratios and M&A volumes are detailed within the full report.

Thermic Fluids Market Market Trends & Opportunities

The global thermic fluids market is projected for robust growth, with an anticipated Compound Annual Growth Rate (CAGR) of over 6% from 2025 to 2033, driving the market value into the billions. This expansion is fueled by increasing industrialization and the growing demand for efficient and reliable heat transfer solutions across a multitude of sectors. Technological shifts are paramount, with a discernible move towards synthetic and bio-based thermic fluids that offer superior thermal stability, extended fluid life, and reduced environmental impact compared to traditional mineral oils. Consumer preferences are increasingly aligning with sustainability goals, creating a significant opportunity for manufacturers of eco-friendly heat transfer fluids. The competitive dynamics are evolving, with companies differentiating themselves through product innovation, specialized formulations, and a focus on providing comprehensive technical support and services. Market penetration rates are expected to rise significantly as new applications emerge and existing ones demand higher performance fluids. The ongoing pursuit of energy efficiency in industrial processes worldwide will continue to be a primary growth catalyst, presenting substantial market penetration opportunities. Emerging markets, particularly in Asia-Pacific and Latin America, are showcasing rapid industrial development, leading to increased adoption of advanced thermic fluid technologies. Furthermore, the stringent regulations being implemented globally to reduce carbon emissions and promote cleaner industrial practices are inadvertently driving the demand for high-efficiency thermic fluids that optimize energy consumption and minimize waste heat. This creates a fertile ground for innovation and market expansion, as companies invest in research and development to meet these evolving demands. The increasing adoption of concentrated solar power (CSP) for renewable energy generation is another significant trend, directly boosting the demand for specialized thermic fluids capable of withstanding high temperatures and ensuring operational efficiency.

Dominant Markets & Segments in Thermic Fluids Market

The Chemical industry stands out as a dominant end-user segment within the thermic fluids market, accounting for a substantial portion of the global demand, projected to reach tens of billions by 2025. This dominance is attributed to the inherent need for precise temperature control in a vast array of chemical synthesis, processing, and manufacturing operations. Key growth drivers include the burgeoning production of petrochemicals, specialty chemicals, and polymers, all of which rely heavily on efficient heat transfer for optimal yields and product quality.

- Chemical Industry Dominance:

- Infrastructure Development: Continuous investment in new chemical plants and expansions globally directly translates to increased demand for thermic fluids.

- Process Optimization: The drive for higher efficiency and lower energy consumption in chemical manufacturing necessitates the use of advanced heat transfer fluids.

- Safety and Environmental Regulations: Increasingly stringent safety and environmental standards favor the use of high-performance, leak-resistant thermic fluids.

- Diverse Applications: From reactors and heat exchangers to distillation columns and drying processes, the chemical industry presents a wide spectrum of thermic fluid applications.

Another highly influential segment is the Oil and Gas industry, which contributes significantly to market value in the billions. The exploration, extraction, refining, and processing of crude oil and natural gas require robust and reliable heat transfer systems to manage high temperatures and pressures.

- Oil and Gas Sector Significance:

- Upstream Operations: Thermic fluids are crucial for maintaining optimal temperatures in drilling operations and for processing extracted hydrocarbons.

- Refining Processes: Essential for various refining units, including crude distillation, catalytic cracking, and hydrotreating, where precise temperature management is critical for product quality and operational safety.

- Petrochemical Production: The integration of refineries with petrochemical complexes further amplifies the demand for thermic fluids.

- Global Energy Demand: The persistent global demand for energy ensures sustained activity and investment in this sector, driving thermic fluid consumption.

Geographically, the Asia-Pacific region is emerging as a dominant market, projected to contribute billions to the global thermic fluids market by 2025. This dominance is propelled by rapid industrialization, significant investments in manufacturing infrastructure, and a burgeoning chemical and oil & gas sector.

- Asia-Pacific Market Leadership:

- Industrial Growth: Rapid economic development and manufacturing expansion across countries like China and India are key drivers.

- Renewable Energy Focus: Growing investments in concentrated solar power (CSP) projects in the region also contribute to thermic fluid demand.

- Government Initiatives: Favorable government policies promoting industrial growth and energy efficiency further bolster market expansion.

Among the types, Glycols are expected to witness substantial growth due to their versatile properties and widespread use, particularly in HVAC and industrial cooling applications, contributing billions to the market.

- Glycol Segment Growth:

- Versatility: Suitable for both high and low-temperature applications.

- Cost-Effectiveness: Often presents a competitive price point compared to some synthetic alternatives.

- Wide Adoption: Used in diverse sectors including HVAC, food and beverage processing, and industrial cooling.

Thermic Fluids Market Product Analysis

The thermic fluids market is characterized by continuous product innovation focused on enhancing thermal stability, extending operational life, and improving environmental profiles. Synthetic aromatic fluids, silicones, and advanced glycols are gaining traction for their superior performance in demanding applications, offering higher heat transfer coefficients and greater resistance to degradation at extreme temperatures. The competitive advantage lies in developing formulations that minimize downtime, reduce maintenance costs, and comply with increasingly stringent environmental regulations, thereby offering a superior market fit for energy-intensive industries.

Key Drivers, Barriers & Challenges in Thermic Fluids Market

The thermic fluids market is primarily propelled by the escalating demand for energy efficiency across industrial sectors, coupled with the growing adoption of renewable energy sources like Concentrated Solar Power (CSP). Technological advancements leading to higher performance and longer-lasting fluids, alongside supportive government policies promoting industrial modernization, are significant growth catalysts. The global push for sustainability and reduced carbon footprints further incentivizes the use of advanced thermic fluids that optimize energy consumption.

Conversely, challenges impacting growth include the inherent cost of advanced synthetic fluids, which can be a barrier for smaller enterprises. Supply chain disruptions, volatility in raw material prices, and the presence of established, lower-cost alternatives in certain applications also pose restraints. Furthermore, navigating complex regulatory landscapes across different regions and ensuring proper handling and disposal of used fluids are ongoing challenges.

Growth Drivers in the Thermic Fluids Market Market

The primary growth drivers in the thermic fluids market are the escalating global demand for energy efficiency, driven by both economic and environmental considerations. The increasing adoption of renewable energy technologies, particularly Concentrated Solar Power (CSP), directly fuels the need for high-performance heat transfer fluids capable of operating under extreme conditions. Technological advancements in fluid formulations, leading to extended fluid life, reduced maintenance requirements, and enhanced thermal stability, are also significant growth catalysts. Furthermore, supportive government policies aimed at promoting industrial modernization and reducing carbon emissions worldwide are creating a favorable market environment.

Challenges Impacting Thermic Fluids Market Growth

Despite robust growth prospects, the thermic fluids market faces several challenges. The initial capital cost associated with advanced synthetic thermic fluids can be a deterrent for some industries, especially in price-sensitive markets. Fluctuations in the prices of crude oil and other raw materials can impact production costs and pricing strategies. Regulatory complexities and variations in environmental standards across different countries can also pose hurdles for manufacturers and end-users. Moreover, ensuring the safe handling, efficient use, and environmentally sound disposal of thermic fluids remains a critical aspect that requires continuous attention and adherence to best practices.

Key Players Shaping the Thermic Fluids Market Market

- BP plc

- Bozzler Energy Pvt Ltd

- Dow

- Dynalene Inc

- Eastman Chemical Company

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Limited

- Multitherm LLC

- Paratherm

- Shell plc

Significant Thermic Fluids Market Industry Milestones

- September 2022: Bozzler Energy Pvt Ltd announced the showcasing of its new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition. These designs are anticipated to be highly suitable for environmental health and eco-friendly applications.

- July 2022: Eastman Chemical Company announced plans to increase its Therminol 66 heat transfer fluid manufacturing capacity in Anniston, Alabama, USA, ensuring global customer needs are met for years. The plant expansion, expected to be completed in 2024, will boost United States-based capacity by 50%.

Future Outlook for Thermic Fluids Market Market

The future outlook for the thermic fluids market is exceptionally promising, with continued growth driven by innovation and the global imperative for energy efficiency. The increasing demand from emerging economies, coupled with advancements in fluid technology that offer enhanced performance and sustainability, will create substantial market opportunities. Strategic investments in research and development, focusing on bio-based and high-performance synthetic fluids, are expected to be key growth catalysts. The expanding role of thermic fluids in renewable energy sectors, such as Concentrated Solar Power, further solidifies their importance in the global energy landscape, pointing towards sustained market expansion well into the future.

Thermic Fluids Market Segmentation

-

1. Type

- 1.1. Mineral Oils

- 1.2. Silicon and Aromatics

- 1.3. Glycols

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Chemical

- 2.3. Pharmaceutical

- 2.4. Oil and Gas

- 2.5. Concentrated Solar Power

- 2.6. Other End-user Industries

Thermic Fluids Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. United Arab Emirates

- 6.3. Rest of Middle East

Thermic Fluids Market Regional Market Share

Geographic Coverage of Thermic Fluids Market

Thermic Fluids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.3. Market Restrains

- 3.3.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.4. Market Trends

- 3.4.1. Extensive Demand from the Oil and Gas Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mineral Oils

- 5.1.2. Silicon and Aromatics

- 5.1.3. Glycols

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Chemical

- 5.2.3. Pharmaceutical

- 5.2.4. Oil and Gas

- 5.2.5. Concentrated Solar Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mineral Oils

- 6.1.2. Silicon and Aromatics

- 6.1.3. Glycols

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Chemical

- 6.2.3. Pharmaceutical

- 6.2.4. Oil and Gas

- 6.2.5. Concentrated Solar Power

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mineral Oils

- 7.1.2. Silicon and Aromatics

- 7.1.3. Glycols

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Chemical

- 7.2.3. Pharmaceutical

- 7.2.4. Oil and Gas

- 7.2.5. Concentrated Solar Power

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mineral Oils

- 8.1.2. Silicon and Aromatics

- 8.1.3. Glycols

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Chemical

- 8.2.3. Pharmaceutical

- 8.2.4. Oil and Gas

- 8.2.5. Concentrated Solar Power

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mineral Oils

- 9.1.2. Silicon and Aromatics

- 9.1.3. Glycols

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Chemical

- 9.2.3. Pharmaceutical

- 9.2.4. Oil and Gas

- 9.2.5. Concentrated Solar Power

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mineral Oils

- 10.1.2. Silicon and Aromatics

- 10.1.3. Glycols

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Chemical

- 10.2.3. Pharmaceutical

- 10.2.4. Oil and Gas

- 10.2.5. Concentrated Solar Power

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Thermic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mineral Oils

- 11.1.2. Silicon and Aromatics

- 11.1.3. Glycols

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Food and Beverage

- 11.2.2. Chemical

- 11.2.3. Pharmaceutical

- 11.2.4. Oil and Gas

- 11.2.5. Concentrated Solar Power

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP plc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bozzler Energy Pvt Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dow

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dynalene Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Eastman Chemical Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Exxon Mobil Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hindustan Petroleum Corporation Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Multitherm LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Paratherm

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Shell plc*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 BP plc

List of Figures

- Figure 1: Global Thermic Fluids Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Thermic Fluids Market Revenue (undefined), by Type 2025 & 2033

- Figure 33: Saudi Arabia Thermic Fluids Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Saudi Arabia Thermic Fluids Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 35: Saudi Arabia Thermic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Saudi Arabia Thermic Fluids Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Thermic Fluids Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Thermic Fluids Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Global Thermic Fluids Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Thermic Fluids Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 37: Global Thermic Fluids Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: South Africa Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Thermic Fluids Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermic Fluids Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Thermic Fluids Market?

Key companies in the market include BP plc, Bozzler Energy Pvt Ltd, Dow, Dynalene Inc, Eastman Chemical Company, Exxon Mobil Corporation, Hindustan Petroleum Corporation Limited, Multitherm LLC, Paratherm, Shell plc*List Not Exhaustive.

3. What are the main segments of the Thermic Fluids Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

6. What are the notable trends driving market growth?

Extensive Demand from the Oil and Gas Sector.

7. Are there any restraints impacting market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

8. Can you provide examples of recent developments in the market?

September 2022: Bozzler Energy Pvt Ltd announced that the company would be showcasing its new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition organized by Orangebeak Technologies, which was to be held at CIDCO Exhibition Centre, Navi Mumbai. The new designs are expected to be highly suitable for environmental health and eco-friendly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermic Fluids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermic Fluids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermic Fluids Market?

To stay informed about further developments, trends, and reports in the Thermic Fluids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence