Key Insights

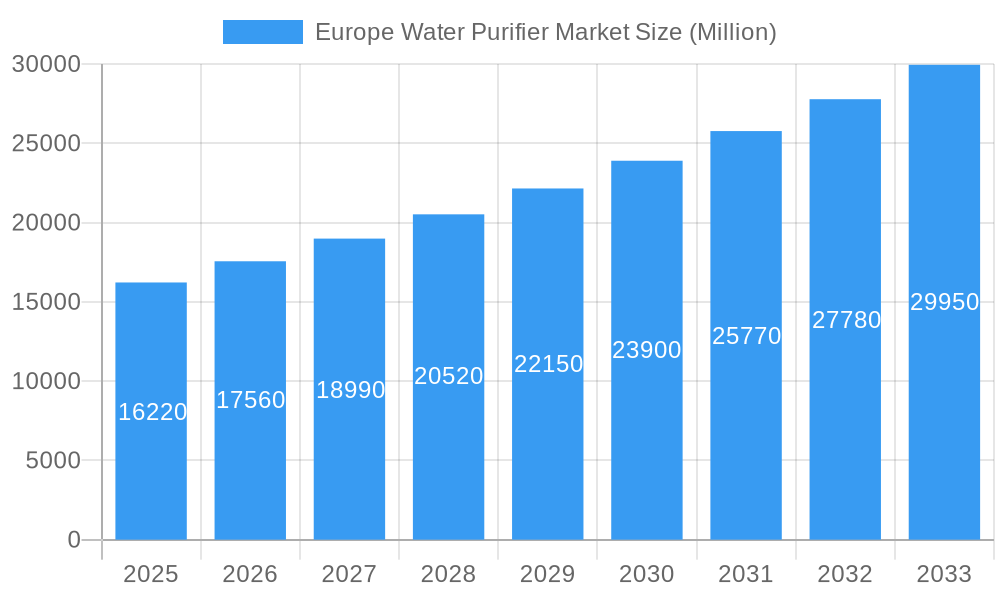

The European Water Purifier Market is poised for significant expansion, projected to reach a substantial USD 16.22 billion in 2025. This robust growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 8.28% over the forecast period, indicating a dynamic and evolving landscape. Key drivers underpinning this surge include increasing public awareness regarding waterborne diseases and the resultant demand for safe drinking water, coupled with stringent government regulations aimed at improving water quality across the continent. The growing emphasis on health and wellness, particularly in densely populated urban areas, further bolsters the adoption of advanced water purification technologies. Furthermore, the burgeoning hospitality and healthcare sectors, along with the continuous need for high-purity water in industrial processes, are creating sustained demand for a diverse range of water purification solutions.

Europe Water Purifier Market Market Size (In Billion)

Technological advancements are at the forefront of this market's evolution, with segments like Reverse Osmosis (RO) and Ultrafiltration (UF) leading the innovation curve. These technologies offer superior contaminant removal capabilities, catering to both household and industrial applications. The Pulp and Paper, Chemical, Food and Beverage, and Healthcare industries represent significant end-user segments, each with unique purification requirements. While a rising demand for clean water is a primary growth stimulant, challenges such as the high initial cost of advanced purification systems and the availability of alternative water sources in certain regions could present moderating factors. Nonetheless, the overarching trend points towards a greater adoption of efficient and sustainable water purification methods across Europe, driven by both consumer needs and regulatory imperatives, with significant growth anticipated in the forecast period of 2025-2033.

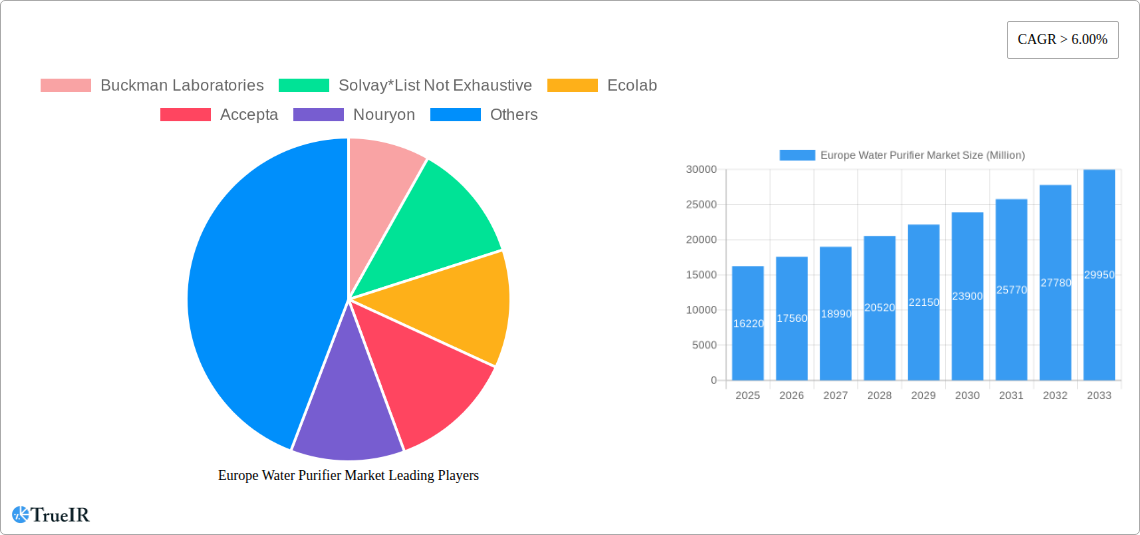

Europe Water Purifier Market Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Water Purifier Market, offering critical insights into market dynamics, key players, technological advancements, and future trajectories. The study encompasses a historical period from 2019 to 2024, a base year of 2025, an estimated year of 2025, and a forecast period extending from 2025 to 2033. With an estimated market size projected to reach multi-billion dollar valuations, this report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning opportunities within the European water purification sector.

Europe Water Purifier Market Market Structure & Competitive Landscape

The Europe Water Purifier Market is characterized by a moderately concentrated structure, with a blend of established global players and emerging regional innovators. Key innovation drivers include the increasing demand for high-purity water across diverse industries, stringent environmental regulations, and a growing consumer awareness regarding water quality. Regulatory impacts are significant, with directives like the EU Water Framework Directive influencing the adoption of advanced purification technologies. Product substitutes, such as bottled water, are present but face increasing scrutiny due to environmental concerns and cost-effectiveness compared to on-site purification.

The competitive landscape is shaped by:

- Market Concentration: While a few large companies hold substantial market share, a growing number of specialized SMEs are catering to niche segments.

- Innovation Drivers:

- Development of energy-efficient purification systems.

- Integration of smart technologies for real-time monitoring and control.

- Focus on sustainable and eco-friendly purification solutions.

- Regulatory Impacts: Stricter water quality standards and waste discharge regulations are compelling end-users to invest in advanced purification technologies.

- Product Substitutes: While bottled water remains a competitor, the long-term sustainability and cost benefits of in-house purification are gaining traction.

- End-User Segmentation: Diversified demand across Municipal, Pulp and Paper, Chemical, Food and Beverage, Healthcare, and Power sectors fuels market growth.

- Mergers & Acquisitions (M&A): The market has witnessed a series of strategic M&A activities, with an estimated volume of xx transactions in the historical period, indicating consolidation and expansion strategies by key players. These moves aim to enhance product portfolios, expand geographical reach, and secure technological leadership.

Europe Water Purifier Market Market Trends & Opportunities

The Europe Water Purifier Market is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This expansion is fueled by increasing industrialization, urbanization, and a heightened awareness of the critical importance of clean water for public health and industrial processes.

Technological shifts are playing a pivotal role, with a discernible move towards more efficient and eco-friendly purification methods. Membrane technologies, such as Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis, are witnessing increased adoption due to their superior performance and ability to remove a wide spectrum of contaminants. The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in water purification systems is emerging as a key trend, enabling real-time monitoring, predictive maintenance, and optimized performance. This leads to enhanced operational efficiency and reduced downtime for end-users, particularly in sectors like Power and Chemical manufacturing.

Consumer preferences are also evolving. Beyond basic purification, there is a growing demand for systems that ensure not only safety but also taste and mineral content, especially within the Food and Beverage and Healthcare segments. Furthermore, the push towards a circular economy is driving interest in water recycling and reuse technologies, creating new opportunities for innovative solutions that minimize water wastage.

Competitive dynamics are intensifying, with companies focusing on developing differentiated products and value-added services. Strategic partnerships and collaborations are becoming more prevalent as firms aim to leverage each other's expertise and market reach. The market penetration rate for advanced water purification systems is expected to rise across all end-user industries, indicating a significant shift from conventional methods. Opportunities abound for companies that can offer tailored solutions, cost-effective technologies, and sustainable water management strategies. The growing need for industrial wastewater treatment and the stringent regulatory environment governing its discharge further amplify the market’s potential. The increasing focus on resource recovery from wastewater also presents a significant avenue for market expansion and innovation.

Dominant Markets & Segments in Europe Water Purifier Market

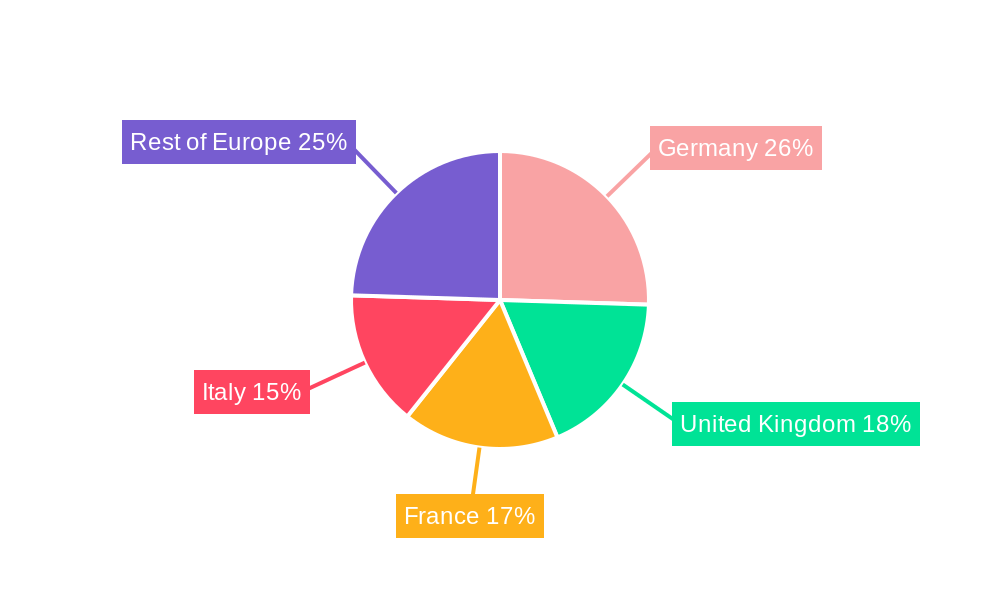

The Europe Water Purifier Market exhibits distinct dominance patterns across its geographical regions and end-user industries, driven by a combination of regulatory frameworks, economic development, and specific industrial needs.

Leading Region: Western Europe, particularly countries like Germany, France, the United Kingdom, and the Netherlands, represent the dominant regional markets. This dominance is attributed to:

- Advanced Industrial Infrastructure: These nations possess highly developed industrial sectors, including robust Chemical, Food and Beverage, and Pharmaceutical industries, all of which are significant consumers of purified water.

- Stringent Environmental Regulations: Strict adherence to EU environmental directives and national water quality standards mandates the use of advanced purification technologies.

- High Consumer Awareness: A well-informed populace with a high disposable income prioritizes access to clean and safe drinking water, driving the adoption of domestic and commercial purifiers.

- Technological Innovation Hubs: These regions are centers for research and development in water treatment technologies, fostering the introduction and adoption of cutting-edge solutions.

Dominant Technologies: Within the technology segment, Reverse Osmosis (RO) continues to hold a significant market share due to its unparalleled ability to remove a broad spectrum of impurities, including dissolved salts, heavy metals, and pathogens. Its effectiveness in producing high-purity water makes it indispensable for critical applications in the Chemical, Pharmaceutical, and Food and Beverage industries.

- Reverse Osmosis (RO):

- Key Growth Drivers: High demand for demineralized water in industrial processes, stringent quality requirements in pharmaceutical manufacturing, and the need for desalination in water-scarce regions.

- Market Dominance: Essential for industries requiring ultra-pure water.

- Ultrafiltration (UF) and Nanofiltration (NF): These technologies are gaining traction as cost-effective alternatives to RO for specific applications and as pre-treatment steps. Their ability to remove suspended solids, bacteria, and larger molecules makes them crucial for Municipal water treatment and the Food and Beverage sector.

- Key Growth Drivers: Increasing adoption in municipal water treatment for pathogen removal, growing demand in the dairy and beverage industries for clarification and purification.

- Microfiltration (MF): Primarily used for removing larger particles, MF finds applications in pre-treatment and in industries where only gross particulate removal is necessary.

- Key Growth Drivers: Pre-treatment for other membrane processes, applications in the dairy industry for milk clarification.

Dominant End-User Industries: The Municipal sector stands out as a primary driver, driven by the universal need for safe drinking water and effective wastewater treatment. The Chemical and Food and Beverage industries also represent significant consumers, with their distinct requirements for water purity influencing technology choices.

- Municipal:

- Key Growth Drivers: Growing urban populations, increasing concerns about water scarcity and quality, government initiatives for improving water infrastructure.

- Market Dominance: Essential for public health and urban development.

- Chemical:

- Key Growth Drivers: Demand for high-purity process water, stringent regulations on wastewater discharge, and the need for efficient effluent treatment.

- Market Dominance: Crucial for ensuring product quality and environmental compliance.

- Food and Beverage:

- Key Growth Drivers: Ensuring product safety and quality, compliance with food safety regulations, growing demand for processed and packaged foods.

- Market Dominance: Essential for product integrity and consumer trust.

The Power industry's demand for purified water for boiler feed and cooling systems, along with the Healthcare sector's need for sterile water in medical applications, further contribute to the market's segmentation and growth. The interplay between these segments and available technologies dictates regional adoption patterns and investment priorities.

Europe Water Purifier Market Product Analysis

The Europe Water Purifier Market is witnessing a surge in product innovation, driven by the need for enhanced efficiency, sustainability, and user convenience. Key product advancements include the development of multi-stage purification systems that integrate technologies like RO, UV sterilization, and activated carbon filtration to achieve comprehensive water purity. There's a growing emphasis on smart purifiers equipped with IoT capabilities, enabling remote monitoring, automated filter replacement alerts, and real-time water quality data. Furthermore, manufacturers are focusing on energy-efficient designs, reducing operational costs and environmental impact. The competitive advantage lies in offering compact, user-friendly systems with extended filter life and robust contaminant removal capabilities, catering to the diverse needs of both industrial and residential consumers across Europe.

Key Drivers, Barriers & Challenges in Europe Water Purifier Market

Key Drivers, Barriers & Challenges in Europe Water Purifier Market

Key Drivers:

- Increasing Water Scarcity and Quality Concerns: Growing awareness of dwindling freshwater resources and the presence of contaminants in water bodies are compelling governments and industries to invest in advanced purification solutions.

- Stringent Environmental Regulations: EU directives and national policies aimed at improving water quality and managing wastewater discharge are a significant catalyst for the adoption of sophisticated water purification technologies.

- Industrial Growth and Demand for High-Purity Water: Expansion in sectors like Chemical, Pharmaceutical, and Food and Beverage necessitates high-purity water for production processes, driving demand for advanced purifiers.

- Technological Advancements: Innovations in membrane technology, smart water management systems, and energy-efficient purification processes are making solutions more effective and cost-competitive.

- Rising Health Consciousness: Increased consumer awareness regarding the health risks associated with contaminated water fuels the demand for domestic and commercial water purifiers.

Challenges Impacting Europe Water Purifier Market Growth

- High Initial Investment Costs: Advanced water purification systems can involve substantial upfront capital expenditure, which can be a deterrent for some smaller industries and households.

- Operational and Maintenance Complexity: Some purification technologies require specialized knowledge for operation and maintenance, including regular filter replacements and system servicing, which can be a barrier for certain end-users.

- Availability of Substitute Solutions: While less sustainable in the long run, alternative water sources or less advanced purification methods can pose competition in certain market segments.

- Fragmented Market and Regulatory Variations: Despite EU directives, variations in national implementation and enforcement of water quality standards can create complexities for manufacturers operating across different European countries.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of essential components and raw materials required for water purifier manufacturing.

Growth Drivers in the Europe Water Purifier Market Market

The Europe Water Purifier Market is propelled by a combination of escalating demand for clean water, stringent regulatory mandates, and continuous technological innovation. Growing urbanization and industrial expansion, particularly in sectors like Chemical, Food and Beverage, and Power, are creating an insatiable need for both process water and effective wastewater treatment. Furthermore, heightened consumer awareness concerning water quality and its direct impact on public health is a significant driver for domestic purification solutions. The EU's commitment to environmental protection, evidenced by directives like the Water Framework Directive, mandates higher water quality standards and encourages the adoption of advanced, sustainable purification technologies. Technological advancements, including improvements in membrane efficiency, energy-saving designs, and the integration of smart IoT features, are making water purification more accessible, cost-effective, and efficient, further fueling market growth.

Challenges Impacting Europe Water Purifier Market Growth

The growth trajectory of the Europe Water Purifier Market is not without its hurdles. The initial capital investment for advanced purification systems can be substantial, posing a significant barrier for small to medium-sized enterprises and budget-conscious consumers. The operational complexity and ongoing maintenance requirements, such as periodic filter replacements and system servicing, can also deter adoption for some users. While advancements are being made, the cost-effectiveness of high-end purification technologies compared to simpler alternatives remains a consideration in certain segments. Moreover, navigating the diverse regulatory landscape across different European countries, despite overarching EU directives, can present challenges for market penetration. Finally, global supply chain disruptions can impact the availability and pricing of critical components, potentially affecting production timelines and overall market stability.

Key Players Shaping the Europe Water Purifier Market Market

- Buckman Laboratories

- Solvay

- Ecolab

- Accepta

- Nouryon

- BWA Water Additives

- Kurita Water Industries Ltd

- Evoqua Water Technologies LLC

- Albemarle Corp

- Arch Chemicals Inc

- Chemtura Corp

- Kemira

- Dow

- Solenis

- Suez

- Ashland Water Technologies

- Chemtreat Inc

- General Chemical Performance Products LLC

Significant Europe Water Purifier Market Industry Milestones

- 2019: Increased adoption of advanced membrane technologies like Nanofiltration for industrial wastewater treatment due to stricter discharge regulations.

- 2020: Rise in demand for domestic water purifiers driven by heightened health and hygiene awareness globally.

- 2021: Significant investment in R&D for sustainable and energy-efficient water purification solutions by major players.

- 2022: Launch of smart water purifiers with IoT integration, offering remote monitoring and enhanced user experience.

- 2023: Increased M&A activities as larger companies aim to consolidate market share and expand their product portfolios.

- 2024: Growing emphasis on circular economy principles, leading to innovations in water recycling and reuse technologies.

Future Outlook for Europe Water Purifier Market Market

The future outlook for the Europe Water Purifier Market is exceptionally promising, driven by persistent megatrends of water scarcity, stringent environmental regulations, and the relentless pursuit of technological innovation. Growth catalysts include the ongoing digitalization of water management systems, with AI and IoT integration becoming standard, leading to more predictive and efficient operations. The increasing focus on resource recovery from wastewater presents a significant opportunity for the development of novel technologies and business models. Furthermore, the expanding demand for ultra-pure water in emerging industries and the continued emphasis on public health will ensure sustained market growth. Strategic investments in sustainable and cost-effective purification solutions, coupled with a deeper understanding of regional specificities, will be key to unlocking the full market potential in the coming years.

Europe Water Purifier Market Segmentation

-

1. Technology

- 1.1. Microfiltration

- 1.2. Ultrafiltration

- 1.3. Nanofiltration

- 1.4. Reverse Osmosis

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Pulp and Paper

- 2.3. Chemical

- 2.4. Food and Beverage

- 2.5. Healthcare

- 2.6. Power

- 2.7. Other End-user Industries

Europe Water Purifier Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Water Purifier Market Regional Market Share

Geographic Coverage of Europe Water Purifier Market

Europe Water Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Low Pressure Membrane Technology; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Membrane Water Treatment Technology; Other Restraints

- 3.4. Market Trends

- 3.4.1. Reverse Osmosis to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Microfiltration

- 5.1.2. Ultrafiltration

- 5.1.3. Nanofiltration

- 5.1.4. Reverse Osmosis

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Pulp and Paper

- 5.2.3. Chemical

- 5.2.4. Food and Beverage

- 5.2.5. Healthcare

- 5.2.6. Power

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Microfiltration

- 6.1.2. Ultrafiltration

- 6.1.3. Nanofiltration

- 6.1.4. Reverse Osmosis

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Municipal

- 6.2.2. Pulp and Paper

- 6.2.3. Chemical

- 6.2.4. Food and Beverage

- 6.2.5. Healthcare

- 6.2.6. Power

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Microfiltration

- 7.1.2. Ultrafiltration

- 7.1.3. Nanofiltration

- 7.1.4. Reverse Osmosis

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Municipal

- 7.2.2. Pulp and Paper

- 7.2.3. Chemical

- 7.2.4. Food and Beverage

- 7.2.5. Healthcare

- 7.2.6. Power

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Microfiltration

- 8.1.2. Ultrafiltration

- 8.1.3. Nanofiltration

- 8.1.4. Reverse Osmosis

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Municipal

- 8.2.2. Pulp and Paper

- 8.2.3. Chemical

- 8.2.4. Food and Beverage

- 8.2.5. Healthcare

- 8.2.6. Power

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Microfiltration

- 9.1.2. Ultrafiltration

- 9.1.3. Nanofiltration

- 9.1.4. Reverse Osmosis

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Municipal

- 9.2.2. Pulp and Paper

- 9.2.3. Chemical

- 9.2.4. Food and Beverage

- 9.2.5. Healthcare

- 9.2.6. Power

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Europe Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Microfiltration

- 10.1.2. Ultrafiltration

- 10.1.3. Nanofiltration

- 10.1.4. Reverse Osmosis

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Municipal

- 10.2.2. Pulp and Paper

- 10.2.3. Chemical

- 10.2.4. Food and Beverage

- 10.2.5. Healthcare

- 10.2.6. Power

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Buckman Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ecolab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accepta

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nouryon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BWA Water Additives

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kurita Water Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evoqua Water Technologies LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Albemarle Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arch Chemicals Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chemtura Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kemira

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dow

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solenis

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Suez

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ashland Water Technologies

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Chemtreat Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 General Chemical Performance Products LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Buckman Laboratories

List of Figures

- Figure 1: Europe Water Purifier Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Water Purifier Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Water Purifier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 17: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Water Purifier Market?

The projected CAGR is approximately 8.28%.

2. Which companies are prominent players in the Europe Water Purifier Market?

Key companies in the market include Buckman Laboratories, Solvay*List Not Exhaustive, Ecolab, Accepta, Nouryon, BWA Water Additives, Kurita Water Industries Ltd, Evoqua Water Technologies LLC, Albemarle Corp, Arch Chemicals Inc, Chemtura Corp, Kemira, Dow, Solenis, Suez, Ashland Water Technologies, Chemtreat Inc, General Chemical Performance Products LLC.

3. What are the main segments of the Europe Water Purifier Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Low Pressure Membrane Technology; Other Drivers.

6. What are the notable trends driving market growth?

Reverse Osmosis to dominate the Market.

7. Are there any restraints impacting market growth?

; High Cost of Membrane Water Treatment Technology; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Water Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Water Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Water Purifier Market?

To stay informed about further developments, trends, and reports in the Europe Water Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence