Key Insights

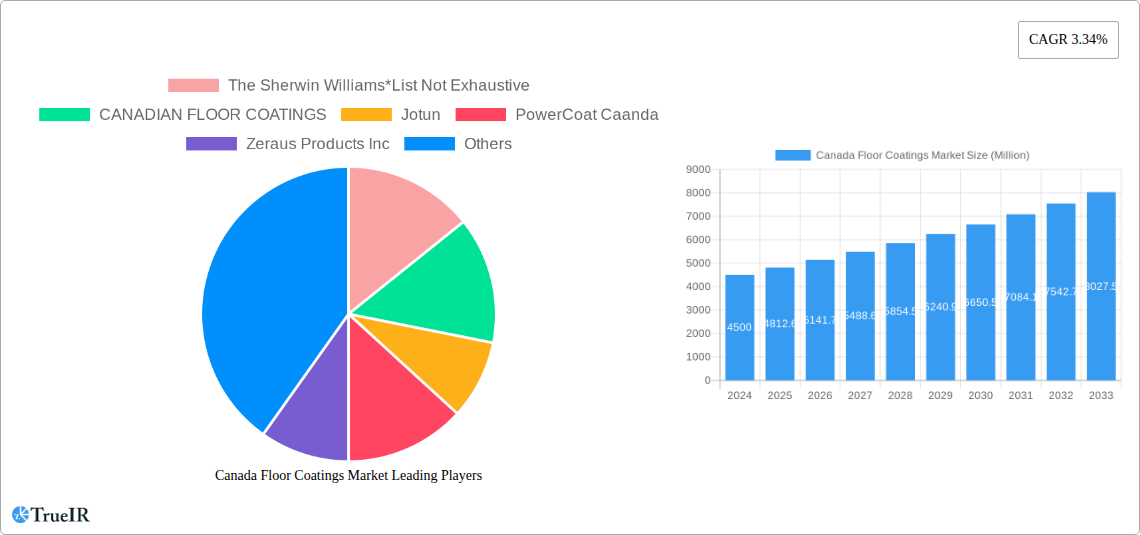

The Canadian floor coatings market is poised for significant expansion, driven by increasing demand from both residential and industrial sectors. With a current market size of USD 4.5 billion in 2024, the industry is projected to experience a robust CAGR of 6.8% throughout the forecast period of 2025-2033. This growth is underpinned by key drivers such as the rising popularity of durable and aesthetically pleasing floor finishes, particularly in commercial spaces like retail, hospitality, and healthcare facilities. The construction industry's steady performance, coupled with government initiatives promoting infrastructure development and renovation projects, further bolsters market demand. Furthermore, advancements in coating technologies, leading to products with enhanced chemical resistance, UV stability, and easier application, are making floor coatings a more attractive and practical solution for a wider range of applications.

Canada Floor Coatings Market Market Size (In Billion)

The market segmentation reveals strong potential across various resin types, with Polyurethane and Epoxy coatings likely to lead due to their superior performance characteristics. Concrete and wood remain the dominant floor materials benefiting from these coatings. In terms of end-user industries, the commercial sector is expected to be a major contributor, fueled by the need for low-maintenance, high-traffic area solutions. The industrial segment, driven by manufacturing, warehousing, and automotive sectors, also presents substantial opportunities. While the market is generally optimistic, potential restraints could include fluctuating raw material prices for resins and the initial higher cost of premium coating systems compared to traditional flooring options. However, the long-term benefits of durability and reduced lifecycle costs are increasingly outweighing these concerns, positioning the Canadian floor coatings market for sustained and dynamic growth.

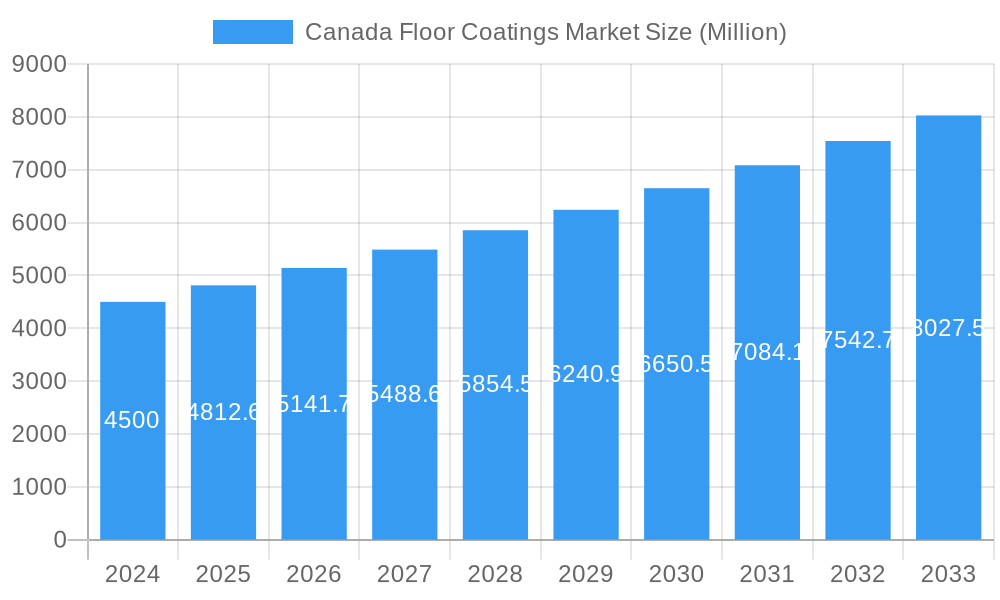

Canada Floor Coatings Market Company Market Share

Here is a dynamic, SEO-optimized report description for the Canada Floor Coatings Market, designed for immediate use and maximum impact:

Canada Floor Coatings Market: Deep Dive Analysis with Forecasts Up to 2033

Unlock comprehensive insights into the burgeoning Canada Floor Coatings Market, valued at over $1 billion in the base year 2025. This in-depth report navigates the evolving landscape of protective and decorative floor coatings across Canada, providing critical data and strategic analysis for industry stakeholders. We forecast robust growth, driven by increasing demand in residential, commercial, and industrial sectors, with a particular emphasis on innovative resin technologies like polyaspartics and epoxies. This analysis spans the historical period of 2019–2024, the base year of 2025, and extends through the forecast period of 2025–2033, offering a complete market view.

Canada Floor Coatings Market Market Structure & Competitive Landscape

The Canada Floor Coatings Market exhibits a moderately consolidated structure, with key players like The Sherwin Williams (List Not Exhaustive), CANADIAN FLOOR COATINGS, Jotun, and PowerCoat Canada vying for market share. Innovation serves as a significant driver, particularly in the development of low-VOC, high-durability, and aesthetically pleasing coating solutions. Regulatory impacts, primarily focused on environmental standards and worker safety, are influencing product formulations and adoption rates. Concrete floor coatings are experiencing significant demand due to their versatility across end-user industries. Product substitutes, while present in the form of conventional paints or tiles, often fall short in delivering the performance characteristics required for demanding applications. The end-user segmentation reveals a dynamic interplay between the growing residential sector's aesthetic demands and the robust needs of commercial and industrial applications requiring superior resilience. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the past historical period (2019-2024) saw several strategic acquisitions aimed at consolidating market presence in specific segments like industrial floor coatings.

Canada Floor Coatings Market Market Trends & Opportunities

The Canada Floor Coatings Market is poised for substantial expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, pushing its valuation well past $X billion. This growth trajectory is fueled by a confluence of factors, including a strong emphasis on infrastructure development across Canada, leading to increased demand for durable and protective concrete floor coatings in commercial and industrial settings. Technological advancements are at the forefront of market evolution, with a notable shift towards high-performance, environmentally friendly coating systems. The rise of polyaspartic coatings, known for their rapid curing times and exceptional resistance to abrasion, chemicals, and UV radiation, presents a significant opportunity, particularly for applications demanding minimal downtime. Similarly, epoxy resin coatings continue to dominate due to their proven track record in industrial environments and growing adoption in residential garages and basements for their aesthetic appeal and durability.

Consumer preferences are also evolving, with an increasing demand for coatings that offer both superior protection and sophisticated aesthetics. Homeowners are investing more in their living spaces, driving demand for premium residential floor coatings that enhance property value and provide long-lasting performance. In the commercial sector, sectors such as healthcare, education, and retail are prioritizing hygiene and ease of maintenance, making seamless, antimicrobial floor coatings a key consideration. The industrial segment, encompassing manufacturing plants, warehouses, and food processing facilities, continues to be a bedrock of demand, driven by the need for safety, chemical resistance, and heavy-duty wear protection. Opportunities abound for manufacturers who can innovate in areas such as anti-static coatings, slip-resistant finishes, and smart coatings that can monitor environmental conditions.

The competitive landscape is dynamic, characterized by both established global players and agile regional manufacturers. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage each other's expertise and market access. The drive towards sustainability is another major trend, with a growing demand for water-based and low-VOC (Volatile Organic Compound) coatings, aligning with Canada's environmental initiatives. This presents a clear opportunity for companies that can develop and market eco-friendly solutions without compromising on performance. Furthermore, the integration of advanced application technologies and digital solutions for product selection and specification is enhancing customer experience and streamlining project execution. The overall market penetration rate for advanced floor coatings is expected to rise significantly as awareness of their benefits grows among end-users.

Dominant Markets & Segments in Canada Floor Coatings Market

The Canada Floor Coatings Market is characterized by dominant segments and regions driven by specific industrial needs and consumer demands.

Resin Type Dominance

- Epoxy Resin: This segment commands a substantial market share due to its exceptional durability, chemical resistance, and adhesion properties, making it ideal for industrial floor coatings in manufacturing, warehousing, and food processing facilities. Its versatility also contributes to its strong presence in the commercial sector, particularly in high-traffic areas like retail spaces and garages.

- Polyurethane Resin: Offering excellent UV resistance, flexibility, and abrasion resistance, polyurethane coatings are increasingly favored for both decorative and protective applications, especially in commercial environments and for outdoor concrete surfaces.

- Polyaspartics: This rapidly growing segment is gaining traction due to its fast curing times, low-temperature application capabilities, and superior resistance to chemicals and abrasion. It presents significant opportunities in sectors requiring minimal downtime, such as automotive repair shops and busy commercial facilities.

- Acrylic Resin: While often positioned as a more economical option, acrylic coatings are valued for their ease of application and quick drying times, finding use in lighter-duty residential and commercial applications.

- Alkyd Resin: Historically significant, alkyd coatings are still utilized in some niche applications, but their market share is comparatively smaller due to slower drying times and less advanced performance characteristics compared to newer resin types.

Floor Material Importance

- Concrete: This is the most dominant floor material across all end-user industries. The demand for concrete floor coatings is paramount, driven by new construction projects and the renovation of existing industrial and commercial spaces. Its porous nature necessitates protective and decorative coatings for enhanced longevity and performance.

- Wood: While less dominant than concrete in industrial settings, wood flooring is prevalent in residential and some commercial spaces. Specialty wood floor coatings are in demand for protection and aesthetic enhancement.

- Other Floor Materials: This category includes various substrates like metal, tiles, and existing vinyl flooring. Specialized coatings are developed to adhere to and protect these diverse surfaces, catering to specific application needs.

End-User Industry Impact

- Industrial: This segment represents the largest consumer of floor coatings, driven by the stringent requirements of manufacturing plants, chemical processing facilities, warehouses, and food and beverage production. The need for extreme durability, chemical resistance, safety (e.g., anti-slip properties), and ease of maintenance makes industrial floor coatings a critical component of operational efficiency and safety. Infrastructure development and the expansion of industrial parks are significant growth catalysts.

- Commercial: This segment is experiencing robust growth, fueled by the expansion of retail spaces, healthcare facilities, educational institutions, hospitality venues, and transportation hubs. Demand is driven by aesthetic appeal, hygiene requirements, durability for high foot traffic, and the need for surfaces that are easy to clean and maintain. Commercial floor coatings contribute to brand image and customer experience.

- Residential: The residential sector is showing increasing demand for high-quality floor coatings, particularly in garages, basements, and patios. Homeowners are seeking durable, aesthetically pleasing, and low-maintenance solutions that enhance their living spaces and property value. DIY-friendly products and decorative finishes are gaining popularity.

The dominance of these segments is further propelled by supportive government policies encouraging infrastructure upgrades and industrial modernization, alongside increasing consumer awareness of the long-term benefits and aesthetic possibilities offered by advanced floor coating systems.

Canada Floor Coatings Market Product Analysis

Innovations in the Canada Floor Coatings Market are centered on enhancing performance, sustainability, and application efficiency. Advanced resin formulations, such as ultra-low VOC polyaspartic coatings, offer rapid cure times and superior resistance to abrasion and chemicals, making them ideal for high-traffic industrial and commercial applications. Epoxy floor coatings continue to evolve with improved adhesion, impact resistance, and a wider range of decorative options, catering to both functional and aesthetic demands in residential and commercial settings. The development of antimicrobial additives for coatings is a significant advancement for healthcare and food processing industries, ensuring enhanced hygiene. Furthermore, the market is witnessing growth in UV-curable and water-based systems, aligning with Canada's stringent environmental regulations and consumer preference for eco-friendly solutions. These product advancements provide competitive advantages by meeting specialized industry needs and offering greater long-term value.

Key Drivers, Barriers & Challenges in Canada Floor Coatings Market

Key Drivers: Technological advancements are a primary driver, with the development of polyaspartic coatings and high-solids epoxy resins offering superior performance. Economic growth and increased construction activity, particularly in the industrial and commercial sectors, boost demand for durable flooring solutions. Supportive government policies promoting infrastructure development and sustainable building practices also act as catalysts. Increased consumer awareness of the benefits of high-performance floor coatings, such as enhanced aesthetics, durability, and ease of maintenance, further propels market growth. For example, investments in retrofitting older industrial facilities with modern, resilient flooring solutions are significant.

Barriers & Challenges: Supply chain disruptions and volatile raw material prices can impact production costs and lead times, presenting a significant challenge. Stringent regulatory hurdles, particularly regarding VOC emissions and hazardous material handling, necessitate ongoing product reformulation and compliance efforts. The concrete floor coatings market, while large, faces competition from alternative flooring materials. Furthermore, a shortage of skilled labor for specialized application techniques can limit project execution. The initial cost of high-performance coatings can also be a barrier for some budget-conscious customers, despite long-term cost-effectiveness.

Growth Drivers in the Canada Floor Coatings Market Market

The Canada Floor Coatings Market is propelled by several key growth drivers. Technological innovation is paramount, with the continuous development of advanced formulations like polyaspartic coatings and low-VOC epoxy resins offering enhanced durability, faster curing times, and improved environmental profiles. Economic expansion and increased investment in infrastructure projects across Canada, particularly within the industrial and commercial sectors, directly translate to higher demand for protective and decorative floor finishes. Government initiatives promoting sustainable construction and energy efficiency also favor the adoption of modern, eco-friendly coating solutions. Furthermore, a growing consumer consciousness regarding the long-term benefits of high-performance floor coatings—including aesthetic appeal, ease of maintenance, and increased property value—is significantly contributing to market expansion. The renovation and retrofitting of existing facilities also present substantial opportunities.

Challenges Impacting Canada Floor Coatings Market Growth

Despite its robust growth, the Canada Floor Coatings Market faces several challenges. Fluctuations in raw material prices and potential supply chain disruptions can impact manufacturing costs and product availability, posing a significant restraint. Stringent environmental regulations, particularly concerning Volatile Organic Compounds (VOCs), necessitate ongoing research and development to ensure compliance and can increase production costs for reformulated products. The inherent complexity of applying certain high-performance coatings requires skilled labor, and a potential shortage of trained applicators can hinder project execution and growth. Additionally, while offering long-term benefits, the initial investment for premium floor coatings can be a barrier for some end-users compared to less expensive traditional flooring options. Competition from alternative flooring materials also continues to exert pressure on market share.

Key Players Shaping the Canada Floor Coatings Market Market

- The Sherwin Williams

- CANADIAN FLOOR COATINGS

- Jotun

- PowerCoat Canada

- Zeraus Products Inc

- ArmorPoxy

- LATICRETE INTERNATIONAL INC

- Grainger Canada

- PPG Industries Inc

- BASF SE

- Teknos Group

- Western Canada Coatings

- AkzoNobel NV

- Sika AG

Significant Canada Floor Coatings Market Industry Milestones

- 2019: Increased adoption of low-VOC formulations driven by evolving environmental regulations.

- 2020: Surge in demand for enhanced hygiene and antimicrobial coatings in commercial and healthcare sectors due to global health concerns.

- 2021: Greater focus on product innovation in polyaspartic coatings, highlighting rapid curing and durability.

- 2022: Significant M&A activity as larger players sought to expand their market reach and technological capabilities.

- 2023: Growing emphasis on sustainable and eco-friendly floor coating solutions across all end-user industries.

- 2024 (Early): Increased investment in R&D for smart coatings with integrated functionalities.

Future Outlook for Canada Floor Coatings Market Market

The future outlook for the Canada Floor Coatings Market remains highly promising, with continued growth anticipated. Key catalysts include ongoing infrastructure development, increasing demand for sustainable building materials, and a persistent trend towards high-performance, aesthetically pleasing flooring solutions across residential, commercial, and industrial sectors. Innovations in resin technology, particularly in polyaspartics and advanced epoxies, will continue to drive product development. Opportunities lie in expanding the application of specialized coatings for niche markets, such as anti-corrosion for industrial environments and decorative finishes for the burgeoning residential renovation market. Strategic partnerships and a focus on customer-centric solutions, including ease of application and long-term value propositions, will be crucial for market leaders to capitalize on the expanding market potential.

Canada Floor Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyaspartics

- 1.6. Other Resin Type

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-User Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Canada Floor Coatings Market Segmentation By Geography

- 1. Canada

Canada Floor Coatings Market Regional Market Share

Geographic Coverage of Canada Floor Coatings Market

Canada Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities; Growing Demand for Floor Coatings in the Industrial Applications

- 3.3. Market Restrains

- 3.3.1. Strict Regulations on VOCs Released for Floor Coatings; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Construction Activities in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Floor Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyaspartics

- 5.1.6. Other Resin Type

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin Williams*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CANADIAN FLOOR COATINGS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PowerCoat Caanda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zeraus Products Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArmorPoxy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LATICRETE INTERNATIONAL INC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grainger Canada

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PPG Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Teknos Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Western Canada Coatings

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AkzoNobel NV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sika AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 The Sherwin Williams*List Not Exhaustive

List of Figures

- Figure 1: Canada Floor Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Floor Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Floor Coatings Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 2: Canada Floor Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Canada Floor Coatings Market Revenue undefined Forecast, by Floor Material 2020 & 2033

- Table 4: Canada Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 5: Canada Floor Coatings Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 6: Canada Floor Coatings Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 7: Canada Floor Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Canada Floor Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Canada Floor Coatings Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 10: Canada Floor Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: Canada Floor Coatings Market Revenue undefined Forecast, by Floor Material 2020 & 2033

- Table 12: Canada Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 13: Canada Floor Coatings Market Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 14: Canada Floor Coatings Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 15: Canada Floor Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Canada Floor Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Floor Coatings Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Canada Floor Coatings Market?

Key companies in the market include The Sherwin Williams*List Not Exhaustive, CANADIAN FLOOR COATINGS, Jotun, PowerCoat Caanda, Zeraus Products Inc, ArmorPoxy, LATICRETE INTERNATIONAL INC, Grainger Canada, PPG Industries Inc, BASF SE, Teknos Group, Western Canada Coatings, AkzoNobel NV, Sika AG.

3. What are the main segments of the Canada Floor Coatings Market?

The market segments include Resin Type, Floor Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities; Growing Demand for Floor Coatings in the Industrial Applications.

6. What are the notable trends driving market growth?

Rising Construction Activities in the Region.

7. Are there any restraints impacting market growth?

Strict Regulations on VOCs Released for Floor Coatings; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Floor Coatings Market?

To stay informed about further developments, trends, and reports in the Canada Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence