Key Insights

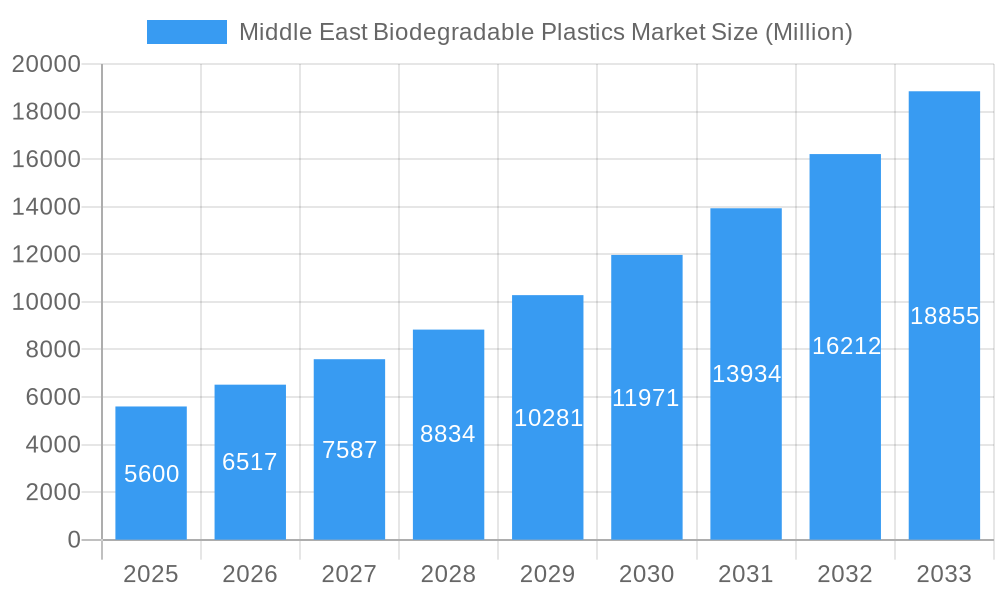

The Middle East Biodegradable Plastics Market is poised for significant expansion, projected to reach USD 5.6 billion by 2025, driven by a robust CAGR of 16.3%. This impressive growth trajectory is fueled by escalating environmental concerns across the region, coupled with increasing governmental regulations aimed at curbing plastic pollution. Key drivers include a rising consumer preference for sustainable products, a growing awareness of the detrimental effects of conventional plastics on ecosystems, and proactive initiatives by businesses to adopt eco-friendly alternatives. The demand for biodegradable plastics is particularly strong in the packaging sector, which accounts for a substantial portion of the market. As the Middle East continues to diversify its economy and embrace sustainability, the adoption of biodegradable plastics is set to accelerate, offering a cleaner and more responsible approach to material usage.

Middle East Biodegradable Plastics Market Market Size (In Billion)

The market is characterized by a dynamic landscape with emerging trends and distinct segments. While starch-based and Polylactic Acid (PLA) plastics represent significant types, "Other Types" are also gaining traction as technological advancements introduce novel biodegradable materials. Beyond packaging, applications are diversifying into other sectors, reflecting the versatility and growing acceptance of these eco-conscious solutions. Restraints, such as higher initial costs compared to conventional plastics and the need for enhanced disposal infrastructure, are gradually being addressed through innovation and economies of scale. Key players like Cargill Incorporated, BASF SE, and Eastman Chemical Company are actively investing in research and development, expanding production capabilities, and forging strategic partnerships to capitalize on the burgeoning opportunities within the United Arab Emirates, Saudi Arabia, Qatar, Iran, and the broader Rest of the Middle East.

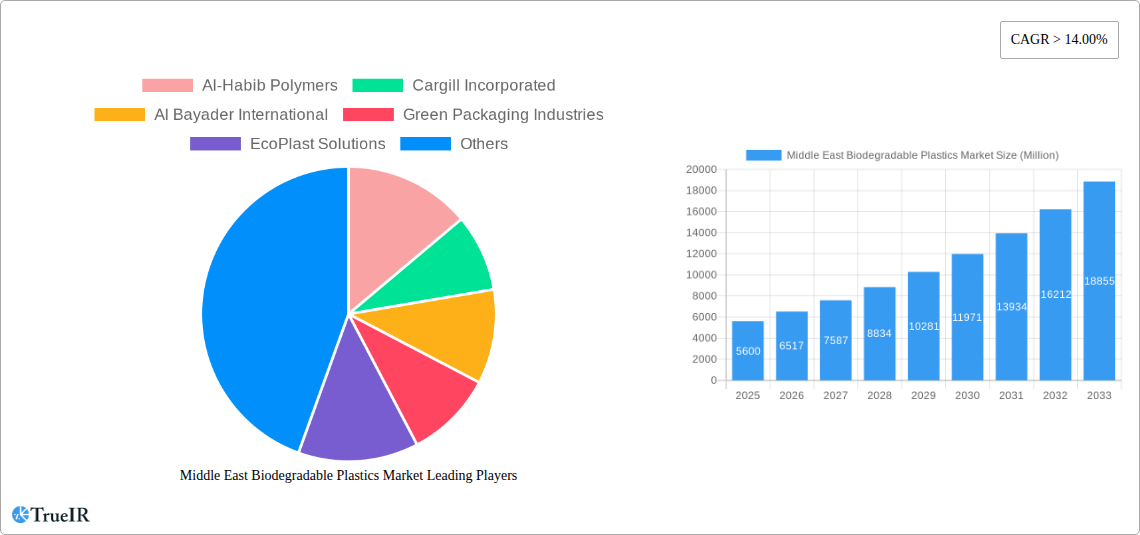

Middle East Biodegradable Plastics Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the Middle East Biodegradable Plastics Market, crucial for stakeholders seeking to understand evolving trends, opportunities, and competitive dynamics. Leveraging high-volume keywords such as "biodegradable plastics Middle East," "sustainable packaging solutions," "bioplastics market growth," and "eco-friendly polymers GCC," this report ensures maximum visibility and engagement for industry professionals. The study encompasses a comprehensive historical period from 2019 to 2024, with the base year set at 2025, and projects market evolution through to 2033.

Middle East Biodegradable Plastics Market Market Structure & Competitive Landscape

The Middle East Biodegradable Plastics Market exhibits a moderately fragmented structure, characterized by the presence of both established global players and emerging regional innovators. Innovation is a key driver, fueled by increasing environmental consciousness and stringent governmental regulations aimed at reducing plastic waste. The market is witnessing significant growth in demand for starch-based and Polylactic Acid (PLA) bioplastics, driven by their versatility and biodegradability. Regulatory impacts are substantial, with governments across the GCC actively promoting the adoption of sustainable materials through incentives and bans on single-use conventional plastics. Product substitutes, primarily conventional plastics, are facing increasing pressure from the superior environmental profile of biodegradable alternatives. End-user segmentation points towards a dominant application in the packaging sector, encompassing food and beverage, consumer goods, and healthcare. Mergers and acquisitions (M&A) trends are gradually emerging as larger companies seek to expand their bioplastics portfolio and market reach within the region. The estimated market concentration ratio for the top five players is approximately 35% in 2025, with an anticipated increase to 40% by 2033 due to strategic consolidations. M&A volumes are projected to rise by 15% annually during the forecast period, signaling a maturing market landscape.

Middle East Biodegradable Plastics Market Market Trends & Opportunities

The Middle East Biodegradable Plastics Market is on an upward trajectory, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated market size of over $4.5 billion by the end of the forecast period. This robust growth is propelled by a confluence of factors, including escalating consumer demand for sustainable products, increasing corporate social responsibility initiatives, and supportive government policies promoting a circular economy. Technological shifts are central to this market expansion, with continuous advancements in biopolymer production and processing enabling the creation of more cost-effective and performance-driven biodegradable plastic solutions. For instance, innovations in starch-based bioplastics are yielding improved tensile strength and heat resistance, making them viable alternatives for a wider array of packaging applications. Furthermore, the development of advanced PLA formulations is unlocking new possibilities in rigid and flexible packaging, medical devices, and even 3D printing.

Consumer preferences are demonstrably shifting towards eco-friendly alternatives. Surveys indicate that over 70% of consumers in the Middle East are willing to pay a premium for products packaged in biodegradable materials, signaling a significant market penetration opportunity for businesses that prioritize sustainability. This burgeoning consumer awareness is compelling manufacturers across various industries, from food and beverage to personal care and e-commerce, to integrate biodegradable plastics into their product offerings. The competitive dynamics are intensifying, with both international bioplastic manufacturers and local enterprises vying for market share. Strategic partnerships and collaborations are becoming more prevalent as companies aim to leverage each other's expertise in production, distribution, and market penetration. For example, collaborations between raw material suppliers and finished product manufacturers are streamlining the supply chain and reducing production costs.

The packaging sector, particularly for food and beverages, remains the largest application segment, driven by the need to reduce single-use plastic waste and comply with emerging regulations. However, opportunities are also expanding in other applications such as agriculture (mulch films), textiles, and disposable cutlery, offering diversified revenue streams for market participants. The increasing adoption of biodegradable plastics in the hospitality industry for food service ware presents another significant avenue for growth. The development of specialized biopolymers with enhanced barrier properties and printability is further broadening the application scope, making biodegradable plastics a truly versatile and competitive alternative to conventional plastics in the Middle Eastern market.

Dominant Markets & Segments in Middle East Biodegradable Plastics Market

The Middle East Biodegradable Plastics Market is characterized by a clear dominance of the Packaging application segment, which is projected to account for over 75% of the total market revenue by 2033. This dominance is primarily attributed to the region's large consumer base, a burgeoning food and beverage industry, and increasing efforts to curb plastic pollution from single-use packaging. Within the Type segmentation, Starch-based bioplastics are emerging as a frontrunner, holding a significant market share estimated at over 40% in 2025, due to their cost-effectiveness and widespread availability of raw materials across the region. Polylactic Acid (PLA) is also a strong contender, driven by its versatility in various applications, particularly in rigid packaging and consumer goods.

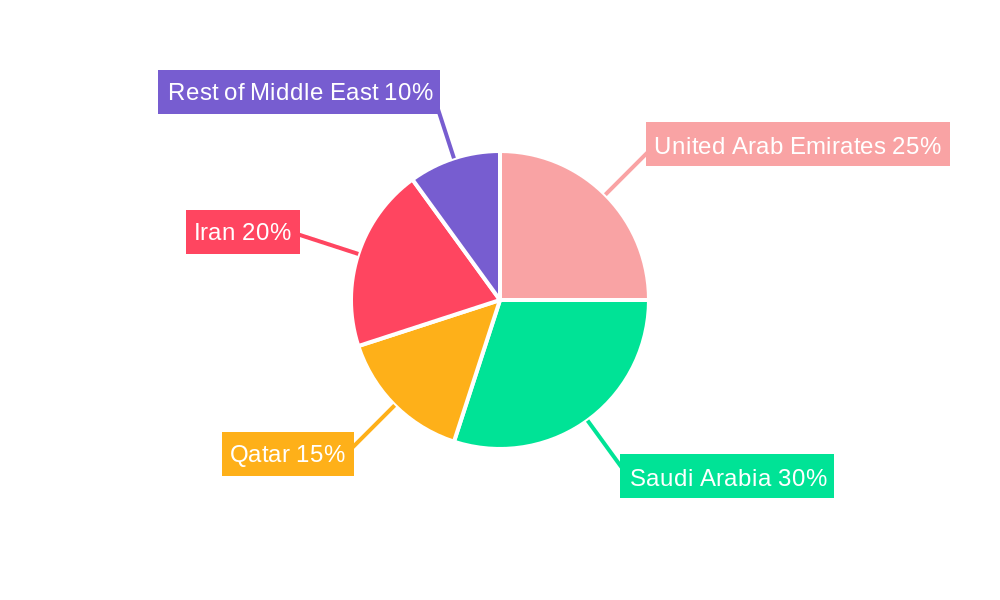

Geographically, the United Arab Emirates (UAE) stands out as the most dominant market within the Middle East, accounting for an estimated 30% of the total market share. This leadership is propelled by its proactive environmental policies, significant investments in sustainable infrastructure, and its role as a major trade and logistics hub. Saudi Arabia follows closely, driven by its Vision 2030 initiatives, which emphasize economic diversification and environmental sustainability.

Key Growth Drivers for Packaging Segment:

- Stringent regulations on single-use plastics across GCC nations.

- Growing consumer preference for sustainable and eco-friendly products.

- Expansion of the food and beverage sector, requiring innovative packaging solutions.

- Government initiatives promoting the circular economy and waste reduction.

- Increased adoption by e-commerce businesses seeking to improve their environmental footprint.

Key Growth Drivers for Starch-based Bioplastics:

- Abundant availability of starch-rich agricultural products.

- Relatively lower production costs compared to other biopolymers.

- Versatility in producing films, bags, and food containers.

- Ongoing research and development leading to improved material properties.

Key Growth Drivers for the UAE Market:

- Proactive government support and incentives for green technologies.

- Development of advanced recycling and waste management infrastructure.

- High disposable income and consumer awareness driving demand for sustainable products.

- Strategic location as a gateway for regional and international trade of biodegradable plastics.

While Packaging and Starch-based bioplastics lead, "Other Applications" are steadily gaining traction, including agriculture, textiles, and automotive components, indicating a diversification of the market in the coming years. Similarly, "Other Types" of bioplastics, such as Polybutylene Adipate Terephthalate (PBAT) and Polyhydroxyalkanoates (PHA), are expected to witness accelerated growth as their performance characteristics improve and production scales up. The forecast suggests a continued strong performance for biodegradable plastics in the region, with a projected market size exceeding $8 billion by 2033.

Middle East Biodegradable Plastics Market Product Analysis

The Middle East Biodegradable Plastics Market is defined by a growing array of innovative products designed to meet diverse application needs. Key product innovations revolve around enhancing the performance characteristics of bioplastics, such as improved barrier properties for food packaging, increased tensile strength for durable goods, and enhanced printability for branding. Starch-based bioplastics are increasingly being formulated for use in compostable films and bags, offering a cost-effective and environmentally sound alternative. Polylactic Acid (PLA) continues to see advancements in injection molding and thermoforming grades, enabling its use in rigid containers, cutlery, and consumer electronics casings. Competitive advantages for these products stem from their reduced carbon footprint, biodegradability, and compliance with evolving environmental regulations. The focus is on creating ‘drop-in’ solutions that require minimal changes to existing manufacturing processes and infrastructure, thereby facilitating wider adoption.

Key Drivers, Barriers & Challenges in Middle East Biodegradable Plastics Market

Key Drivers:

- Governmental Initiatives and Regulations: Proactive policies promoting sustainability, reducing plastic waste, and encouraging the adoption of biodegradable alternatives are significant drivers. For instance, several GCC countries are implementing bans on single-use plastics, directly boosting demand for biodegradable options.

- Growing Environmental Awareness: Increasing public concern over plastic pollution and climate change is fueling consumer preference for eco-friendly products, compelling manufacturers to shift towards biodegradable materials.

- Technological Advancements: Ongoing research and development in biopolymer production and processing are leading to improved material properties, cost reductions, and expanded application possibilities for biodegradable plastics.

- Corporate Sustainability Goals: A growing number of corporations are integrating sustainability into their core business strategies, leading to increased demand for biodegradable packaging and products to meet their ESG targets.

Barriers & Challenges:

- Higher Production Costs: Currently, the production cost of most biodegradable plastics remains higher than conventional plastics, posing a significant barrier to widespread adoption, particularly for price-sensitive markets.

- Infrastructure for Composting and Recycling: The lack of adequate industrial composting facilities and specialized recycling infrastructure in many parts of the Middle East hinders the end-of-life management of biodegradable plastics, potentially leading to contamination of conventional recycling streams.

- Performance Limitations: While improving, some biodegradable plastics still exhibit performance limitations compared to conventional plastics, such as lower heat resistance or barrier properties, restricting their use in certain high-performance applications.

- Consumer Education and Misconceptions: A lack of clear understanding and potential misconceptions among consumers regarding the biodegradability and disposal requirements of different bioplastic types can lead to improper waste management and reduce the overall environmental benefit.

Growth Drivers in the Middle East Biodegradable Plastics Market Market

The Middle East Biodegradable Plastics Market is propelled by a potent combination of factors. Technologically, continuous innovation in biopolymer synthesis and processing is yielding more cost-effective and performance-enhanced materials, expanding their applicability across diverse sectors. Economically, the rising disposable incomes and a growing middle class in the region are contributing to increased consumption of goods, with a parallel rise in demand for sustainable packaging solutions. Regulatory drivers are particularly impactful; governments across the GCC are implementing stringent policies and offering incentives for businesses that embrace eco-friendly alternatives. For example, bans on specific single-use conventional plastics are directly stimulating the demand for biodegradable counterparts. Furthermore, increasing corporate commitments to Environmental, Social, and Governance (ESG) principles are driving businesses to invest in and adopt biodegradable materials to reduce their environmental footprint.

Challenges Impacting Middle East Biodegradable Plastics Market Growth

Despite the promising growth trajectory, several challenges impede the full potential of the Middle East Biodegradable Plastics Market. A primary restraint is the higher initial production cost compared to conventional plastics, making them less competitive in price-sensitive markets. A significant hurdle is the lack of robust end-of-life infrastructure, including widespread industrial composting facilities and specialized recycling streams, which can lead to improper disposal and negate the environmental benefits. Performance limitations in certain biodegradable polymers, such as lower heat or moisture resistance, still restrict their use in demanding applications. Moreover, consumer education and awareness gaps persist, with some consumers not fully understanding the proper disposal methods for biodegradable plastics, potentially leading to contamination of waste streams.

Key Players Shaping the Middle East Biodegradable Plastics Market Market

- Al-Habib Polymers

- Cargill Incorporated

- Al Bayader International

- Green Packaging Industries

- EcoPlast Solutions

- BASF SE

- Eastman Chemical Company

- KiSabz (Maadiran)

- Plastcom Middle East FZC

- Ecoway Biopolymers LLC

- Avani Eco

- Symphony Environmental Technologies Plc (through its manufacturing arrangement)

Significant Middle East Biodegradable Plastics Market Industry Milestones

- October 2022: UAE-based cleantech company Avani Eco Middle East secured a guarantee of USD 680,000 in funding support from the Mohammed Bin Rashid Innovation Fund (MBRIF)'s Guarantee Scheme. Avani develops compostable bioplastics from cassava starch and a full range of sustainable food packaging and hospitality products from renewable resources, marking a significant boost to its expansion and product development capabilities in the region.

- August 2022: UK-based Symphony Environmental Technologies Plc finalized a manufacturing arrangement with the Ecobatch Plastic Factory in the United Arab Emirates. This agreement, with production anticipated near the end of 2022, will see Symphony supplying its D2W oxo-biodegradable plastic technology, designed to mitigate plastic waste and pollution, for use in products like shopping bags and food packaging, signaling an expansion of oxo-biodegradable solutions in the regional market.

Future Outlook for Middle East Biodegradable Plastics Market Market

The future outlook for the Middle East Biodegradable Plastics Market is exceptionally promising, with sustained growth anticipated through 2033. Strategic opportunities lie in leveraging ongoing advancements in biopolymer technology to develop high-performance and cost-competitive materials, thereby overcoming current price barriers. The expansion of industrial composting and specialized recycling infrastructure across the GCC will be critical to realizing the full environmental potential of these materials. Increased collaboration between raw material suppliers, manufacturers, and waste management companies will foster a more robust and efficient value chain. Furthermore, targeted consumer education campaigns will play a vital role in driving adoption and ensuring proper disposal practices. The market is poised for significant expansion, driven by a confluence of supportive government policies, growing environmental consciousness, and increasing corporate commitment to sustainability, solidifying its position as a key enabler of a circular economy in the region.

Middle East Biodegradable Plastics Market Segmentation

-

1. Type

- 1.1. Strach based

- 1.2. Polylactic Acid (PLA)

- 1.3. Other Types

-

2. Application

- 2.1. Packaging

- 2.2. Other Applications

Middle East Biodegradable Plastics Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Qatar

- 4. Iran

- 5. Rest of Middle East

Middle East Biodegradable Plastics Market Regional Market Share

Geographic Coverage of Middle East Biodegradable Plastics Market

Middle East Biodegradable Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Environmental Factors Encouraging a Paradigm Shift; Growing Demand for Bioplastics in Packaging

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Alternatives; Other Restraints

- 3.4. Market Trends

- 3.4.1. Soaring Demand from the Packaging Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Strach based

- 5.1.2. Polylactic Acid (PLA)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Iran

- 5.3.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Strach based

- 6.1.2. Polylactic Acid (PLA)

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Packaging

- 6.2.2. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Strach based

- 7.1.2. Polylactic Acid (PLA)

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Packaging

- 7.2.2. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Strach based

- 8.1.2. Polylactic Acid (PLA)

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Packaging

- 8.2.2. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Iran Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Strach based

- 9.1.2. Polylactic Acid (PLA)

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Packaging

- 9.2.2. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle East Middle East Biodegradable Plastics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Strach based

- 10.1.2. Polylactic Acid (PLA)

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Packaging

- 10.2.2. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Al-Habib Polymers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Bayader International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Green Packaging Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EcoPlast Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eastman Chemical Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KiSabz (Maadiran)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Plastcom Middle East FZC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ecoway Biopolymers LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avani Eco

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Al-Habib Polymers

List of Figures

- Figure 1: Middle East Biodegradable Plastics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Biodegradable Plastics Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 35: Middle East Biodegradable Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Middle East Biodegradable Plastics Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Biodegradable Plastics Market?

The projected CAGR is approximately 16.3%.

2. Which companies are prominent players in the Middle East Biodegradable Plastics Market?

Key companies in the market include Al-Habib Polymers, Cargill Incorporated, Al Bayader International, Green Packaging Industries, EcoPlast Solutions, BASF SE, Eastman Chemical Company, KiSabz (Maadiran), Plastcom Middle East FZC, Ecoway Biopolymers LLC, Avani Eco.

3. What are the main segments of the Middle East Biodegradable Plastics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Environmental Factors Encouraging a Paradigm Shift; Growing Demand for Bioplastics in Packaging.

6. What are the notable trends driving market growth?

Soaring Demand from the Packaging Industry.

7. Are there any restraints impacting market growth?

Availability of Cheaper Alternatives; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: UAE-based cleantech company Avani Eco Middle East has been granted a guarantee of USD 680,000 in funding support from the Mohammed Bin Rashid Innovation Fund (MBRIF)'s Guarantee Scheme. Avani develops compostable bioplastics made from cassava starch as well as a full range of sustainable food packaging and hospitality products made from renewable resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Biodegradable Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Biodegradable Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Biodegradable Plastics Market?

To stay informed about further developments, trends, and reports in the Middle East Biodegradable Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence