Key Insights

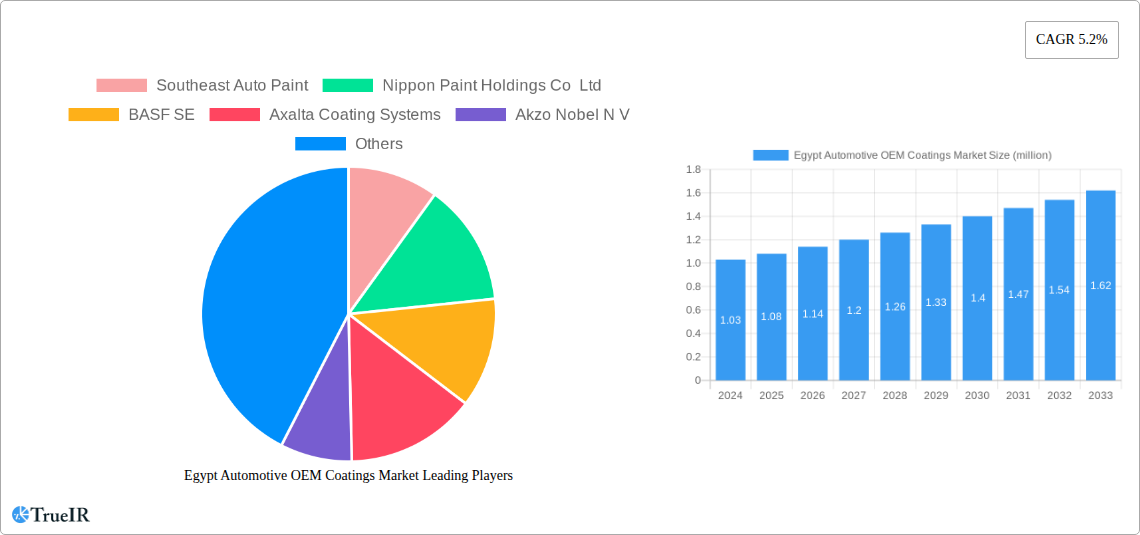

The Egypt Automotive OEM Coatings Market is poised for significant expansion, estimated to reach approximately USD 1.03 million in 2024, with a robust CAGR of 5.2% projected from 2025 to 2033. This growth is primarily propelled by the burgeoning automotive sector in Egypt, driven by increasing domestic vehicle production and a growing demand for passenger and commercial vehicles. The strategic importance of the automotive industry as a key contributor to Egypt's economic development, coupled with government initiatives to boost manufacturing, creates a fertile ground for automotive OEM coatings. Emerging trends such as the increasing adoption of water-borne and eco-friendly coating technologies, driven by environmental regulations and consumer preferences for sustainable products, are also key market influencers. Furthermore, advancements in coating technologies, including enhanced durability, corrosion resistance, and aesthetic appeal, are essential for meeting the evolving demands of automotive manufacturers.

Egypt Automotive OEM Coatings Market Market Size (In Million)

While the market is experiencing strong growth, certain restraints such as the fluctuating raw material prices and the initial investment costs associated with advanced coating technologies might pose challenges. However, the ongoing technological advancements in the automotive OEM coatings sector, encompassing innovations in E-coat, primer, base coat, and clear coat layers, are expected to mitigate these challenges. The demand for high-performance and aesthetically pleasing finishes continues to fuel innovation across various resin types, including acrylic, alkyd, epoxy, and polyurethane. The application segment, particularly for passenger and commercial vehicles, is expected to witness substantial growth, indicating a healthy pipeline of upcoming automotive production and a corresponding need for premium OEM coatings. The ACE (Automotive, Commercial, and Equipment) sector also presents a considerable opportunity for market players.

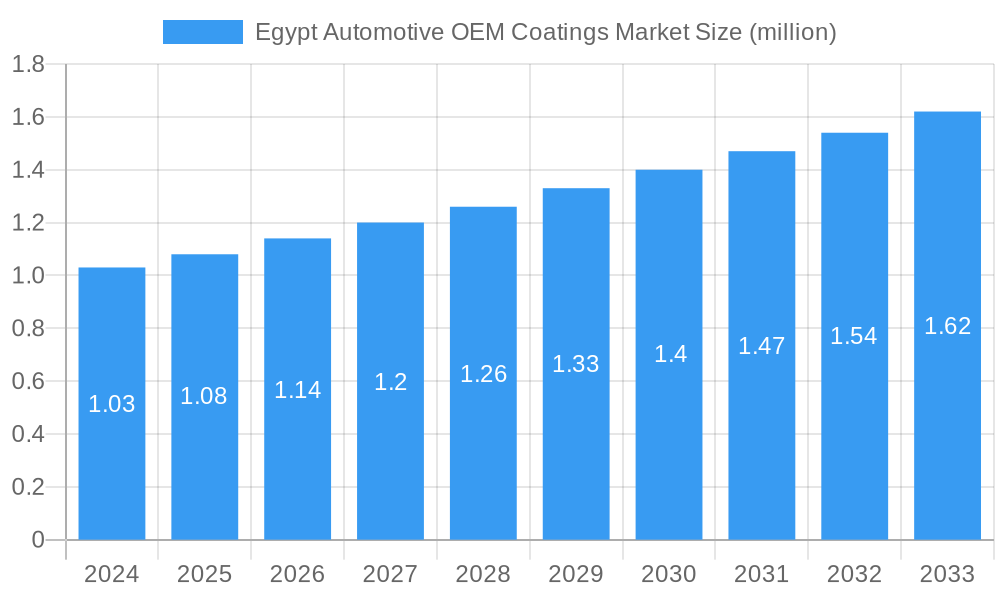

Egypt Automotive OEM Coatings Market Company Market Share

This in-depth report delivers a dynamic, SEO-optimized analysis of the Egypt Automotive OEM Coatings Market. Leveraging high-volume keywords such as "automotive coatings Egypt," "OEM paint Egypt," "car coatings market," and "automotive refinish Egypt," this study is designed to provide actionable insights for industry stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers detailed forecasts and trend analysis for this crucial sector. The market size for Egypt Automotive OEM Coatings is projected to reach approximately 500 million USD by 2025, with an anticipated CAGR of 6.5% during the forecast period.

Egypt Automotive OEM Coatings Market Market Structure & Competitive Landscape

The Egypt Automotive OEM Coatings market is characterized by a moderate to high level of concentration, with key players vying for market share through product innovation and strategic partnerships. Innovation drivers include the increasing demand for sustainable, low-VOC (Volatile Organic Compound) coatings and the continuous advancements in application technologies. Regulatory impacts, primarily driven by environmental standards and safety regulations, are also shaping market dynamics, pushing manufacturers towards eco-friendlier solutions. Product substitutes, such as advanced composites and alternative finishing materials, pose a limited threat due to the established infrastructure and performance requirements for automotive coatings. The end-user segmentation is heavily dominated by passenger vehicles, followed by commercial vehicles and the ACE (Agricultural, Construction, and Earthmoving) sector. Mergers and acquisitions (M&A) are a recurring trend, with recent activity indicating a drive towards consolidating market presence and expanding technological capabilities. For instance, M&A volumes have seen an average of 2 significant deals annually over the historical period 2019-2024.

- Market Concentration: Estimated concentration ratio (CR4) of 60% in 2025.

- Innovation Drivers:

- Development of advanced, high-durability coatings.

- Focus on environmentally friendly and sustainable coating solutions.

- Integration of smart coating technologies for enhanced functionality.

- Regulatory Impacts: Stringent VOC emission standards and waste management regulations.

- Product Substitutes: Limited, primarily in niche applications.

- End-User Segmentation: Passenger Vehicles (approximately 75% market share), Commercial Vehicles (approximately 20%), ACE (approximately 5%).

- M&A Trends: Strategic acquisitions to expand product portfolios and geographic reach.

Egypt Automotive OEM Coatings Market Market Trends & Opportunities

The Egypt Automotive OEM Coatings market is experiencing robust growth, driven by increasing automotive production and a rising demand for premium, durable, and aesthetically appealing finishes. The market size, estimated at 450 million USD in 2024, is projected to expand significantly, reaching approximately 500 million USD by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period (2025-2033). Technological shifts are a major trend, with a pronounced move towards water-borne coatings and a decline in solvent-borne technologies due to environmental regulations and a growing emphasis on sustainability. Electric vehicle (EV) production, while still nascent in Egypt, presents a future opportunity for specialized coatings that offer thermal management and electromagnetic interference (EMI) shielding properties. Consumer preferences are increasingly leaning towards personalized color options, advanced protective coatings that enhance vehicle longevity, and finishes that contribute to fuel efficiency through reduced weight. Competitive dynamics are intense, with global players investing in local manufacturing and distribution networks to cater to the growing demand. The "Make in Egypt" initiative and favorable foreign direct investment policies are creating a conducive environment for market expansion. Opportunities also lie in the development of coatings with enhanced scratch resistance, UV protection, and self-healing properties, aligning with consumer expectations for long-lasting vehicle appearance and value. The growing middle class and an expanding export market for Egyptian-assembled vehicles are further augmenting the demand for high-quality OEM coatings.

Dominant Markets & Segments in Egypt Automotive OEM Coatings Market

The Passenger Vehicles segment is the undisputed dominant market within Egypt's Automotive OEM Coatings landscape, accounting for an estimated 75% of the total market share in 2025. This dominance is fueled by the high volume of passenger car production and assembly within the country, catering to both domestic consumption and potential export markets. Within the Resin segment, Polyurethane coatings hold a significant share due to their excellent durability, flexibility, and resistance to chemicals and weathering, making them ideal for automotive applications. However, Acrylic resins are also witnessing strong growth owing to their cost-effectiveness and good performance characteristics.

In terms of Layer, the Base Coat segment is crucial, providing the color and visual appeal of the vehicle. However, the Clear Coat segment is equally vital, offering protection against environmental damage, UV radiation, and abrasion, thereby extending the aesthetic life of the vehicle. The E-Coat and Primer layers are foundational, providing corrosion resistance and excellent adhesion for subsequent layers.

Technology-wise, while Solvent-Borne coatings have historically been dominant, a clear trend towards Water-Borne coatings is emerging, driven by stricter environmental regulations and a global push for sustainability. Electrocoats are critical for initial corrosion protection, especially for challenging geometries.

The Application segment sees Passenger Vehicles leading, followed by Commercial Vehicles, which include trucks, buses, and vans. The ACE (Agricultural, Construction, and Earthmoving) sector, while smaller, requires highly durable and robust coatings to withstand harsh operating environments. Key growth drivers for these segments include government incentives for local automotive manufacturing, infrastructure development projects requiring commercial and specialized vehicles, and increasing consumer disposable income leading to higher demand for passenger cars. Policies promoting automotive sector growth and investments in advanced manufacturing technologies are also crucial.

- Dominant Application: Passenger Vehicles (approx. 75% market share).

- Key Resin Trends: Strong demand for Polyurethane and growing adoption of Acrylic resins.

- Dominant Layers: Base Coat and Clear Coat are critical for aesthetics and protection, with E-Coat and Primer essential for foundational protection.

- Technological Shift: Transition towards Water-Borne coatings from Solvent-Borne due to environmental regulations.

- Growth Drivers in Segments:

- Passenger Vehicles: Increased domestic production, rising consumer demand, and export potential.

- Commercial Vehicles: Government infrastructure projects, logistics sector expansion.

- ACE: Demand for durable coatings in challenging operating conditions.

- Resins: Performance requirements, cost-effectiveness, and environmental compliance.

- Layers: Focus on enhanced durability, aesthetic appeal, and corrosion resistance.

- Technology: Growing adoption of eco-friendly water-borne systems.

Egypt Automotive OEM Coatings Market Product Analysis

Product innovation in the Egypt Automotive OEM Coatings market centers on developing advanced formulations that meet stringent performance, environmental, and aesthetic demands. Key advancements include the creation of low-VOC, water-borne coatings that significantly reduce environmental impact while offering comparable or superior performance to traditional solvent-borne systems. Technologies such as clear coats with enhanced scratch resistance, UV protection, and self-healing capabilities are gaining traction, providing automotive manufacturers with competitive advantages in terms of vehicle durability and longevity. The integration of smart coatings with features like color-changing properties or integrated sensor functionalities represents a future frontier. These product innovations are crucial for manufacturers to align with evolving consumer preferences for sustainable, high-performance, and visually appealing automotive finishes, ensuring market fit in an increasingly competitive landscape.

Key Drivers, Barriers & Challenges in Egypt Automotive OEM Coatings Market

The Egypt Automotive OEM Coatings market is propelled by several key drivers, including the burgeoning domestic automotive manufacturing sector, driven by government initiatives and foreign investment, and the increasing demand for passenger vehicles due to a growing middle class. Technological advancements in coating formulations, focusing on sustainability and enhanced performance, also play a pivotal role. Economic growth, leading to higher disposable incomes, further fuels vehicle sales and, consequently, coating demand.

However, the market faces significant barriers and challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and availability. Stringent environmental regulations, while driving innovation, also necessitate substantial investment in new technologies and compliance measures. Intense competition from both global and local players can lead to price pressures. Furthermore, the availability of skilled labor for advanced application processes and the need for continuous quality control remain critical challenges.

- Key Drivers:

- Growth in automotive production and assembly.

- Increasing consumer demand for passenger vehicles.

- Technological advancements in eco-friendly and high-performance coatings.

- Favorable government policies supporting the automotive industry.

- Challenges & Restraints:

- Raw material price volatility and supply chain disruptions.

- Stringent environmental regulations requiring compliance investments.

- Intense competition leading to price pressures.

- Availability of skilled labor and quality control demands.

- Economic slowdowns impacting consumer spending.

Growth Drivers in the Egypt Automotive OEM Coatings Market Market

The growth drivers in the Egypt Automotive OEM Coatings market are multifaceted, encompassing technological, economic, and regulatory factors. The sustained expansion of the automotive manufacturing base within Egypt, bolstered by government incentives aimed at boosting local production and exports, is a primary catalyst. Economic growth and an expanding middle-class population translate to increased demand for new vehicles, particularly passenger cars, directly driving the need for OEM coatings. Technological innovation, with a strong emphasis on developing sustainable, low-VOC, water-borne coatings and advanced formulations offering superior durability and aesthetic appeal, is also a significant growth enabler. Furthermore, evolving regulatory frameworks that promote environmentally responsible manufacturing practices indirectly encourage the adoption of advanced coating technologies.

Challenges Impacting Egypt Automotive OEM Coatings Market Growth

Several challenges impact the growth of the Egypt Automotive OEM Coatings market. Supply chain vulnerabilities, including the dependency on imported raw materials and potential disruptions due to global events or trade restrictions, can lead to increased costs and production delays. The increasing complexity of regulatory requirements, particularly concerning environmental emissions and chemical usage, necessitates ongoing adaptation and investment, potentially straining smaller market players. Intense competitive pressures from established global players and emerging local manufacturers can lead to price wars and reduced profit margins. Economic instability, currency fluctuations, and unpredictable shifts in consumer purchasing power can also dampen demand for new vehicles and, consequently, OEM coatings.

Key Players Shaping the Egypt Automotive OEM Coatings Market Market

- Southeast Auto Paint

- Nippon Paint Holdings Co Ltd

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- RPM International

- PPG Industries Inc

- Kansai Paint Co., Ltd.

- The Sherwin-Williams Company

Significant Egypt Automotive OEM Coatings Market Industry Milestones

- 2019: Launch of new eco-friendly water-borne coating technologies by leading global manufacturers, increasing their market presence.

- 2020: Significant investment by a major automotive OEM in expanding its Egyptian assembly plant, leading to increased demand for local coatings.

- 2021: Introduction of enhanced quality control standards by the Egyptian Automotive Manufacturing Association, pushing for higher-grade OEM coatings.

- 2022: Strategic partnership formed between a global coatings supplier and a local automotive component manufacturer to co-develop specialized coatings.

- 2023: Government announces new incentives for domestic production of automotive paints and coatings, encouraging local manufacturing expansion.

- 2024: Rollout of a new generation of scratch-resistant and self-healing clear coats by leading players, enhancing vehicle aesthetics and durability.

Future Outlook for Egypt Automotive OEM Coatings Market Market

The future outlook for the Egypt Automotive OEM Coatings market remains exceptionally positive, driven by sustained growth in automotive production and an increasing consumer appetite for high-quality, durable, and aesthetically pleasing vehicles. Strategic opportunities lie in the further adoption of sustainable coating technologies, particularly water-borne systems, and the development of specialized coatings for the growing electric vehicle segment. Investments in local manufacturing capabilities, research and development for region-specific coating solutions, and collaborations with automotive manufacturers will be crucial for market players to capitalize on this growth trajectory. The Egyptian market is poised for continued expansion, offering significant potential for innovation and market penetration in the coming years.

Egypt Automotive OEM Coatings Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resins

-

2. Layer

- 2.1. E-Coat

- 2.2. Pirmer

- 2.3. Base Coat

- 2.4. Clear Coat

-

3. Technology

- 3.1. Water-Borne

- 3.2. Solvent-Borne

- 3.3. Electrocoats

- 3.4. Powder Coatings

-

4. Application

- 4.1. Passenger Vehicles

- 4.2. Commercial Vehicles

- 4.3. ACE

Egypt Automotive OEM Coatings Market Segmentation By Geography

- 1. Egypt

Egypt Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of Egypt Automotive OEM Coatings Market

Egypt Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of Government Strategies to Localize Autotmotive Manufacturing Industry

- 3.3. Market Restrains

- 3.3.1. Slow Growth in Automotive Industry; Economical Conditions; Stringent VOC Regulations Set By The Governing Bodies

- 3.4. Market Trends

- 3.4.1. Economical Conditions having a negative impact on the demand for Automotive OEM coaitngs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Layer

- 5.2.1. E-Coat

- 5.2.2. Pirmer

- 5.2.3. Base Coat

- 5.2.4. Clear Coat

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-Borne

- 5.3.2. Solvent-Borne

- 5.3.3. Electrocoats

- 5.3.4. Powder Coatings

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Passenger Vehicles

- 5.4.2. Commercial Vehicles

- 5.4.3. ACE

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Southeast Auto Paint

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Paint Holdings Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axalta Coating Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Akzo Nobel N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RPM International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PPG Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kansai Paint Co. Ltd.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Sherwin-Williams Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Southeast Auto Paint

List of Figures

- Figure 1: Egypt Automotive OEM Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Egypt Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Resin 2020 & 2033

- Table 2: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Resin 2020 & 2033

- Table 3: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 4: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Layer 2020 & 2033

- Table 5: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 6: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Technology 2020 & 2033

- Table 7: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Application 2020 & 2033

- Table 9: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Region 2020 & 2033

- Table 11: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Resin 2020 & 2033

- Table 12: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Resin 2020 & 2033

- Table 13: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 14: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Layer 2020 & 2033

- Table 15: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 16: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Technology 2020 & 2033

- Table 17: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Application 2020 & 2033

- Table 19: Egypt Automotive OEM Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Egypt Automotive OEM Coatings Market Volume liter per unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Automotive OEM Coatings Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Egypt Automotive OEM Coatings Market?

Key companies in the market include Southeast Auto Paint, Nippon Paint Holdings Co Ltd, BASF SE, Axalta Coating Systems, Akzo Nobel N V, RPM International, PPG Industries Inc, Kansai Paint Co., Ltd., The Sherwin-Williams Company.

3. What are the main segments of the Egypt Automotive OEM Coatings Market?

The market segments include Resin, Layer, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of Government Strategies to Localize Autotmotive Manufacturing Industry.

6. What are the notable trends driving market growth?

Economical Conditions having a negative impact on the demand for Automotive OEM coaitngs.

7. Are there any restraints impacting market growth?

Slow Growth in Automotive Industry; Economical Conditions; Stringent VOC Regulations Set By The Governing Bodies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter per unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the Egypt Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence