Key Insights

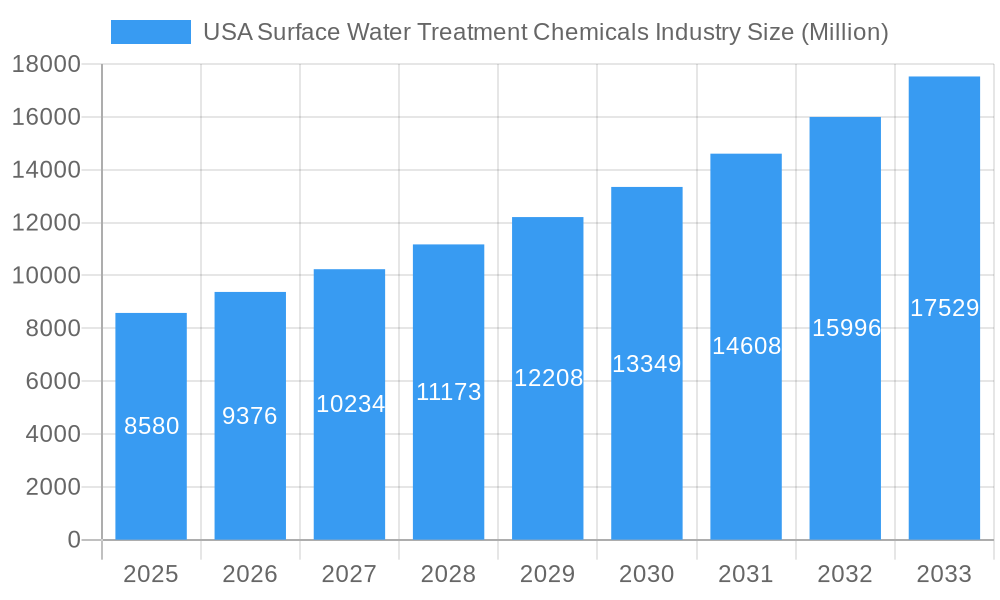

The USA Surface Water Treatment Chemicals market is poised for robust growth, with a projected market size of $8.58 billion in 2025, driven by an estimated CAGR of 9.24% throughout the forecast period (2025-2033). This significant expansion is underpinned by the escalating demand for clean and safe water across various sectors, including municipal, industrial, and agricultural applications. Increasing stringent environmental regulations and a growing awareness of waterborne diseases are compelling greater adoption of advanced water treatment solutions. The sector is further propelled by substantial investments in upgrading aging water infrastructure and the development of new facilities, particularly in rapidly urbanizing areas. Key drivers include the rising need for industrial process water purification, especially within the power generation and oil and gas industries, which require specialized chemicals for efficiency and environmental compliance. The food and beverage and pulp and paper industries also contribute significantly to this demand, prioritizing water quality for product integrity and sustainable operations.

USA Surface Water Treatment Chemicals Industry Market Size (In Billion)

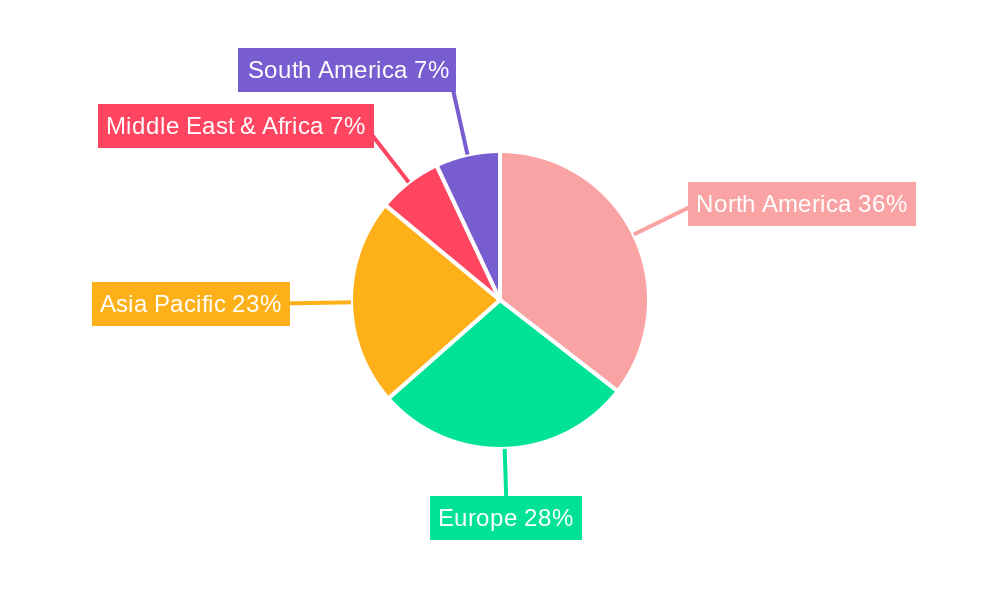

The market is segmented by product type, with Biocides and Disinfectants, and Coagulants and Flocculants anticipated to dominate, reflecting the fundamental need for microbial control and impurity removal. Corrosion and Scale Inhibitors are also crucial, especially in industrial settings to maintain equipment longevity and operational efficiency. Emerging trends indicate a growing preference for eco-friendly and sustainable chemical solutions, alongside advancements in smart water treatment technologies that integrate real-time monitoring and automated chemical dosing. However, the market faces certain restraints, including the volatile pricing of raw materials and the high initial investment costs associated with advanced treatment systems. Regional dynamics highlight North America as a leading market, benefiting from well-established infrastructure and stringent water quality standards, while Asia Pacific presents the fastest-growing segment due to rapid industrialization and increasing water scarcity concerns. Key industry players are actively engaged in strategic partnerships and research and development to introduce innovative and cost-effective solutions, ensuring continued market dynamism.

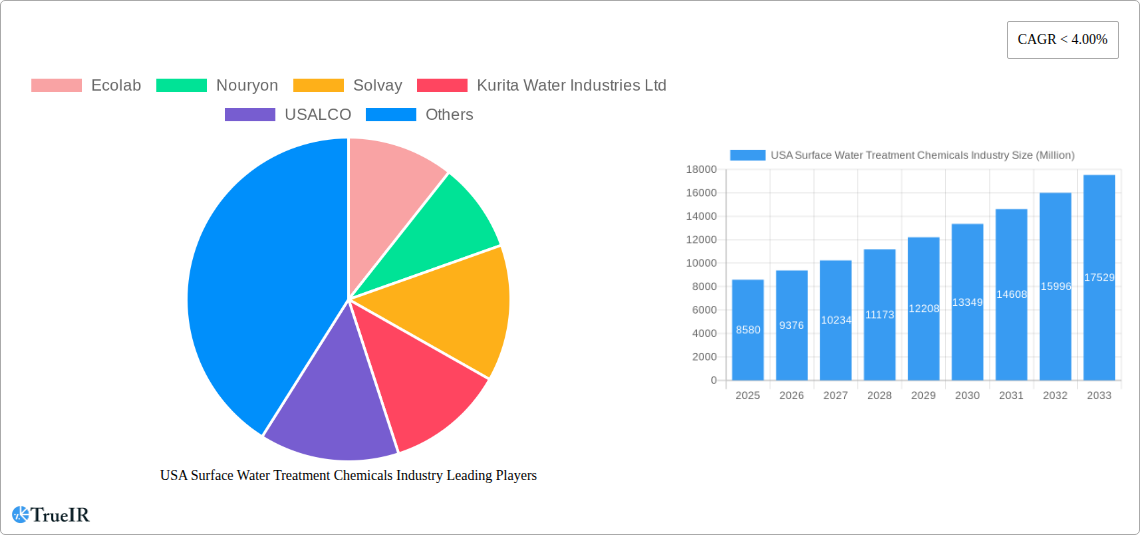

USA Surface Water Treatment Chemicals Industry Company Market Share

USA Surface Water Treatment Chemicals Industry Market Analysis: A Comprehensive Outlook (2019-2033)

This report provides an in-depth analysis of the USA Surface Water Treatment Chemicals Industry, offering critical insights into market dynamics, competitive landscapes, and future growth trajectories. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this vital sector. The market is projected to reach over XXX billion USD by 2033, exhibiting a robust CAGR.

USA Surface Water Treatment Chemicals Industry Market Structure & Competitive Landscape

The USA Surface Water Treatment Chemicals Industry exhibits a moderately concentrated market structure, with key players such as Ecolab, Nouryon, Solvay, and Kurita Water Industries Ltd. holding significant market shares. Innovation drivers are primarily focused on developing more eco-friendly and efficient chemical formulations, alongside advancements in digital monitoring and dosage optimization. Regulatory impacts, driven by stringent EPA standards and increasing water quality mandates, are shaping product development and market entry strategies. Product substitutes, while existing, often fall short in efficacy or cost-effectiveness for large-scale industrial and municipal applications.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized chemical manufacturers. The top 10 players are estimated to hold over 70% of the market share.

- Innovation Drivers:

- Development of biodegradable and low-toxicity treatment chemicals.

- Integration of IoT and AI for real-time water quality monitoring and automated chemical dosing.

- Focus on sustainable production processes and reduced environmental footprints.

- Regulatory Impacts: Stricter discharge limits and evolving drinking water standards necessitate continuous product innovation and compliance adherence.

- Product Substitutes: While alternative physical treatment methods exist, chemical treatments remain essential for cost-effectiveness and broad-spectrum efficacy.

- End-User Segmentation: Diverse applications across municipal water treatment, industrial processes (power, oil & gas, chemical manufacturing), and food & beverage sectors.

- M&A Trends: Consolidation is a notable trend, with larger entities acquiring smaller, specialized firms to expand their product portfolios and geographical reach. Over X billion USD in M&A deals were recorded in the historical period (2019-2024).

USA Surface Water Treatment Chemicals Industry Market Trends & Opportunities

The USA Surface Water Treatment Chemicals Industry is experiencing significant growth, driven by escalating demand for clean water and increasingly stringent environmental regulations. The market size, estimated to be over XXX billion USD in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025-2033. Technological shifts are playing a pivotal role, with a growing emphasis on smart water management solutions and the adoption of advanced chemical formulations that offer superior performance with reduced environmental impact. For instance, the development of novel coagulants and flocculants with enhanced settling capabilities and lower dosage requirements is transforming operational efficiencies for end-users.

Consumer preferences are also influencing market dynamics, with a heightened awareness of water quality and sustainability. This translates into a greater demand for chemicals that are not only effective but also compliant with green chemistry principles. Consequently, manufacturers are investing heavily in research and development to introduce products that minimize residual contaminants and offer better biodegradability. The competitive landscape is characterized by intense rivalry, with companies differentiating themselves through product innovation, strategic partnerships, and a focus on providing comprehensive water treatment solutions rather than just chemical supply.

Opportunities abound in niche segments, particularly in addressing emerging contaminants and in providing customized treatment solutions for specific industrial needs. The increasing focus on water reuse and recycling across various industries is also creating new avenues for growth. Furthermore, government initiatives aimed at upgrading aging water infrastructure and ensuring reliable access to potable water are expected to further bolster market expansion. The market penetration rate for advanced water treatment chemicals is expected to rise significantly as industries seek to optimize their water usage and comply with evolving environmental standards. The market is poised for substantial value creation as companies adapt to these evolving trends and proactively address the growing challenges of water scarcity and pollution.

Dominant Markets & Segments in USA Surface Water Treatment Chemicals Industry

The USA Surface Water Treatment Chemicals Industry is characterized by several dominant markets and segments, each contributing significantly to the overall market value. The Municipal end-user industry stands out as a primary driver, fueled by the continuous need for safe and accessible drinking water for a growing population and the ongoing upgrades to aging water infrastructure across the nation. The Power industry also represents a substantial segment, driven by the critical role of water in cooling systems and steam generation, where effective treatment prevents scale buildup and corrosion, thereby ensuring operational efficiency and longevity of equipment.

Product Type analysis reveals that Coagulants and Flocculants hold a dominant position. These chemicals are fundamental to removing suspended solids and impurities from raw surface water, making them indispensable in virtually all water treatment processes. Their widespread application across municipal and industrial sectors underscores their market importance. Following closely are Biocides and Disinfectants, crucial for controlling microbial growth and ensuring water safety, particularly in drinking water applications and industrial cooling towers.

Leading End-User Industry: Municipal

- Growth Drivers:

- Extensive federal and state funding for water infrastructure modernization.

- Increasingly strict drinking water quality standards from the EPA.

- Population growth necessitating expanded treatment capacities.

- Focus on public health and safety driving demand for effective disinfection.

- Market Dominance Analysis: Municipal water treatment accounts for an estimated XX% of the total market revenue. The continuous demand for potable water, coupled with the imperative to address emerging contaminants like PFAS, ensures sustained investment in advanced treatment chemicals. Government grants and public-private partnerships are further stimulating this segment.

- Growth Drivers:

Leading Product Type: Coagulants and Flocculants

- Growth Drivers:

- Essential for primary clarification in both potable and wastewater treatment.

- Versatility in treating a wide range of water sources with varying turbidity levels.

- Advancements in polymer technology leading to more efficient and cost-effective formulations.

- Strict regulations on effluent quality in industrial discharge.

- Market Dominance Analysis: This segment commands an estimated XX% of the market share by revenue. The effectiveness of these chemicals in removing particulate matter makes them a cornerstone of water purification. The ongoing development of higher-performance, lower-dosage coagulants and flocculants continues to drive their market leadership.

- Growth Drivers:

Other significant segments include Corrosion and Scale Inhibitors, critical for maintaining the integrity of industrial pipelines and equipment, and pH & Adjusters and Softeners, essential for optimizing treatment processes and meeting discharge requirements. The Oil and Gas and Chemical Manufacturing industries, while consuming substantial volumes of water treatment chemicals, are subject to cyclical demands influenced by commodity prices and production levels.

USA Surface Water Treatment Chemicals Industry Product Analysis

Product innovation in the USA Surface Water Treatment Chemicals Industry is driven by the need for enhanced efficacy, environmental sustainability, and cost-effectiveness. Manufacturers are developing advanced formulations of coagulants and flocculants, including organic polymers and hybrid inorganic/organic compounds, that offer superior particle removal with lower dosage requirements and sludge generation. Biocides and disinfectants are evolving towards more targeted and less persistent solutions, addressing concerns about disinfection byproducts and environmental impact. Corrosion and scale inhibitors are incorporating smart functionalities for real-time performance monitoring and automated adjustment. These advancements aim to provide clients with optimized water treatment processes, reduced operational costs, and improved compliance with stringent environmental regulations.

Key Drivers, Barriers & Challenges in USA Surface Water Treatment Chemicals Industry

The USA Surface Water Treatment Chemicals Industry is propelled by several key drivers, including stringent environmental regulations mandating cleaner water, increasing demand for potable water due to population growth, and the critical need for water in industrial processes like power generation and manufacturing. Technological advancements in chemical formulations, offering greater efficiency and reduced environmental impact, also serve as a significant growth catalyst.

Conversely, the industry faces substantial barriers and challenges. Regulatory complexities and the evolving landscape of chemical approvals can slow down product introductions. Supply chain disruptions, particularly for key raw materials, can impact production volumes and pricing. Furthermore, intense competitive pressures and the need for continuous R&D investment to stay ahead of innovation can strain profit margins for smaller players. The capital-intensive nature of some advanced treatment technologies can also pose a barrier to widespread adoption.

Growth Drivers in the USA Surface Water Treatment Chemicals Industry Market

Key drivers fueling the growth of the USA Surface Water Treatment Chemicals Industry are multifaceted. Regulatory mandates are paramount, with the U.S. Environmental Protection Agency (EPA) continually updating water quality standards, forcing industries and municipalities to adopt more advanced treatment solutions. Population growth directly translates to an increased demand for safe drinking water, necessitating expanded and upgraded treatment facilities. Industrial expansion, particularly in sectors like manufacturing and energy, amplifies the need for process water treatment to ensure operational efficiency and prevent equipment damage from scaling and corrosion. Technological advancements in chemical formulations, leading to more eco-friendly and highly effective products, also act as a strong growth catalyst, enabling better performance at potentially lower costs.

Challenges Impacting USA Surface Water Treatment Chemicals Industry Growth

Several challenges significantly impact the growth of the USA Surface Water Treatment Chemicals Industry. Regulatory complexities and the lengthy approval processes for new chemical substances can impede market penetration and innovation timelines. Supply chain volatility, including fluctuating raw material prices and availability, poses a constant threat to production and cost management. Intense competitive pressures from both established giants and emerging specialized firms necessitate continuous investment in research and development, which can be a significant financial strain. Furthermore, the increasing scrutiny on the environmental impact of chemicals, including the potential for trace contaminants and byproducts, requires manufacturers to innovate towards greener alternatives, often involving higher upfront R&D and production costs.

Key Players Shaping the USA Surface Water Treatment Chemicals Industry Market

- Ecolab

- Nouryon

- Solvay

- Kurita Water Industries Ltd

- USALCO

- SUEZ

- Kemira

- Dow

- ChemTreat Inc

- Solenis

- Buckman Laboratories Inc

- Veolia

- Albemarle Corporation

- Chemtrade

Significant USA Surface Water Treatment Chemicals Industry Industry Milestones

- 2019: Increased regulatory focus on emerging contaminants like PFAS leads to intensified R&D for specialized treatment solutions.

- 2020: Supply chain disruptions due to global events prompt a re-evaluation of raw material sourcing and inventory management strategies.

- 2021: Growing adoption of digital water management technologies integrates chemical dosing with real-time monitoring.

- 2022: Major M&A activities by leading players aim to consolidate market share and expand product portfolios.

- 2023: Introduction of new biodegradable and low-toxicity coagulants and flocculants gains market traction.

- 2024: Enhanced government funding for water infrastructure projects stimulates demand for a broad range of treatment chemicals.

Future Outlook for USA Surface Water Treatment Chemicals Industry Market

The future outlook for the USA Surface Water Treatment Chemicals Industry remains highly promising, driven by sustained demand for clean water and ongoing technological advancements. Strategic opportunities lie in the development of advanced treatment solutions for emerging contaminants, such as microplastics and pharmaceuticals, and in leveraging digital technologies for smarter, more efficient water management. The increasing emphasis on water reuse and recycling across industrial sectors will further expand the market for specialized treatment chemicals. Companies that can innovate with sustainable, high-performance products and offer integrated solutions will be well-positioned to capitalize on the projected market growth, which is expected to exceed XXX billion USD by 2033.

USA Surface Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH & Adjusters and Softeners

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Food and Beverage

- 2.7. Pulp and Paper

- 2.8. Other End-user Industries

USA Surface Water Treatment Chemicals Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Surface Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of USA Surface Water Treatment Chemicals Industry

USA Surface Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Initiatives to Control Production and Disposal of wastewater; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 on the Industry; High Cost and Hazardous Nature

- 3.4. Market Trends

- 3.4.1. Corrosion and Scale Inhibitors to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH & Adjusters and Softeners

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Food and Beverage

- 5.2.7. Pulp and Paper

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Biocides and Disinfectants

- 6.1.2. Coagulants and Flocculants

- 6.1.3. Corrosion and Scale Inhibitors

- 6.1.4. Defoamers and Defoaming Agents

- 6.1.5. pH & Adjusters and Softeners

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil and Gas

- 6.2.3. Chemical Manufacturing

- 6.2.4. Mining and Mineral Processing

- 6.2.5. Municipal

- 6.2.6. Food and Beverage

- 6.2.7. Pulp and Paper

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Biocides and Disinfectants

- 7.1.2. Coagulants and Flocculants

- 7.1.3. Corrosion and Scale Inhibitors

- 7.1.4. Defoamers and Defoaming Agents

- 7.1.5. pH & Adjusters and Softeners

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil and Gas

- 7.2.3. Chemical Manufacturing

- 7.2.4. Mining and Mineral Processing

- 7.2.5. Municipal

- 7.2.6. Food and Beverage

- 7.2.7. Pulp and Paper

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Biocides and Disinfectants

- 8.1.2. Coagulants and Flocculants

- 8.1.3. Corrosion and Scale Inhibitors

- 8.1.4. Defoamers and Defoaming Agents

- 8.1.5. pH & Adjusters and Softeners

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil and Gas

- 8.2.3. Chemical Manufacturing

- 8.2.4. Mining and Mineral Processing

- 8.2.5. Municipal

- 8.2.6. Food and Beverage

- 8.2.7. Pulp and Paper

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Biocides and Disinfectants

- 9.1.2. Coagulants and Flocculants

- 9.1.3. Corrosion and Scale Inhibitors

- 9.1.4. Defoamers and Defoaming Agents

- 9.1.5. pH & Adjusters and Softeners

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power

- 9.2.2. Oil and Gas

- 9.2.3. Chemical Manufacturing

- 9.2.4. Mining and Mineral Processing

- 9.2.5. Municipal

- 9.2.6. Food and Beverage

- 9.2.7. Pulp and Paper

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific USA Surface Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Biocides and Disinfectants

- 10.1.2. Coagulants and Flocculants

- 10.1.3. Corrosion and Scale Inhibitors

- 10.1.4. Defoamers and Defoaming Agents

- 10.1.5. pH & Adjusters and Softeners

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power

- 10.2.2. Oil and Gas

- 10.2.3. Chemical Manufacturing

- 10.2.4. Mining and Mineral Processing

- 10.2.5. Municipal

- 10.2.6. Food and Beverage

- 10.2.7. Pulp and Paper

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ecolab

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kurita Water Industries Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 USALCO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SUEZ

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemira

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ChemTreat Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Solenis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Buckman Laboratories Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veolia

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Albemarle Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Chemtrade

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ecolab

List of Figures

- Figure 1: Global USA Surface Water Treatment Chemicals Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global USA Surface Water Treatment Chemicals Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Product Type 2025 & 2033

- Figure 5: North America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America USA Surface Water Treatment Chemicals Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 8: North America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: North America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America USA Surface Water Treatment Chemicals Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America USA Surface Water Treatment Chemicals Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: South America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Product Type 2025 & 2033

- Figure 17: South America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: South America USA Surface Water Treatment Chemicals Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: South America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: South America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: South America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: South America USA Surface Water Treatment Chemicals Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: South America USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: South America USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America USA Surface Water Treatment Chemicals Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Europe USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Product Type 2025 & 2033

- Figure 29: Europe USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe USA Surface Water Treatment Chemicals Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe USA Surface Water Treatment Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 32: Europe USA Surface Water Treatment Chemicals Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe USA Surface Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe USA Surface Water Treatment Chemicals Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe USA Surface Water Treatment Chemicals Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Product Type 2025 & 2033

- Figure 41: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Product Type 2025 & 2033

- Figure 53: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 56: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 57: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume (K Tons), by Country 2025 & 2033

- Figure 61: Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific USA Surface Water Treatment Chemicals Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 21: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Brazil USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Argentina USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 33: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 35: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: United Kingdom USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Germany USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: France USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Italy USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Spain USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Russia USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Benelux USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Nordics USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 56: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 57: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 58: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 59: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Turkey USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Israel USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: GCC USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: North Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: South Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 74: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 75: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 76: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 77: Global USA Surface Water Treatment Chemicals Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global USA Surface Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 79: China USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 81: India USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Japan USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: South Korea USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 87: ASEAN USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 89: Oceania USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific USA Surface Water Treatment Chemicals Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific USA Surface Water Treatment Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Surface Water Treatment Chemicals Industry?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the USA Surface Water Treatment Chemicals Industry?

Key companies in the market include Ecolab, Nouryon, Solvay, Kurita Water Industries Ltd, USALCO, SUEZ, Kemira, Dow, ChemTreat Inc, Solenis, Buckman Laboratories Inc, Veolia, Albemarle Corporation, Chemtrade.

3. What are the main segments of the USA Surface Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Government Initiatives to Control Production and Disposal of wastewater; Other Drivers.

6. What are the notable trends driving market growth?

Corrosion and Scale Inhibitors to Dominate the market.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 on the Industry; High Cost and Hazardous Nature.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Surface Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Surface Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Surface Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the USA Surface Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence