Key Insights

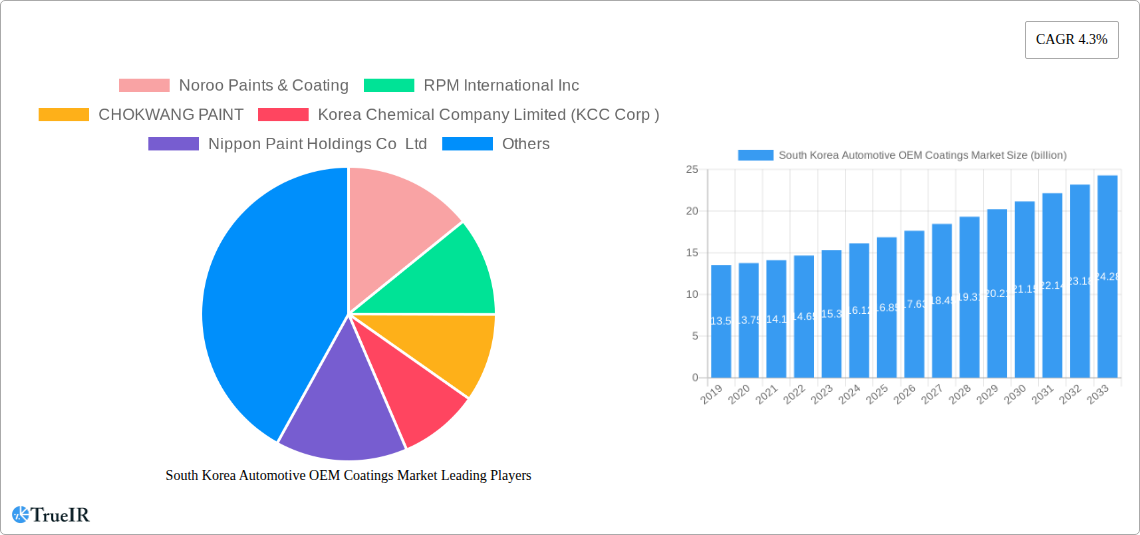

The South Korean automotive OEM coatings market is poised for steady growth, projected to reach an estimated USD 16.12 billion in 2024, with a CAGR of 4.3% anticipated to extend through 2033. This expansion is underpinned by the nation's robust automotive manufacturing sector and its commitment to innovation in vehicle aesthetics and durability. Key growth drivers include the increasing demand for high-performance coatings offering superior protection against environmental factors and corrosion, alongside the rising preference for visually appealing finishes that enhance vehicle desirability. The market's evolution is also significantly influenced by technological advancements, particularly the shift towards sustainable and environmentally friendly coating solutions. Water-borne and electrocoat technologies are gaining traction due to stringent environmental regulations and a growing consumer awareness regarding ecological impact. Furthermore, the continuous development of advanced resin technologies, such as specialized epoxy and polyurethane formulations, is enabling coatings with improved scratch resistance, UV stability, and overall longevity, catering to the sophisticated demands of the automotive industry.

South Korea Automotive OEM Coatings Market Market Size (In Million)

The automotive OEM coatings landscape in South Korea is characterized by a dynamic interplay of resin types, application layers, and coating technologies. Acrylic, alkyd, epoxy, polyurethane, and polyester resins form the foundational components, each offering distinct properties tailored for specific automotive applications. The layering process, encompassing e-coats, primers, base coats, and clear coats, is crucial for achieving the desired aesthetic appeal, protective qualities, and durability. The dominant coating technologies are witnessing a significant shift towards environmentally conscious options. Water-borne coatings are increasingly favored for their low volatile organic compound (VOC) emissions, while electrocoat provides excellent corrosion resistance and uniform coverage. Powder coatings are also emerging as a viable alternative for specific components due to their durability and environmental benefits. The primary applications span passenger vehicles, commercial vehicles, and the ACE (Automotive, Construction, and Electronics) segments, with the automotive sector remaining the largest consumer of OEM coatings. Leading players such as Nippon Paint Holdings, BASF SE, Akzo Nobel N.V., and PPG Industries are actively investing in research and development to innovate and maintain their competitive edge in this evolving market.

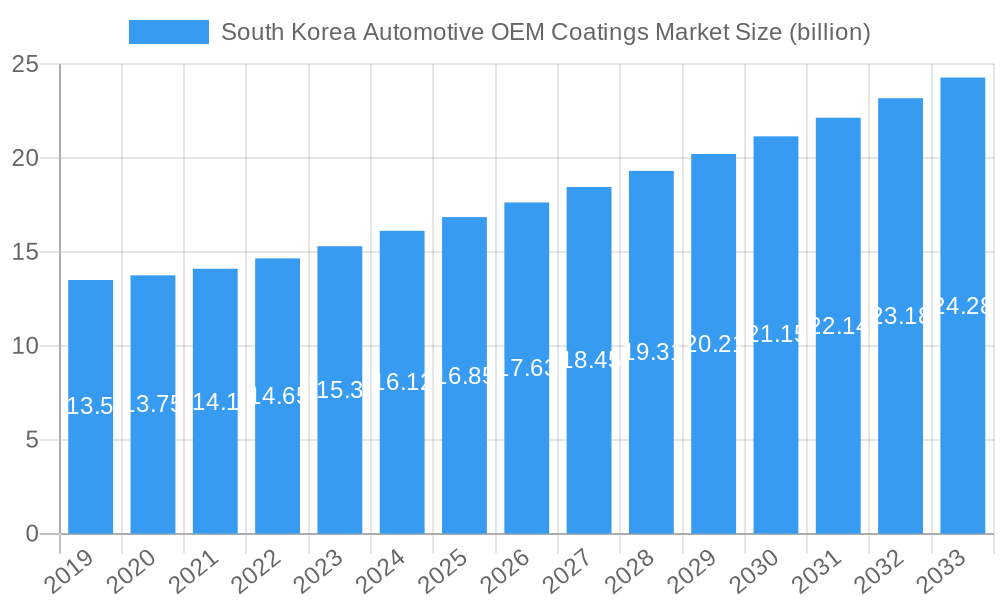

South Korea Automotive OEM Coatings Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the South Korea Automotive OEM Coatings market, covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033. Leveraging high-volume keywords, this report is designed to enhance search rankings and engage industry professionals seeking critical insights into market size, trends, competitive landscape, and future opportunities. The total market value is projected to reach hundreds of billions of dollars by 2033.

South Korea Automotive OEM Coatings Market Market Structure & Competitive Landscape

The South Korea Automotive OEM Coatings market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a vibrant ecosystem of specialized manufacturers. Innovation is a key driver, fueled by the relentless pursuit of enhanced performance, sustainability, and aesthetic appeal by Original Equipment Manufacturers (OEMs). Regulatory impacts, particularly concerning environmental standards for volatile organic compounds (VOCs) and emissions, are shaping product development and market entry strategies. Product substitutes, while less prevalent in the OEM segment due to stringent OEM specifications, can emerge from advancements in alternative finishing technologies. End-user segmentation primarily revolves around passenger vehicles, commercial vehicles, and ACE (Aerospace, Construction, and Earthmoving equipment) sectors, each with distinct coating requirements. Mergers and Acquisitions (M&A) activity plays a strategic role in market consolidation, technology acquisition, and expanded geographic reach. M&A volumes are expected to trend upwards, driven by the need for economies of scale and portfolio diversification.

- Key characteristics of market concentration: Domination by global chemical giants and strong domestic players, indicating intense competition.

- Innovation drivers: Focus on eco-friendly formulations, advanced functionalities (e.g., scratch resistance, self-healing), and enhanced color palettes.

- Regulatory impacts: Stringent VOC emission standards, increasing demand for water-borne and powder coatings.

- Product substitutes: Exploration of alternative surface treatments and advanced material coatings.

- End-user segmentation: Predominance of passenger vehicles, with growing contributions from commercial vehicles and specialized ACE applications.

- M&A trends: Strategic acquisitions to gain market share, access new technologies, and expand product portfolios.

South Korea Automotive OEM Coatings Market Market Trends & Opportunities

The South Korea Automotive OEM Coatings market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025-2033), driving the market size to an estimated several hundred billion dollars. This expansion is underpinned by several converging trends and emerging opportunities. The increasing global demand for automobiles, particularly in emerging economies, directly translates into higher consumption of OEM coatings. South Korea, as a leading automotive manufacturing hub, is at the forefront of this demand.

Technological shifts are profoundly impacting the market. There is a pronounced move towards sustainable coating solutions, driven by both regulatory pressures and growing consumer awareness. This includes a significant rise in the adoption of water-borne coatings, which offer lower VOC emissions and reduced environmental impact compared to traditional solvent-borne systems. Powder coatings are also gaining traction due to their durability and solvent-free nature. Electrocoating (E-coat) remains a foundational technology for corrosion protection, with continuous advancements in its application and efficiency.

Consumer preferences are evolving, with a growing emphasis on aesthetics, durability, and personalization. This translates into demand for a wider spectrum of colors, finishes, and advanced coating functionalities such as self-healing properties, improved scratch resistance, and enhanced UV protection. The rise of electric vehicles (EVs) presents unique opportunities. EVs often require specialized coatings that address thermal management, noise reduction, and lightweighting, creating a niche for innovative solutions. Furthermore, the increasing complexity of vehicle designs and the integration of new materials necessitate adaptive and high-performance coating systems.

The competitive dynamics within the market are characterized by strategic partnerships between coating manufacturers and automotive OEMs, aimed at co-developing bespoke coating solutions. Players are investing heavily in R&D to stay ahead of the curve in terms of environmental compliance and performance enhancement. The opportunity lies in developing coatings that not only meet but exceed these evolving demands, offering superior protection, aesthetic appeal, and sustainability credentials. The growing aftermarket for automotive repairs and refinishing also presents a tangential opportunity, though the focus of this report remains on the OEM segment. Companies that can demonstrate a strong commitment to sustainability, innovation, and collaborative development with OEMs are best positioned to capitalize on the future growth trajectory of the South Korean automotive OEM coatings market.

Dominant Markets & Segments in South Korea Automotive OEM Coatings Market

The South Korea Automotive OEM Coatings market showcases distinct dominance across various segments, driven by technological advancements, application demands, and evolving consumer preferences.

Resin Dominance:

- Polyurethane: This resin segment is a dominant force due to its exceptional durability, flexibility, and resistance to chemicals and weathering, making it a preferred choice for topcoats and clear coats in passenger vehicles. Its ability to provide a high-gloss finish and excellent UV resistance contributes significantly to its market leadership.

- Acrylic: Acrylic resins are widely used across various layers, from primers to clear coats, owing to their good weatherability, color retention, and fast drying times. They are particularly prevalent in base coats for their vibrant color options and compatibility with different finishing systems.

- Epoxy: While primarily used in E-coats for its superior adhesion and corrosion resistance, the epoxy segment plays a critical role in the foundational protection of vehicle bodies. Its robust performance ensures long-term durability against environmental aggressors.

Layer Dominance:

- Clear Coat: The clear coat segment commands a substantial market share due to its role in providing the final aesthetic appeal, gloss, and protective layer against scratches, UV radiation, and chemical damage. Continuous innovation in clear coat technology, focusing on scratch resistance and self-healing properties, further solidifies its dominance.

- Base Coat: Base coats are essential for delivering the wide array of colors and visual effects desired by consumers and OEMs. Their market significance is directly tied to vehicle customization trends and the demand for high-quality finishes.

- E-Coat: As the initial layer for corrosion protection, E-coat is indispensable. While not always visible, its critical role in vehicle longevity and structural integrity ensures its consistent demand and dominance in the foundational stages of the coating process.

Technology Dominance:

- Water-Borne Coatings: This technology segment is experiencing rapid growth and is increasingly dominant, driven by stringent environmental regulations targeting VOC emissions. Manufacturers are heavily investing in and adopting water-borne systems to meet sustainability goals and comply with evolving legislation.

- Solvent-Borne Coatings: Despite the rise of water-borne alternatives, solvent-borne coatings still hold a significant market share due to their established performance characteristics, cost-effectiveness in certain applications, and OEM familiarity. However, their dominance is gradually waning.

Application Dominance:

- Passenger Vehicles: This segment represents the largest application area for automotive OEM coatings. The sheer volume of passenger vehicle production globally and in South Korea, coupled with consumer demand for aesthetic appeal and durability, makes this the dominant application.

- Commercial Vehicles: While smaller than passenger vehicles, the commercial vehicle segment is a significant contributor, characterized by the need for highly durable and protective coatings that can withstand harsh operating conditions.

South Korea Automotive OEM Coatings Market Product Analysis

The South Korea Automotive OEM Coatings market is characterized by a continuous stream of product innovations designed to enhance performance, aesthetics, and sustainability. Manufacturers are focused on developing advanced formulations that offer superior scratch resistance, self-healing capabilities, and enhanced UV protection, catering to the evolving demands for longer-lasting and visually appealing vehicle finishes. The shift towards eco-friendly solutions is driving the development of low-VOC and water-borne coating systems, aligning with global environmental regulations and consumer preferences. These innovations often leverage advanced resin technologies, such as nano-composites and specialized polymers, to achieve desired properties. The competitive advantage lies in offering integrated coating solutions that streamline the application process for OEMs, reduce production costs, and contribute to the overall quality and lifecycle of the vehicle.

Key Drivers, Barriers & Challenges in South Korea Automotive OEM Coatings Market

Key Drivers: The South Korea Automotive OEM Coatings market is propelled by several key drivers. Technological advancements in coating formulations, leading to improved durability, scratch resistance, and aesthetic finishes, are paramount. The increasing global demand for automobiles, particularly in the passenger vehicle segment, directly fuels the need for OEM coatings. Growing environmental awareness and stringent government regulations mandating lower VOC emissions are accelerating the adoption of sustainable coating technologies like water-borne and powder coatings. Economic growth and rising disposable incomes in key markets translate to higher vehicle sales, further boosting demand.

Barriers & Challenges: Despite the growth drivers, the market faces significant barriers and challenges. The high cost of R&D for developing new, compliant, and high-performance coating solutions can be substantial. Strict regulatory hurdles and the complex approval processes for new coatings in the automotive industry can slow down market penetration. Intense price competition among established players and the emergence of new market entrants can exert downward pressure on profit margins. Supply chain disruptions, raw material price volatility, and geopolitical uncertainties pose risks to production and cost management. Furthermore, the transition to new coating technologies requires significant investment in new application equipment and training for automotive manufacturers, which can be a considerable challenge.

Growth Drivers in the South Korea Automotive OEM Coatings Market Market

The South Korea Automotive OEM Coatings market is experiencing robust growth driven by a confluence of factors. Technological innovation is a primary catalyst, with advancements in nanotechnology, UV-curable coatings, and sustainable formulations enhancing product performance and appeal. The burgeoning demand for electric vehicles (EVs) presents a significant growth opportunity, requiring specialized coatings for battery thermal management, lightweighting, and electromagnetic shielding. Stringent environmental regulations, particularly concerning VOC emissions, are compelling manufacturers to invest in and adopt eco-friendly coating technologies such as water-borne and powder coatings, creating a sustained demand for these solutions. The increasing preference for personalized vehicle aesthetics, including a wider palette of colors and special effects, also drives innovation and demand for advanced base and clear coats.

Challenges Impacting South Korea Automotive OEM Coatings Market Growth

Several challenges are impacting the growth trajectory of the South Korea Automotive OEM Coatings market. The volatile prices of raw materials, such as titanium dioxide and petrochemical derivatives, can significantly affect manufacturing costs and profit margins. Stringent and evolving environmental regulations, while driving innovation in sustainable coatings, also impose compliance costs and necessitate significant R&D investments to meet new standards. The global automotive industry's susceptibility to economic downturns and trade disputes can lead to fluctuations in vehicle production volumes, directly impacting OEM coating demand. Furthermore, the complex and lengthy OEM approval processes for new coating technologies can delay market entry and adoption. Intense competition among global and domestic players also pressures pricing and necessitates continuous product differentiation.

Key Players Shaping the South Korea Automotive OEM Coatings Market Market

- Noroo Paints & Coating

- RPM International Inc

- CHOKWANG PAINT

- Korea Chemical Company Limited (KCC Corp)

- Nippon Paint Holdings Co Ltd

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- Samhwa Paint Industrial Co

- PPG Industries

- Covestro AG

- Kansai Paint Co Ltd

Significant South Korea Automotive OEM Coatings Market Industry Milestones

- 2019: Introduction of new water-borne clear coats with enhanced scratch resistance by leading players, meeting evolving OEM sustainability targets.

- 2020: Increased investment in R&D for EV-specific coatings, focusing on thermal management and lightweighting solutions, by major chemical companies.

- 2021: Implementation of stricter VOC emission regulations across South Korea, accelerating the shift towards eco-friendly coating technologies.

- 2022: Key partnerships formed between automotive OEMs and coating manufacturers for the co-development of next-generation sustainable paint systems.

- 2023: Launch of advanced self-healing clear coat technologies, offering superior durability and longevity for automotive exteriors.

- 2024: Significant advancements in powder coating technology for automotive applications, promising faster curing times and improved aesthetics.

Future Outlook for South Korea Automotive OEM Coatings Market Market

The future outlook for the South Korea Automotive OEM Coatings market is exceptionally promising, driven by continuous innovation and increasing demand for sustainable and high-performance solutions. The ongoing transition to electric vehicles will create new avenues for specialized coatings, particularly those addressing thermal management and lightweighting. The industry's commitment to environmental stewardship will further propel the adoption of water-borne and powder coatings, aligning with global sustainability goals. Strategic collaborations between coating manufacturers and automotive OEMs will remain crucial for developing tailored solutions that meet stringent performance and aesthetic requirements. Opportunities lie in expanding capabilities in smart coatings, advanced color effects, and integrated coating systems that enhance both vehicle protection and visual appeal, positioning the market for sustained, multi-billion dollar growth in the coming years.

South Korea Automotive OEM Coatings Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resins

-

2. Layer

- 2.1. E-Coat

- 2.2. Pirmer

- 2.3. Base Coat

- 2.4. Clear Coat

-

3. Technology

- 3.1. Water-Borne

- 3.2. Solvent-Borne

- 3.3. Electrocoat

- 3.4. Powder Coatings

-

4. Application

- 4.1. Passenger Vehicles

- 4.2. Commercial Vehicles

- 4.3. ACE

South Korea Automotive OEM Coatings Market Segmentation By Geography

- 1. South Korea

South Korea Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of South Korea Automotive OEM Coatings Market

South Korea Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies

- 3.4. Market Trends

- 3.4.1. Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Layer

- 5.2.1. E-Coat

- 5.2.2. Pirmer

- 5.2.3. Base Coat

- 5.2.4. Clear Coat

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-Borne

- 5.3.2. Solvent-Borne

- 5.3.3. Electrocoat

- 5.3.4. Powder Coatings

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Passenger Vehicles

- 5.4.2. Commercial Vehicles

- 5.4.3. ACE

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Noroo Paints & Coating

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPM International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHOKWANG PAINT

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korea Chemical Company Limited (KCC Corp )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Axalta Coating Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samhwa Paint Industrial Co*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covestro AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Paint Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Noroo Paints & Coating

List of Figures

- Figure 1: South Korea Automotive OEM Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 2: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2020 & 2033

- Table 3: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Layer 2020 & 2033

- Table 4: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2020 & 2033

- Table 5: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 7: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2020 & 2033

- Table 9: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2020 & 2033

- Table 11: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 12: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2020 & 2033

- Table 13: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Layer 2020 & 2033

- Table 14: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2020 & 2033

- Table 15: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 17: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2020 & 2033

- Table 19: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive OEM Coatings Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the South Korea Automotive OEM Coatings Market?

Key companies in the market include Noroo Paints & Coating, RPM International Inc, CHOKWANG PAINT, Korea Chemical Company Limited (KCC Corp ), Nippon Paint Holdings Co Ltd, BASF SE, Axalta Coating Systems, Akzo Nobel N V, Samhwa Paint Industrial Co*List Not Exhaustive, PPG Industries, Covestro AG, Kansai Paint Co Ltd.

3. What are the main segments of the South Korea Automotive OEM Coatings Market?

The market segments include Resin, Layer, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market.

7. Are there any restraints impacting market growth?

Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence