Key Insights

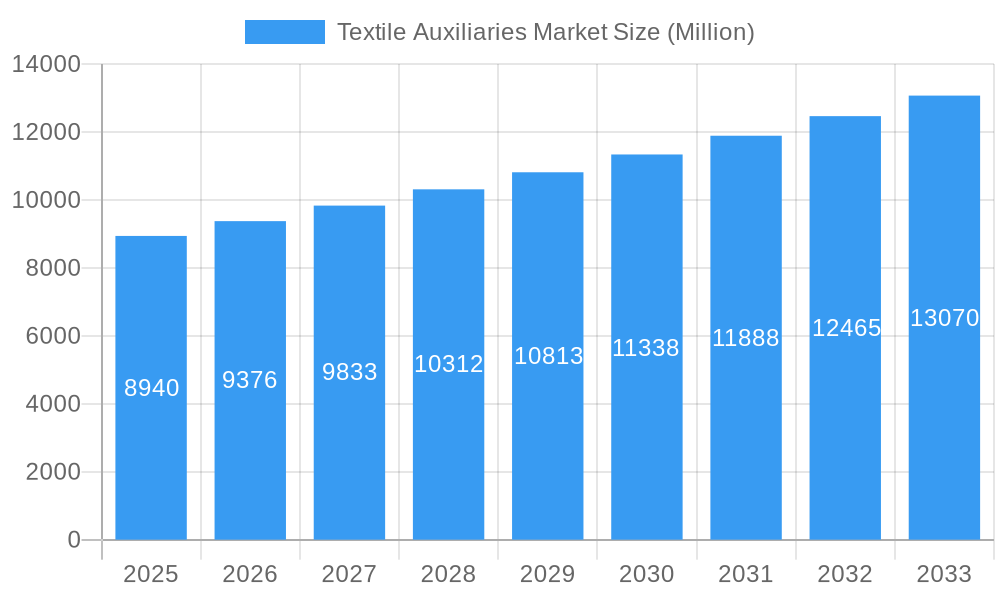

The global Textile Auxiliaries Market is poised for significant expansion, projected to reach a market size of USD 8.94 billion by 2025, driven by a robust compound annual growth rate (CAGR) of 4.8%. This sustained growth trajectory is underpinned by evolving consumer demand for high-performance and aesthetically pleasing textiles, coupled with increasing adoption of sustainable and eco-friendly chemical solutions across the textile value chain. The demand for advanced finishing agents, specialized coatings, and efficient colorants is escalating as manufacturers strive to enhance fabric properties such as durability, water repellency, flame retardancy, and antimicrobial resistance. Furthermore, the burgeoning apparel and home furnishing sectors, particularly in emerging economies, are acting as major catalysts, boosting the consumption of textile auxiliaries for dyeing, printing, and finishing processes. The automotive textile segment also presents a substantial growth avenue, driven by the increasing sophistication of interior textiles in vehicles.

Textile Auxiliaries Market Market Size (In Billion)

The market dynamics are further shaped by key trends such as the growing emphasis on digitalization and automation in textile processing, leading to the demand for smart auxiliaries that offer precise application and improved efficiency. Innovation in bio-based and biodegradable textile auxiliaries is also gaining traction as environmental regulations tighten and consumer consciousness towards sustainability rises. However, the market faces certain restraints, including the volatility of raw material prices, stringent environmental regulations regarding chemical usage, and the high cost of research and development for novel chemical formulations. Despite these challenges, strategic collaborations, mergers, and acquisitions among key players like Kemira Oyj, Nouryon, and Evonik Industries AG are expected to foster innovation and expand market reach. The Asia Pacific region, led by China and India, is anticipated to dominate the market share due to its large manufacturing base and growing domestic consumption.

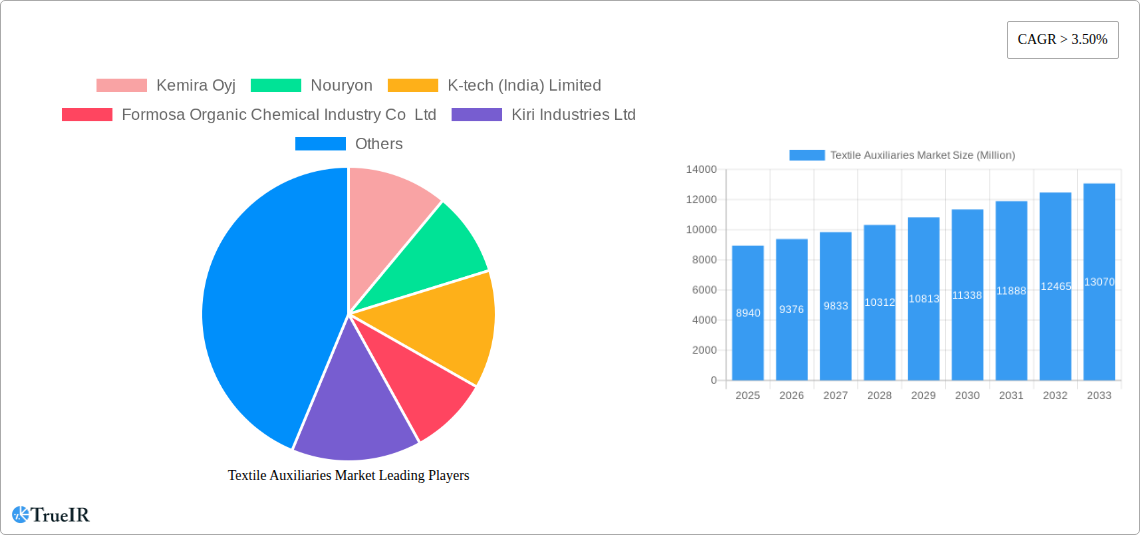

Textile Auxiliaries Market Company Market Share

This comprehensive report delves into the dynamic Textile Auxiliaries Market, a critical sector supporting the global textile industry's innovation and performance. With a projected market value of $XX billion by 2033, driven by a CAGR of XX% from 2025 to 2033, this analysis offers unparalleled insights into market dynamics, competitive strategies, and future opportunities. Explore the evolving landscape of textile chemicals, from high-performance finishing agents to sustainable colorant solutions.

Textile Auxiliaries Market Market Structure & Competitive Landscape

The Textile Auxiliaries Market exhibits a moderately concentrated structure, characterized by the presence of established global players and a growing number of regional specialists. Innovation drivers are primarily fueled by the demand for sustainable solutions, enhanced fabric performance, and stricter environmental regulations. Regulatory impacts, particularly concerning chemical usage and effluent treatment, significantly shape product development and market entry strategies. Product substitutes, while existing, often lack the specialized functionalities and performance characteristics offered by dedicated textile auxiliaries. End-user segmentation, spanning apparel, home furnishings, automotive textiles, and industrial applications, dictates varied product requirements and market penetration rates. Mergers and acquisitions (M&A) are a notable trend, with recent activities indicating consolidation and strategic portfolio expansion to capture a larger market share. The Textile Auxiliaries Market sees ongoing M&A activities, with an estimated XX billion USD in transactions over the historical period, reflecting a strategic drive for market consolidation and expanded product offerings.

- Market Concentration: Moderate to High, with key players holding significant market share.

- Innovation Drivers: Sustainability, performance enhancement, regulatory compliance, digitalization.

- Regulatory Impacts: Stringent environmental standards (e.g., REACH, ZDHC), eco-labeling requirements.

- Product Substitutes: Limited for specialized applications, but general chemicals may serve basic functions.

- End-User Segmentation: Apparel (XX%), Home Furnishing (XX%), Automotive Textile (XX%), Industrial Textile (XX%), Other (XX%).

- M&A Trends: Strategic acquisitions for portfolio enhancement and market reach.

Textile Auxiliaries Market Market Trends & Opportunities

The Textile Auxiliaries Market is experiencing robust growth, projected to reach a market size of $XX billion by 2033. This expansion is driven by a confluence of factors, including increasing consumer demand for high-performance and eco-friendly textiles, the growing adoption of technical textiles in various industries, and ongoing technological advancements in chemical formulations. The market's CAGR from 2025 to 2033 is estimated at XX%, indicating a strong upward trajectory. Key trends shaping this market include the escalating demand for sustainable auxiliaries, such as bio-based softeners and low-VOC (Volatile Organic Compound) dyes, which align with global environmental consciousness and stringent regulatory frameworks. The rise of digital printing in textiles also presents new opportunities for specialized ink auxiliaries and pretreatment chemicals. Furthermore, advancements in nanotechnology are enabling the development of auxiliaries that impart novel functionalities like antimicrobial properties, UV protection, and water repellency to fabrics. The automotive sector's increasing reliance on lightweight and durable textiles for interiors, coupled with the expansion of the home furnishing market, are significant application-driven growth catalysts. Opportunities abound for companies that can innovate in areas of circular economy principles, offering solutions that facilitate textile recycling and reduce environmental impact throughout the product lifecycle. The penetration rate of advanced textile auxiliaries is steadily increasing across all major application segments, as manufacturers seek to differentiate their products and meet evolving consumer expectations for quality, sustainability, and functionality. The shift towards smart textiles and functional apparel further fuels the demand for specialized chemical solutions.

Dominant Markets & Segments in Textile Auxiliaries Market

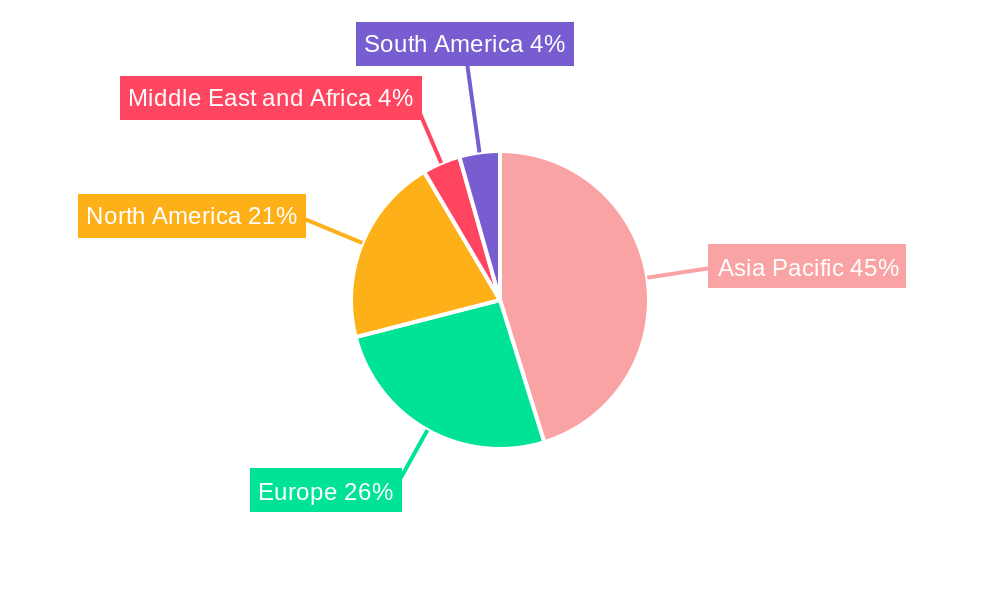

The Textile Auxiliaries Market is characterized by regional dominance and segment-specific growth patterns. Asia Pacific, particularly countries like China and India, continues to be the largest market due to its extensive textile manufacturing base, competitive production costs, and growing domestic consumption. Within this region, key growth drivers include government initiatives promoting manufacturing and exports, significant investments in R&D by local chemical companies, and a burgeoning middle class driving demand for apparel and home furnishings.

- Leading Region: Asia Pacific, with China and India as primary contributors.

- Growth Drivers: Large-scale textile production, favorable manufacturing costs, increasing consumer disposable income, government support for the textile industry.

- Dominant Segment by Type: Finishing Agents are expected to lead the market, driven by the demand for enhanced fabric properties such as softness, wrinkle resistance, water repellency, and flame retardancy.

- Key Growth Drivers: Increasing demand for high-performance apparel and home textiles, technological advancements in finishing formulations, growing application in technical textiles for automotive and industrial use.

- Dominant Segment by Application: Apparel remains the largest application segment, accounting for a significant share of the global Textile Auxiliaries Market.

- Key Growth Drivers: Growing global population, rising fashion consciousness, demand for functional and sustainable apparel, increasing per capita spending on clothing.

The Coating and Sizing Chemicals segment is also witnessing substantial growth, propelled by the production of technical textiles for industries such as automotive, healthcare, and construction, where specialized coatings are crucial for durability and functionality. The Colorants and Auxiliaries segment benefits from the continuous need for vibrant and durable colors, with a growing emphasis on eco-friendly dyes and pigment formulations. The Desizing Agents segment, while more niche, is critical for efficient fabric preparation and is influenced by the overall production volume of textiles. The Other Ty segment, encompassing emulsifiers, dispersants, and wetting agents, plays a vital supporting role across various textile processing stages.

Textile Auxiliaries Market Product Analysis

The Textile Auxiliaries Market is witnessing a surge in product innovation focused on sustainability, performance enhancement, and specialized functionalities. Key advancements include the development of bio-based and biodegradable auxiliaries, low-VOC formulations, and water-saving processing chemicals. For instance, new generation finishing agents are providing superior softness and wrinkle resistance with reduced environmental impact, while advanced colorant auxiliaries enable brighter, more durable, and eco-friendlier dyeing processes. The competitive advantage lies in offering solutions that not only meet the functional needs of textile manufacturers but also align with increasing regulatory pressures and consumer demand for greener products.

Key Drivers, Barriers & Challenges in Textile Auxiliaries Market

The Textile Auxiliaries Market is propelled by several key drivers. Technological advancements in chemical formulations, leading to enhanced fabric performance and sustainability, are paramount. Economic growth, particularly in emerging markets, fuels demand for textiles and consequently, auxiliaries. Favorable government policies promoting domestic manufacturing and sustainable practices also play a crucial role. For instance, initiatives supporting eco-friendly textile production in countries like India and Bangladesh are significant growth catalysts.

Conversely, several barriers and challenges restrain market growth. Stringent and evolving environmental regulations worldwide necessitate costly research and development for compliance. Supply chain disruptions, particularly for key raw materials, can impact production costs and lead times. Intense competitive pressures from both global giants and smaller regional players can affect pricing strategies and market penetration. For example, fluctuating raw material prices can directly impact the profitability of Textile Auxiliaries Market manufacturers, with some raw material costs seeing increases of up to XX% over the past year.

Growth Drivers in the Textile Auxiliaries Market Market

Key drivers propelling the Textile Auxiliaries Market include the relentless pursuit of sustainable textile production, pushing demand for eco-friendly auxiliaries. Technological advancements are enabling the creation of high-performance chemicals that impart unique properties to fabrics, such as water repellency and antimicrobial resistance, catering to niche markets and premium apparel. Economic growth in developing nations, coupled with rising disposable incomes, translates to increased consumption of textiles, thereby boosting the demand for auxiliaries. Government initiatives promoting green manufacturing and stringent environmental regulations are also significant catalysts, forcing manufacturers to adopt more sustainable chemical solutions.

Challenges Impacting Textile Auxiliaries Market Growth

Challenges impacting the Textile Auxiliaries Market growth are multifaceted. The increasing complexity and stringency of global environmental regulations, such as those concerning chemical usage and wastewater discharge, pose significant compliance hurdles and necessitate substantial investment in R&D. Supply chain volatility, including raw material price fluctuations and availability issues, can disrupt production and impact profitability. Intense competition from a wide array of players, from global conglomerates to smaller regional manufacturers, leads to pricing pressures and the need for continuous innovation to maintain market share. For instance, the cost of key petrochemical-based raw materials has seen a XX% increase in the last two years, directly affecting the cost of production for many auxiliaries.

Key Players Shaping the Textile Auxiliaries Market Market

The Textile Auxiliaries Market is shaped by a diverse range of companies, from global chemical giants to specialized regional manufacturers. These players are instrumental in driving innovation, expanding market reach, and influencing industry standards.

- Kemira Oyj

- Nouryon

- K-tech (India) Limited

- Formosa Organic Chemical Industry Co Ltd

- Kiri Industries Ltd

- L N Chemical Industries

- Evonik Industries AG

- CHT Group

- Croda International PLC

- Chemipol (Kothari Group Of Industries)

- Arkema Group

- Huntsman International LLC

- Tanatex Chemicals BV

- Rudolf GmbH

- Dow

- Archroma

- The Lubrizol Corporation

- Sarex

- Covestro AG

- Wacker Chemie AG

- Achitex Minerva SpA

- Giovanni Bozzetto SpA

Significant Textile Auxiliaries Market Industry Milestones

The Textile Auxiliaries Market has witnessed several significant developments that have shaped its trajectory and competitive landscape.

- August 2022: Archroma entered into a definitive agreement with Huntsman Corporation to acquire the latter's Textile Effect business. The transaction, awaiting regulatory approvals, is expected to close in the first half of 2023. The acquisition is expected to benefit Archroma in building a comprehensive portfolio of chemical solutions to cater to the textile market, significantly consolidating its market position and expanding its product offerings.

- February 2022: Archroma rolled out a new vegan textile softener, EARTH SOFT system based on Siligen EH1, with one-third plant-based active content. The new product line offers an alternative to textile manufacturers seeking to reduce fossil fuel-based ingredients in their end products, underscoring the growing market demand for sustainable and environmentally friendly solutions.

Future Outlook for Textile Auxiliaries Market Market

The future outlook for the Textile Auxiliaries Market is exceptionally positive, driven by continued innovation and evolving industry demands. Strategic opportunities lie in the development of advanced bio-based and biodegradable auxiliaries, catering to the growing global emphasis on sustainability and circular economy principles. The expansion of technical textiles in sectors like automotive, healthcare, and protective wear will further fuel demand for specialized performance-enhancing chemicals. Companies that invest in R&D for eco-friendly formulations, water-saving processing technologies, and digital printing auxiliaries are poised for significant growth. The market potential is further amplified by increasing consumer awareness regarding the environmental impact of textiles, pushing brands towards more sustainable supply chains. Anticipate continued consolidation through strategic mergers and acquisitions as companies seek to broaden their product portfolios and geographical reach.

Textile Auxiliaries Market Segmentation

-

1. Type

- 1.1. Coating and Sizing Chemicals

- 1.2. Colorants and Auxiliaries

- 1.3. Finishing Agents

- 1.4. Desizing Agents

- 1.5. Other Ty

-

2. Application

- 2.1. Apparel

- 2.2. Home Furnishing

- 2.3. Automotive Textile

- 2.4. Industrial Textile

- 2.5. Other Ap

Textile Auxiliaries Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Textile Auxiliaries Market Regional Market Share

Geographic Coverage of Textile Auxiliaries Market

Textile Auxiliaries Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Growth in Textile Production in Developing Economies; Growing Demand for Industrial Textiles

- 3.3. Market Restrains

- 3.3.1. Environmental Pollution Caused by the Textile Dyeing and Finishing Industry

- 3.4. Market Trends

- 3.4.1. Apparel Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Coating and Sizing Chemicals

- 5.1.2. Colorants and Auxiliaries

- 5.1.3. Finishing Agents

- 5.1.4. Desizing Agents

- 5.1.5. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Apparel

- 5.2.2. Home Furnishing

- 5.2.3. Automotive Textile

- 5.2.4. Industrial Textile

- 5.2.5. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Coating and Sizing Chemicals

- 6.1.2. Colorants and Auxiliaries

- 6.1.3. Finishing Agents

- 6.1.4. Desizing Agents

- 6.1.5. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Apparel

- 6.2.2. Home Furnishing

- 6.2.3. Automotive Textile

- 6.2.4. Industrial Textile

- 6.2.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Coating and Sizing Chemicals

- 7.1.2. Colorants and Auxiliaries

- 7.1.3. Finishing Agents

- 7.1.4. Desizing Agents

- 7.1.5. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Apparel

- 7.2.2. Home Furnishing

- 7.2.3. Automotive Textile

- 7.2.4. Industrial Textile

- 7.2.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Coating and Sizing Chemicals

- 8.1.2. Colorants and Auxiliaries

- 8.1.3. Finishing Agents

- 8.1.4. Desizing Agents

- 8.1.5. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Apparel

- 8.2.2. Home Furnishing

- 8.2.3. Automotive Textile

- 8.2.4. Industrial Textile

- 8.2.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Coating and Sizing Chemicals

- 9.1.2. Colorants and Auxiliaries

- 9.1.3. Finishing Agents

- 9.1.4. Desizing Agents

- 9.1.5. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Apparel

- 9.2.2. Home Furnishing

- 9.2.3. Automotive Textile

- 9.2.4. Industrial Textile

- 9.2.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Textile Auxiliaries Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Coating and Sizing Chemicals

- 10.1.2. Colorants and Auxiliaries

- 10.1.3. Finishing Agents

- 10.1.4. Desizing Agents

- 10.1.5. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Apparel

- 10.2.2. Home Furnishing

- 10.2.3. Automotive Textile

- 10.2.4. Industrial Textile

- 10.2.5. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kemira Oyj

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 K-tech (India) Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Formosa Organic Chemical Industry Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kiri Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L N Chemical Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evonik Industries AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CHT Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Croda International PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chemipol (Kothari Group Of Industries)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arkema Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huntsman International LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tanatex Chemicals BV

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Rudolf GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dow

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Archroma

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 The Lubrizol Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Sarex

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Covestro AG

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Wacker Chemie AG*List Not Exhaustive

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Achitex Minerva SpA

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Giovanni Bozzetto SpA

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Kemira Oyj

List of Figures

- Figure 1: Global Textile Auxiliaries Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Textile Auxiliaries Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Textile Auxiliaries Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Textile Auxiliaries Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Textile Auxiliaries Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Textile Auxiliaries Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Textile Auxiliaries Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Textile Auxiliaries Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Textile Auxiliaries Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Textile Auxiliaries Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Textile Auxiliaries Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Textile Auxiliaries Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Textile Auxiliaries Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Textile Auxiliaries Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Textile Auxiliaries Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Textile Auxiliaries Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Textile Auxiliaries Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Textile Auxiliaries Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Textile Auxiliaries Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Textile Auxiliaries Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Textile Auxiliaries Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Textile Auxiliaries Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Textile Auxiliaries Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Textile Auxiliaries Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Textile Auxiliaries Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Textile Auxiliaries Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Textile Auxiliaries Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Textile Auxiliaries Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Textile Auxiliaries Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Textile Auxiliaries Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Textile Auxiliaries Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Textile Auxiliaries Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Textile Auxiliaries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Textile Auxiliaries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United States Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Canada Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Textile Auxiliaries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Germany Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 28: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Textile Auxiliaries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Brazil Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Argentina Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Textile Auxiliaries Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Textile Auxiliaries Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Textile Auxiliaries Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Textile Auxiliaries Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Auxiliaries Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Textile Auxiliaries Market?

Key companies in the market include Kemira Oyj, Nouryon, K-tech (India) Limited, Formosa Organic Chemical Industry Co Ltd, Kiri Industries Ltd, L N Chemical Industries, Evonik Industries AG, CHT Group, Croda International PLC, Chemipol (Kothari Group Of Industries), Arkema Group, Huntsman International LLC, Tanatex Chemicals BV, Rudolf GmbH, Dow, Archroma, The Lubrizol Corporation, Sarex, Covestro AG, Wacker Chemie AG*List Not Exhaustive, Achitex Minerva SpA, Giovanni Bozzetto SpA.

3. What are the main segments of the Textile Auxiliaries Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Robust Growth in Textile Production in Developing Economies; Growing Demand for Industrial Textiles.

6. What are the notable trends driving market growth?

Apparel Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Pollution Caused by the Textile Dyeing and Finishing Industry.

8. Can you provide examples of recent developments in the market?

August 2022: Archroma entered into a definitive agreement with Huntsman Corporation to acquire the latter's Textile Effect business. The transaction, awaiting regulatory approvals, is expected to close in the first half of 2023. The acquisition is expected to benefit Archroma in building a comprehensive portfolio of chemical solutions to cater to the textile market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Auxiliaries Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Auxiliaries Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Auxiliaries Market?

To stay informed about further developments, trends, and reports in the Textile Auxiliaries Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence