Key Insights

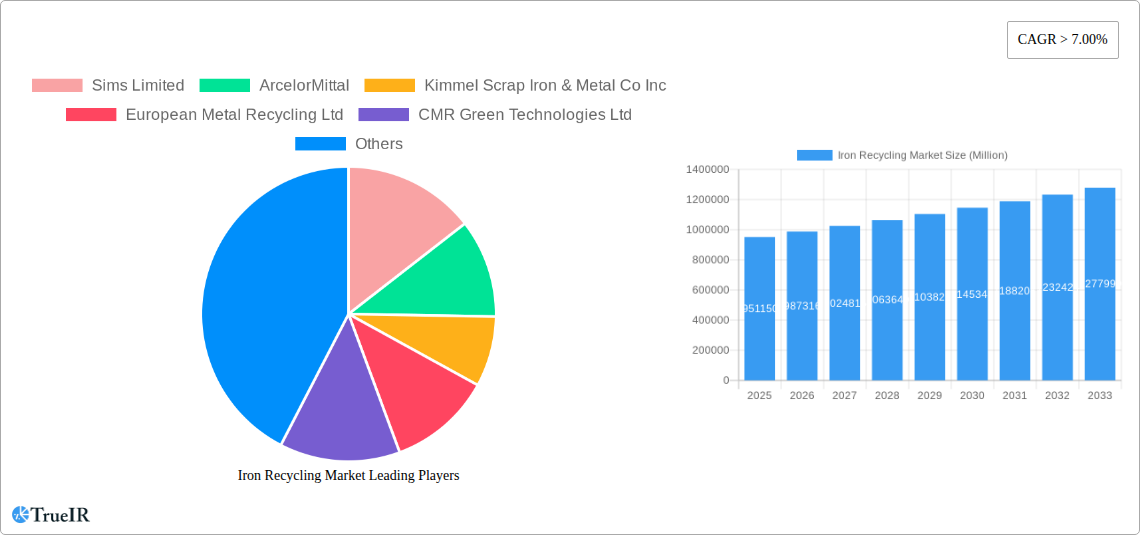

The global Iron Recycling Market is poised for significant expansion, projected to reach approximately $951.15 billion by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 3.9% during the forecast period of 2025-2033. The market's robust performance is primarily driven by increasing environmental consciousness and stringent government regulations promoting sustainable waste management and circular economy principles. A growing emphasis on reducing the carbon footprint associated with primary iron production is also a major catalyst, making recycled iron a more attractive and eco-friendly alternative. The automotive sector, with its continuous demand for steel and iron components, along with the burgeoning building and construction industry, are expected to be the dominant end-user segments, fueling consistent demand for recycled iron. Furthermore, the packaging industry's increasing adoption of metal packaging, alongside the vital role of iron in shipbuilding and electronics, contribute to a diversified and resilient market.

Iron Recycling Market Market Size (In Billion)

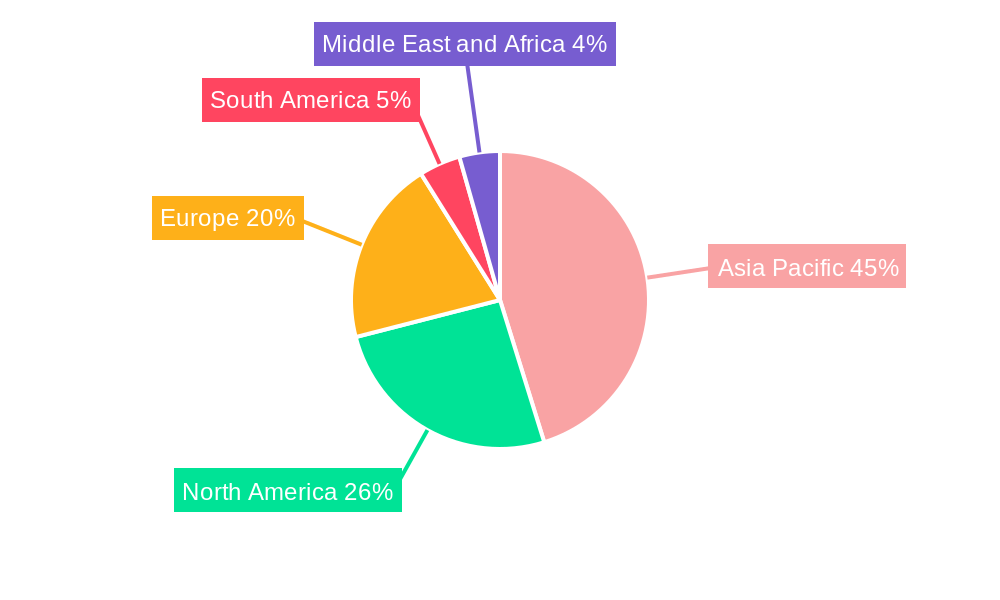

The market's trajectory is further shaped by evolving trends such as advancements in recycling technologies, which are improving the efficiency and purity of recovered iron. Innovations in sorting and processing are enabling higher quality recycled materials, broadening their applicability across various industries. Geographically, the Asia Pacific region, led by China and India, is anticipated to dominate the market share due to rapid industrialization and extensive infrastructure development. North America and Europe also represent substantial markets, driven by established recycling frameworks and a strong commitment to sustainability. While opportunities are abundant, the market may encounter challenges related to fluctuating scrap metal prices, the cost of advanced recycling infrastructure, and logistical complexities in collection and transportation. Nevertheless, the inherent economic and environmental benefits of iron recycling are expected to propel sustained growth and innovation throughout the study period.

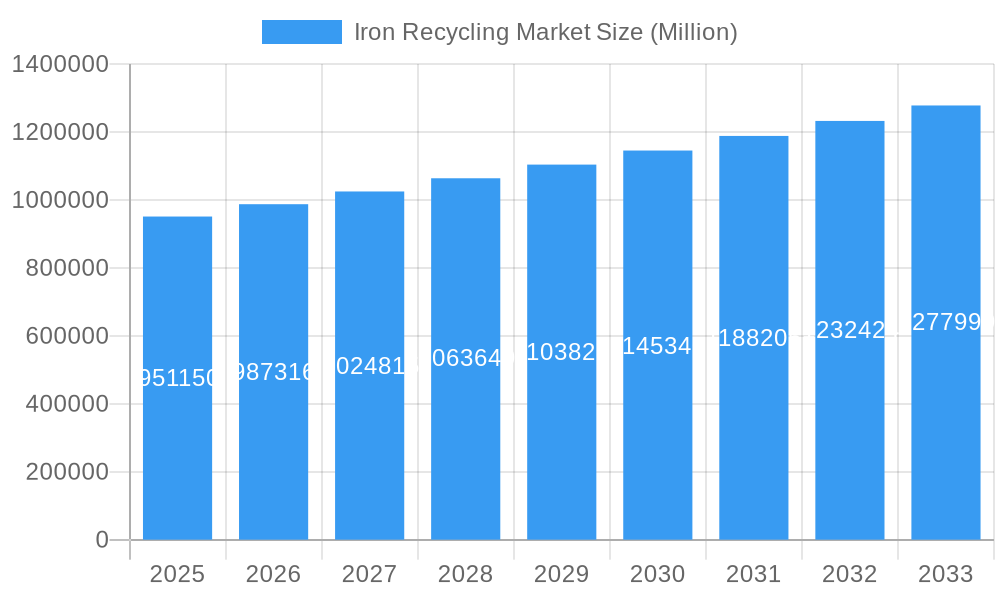

Iron Recycling Market Company Market Share

The global Iron Recycling Market is experiencing significant growth driven by increasing environmental consciousness, stringent regulations promoting circular economy principles, and the rising demand for sustainable steel production. This comprehensive report delves into the intricate dynamics of the iron recycling industry, providing in-depth analysis, actionable insights, and future projections. With a study period spanning from 2019 to 2033, this report leverages a base year of 2025 and an estimated year also of 2025 to offer a robust forecast for the period 2025–2033. The historical period of 2019–2024 provides crucial context for understanding current market trajectories.

Iron Recycling Market Market Structure & Competitive Landscape

The Iron Recycling Market exhibits a moderately concentrated structure, with a mix of large global players and smaller regional entities. Innovation is primarily driven by advancements in sorting technologies, processing efficiency, and the development of higher-grade recycled iron products. Regulatory frameworks, particularly those focused on waste management and carbon emission reduction, play a pivotal role in shaping market entry and operational strategies. Product substitutes, while present in some applications, are generally less economically viable or environmentally friendly than recycled iron. The end-user segmentation highlights the diverse applications of recycled iron, with the Building and Construction and Automotive sectors being major consumers. Mergers and Acquisitions (M&A) are a significant trend, with companies consolidating to achieve economies of scale, expand geographical reach, and enhance their recycling capabilities. For instance, recent M&A activities indicate a growing emphasis on vertical integration and the acquisition of specialized recycling businesses. The concentration ratio is estimated to be around 45%, with the top five players holding a substantial market share. M&A volumes have seen a consistent upward trend, with over $5 billion in transactions recorded in the historical period.

Iron Recycling Market Market Trends & Opportunities

The Iron Recycling Market is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period (2025–2033). This robust growth is fueled by a confluence of powerful trends. The escalating global demand for steel, coupled with the inherent environmental imperative to reduce reliance on virgin iron ore extraction, positions recycled iron as a critical component of the future steel supply chain. Governments worldwide are implementing increasingly stringent environmental regulations and offering incentives for industries adopting circular economy practices, directly benefiting the iron recycling sector. The continuous evolution of recycling technologies, including advanced sorting, shredding, and purification techniques, is enhancing the quality and usability of recycled iron, thereby broadening its application scope. Consumer preferences are also shifting towards products manufactured with a higher percentage of recycled content, influencing procurement decisions across various end-user industries. The automotive industry, driven by the pursuit of lighter, more fuel-efficient vehicles and the growing adoption of electric vehicles, is a significant driver of demand for high-quality recycled steel. The building and construction sector, propelled by global infrastructure development and a focus on sustainable building materials, represents another substantial market. Opportunities abound for companies that can invest in cutting-edge recycling infrastructure, develop innovative solutions for processing complex scrap materials, and forge strong partnerships across the value chain. The market penetration rate for recycled iron in certain steelmaking processes is expected to surpass 30% by the end of the forecast period. The overall market size is projected to reach over $75 billion by 2033, a significant increase from its current valuation.

Dominant Markets & Segments in Iron Recycling Market

The Building and Construction sector stands as a dominant force within the Iron Recycling Market. This segment's growth is intrinsically linked to global infrastructure development initiatives, urbanization trends, and the increasing adoption of green building practices. Governments worldwide are investing heavily in new construction projects, ranging from residential complexes and commercial buildings to essential infrastructure like bridges, roads, and railways. These projects require vast quantities of steel, and recycled iron offers a cost-effective and environmentally responsible alternative to virgin steel. Policies promoting the use of recycled materials in construction, coupled with the inherent durability and recyclability of iron and steel products, further bolster demand.

- Key Growth Drivers in Building and Construction:

- Infrastructure Development: Massive government spending on public works and infrastructure projects globally.

- Urbanization: Rapid growth of cities leading to increased demand for residential and commercial construction.

- Green Building Standards: Growing emphasis on sustainable construction materials and practices, favoring recycled content.

- Cost-Effectiveness: Recycled iron often provides a more economical option compared to primary iron production.

The Automotive industry is another significant segment driving the Iron Recycling Market. The automotive sector is under immense pressure to reduce its environmental footprint, and the extensive use of steel in vehicle manufacturing makes recycled iron a crucial component in achieving these sustainability goals. Modern vehicles are designed for recyclability, and the efficient recovery of steel scrap is paramount. The increasing demand for electric vehicles (EVs) also contributes, as EVs typically contain a substantial amount of steel in their chassis and body structures, and their lifecycle assessment increasingly favors recycled materials.

- Key Growth Drivers in Automotive:

- Lightweighting Initiatives: Demand for lighter vehicles to improve fuel efficiency and EV range, with advanced high-strength steels often incorporating recycled content.

- Circular Economy in Manufacturing: Automakers are committed to increasing the use of recycled materials in new vehicles.

- EV Production Growth: The burgeoning EV market necessitates a sustainable supply chain for vehicle components.

- End-of-Life Vehicle (ELV) Directives: Stringent regulations for recycling and recovering materials from decommissioned vehicles.

The Packaging segment, while smaller than construction or automotive, is also a consistent contributor. The production of tin cans and other ferrous packaging materials relies on iron, and recycling plays a vital role in meeting this demand efficiently and sustainably. The Shipbuilding industry, requiring robust and durable materials, also benefits from the use of recycled iron in its construction processes.

Iron Recycling Market Product Analysis

The Iron Recycling Market is characterized by a diverse range of recycled iron products, primarily categorized by their grade and purity. These products, derived from scrap metal, find widespread application across various industries. Technological advancements in shredding, magnetic separation, and other sorting techniques are enabling the production of higher-quality recycled iron, approaching the purity levels of virgin iron in many cases. This enhanced quality expands the applicability of recycled iron into more demanding sectors. Competitive advantages in this segment stem from efficient processing capabilities, the ability to consistently produce to specific customer specifications, and a strong emphasis on quality control. Innovations in downstream processing allow for the creation of specialized ferrous alloys from recycled materials, catering to niche market demands.

Key Drivers, Barriers & Challenges in Iron Recycling Market

Key Drivers:

- Environmental Regulations: Increasingly stringent global policies promoting waste reduction, recycling, and carbon emission mitigation are major catalysts.

- Economic Viability: The fluctuating prices of virgin iron ore and the generally lower cost of recycled iron make it an attractive economic alternative for steel producers.

- Technological Advancements: Improved sorting, processing, and purification technologies enhance the quality and applicability of recycled iron.

- Corporate Sustainability Goals: A growing number of companies across industries are setting ambitious sustainability targets, including increasing the use of recycled materials.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in scrap metal availability and quality can impact consistent supply for steel manufacturers.

- Contamination Issues: Impurities in scrap metal can affect the quality of the final recycled iron product and require advanced processing.

- Logistical Complexities: The transportation of bulky scrap metal and finished recycled iron can be costly and logistically challenging.

- Market Perception: In certain high-specification applications, a residual perception of lower quality compared to virgin iron can be a barrier.

- Energy Intensity of Processing: While reducing the need for mining, the recycling process itself can be energy-intensive if not optimized.

Growth Drivers in the Iron Recycling Market Market

The Iron Recycling Market is propelled by several interconnected growth drivers. Technologically, advancements in automated sorting, eddy current separation, and plasma torches are significantly improving the efficiency and purity of recycled iron streams. Economically, the rising cost of virgin iron ore, coupled with the often lower processing costs associated with recycling, makes it a more attractive proposition for steel manufacturers. Government policies, such as carbon pricing mechanisms and mandates for recycled content in new products, are creating a strong regulatory push. Furthermore, the increasing corporate focus on Environmental, Social, and Governance (ESG) metrics encourages companies to adopt sustainable sourcing practices, including the extensive use of recycled ferrous materials. The circular economy model, emphasizing resource efficiency and waste reduction, provides a foundational framework for sustained growth in this sector.

Challenges Impacting Iron Recycling Market Growth

Despite its positive trajectory, the Iron Recycling Market faces several challenges. Regulatory complexities can arise from varying national and regional waste management laws, impacting cross-border trade of scrap materials. Supply chain issues, including the availability and quality of scrap iron, can create bottlenecks and affect production schedules for steelmakers. Competitive pressures, both from primary iron producers and other recycling sectors, necessitate continuous innovation and cost optimization. Furthermore, the energy-intensive nature of some recycling processes, if not powered by renewable energy sources, can present a sustainability challenge. The need for significant capital investment in advanced recycling infrastructure can also act as a barrier to entry for smaller players.

Key Players Shaping the Iron Recycling Market Market

- Sims Limited

- ArcelorMittal

- Kimmel Scrap Iron & Metal Co Inc

- European Metal Recycling Ltd

- CMR Green Technologies Ltd

- CMC

- OmniSource LLC

- Schnitzer Steel Industries Inc

- Nucor Corporation

- Tata Steel

Significant Iron Recycling Market Industry Milestones

- December 2022: Nucor Corporation, the largest U.S.-based steel producer, announced its partnership with green iron company, Electra. Through this partnership, Nucor Corporation used Electra's iron to further lower the carbon emissions of its industry-leading sustainable steel and steel products.

- March 2022: ArcelorMittal acquired Scottish steel recycling business John Lawrie Metals Ltd., as part of the company's strategy of increasing the use of scrap steel to lower CO2 emissions from steelmaking.

Future Outlook for Iron Recycling Market Market

The future outlook for the Iron Recycling Market is exceptionally bright, driven by an unyielding global commitment to sustainability and resource efficiency. Strategic opportunities lie in developing advanced recycling technologies that can handle increasingly complex scrap streams and produce even higher grades of recycled iron. Expansion into emerging markets with growing industrial bases and increasing environmental awareness will be crucial. Furthermore, fostering stronger collaborations between scrap metal recyclers, steel producers, and end-users will create a more integrated and resilient circular economy for iron and steel. The market is projected to witness sustained growth, fueled by ongoing investments in green infrastructure, the automotive industry's transition to more sustainable materials, and a global push towards carbon neutrality. The demand for recycled iron is expected to outpace that of primary iron, solidifying its position as a cornerstone of future steel production.

Iron Recycling Market Segmentation

-

1. End-user Industry

- 1.1. Building and Construction

- 1.2. Automotive

- 1.3. Packaging

- 1.4. Shipbuilding

- 1.5. Electronics & Electrical Equipment

- 1.6. Consumer Appliances

- 1.7. Other End-User Industries

Iron Recycling Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Iron Recycling Market Regional Market Share

Geographic Coverage of Iron Recycling Market

Iron Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Urbanization and Industrialization; Increasing Awareness regarding the Depletion of Metal Reserves; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Unorganised Flow of Waste Metals; Other Restraints

- 3.4. Market Trends

- 3.4.1. Building and Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Building and Construction

- 5.1.2. Automotive

- 5.1.3. Packaging

- 5.1.4. Shipbuilding

- 5.1.5. Electronics & Electrical Equipment

- 5.1.6. Consumer Appliances

- 5.1.7. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Building and Construction

- 6.1.2. Automotive

- 6.1.3. Packaging

- 6.1.4. Shipbuilding

- 6.1.5. Electronics & Electrical Equipment

- 6.1.6. Consumer Appliances

- 6.1.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Building and Construction

- 7.1.2. Automotive

- 7.1.3. Packaging

- 7.1.4. Shipbuilding

- 7.1.5. Electronics & Electrical Equipment

- 7.1.6. Consumer Appliances

- 7.1.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Building and Construction

- 8.1.2. Automotive

- 8.1.3. Packaging

- 8.1.4. Shipbuilding

- 8.1.5. Electronics & Electrical Equipment

- 8.1.6. Consumer Appliances

- 8.1.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Building and Construction

- 9.1.2. Automotive

- 9.1.3. Packaging

- 9.1.4. Shipbuilding

- 9.1.5. Electronics & Electrical Equipment

- 9.1.6. Consumer Appliances

- 9.1.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Iron Recycling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Building and Construction

- 10.1.2. Automotive

- 10.1.3. Packaging

- 10.1.4. Shipbuilding

- 10.1.5. Electronics & Electrical Equipment

- 10.1.6. Consumer Appliances

- 10.1.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sims Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ArcelorMittal

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kimmel Scrap Iron & Metal Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 European Metal Recycling Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CMR Green Technologies Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CMC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OmniSource LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schnitzer Steel Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nucor Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tata Steel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sims Limited

List of Figures

- Figure 1: Global Iron Recycling Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Iron Recycling Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: Asia Pacific Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: North America Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: North America Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: Europe Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: Europe Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: South America Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: South America Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South America Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: South America Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Iron Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Iron Recycling Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Iron Recycling Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 37: Middle East and Africa Iron Recycling Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Middle East and Africa Iron Recycling Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Iron Recycling Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: Middle East and Africa Iron Recycling Market Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Iron Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Iron Recycling Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Iron Recycling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Iron Recycling Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: China Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Korea Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 23: United States Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United States Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Canada Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Canada Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Mexico Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Mexico Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Germany Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Germany Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Italy Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: France Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: France Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: Brazil Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Brazil Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Argentina Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Argentina Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Iron Recycling Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Iron Recycling Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Iron Recycling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global Iron Recycling Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: South Africa Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Africa Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Iron Recycling Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Iron Recycling Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iron Recycling Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Iron Recycling Market?

Key companies in the market include Sims Limited, ArcelorMittal, Kimmel Scrap Iron & Metal Co Inc, European Metal Recycling Ltd, CMR Green Technologies Ltd, CMC, OmniSource LLC, Schnitzer Steel Industries Inc, Nucor Corporation, Tata Steel.

3. What are the main segments of the Iron Recycling Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Urbanization and Industrialization; Increasing Awareness regarding the Depletion of Metal Reserves; Other Drivers.

6. What are the notable trends driving market growth?

Building and Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Unorganised Flow of Waste Metals; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Nucor Corporation, the largest U.S.-based steel producer announced its partnership with green iron company, Electra. Through this partnership, Nucor Corporation used Electra's iron to further lower the carbon emissions of its industry-leading sustainable steel and steel products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iron Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iron Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iron Recycling Market?

To stay informed about further developments, trends, and reports in the Iron Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence