Key Insights

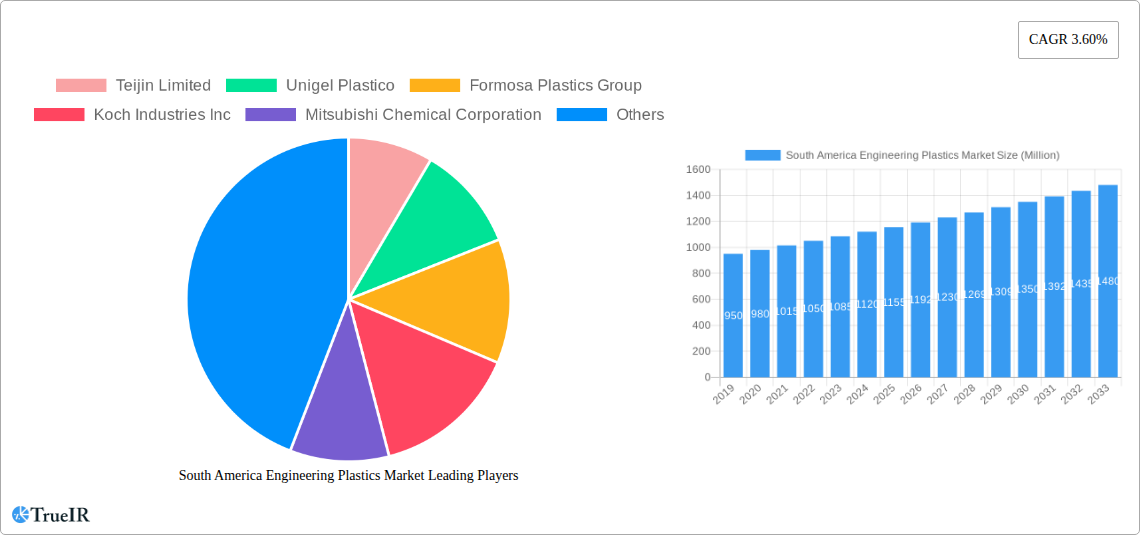

The South American engineering plastics market is poised for robust growth, projected to reach approximately $1.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.60% anticipated between 2025 and 2033. This expansion is primarily fueled by the escalating demand from key end-user industries such as automotive, building and construction, and electrical and electronics. The automotive sector, in particular, is a significant driver, with manufacturers increasingly adopting engineering plastics for lightweighting, fuel efficiency, and enhanced safety features in vehicles. Furthermore, the burgeoning infrastructure development and renovation projects across South America, especially in Brazil, are creating substantial opportunities for engineering plastics in construction applications, ranging from durable pipes and window profiles to advanced insulation materials. The growing adoption of advanced resins like Polycarbonate (PC), Polyethylene Terephthalate (PET), and Polyoxymethylene (POM) is attributed to their superior mechanical properties, thermal resistance, and chemical inertness, making them suitable replacements for traditional materials.

South America Engineering Plastics Market Market Size (In Million)

Despite the optimistic outlook, the market faces certain restraints, including price volatility of raw materials and increasing competition from alternative materials. Geopolitical factors and supply chain disruptions can also impact the cost and availability of essential feedstocks. However, ongoing technological advancements, the development of innovative resin formulations with improved performance characteristics, and a growing emphasis on sustainability and recyclability are expected to mitigate these challenges. The market is also witnessing a trend towards bio-based and recycled engineering plastics, driven by increasing environmental regulations and consumer preference for eco-friendly products. Emerging economies within South America, such as Colombia and Peru, are also expected to contribute significantly to market growth as their industrial bases mature and their adoption of advanced materials accelerates. Key players like Teijin Limited, Formosa Plastics Group, and BASF SE are strategically expanding their presence and product portfolios to capitalize on these market dynamics.

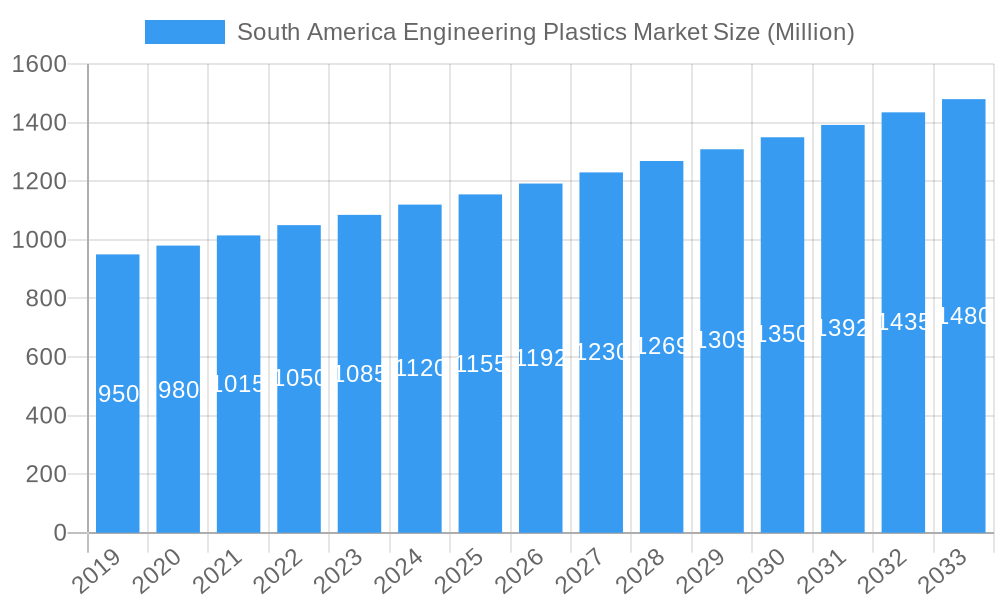

South America Engineering Plastics Market Company Market Share

Here is a dynamic, SEO-optimized report description for the South America Engineering Plastics Market, incorporating high-volume keywords and the requested structure and details:

South America Engineering Plastics Market: Growth, Trends, and Forecast 2025-2033

Unlock critical insights into the South America engineering plastics market with this comprehensive report. Covering the study period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, key players, and future projections. Discover opportunities in high-growth sectors like automotive, electrical & electronics, and packaging, driven by robust demand for advanced materials such as Polyamide (PA), Polycarbonate (PC), and Fluoropolymers. This report provides an in-depth examination of market structure, trends, dominant segments, product innovations, and the crucial drivers and challenges shaping the engineering plastics landscape across South America. With an estimated market size of over $5,000 Million in 2025, this report is an essential resource for stakeholders seeking to navigate and capitalize on this expanding market.

South America Engineering Plastics Market Market Structure & Competitive Landscape

The South America engineering plastics market exhibits a moderately concentrated structure, with key global players like BASF SE, SABIC, Celanese Corporation, and Covestro AG holding significant market shares. Innovation drivers are primarily focused on developing high-performance, sustainable, and lightweight materials to meet the evolving needs of industries such as automotive and electrical & electronics. Regulatory impacts, while present, are largely focused on safety and environmental standards, encouraging the adoption of compliant and eco-friendly plastic solutions. Product substitutes, while existing in the form of traditional plastics or alternative materials, are increasingly being outpaced by the superior properties of engineering plastics in demanding applications. End-user segmentation reveals a strong reliance on the automotive sector, followed closely by electrical & electronics and building & construction, indicating robust demand from these core industries. Mergers and acquisitions (M&A) trends are evident, with strategic acquisitions aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of DuPont's Mobility & Materials business by Celanese Corporation in November 2022 signifies a consolidation trend and a move to enhance competitive offerings. The market concentration is estimated to be around 65% for the top five players. M&A activities have seen a volume of over $500 Million in recent years, indicating strategic consolidation.

South America Engineering Plastics Market Market Trends & Opportunities

The South America engineering plastics market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust expansion is driven by increasing industrialization, a growing middle class, and a surging demand for advanced materials across various end-use industries. The automotive sector is a significant contributor, with a growing emphasis on lightweighting vehicles to improve fuel efficiency and reduce emissions, leading to increased adoption of engineering plastics like polyamides and polycarbonates. The electrical and electronics industry is another key growth engine, fueled by the proliferation of consumer electronics, advanced telecommunications infrastructure, and the burgeoning electric vehicle market, all of which require high-performance and durable plastic components. In the building and construction sector, engineering plastics are gaining traction for their durability, insulation properties, and ease of installation, particularly in applications such as window profiles, pipes, and insulation materials. The packaging industry, driven by the demand for more sustainable and functional packaging solutions, is also presenting significant opportunities for specialized engineering plastics. Technological advancements are continuously introducing new grades of engineering plastics with enhanced properties, such as improved thermal resistance, chemical inertness, and mechanical strength, catering to niche and demanding applications. Consumer preferences are shifting towards products that offer greater durability, aesthetic appeal, and environmental consciousness, further driving the demand for innovative engineering plastic solutions. Competitive dynamics are intensifying, with both global and regional players vying for market share through product differentiation, strategic partnerships, and capacity expansions. The market penetration rate for engineering plastics in certain automotive components is estimated to be above 70%. Opportunities also lie in the development of bio-based and recycled engineering plastics, aligning with global sustainability trends and regulatory pressures. The increasing investment in infrastructure projects across South America will also stimulate demand from the industrial and machinery segment. The market size for South America engineering plastics is projected to reach over $9,000 Million by 2033.

Dominant Markets & Segments in South America Engineering Plastics Market

The South America engineering plastics market is characterized by several dominant segments, with the Automotive end-user industry consistently leading in terms of consumption and growth potential. This dominance is fueled by the region's expanding automotive manufacturing base and a growing consumer demand for vehicles equipped with advanced safety features, enhanced fuel efficiency, and improved aesthetics. The shift towards electric vehicles is further accelerating the demand for lightweight and high-performance engineering plastics that can withstand demanding operational conditions. Within resin types, Polyamide (PA), particularly Polyamide (PA) 6 and Polyamide (PA) 66, holds a significant market share due to its excellent mechanical strength, thermal stability, and chemical resistance, making it ideal for under-the-hood automotive components, interior parts, and electrical connectors. Polycarbonate (PC) is another major resin type, valued for its impact resistance, transparency, and dimensional stability, finding widespread application in automotive lighting, glazing, and interior components, as well as in the electrical and electronics sector for device housings and connectors.

The Electrical and Electronics end-user industry is the second-largest contributor, driven by the increasing demand for consumer electronics, telecommunications equipment, and the ongoing digitalization of various sectors. Engineering plastics are crucial for their insulating properties, flame retardancy, and miniaturization capabilities, enabling the production of smaller, more efficient, and safer electronic devices. Styrene Copolymers (ABS and SAN) are widely used in this sector for their excellent impact resistance, surface finish, and processability, commonly found in casings for computers, televisions, and household appliances.

The Building and Construction sector is a growing market for engineering plastics, with applications ranging from durable window profiles and pipes to insulation materials and architectural components. The demand for energy-efficient and sustainable construction solutions is boosting the adoption of materials like Polyvinylidene Fluoride (PVDF) for its weatherability and chemical resistance.

Key growth drivers in these dominant segments include:

- Automotive:

- Increasing production of passenger cars and commercial vehicles.

- Growing adoption of electric vehicles (EVs) requiring lightweight and high-performance materials.

- Stringent regulations on vehicle emissions and safety standards.

- Consumer demand for advanced features and improved aesthetics.

- Electrical and Electronics:

- Rapid growth in the consumer electronics market.

- Expansion of 5G network infrastructure and IoT devices.

- Demand for durable and flame-retardant materials for electronic components.

- Miniaturization trends in electronic devices.

- Building and Construction:

- Urbanization and infrastructure development projects.

- Increasing focus on energy-efficient buildings.

- Demand for durable and weather-resistant construction materials.

- Growth in renovation and retrofitting activities.

While the Packaging segment is significant, its growth is more focused on specialized applications requiring higher performance compared to commodity plastics. The Industrial and Machinery segment also contributes steadily, with engineering plastics used in components requiring high strength and wear resistance. The Aerospace industry, though smaller in volume, represents a high-value segment driven by the need for lightweight, high-strength, and fire-resistant materials.

South America Engineering Plastics Market Product Analysis

South America engineering plastics market is witnessing continuous product innovation driven by the pursuit of enhanced performance, sustainability, and cost-effectiveness. Key advancements include the development of specialized grades of Polycarbonate (PC) with improved UV resistance and impact strength for automotive applications and the introduction of high-flow Polyamide (PA) grades for intricate component manufacturing in the electrical and electronics sector. Fluoropolymers, particularly PVDF and PTFE, are gaining traction for their exceptional chemical resistance and thermal stability, finding applications in demanding industrial environments and advanced filtration systems. The market is also seeing an increasing focus on bio-based and recycled engineering plastics, aligning with global sustainability goals and catering to environmentally conscious manufacturers and consumers. These innovations aim to offer superior mechanical, thermal, and chemical properties, enabling engineers to design lighter, stronger, and more durable products across diverse applications, providing a significant competitive advantage in their respective markets.

Key Drivers, Barriers & Challenges in South America Engineering Plastics Market

Key Drivers:

- Robust Automotive Sector Growth: Increasing vehicle production and the transition towards electric vehicles are major catalysts, demanding lightweight and high-performance engineering plastics for enhanced fuel efficiency and battery performance.

- Expanding Electrical & Electronics Industry: The proliferation of consumer electronics, telecommunications infrastructure, and smart devices drives demand for insulating, durable, and miniaturized plastic components.

- Infrastructure Development: Government initiatives and private investments in infrastructure projects across South America spur demand for engineering plastics in construction, industrial machinery, and transportation.

- Technological Advancements: Continuous innovation in material science leads to the development of engineering plastics with superior mechanical, thermal, and chemical properties, opening new application avenues.

- Growing Consumer Demand: An increasing middle class with higher disposable income fuels demand for durable goods, appliances, and vehicles, indirectly benefiting the engineering plastics market.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the prices of crude oil and petrochemical feedstocks can impact the manufacturing costs of engineering plastics, affecting market competitiveness.

- Economic Instability and Political Uncertainty: Economic downturns and political instability in some South American countries can dampen industrial output and consumer spending, thereby restraining market growth.

- Supply Chain Disruptions: Global and regional supply chain issues, including logistics challenges and raw material availability, can lead to production delays and increased costs.

- Competition from Traditional Plastics and Substitutes: While engineering plastics offer superior performance, they face competition from lower-cost commodity plastics and alternative materials in less demanding applications.

- Environmental Regulations and Sustainability Pressures: Increasing environmental scrutiny and the demand for sustainable materials necessitate investment in recycling technologies and the development of eco-friendly alternatives, posing a challenge for some manufacturers. The cost associated with compliance to evolving environmental standards can be significant.

Growth Drivers in the South America Engineering Plastics Market Market

Key growth drivers in the South America Engineering Plastics Market are multi-faceted. The automotive industry's persistent expansion, coupled with the accelerating shift towards electric vehicles (EVs), is a primary catalyst. EVs require lighter materials for better battery range, directly boosting demand for engineering plastics like Polyamide (PA) and Polycarbonate (PC). Economic development and infrastructure investments across nations like Brazil and Argentina are significantly driving demand from the building and construction and industrial and machinery sectors, utilizing these durable and high-performance materials for various applications. Technological advancements are continuously enabling the creation of novel engineering plastics with superior properties, opening up new market opportunities, especially in the high-value electrical and electronics segment for advanced device manufacturing. Furthermore, growing consumer purchasing power and a preference for durable, aesthetically pleasing goods are indirectly fueling market growth.

Challenges Impacting South America Engineering Plastics Market Growth

Challenges impacting the South America Engineering Plastics Market include significant economic volatility and political uncertainties within several regional economies, which can hinder industrial investment and consumer spending. The price volatility of raw materials, primarily linked to petrochemical feedstocks, poses a constant threat to profit margins and price competitiveness. Supply chain disruptions, exacerbated by global events and regional logistics complexities, can lead to production delays and increased operational costs, impacting timely delivery. Intense competition from lower-cost commodity plastics and alternative materials also presents a restraint, particularly in price-sensitive applications. Moreover, evolving environmental regulations and increasing consumer demand for sustainable solutions necessitate substantial investments in recycling technologies and the development of bio-based alternatives, creating a hurdle for some manufacturers to adapt quickly.

Key Players Shaping the South America Engineering Plastics Market Market

- Teijin Limited

- Unigel Plastico

- Formosa Plastics Group

- Koch Industries Inc

- Mitsubishi Chemical Corporation

- Celanese Corporation

- Indorama Ventures Public Company Limited

- China Petroleum & Chemical Corporation

- LANXESS

- BASF SE

- SABIC

- Trinseo

- Alfa S A B de C V

- Covestro AG

- Enka

Significant South America Engineering Plastics Market Industry Milestones

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing. This product launch diversifies applications and targets a high-growth, high-value sector.

- January 2023: UNIGEL decided to partner with MECS Inc. for the construction of a new sulfuric acid plant, which will subsequently increase the production of PMMA. This partnership aims to bolster production capacity for PMMA, addressing potential market demand increases.

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont, solidifying its market position and expanding its offering.

Future Outlook for South America Engineering Plastics Market Market

The future outlook for the South America engineering plastics market is exceptionally promising, driven by sustained demand from key sectors and ongoing technological advancements. The automotive industry's transition to electric mobility will continue to be a major growth catalyst, alongside robust expansion in electrical & electronics and building & construction. Emerging opportunities also lie in the development and adoption of sustainable, bio-based, and recycled engineering plastics, aligning with global environmental imperatives and regulatory trends. Strategic investments in capacity expansion, research and development for high-performance materials, and potential consolidation through mergers and acquisitions are expected to shape the market landscape. The increasing focus on industrial automation and digitalization will further create demand for specialized engineering plastics with superior functionalities. Overall, the market is poised for consistent growth, presenting significant strategic opportunities for stakeholders to capitalize on evolving industry needs and technological innovations.

South America Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

South America Engineering Plastics Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Engineering Plastics Market Regional Market Share

Geographic Coverage of South America Engineering Plastics Market

South America Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment

- 3.3. Market Restrains

- 3.3.1. Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Engineering Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teijin Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unigel Plastico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Formosa Plastics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koch Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Chemical Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Celanese Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indorama Ventures Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Petroleum & Chemical Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LANXESS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SABIC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Trinseo

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Alfa S A B de C V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Covestro AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Enka

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Teijin Limited

List of Figures

- Figure 1: South America Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Engineering Plastics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Engineering Plastics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 2: South America Engineering Plastics Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 3: South America Engineering Plastics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Engineering Plastics Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 5: South America Engineering Plastics Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 6: South America Engineering Plastics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Engineering Plastics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Engineering Plastics Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the South America Engineering Plastics Market?

Key companies in the market include Teijin Limited, Unigel Plastico, Formosa Plastics Group, Koch Industries Inc, Mitsubishi Chemical Corporation, Celanese Corporation, Indorama Ventures Public Company Limited, China Petroleum & Chemical Corporation, LANXESS, BASF SE, SABIC, Trinseo, Alfa S A B de C V, Covestro AG, Enka.

3. What are the main segments of the South America Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.January 2023: UNIGEL decided to partner with MECS Inc. for the construction of a new sulfuric acid plant, which will subsequently increase the production of PMMA.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the South America Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence