Key Insights

The South American swine feed market, covering Brazil, Argentina, and other South American nations, is projected for robust expansion. With a projected market size of $12.5 billion for 2025, and a Compound Annual Growth Rate (CAGR) of 4.9% from the base year 2025, this sector is poised for significant development. Key growth drivers include escalating pork consumption, fueled by regional population increases and a rising middle class. Moreover, advancements in swine farming practices, encompassing enhanced breeding and disease control, are boosting feed efficiency and demand. A growing emphasis on sustainable and efficient feed production, through the utilization of by-products and optimized ingredient sourcing, also contributes to market growth. However, potential restraints include fluctuating raw material prices, particularly for cereals and oilseeds, and regional economic volatility.

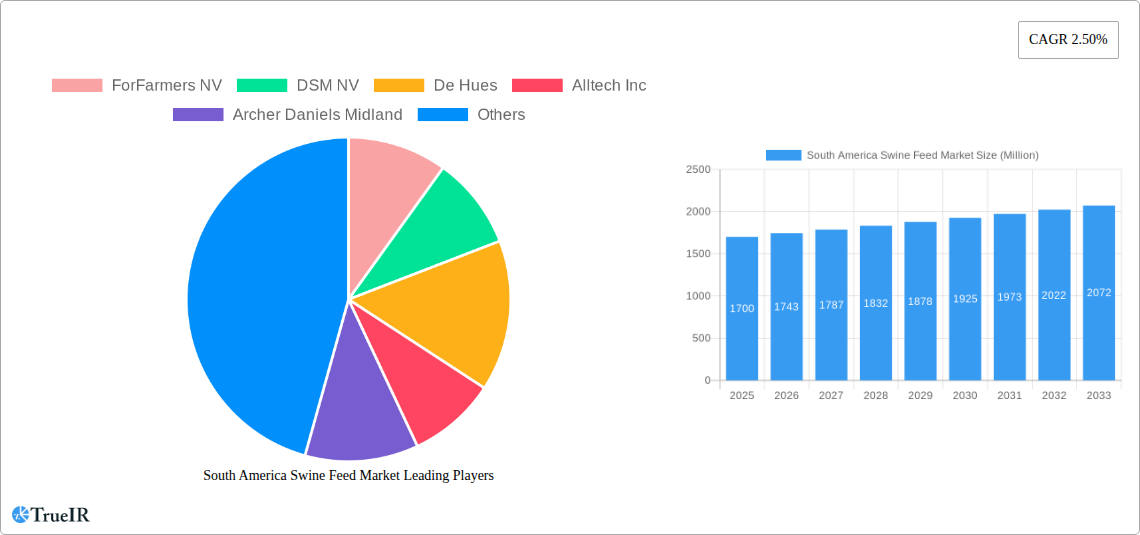

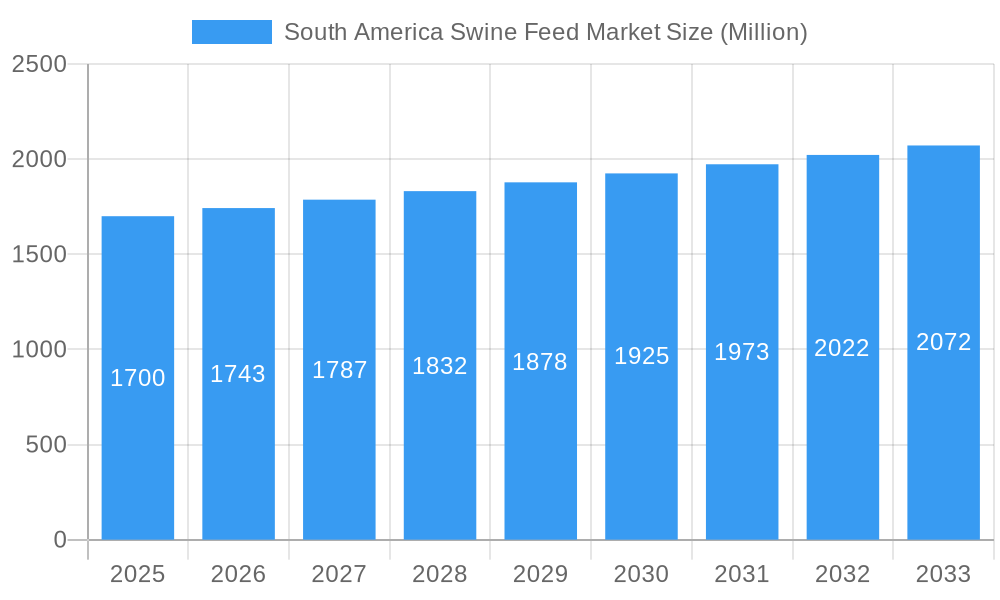

South America Swine Feed Market Market Size (In Billion)

Market segmentation highlights substantial opportunities. Cereals and their by-products constitute a primary segment, while the supplements sector (vitamins, amino acids, probiotics) is experiencing accelerated growth due to an increasing focus on animal health and performance optimization. Leading entities such as ForFarmers NV, DSM NV, and Cargill Inc. are strategically establishing their presence in this dynamic market through investments in research and development and the expansion of their regional distribution networks. The competitive environment features both established global corporations and regional enterprises, resulting in a blend of advanced feed formulations and localized solutions. Future market forecasts, assuming a continued 4.9% CAGR from the $12.5 billion 2025 valuation, indicate sustained growth through 2033. Vigilant monitoring of economic conditions and raw material costs remains essential for precise market forecasting in this evolving landscape.

South America Swine Feed Market Company Market Share

South America Swine Feed Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the South America Swine Feed market, offering crucial insights for businesses, investors, and stakeholders. Leveraging extensive research and data analysis from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report illuminates market trends, competitive dynamics, and future growth prospects. With a focus on key segments including Ingredient Type (Cereals, Cereals by-products, Oil Seed Meal, Oils, Supplements, Others) and Supplement Type (Vitamins, Amino Acids, Antibiotics, Enzymes, Antioxidants, Acidifiers, Probiotics & Prebiotics, Others), this report is an indispensable resource for navigating the complexities of this rapidly evolving market. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

South America Swine Feed Market Structure & Competitive Landscape

The South America Swine Feed market is characterized by a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players such as ForFarmers NV, DSM NV, De Hues, Alltech Inc, Archer Daniels Midland, Cargill Inc, Lallemand Animal Nutrition, Biomi, Trouw Nutrition (Nutreco NV), and Purina Mills Inc (Land O Lakes) compete intensely, driving innovation and influencing market dynamics. The market's competitive landscape is shaped by several factors:

- Innovation Drivers: Continuous research and development in feed formulations, focusing on enhanced nutritional value, improved digestibility, and disease resistance, are key drivers. The incorporation of novel ingredients and technologies further fuels competition.

- Regulatory Impacts: Government regulations regarding feed safety, animal welfare, and environmental sustainability significantly impact market players' strategies and operational costs. Compliance with evolving regulations is paramount.

- Product Substitutes: While limited, alternative feed sources and the increasing adoption of vertical integration strategies by some players create subtle competitive pressure.

- End-User Segmentation: The market caters to various swine farming sizes, from small-scale operations to large-scale industrial farms, each presenting specific needs and preferences influencing product development and marketing strategies.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) has been observed in the past few years, with xx major deals recorded between 2019 and 2024, primarily driven by economies of scale and market expansion ambitions.

South America Swine Feed Market Trends & Opportunities

The South America Swine Feed market is experiencing robust growth, fueled by several key factors: rising per capita meat consumption, increasing demand for high-quality pork, and the expansion of the swine farming industry. The market size exhibited a CAGR of xx% during the historical period (2019-2024) and is poised to continue this trajectory throughout the forecast period (2025-2033). This growth is driven by several factors:

Technological advancements in feed formulation and production processes are enhancing efficiency and nutritional value, leading to improved animal health and productivity. Consumer preferences for healthier and ethically sourced pork are indirectly driving the demand for advanced feed solutions. The growing adoption of precision feeding techniques and data-driven farming practices further contributes to market expansion. Competitive dynamics are pushing companies to invest in R&D, leading to innovative product offerings and improved supply chain management. Market penetration of technologically advanced feed solutions is steadily increasing, with estimates showing a xx% penetration rate in 2025, projected to reach xx% by 2033. These trends create significant opportunities for market players to capitalize on the growing demand for high-quality and efficient swine feed solutions.

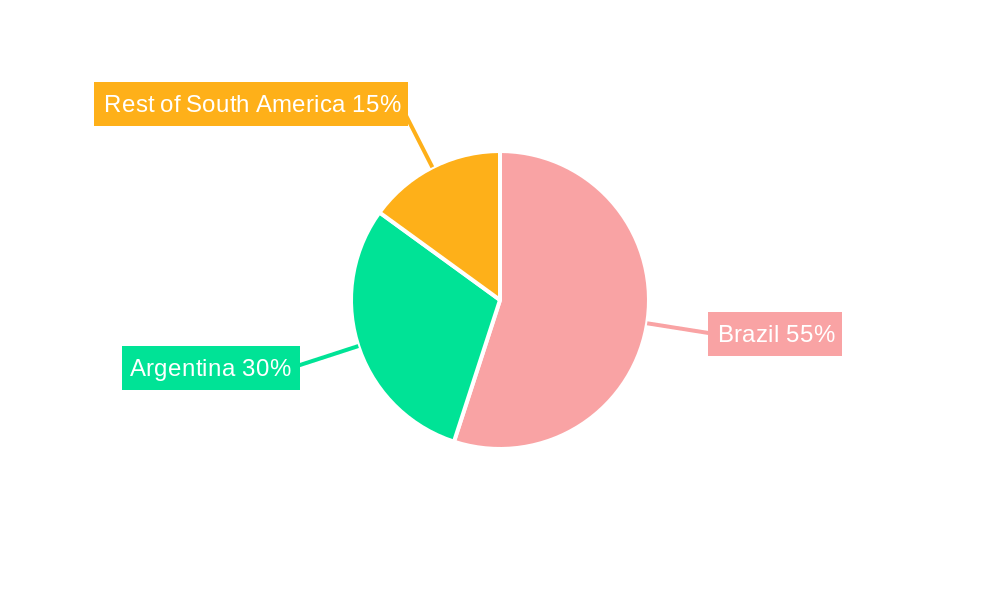

Dominant Markets & Segments in South America Swine Feed Market

While specific data is needed to pinpoint exact market share dominance, the Brazilian swine feed market represents a significant portion of the total South America market due to its extensive swine production. Within the segment breakdown, the ‘Cereals’ category under Ingredient Type and the ‘Vitamins’ category under Supplement Type are projected to dominate the market in 2025, driven by their essential role in animal nutrition.

Key Growth Drivers in Brazil:

- Robust infrastructure supporting the swine industry, including feed mills and transportation networks.

- Government policies promoting agricultural development and livestock production.

- Favorable climatic conditions contributing to efficient feed crop cultivation.

- High demand for pork from a growing population.

Detailed Analysis of Market Dominance: The dominance of cereals is largely due to their affordability and accessibility as a primary energy source. Vitamins are essential for maintaining animal health and productivity. The market shares for other segments will be further investigated and detailed in the full report. Competition within the cereals segment is primarily focused on quality, price, and sourcing. Competition in the vitamins segment hinges on efficacy, safety, and regulatory compliance.

South America Swine Feed Market Product Analysis

The South America Swine Feed market showcases a diverse range of products tailored to different swine life stages and production systems. Recent technological advancements have led to the development of specialized feed formulations focusing on improved nutrient bioavailability, reduced environmental impact (e.g., reduced phosphorus excretion), and enhanced disease resistance through the incorporation of prebiotics and probiotics. These innovations are increasing the market appeal of premium products, but also facing challenges in affordability and access for smaller producers. The competitive advantage lies in delivering superior value proposition through enhanced animal performance, reduced production costs, and improved sustainability.

Key Drivers, Barriers & Challenges in South America Swine Feed Market

Key Drivers: Rising pork consumption, expanding swine farming industry, government support for agricultural development, technological advancements in feed production and formulation, and the increasing adoption of precision feeding technologies.

Challenges: Fluctuations in raw material prices, complex regulatory landscape impacting feed formulation and labeling, logistical challenges impacting feed distribution, and intense competition among established players. These factors can lead to unpredictable price volatility and operational constraints.

Growth Drivers in the South America Swine Feed Market

Key growth drivers are the expanding swine production sector, technological advancements in feed formulation, growing consumer demand for higher-quality pork, and government initiatives promoting agricultural development. These factors combined are contributing to the substantial growth seen and expected in the South American Swine Feed market.

Challenges Impacting South America Swine Feed Market Growth

Challenges include fluctuations in raw material prices, particularly grains and oilseeds, logistical constraints in transporting feed to remote areas, and regulatory hurdles concerning feed safety and environmental regulations. These barriers, if not addressed effectively, can impede market growth and profitability.

Key Players Shaping the South America Swine Feed Market

- ForFarmers NV

- DSM NV

- De Hues

- Alltech Inc

- Archer Daniels Midland

- Cargill Inc

- Lallemand Animal Nutrition

- Biomi

- Trouw Nutrition (Nutreco NV)

- Purina Mills Inc (Land O Lakes)

Significant South America Swine Feed Market Industry Milestones

- 2021: Launch of a new line of sustainable feed solutions by DSM NV focusing on reduced environmental impact.

- 2022: Acquisition of a regional feed mill by Cargill Inc, expanding its market reach in Brazil.

- 2023: Introduction of a novel feed additive by Alltech Inc enhancing swine gut health and immunity.

- 2024: Implementation of stricter feed safety regulations in key South American countries. (Further milestones require additional data.)

Future Outlook for South America Swine Feed Market

The South America Swine Feed market is projected to experience continued growth driven by rising pork consumption, advancements in feed technology, and supportive government policies. Strategic opportunities exist for companies to invest in innovative feed solutions, optimize supply chains, and capitalize on the increasing demand for sustainable and efficient animal production practices. The market’s future potential is significant, promising healthy returns for those who adapt to the evolving needs of the industry.

South America Swine Feed Market Segmentation

-

1. Ingredient Type

- 1.1. Cereals

- 1.2. Cereals by-products

- 1.3. Oil Seed Meal

- 1.4. Oils

- 1.5. Suplements

- 1.6. Others

-

2. Supplement Type

- 2.1. Vitamins

- 2.2. Amino Acids

- 2.3. Antibiotics

- 2.4. Enzymes

- 2.5. Antioxidants

- 2.6. Acidifiers

- 2.7. Probiotics & Prebiotics

- 2.8. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Swine Feed Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Swine Feed Market Regional Market Share

Geographic Coverage of South America Swine Feed Market

South America Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Pig Stocks in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Cereals

- 5.1.2. Cereals by-products

- 5.1.3. Oil Seed Meal

- 5.1.4. Oils

- 5.1.5. Suplements

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Supplement Type

- 5.2.1. Vitamins

- 5.2.2. Amino Acids

- 5.2.3. Antibiotics

- 5.2.4. Enzymes

- 5.2.5. Antioxidants

- 5.2.6. Acidifiers

- 5.2.7. Probiotics & Prebiotics

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. Brazil South America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Cereals

- 6.1.2. Cereals by-products

- 6.1.3. Oil Seed Meal

- 6.1.4. Oils

- 6.1.5. Suplements

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Supplement Type

- 6.2.1. Vitamins

- 6.2.2. Amino Acids

- 6.2.3. Antibiotics

- 6.2.4. Enzymes

- 6.2.5. Antioxidants

- 6.2.6. Acidifiers

- 6.2.7. Probiotics & Prebiotics

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Argentina South America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Cereals

- 7.1.2. Cereals by-products

- 7.1.3. Oil Seed Meal

- 7.1.4. Oils

- 7.1.5. Suplements

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Supplement Type

- 7.2.1. Vitamins

- 7.2.2. Amino Acids

- 7.2.3. Antibiotics

- 7.2.4. Enzymes

- 7.2.5. Antioxidants

- 7.2.6. Acidifiers

- 7.2.7. Probiotics & Prebiotics

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Rest of South America South America Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Cereals

- 8.1.2. Cereals by-products

- 8.1.3. Oil Seed Meal

- 8.1.4. Oils

- 8.1.5. Suplements

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Supplement Type

- 8.2.1. Vitamins

- 8.2.2. Amino Acids

- 8.2.3. Antibiotics

- 8.2.4. Enzymes

- 8.2.5. Antioxidants

- 8.2.6. Acidifiers

- 8.2.7. Probiotics & Prebiotics

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ForFarmers NV

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 DSM NV

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 De Hues

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Alltech Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Archer Daniels Midland

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cargill Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Lallemand Animal Nutrition

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Biomi

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Trouw Nutrition (Nutreco NV)

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Purina Mills Inc ( Land O Lakes )

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 ForFarmers NV

List of Figures

- Figure 1: South America Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: South America Swine Feed Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 2: South America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 3: South America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Swine Feed Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 6: South America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 7: South America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Swine Feed Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 10: South America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 11: South America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Swine Feed Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 14: South America Swine Feed Market Revenue billion Forecast, by Supplement Type 2020 & 2033

- Table 15: South America Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Swine Feed Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the South America Swine Feed Market?

Key companies in the market include ForFarmers NV, DSM NV, De Hues, Alltech Inc, Archer Daniels Midland, Cargill Inc, Lallemand Animal Nutrition, Biomi, Trouw Nutrition (Nutreco NV), Purina Mills Inc ( Land O Lakes ).

3. What are the main segments of the South America Swine Feed Market?

The market segments include Ingredient Type, Supplement Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Pig Stocks in the Region.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Swine Feed Market?

To stay informed about further developments, trends, and reports in the South America Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence