Key Insights

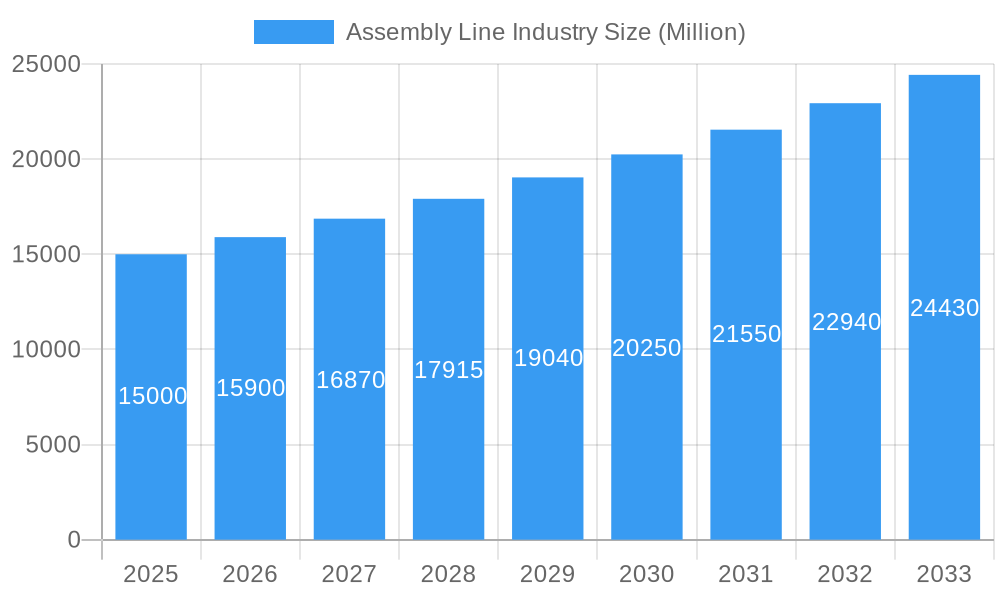

The global assembly line market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 7.85% from a base year of 2025. This robust growth is propelled by several key factors. Widespread automation adoption across diverse manufacturing sectors, driven by the imperative for enhanced efficiency, precision, and cost reduction, stands as a primary catalyst. The escalating integration of Industry 4.0 technologies, encompassing robotics, artificial intelligence, and the Internet of Things (IoT), is accelerating this trend, fostering the development of smart factories and optimized production workflows. Increasing demand for bespoke products and expedited product lifecycles necessitates agile and adaptable assembly lines, spurring investment in sophisticated automation solutions. Furthermore, the burgeoning e-commerce sector and its resultant surge in consumer goods demand are significant contributors to the industry's upward trajectory. Challenges include substantial initial capital expenditure for advanced automation and the requirement for a skilled workforce. However, sustained innovation in areas such as collaborative robots (cobots) and predictive maintenance is expected to counterbalance these constraints, ensuring a positive long-term outlook. The current market size is estimated at $307.15 billion.

Assembly Line Industry Market Size (In Billion)

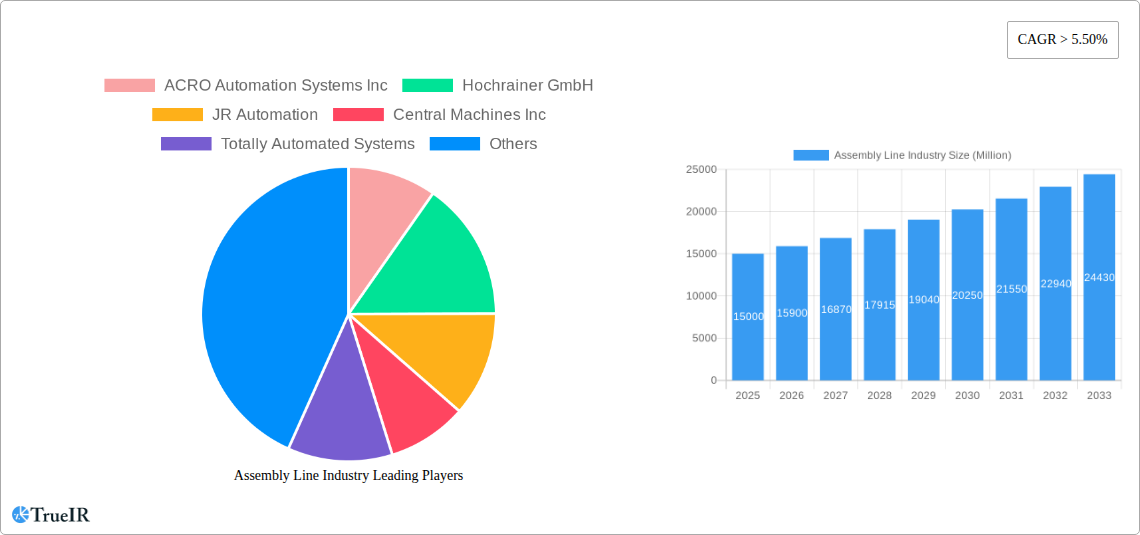

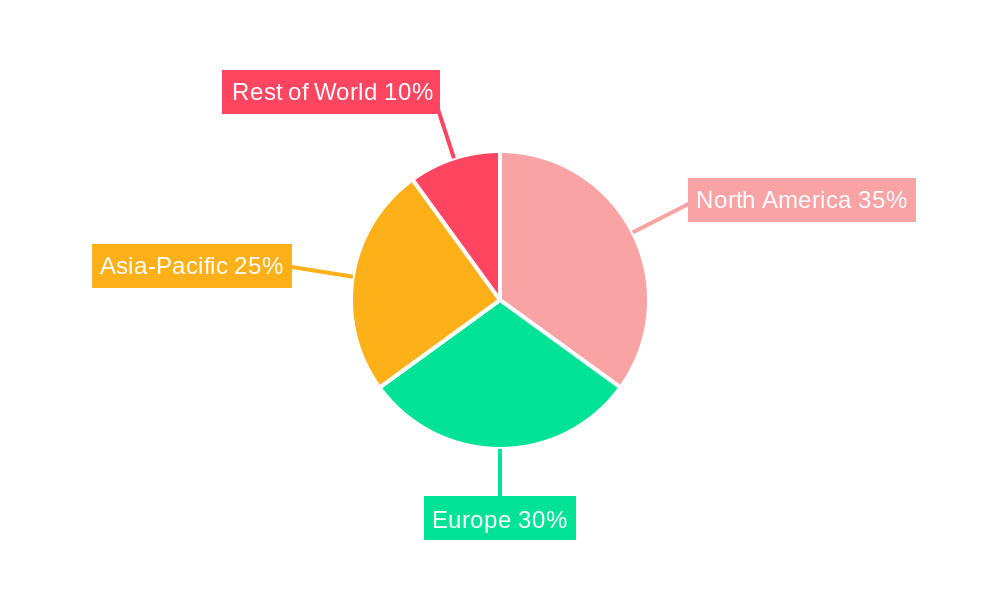

The competitive arena features a blend of major multinational corporations and specialized niche providers. Key industry participants are distinguished by their technical prowess, comprehensive product offerings, and global presence. Regional growth disparities are anticipated, with North America and Europe exhibiting significant expansion due to technological advancements and established manufacturing infrastructure. Emerging economies, particularly in Asia-Pacific and Latin America, are also projected for considerable growth, fueled by industrial development and increased foreign direct investment. Market segmentation is expected to be influenced by automation type (e.g., robotic, automated guided vehicles), served industries (e.g., automotive, electronics, pharmaceuticals), and geographic location. A granular analysis of specific industry segments and regional dynamics is crucial for precise forecasting, yet the overarching growth trend signifies substantial opportunities within this dynamic sector.

Assembly Line Industry Company Market Share

Assembly Line Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global assembly line industry, encompassing market size, competitive landscape, technological advancements, and future growth projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report projects a market value exceeding $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Assembly Line Industry Market Structure & Competitive Landscape

The global assembly line industry is characterized by a moderately concentrated market structure. While a few large players dominate, a significant number of smaller, specialized companies cater to niche segments. The industry's concentration ratio (CR4) is estimated at XX%, indicating a moderate level of competition. Key drivers of innovation include the increasing adoption of automation technologies, Industry 4.0 initiatives, and the growing demand for customized assembly solutions. Regulatory impacts vary across regions, with differing safety and environmental standards influencing production costs and processes. Product substitutes, such as manual assembly, are increasingly less viable due to rising labor costs and the need for higher production efficiency. End-user segmentation includes automotive, electronics, food and beverage, pharmaceuticals, and other manufacturing sectors. M&A activity has been significant, with a total transaction value exceeding $XX Million in the historical period (2019-2024).

- Concentration Ratios: CR4 estimated at XX% in 2024.

- M&A Volume (2019-2024): $XX Million.

- Key Innovation Drivers: Automation, Industry 4.0, Customization.

- Regulatory Impacts: Vary significantly by region.

- Major End-Users: Automotive, Electronics, Food & Beverage, Pharmaceuticals.

Assembly Line Industry Market Trends & Opportunities

The global assembly line industry is experiencing robust growth, driven by several factors. Market size is projected to reach $XX Million by 2025 and exceed $XX Million by 2033. Technological advancements, such as the increasing integration of robotics, AI, and IoT, are transforming assembly processes, leading to enhanced efficiency and productivity. The shift towards flexible manufacturing and customized solutions is also driving demand. The automotive industry remains a key driver, with ongoing investments in electric vehicle production and the increasing adoption of automated assembly lines. Competitive dynamics are intense, with companies focusing on innovation, cost optimization, and strategic partnerships to maintain their market share. The market penetration rate of advanced automation technologies is growing steadily, exceeding XX% in key regions. The CAGR for the forecast period is projected at XX%. Specific opportunities exist in emerging markets with expanding manufacturing sectors and a growing demand for efficient assembly solutions.

Dominant Markets & Segments in Assembly Line Industry

The Asia-Pacific region dominates the global assembly line industry, accounting for over XX% of the market share in 2024. This dominance is primarily driven by rapid industrialization, a large manufacturing base, and increasing investments in automation. China and Japan are the leading countries within this region.

- Key Growth Drivers in Asia-Pacific:

- Rapid Industrialization

- Extensive Manufacturing Base

- Significant Investments in Automation Technologies

- Supportive Government Policies

- Market Dominance Analysis: The Asia-Pacific region's leadership stems from its robust manufacturing sector, supportive government policies promoting automation, and the presence of several major players in the assembly line industry. This dominance is expected to continue throughout the forecast period, though other regions are projected to witness significant growth as well.

Assembly Line Industry Product Analysis

The assembly line industry is witnessing a wave of product innovations focused on enhancing efficiency, flexibility, and safety. These innovations include collaborative robots (cobots), advanced vision systems, and modular assembly lines that can adapt to changing production requirements. The competitive advantage lies in offering customized solutions, integrating advanced technologies, and providing robust after-sales support. These advancements are effectively addressing market needs for greater speed, precision, and reduced labor costs in various sectors, leading to increased adoption across industries.

Key Drivers, Barriers & Challenges in Assembly Line Industry

Key Drivers: The increasing demand for automation across diverse industries, the growing adoption of Industry 4.0 technologies, and favorable government policies promoting industrial automation are primary growth drivers. The increasing need for customized products and flexible manufacturing systems also fuels market expansion.

Challenges: Supply chain disruptions, particularly concerning semiconductor components, have significantly impacted production capacities and timelines. Stricter environmental regulations are increasing compliance costs, and intense competition necessitates continuous innovation to maintain market share.

Growth Drivers in the Assembly Line Industry Market

Technological advancements, including AI-powered robotics and sophisticated vision systems, are significantly impacting growth. Economic factors, such as rising labor costs and the increasing demand for efficient production, are driving automation adoption. Favorable government policies promoting industrial automation in various regions contribute to market expansion. The expanding global manufacturing base, particularly in emerging economies, also fuels growth.

Challenges Impacting Assembly Line Industry Growth

Supply chain vulnerabilities, particularly the reliance on specific geographical regions for key components, pose a significant challenge. Regulatory complexities, including varying safety and environmental standards across regions, increase compliance costs and operational challenges. Intense competition, with both established players and new entrants vying for market share, creates pressure on pricing and profitability.

Key Players Shaping the Assembly Line Industry Market

- ACRO Automation Systems Inc

- Hochrainer GmbH

- JR Automation

- Central Machines Inc

- Totally Automated Systems

- Fusion Systems Group

- Adescor Inc

- Gemtec GmbH

- Markone Control Systems

- Eriez Manufacturing Co

- NEVMAT Australia PTY LTD

- RNA Automation

- UMD Automated Systems

- Mondragon Assembly

- Hitachi Power Solutions Co Ltd

- MechTech Automation Group

- RG-Luma Automation

- BBS Automation

- SITEC Industrietechnologie GmbH

Significant Assembly Line Industry Milestones

- May 2021: Mondragon Assembly expands into the USA market with a new Chicago subsidiary. This significantly broadens their reach and provides enhanced service to US customers, positively impacting market share.

- Aug 2021: JR Automation unifies its five divisional brands under a single corporate identity. This streamlining improves operational efficiency and strengthens brand recognition, enhancing its competitive position.

Future Outlook for Assembly Line Industry Market

The assembly line industry is poised for continued growth, driven by ongoing technological advancements, the increasing demand for automation across various sectors, and supportive government policies. Strategic opportunities exist in developing customized solutions, integrating advanced technologies, and expanding into emerging markets. The market potential is substantial, with significant growth projected across all major regions.

Assembly Line Industry Segmentation

-

1. Type

- 1.1. Manual Assembly Lines

- 1.2. Semi-automated Assembly Lines

- 1.3. Fully Automated Assembly Lines

-

2. End-user

- 2.1. Automotive

- 2.2. Industrial Manufacturing

- 2.3. Electronics and Semiconductors

- 2.4. Medical & Pharmaceutical

- 2.5. Others

Assembly Line Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Rest of the World

Assembly Line Industry Regional Market Share

Geographic Coverage of Assembly Line Industry

Assembly Line Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Electric Vehicle Companies Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Manual Assembly Lines

- 5.1.2. Semi-automated Assembly Lines

- 5.1.3. Fully Automated Assembly Lines

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Industrial Manufacturing

- 5.2.3. Electronics and Semiconductors

- 5.2.4. Medical & Pharmaceutical

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Manual Assembly Lines

- 6.1.2. Semi-automated Assembly Lines

- 6.1.3. Fully Automated Assembly Lines

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Industrial Manufacturing

- 6.2.3. Electronics and Semiconductors

- 6.2.4. Medical & Pharmaceutical

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Manual Assembly Lines

- 7.1.2. Semi-automated Assembly Lines

- 7.1.3. Fully Automated Assembly Lines

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Industrial Manufacturing

- 7.2.3. Electronics and Semiconductors

- 7.2.4. Medical & Pharmaceutical

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Manual Assembly Lines

- 8.1.2. Semi-automated Assembly Lines

- 8.1.3. Fully Automated Assembly Lines

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Industrial Manufacturing

- 8.2.3. Electronics and Semiconductors

- 8.2.4. Medical & Pharmaceutical

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Manual Assembly Lines

- 9.1.2. Semi-automated Assembly Lines

- 9.1.3. Fully Automated Assembly Lines

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Industrial Manufacturing

- 9.2.3. Electronics and Semiconductors

- 9.2.4. Medical & Pharmaceutical

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the World Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Manual Assembly Lines

- 10.1.2. Semi-automated Assembly Lines

- 10.1.3. Fully Automated Assembly Lines

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Industrial Manufacturing

- 10.2.3. Electronics and Semiconductors

- 10.2.4. Medical & Pharmaceutical

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ACRO Automation Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hochrainer GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JR Automation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Central Machines Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Totally Automated Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fusion Systems Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adescor Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gemtec GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Markone Control Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eriez Manufacturing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEVMAT Australia PTY LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RNA Automation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UMD Automated Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mondragon Assembly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hitachi Power Solutions Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 MechTech Automation Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RG-Luma Automation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BBS Automation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SITEC Industrietechnologie GmbH**List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 ACRO Automation Systems Inc

List of Figures

- Figure 1: Global Assembly Line Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Asia Pacific Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Asia Pacific Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Rest of the World Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Rest of the World Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of the World Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Assembly Line Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 9: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Assembly Line Industry?

The projected CAGR is approximately 7.85%.

2. Which companies are prominent players in the Assembly Line Industry?

Key companies in the market include ACRO Automation Systems Inc, Hochrainer GmbH, JR Automation, Central Machines Inc, Totally Automated Systems, Fusion Systems Group, Adescor Inc, Gemtec GmbH, Markone Control Systems, Eriez Manufacturing Co, NEVMAT Australia PTY LTD, RNA Automation, UMD Automated Systems, Mondragon Assembly, Hitachi Power Solutions Co Ltd, MechTech Automation Group, RG-Luma Automation, BBS Automation, SITEC Industrietechnologie GmbH**List Not Exhaustive.

3. What are the main segments of the Assembly Line Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Electric Vehicle Companies Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2021: Mondragon Assembly is expanding into the USA market. The opening of a new subsidiary in Chicago will enable Mondragon Assembly to provide a closer and personalized service to the customers in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Assembly Line Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Assembly Line Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Assembly Line Industry?

To stay informed about further developments, trends, and reports in the Assembly Line Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence