Key Insights

The global cutting equipment market is poised for significant expansion, propelled by escalating industrial automation, sophisticated manufacturing advancements, and robust demand across key sectors including automotive, aerospace, and construction. The projected Compound Annual Growth Rate (CAGR) of 5.2% underscores a sustained period of robust market development. This growth trajectory is further amplified by technological innovations such as laser, waterjet, and plasma cutting, delivering unparalleled precision, speed, and operational efficiency. Leading industry players are actively investing in research and development to pioneer advanced cutting solutions, addressing evolving sector requirements. Market segmentation spans diverse cutting methodologies, equipment classifications, and end-use industries, reflecting a dynamic and multifaceted market.

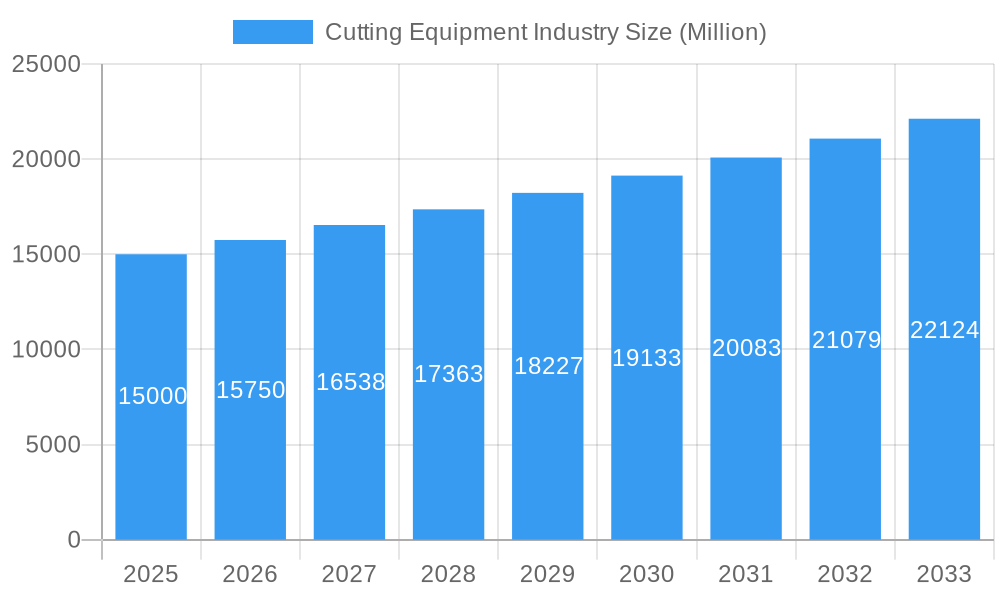

Cutting Equipment Industry Market Size (In Billion)

While the market exhibits strong upward momentum, it also navigates potential challenges including supply chain volatilities, fluctuating material costs, and the growing imperative for sustainable alternatives. Nevertheless, the pervasive trend toward automation and precision manufacturing is expected to offset these restraints. Future market evolution will be shaped by the integration of Industry 4.0 technologies, encompassing smart manufacturing and holistic automation, thereby optimizing cutting application efficiency and productivity. The competitive arena features established corporations and innovative startups, fostering a vibrant environment of continuous product refinement and intensified competition. Regional growth patterns are anticipated to vary, with developed economies spearheading advanced technology adoption, while emerging economies present substantial growth opportunities driven by industrialization. The forecast period is expected to witness continued market consolidation and diversification, with a strategic emphasis on sustainable and technologically advanced cutting equipment. Based on current trends and projected growth, the market size is estimated to reach $15 billion by 2025, with a base year of 2025 and a CAGR of 5.2%.

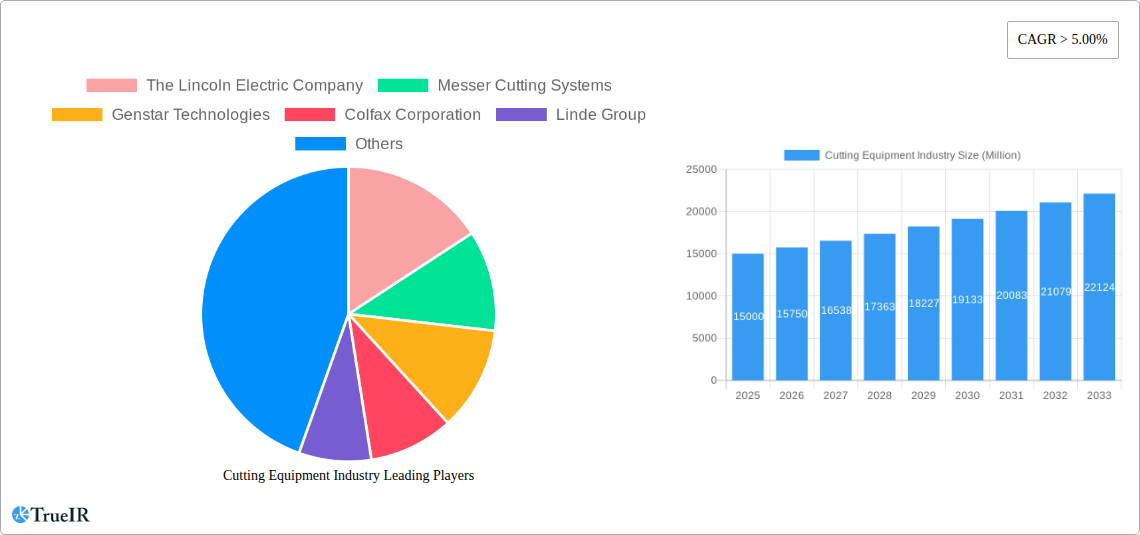

Cutting Equipment Industry Company Market Share

Cutting Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global cutting equipment industry, encompassing market size, segmentation, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The report leverages extensive market research and data analysis to deliver actionable insights and projections. The market is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Cutting Equipment Industry Market Structure & Competitive Landscape

The cutting equipment industry exhibits a moderately concentrated market structure, with a few large players dominating significant market share. The Herfindahl-Hirschman Index (HHI) for the industry is estimated at approximately XX, indicating a moderately concentrated landscape. However, the presence of numerous smaller, specialized players fosters competition and innovation. Key drivers of innovation include the demand for increased precision, automation, and efficiency in cutting processes across diverse end-user industries. Regulatory impacts, such as safety standards and environmental regulations, play a significant role in shaping market dynamics and driving technological advancements. Product substitutes, such as waterjet cutting and laser ablation techniques, offer alternative solutions to traditional cutting methods, influencing market segmentation. The industry witnesses frequent mergers and acquisitions (M&A) activity, as larger companies consolidate their market position and expand their product portfolios. The total value of M&A transactions within the cutting equipment sector between 2019 and 2024 is estimated to be around $XX Million.

- Market Concentration: Moderately concentrated, with an estimated HHI of XX.

- Innovation Drivers: Demand for precision, automation, and efficiency.

- Regulatory Impacts: Safety and environmental standards.

- Product Substitutes: Waterjet cutting, laser ablation.

- End-User Segmentation: Manufacturing, construction, automotive, aerospace, etc.

- M&A Trends: Significant activity, with a total value of approximately $XX Million (2019-2024).

Cutting Equipment Industry Market Trends & Opportunities

The global cutting equipment market is a dynamic and expanding sector, fueled by a burgeoning demand across a wide spectrum of industries. Market projections indicate a significant valuation, with an anticipated reach of $XX Million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of XX%. This growth is intrinsically linked to ongoing technological advancements, including the integration of sophisticated sensor technologies, sophisticated AI-driven automation, and the development of next-generation cutting materials. Consequently, consumer preferences are increasingly leaning towards equipment that offers enhanced energy efficiency, superior precision, and an intuitive user experience, prompting manufacturers to prioritize innovation and the development of cutting-edge solutions. The competitive landscape is characterized by vigorous rivalry between well-established industry leaders and agile emerging players. Furthermore, there's a discernible acceleration in the market penetration of advanced cutting technologies such as laser and waterjet cutting, largely attributed to their unparalleled precision and efficiency advantages over conventional methods. Key opportunities lie in the creation of bespoke solutions tailored to specific niche applications and the seamless integration of cutting equipment into comprehensive industrial automation frameworks.

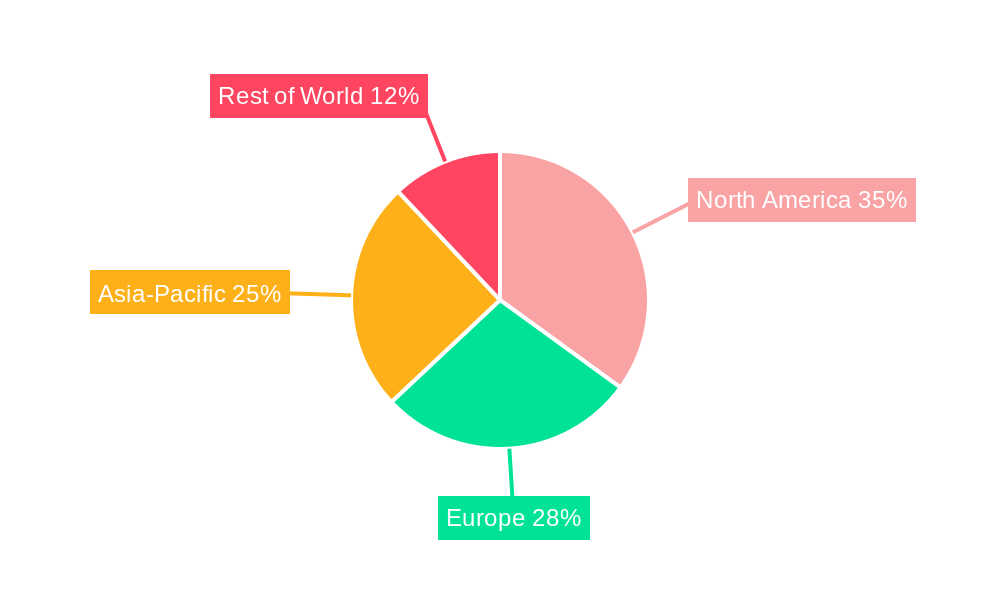

Dominant Markets & Segments in Cutting Equipment Industry

The Asia-Pacific region currently dominates the cutting equipment market, driven by robust industrial growth and infrastructure development within countries like China, India, and Japan. The North American and European markets also represent significant segments, demonstrating consistent growth albeit at a slightly slower pace than the Asia-Pacific region.

- Key Growth Drivers in Asia-Pacific:

- Rapid industrialization and urbanization.

- Increasing investments in infrastructure projects.

- Favorable government policies promoting manufacturing.

- Key Growth Drivers in North America:

- Technological advancements and adoption of automation.

- High demand in aerospace, automotive, and manufacturing.

- Key Growth Drivers in Europe:

- Focus on sustainable manufacturing practices.

- Stringent regulatory standards driving technological innovation.

Cutting Equipment Industry Product Analysis

The cutting equipment industry offers a wide range of products, from traditional oxy-fuel cutting systems to advanced laser and waterjet cutting machines. Recent technological advancements have focused on enhancing precision, speed, and automation, leading to the development of high-performance cutting systems capable of handling diverse materials and applications. These innovations provide significant competitive advantages, enabling manufacturers to cater to the evolving needs of their customers and expand their market reach. The integration of advanced software and control systems further enhances the capabilities of modern cutting equipment, increasing efficiency and reducing operational costs.

Key Drivers, Barriers & Challenges in Cutting Equipment Industry

Key Drivers: Technological advancements (e.g., laser and waterjet cutting), rising demand from diverse industries (automotive, aerospace, construction), growing infrastructure spending in developing economies, favorable government policies supporting industrial growth.

Challenges: Supply chain disruptions impacting component availability and cost, increasing raw material prices, stringent environmental regulations increasing manufacturing costs, intense competition leading to price pressures, skilled labor shortages in certain regions. These challenges are estimated to have reduced market growth by approximately XX% in 2023.

Growth Drivers in the Cutting Equipment Industry Market

The cutting equipment market's impressive trajectory is propelled by a confluence of powerful factors. Paramount among these are continuous technological advancements that translate into heightened precision, improved operational efficiency, and greater automation capabilities. This is further amplified by strong and sustained demand emanating from a diverse array of industries, including the automotive, construction, and aerospace sectors. Additionally, significant investments in infrastructure development, particularly within rapidly expanding emerging economies, play a crucial role. Government initiatives and policies designed to foster industrialization and encourage the adoption of automation also serve as potent catalysts for market expansion.

Challenges Impacting Cutting Equipment Industry Growth

Despite the positive outlook, the cutting equipment industry navigates several significant challenges. Persistent supply chain disruptions contribute to increased costs and extended lead times, impacting production schedules and profitability. The escalating prices of raw materials represent another considerable hurdle, directly affecting manufacturing expenses. The market's competitive nature, characterized by intense rivalries, often leads to price pressures, requiring companies to optimize their cost structures. Moreover, increasingly stringent environmental regulations present a substantial challenge. Compliance with these standards necessitates significant investment in research and development for cleaner manufacturing processes and more sustainable product designs, thereby increasing overall manufacturing costs and driving the need for continuous technological innovation.

Key Players Shaping the Cutting Equipment Industry Market

- The Lincoln Electric Company

- Messer Cutting Systems

- Genstar Technologies

- Colfax Corporation

- Linde Group

- Struers

- Ador Welding Ltd

- GCE Group

- DAIHEN Corporation

- Hypertherm

- Amada Miyachi

- Koike Aronson Inc

- Kennametal

- TRUMPF GmbH + Co KG

- Bystronic Laser AG

Significant Cutting Equipment Industry Milestones

- July 2022: Lincoln Electric introduced the POWER MIG 215 MPi multi-process welder, a lightweight, dual-input voltage machine with an ergonomic design. This enhanced the company's product portfolio and strengthened its competitiveness.

- February 2022: Messer Cutting Systems acquired Flame Technologies, Inc., expanding its oxyfuel solutions and solidifying its position as an international solution provider. This acquisition broadened Messer's product offerings and market reach.

Future Outlook for Cutting Equipment Industry Market

The cutting equipment industry is on a trajectory for sustained and significant growth in the foreseeable future. This expansion will be primarily driven by relentless technological innovation, the discovery and adoption of new industrial applications, and ongoing substantial investments in global infrastructure projects. Strategic opportunities abound for companies that can effectively develop and deploy advanced automation solutions, create highly customized cutting systems designed for specific niche markets, and champion sustainable manufacturing practices. The market is also anticipated to witness an acceleration in industry consolidation through strategic mergers and acquisitions, as companies aim to bolster their competitive standing and extend their global footprint.

Cutting Equipment Industry Segmentation

-

1. Technology

- 1.1. Laser

- 1.2. Plasma

- 1.3. Waterjet

- 1.4. Flame

- 1.5. Other Technologies

-

2. End-user

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Electrical and Electronics

- 2.4. Construction

- 2.5. Other End-Users

Cutting Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Cutting Equipment Industry Regional Market Share

Geographic Coverage of Cutting Equipment Industry

Cutting Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Positive Outlook for the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Laser

- 5.1.2. Plasma

- 5.1.3. Waterjet

- 5.1.4. Flame

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Electrical and Electronics

- 5.2.4. Construction

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Laser

- 6.1.2. Plasma

- 6.1.3. Waterjet

- 6.1.4. Flame

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Electrical and Electronics

- 6.2.4. Construction

- 6.2.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Laser

- 7.1.2. Plasma

- 7.1.3. Waterjet

- 7.1.4. Flame

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Electrical and Electronics

- 7.2.4. Construction

- 7.2.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Laser

- 8.1.2. Plasma

- 8.1.3. Waterjet

- 8.1.4. Flame

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Electrical and Electronics

- 8.2.4. Construction

- 8.2.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Laser

- 9.1.2. Plasma

- 9.1.3. Waterjet

- 9.1.4. Flame

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Electrical and Electronics

- 9.2.4. Construction

- 9.2.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Laser

- 10.1.2. Plasma

- 10.1.3. Waterjet

- 10.1.4. Flame

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Aerospace and Defense

- 10.2.3. Electrical and Electronics

- 10.2.4. Construction

- 10.2.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Lincoln Electric Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Messer Cutting Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Genstar Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Colfax Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Linde Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Struers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ador Welding Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GCE Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAIHEN Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hypertherm

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amada Miyachi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Koike Aronson Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kennametal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TRUMPF GmbH + Co KG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bystronic Laser AG**List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 The Lincoln Electric Company

List of Figures

- Figure 1: Global Cutting Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: South America Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: South America Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: South America Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Cutting Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 21: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: South Korea Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 29: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 35: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: UAE Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Egypt Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cutting Equipment Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Cutting Equipment Industry?

Key companies in the market include The Lincoln Electric Company, Messer Cutting Systems, Genstar Technologies, Colfax Corporation, Linde Group, Struers, Ador Welding Ltd, GCE Group, DAIHEN Corporation, Hypertherm, Amada Miyachi, Koike Aronson Inc, Kennametal, TRUMPF GmbH + Co KG, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Cutting Equipment Industry?

The market segments include Technology, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Positive Outlook for the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022 - Lincoln Electric has introduced the POWER MIG 215 MPi multi-process welder, a lightweight dual-input voltage machine with a new ergonomic design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cutting Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cutting Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cutting Equipment Industry?

To stay informed about further developments, trends, and reports in the Cutting Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence