Key Insights

The European Metal Fabrication Equipment Market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of 3.7%. Driven by increasing automation in automotive, aerospace, and construction sectors, the demand for advanced metal fabrication technologies is on the rise. Key growth drivers include vehicle lightweighting initiatives and the growing adoption of sustainable manufacturing practices. While challenges like supply chain disruptions and raw material price volatility persist, technological advancements, including the integration of Industry 4.0 technologies like AI and robotics, are enhancing efficiency, precision, and production speed, attracting significant investment. The market is segmented by equipment type (e.g., press brakes, laser cutting machines, welding robots), application, and European regions. Leading companies such as TRUMPF, Dürr, Amada, and GF Machining Solutions are prioritizing innovation and portfolio expansion. The market's structure is dynamic, featuring both established leaders and a significant number of smaller, specialized players.

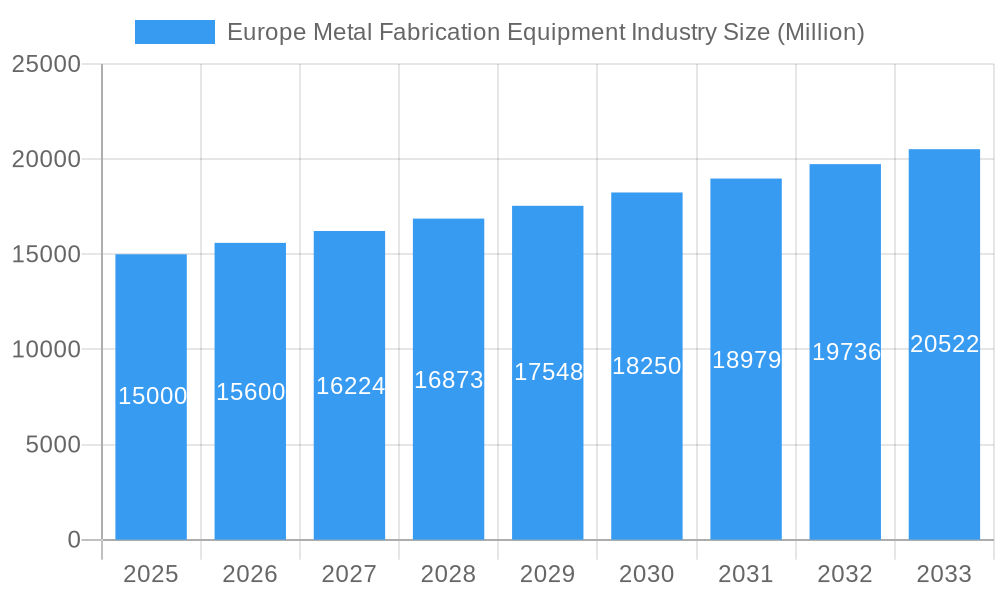

Europe Metal Fabrication Equipment Industry Market Size (In Billion)

The forecast period, commencing in the base year of 2025, anticipates sustained market expansion. The market size is estimated to reach 850.5 billion by the end of the forecast period. While mature, the market shows potential for accelerated growth within specific segments fueled by technological breakthroughs and niche applications. The competitive environment remains highly active, with both major players and specialized solution providers. Future success hinges on adapting to technological innovations, providing customized solutions, and effectively managing supply chain risks. Strategic expansion into emerging sectors and the formation of partnerships and acquisitions will be critical for continued growth. Regional market dynamics will vary, reflecting diverse industrial development and technology adoption rates across European nations.

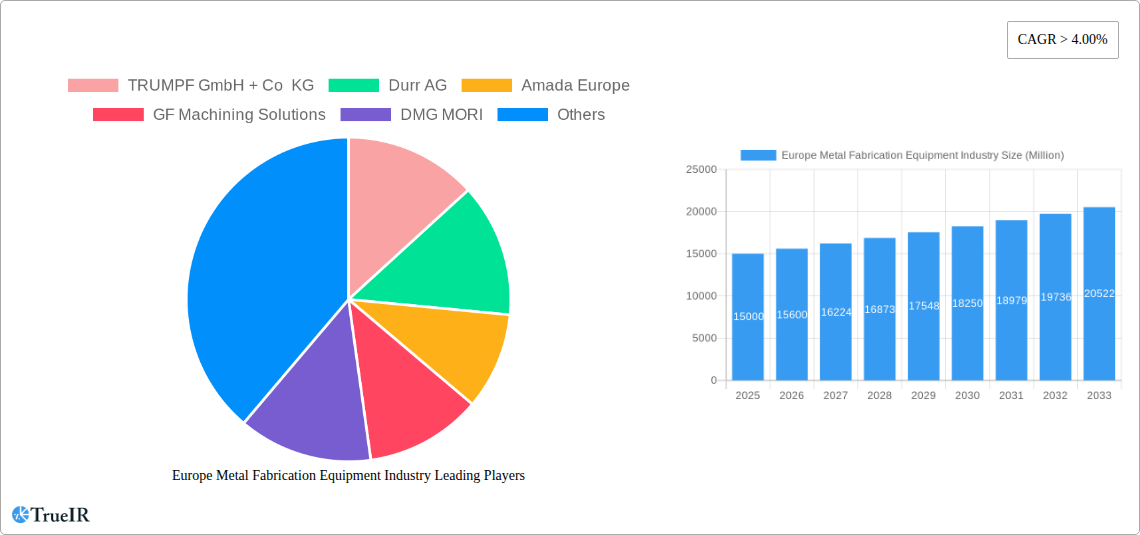

Europe Metal Fabrication Equipment Industry Company Market Share

Europe Metal Fabrication Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Metal Fabrication Equipment industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive data analysis and expert insights to deliver a crucial resource for strategic decision-making. The European market, valued at xx Million in 2025, is poised for significant growth, driven by technological advancements and increasing industrial automation. This report is essential for manufacturers, investors, and industry professionals seeking to navigate this dynamic market.

Europe Metal Fabrication Equipment Industry Market Structure & Competitive Landscape

The European metal fabrication equipment market exhibits a moderately concentrated structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Key players such as TRUMPF GmbH + Co KG, Dürr AG, Amada Europe, GF Machining Solutions, DMG MORI, Schuler AG, GROB-WERKE GmbH, Bystronic Maschinen AG, Feintool International Holding AG, and Mazak U K Limited hold substantial market share. However, the presence of numerous smaller and specialized companies fosters competition and innovation.

- Market Concentration: The top 10 companies account for approximately xx% of the total market revenue in 2025.

- Innovation Drivers: The drive for increased productivity, automation, and precision in manufacturing processes fuels continuous innovation in metal fabrication equipment. This includes advancements in robotics, digitalization (Industry 4.0), and advanced materials.

- Regulatory Impacts: EU regulations concerning environmental protection, worker safety, and energy efficiency influence equipment design and manufacturing practices. Compliance costs and potential penalties impact profitability and competitiveness.

- Product Substitutes: While specific substitutes are limited, advancements in additive manufacturing (3D printing) and alternative materials present some degree of substitution pressure, particularly in niche applications.

- End-User Segmentation: The market serves diverse end-user segments, including automotive, aerospace, construction, energy, and consumer goods manufacturers. Each segment exhibits unique demands and preferences, shaping market demand.

- M&A Trends: The industry has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, driven by consolidation efforts and expansion strategies. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

Europe Metal Fabrication Equipment Industry Market Trends & Opportunities

The European metal fabrication equipment market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

The increasing demand for customized and high-precision components across various industries is a primary driver. The shift towards automation and smart factories is revolutionizing manufacturing processes, boosting demand for advanced metal fabrication equipment. Furthermore, government initiatives promoting industrial modernization and technological advancements in Europe are bolstering market growth. The growing adoption of Industry 4.0 technologies, including IoT and data analytics, is enhancing efficiency and productivity in metal fabrication processes. This facilitates improved product quality, reduced operational costs, and faster production times. The market penetration of advanced equipment such as laser cutting machines and robotic welding systems is steadily increasing, indicating a growing preference for automation. The automotive industry's rising demand for lightweight materials and sophisticated designs is accelerating the adoption of advanced metal fabrication technologies. Competitive dynamics are further driving innovation and efficiency improvements, creating opportunities for market expansion.

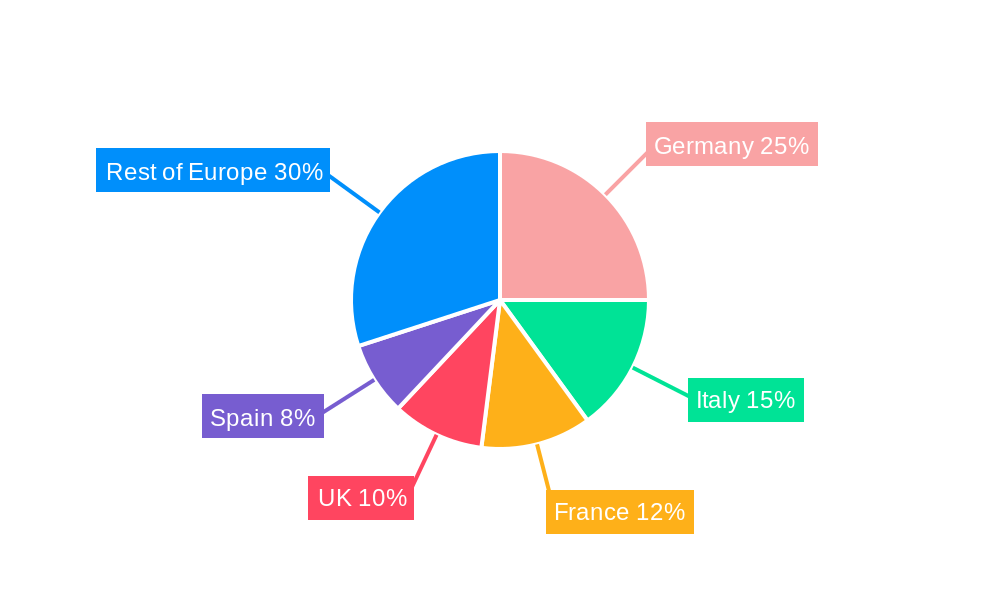

Dominant Markets & Segments in Europe Metal Fabrication Equipment Industry

Germany stands as the undisputed leader in the European metal fabrication equipment market, with Italy, France, and the United Kingdom following closely behind. This leadership is underpinned by a confluence of powerful factors:

- Robust Industrial Ecosystem: Germany's highly developed and diversified manufacturing sector provides a substantial and consistent demand for advanced metal fabrication equipment.

- Pioneering Technological Innovation: As a global powerhouse in engineering and manufacturing technology, Germany consistently drives innovation and maintains a competitive edge within the industry.

- Proactive Government Support: Favorable government policies and strategic initiatives aimed at fostering industrial development and technological advancement have significantly propelled market expansion.

- Highly Skilled Workforce: The availability of a skilled and proficient workforce in Germany ensures the efficient operation, maintenance, and integration of sophisticated metal fabrication machinery.

- Dominant Automotive Sector: Germany's preeminent automotive industry, particularly its high-end luxury segment, creates a significant demand for precision engineering and state-of-the-art metal fabrication solutions.

Beyond Germany, other European nations such as Italy, France, and the UK represent vital growth arenas. Their substantial manufacturing bases and governmental commitment to industrial modernization are key catalysts. Within the market segments, laser cutting technology currently holds a dominant position due to its exceptional precision, speed, and automation capabilities, making it indispensable for modern manufacturing processes.

Europe Metal Fabrication Equipment Industry Product Analysis

The market offers a broad range of metal fabrication equipment, encompassing traditional machinery like presses, shears, and bending machines, as well as advanced technologies such as laser cutting systems, robotic welding systems, and additive manufacturing solutions. Technological advancements emphasize precision, automation, and connectivity, enabling streamlined manufacturing processes and improved product quality. The key competitive advantages stem from the equipment's efficiency, precision, automation features, and integration with smart factory solutions, allowing for improved productivity and reduced operational costs.

Key Drivers, Barriers & Challenges in Europe Metal Fabrication Equipment Industry

Key Drivers: The relentless pursuit of automation, enhanced precision, and increased manufacturing efficiency serves as a primary impetus for market expansion. Governmental programs championing industrial upgrading and digital transformation further accelerate the adoption of cutting-edge equipment. The automotive sector's increasing need for lightweight materials and intricate component designs also fuels significant demand for specialized fabrication solutions.

Key Barriers & Challenges: Persistent supply chain volatilities, particularly concerning raw material availability and component sourcing, can impede production schedules and escalate operational costs. Increasingly stringent environmental regulations impose higher compliance burdens and can restrict the deployment of certain technological applications. Furthermore, intense competition from established industry stalwarts and the emergence of new, agile market entrants exert downward pressure on profit margins.

Growth Drivers in the Europe Metal Fabrication Equipment Industry Market

Technological advancements, including automation, robotics, and digitalization, are key drivers. The automotive, aerospace, and energy sectors are significant growth engines due to their high demand for precision-engineered metal components. Government incentives and policies supporting industrial modernization further boost market expansion.

Challenges Impacting Europe Metal Fabrication Equipment Industry Growth

The industry faces significant headwinds from supply chain vulnerabilities, exacerbated by geopolitical uncertainties and persistent raw material shortages. Escalating energy costs and rigorous environmental mandates directly increase operational expenditures and can constrain production volumes. The fiercely competitive landscape, characterized by both established global leaders and burgeoning new companies, intensifies pressure on profit margins and can limit avenues for substantial growth.

Key Players Shaping the Europe Metal Fabrication Equipment Industry Market

- TRUMPF GmbH + Co KG

- Durr AG

- Amada Europe

- GF Machining Solutions

- DMG MORI

- Schuler AG

- GROB-WERKE GmbH

- Bystronic Maschinen AG

- Feintool International Holding AG

- Mazak U K Limited

- Reishauer AG

- Okuma Europe

- Gebr. Heller Maschinenfabrik GmbH

- Starrag Group Holding AG

- Meusburger Georg GmbH

- Baileigh Industrial

Significant Europe Metal Fabrication Equipment Industry Industry Milestones

- December 2022: TRUMPF and STOPA announced a collaboration to integrate automated storage systems into TRUMPF's smart factory solutions, enhancing production efficiency.

- December 2022: Dürr launched a new generation of EcoPump2 VP pneumatic vertical piston pumps, improving process reliability and reducing maintenance needs across various industries, including metalworking.

Future Outlook for Europe Metal Fabrication Equipment Industry Market

The European metal fabrication equipment market is poised for robust and sustained growth. This optimism is fueled by ongoing advancements in technology, the escalating adoption of automation across manufacturing sectors, and proactive governmental support for industrial modernization initiatives. Significant growth opportunities lie in the development of sophisticated automation solutions, a strong emphasis on sustainable manufacturing practices, and the ability to cater to the unique demands of rapidly expanding industries such as renewable energy and electric vehicles. The market demonstrates substantial potential, with expectations of continued upward trajectory throughout the foreseeable future.

Europe Metal Fabrication Equipment Industry Segmentation

-

1. Service type

- 1.1. Machining

- 1.2. Cutting

- 1.3. Welding

- 1.4. Forming

- 1.5. Other Service Types

-

2. End-user Industries

- 2.1. Automotive

- 2.2. Construction

- 2.3. Aerospace

- 2.4. Electrical and Electronics

- 2.5. Other End-user Industries

Europe Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Rest of the Europe

Europe Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Europe Metal Fabrication Equipment Industry

Europe Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Technological Innovations in Metal Fabrication Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service type

- 5.1.1. Machining

- 5.1.2. Cutting

- 5.1.3. Welding

- 5.1.4. Forming

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Automotive

- 5.2.2. Construction

- 5.2.3. Aerospace

- 5.2.4. Electrical and Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. UK

- 5.3.3. France

- 5.3.4. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Service type

- 6. Germany Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service type

- 6.1.1. Machining

- 6.1.2. Cutting

- 6.1.3. Welding

- 6.1.4. Forming

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Automotive

- 6.2.2. Construction

- 6.2.3. Aerospace

- 6.2.4. Electrical and Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service type

- 7. UK Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service type

- 7.1.1. Machining

- 7.1.2. Cutting

- 7.1.3. Welding

- 7.1.4. Forming

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Automotive

- 7.2.2. Construction

- 7.2.3. Aerospace

- 7.2.4. Electrical and Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service type

- 8. France Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service type

- 8.1.1. Machining

- 8.1.2. Cutting

- 8.1.3. Welding

- 8.1.4. Forming

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Automotive

- 8.2.2. Construction

- 8.2.3. Aerospace

- 8.2.4. Electrical and Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service type

- 9. Rest of the Europe Europe Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service type

- 9.1.1. Machining

- 9.1.2. Cutting

- 9.1.3. Welding

- 9.1.4. Forming

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Automotive

- 9.2.2. Construction

- 9.2.3. Aerospace

- 9.2.4. Electrical and Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TRUMPF GmbH + Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Durr AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amada Europe

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GF Machining Solutions

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DMG MORI

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schuler AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GROB-WERKE GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bystronic Maschinen AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Feintool International Holding AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mazak U K Limited**List Not Exhaustive 6 3 Other Companies (Reishauer AG Okuma Europe Gebr Heller Maschinenfabrik GmbH Starrag Group Holding AG Meusburger Georg Gmbh Baileigh Industrial

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TRUMPF GmbH + Co KG

List of Figures

- Figure 1: Global Europe Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 3: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 4: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 5: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: Germany Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 9: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 10: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 11: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: UK Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: UK Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 15: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 16: France Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 17: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: France Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by Service type 2025 & 2033

- Figure 21: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by Service type 2025 & 2033

- Figure 22: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 23: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the Europe Europe Metal Fabrication Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 2: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 5: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 8: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 9: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 11: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Service type 2020 & 2033

- Table 14: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Europe Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Fabrication Equipment Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Europe Metal Fabrication Equipment Industry?

Key companies in the market include TRUMPF GmbH + Co KG, Durr AG, Amada Europe, GF Machining Solutions, DMG MORI, Schuler AG, GROB-WERKE GmbH, Bystronic Maschinen AG, Feintool International Holding AG, Mazak U K Limited**List Not Exhaustive 6 3 Other Companies (Reishauer AG Okuma Europe Gebr Heller Maschinenfabrik GmbH Starrag Group Holding AG Meusburger Georg Gmbh Baileigh Industrial.

3. What are the main segments of the Europe Metal Fabrication Equipment Industry?

The market segments include Service type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 850.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Technological Innovations in Metal Fabrication Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: One of the top producers of automated storage systems, STOPA, and the high-tech business TRUMPF have announced a deal to cooperate more in the future. Numerous applications, including TRUMPF's smart-factory solutions, leverage STOPA's automated storage options. Customers may automatically load and unload their machines with STOPA systems, and they can connect units to create logistics networks. This greatly reduces non-productive time, which increases shop floor production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence