Key Insights

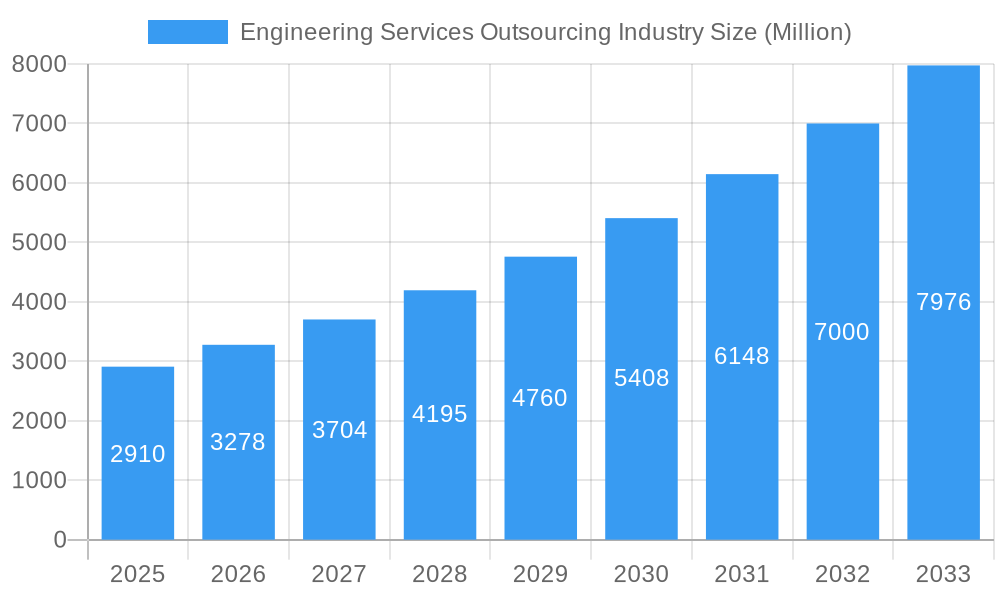

The Engineering Services Outsourcing (ESO) market is experiencing robust growth, projected to reach $2.91 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.89% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing complexity of engineering projects across various industries, coupled with the rising demand for specialized skills, is driving companies to outsource their engineering needs. This allows companies to focus on core competencies while leveraging the expertise and cost-effectiveness of specialized ESO providers. Secondly, the adoption of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) in engineering processes is creating new opportunities and driving demand for skilled professionals in these areas. This technological advancement necessitates outsourcing to access the necessary talent and expertise efficiently. Finally, globalization and the availability of a large pool of skilled engineers in various regions, particularly in developing economies, contribute significantly to the growth of the ESO market. The leading players – including Tech Mahindra, TCS, Infosys, HCL Technologies, Wipro, Capgemini, GlobalLogic, Accenture, and others – are strategically positioned to benefit from this market expansion, constantly innovating and expanding their service offerings to meet evolving client demands.

Engineering Services Outsourcing Industry Market Size (In Billion)

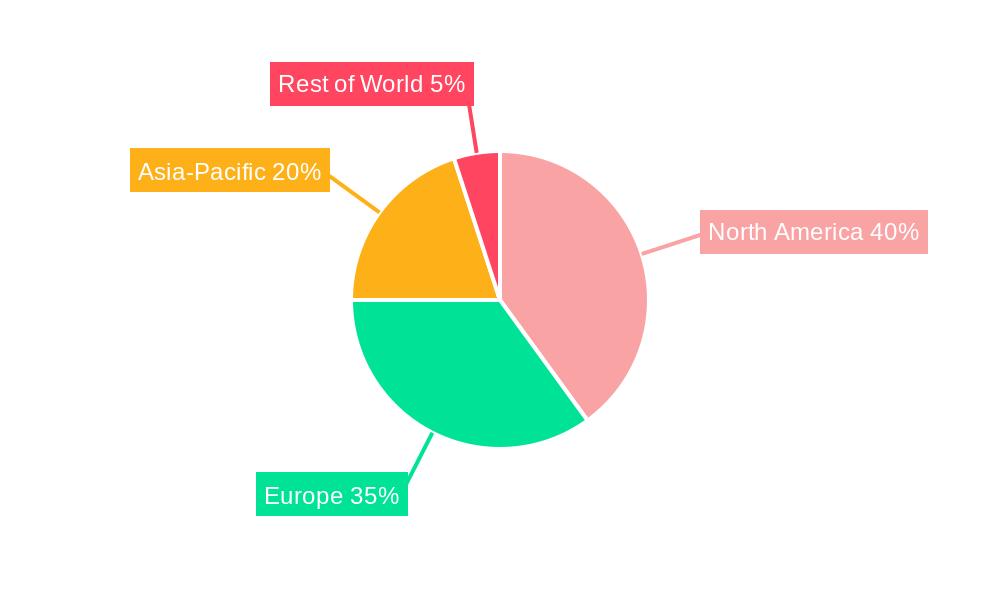

The market segmentation, while not explicitly detailed, likely includes various engineering disciplines such as mechanical, electrical, software, and civil engineering services. Geographic segmentation will undoubtedly show strong representation from North America and Europe, given the high concentration of companies requiring these services. However, regions like Asia-Pacific are also expected to show significant growth driven by increasing industrialization and technological advancements. While restraints could include challenges related to data security, intellectual property protection, and communication barriers, the overall positive market outlook suggests these challenges are being effectively managed by the industry's leading players. The forecast period (2025-2033) presents significant opportunities for market expansion and further consolidation among major players. The historical period (2019-2024) serves as a strong foundation for the current growth trajectory.

Engineering Services Outsourcing Industry Company Market Share

Engineering Services Outsourcing Industry Report: A Comprehensive Market Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the Engineering Services Outsourcing (ESO) industry, projecting market trends and competitive landscapes from 2019 to 2033. We delve into key segments, dominant players, and future growth potential, offering invaluable insights for businesses and investors. The report leverages extensive data analysis, forecasting a market valued at $XX Million in 2025, growing at a CAGR of XX% from 2025 to 2033.

Engineering Services Outsourcing Industry Market Structure & Competitive Landscape

The Engineering Services Outsourcing industry is characterized by a moderately concentrated market structure. While a few large players dominate, numerous smaller firms compete in niche segments. The top 10 companies (including Tech Mahindra Limited, Tata Consultancy Services Limited, Infosys Limited, HCL Technologies Limited, Wipro Ltd, Capgemini Technology Services India Limited, Globallogic Inc, Accenture, RLE International Inc, ASAP Holding GmbH, and Tata Technologies – list not exhaustive) control an estimated XX% of the market share in 2025. However, the market demonstrates considerable dynamism due to ongoing mergers and acquisitions (M&A), with an estimated XX Million in M&A activity in 2024.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the industry is estimated at XX, suggesting a moderately concentrated market.

- Innovation Drivers: Continuous advancements in technologies like AI, IoT, and cloud computing are significant innovation drivers.

- Regulatory Impacts: Government regulations concerning data privacy and cybersecurity significantly influence industry practices.

- Product Substitutes: Internal engineering teams and open-source solutions represent potential substitutes.

- End-User Segmentation: The industry caters to various sectors, including manufacturing, automotive, aerospace, and energy, with varying demands and requirements.

- M&A Trends: Strategic acquisitions are driving consolidation, leading to enhanced service offerings and broader market reach.

Engineering Services Outsourcing Industry Market Trends & Opportunities

The global Engineering Services Outsourcing market is experiencing robust growth, driven by several factors. Increasing demand for specialized engineering skills, coupled with the rising adoption of digital technologies across industries, is fueling market expansion. The market size is projected to reach $XX Million by 2025 and further expand to $XX Million by 2033, reflecting a significant opportunity for industry players. Technological advancements, such as the increasing adoption of AI and machine learning in engineering processes, are reshaping the industry landscape. Businesses are increasingly adopting outsourcing strategies to optimize costs, enhance efficiency, and access specialized expertise, further driving market growth. Companies are increasingly focused on improving customer satisfaction, thus creating opportunities in the market. The increasing focus on sustainability and environmental concerns is also creating new opportunities in the market. The increasing penetration of digital technologies and the rise of Industry 4.0 are creating substantial opportunities in the ESO market. The adoption of cloud-based solutions and the development of sophisticated software platforms are streamlining workflows and improving productivity. This trend is expected to continue, driving significant growth in the forecast period. Competitive dynamics are shaping market growth, with large players consolidating their market position through acquisitions and strategic partnerships.

Dominant Markets & Segments in Engineering Services Outsourcing Industry

North America currently holds a dominant position in the ESO market, accounting for an estimated XX% of the global market share in 2025, followed by Europe and Asia Pacific. This dominance is driven by factors such as:

- Strong Technological Infrastructure: Mature technological infrastructure and a large pool of skilled engineers fuel high demand for ESO services.

- Favorable Government Policies: Supportive regulatory environments and government initiatives promoting technological innovation contribute to market expansion.

- High Adoption Rates: A high adoption rate of advanced technologies amongst businesses creates a strong demand for sophisticated engineering services.

The Automotive and Aerospace segments are projected to witness significant growth due to increasing product complexity and the need for cost-effective solutions.

Engineering Services Outsourcing Industry Product Analysis

The ESO industry offers a diverse range of services, including product design and development, engineering simulations, testing and validation, and technical support. Product innovation is largely driven by technological advancements in software and hardware. Companies are adopting cloud-based platforms and AI-powered tools to improve efficiency and accuracy. The market shows increasing demand for specialized services, such as AI/ML-driven engineering and digital twin technologies, which are becoming critical competitive advantages. Market fit is driven by the ability of providers to address specific customer needs and offer customized solutions.

Key Drivers, Barriers & Challenges in Engineering Services Outsourcing Industry

Key Drivers:

- Technological advancements: AI, IoT, and cloud computing are creating new opportunities and enhancing efficiency.

- Cost optimization: Businesses are leveraging outsourcing to reduce costs and optimize resource allocation.

- Access to specialized skills: Outsourcing provides access to a wider talent pool with specialized expertise.

Challenges:

- Data security and intellectual property concerns: Data breaches and IP theft represent significant risks. Companies face potential losses amounting to XX Million annually due to security breaches.

- Communication and coordination challenges: Effective communication and collaboration across geographical boundaries are crucial for project success.

- Regulatory compliance: Compliance with diverse international and regional regulations adds complexity and cost.

Growth Drivers in the Engineering Services Outsourcing Industry Market

The growth of the ESO industry is propelled by the increasing adoption of digital technologies across various industries, the demand for specialized engineering skills, and the drive for cost optimization among businesses. Government initiatives promoting technological innovation and supportive regulatory environments further stimulate market expansion.

Challenges Impacting Engineering Services Outsourcing Industry Growth

Challenges include maintaining data security, ensuring seamless communication across geographical boundaries, and navigating complex international regulations. These factors can impact project timelines and overall costs, potentially hindering market growth. Supply chain disruptions due to geopolitical instability could also negatively impact delivery schedules and increase costs by approximately XX Million annually.

Key Players Shaping the Engineering Services Outsourcing Industry Market

- Tech Mahindra Limited

- Tata Consultancy Services Limited

- Infosys Limited

- HCL Technologies Limited

- Wipro Ltd

- Capgemini Technology Services India Limited

- Globallogic Inc

- Accenture

- RLE International Inc

- ASAP Holding GmbH

- Tata Technologies

Significant Engineering Services Outsourcing Industry Industry Milestones

- April 2023: Marks & Spencer PLC extends its relationship with Tata Consultancy Services (TCS) for a core technology stack modernization program, focusing on increased innovation speed, resilience, and sustainable growth.

- February 2023: Tech Mahindra signs a Memorandum of Understanding (MoU) with Saudi Arabia's Ministry of Communication and Information Technology (MCIT) to establish a Data & AI and Cloud Centre of Excellence in Riyadh.

Future Outlook for Engineering Services Outsourcing Industry Market

The ESO market is poised for continued robust growth, driven by technological advancements, increasing demand for specialized skills, and the ongoing digital transformation across industries. Strategic partnerships, acquisitions, and investments in emerging technologies will play a crucial role in shaping the future of the market. The market's potential is vast, with significant opportunities for companies that can offer innovative solutions and adapt to evolving customer needs.

Engineering Services Outsourcing Industry Segmentation

-

1. Services

- 1.1. Designing

- 1.2. Prototyping

- 1.3. System Integration

- 1.4. Testing

- 1.5. Others

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Consumer Electronics And Semiconductors

- 2.4. Telecom

- 2.5. Others

Engineering Services Outsourcing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Thailand

- 3.6. Indonesia

- 3.7. Rest of Asia pacific

- 4. Rest of the World

Engineering Services Outsourcing Industry Regional Market Share

Geographic Coverage of Engineering Services Outsourcing Industry

Engineering Services Outsourcing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Integrated Solutions Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Engineering Services Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Designing

- 5.1.2. Prototyping

- 5.1.3. System Integration

- 5.1.4. Testing

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Consumer Electronics And Semiconductors

- 5.2.4. Telecom

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Engineering Services Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Designing

- 6.1.2. Prototyping

- 6.1.3. System Integration

- 6.1.4. Testing

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Consumer Electronics And Semiconductors

- 6.2.4. Telecom

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Engineering Services Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Designing

- 7.1.2. Prototyping

- 7.1.3. System Integration

- 7.1.4. Testing

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Consumer Electronics And Semiconductors

- 7.2.4. Telecom

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Engineering Services Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Designing

- 8.1.2. Prototyping

- 8.1.3. System Integration

- 8.1.4. Testing

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Consumer Electronics And Semiconductors

- 8.2.4. Telecom

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Rest of the World Engineering Services Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Designing

- 9.1.2. Prototyping

- 9.1.3. System Integration

- 9.1.4. Testing

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Consumer Electronics And Semiconductors

- 9.2.4. Telecom

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tech Mahindra Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tata Consultancy Services Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infosys Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HCL Technologies Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wipro Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Capgemini Technology Services India Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Globallogic Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Accenture

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 RLE International Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ASAP Holding GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Tata Technologies**List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Tech Mahindra Limited

List of Figures

- Figure 1: Global Engineering Services Outsourcing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Engineering Services Outsourcing Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Engineering Services Outsourcing Industry Revenue (Million), by Services 2025 & 2033

- Figure 4: North America Engineering Services Outsourcing Industry Volume (Trillion), by Services 2025 & 2033

- Figure 5: North America Engineering Services Outsourcing Industry Revenue Share (%), by Services 2025 & 2033

- Figure 6: North America Engineering Services Outsourcing Industry Volume Share (%), by Services 2025 & 2033

- Figure 7: North America Engineering Services Outsourcing Industry Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Engineering Services Outsourcing Industry Volume (Trillion), by End User 2025 & 2033

- Figure 9: North America Engineering Services Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Engineering Services Outsourcing Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Engineering Services Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Engineering Services Outsourcing Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Engineering Services Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Engineering Services Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Engineering Services Outsourcing Industry Revenue (Million), by Services 2025 & 2033

- Figure 16: Europe Engineering Services Outsourcing Industry Volume (Trillion), by Services 2025 & 2033

- Figure 17: Europe Engineering Services Outsourcing Industry Revenue Share (%), by Services 2025 & 2033

- Figure 18: Europe Engineering Services Outsourcing Industry Volume Share (%), by Services 2025 & 2033

- Figure 19: Europe Engineering Services Outsourcing Industry Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Engineering Services Outsourcing Industry Volume (Trillion), by End User 2025 & 2033

- Figure 21: Europe Engineering Services Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Engineering Services Outsourcing Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Engineering Services Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Engineering Services Outsourcing Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe Engineering Services Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Engineering Services Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Engineering Services Outsourcing Industry Revenue (Million), by Services 2025 & 2033

- Figure 28: Asia Pacific Engineering Services Outsourcing Industry Volume (Trillion), by Services 2025 & 2033

- Figure 29: Asia Pacific Engineering Services Outsourcing Industry Revenue Share (%), by Services 2025 & 2033

- Figure 30: Asia Pacific Engineering Services Outsourcing Industry Volume Share (%), by Services 2025 & 2033

- Figure 31: Asia Pacific Engineering Services Outsourcing Industry Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Pacific Engineering Services Outsourcing Industry Volume (Trillion), by End User 2025 & 2033

- Figure 33: Asia Pacific Engineering Services Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Engineering Services Outsourcing Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Engineering Services Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Engineering Services Outsourcing Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Asia Pacific Engineering Services Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Engineering Services Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Engineering Services Outsourcing Industry Revenue (Million), by Services 2025 & 2033

- Figure 40: Rest of the World Engineering Services Outsourcing Industry Volume (Trillion), by Services 2025 & 2033

- Figure 41: Rest of the World Engineering Services Outsourcing Industry Revenue Share (%), by Services 2025 & 2033

- Figure 42: Rest of the World Engineering Services Outsourcing Industry Volume Share (%), by Services 2025 & 2033

- Figure 43: Rest of the World Engineering Services Outsourcing Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Rest of the World Engineering Services Outsourcing Industry Volume (Trillion), by End User 2025 & 2033

- Figure 45: Rest of the World Engineering Services Outsourcing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of the World Engineering Services Outsourcing Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Rest of the World Engineering Services Outsourcing Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Rest of the World Engineering Services Outsourcing Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: Rest of the World Engineering Services Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Engineering Services Outsourcing Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Services 2020 & 2033

- Table 3: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by End User 2020 & 2033

- Table 5: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Services 2020 & 2033

- Table 9: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by End User 2020 & 2033

- Table 11: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 20: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Services 2020 & 2033

- Table 21: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by End User 2020 & 2033

- Table 23: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Germany Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: France Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Italy Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: Spain Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 38: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Services 2020 & 2033

- Table 39: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by End User 2020 & 2033

- Table 41: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 43: China Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: India Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: India Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Japan Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Korea Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Thailand Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Thailand Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Indonesia Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Indonesia Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia pacific Engineering Services Outsourcing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia pacific Engineering Services Outsourcing Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 58: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Services 2020 & 2033

- Table 59: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 60: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by End User 2020 & 2033

- Table 61: Global Engineering Services Outsourcing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Engineering Services Outsourcing Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Engineering Services Outsourcing Industry?

The projected CAGR is approximately 12.89%.

2. Which companies are prominent players in the Engineering Services Outsourcing Industry?

Key companies in the market include Tech Mahindra Limited, Tata Consultancy Services Limited, Infosys Limited, HCL Technologies Limited, Wipro Ltd, Capgemini Technology Services India Limited, Globallogic Inc, Accenture, RLE International Inc, ASAP Holding GmbH, Tata Technologies**List Not Exhaustive.

3. What are the main segments of the Engineering Services Outsourcing Industry?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Adoption of Integrated Solutions Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: The relationship between Marks and Spencer PLC (M&S) and Tata Consultancy Services (TCS) has been extended to change M&S's core technology stack, increase innovation speed and resilience, and promote sustainable growth. The modernization program will enhance speed to market, lower technological debt, and boost operating model efficiency and effectiveness for M&S. M&S' strategic aims of providing better customer experience, driving online growth, leading in omnichannel and sustainability, modernizing its supply chain, increasing its worldwide reach will be expedited by the transformation into a simple, agile, data-led business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Engineering Services Outsourcing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Engineering Services Outsourcing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Engineering Services Outsourcing Industry?

To stay informed about further developments, trends, and reports in the Engineering Services Outsourcing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence