Key Insights

The North American precision turned product manufacturing market is projected to reach $110.33 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.7% through 2033. This growth is propelled by escalating demand for high-tolerance components across pivotal industries. The automotive sector, driven by the transition to electric vehicles (EVs) and advanced driver-assistance systems (ADAS), requires an increasing volume of precision-machined parts for critical engine, sensor, and power management systems. Concurrently, the electronics industry's continuous innovation in miniaturization and complex circuitry fuels demand for precision turned products in connectors, casings, and internal components. Further expansion is supported by defense sector modernization and the healthcare industry's need for sophisticated medical devices and surgical instruments.

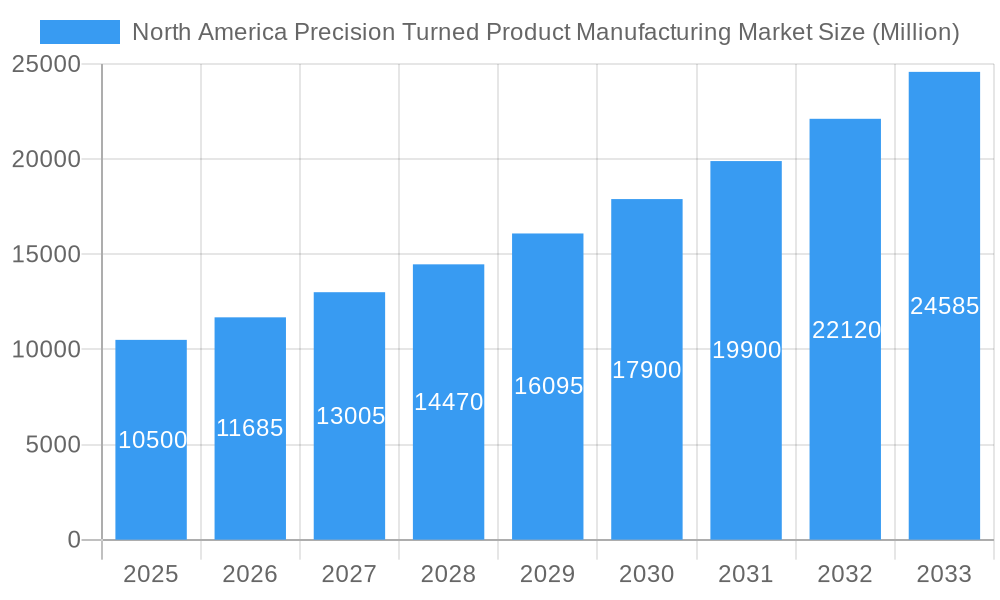

North America Precision Turned Product Manufacturing Market Market Size (In Billion)

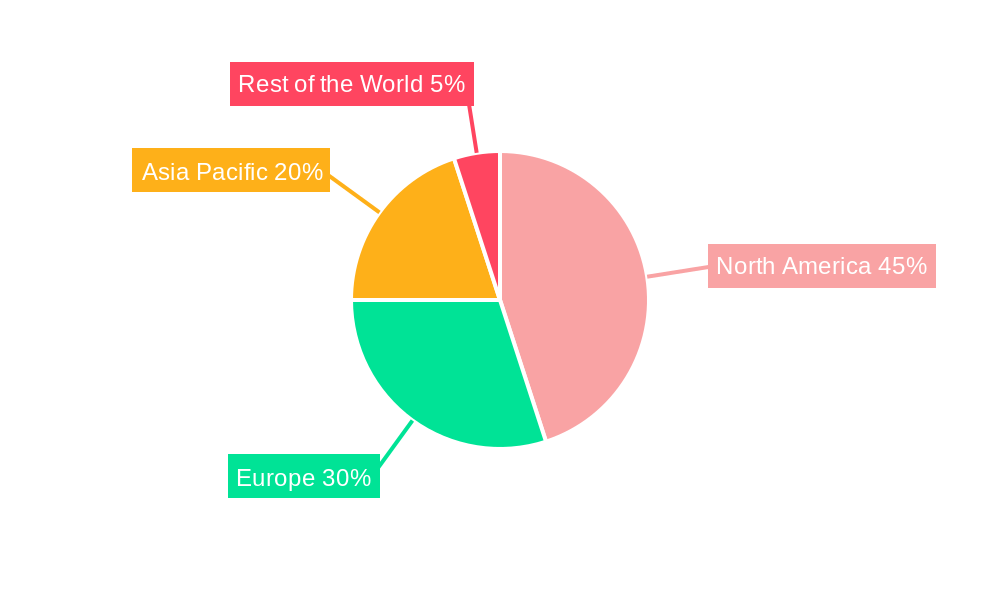

Market segmentation highlights the dominance of CNC operations, driven by their precision, efficiency, and capability to manage intricate geometries. Machine types such as CNC machines and lathes/turning centers are crucial, offering advanced production of parts from diverse materials including steel, plastics, and specialized alloys. While automotive and electronics lead in end-use applications, defense and healthcare present significant growth avenues. Geographically, North America, encompassing the United States, Canada, and Mexico, holds a dominant position due to its robust manufacturing infrastructure and high adoption of advanced technologies. Potential restraints include fluctuating raw material costs and the demand for skilled labor to operate sophisticated machinery.

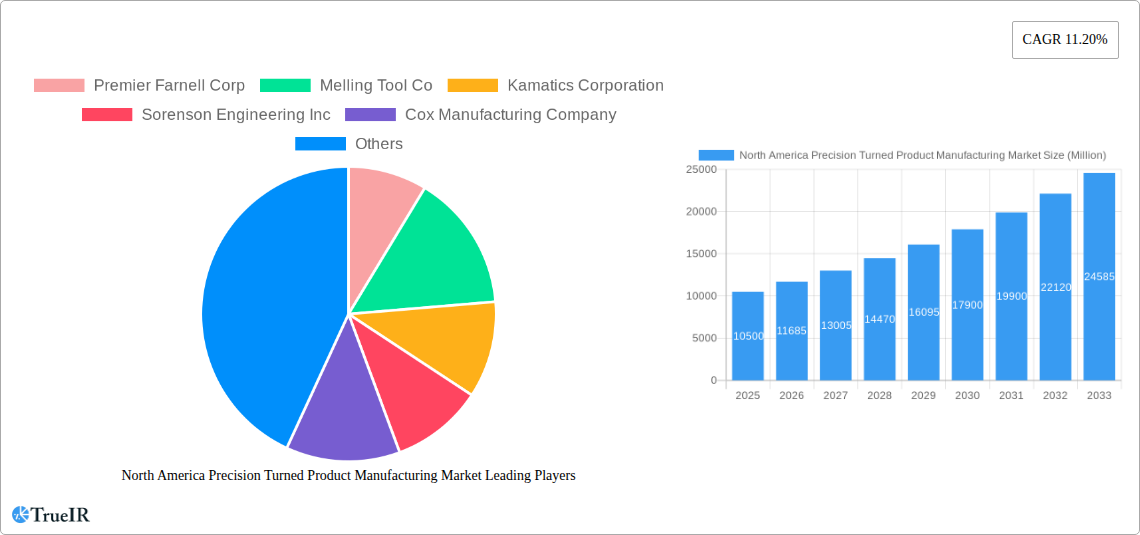

North America Precision Turned Product Manufacturing Market Company Market Share

North America Precision Turned Product Manufacturing Market Analysis and Forecast (2019-2033)

This report offers an in-depth analysis of the North America Precision Turned Product Manufacturing Market, detailing market dynamics, key trends, the competitive landscape, and future projections. Spanning 2019 to 2033, with a base year of 2025, this study is vital for stakeholders seeking to understand evolving opportunities and challenges within this essential industrial sector.

North America Precision Turned Product Manufacturing Market Market Structure & Competitive Landscape

The North America Precision Turned Product Manufacturing Market is characterized by a moderate level of market concentration, with a blend of large, established players and a significant number of specialized, mid-sized, and smaller enterprises. Innovation drivers are predominantly centered around advancements in CNC machining technology, automation, and the adoption of new materials to meet increasingly stringent performance requirements across various end-use industries. Regulatory impacts, while not overtly restrictive, focus on quality standards, environmental compliance, and worker safety, influencing manufacturing processes and investment decisions. Product substitutes are generally limited for highly specialized precision turned components, though advancements in additive manufacturing present a potential long-term disruptive force in certain applications. End-user segmentation reveals a strong reliance on the automotive, electronics, defense, and healthcare sectors, each with unique demands for precision and material integrity. Mergers and acquisitions (M&A) activity plays a crucial role in market consolidation and capability expansion, as evidenced by recent strategic buyouts aimed at enhancing service offerings and market reach. For instance, the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group in November 2022 signifies a trend towards larger entities consolidating market share and expanding their footprint into mission-critical end markets. Similarly, Plansee Group's acquisition of Mi-Tech Tungsten Metals in December 2021 highlights the strategic importance of specialized material expertise and market position reinforcement. The market concentration ratio is estimated to be in the XX% range for the top five players, with M&A volumes averaging XX deals per year in the historical period.

North America Precision Turned Product Manufacturing Market Market Trends & Opportunities

The North America Precision Turned Product Manufacturing Market is projected to experience robust growth, driven by escalating demand from key end-use sectors and continuous technological advancements. The market size is estimated to reach approximately $XX Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by the increasing sophistication of automotive components, the miniaturization and complexity of electronic devices, the stringent requirements of defense applications, and the critical precision needed in the healthcare industry. Technological shifts are a primary trend, with the widespread adoption of advanced CNC machining centers, including multi-axis turning and live tooling capabilities, leading to enhanced precision, reduced cycle times, and improved efficiency. Automation and robotics are increasingly integrated into manufacturing processes to optimize production flow and address labor shortages. Consumer preferences are evolving towards higher quality, greater durability, and more customized components, pushing manufacturers to invest in superior material science and process control. Competitive dynamics are intensifying, with a focus on value-added services such as design assistance, prototyping, and quality assurance. Opportunities abound for manufacturers who can leverage Industry 4.0 principles, implement smart manufacturing solutions, and offer specialized expertise in high-performance materials like advanced plastics and specialized steels. The market penetration rate for high-precision turned products is estimated to be XX% in the automotive sector and XX% in electronics, with significant untapped potential in emerging applications and specialized niches. The transition towards electric vehicles (EVs) is creating new demand for precision-turned components in battery systems, powertrains, and charging infrastructure, presenting a significant growth avenue. Furthermore, the growing emphasis on medical device innovation and implantable technologies will continue to drive demand for biocompatible and highly precise turned parts. The overall market trajectory indicates a sustained upward trend, supported by economic recovery, industrial investment, and ongoing innovation.

Dominant Markets & Segments in North America Precision Turned Product Manufacturing Market

The North America Precision Turned Product Manufacturing Market is demonstrating significant dominance across several key regions and segments. Geographically, the United States stands as the leading market, accounting for an estimated XX% of the total market revenue. This dominance is attributed to its large industrial base, strong presence of automotive, electronics, and defense industries, and a high level of technological adoption. Within the United States, regions with a strong manufacturing heritage, such as the Midwest and the Southeast, are particularly influential.

Operational Segments:

- CNC Operation: This segment is the most dominant, driven by the inherent need for precision, repeatability, and efficiency in modern manufacturing. CNC machines offer superior control over complex geometries and tight tolerances, essential for a wide array of applications.

- Key Growth Drivers: Advancements in CNC controller technology, availability of skilled CNC machinists, and increasing automation integrated with CNC systems.

- Manual Operation: While declining in share, manual operations still hold relevance for low-volume production, prototyping, and highly specialized tasks where manual dexterity and operator judgment are paramount.

Machine Types:

- Computer Numerically Controlled (CNC) Lathes or Turning Centers: These are the workhorses of the precision turned product industry, offering versatility and precision for a wide range of components.

- Key Growth Drivers: Development of more sophisticated multi-axis turning centers, integration of live tooling, and advancements in CAM software for programming.

- Automatic Screw Machines: Remain significant for high-volume production of relatively simpler turned parts, offering cost-effectiveness and speed.

- Rotary Transfer Machines: Excel in high-speed, high-volume production of complex parts from bar stock, often used in the automotive industry.

Material Types:

- Steel: Continues to be the dominant material type due to its strength, durability, cost-effectiveness, and widespread availability. Various grades of steel are utilized across different industries.

- Key Growth Drivers: Demand from automotive for engine and chassis components, defense applications requiring robust materials, and general industrial machinery.

- Plastic: Growing in importance, particularly in electronics and healthcare, due to its lightweight properties, corrosion resistance, and electrical insulation capabilities.

- Other Material Types: Includes aluminum, brass, titanium, and specialized alloys, catering to niche applications requiring specific properties like high strength-to-weight ratio or biocompatibility.

End Uses:

- Automobile: This sector is the largest consumer of precision turned products, requiring components for engines, transmissions, suspensions, and braking systems. The shift towards electric vehicles is opening new avenues for precision-turned parts in battery management systems and electric powertrains.

- Key Growth Drivers: Growth of the automotive industry, increasing complexity of vehicle components, and the transition to electric mobility.

- Electronics: Miniaturization and the increasing complexity of electronic devices drive demand for high-precision turned components in connectors, sensors, and internal mechanisms.

- Defense: Stringent requirements for reliability and performance in aerospace and defense applications ensure a steady demand for high-precision turned parts, often made from specialized alloys.

- Healthcare: The medical device industry relies heavily on precision turned components for surgical instruments, implants, diagnostic equipment, and drug delivery systems, demanding biocompatible materials and extremely tight tolerances.

The dominance of CNC operations, turning centers, steel materials, and the automotive end-use segment underscores the current landscape, while the growing influence of plastics and the evolving demands of the healthcare and electronics sectors present significant future growth opportunities.

North America Precision Turned Product Manufacturing Market Product Analysis

The North America Precision Turned Product Manufacturing Market is defined by a continuous stream of product innovations aimed at enhancing performance, reducing size, and improving cost-effectiveness. Key advancements include the development of multi-functional turning centers capable of milling, drilling, and threading in a single setup, significantly reducing lead times and improving accuracy. The application of advanced coatings and surface treatments is also a crucial product development area, enhancing wear resistance, corrosion protection, and overall component longevity. In the electronics sector, the demand for ultra-miniature turned components for smartphones and wearable devices is a driving force. In healthcare, innovations focus on biocompatible materials like titanium and specialized polymers for implants and surgical tools, demanding sub-micron tolerances. Competitive advantages are increasingly derived from a manufacturer's ability to handle complex geometries, work with exotic materials, and provide integrated solutions from design to finished product.

Key Drivers, Barriers & Challenges in North America Precision Turned Product Manufacturing Market

Key Drivers:

The North America Precision Turned Product Manufacturing Market is propelled by several key factors. Technologically, the ongoing evolution of CNC machining, including advanced tooling and automation, allows for greater precision and efficiency. Economically, robust demand from the automotive, electronics, and healthcare sectors, driven by product innovation and consumer spending, is a primary catalyst. Policy-driven initiatives promoting advanced manufacturing and reshoring efforts also provide a supportive environment. The increasing complexity and miniaturization of components across various industries necessitate high-precision turning capabilities.

Barriers and Challenges:

Despite strong growth drivers, the market faces significant challenges. Supply chain disruptions, particularly for raw materials and specialized tooling, can impact production timelines and costs. Regulatory complexities, including evolving environmental standards and quality certifications, require continuous adaptation and investment. Competitive pressures are intense, with a constant need to innovate and maintain cost-effectiveness. Furthermore, the shortage of skilled labor, particularly experienced CNC machinists and programmers, poses a significant operational hurdle. The capital-intensive nature of advanced machining equipment also presents a barrier to entry for smaller players.

Growth Drivers in the North America Precision Turned Product Manufacturing Market Market

The North America Precision Turned Product Manufacturing Market's growth is significantly influenced by technological advancements, particularly in the realm of CNC machining and automation, enabling higher precision and efficiency. Economic factors, including sustained demand from the automotive sector for both traditional and electric vehicles, and the burgeoning electronics industry's need for increasingly intricate components, are paramount. Policy initiatives encouraging domestic manufacturing and technological innovation also serve as crucial growth catalysts. The healthcare sector's continuous drive for advanced medical devices and implants, requiring highly precise and biocompatible components, further fuels market expansion.

Challenges Impacting North America Precision Turned Product Manufacturing Market Growth

Several challenges impact the growth of the North America Precision Turned Product Manufacturing Market. Regulatory complexities, such as stringent quality control mandates and environmental compliance standards, necessitate significant investment and operational adjustments. Persistent supply chain issues, including the availability and cost of raw materials and critical components, can disrupt production schedules and increase overheads. Intense competitive pressures from both domestic and international players demand continuous innovation and cost optimization. Furthermore, a persistent shortage of skilled labor, especially experienced machinists and engineers, poses a significant impediment to scaling operations and adopting advanced technologies.

Key Players Shaping the North America Precision Turned Product Manufacturing Market Market

- Premier Farnell Corp

- Melling Tool Co

- Kamatics Corporation

- Sorenson Engineering Inc

- Cox Manufacturing Company

- Nook Industries LLC

- Creed-Monarch Inc

- Camcraft Inc

- M & W Industries Inc

- Greystone of Lincoln Inc

- Swagelok Hy-Level Company

- Herker Industries Inc

- Supreme Screw Products Inc

Significant North America Precision Turned Product Manufacturing Market Industry Milestones

- November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

- December 2021: A legally binding agreement was signed by the Reutte, Austria-based Plansee Group to buy the Indianapolis-based Mi-Tech Tungsten Metals. Nearly 100 individuals work for Mi-Tech, which is regarded as one of the top manufacturers of tungsten-based goods in the United States. It is strengthening its market position for tungsten goods in North America with the acquisition of Mi-Tech.

Future Outlook for North America Precision Turned Product Manufacturing Market Market

The future outlook for the North America Precision Turned Product Manufacturing Market remains highly promising, driven by a confluence of technological advancements and robust end-use industry growth. Key growth catalysts include the continued evolution of Industry 4.0 principles, leading to smarter, more integrated manufacturing processes and the widespread adoption of advanced materials offering superior performance characteristics. Strategic opportunities lie in serving emerging sectors like advanced robotics, aerospace, and renewable energy, alongside the established automotive, electronics, and healthcare markets. The market's potential is further amplified by ongoing reshoring initiatives and the global demand for high-precision, reliable components, positioning manufacturers for sustained expansion and profitability in the coming years.

North America Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC)

- 2.4. Lathes or Turning Centers

-

3. Material Type

- 3.1. Plastic

- 3.2. Steel

- 3.3. Other Material Types

-

4. End Use

- 4.1. Automobile

- 4.2. Electronics

- 4.3. Defense

- 4.4. Healthcare

North America Precision Turned Product Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of North America Precision Turned Product Manufacturing Market

North America Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC)

- 5.2.4. Lathes or Turning Centers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Plastic

- 5.3.2. Steel

- 5.3.3. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Automobile

- 5.4.2. Electronics

- 5.4.3. Defense

- 5.4.4. Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Farnell Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Melling Tool Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kamatics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sorenson Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cox Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nook Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creed-Monarch Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Camcraft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greystone of Lincoln Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swagelok Hy-Level Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Herker Industries Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Supreme Screw Products Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Premier Farnell Corp

List of Figures

- Figure 1: North America Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 2: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 3: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 5: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 7: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 8: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Precision Turned Product Manufacturing Market?

Key companies in the market include Premier Farnell Corp, Melling Tool Co, Kamatics Corporation, Sorenson Engineering Inc, Cox Manufacturing Company, Nook Industries LLC, Creed-Monarch Inc, Camcraft Inc, M & W Industries Inc, Greystone of Lincoln Inc, Swagelok Hy-Level Company, Herker Industries Inc, Supreme Screw Products Inc **List Not Exhaustive.

3. What are the main segments of the North America Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, Material Type, End Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 110.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT).

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence