Key Insights

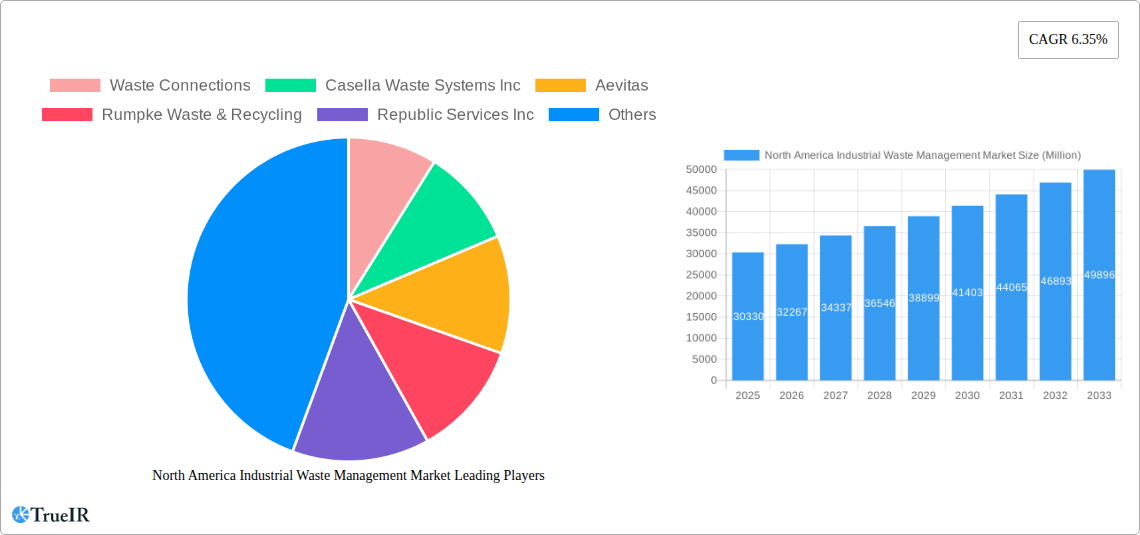

The North American industrial waste management market, valued at $30.33 billion in 2025, is projected to experience robust growth, driven by increasing industrial activity, stringent environmental regulations, and a rising focus on sustainable waste disposal practices. The market's Compound Annual Growth Rate (CAGR) of 6.35% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the growing manufacturing sector, particularly in automotive and electronics, leading to a substantial increase in hazardous and non-hazardous waste generation. Furthermore, the increasing adoption of advanced waste management technologies, such as waste-to-energy conversion and advanced recycling methods, contributes to market growth. Government initiatives promoting circular economy models and imposing stricter penalties for non-compliance with environmental regulations further incentivize businesses to adopt efficient and environmentally responsible waste management strategies.

North America Industrial Waste Management Market Market Size (In Billion)

However, the market also faces certain challenges. Fluctuations in raw material prices, particularly for recyclable materials, can impact profitability for waste management companies. Additionally, the high capital expenditure required for setting up and maintaining advanced waste processing facilities could hinder smaller players' market entry. Nevertheless, the long-term outlook remains positive, driven by consistent industrial growth and the increasing urgency to address environmental concerns. The competitive landscape features a mix of large multinational corporations such as Waste Management Inc., Republic Services Inc., and Veolia North America, alongside smaller regional players specializing in niche waste streams. This dynamic market will continue to be shaped by technological innovation, regulatory changes, and the ongoing shift towards sustainable practices across various industrial sectors.

North America Industrial Waste Management Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America Industrial Waste Management Market, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a focus on the estimated year 2025, this report is an essential resource for businesses, investors, and stakeholders operating within this rapidly evolving sector. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

North America Industrial Waste Management Market Structure & Competitive Landscape

The North American industrial waste management market is characterized by a moderately concentrated structure, with several large players holding significant market share. Key players such as Waste Management Inc., Republic Services Inc., Waste Connections, and Veolia North America dominate the landscape, accounting for an estimated xx% of the total market revenue in 2025. However, the presence of numerous smaller, regional players creates a competitive environment.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in waste-to-energy technologies, advanced recycling processes, and digital waste management solutions are driving market innovation.

- Regulatory Impacts: Stringent environmental regulations and policies related to waste disposal and recycling significantly influence market dynamics, prompting companies to adopt sustainable waste management practices.

- Product Substitutes: Limited viable substitutes exist for traditional waste management services; however, advancements in waste reduction and recycling are altering market shares.

- End-User Segmentation: The market is segmented by industry (manufacturing, construction, healthcare, etc.), waste type (hazardous, non-hazardous, recyclable), and service type (collection, processing, disposal, recycling).

- M&A Trends: The market has witnessed significant mergers and acquisitions (M&A) activity, particularly in recent years. The acquisition of U.S. Industrial Technologies by Veolia North America (October 2023) and Casella Waste Systems' acquisition of Twin Bridges (June 2023) demonstrate the ongoing consolidation trend, aimed at expanding market share and service offerings. The total value of M&A deals in the sector from 2019-2024 is estimated at xx Million.

North America Industrial Waste Management Market Market Trends & Opportunities

The North American industrial waste management market is experiencing robust growth fueled by several key trends. Increasing industrialization, stricter environmental regulations, and rising awareness of sustainable waste management practices are major contributors to this expansion. Technological advancements, such as AI-powered waste sorting and advanced recycling technologies, are further enhancing efficiency and creating new opportunities. The market is projected to grow at a CAGR of xx% from 2025 to 2033, driven by increasing industrial output and government initiatives promoting circular economy models. Market penetration of advanced waste management technologies is expected to increase from xx% in 2025 to xx% by 2033. Changes in consumer preferences towards environmentally conscious businesses are influencing corporate sustainability strategies, thereby boosting demand for responsible waste management solutions. Intense competition among existing players is pushing innovation and price optimization, shaping market dynamics.

Dominant Markets & Segments in North America Industrial Waste Management Market

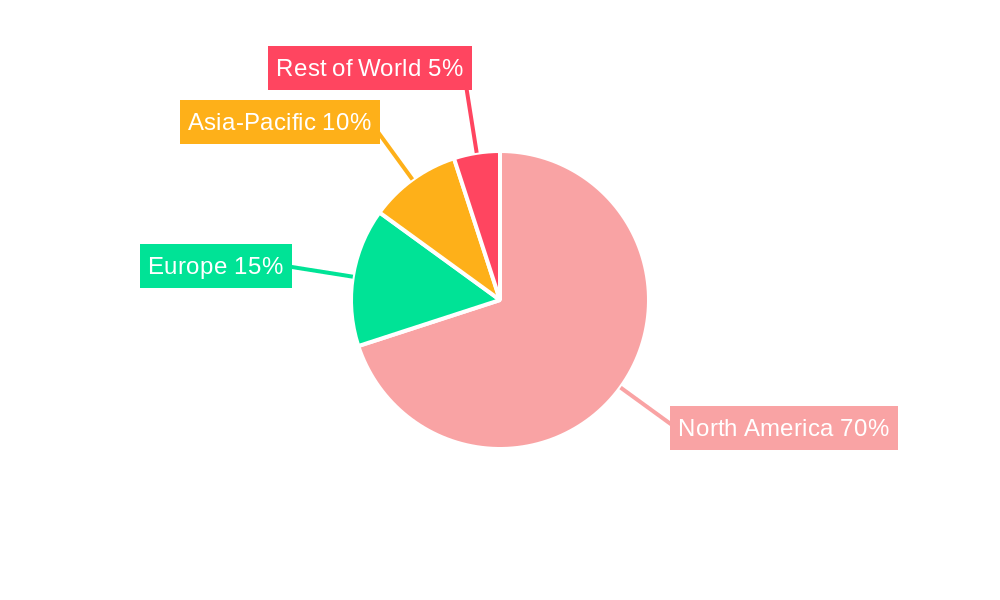

The United States represents the largest market for industrial waste management in North America, driven by its robust industrial base and stringent environmental regulations. The manufacturing sector constitutes a significant segment within the U.S. market.

- Key Growth Drivers in the US:

- Robust industrial activity, particularly in manufacturing and construction.

- Stringent environmental regulations and penalties for non-compliance.

- Growing focus on sustainability and circular economy initiatives.

- Investments in advanced waste management infrastructure.

- Market Dominance Analysis: The US market accounts for approximately xx% of the total North American market revenue in 2025. This dominance is attributed to the factors mentioned above and the presence of major players with extensive operational networks. Canada is the second largest market, with a relatively lower concentration of large players compared to the US, offering opportunities for growth and market entry for smaller companies.

North America Industrial Waste Management Market Product Analysis

Technological advancements are revolutionizing waste management, leading to innovations such as AI-powered waste sorting systems, advanced recycling technologies, and improved waste-to-energy solutions. These innovations offer enhanced efficiency, cost-effectiveness, and environmental sustainability, leading to increased market acceptance and adoption. Companies are focusing on developing integrated waste management solutions that combine various services to cater to specific client needs. This trend is driving competition and shaping product differentiation strategies in the market.

Key Drivers, Barriers & Challenges in North America Industrial Waste Management Market

Key Drivers: Stringent environmental regulations, increasing industrial output, growing demand for sustainable solutions, and technological advancements are key drivers. The rising cost of landfill disposal is also pushing businesses to explore more cost-effective and environmentally responsible alternatives like recycling and waste-to-energy.

Key Challenges: Fluctuating commodity prices for recycled materials, high capital investment costs for advanced technologies, and complexities related to waste management regulations across different jurisdictions pose significant challenges. Supply chain disruptions can also impact the availability and cost of equipment and materials required for waste management operations. Competition from established players and the need to manage the cost of labor continue to exert pressure on margins.

Growth Drivers in the North America Industrial Waste Management Market Market

The market's growth is primarily driven by stricter environmental regulations, promoting waste reduction and recycling. Expansion of industrial activities and the growing adoption of sustainable practices by businesses contribute significantly to market growth. Technological advancements, particularly in waste-to-energy and advanced recycling, offer opportunities for improved efficiency and reduced environmental impact, thus stimulating market expansion.

Challenges Impacting North America Industrial Waste Management Market Growth

Regulatory complexities, varying across different states and provinces, pose a significant challenge for waste management companies. Supply chain issues, particularly related to the availability and cost of raw materials and equipment, can affect operational efficiency. Intense competition among established players and the entry of new players necessitates continuous improvement in efficiency and service offerings, impacting profitability.

Key Players Shaping the North America Industrial Waste Management Market Market

- Waste Connections

- Casella Waste Systems Inc

- Aevitas

- Rumpke Waste & Recycling

- Republic Services Inc

- FCC Environment Limited

- Biffa

- Stericycle

- Veolia North America

- Waste Management Inc

- Covanta

- Clean Harbors Inc (List Not Exhaustive)

Significant North America Industrial Waste Management Market Industry Milestones

- October 2023: Veolia North America completed the acquisition of U.S. Industrial Technologies, expanding its market share in the U.S. industrial waste management sector.

- June 2023: Casella Waste Systems, Inc. acquired the assets of Consolidated Waste Services, LLC (Twin Bridges) for USD 219 Million, enhancing its operational capacity and market reach.

Future Outlook for North America Industrial Waste Management Market Market

The North American industrial waste management market is poised for continued growth, driven by increasing industrial activity, stringent environmental regulations, and the rising adoption of sustainable waste management practices. Strategic investments in advanced technologies, expansion of recycling infrastructure, and a focus on circular economy models will further shape market dynamics and create opportunities for growth. The market is expected to witness significant consolidation through M&A activity, creating larger, more integrated players capable of delivering comprehensive waste management solutions.

North America Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition Waste

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

North America Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Industrial Waste Management Market Regional Market Share

Geographic Coverage of North America Industrial Waste Management Market

North America Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations; Increasing Number of Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Increasing Number of Industries

- 3.4. Market Trends

- 3.4.1. Oil and gas Production is Expected to Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition Waste

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Connections

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Casella Waste Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aevitas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rumpke Waste & Recycling

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Republic Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FCC Environment Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biffa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stericylce

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia North America

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waste Management Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covanta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Clean Harbors Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Waste Connections

List of Figures

- Figure 1: North America Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: North America Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: North America Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Waste Management Market?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the North America Industrial Waste Management Market?

Key companies in the market include Waste Connections, Casella Waste Systems Inc, Aevitas, Rumpke Waste & Recycling, Republic Services Inc, FCC Environment Limited, Biffa, Stericylce, Veolia North America, Waste Management Inc, Covanta, Clean Harbors Inc **List Not Exhaustive.

3. What are the main segments of the North America Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations; Increasing Number of Industries.

6. What are the notable trends driving market growth?

Oil and gas Production is Expected to Dominated the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Increasing Number of Industries.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia North America, one of the leading integrated providers of environmental services in the U.S. and Canada, announced that it completed the acquisition of U.S. Industrial Technologies, a Michigan-based provider of total waste and recycling services that managed industrial waste streams for automakers as well as other large manufacturers, medium and small businesses and governments and municipalities since 1996. The acquisition was likely to expand the U.S. market share for Veolia’s Environmental Solutions and Services (ESS) division, which is already recognized for its ability to provide customized integrated services for the management and treatment of hazardous, non-hazardous and recyclable waste for thousands of U.S. industrial, commercial and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence