Key Insights

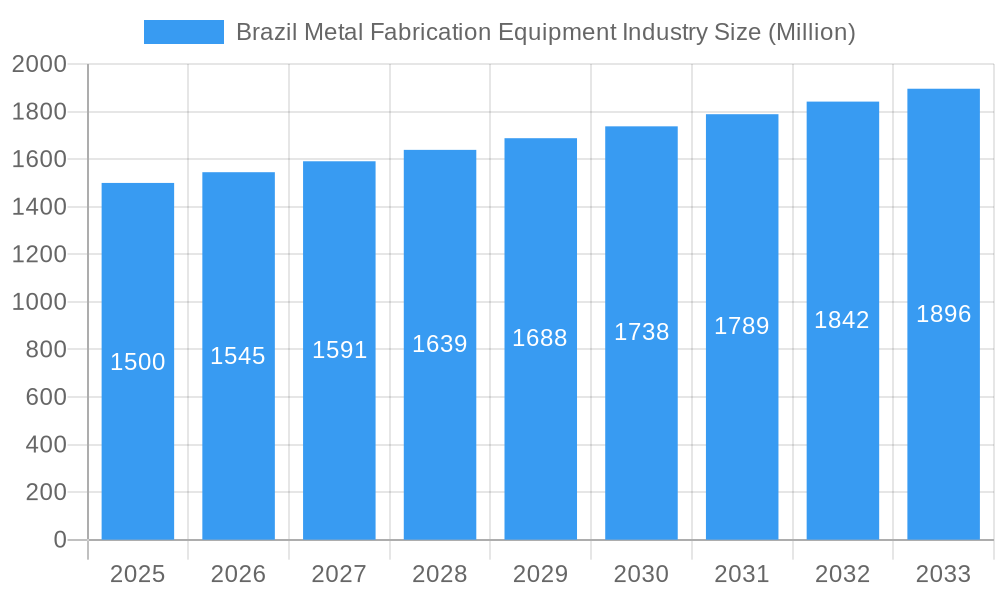

The Brazilian metal fabrication equipment market, valued at approximately $1.3 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 2.86% through 2033. Key growth drivers include significant investments in infrastructure projects within the automotive and construction sectors, alongside the increasing adoption of automation and Industry 4.0 technologies to enhance productivity. Market expansion spans sheet metal processing, welding, and machining equipment segments. Despite challenges such as economic volatility and raw material price fluctuations, the long-term outlook remains positive, supported by Brazil's expanding industrial base and government initiatives promoting manufacturing and technological advancement.

Brazil Metal Fabrication Equipment Industry Market Size (In Billion)

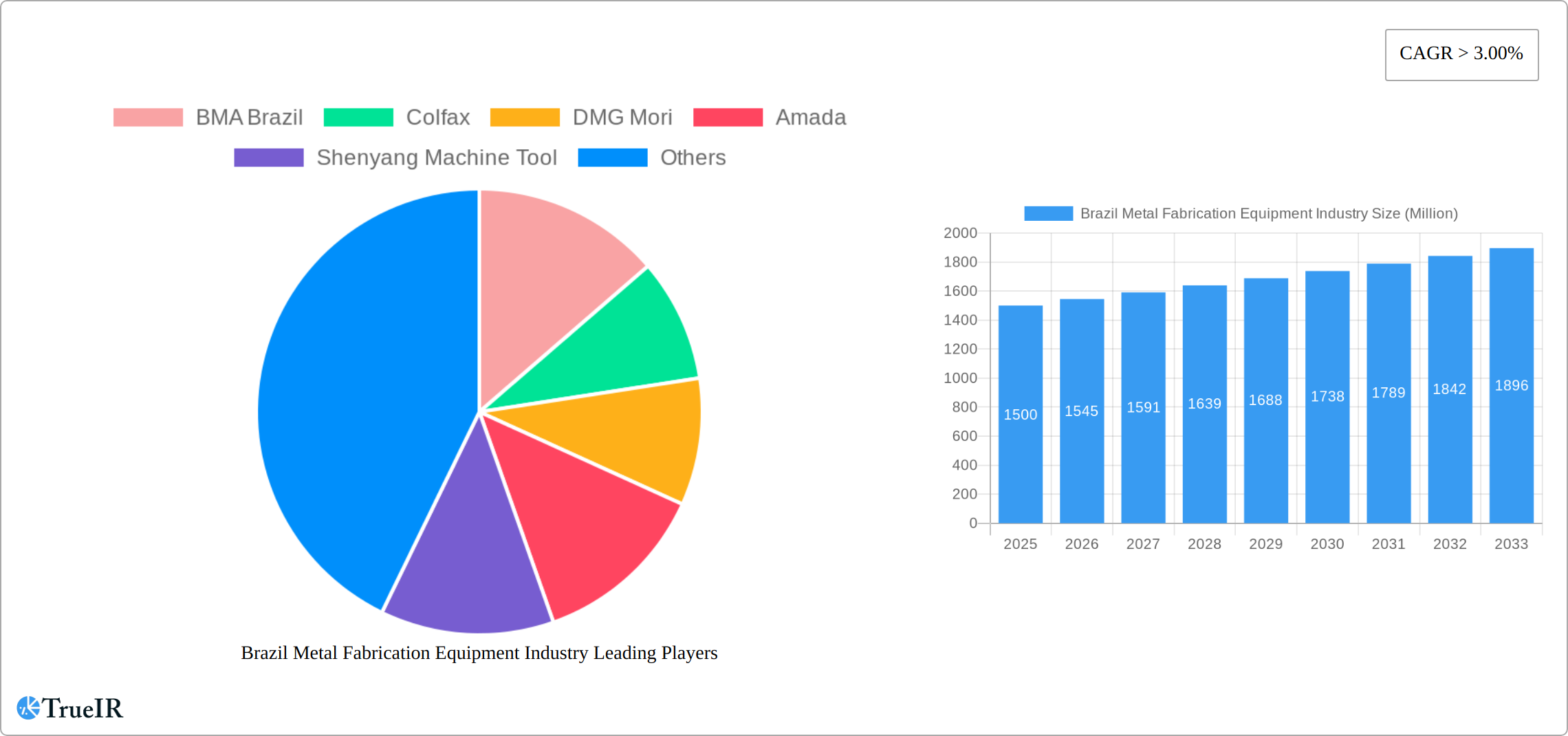

Key industry players, including BMA Brazil, Colfax, DMG Mori, Amada, Shenyang Machine Tool, Hurco, Kennametal, and MAG Giddings & Lewis, are driving market evolution through innovation and strategic collaborations. The competitive landscape features both domestic and international manufacturers, with segmentation by equipment type and end-use industry offering specialized opportunities. Future growth will be shaped by supportive government policies for domestic manufacturing, advancements in additive manufacturing and laser cutting, and overall economic performance. Continued R&D investment and a focus on sustainable practices are crucial for sustained success in this evolving market.

Brazil Metal Fabrication Equipment Industry Company Market Share

Brazil Metal Fabrication Equipment Market Analysis: Trends, Growth, and Forecast (2019-2033)

This comprehensive report offers critical insights into the Brazil metal fabrication equipment industry, targeting investors, industry professionals, and decision-makers. Utilizing extensive market research and data analysis from 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), the report details key trends, challenges, and opportunities. Optimized for high-impact keywords such as Brazil metal fabrication, metalworking machinery, industrial equipment Brazil, and manufacturing technology Brazil, this analysis ensures maximum industry visibility.

Brazil Metal Fabrication Equipment Industry Market Structure & Competitive Landscape

The Brazilian metal fabrication equipment market presents a moderately concentrated structure, characterized by a blend of established multinational corporations and a substantial number of smaller, domestically-owned businesses. While precise figures require ongoing analysis, the market's Herfindahl-Hirschman Index (HHI) suggests a moderately competitive landscape, fostering both collaboration and rivalry. Innovation is a pivotal driver, with companies aggressively investing in automation technologies, including robotics and advanced materials processing techniques like laser cutting and 3D printing integration. Stringent government regulations, particularly concerning safety and environmental compliance, significantly influence market dynamics and necessitate continuous adaptation. The emergence of substitute technologies such as advanced 3D printing and additive manufacturing presents both a challenge and an opportunity for market participants to innovate and integrate these newer processes. The end-user base is remarkably diverse, encompassing key sectors such as automotive, aerospace, construction, energy, and increasingly, renewable energy infrastructure development. Mergers and acquisitions (M&A) activity, while fluctuating, showcases potential for future consolidation. While past activity (2019-2024) indicated a total transaction value of approximately $XX Million, future projections suggest increased M&A activity fueled by the pursuit of market dominance and expansion into lucrative niche segments.

- Market Concentration: Moderately concentrated; HHI data requires further analysis for precise quantification.

- Innovation Drivers: Automation, Robotics, Advanced Materials Processing (Laser Cutting, Additive Manufacturing), AI-driven optimization

- Regulatory Impacts: Stringent safety and environmental regulations driving sustainable manufacturing practices.

- Product Substitutes: Advanced 3D Printing, Additive Manufacturing, posing both challenges and opportunities.

- End-User Segmentation: Automotive, Aerospace, Construction, Energy (including Renewables), Infrastructure.

- M&A Activity (2019-2024): Total Transaction Value: $XX Million (Further analysis needed for updated figures).

Brazil Metal Fabrication Equipment Industry Market Trends & Opportunities

The Brazilian metal fabrication equipment market is poised for substantial growth, fueled by a confluence of factors. Robust infrastructure development projects, expanding industrial output across various sectors, and a burgeoning demand for sophisticated manufacturing technologies are key drivers. Market projections anticipate reaching $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (Source: [Insert Source Here]). Technological advancements, especially in digitalization and automation, are reshaping production processes, improving efficiency, and elevating product quality. A growing emphasis on sustainability is driving demand for eco-friendly and energy-efficient equipment. The competitive landscape is dynamic, characterized by rising foreign direct investment, continuous technological innovation, and the emergence of specialized niche players catering to specific industry needs. Despite significant advancements, market penetration rates for cutting-edge technologies remain relatively low, signifying substantial untapped potential for future growth.

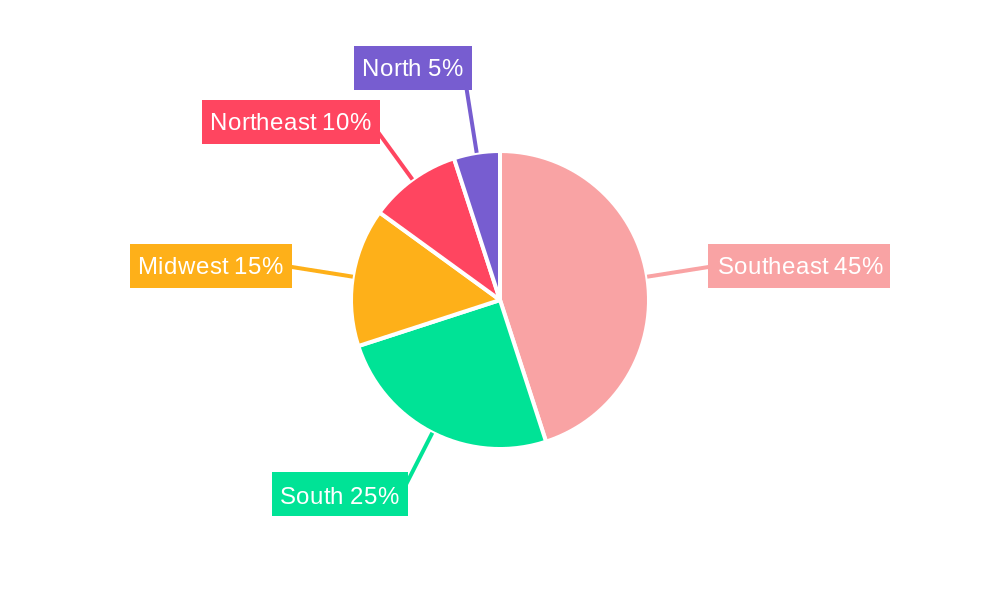

Dominant Markets & Segments in Brazil Metal Fabrication Equipment Industry

The Southeast region of Brazil dominates the metal fabrication equipment market, accounting for xx% of total sales in 2025. This dominance is attributed to the region's concentration of industrial activity, strong infrastructure, and favorable business environment.

- Key Growth Drivers in the Southeast Region:

- Robust Industrial Base

- Well-Developed Infrastructure

- Government Incentives for Manufacturing

- Proximity to Major Ports

The automotive and aerospace sectors represent the most significant end-user segments, with high demand for advanced equipment capable of meeting stringent quality and precision standards. The construction sector also presents a significant market segment, particularly for equipment used in steel fabrication and infrastructure projects.

Brazil Metal Fabrication Equipment Industry Product Analysis

The Brazilian market features a wide array of metal fabrication equipment, ranging from state-of-the-art laser cutting systems and advanced robotic welding solutions to high-precision CNC machining centers. These technologies are increasingly integrated with smart manufacturing systems and sophisticated data analytics platforms to optimize production processes and enhance overall efficiency. A key competitive differentiator lies in factors such as precision, speed, automation capabilities, and seamless integration with existing manufacturing infrastructure. The industry trend is shifting towards solutions that provide higher productivity, superior quality, reduced operational costs, and customizable configurations tailored to meet the diverse requirements of various industries.

Key Drivers, Barriers & Challenges in Brazil Metal Fabrication Equipment Industry

Key Drivers:

- Infrastructure Development: Government investments in infrastructure projects significantly drive demand for metal fabrication equipment.

- Industrial Expansion: Growth across key sectors such as automotive and construction fuels demand for advanced manufacturing solutions.

- Technological Advancements: Adoption of automation and digitalization boosts productivity and efficiency.

Challenges:

- Economic Volatility: Fluctuations in the Brazilian economy can negatively impact investment decisions and hinder market growth. The impact of these fluctuations on equipment sales is estimated at an average of xx% per year.

- Supply Chain Disruptions: Global supply chain vulnerabilities can lead to delays and increased costs, potentially hindering market expansion.

- Competitive Intensity: The presence of both domestic and international players creates intense competition and price pressure, thereby affecting profit margins of companies.

Growth Drivers in the Brazil Metal Fabrication Equipment Industry Market

The robust expansion of the Brazilian metal fabrication equipment industry is driven by several interconnected factors. Large-scale infrastructure projects, coupled with the growth of key industrial sectors – particularly automotive and construction – create a significant demand for advanced equipment. Furthermore, the increasing adoption of sophisticated technologies aimed at boosting productivity and enhancing product quality fuels market growth. Government initiatives supporting industrial modernization and technological upgrades play a crucial role in fostering this positive momentum.

Challenges Impacting Brazil Metal Fabrication Equipment Industry Growth

Economic volatility, supply chain disruptions, and stiff competition from both domestic and international players pose considerable challenges to market expansion. Regulatory hurdles and the cost of adopting new technologies also restrict growth in this industry.

Key Players Shaping the Brazil Metal Fabrication Equipment Industry Market

- BMA Brazil

- Colfax

- DMG Mori

- Amada

- Shenyang Machine Tool

- Hurco

- Kennametal

- MAG Giddings & Lewis

- List Not Exhaustive

Significant Brazil Metal Fabrication Equipment Industry Industry Milestones

- 2020, Q4: Government announces a significant infrastructure investment plan, boosting demand for metal fabrication equipment.

- 2022, Q1: Major automotive manufacturer invests in new robotic welding systems, demonstrating industry's adoption of advanced technologies.

- 2023, Q3: A leading Brazilian metal fabrication company acquires a smaller competitor, consolidating market share. (Further milestones require specific data)

Future Outlook for Brazil Metal Fabrication Equipment Industry Market

The Brazilian metal fabrication equipment market is expected to witness robust growth over the forecast period. Continued government investment in infrastructure, expansion of key industrial sectors, and increasing demand for automation and advanced manufacturing technologies will be major drivers. The strategic focus on sustainable and energy-efficient solutions will unlock further opportunities for market players. This growth trajectory presents significant prospects for both domestic and international companies operating in this sector.

Brazil Metal Fabrication Equipment Industry Segmentation

-

1. Product type

- 1.1. Automatic

- 1.2. Semi - automatic

- 1.3. Manual

-

2. Equipment type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End User industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Brazil Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Brazil

Brazil Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Brazil Metal Fabrication Equipment Industry

Brazil Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing sector promises a greater boom in the region for the metal fabrication equipment market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Automatic

- 5.1.2. Semi - automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End User industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BMA Brazil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DMG Mori

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amada

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shenyang Machine Tool

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hurco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kennametal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAG Giddings & Lewis*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BMA Brazil

List of Figures

- Figure 1: Brazil Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 2: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Equipment type 2020 & 2033

- Table 3: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by End User industry 2020 & 2033

- Table 4: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 6: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Equipment type 2020 & 2033

- Table 7: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by End User industry 2020 & 2033

- Table 8: Brazil Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Metal Fabrication Equipment Industry?

The projected CAGR is approximately 2.86%.

2. Which companies are prominent players in the Brazil Metal Fabrication Equipment Industry?

Key companies in the market include BMA Brazil, Colfax, DMG Mori, Amada, Shenyang Machine Tool, Hurco, Kennametal, MAG Giddings & Lewis*List Not Exhaustive.

3. What are the main segments of the Brazil Metal Fabrication Equipment Industry?

The market segments include Product type, Equipment type, End User industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing sector promises a greater boom in the region for the metal fabrication equipment market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Brazil Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence