Key Insights

The global drilling machine market is poised for significant expansion, projected to reach $26.56 billion by 2033. This growth is driven by increasing industrial automation, particularly in the automotive, aerospace, and electronics sectors, necessitating high-precision drilling solutions. The adoption of advanced technologies, such as CNC drilling machines, enhances accuracy and repeatability, further fueling market demand. Sectors like construction and infrastructure development also contribute to this upward trend. Key market drivers include growing industrialization and technological advancements. The market is segmented by drilling machine type, including vertical, horizontal, and radial, catering to diverse application requirements.

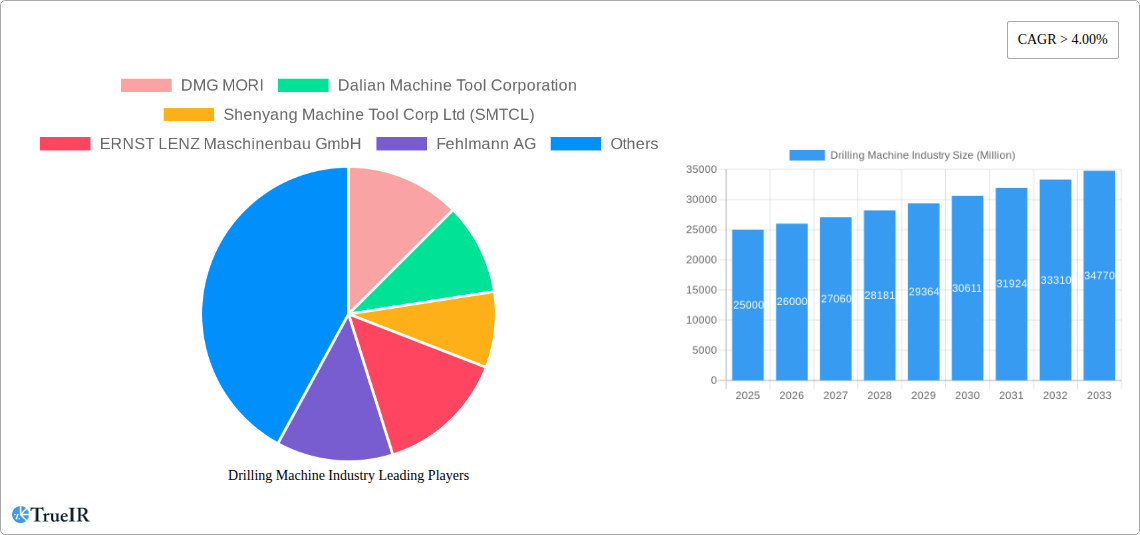

Drilling Machine Industry Market Size (In Billion)

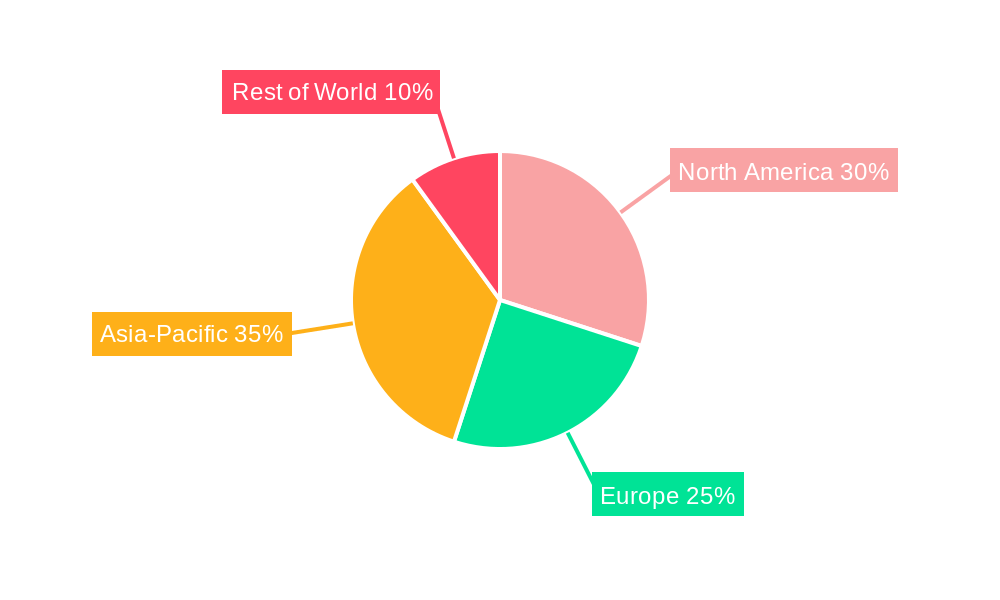

The forecast period (2025-2033) anticipates sustained market growth. While North America and Europe will maintain substantial market shares due to established manufacturing bases, the Asia-Pacific region, particularly China and India, is expected to exhibit the most rapid expansion, driven by burgeoning industrialization and manufacturing capacity. Companies must navigate challenges such as fluctuating raw material costs and intense competition by focusing on innovation, energy-efficient, and environmentally friendly solutions to secure a competitive edge.

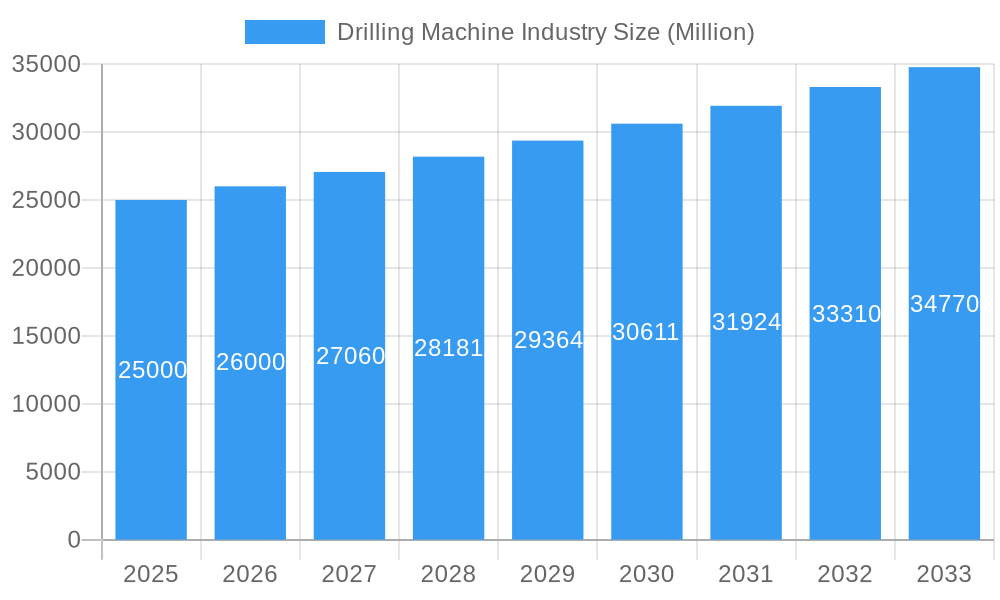

Drilling Machine Industry Company Market Share

Drilling Machine Market Analysis: 2025-2033 Outlook

This report offers a comprehensive analysis of the global drilling machine industry, providing critical insights into market dynamics, competitive landscapes, and future growth potential. It covers the forecast period from 2025 to 2033, detailing market size, segmentation, and key player strategies. This analysis is essential for investors, manufacturers, and industry professionals aiming to gain strategic advantages in this dynamic sector.

Drilling Machine Industry Market Structure & Competitive Landscape

The global drilling machine industry exhibits a moderately concentrated market structure, with several large players and a multitude of smaller, specialized firms. The industry's Herfindahl-Hirschman Index (HHI) is estimated to be approximately xx, indicating a moderately competitive landscape. Innovation plays a crucial role, driven by the need for enhanced precision, automation, and efficiency. Stringent safety regulations and environmental concerns significantly influence industry practices. Product substitutes, such as laser cutting and other advanced machining technologies, exert competitive pressure. The market is segmented by end-user industries, including construction, automotive, aerospace, and energy.

- Market Concentration: HHI estimated at xx (Moderate Concentration)

- Innovation Drivers: Demand for higher precision, automation, and faster machining speeds.

- Regulatory Impacts: Safety and environmental regulations increasingly impacting manufacturing processes.

- Product Substitutes: Laser cutting, 3D printing, and other advanced machining technologies.

- End-User Segmentation: Construction, automotive, aerospace, energy, and more.

- M&A Trends: A recent increase in mergers and acquisitions (M&A) activity indicates industry consolidation, with a total estimated value of USD xx Million in M&A activity in the past 5 years.

Drilling Machine Industry Market Trends & Opportunities

The global drilling machine market is experiencing a period of dynamic expansion, fueled by a confluence of technological advancements and evolving industry demands. Projections indicate the market size will reach an impressive USD [Insert Market Size Figure] Million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]% throughout the forecast period (2025-2033). At the forefront of this growth is the widespread adoption of cutting-edge technologies such as Computer Numerical Control (CNC), sophisticated automation, and comprehensive digitalization, which are fundamentally reshaping market dynamics. Consumers and industries are increasingly prioritizing drilling machines that offer exceptional precision, heightened efficiency, and remarkable adaptability to diverse operational needs. The burgeoning trend of smart manufacturing practices is further accelerating this market trajectory. While market penetration rates exhibit regional and segment variations, developed economies, characterized by higher levels of industrial automation, showcase the most significant adoption. The intensely competitive landscape necessitates continuous innovation from market participants, fostering a virtuous cycle of enhanced product development and improved market performance.

Dominant Markets & Segments in Drilling Machine Industry

Currently, the Asia-Pacific region, with China at its helm, stands as the dominant force in the global drilling machine market. This preeminence is a direct consequence of the region's rapid industrial expansion, substantial investments in burgeoning infrastructure projects, and a vast and active manufacturing base.

-

Key Growth Drivers in Asia-Pacific:

- Accelerated industrialization and rapid urbanization trends.

- Government-led initiatives and policies actively supporting and promoting infrastructure development.

- Increasing investments in advanced manufacturing capabilities and industrial automation solutions.

- Significant and sustained growth in construction activities across the region.

Complementing the Asia-Pacific powerhouse, Europe and North America represent substantial and influential markets. Their growth is primarily propelled by strategic upgrades in automation systems and significant investments in state-of-the-art manufacturing technologies. The automotive industry stands out as a major and consistent consumer of drilling machines across all these leading global regions.

Drilling Machine Industry Product Analysis

The evolution of drilling machine technology is characterized by relentless advancements, with a particular focus on elevating precision, enhancing automation, and boosting overall efficiency. CNC drilling machines are experiencing a surge in popularity due to their unparalleled accuracy and sophisticated programmability. Innovations are further being driven by advanced functionalities such as automated tool changing systems, intelligent adaptive control mechanisms, and integrated sensors that provide real-time operational feedback. The market effectively caters to a wide spectrum of applications, offering a diverse range of drilling machines from those designed for minute, precision tasks to heavy-duty industrial applications. The key to achieving a competitive edge in this market lies in the seamless integration of cutting-edge technology, intuitive and user-friendly interfaces, and exceptionally robust machine construction, all contributing to extended machine lifespans and an improved total cost of ownership for end-users.

Key Drivers, Barriers & Challenges in Drilling Machine Industry

Key Drivers:

- Technological Advancements: The increasing integration and adoption of CNC and automation technologies are pivotal in boosting productivity and precision levels across operations.

- Growing Industrialization: The continuous expansion of manufacturing sectors and infrastructure development projects worldwide directly fuels the demand for drilling machines.

- Favorable Government Policies: Strategic investment incentives, coupled with government initiatives promoting industrial automation and the adoption of Industry 4.0 principles, significantly bolster market growth.

Challenges:

- Supply Chain Disruptions: Ongoing geopolitical instability and persistent material shortages are creating significant impacts on production timelines and pricing strategies. This has, in the past year alone, led to an estimated [Insert Input Cost Increase Percentage]% increase in input costs.

- Regulatory Hurdles: Increasingly stringent safety and environmental regulations impose higher compliance costs and add layers of complexity to manufacturing and operational processes.

- Intense Competition: The market is characterized by a high degree of competition, with a multitude of players, including established multinational corporations and agile niche manufacturers, constantly vying for market share.

Growth Drivers in the Drilling Machine Industry Market

A significant impetus for growth in the drilling machine industry market stems from the increasing integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) into drilling machine functionalities, enhancing their capabilities and operational intelligence. Furthermore, the robust expansion of the global manufacturing sector, intrinsically linked with substantial investments in infrastructure development, creates a consistent and growing demand. Complementing these factors, proactive government initiatives aimed at promoting industrial automation and the adoption of smart manufacturing paradigms are actively contributing to and accelerating market expansion.

Challenges Impacting Drilling Machine Industry Growth

Supply chain vulnerabilities, particularly related to the availability of critical components, pose a significant challenge. Rising raw material costs and geopolitical uncertainties exacerbate the situation. Intense competition and price pressures also constrain profitability. Stringent environmental regulations impose added compliance burdens.

Key Players Shaping the Drilling Machine Industry Market

- DMG MORI

- Dalian Machine Tool Corporation

- Shenyang Machine Tool Corp Ltd (SMTCL)

- ERNST LENZ Maschinenbau GmbH

- Fehlmann AG

- Gate Machinery International Limited

- Hsin Geeli Hardware Enterprise

- Kaufman Mfg Co

- LTF SpA

- Minitool Inc

- Roku-Roku Co Ltd

- Scantool Group

- Taiwan Winnerstech Machinery Co Ltd

- Tongtai Machine & Tool Co Ltd

Significant Drilling Machine Industry Milestones

- December 2022: Komatsu Limited acquired GHH Group GmbH, expanding its presence in underground mining equipment.

- November 2022: Nidec Corporation acquired PAMA, a significant player in the machine tool industry, for USD 108 Million.

Future Outlook for Drilling Machine Industry Market

The drilling machine industry is poised for sustained growth, driven by ongoing technological innovation, increasing automation across various sectors, and continued infrastructure development globally. Strategic opportunities exist in developing advanced automation solutions, focusing on sustainability, and penetrating emerging markets. The market presents significant potential for companies that can adapt to evolving technological trends and meet the growing demand for efficient and precise drilling solutions.

Drilling Machine Industry Segmentation

-

1. Type

- 1.1. Sensitive Drilling Machine

- 1.2. Upright Drilling Machine

- 1.3. Radial Drilling Machine

- 1.4. Gang Drilling Machine

- 1.5. Multiple Spindle Drilling Machine

- 1.6. Deep Hole Drilling Machine

- 1.7. Other Types

-

2. End-user

- 2.1. Fabrication and Industrial Machinery Manufacturing

- 2.2. Aerospace

- 2.3. Heavy Equipment

- 2.4. Automotive

- 2.5. Energy Industry

- 2.6. Military & Defense

- 2.7. Oil & Gas

- 2.8. Other End-Users

Drilling Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Drilling Machine Industry Regional Market Share

Geographic Coverage of Drilling Machine Industry

Drilling Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Drilling Machines in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sensitive Drilling Machine

- 5.1.2. Upright Drilling Machine

- 5.1.3. Radial Drilling Machine

- 5.1.4. Gang Drilling Machine

- 5.1.5. Multiple Spindle Drilling Machine

- 5.1.6. Deep Hole Drilling Machine

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Fabrication and Industrial Machinery Manufacturing

- 5.2.2. Aerospace

- 5.2.3. Heavy Equipment

- 5.2.4. Automotive

- 5.2.5. Energy Industry

- 5.2.6. Military & Defense

- 5.2.7. Oil & Gas

- 5.2.8. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sensitive Drilling Machine

- 6.1.2. Upright Drilling Machine

- 6.1.3. Radial Drilling Machine

- 6.1.4. Gang Drilling Machine

- 6.1.5. Multiple Spindle Drilling Machine

- 6.1.6. Deep Hole Drilling Machine

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Fabrication and Industrial Machinery Manufacturing

- 6.2.2. Aerospace

- 6.2.3. Heavy Equipment

- 6.2.4. Automotive

- 6.2.5. Energy Industry

- 6.2.6. Military & Defense

- 6.2.7. Oil & Gas

- 6.2.8. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sensitive Drilling Machine

- 7.1.2. Upright Drilling Machine

- 7.1.3. Radial Drilling Machine

- 7.1.4. Gang Drilling Machine

- 7.1.5. Multiple Spindle Drilling Machine

- 7.1.6. Deep Hole Drilling Machine

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Fabrication and Industrial Machinery Manufacturing

- 7.2.2. Aerospace

- 7.2.3. Heavy Equipment

- 7.2.4. Automotive

- 7.2.5. Energy Industry

- 7.2.6. Military & Defense

- 7.2.7. Oil & Gas

- 7.2.8. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sensitive Drilling Machine

- 8.1.2. Upright Drilling Machine

- 8.1.3. Radial Drilling Machine

- 8.1.4. Gang Drilling Machine

- 8.1.5. Multiple Spindle Drilling Machine

- 8.1.6. Deep Hole Drilling Machine

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Fabrication and Industrial Machinery Manufacturing

- 8.2.2. Aerospace

- 8.2.3. Heavy Equipment

- 8.2.4. Automotive

- 8.2.5. Energy Industry

- 8.2.6. Military & Defense

- 8.2.7. Oil & Gas

- 8.2.8. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sensitive Drilling Machine

- 9.1.2. Upright Drilling Machine

- 9.1.3. Radial Drilling Machine

- 9.1.4. Gang Drilling Machine

- 9.1.5. Multiple Spindle Drilling Machine

- 9.1.6. Deep Hole Drilling Machine

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Fabrication and Industrial Machinery Manufacturing

- 9.2.2. Aerospace

- 9.2.3. Heavy Equipment

- 9.2.4. Automotive

- 9.2.5. Energy Industry

- 9.2.6. Military & Defense

- 9.2.7. Oil & Gas

- 9.2.8. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Drilling Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sensitive Drilling Machine

- 10.1.2. Upright Drilling Machine

- 10.1.3. Radial Drilling Machine

- 10.1.4. Gang Drilling Machine

- 10.1.5. Multiple Spindle Drilling Machine

- 10.1.6. Deep Hole Drilling Machine

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Fabrication and Industrial Machinery Manufacturing

- 10.2.2. Aerospace

- 10.2.3. Heavy Equipment

- 10.2.4. Automotive

- 10.2.5. Energy Industry

- 10.2.6. Military & Defense

- 10.2.7. Oil & Gas

- 10.2.8. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DMG MORI

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dalian Machine Tool Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shenyang Machine Tool Corp Ltd (SMTCL)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ERNST LENZ Maschinenbau GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fehlmann AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gate Machinery International Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hsin Geeli Hardware Enterprise

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kaufman Mfg Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LTF SpA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Minitool Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Roku-Roku Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Scantool Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Taiwan Winnerstech Machinery Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tongtai Machine & Tool Co Ltd**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 DMG MORI

List of Figures

- Figure 1: Global Drilling Machine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Drilling Machine Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Drilling Machine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Drilling Machine Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Drilling Machine Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Drilling Machine Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Drilling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Drilling Machine Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Drilling Machine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Drilling Machine Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Drilling Machine Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Drilling Machine Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Drilling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Drilling Machine Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Drilling Machine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Drilling Machine Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Drilling Machine Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Drilling Machine Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Drilling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Drilling Machine Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East and Africa Drilling Machine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Drilling Machine Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East and Africa Drilling Machine Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East and Africa Drilling Machine Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Drilling Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Drilling Machine Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin America Drilling Machine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Drilling Machine Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Latin America Drilling Machine Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Latin America Drilling Machine Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin America Drilling Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Drilling Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Drilling Machine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 9: Global Drilling Machine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Drilling Machine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Drilling Machine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Drilling Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Drilling Machine Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Drilling Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drilling Machine Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Drilling Machine Industry?

Key companies in the market include DMG MORI, Dalian Machine Tool Corporation, Shenyang Machine Tool Corp Ltd (SMTCL), ERNST LENZ Maschinenbau GmbH, Fehlmann AG, Gate Machinery International Limited, Hsin Geeli Hardware Enterprise, Kaufman Mfg Co, LTF SpA, Minitool Inc, Roku-Roku Co Ltd, Scantool Group, Taiwan Winnerstech Machinery Co Ltd, Tongtai Machine & Tool Co Ltd**List Not Exhaustive.

3. What are the main segments of the Drilling Machine Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.56 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in Demand for Drilling Machines in the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Komatsu Limited (a Japanese manufacturing company) announced that it has agreed to acquire GHH Group GmbH (GHH), a manufacturer of underground mining, tunneling, and special civil engineering equipment headquartered in Gelsenkirchen, Germany. This acquisition represents a great opportunity for Komatsu to expand its offerings for underground mining equipment and accelerate new product development through synergies with Komatsu's existing team and product offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drilling Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drilling Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drilling Machine Industry?

To stay informed about further developments, trends, and reports in the Drilling Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence