Key Insights

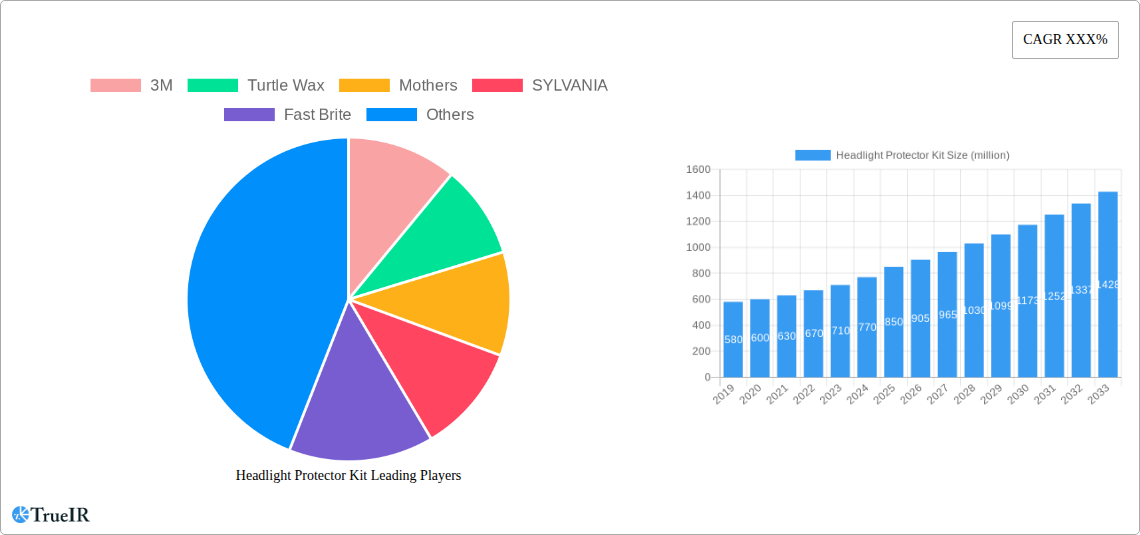

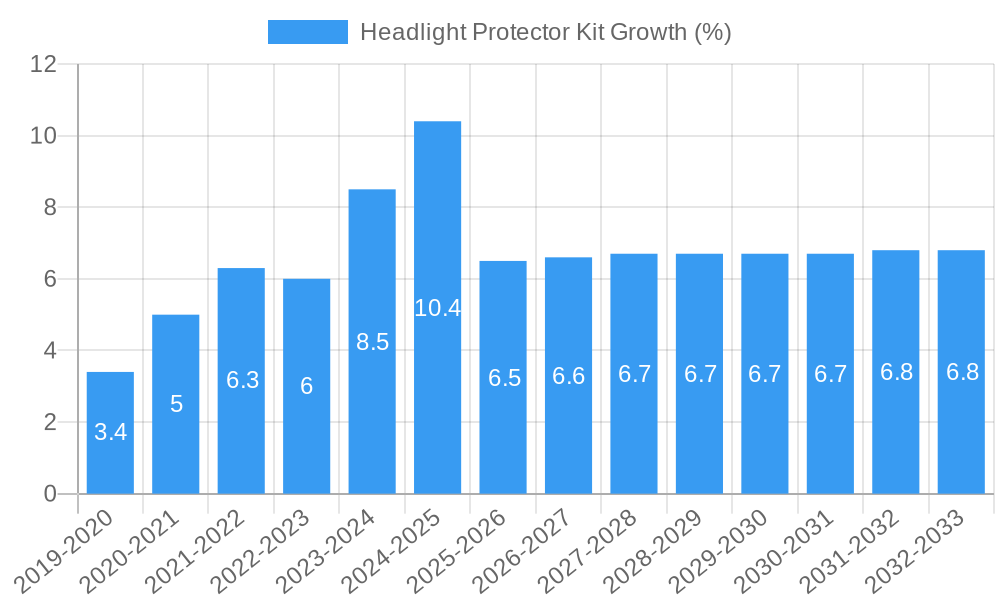

The global Headlight Protector Kit market is poised for robust growth, projected to reach an estimated $850 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.2% anticipated throughout the forecast period extending to 2033. This expansion is primarily fueled by a burgeoning automotive industry, the increasing emphasis on vehicle aesthetics and longevity, and the growing consumer awareness regarding the protective benefits of these kits. The market is segmented into applications for Passenger Cars and Commercial Vehicles, with further segmentation by type into Heavy Duty and Light Duty. Passenger cars are expected to dominate the application segment, driven by the sheer volume of vehicles and a rising trend in aftermarket customization and protection. The Light Duty segment, encompassing most passenger vehicles, will likely hold the larger share within the type segmentation.

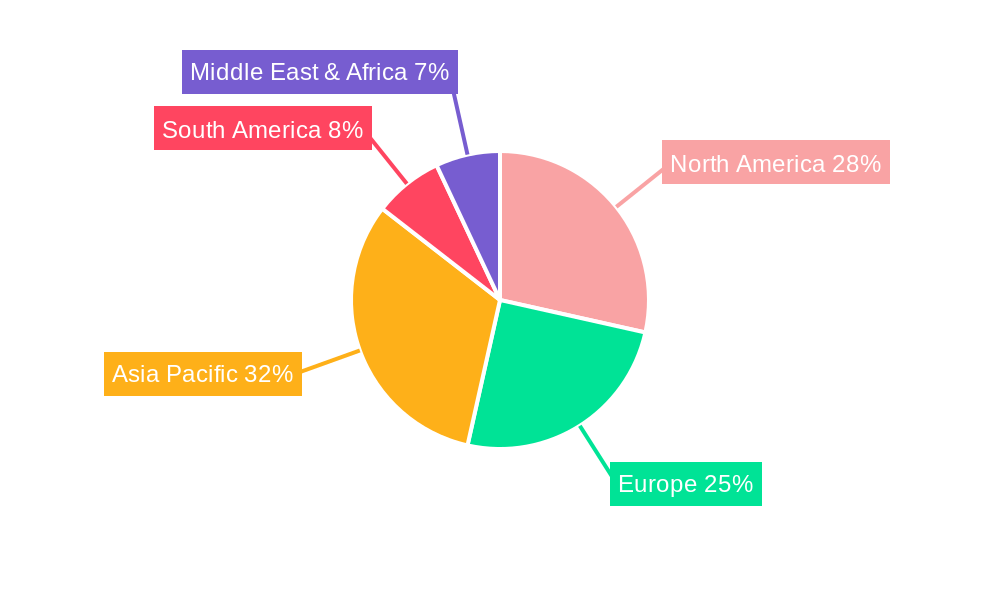

Key market drivers include the rising disposable incomes in emerging economies, leading to greater investment in vehicle maintenance and protection. Furthermore, the increasing lifespan of vehicles due to advanced manufacturing and the desire to preserve resale value contribute significantly to the demand for headlight protection solutions. Manufacturers like 3M, Turtle Wax, and Mothers are actively innovating with advanced materials and application technologies, offering enhanced UV resistance, scratch protection, and clarity. While the market enjoys strong growth, restraints such as the availability of cheaper, less durable alternatives and potential consumer perception of complexity in application could pose challenges. However, the long-term outlook remains positive, with ongoing technological advancements and increasing consumer education on the benefits of headlight protector kits expected to drive sustained market penetration and value. The Asia Pacific region, particularly China and India, is anticipated to be a significant growth engine due to its massive automotive production and consumption.

Here is a dynamic, SEO-optimized report description for the Headlight Protector Kit Market, designed for immediate use without further modification.

Headlight Protector Kit Market Structure & Competitive Landscape

The global headlight protector kit market is characterized by a moderate to high level of fragmentation, with approximately 45 companies actively participating. Key players like 3M, Turtle Wax, Mothers, SYLVANIA, Fast Brite, T-Cut, Blue Magic, Dupli-Color, and Permatex hold significant market shares, contributing to a healthy competitive environment. Innovation is a primary driver, with companies investing heavily in research and development to create more durable, optically clear, and easily applicable protector kits. Regulatory impacts are generally positive, focusing on vehicle safety and longevity, though varying standards across regions can present challenges. Product substitutes, such as traditional headlight restoration kits and replacement headlights, exist but often lack the preventative benefits of protector kits. End-user segmentation reveals a strong demand from the passenger car segment, accounting for roughly 70% of the market, while the commercial vehicle segment, making up approximately 30%, is experiencing robust growth due to fleet maintenance cost considerations. Mergers and acquisitions (M&A) activity in the historical period (2019-2024) was moderate, with an estimated 12 deals valued at over $50 million collectively, primarily aimed at expanding product portfolios and geographical reach. The concentration ratio for the top 5 players is estimated at 55%, indicating a substantial but not overly monopolistic market.

Headlight Protector Kit Market Trends & Opportunities

The headlight protector kit market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This robust growth trajectory is fueled by a confluence of evolving industry trends and emerging opportunities. The market size is estimated to reach over $2.5 billion by 2033, up from an estimated $1.5 billion in the base year of 2025. A key trend is the increasing consumer awareness regarding vehicle maintenance and longevity, leading to a greater demand for protective solutions. Consumers are increasingly recognizing the value of preserving the aesthetic appeal and functional performance of their vehicles, which directly translates to a higher uptake of headlight protector kits. Technological shifts are also playing a pivotal role. Advancements in material science have led to the development of more advanced films and coatings that offer superior UV resistance, scratch resistance, and clarity retention. These innovations not only enhance the performance of the protector kits but also extend their lifespan, making them a more attractive investment for vehicle owners. Furthermore, the rise of DIY automotive care has created a substantial opportunity for user-friendly and easy-to-apply protector kits. Manufacturers are responding by developing kits that require minimal expertise and tools, broadening the appeal to a wider consumer base. The growing trend towards personalized vehicle customization also presents an avenue for growth, with opportunities for kits offering various finishes or integrated styling elements. The competitive dynamics are intensifying, with both established automotive aftermarket brands and new entrants vying for market share. Companies that can effectively leverage digital marketing channels and e-commerce platforms to reach a global audience are likely to gain a competitive edge. The increasing stringency of vehicle inspection regulations in several key markets, emphasizing headlight clarity and functionality, will further bolster demand for preventative measures like protector kits. The global market penetration rate for headlight protector kits is expected to rise from an estimated 20% in 2025 to over 35% by 2033, indicating significant untapped potential. Opportunities also lie in catering to the burgeoning electric vehicle (EV) market, where the aesthetic preservation of advanced lighting systems is paramount. The ongoing development of smart headlight technologies will necessitate protective solutions that do not interfere with sensor functionality, presenting a niche but high-value opportunity for innovative product development.

Dominant Markets & Segments in Headlight Protector Kit

The Passenger Car segment unequivocally dominates the global headlight protector kit market, representing approximately 70% of the total market value. This dominance is driven by several key growth factors inherent to the passenger vehicle landscape. The sheer volume of passenger cars on global roads, estimated to be in the hundreds of millions, forms the foundational basis for this segment's leadership. Furthermore, passenger car owners often exhibit a higher propensity for aesthetic maintenance and personalization, viewing their vehicles as significant investments. This inclination translates directly into a greater demand for products that preserve and enhance the appearance and functionality of critical components like headlights. Infrastructure development, including well-maintained road networks in developed economies, indirectly supports the passenger car segment by encouraging more frequent use and thus increasing exposure of headlights to environmental factors like UV radiation and debris, which protector kits mitigate. Policies promoting vehicle longevity and resale value also indirectly benefit this segment, as consumers seek to protect their assets.

Within the Type segmentation, Light Duty protector kits command a significant market share, largely mirroring the dominance of the passenger car application. These kits are designed for everyday use and are therefore highly sought after by individual car owners. The accessibility and affordability of light-duty kits, coupled with their ease of application, make them the preferred choice for a broad consumer base. The market penetration for light-duty kits is substantial due to their widespread availability through automotive retail channels and online platforms.

Conversely, the Commercial Vehicle segment, while smaller at approximately 30% of the market, is exhibiting a strong growth trajectory with a projected CAGR of around 8.5%. This expansion is primarily driven by fleet operators' focus on operational efficiency and cost reduction. For commercial fleets, maintaining optimal headlight performance is not just about aesthetics but directly impacts safety and operational uptime. Reduced visibility due to yellowed or scratched headlights can lead to accidents and costly downtime, making preventative measures like protector kits a sound investment for fleet managers. Policies aimed at enhancing road safety for heavy-duty vehicles, coupled with the increasing adoption of advanced lighting technologies in trucks and vans, are further propelling this segment. The demand for Heavy Duty protector kits within the commercial vehicle segment is growing as manufacturers develop more robust solutions capable of withstanding harsher operating conditions.

Geographically, North America and Europe currently represent the largest regional markets, driven by established automotive industries, higher disposable incomes, and a strong culture of vehicle maintenance. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by the rapid expansion of automotive production and increasing vehicle ownership, particularly in emerging economies like China and India. Government initiatives to improve road infrastructure and vehicle safety standards in these regions are expected to significantly boost the demand for headlight protector kits.

Headlight Protector Kit Product Analysis

The headlight protector kit market is witnessing a wave of product innovations centered on enhanced material durability and user-friendliness. Advanced polymer films with superior UV resistance and self-healing properties are gaining traction, offering extended protection against yellowing and abrasions. Easy-to-apply adhesive technologies and pre-cut kits are also simplifying the application process, broadening market appeal. Competitive advantages are being forged through superior optical clarity, long-term performance, and comprehensive kits that include cleaning and application accessories.

Key Drivers, Barriers & Challenges in Headlight Protector Kit

Key Drivers:

- Rising Vehicle Ownership: Increasing global vehicle production and ownership directly expands the potential customer base for headlight protector kits.

- Growing Awareness of Vehicle Maintenance: Consumers are becoming more proactive in protecting their vehicle's aesthetics and functionality, recognizing the long-term value.

- Technological Advancements: Development of more durable, optically clear, and easier-to-apply protector materials and application methods.

- Regulatory Emphasis on Road Safety: Stricter regulations concerning vehicle lighting clarity and functionality encourage preventative measures.

- DIY Automotive Trend: The growing preference for self-service car maintenance drives demand for user-friendly kits.

Key Barriers & Challenges:

- Price Sensitivity: While consumers recognize the value, the upfront cost of protector kits can be a barrier for some, especially in price-sensitive markets.

- Availability of Cheaper Alternatives: Competition from lower-quality, less durable products can dilute market perception and lead to consumer dissatisfaction.

- Consumer Inertia: Some vehicle owners may not perceive the immediate need for headlight protection, requiring greater market education.

- Supply Chain Disruptions: Global events and geopolitical factors can impact the availability and cost of raw materials and finished goods.

- Counterfeit Products: The presence of counterfeit or substandard products can damage brand reputation and consumer trust.

Growth Drivers in the Headlight Protector Kit Market

The headlight protector kit market is propelled by several interconnected growth drivers. Technologically, the ongoing innovation in polymer science is leading to the development of advanced protective films offering enhanced durability, UV resistance, and scratch-proof capabilities, thereby extending the lifespan of headlights and increasing consumer satisfaction. Economically, the increasing disposable incomes in emerging economies are making vehicle ownership more accessible, thereby expanding the addressable market for automotive aftermarket products, including headlight protector kits. Furthermore, the growing trend of retaining vehicles for longer periods encourages owners to invest in maintenance and protection solutions to preserve their resale value. Regulatory factors also play a crucial role, with an increasing number of regions implementing stricter vehicle safety standards that mandate clear and functional headlights, driving demand for preventative solutions.

Challenges Impacting Headlight Protector Kit Growth

Despite the promising growth outlook, the headlight protector kit market faces several challenges. Regulatory complexities can arise from varying safety standards and product approval processes across different countries, hindering global market expansion. Supply chain issues, including the sourcing of specialized raw materials and logistical bottlenecks, can impact product availability and increase manufacturing costs. Competitive pressures are intensifying, with a fragmented market landscape and the constant threat of new entrants, as well as the emergence of alternative solutions like advanced headlight coatings, potentially impacting market share. Furthermore, consumer education remains a key challenge; many vehicle owners are still unaware of the long-term benefits of proactive headlight protection, relying instead on restoration methods when damage is already significant. The economic downturns and inflation can also lead to reduced consumer spending on non-essential automotive accessories.

Key Players Shaping the Headlight Protector Kit Market

- 3M

- Turtle Wax

- Mothers

- SYLVANIA

- Fast Brite

- T-Cut

- Blue Magic

- Dupli-Color

- Permatex

Significant Headlight Protector Kit Industry Milestones

- 2019: Launch of advanced UV-resistant headlight protector films by major chemical manufacturers, significantly improving product longevity.

- 2020: Increased adoption of online retail channels for automotive aftermarket products, boosting accessibility for headlight protector kits.

- 2021: Introduction of self-healing headlight protector coatings, offering enhanced resistance to minor scratches and scuffs.

- 2022: Growing regulatory focus on vehicle lighting safety in key markets, driving demand for preventative solutions.

- 2023: Emergence of pre-cut headlight protector kits tailored for specific vehicle models, simplifying DIY application.

- 2024: Strategic partnerships formed between automotive manufacturers and aftermarket brands to offer integrated headlight protection solutions.

Future Outlook for Headlight Protector Kit Market

The future outlook for the headlight protector kit market is exceptionally bright, driven by sustained growth catalysts. Strategic opportunities lie in tapping into the burgeoning electric vehicle (EV) market, where the preservation of advanced lighting systems is paramount, and in expanding product offerings to cater to the commercial vehicle segment, emphasizing fleet cost-efficiency and safety. The increasing consumer focus on vehicle longevity and aesthetic appeal, coupled with ongoing technological advancements in material science and application ease, will continue to fuel demand. The market is anticipated to witness further consolidation as key players aim to enhance their product portfolios and global reach, ensuring a dynamic and evolving competitive landscape. The ongoing investment in research and development will likely lead to even more innovative and user-centric solutions, solidifying the position of headlight protector kits as an essential automotive aftermarket product.

Headlight Protector Kit Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Heavy Duty

- 2.2. Light Duty

Headlight Protector Kit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Headlight Protector Kit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Heavy Duty

- 5.2.2. Light Duty

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Heavy Duty

- 6.2.2. Light Duty

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Heavy Duty

- 7.2.2. Light Duty

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Heavy Duty

- 8.2.2. Light Duty

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Heavy Duty

- 9.2.2. Light Duty

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Headlight Protector Kit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Heavy Duty

- 10.2.2. Light Duty

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Turtle Wax

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mothers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SYLVANIA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fast Brite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 T-Cut

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue Magic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dupli-Color

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Permatex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Headlight Protector Kit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Headlight Protector Kit Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Headlight Protector Kit Revenue (million), by Application 2024 & 2032

- Figure 4: North America Headlight Protector Kit Volume (K), by Application 2024 & 2032

- Figure 5: North America Headlight Protector Kit Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Headlight Protector Kit Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Headlight Protector Kit Revenue (million), by Type 2024 & 2032

- Figure 8: North America Headlight Protector Kit Volume (K), by Type 2024 & 2032

- Figure 9: North America Headlight Protector Kit Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Headlight Protector Kit Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Headlight Protector Kit Revenue (million), by Country 2024 & 2032

- Figure 12: North America Headlight Protector Kit Volume (K), by Country 2024 & 2032

- Figure 13: North America Headlight Protector Kit Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Headlight Protector Kit Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Headlight Protector Kit Revenue (million), by Application 2024 & 2032

- Figure 16: South America Headlight Protector Kit Volume (K), by Application 2024 & 2032

- Figure 17: South America Headlight Protector Kit Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Headlight Protector Kit Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Headlight Protector Kit Revenue (million), by Type 2024 & 2032

- Figure 20: South America Headlight Protector Kit Volume (K), by Type 2024 & 2032

- Figure 21: South America Headlight Protector Kit Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Headlight Protector Kit Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Headlight Protector Kit Revenue (million), by Country 2024 & 2032

- Figure 24: South America Headlight Protector Kit Volume (K), by Country 2024 & 2032

- Figure 25: South America Headlight Protector Kit Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Headlight Protector Kit Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Headlight Protector Kit Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Headlight Protector Kit Volume (K), by Application 2024 & 2032

- Figure 29: Europe Headlight Protector Kit Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Headlight Protector Kit Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Headlight Protector Kit Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Headlight Protector Kit Volume (K), by Type 2024 & 2032

- Figure 33: Europe Headlight Protector Kit Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Headlight Protector Kit Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Headlight Protector Kit Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Headlight Protector Kit Volume (K), by Country 2024 & 2032

- Figure 37: Europe Headlight Protector Kit Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Headlight Protector Kit Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Headlight Protector Kit Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Headlight Protector Kit Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Headlight Protector Kit Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Headlight Protector Kit Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Headlight Protector Kit Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Headlight Protector Kit Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Headlight Protector Kit Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Headlight Protector Kit Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Headlight Protector Kit Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Headlight Protector Kit Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Headlight Protector Kit Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Headlight Protector Kit Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Headlight Protector Kit Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Headlight Protector Kit Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Headlight Protector Kit Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Headlight Protector Kit Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Headlight Protector Kit Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Headlight Protector Kit Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Headlight Protector Kit Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Headlight Protector Kit Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Headlight Protector Kit Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Headlight Protector Kit Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Headlight Protector Kit Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Headlight Protector Kit Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Headlight Protector Kit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Headlight Protector Kit Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Headlight Protector Kit Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Headlight Protector Kit Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Headlight Protector Kit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Headlight Protector Kit Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Headlight Protector Kit Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Headlight Protector Kit Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Headlight Protector Kit Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Headlight Protector Kit Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Headlight Protector Kit Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Headlight Protector Kit Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Headlight Protector Kit Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Headlight Protector Kit Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Headlight Protector Kit Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Headlight Protector Kit Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Headlight Protector Kit Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Headlight Protector Kit Volume K Forecast, by Country 2019 & 2032

- Table 81: China Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Headlight Protector Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Headlight Protector Kit Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Headlight Protector Kit?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Headlight Protector Kit?

Key companies in the market include 3M, Turtle Wax, Mothers, SYLVANIA, Fast Brite, T-Cut, Blue Magic, Dupli-Color, Permatex.

3. What are the main segments of the Headlight Protector Kit?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Headlight Protector Kit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Headlight Protector Kit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Headlight Protector Kit?

To stay informed about further developments, trends, and reports in the Headlight Protector Kit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence