Key Insights

The Italy automotive composites market, projected to reach €11.1 billion by 2025, is experiencing substantial growth. This expansion is primarily driven by the automotive industry's increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions, aligning with global sustainability initiatives and stringent environmental regulations. Key growth catalysts include the rising adoption of electric vehicles (EVs), where composites provide critical advantages in battery enclosures and structural components. Innovations in composite materials, advanced manufacturing techniques such as vacuum infusion and injection molding, and the inherent design flexibility of composites further propel market development. Dominant material types include thermoplastic polymers and carbon fiber, utilized across structural assemblies, powertrain systems, and interior/exterior vehicle applications. Major industry participants, including Delphi, BASF, and Gurit, are actively investing in R&D to refine material performance and manufacturing processes.

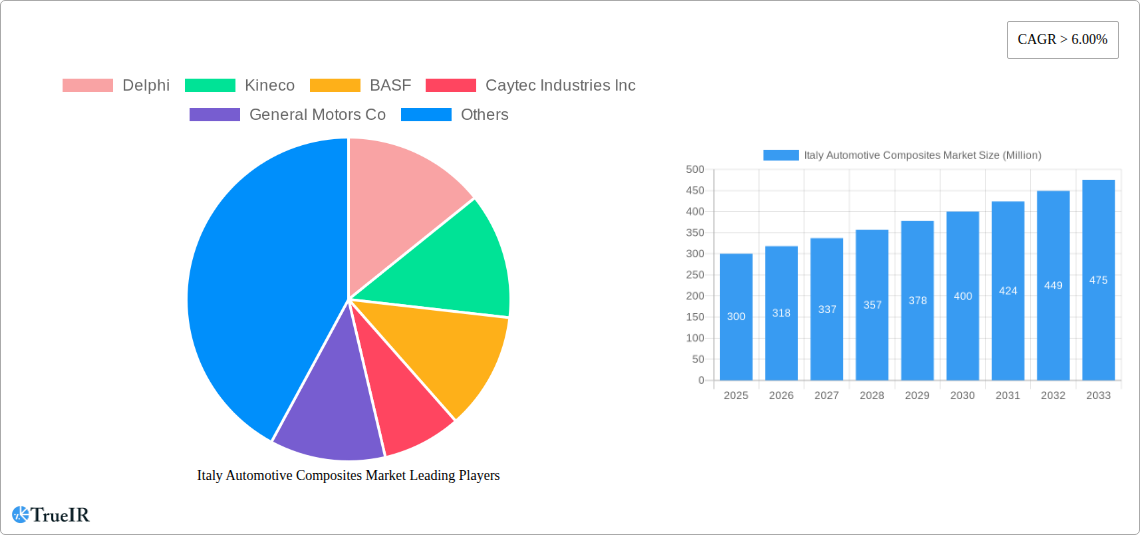

Italy Automotive Composites Market Market Size (In Billion)

Despite challenges like the cost premium of certain composite materials over traditional metals and the requirement for specialized manufacturing expertise, the market is forecast to achieve a compound annual growth rate (CAGR) of 14.5% between 2025 and 2033. This robust growth trajectory is supported by ongoing innovation in composite technologies, substantial investment in automotive lightweighting by Italian manufacturers, and the increasing prevalence of hybrid and electric vehicles. Structural assemblies and powertrain components represent significant application segments, underscoring the industry's commitment to optimizing vehicle performance and longevity. Continued emphasis on environmental sustainability and supportive government policies for eco-friendly technologies solidify a positive outlook for the Italy automotive composites market.

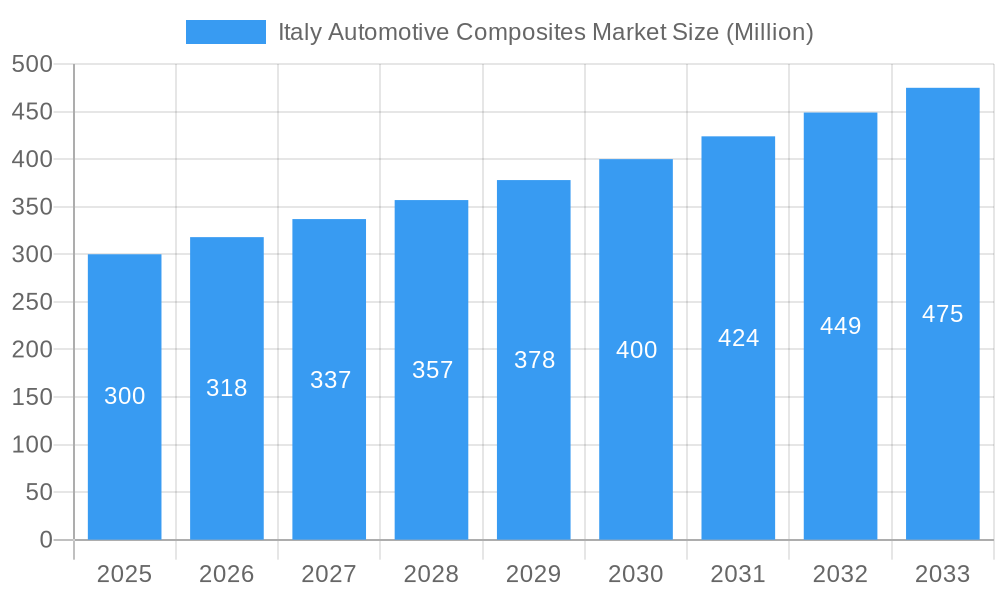

Italy Automotive Composites Market Company Market Share

Italy Automotive Composites Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Italy Automotive Composites Market, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive market research and data analysis to forecast market trends and growth opportunities. Key market segments, including material type, application type, and production type, are meticulously examined, along with a competitive landscape analysis featuring key players such as Delphi, Kineco, BASF, and more.

Italy Automotive Composites Market Market Structure & Competitive Landscape

The Italian automotive composites market exhibits a moderately concentrated structure, with a few dominant players and several smaller niche players. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive market. Innovation is a key driver, with companies continually developing lighter, stronger, and more cost-effective composite materials to meet stringent automotive industry demands. Regulatory pressures, including EU emission standards and safety regulations, significantly impact material selection and manufacturing processes. Product substitutes, such as traditional metals, pose a competitive challenge, although composites' advantages in weight reduction and fuel efficiency are driving substitution.

The market is segmented by end-users, primarily encompassing major automotive manufacturers and their tier-1 suppliers. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with an estimated xx deals recorded between 2019 and 2024. Future M&A activity is expected to increase driven by the need for consolidation and access to advanced technologies.

- Market Concentration: HHI estimated at xx in 2025

- Innovation Drivers: Lightweighting, fuel efficiency, design flexibility

- Regulatory Impacts: EU emission standards, safety regulations

- Product Substitutes: Traditional metals (steel, aluminum)

- End-User Segmentation: OEMs, Tier-1 suppliers

- M&A Trends: xx deals between 2019-2024, expected increase in future

Italy Automotive Composites Market Market Trends & Opportunities

The Italy Automotive Composites Market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This growth is fueled by increasing demand for lightweight vehicles to improve fuel efficiency and meet stringent emission regulations. Technological advancements in composite materials, such as the development of high-performance carbon fiber reinforced polymers (CFRP) and improved manufacturing processes, are further driving market expansion. Consumer preferences for fuel-efficient and environmentally friendly vehicles are also contributing factors.

The market is characterized by intense competition, with both established players and new entrants vying for market share. The market penetration rate of composites in the Italian automotive sector is currently estimated at xx%, with significant potential for further growth. Strategic partnerships and collaborations between material suppliers, automotive manufacturers, and technology providers are becoming increasingly prevalent, fostering innovation and accelerating market expansion.

Dominant Markets & Segments in Italy Automotive Composites Market

Within the Italy Automotive Composites Market, the Thermoset Polymer segment dominates the material type category, holding a market share of approximately xx% in 2025. This is primarily due to its cost-effectiveness and established manufacturing processes. However, the Carbon Fiber segment is expected to witness the fastest growth during the forecast period, driven by its superior strength-to-weight ratio and increasing applications in high-performance vehicles.

In terms of application type, the Structural Assembly segment holds the largest market share, followed by Power Train Components. The Vacuum Infusion Processing method dominates the production type segment due to its suitability for large-scale production.

- Key Growth Drivers (Thermoset Polymer): Established manufacturing, cost-effectiveness

- Key Growth Drivers (Carbon Fiber): Superior strength-to-weight ratio, high-performance vehicle applications

- Key Growth Drivers (Structural Assembly): Increasing demand for lightweight vehicles

- Key Growth Drivers (Vacuum Infusion Processing): Suitability for large-scale production

The Northern region of Italy is currently the most dominant market due to the higher concentration of automotive manufacturing facilities.

Italy Automotive Composites Market Product Analysis

The Italian automotive composites market showcases continuous product innovation, with a focus on developing advanced materials with improved mechanical properties, thermal stability, and durability. Significant advancements are observed in lightweight, high-strength carbon fiber composites, and bio-based composites. These materials are increasingly adopted in various automotive applications, including structural parts, body panels, and interior components. The key competitive advantages lie in reducing vehicle weight, enhancing fuel efficiency, and offering design flexibility.

Key Drivers, Barriers & Challenges in Italy Automotive Composites Market

Key Drivers:

- Growing demand for lightweight vehicles to improve fuel economy and reduce emissions.

- Technological advancements leading to improved composite materials with enhanced properties.

- Favorable government policies and incentives promoting the adoption of sustainable materials.

Challenges:

- High initial investment costs associated with composite material production and processing.

- Supply chain complexities and potential disruptions affecting material availability and costs.

- Stringent quality control and safety standards required for automotive applications.

- Competition from established materials like steel and aluminum.

Growth Drivers in the Italy Automotive Composites Market Market

The growth of the Italy Automotive Composites Market is driven by increasing demand for fuel-efficient vehicles, advancements in composite material technology, and supportive government regulations. The rising adoption of electric and hybrid vehicles further fuels demand, as composites offer significant weight reduction benefits. Furthermore, the ongoing development of cost-effective manufacturing processes makes composites increasingly competitive.

Challenges Impacting Italy Automotive Composites Market Growth

Challenges to market growth include high initial investment costs associated with composite material production, complexities in supply chain management, and the need to meet stringent quality and safety standards. The competitive landscape, with established materials like steel and aluminum, also presents a barrier. Furthermore, fluctuations in raw material prices can impact profitability.

Key Players Shaping the Italy Automotive Composites Market Market

- Delphi

- Kineco

- BASF

- Caytec Industries Inc

- General Motors Co

- Nippon Sheet Glass Co Ltd

- Gurit

- 3B-Fiberglass

- Johns Manville

- Base Group

Significant Italy Automotive Composites Market Industry Milestones

- 2021 (Q3): Kineco launches a new high-strength carbon fiber composite material for automotive applications.

- 2022 (Q1): BASF and an Italian automotive manufacturer announce a strategic partnership for the development of sustainable composite materials.

- 2023 (Q2): New regulations regarding the use of recycled materials in automotive composites come into effect in Italy.

Future Outlook for Italy Automotive Composites Market Market

The Italy Automotive Composites Market is poised for continued growth, driven by the increasing demand for lightweight and fuel-efficient vehicles and advancements in material technology. The development of sustainable and recyclable composite materials will further propel market expansion. Strategic partnerships and collaborations will play a crucial role in driving innovation and accelerating market penetration. Significant opportunities exist for companies focusing on cost reduction and developing advanced manufacturing techniques. The market is predicted to reach xx Million by 2033.

Italy Automotive Composites Market Segmentation

-

1. Production Type

- 1.1. Vacuum Infusion Processing

- 1.2. Injection Molding

- 1.3. Compression Molding

- 1.4. Others

-

2. Material Type

- 2.1. Thermoset Polymer

- 2.2. Thermoplastic Polymer

- 2.3. Carbon Fiber

- 2.4. Others

-

3. Application Type

- 3.1. Structural Assembly

- 3.2. Power Train Components

- 3.3. Interior

- 3.4. Exterior

- 3.5. Others

Italy Automotive Composites Market Segmentation By Geography

- 1. Italy

Italy Automotive Composites Market Regional Market Share

Geographic Coverage of Italy Automotive Composites Market

Italy Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Commercial Vehicle Sales to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Interest Rates to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Super Cars Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Vacuum Infusion Processing

- 5.1.2. Injection Molding

- 5.1.3. Compression Molding

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Thermoset Polymer

- 5.2.2. Thermoplastic Polymer

- 5.2.3. Carbon Fiber

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Structural Assembly

- 5.3.2. Power Train Components

- 5.3.3. Interior

- 5.3.4. Exterior

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delphi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kineco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Caytec Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Motors Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Co Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gurit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3B-Fiberglass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johns Manville

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Base Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delphi

List of Figures

- Figure 1: Italy Automotive Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Automotive Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: Italy Automotive Composites Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: Italy Automotive Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Italy Automotive Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Automotive Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 6: Italy Automotive Composites Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: Italy Automotive Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: Italy Automotive Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Italy Automotive Composites Market?

Key companies in the market include Delphi, Kineco, BASF, Caytec Industries Inc, General Motors Co, Nippon Sheet Glass Co Ltd *List Not Exhaustive, Gurit, 3B-Fiberglass, Johns Manville, Base Group.

3. What are the main segments of the Italy Automotive Composites Market?

The market segments include Production Type, Material Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Commercial Vehicle Sales to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Super Cars Sales Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuations in Interest Rates to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Italy Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence