Key Insights

The Canadian commercial vehicle market is projected for significant expansion, fueled by infrastructure development, robust e-commerce logistics, and the increasing demand for efficient freight transport across Eastern, Western, and Central Canada. The market, valued at $1.56 billion in 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3% from 2025 to 2033. Key growth drivers include the transition to sustainable transportation with rising demand for hybrid and electric commercial vehicles, government investments in infrastructure projects, and technological advancements like autonomous driving and advanced telematics. Potential restraints encompass high initial investment costs for alternative fuel vehicles, fluctuating fuel prices, and supply chain vulnerabilities. LPG-powered vehicles currently lead the market, though hybrid and electric segments are expected to gain substantial share due to supportive policies and increased consumer awareness. The commercial vehicle sector offers a diverse range of vehicle types to meet varied logistical needs. Leading manufacturers and suppliers, including Hino Motors, Navistar, Ram Trucking, Nissan, Isuzu, General Motors, Rivian, Honda, Ford, and Toyota, are actively innovating and investing in research and development.

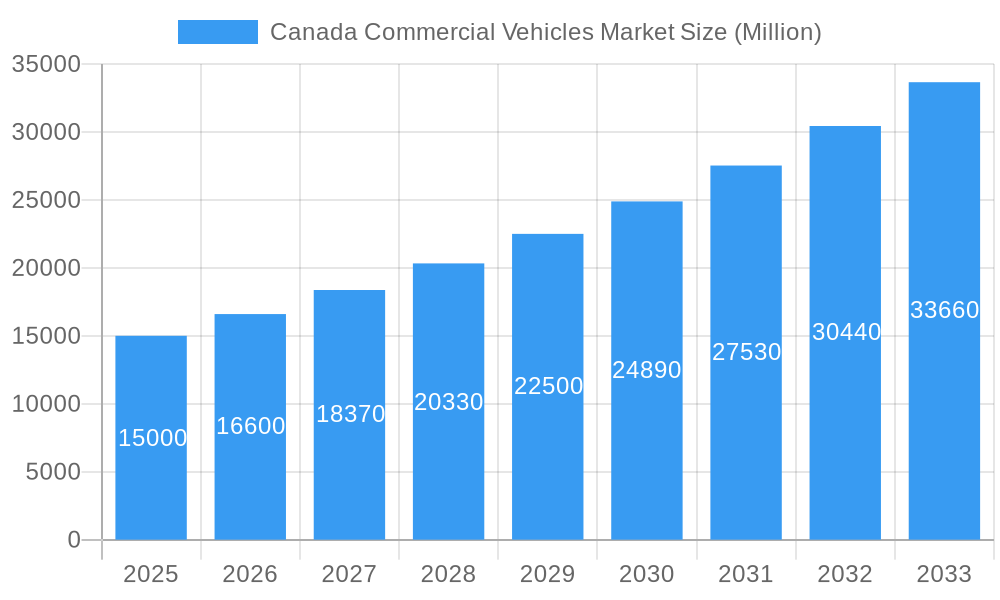

Canada Commercial Vehicles Market Market Size (In Million)

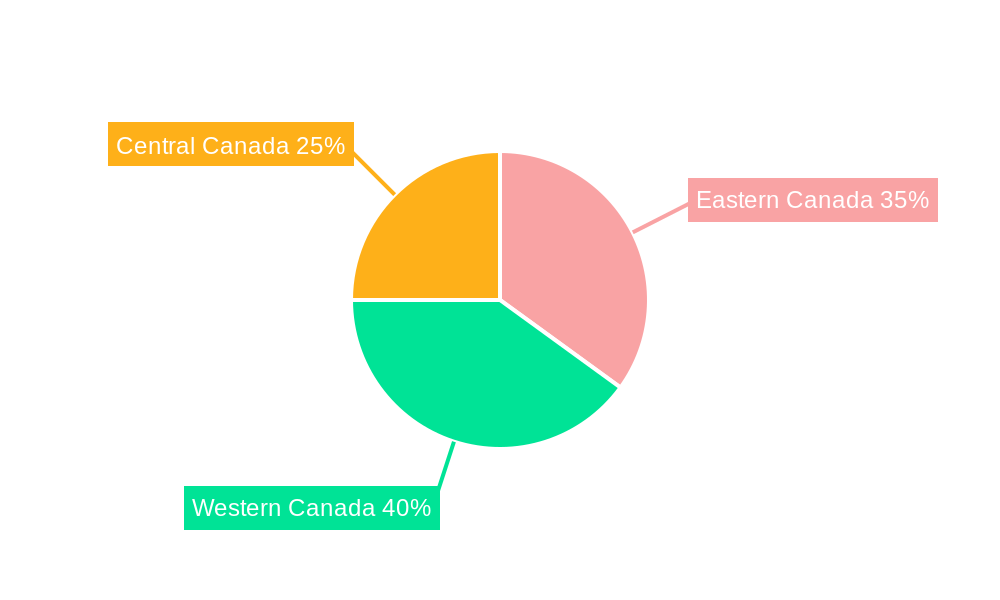

All Canadian regions—Eastern, Western, and Central—are expected to contribute substantially to market growth. Variations in infrastructure and economic activity will influence regional adoption rates. Western Canada's extensive transportation networks for resource extraction and inter-provincial trade, along with Central Canada's manufacturing and logistics hubs, represent significant market opportunities. The forecast period (2025-2033) presents considerable opportunities for businesses in commercial vehicle manufacturing, sales, and servicing. The market's steady growth, driven by internal and external factors, indicates a favorable investment climate for adaptable companies focused on evolving market dynamics and technological advancements.

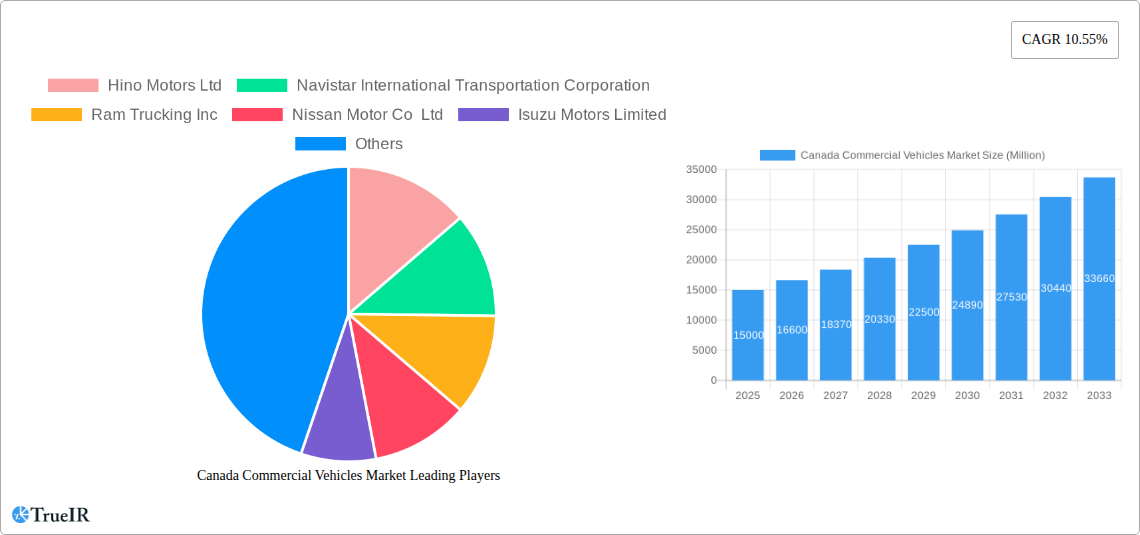

Canada Commercial Vehicles Market Company Market Share

Canada Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Canada Commercial Vehicles Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). The report leverages extensive market research to provide a clear understanding of market size, segmentation, growth drivers, challenges, and key players. Expect in-depth analysis of key segments including LPG vehicles, hybrid and electric vehicles, and various commercial vehicle types. The total market value is projected to reach xx Million by 2033.

Canada Commercial Vehicles Market Structure & Competitive Landscape

The Canadian commercial vehicle market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2024. Key players such as Ford Motor Company, General Motors Company, and Toyota Motor Corporation hold significant market share, driving innovation and competition. Regulatory changes, particularly concerning emissions and safety standards, significantly influence market dynamics. The increasing adoption of alternative fuels, like LPG, and the rise of electric and hybrid commercial vehicles present both opportunities and challenges for existing players.

- Market Concentration: The HHI indicates a moderately concentrated market, with opportunities for both established players and new entrants.

- Innovation Drivers: Stringent emission regulations and the demand for fuel efficiency are major drivers of innovation in engine technology and vehicle design.

- Regulatory Impacts: Government policies focused on reducing carbon emissions are shaping the market, favoring electric and hybrid vehicles.

- Product Substitutes: The availability of alternative transportation solutions, such as rail and maritime freight, presents a competitive challenge.

- End-User Segmentation: The market is segmented based on various end-users, including logistics companies, construction firms, and public transportation authorities, each with unique needs and preferences.

- M&A Trends: The past five years have witnessed xx M&A transactions in the Canadian commercial vehicle sector, primarily driven by consolidation and expansion strategies. The average deal value was approximately xx Million.

Canada Commercial Vehicles Market Market Trends & Opportunities

The Canada Commercial Vehicles Market is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. This growth is fuelled by several factors, including increasing demand for efficient and sustainable transportation solutions, ongoing infrastructural development, and expanding e-commerce activities. The market is witnessing a rapid shift towards the adoption of hybrid and electric vehicles, driven by government incentives and environmental concerns. Consumer preferences are also evolving towards vehicles with advanced safety features and improved fuel efficiency. Intense competition among established players and new entrants continues to drive innovation and price optimization. Market penetration rates for electric and hybrid commercial vehicles are projected to reach xx% by 2033, reflecting strong growth in this segment. Furthermore, the growing adoption of connected vehicle technologies and telematics solutions is transforming the market.

Dominant Markets & Segments in Canada Commercial Vehicles Market

The Ontario region dominates the Canadian commercial vehicle market, driven by its robust industrial sector and extensive transportation network. Within segments, the demand for heavy-duty commercial vehicles remains substantial. However, the hybrid and electric vehicle segment is experiencing the fastest growth.

Key Growth Drivers:

- Robust infrastructure development: Ongoing investments in road and transportation networks are driving demand for commercial vehicles.

- Government policies and incentives: Incentive programs supporting the adoption of fuel-efficient and electric vehicles are accelerating market growth.

- Expanding e-commerce sector: The surge in online shopping is boosting demand for last-mile delivery solutions and related commercial vehicles.

Market Dominance Analysis: Ontario's strong manufacturing base and high population density contribute to its leading market position. The hybrid and electric vehicle segment is experiencing the fastest growth due to government support and environmental awareness.

Canada Commercial Vehicles Market Product Analysis

The Canadian commercial vehicle market showcases a diverse range of products, from conventional gasoline and diesel-powered trucks to the emerging hybrid and fully electric alternatives. Recent innovations focus on improving fuel efficiency, reducing emissions, and enhancing safety features. The market is witnessing increased integration of telematics and advanced driver-assistance systems (ADAS), creating safer and more efficient operations. The market fit for electric vehicles is increasingly strong, particularly in urban areas where infrastructure is developing and government incentives are available.

Key Drivers, Barriers & Challenges in Canada Commercial Vehicles Market

Key Drivers: The market is propelled by factors such as increasing freight volumes, infrastructure development, growing e-commerce, and government incentives promoting sustainable transportation. Technological advancements, specifically in hybrid and electric vehicle technology, are also crucial drivers.

Challenges and Restraints: Supply chain disruptions, especially in the procurement of critical components like batteries for electric vehicles, present significant challenges. The high initial cost of electric vehicles and the limited charging infrastructure remain barriers to wider adoption. Stringent emissions regulations also pose cost challenges for manufacturers. These factors may collectively decrease the market growth by an estimated xx% by 2030.

Growth Drivers in the Canada Commercial Vehicles Market

Technological advancements, government support for green initiatives, and the ongoing expansion of e-commerce are key drivers. The increasing demand for efficient and sustainable transportation solutions also significantly contributes to market growth.

Challenges Impacting Canada Commercial Vehicles Market Growth

Regulatory hurdles, high initial costs of electric and hybrid vehicles, limited charging infrastructure, and supply chain disruptions pose significant challenges. The competition from established and emerging players also influences market dynamics.

Key Players Shaping the Canada Commercial Vehicles Market Market

Significant Canada Commercial Vehicles Market Industry Milestones

- August 2023: General Motors announces the launch of an all-electric Cadillac Escalade in late 2024. This signifies a commitment to the EV market and is likely to influence competitor strategies.

- August 2023: General Motors reinforces its commitment to electric vehicles in the Middle East, indicating a broader global push towards electrification. This could influence market trends and investment strategies.

- August 2023: Toyota Kirloskar Motor launches the all-new MPV Vellfire SHEV, highlighting the increasing popularity of hybrid electric vehicles in the global market. This underscores the growing consumer preference for eco-friendly vehicles.

Future Outlook for Canada Commercial Vehicles Market Market

The Canadian commercial vehicle market is expected to experience continued growth, driven by technological advancements, supportive government policies, and the burgeoning e-commerce sector. Strategic opportunities exist for companies focusing on electric and hybrid vehicle technologies, connected vehicle solutions, and innovative logistics management. The market's potential is vast, with significant opportunities for players able to navigate the challenges of supply chain disruptions and regulatory complexities.

Canada Commercial Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Canada Commercial Vehicles Market Segmentation By Geography

- 1. Canada

Canada Commercial Vehicles Market Regional Market Share

Geographic Coverage of Canada Commercial Vehicles Market

Canada Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hino Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Navistar International Transportation Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ram Trucking Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nissan Motor Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Isuzu Motors Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Motors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rivian Automotive Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honda Motor Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ford Motor Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Canada Commercial Vehicles Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canada Commercial Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Commercial Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Canada Commercial Vehicles Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 3: Canada Commercial Vehicles Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Canada Commercial Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Canada Commercial Vehicles Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Canada Commercial Vehicles Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Vehicles Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Canada Commercial Vehicles Market?

Key companies in the market include Hino Motors Ltd, Navistar International Transportation Corporation, Ram Trucking Inc, Nissan Motor Co Ltd, Isuzu Motors Limited, General Motors Company, Rivian Automotive Inc, Honda Motor Co Ltd, Ford Motor Company, Toyota Motor Corporatio.

3. What are the main segments of the Canada Commercial Vehicles Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

August 2023: General Motors will launch an all-electric Cadillac Escalade in late 2024August 2023: General Motors doubles down on plans for an electric future in the Middle East.August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) for a starting price of INR 11.99 million and going to INR 12.99 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence