Key Insights

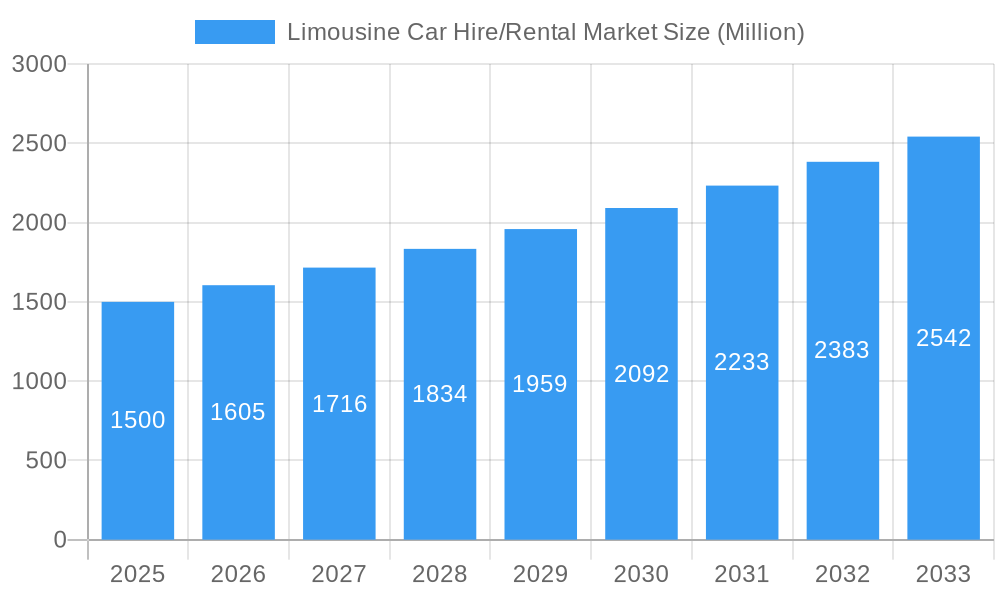

The global limousine car hire and rental market is poised for significant expansion, forecasted to achieve a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 (base year) to 2033. This growth is propelled by a confluence of factors, including the robust expansion of the tourism and leisure sectors, driven by rising disposable incomes and a growing preference for luxury travel experiences. The business travel segment also plays a pivotal role, particularly in urban centers, where limousines are essential for executive transportation, corporate events, and client engagements. The increasing adoption of online booking platforms enhances accessibility and convenience, further accelerating market penetration. The market is segmented by application (leisure/tourism, administrative, business), booking type (offline, online), and vehicle type (ultra-luxury, premium). The premium car segment is anticipated to experience accelerated growth due to its greater affordability, attracting a wider customer base. While challenges such as fluctuating fuel prices and regulatory landscapes exist, the market's upward trajectory remains strong.

Limousine Car Hire/Rental Market Market Size (In Billion)

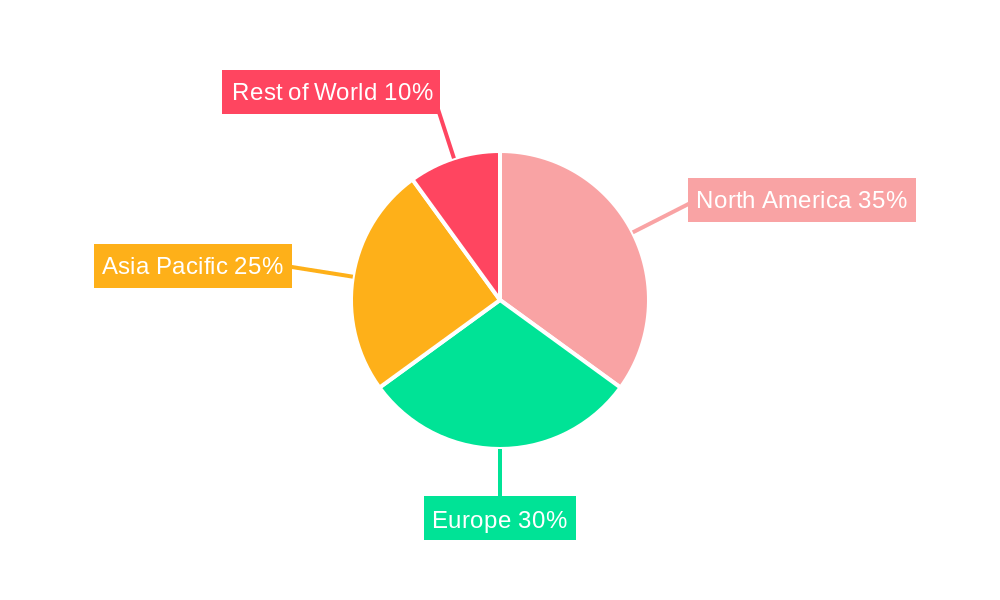

Geographically, North America and Europe demonstrate robust performance, supported by established service providers and high demand in key metropolitan areas. The Asia Pacific region presents substantial future growth opportunities, fueled by increasing disposable incomes and expanding tourism infrastructure in markets such as India and China. The competitive environment features a blend of established global entities and regional operators. Key players like Uber, DiDi, and Sixt are leveraging their existing platforms and brand equity, while localized companies serve niche markets. Future market expansion will be contingent upon sustained economic growth, technological advancements within the ride-hailing sector, and the adaptability of limousine services to evolving consumer preferences and travel trends. Strategic alliances and innovative technology adoption will be critical determinants of the competitive landscape.

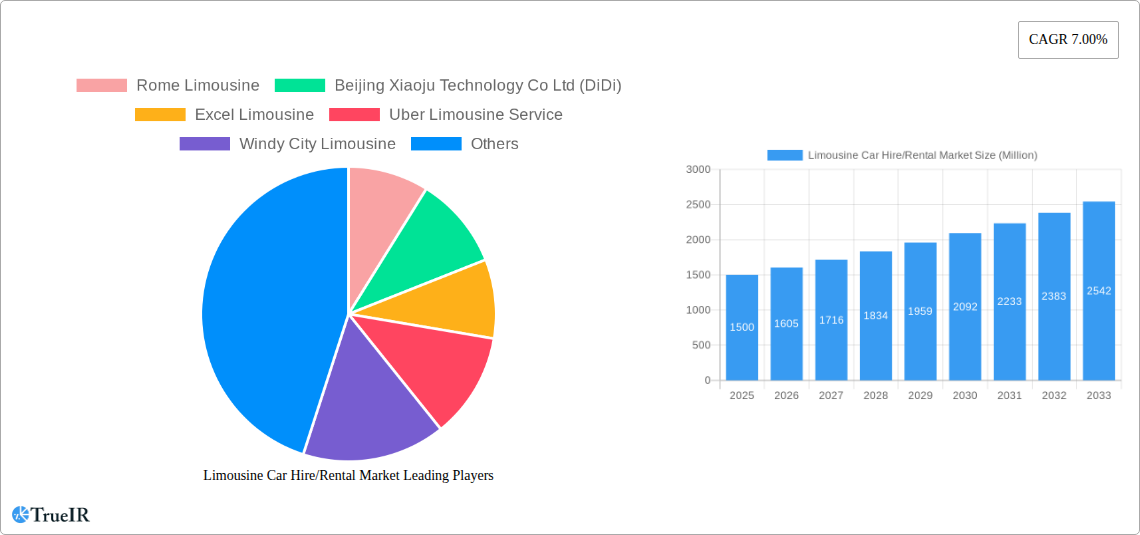

Limousine Car Hire/Rental Market Company Market Share

Limousine Car Hire/Rental Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global Limousine Car Hire/Rental Market, projecting a market value of $XX Million by 2033. Leveraging a robust methodology and incorporating extensive market research, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this in-depth analysis dissects market segments, competitive landscapes, and future growth trajectories.

Limousine Car Hire/Rental Market Structure & Competitive Landscape

The global limousine car hire/rental market is characterized by a moderately concentrated structure, with a handful of major players commanding significant market share. However, the market also exhibits substantial fragmentation, particularly at the regional and local levels. Concentration ratios, while not publicly available for this specific market, are estimated to be in the range of xx% for the top 5 players. This indicates a moderately competitive landscape with opportunities for both established players and new entrants.

Innovation Drivers: Technological advancements, such as the introduction of hybrid and electric limousines and AI-powered booking platforms, are driving significant changes. The increasing adoption of ride-hailing apps is further reshaping the market dynamics.

Regulatory Impacts: Government regulations concerning licensing, safety standards, and environmental regulations significantly impact market growth and operations. Varying regulations across different regions contribute to market complexity.

Product Substitutes: The market faces competition from alternative transportation modes such as premium taxis, ride-sharing services (with luxury options), and private car services. The extent of this substitution depends on pricing, convenience, and service quality.

End-User Segmentation: The market caters to diverse end-user segments including Leisure/Tourism, Administrative, and Business travelers. The relative importance of these segments varies geographically and temporally.

M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The volume and value of M&A deals are estimated to be in the range of xx Million annually, driven by consolidation efforts and expansion strategies of major players.

Limousine Car Hire/Rental Market Trends & Opportunities

The global limousine car hire/rental market is experiencing substantial growth, driven by factors like increasing disposable incomes, rising demand for luxury travel, and the growing popularity of corporate events. The market size is expected to reach $XX Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration rates vary considerably across regions, with developed economies generally exhibiting higher penetration than emerging markets.

Technological advancements such as the adoption of electric and hybrid vehicles are transforming the industry, presenting both opportunities and challenges. Consumer preferences are shifting towards more sustainable and technologically advanced services. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants vying for market share.

Dominant Markets & Segments in Limousine Car Hire/Rental Market

While precise market share data is unavailable for all segments, the Business segment is predicted to dominate the Application Type category due to high corporate spending on travel and events. The Online Booking segment is rapidly gaining traction across all application types, driven by increased internet penetration and consumer preference for convenience. Premium cars represent the largest segment within Vehicle Type, demonstrating the appeal of high-quality vehicles and associated services.

Key Growth Drivers:

- Rising Disposable Incomes: Increased affluence in several regions fuels demand for luxury transportation.

- Growth of Business Travel: Corporate events and business trips create significant demand for limousine services.

- Technological Advancements: Electric vehicle adoption and AI-powered booking platforms boost efficiency and appeal.

- Expanding Tourism Sector: Increased tourist arrivals in many regions boosts demand for luxury transportation options.

Market Dominance Analysis: North America and Europe currently dominate the global market, driven by high disposable incomes, robust tourism sectors, and established limousine service providers. However, rapid economic growth in Asia-Pacific is expected to fuel significant growth in this region over the forecast period.

Limousine Car Hire/Rental Market Product Analysis

The limousine car hire/rental market offers a diverse range of vehicles, from premium sedans to ultra-luxury limousines. Technological innovations, such as the integration of advanced safety features, infotainment systems, and eco-friendly powertrains, are enhancing the overall customer experience. The competitive advantage rests on offering a superior combination of vehicle quality, service reliability, and technological sophistication.

Key Drivers, Barriers & Challenges in Limousine Car Hire/Rental Market

Key Drivers:

- Rising disposable incomes and increased tourism: Fuels demand for luxury travel and limousine services.

- Technological advancements in vehicle technology and booking platforms: Increases efficiency and customer convenience.

- Favorable regulatory environment in some regions: Promotes market growth and expansion.

Key Challenges & Restraints:

- High operating costs: Fuel prices, vehicle maintenance, and driver salaries significantly impact profitability.

- Intense competition from ride-sharing and taxi services: This pressure forces companies to offer competitive pricing and superior services.

- Fluctuations in fuel prices: Fuel price volatility directly affects profitability.

- Regulatory hurdles and licensing requirements: Varying regulations across regions pose challenges to market expansion. An estimated xx% of potential market growth is hindered by these constraints.

Growth Drivers in the Limousine Car Hire/Rental Market Market

The key drivers remain consistent with those listed above: rising disposable incomes, technological innovations, and favorable regulatory environments in specific locations continue to fuel market expansion.

Challenges Impacting Limousine Car Hire/Rental Market Growth

The key challenges remain consistent with those highlighted above: high operating costs, intense competition, and fluctuating fuel prices continue to present significant hurdles. Regulatory complexities further restrict market expansion in certain regions.

Key Players Shaping the Limousine Car Hire/Rental Market Market

- Rome Limousine

- Beijing Xiaoju Technology Co Ltd (DiDi)

- Excel Limousine

- Uber Limousine Service

- Windy City Limousine

- Cabo Baja Limousines

- EMPIRECLS COM

- Penguin Limousine Services

- Sixt SE

- Addison Lee

Significant Limousine Car Hire/Rental Market Industry Milestones

- July 2022: Sixt SE expands facilities across Canada, extending its North American network.

- October 2021: Sixt SE introduces hybrid and fully electric limousine rental services in multiple European cities.

- August 2021: Limousine Cabs Limited announces taxi services in Telangana, India, highlighting AI-powered booking.

Future Outlook for Limousine Car Hire/Rental Market Market

The future of the limousine car hire/rental market appears promising, with continued growth anticipated driven by sustained economic growth, technological innovations, and the expanding tourism sector. Strategic partnerships, investments in technology, and expansion into new markets represent key opportunities for market players. The market is poised for further consolidation, with larger players likely acquiring smaller businesses to gain market share. Sustainability initiatives and the adoption of electric vehicles will also shape future market dynamics.

Limousine Car Hire/Rental Market Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Administrative

- 1.3. Business

-

2. Booking Type

- 2.1. Offline Booking

- 2.2. Online Booking

-

3. Vehicle Type

- 3.1. Ultra Luxury Cars

- 3.2. Premium Cars

Limousine Car Hire/Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Limousine Car Hire/Rental Market Regional Market Share

Geographic Coverage of Limousine Car Hire/Rental Market

Limousine Car Hire/Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Sector and leisure travelling

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Administrative

- 5.1.3. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline Booking

- 5.2.2. Online Booking

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Ultra Luxury Cars

- 5.3.2. Premium Cars

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Leisure/Tourism

- 6.1.2. Administrative

- 6.1.3. Business

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Offline Booking

- 6.2.2. Online Booking

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Ultra Luxury Cars

- 6.3.2. Premium Cars

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Leisure/Tourism

- 7.1.2. Administrative

- 7.1.3. Business

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Offline Booking

- 7.2.2. Online Booking

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Ultra Luxury Cars

- 7.3.2. Premium Cars

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Leisure/Tourism

- 8.1.2. Administrative

- 8.1.3. Business

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Offline Booking

- 8.2.2. Online Booking

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Ultra Luxury Cars

- 8.3.2. Premium Cars

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of World Limousine Car Hire/Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Leisure/Tourism

- 9.1.2. Administrative

- 9.1.3. Business

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Offline Booking

- 9.2.2. Online Booking

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Ultra Luxury Cars

- 9.3.2. Premium Cars

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rome Limousine

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Beijing Xiaoju Technology Co Ltd (DiDi)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Excel Limousine

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Uber Limousine Service

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Windy City Limousine

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cabo Baja Limousines

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EMPIRECLS COM

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Penguin Limousine Services

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sixt SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Addison Lee

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Rome Limousine

List of Figures

- Figure 1: Global Limousine Car Hire/Rental Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Limousine Car Hire/Rental Market Revenue (billion), by Application Type 2025 & 2033

- Figure 3: North America Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Limousine Car Hire/Rental Market Revenue (billion), by Booking Type 2025 & 2033

- Figure 5: North America Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 6: North America Limousine Car Hire/Rental Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Limousine Car Hire/Rental Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Limousine Car Hire/Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Limousine Car Hire/Rental Market Revenue (billion), by Application Type 2025 & 2033

- Figure 11: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Limousine Car Hire/Rental Market Revenue (billion), by Booking Type 2025 & 2033

- Figure 13: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 14: Europe Limousine Car Hire/Rental Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Limousine Car Hire/Rental Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Limousine Car Hire/Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Limousine Car Hire/Rental Market Revenue (billion), by Application Type 2025 & 2033

- Figure 19: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 20: Asia Pacific Limousine Car Hire/Rental Market Revenue (billion), by Booking Type 2025 & 2033

- Figure 21: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 22: Asia Pacific Limousine Car Hire/Rental Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Limousine Car Hire/Rental Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Limousine Car Hire/Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of World Limousine Car Hire/Rental Market Revenue (billion), by Application Type 2025 & 2033

- Figure 27: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 28: Rest of World Limousine Car Hire/Rental Market Revenue (billion), by Booking Type 2025 & 2033

- Figure 29: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 30: Rest of World Limousine Car Hire/Rental Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of World Limousine Car Hire/Rental Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of World Limousine Car Hire/Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 13: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 14: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 21: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 22: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 29: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 30: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Limousine Car Hire/Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Middle East and Africa Limousine Car Hire/Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Limousine Car Hire/Rental Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Limousine Car Hire/Rental Market?

Key companies in the market include Rome Limousine, Beijing Xiaoju Technology Co Ltd (DiDi), Excel Limousine, Uber Limousine Service, Windy City Limousine, Cabo Baja Limousines, EMPIRECLS COM, Penguin Limousine Services, Sixt SE, Addison Lee.

3. What are the main segments of the Limousine Car Hire/Rental Market?

The market segments include Application Type, Booking Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

Rise in Tourism Sector and leisure travelling.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

In July 2022, Sixt SE expanded its facilities across Canada. Through this expansion, the company expands across the North American continent with a growing network that offers best-in-class service for business and leisure travelers in the US and Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Limousine Car Hire/Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Limousine Car Hire/Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Limousine Car Hire/Rental Market?

To stay informed about further developments, trends, and reports in the Limousine Car Hire/Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence