Key Insights

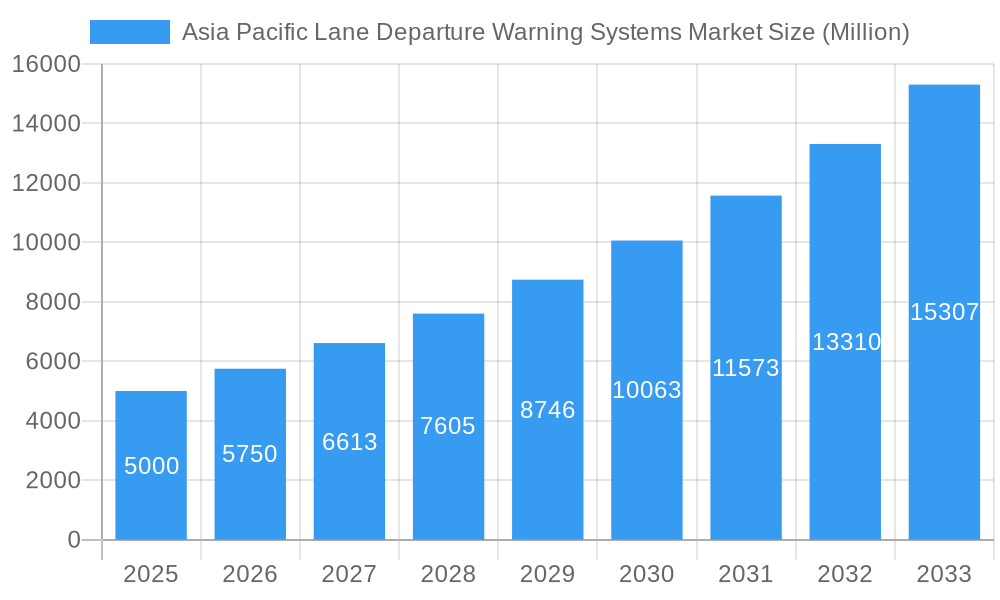

The Asia Pacific Lane Departure Warning Systems market is projected for substantial growth, fueled by a rapidly expanding automotive sector and an intensified focus on road safety. Expected to reach $4.6 billion by 2024, the market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.86%. This expansion is primarily driven by government mandates for vehicle safety, increasing consumer demand for Advanced Driver-Assistance Systems (ADAS), and the swift integration of sophisticated automotive technologies, particularly in key markets like China, Japan, and South Korea. The rise in passenger car sales and the growing commercial vehicle segment, necessitated by logistics and transportation demands, further elevate the need for these essential safety features. Key growth catalysts include stringent automotive safety regulations, a commitment to reducing accident fatalities, and the incorporation of these systems as standard or optional offerings by major automotive manufacturers.

Asia Pacific Lane Departure Warning Systems Market Market Size (In Billion)

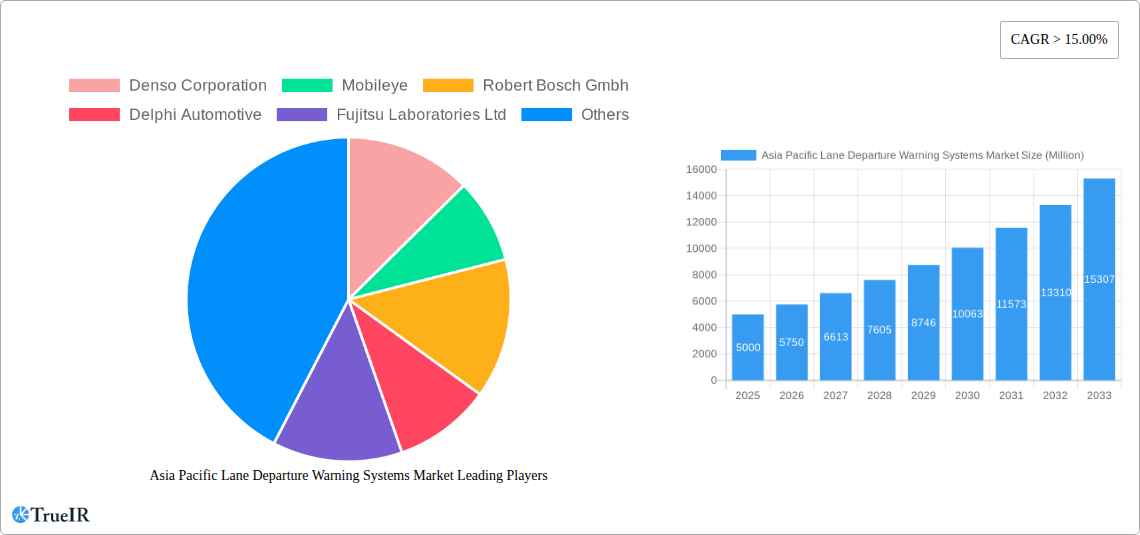

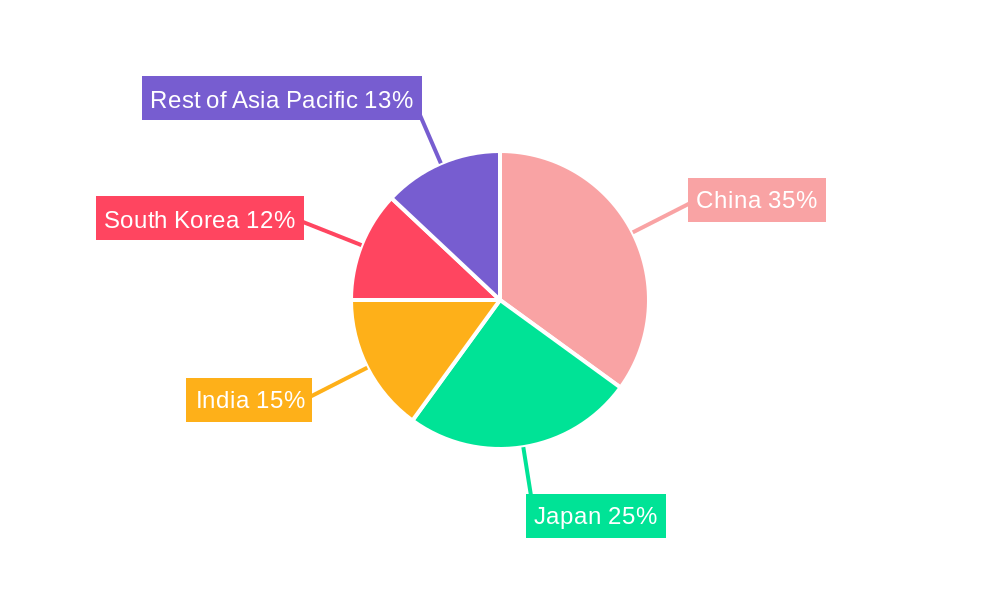

Technological advancements and the competitive environment are shaping the market's trajectory. Video sensors are anticipated to lead the sensor segment due to their cost-efficiency and advanced object detection capabilities, with laser and infrared sensors also contributing significantly across varying environmental conditions. While the market presents strong growth prospects, potential challenges include the initial integration costs for some manufacturers and the requirement for robust infrastructure to support advanced sensor systems. Nevertheless, the overarching trend towards autonomous driving and intelligent vehicle systems is expected to surmount these obstacles. Leading players such as Denso Corporation, Mobileye, Robert Bosch GmbH, and Continental AG are heavily investing in research and development, fostering innovation and expanding their presence across the Asia Pacific. The region's varied economic landscape offers unique opportunities, with China and Japan projected as dominant markets, followed by India and South Korea, collectively contributing to the robust expansion of the Asia Pacific Lane Departure Warning Systems market.

Asia Pacific Lane Departure Warning Systems Market Company Market Share

Asia Pacific Lane Departure Warning Systems Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the Asia Pacific Lane Departure Warning Systems (LDWS) market, offering actionable insights for stakeholders. The study covers a comprehensive period from 2019 to 2033, with a base year of 2025, and forecasts a robust growth trajectory. We delve into market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, leading players, significant industry milestones, and a future outlook, leveraging high-volume SEO keywords to ensure maximum visibility and engagement.

Asia Pacific Lane Departure Warning Systems Market Market Structure & Competitive Landscape

The Asia Pacific Lane Departure Warning Systems market is characterized by a moderately concentrated competitive landscape, with a significant presence of both established automotive component manufacturers and specialized technology providers. Innovation drivers are primarily fueled by increasing safety regulations, advancements in sensor technology, and the growing consumer demand for advanced driver-assistance systems (ADAS). Regulatory impacts are a crucial factor, with governments in key markets like China and Japan mandating or incentivizing the adoption of safety features, directly influencing market growth. Product substitutes, while present in the broader ADAS segment, are limited for direct LDWS functionality. End-user segmentation reveals a strong demand from passenger car manufacturers seeking to enhance vehicle safety and meet stringent NCAP ratings. Merger and acquisition (M&A) trends are expected to rise as larger players seek to consolidate their market position and acquire innovative technologies. For instance, an estimated xx% of market players have engaged in M&A activities within the historical period (2019-2024) to expand their portfolios. Concentration ratios are estimated to be around xx% for the top five players in the base year 2025.

Asia Pacific Lane Departure Warning Systems Market Market Trends & Opportunities

The Asia Pacific Lane Departure Warning Systems market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033, reaching an estimated market size of over $xx Billion by 2033. This expansion is largely attributed to the increasing adoption of ADAS features in passenger cars, a segment expected to dominate the market with a penetration rate of xx% in new vehicle sales by 2030. The technological shift towards more sophisticated sensor fusion, incorporating AI and machine learning for enhanced accuracy and reduced false positives, presents a significant opportunity for market players. Consumer preferences are increasingly leaning towards vehicles equipped with advanced safety features, driven by a heightened awareness of road safety and the desire for a more secure driving experience. Competitive dynamics are intensifying, with companies investing heavily in research and development to offer integrated ADAS solutions rather than standalone LDWS. Emerging markets like India are witnessing rapid growth in automotive production and sales, presenting untapped opportunities for LDWS adoption. The integration of LDWS with other safety systems, such as automatic emergency braking (AEB) and adaptive cruise control (ACC), will further drive market penetration. The growing trend of shared mobility services and fleet management also presents a lucrative avenue, as these operators prioritize driver safety and reduced accident rates. Furthermore, the increasing prevalence of autonomous driving features will necessitate robust LDWS as a foundational safety element. The growing disposable income in many Asia Pacific nations is also contributing to a higher demand for premium vehicle features, including advanced safety systems. The development of low-cost LDWS solutions suitable for entry-level vehicles is another critical trend that will broaden market reach and accessibility. The evolving automotive landscape, with a focus on connected and intelligent vehicles, will further propel the demand for sophisticated LDWS technologies.

Dominant Markets & Segments in Asia Pacific Lane Departure Warning Systems Market

The Asia Pacific Lane Departure Warning Systems market exhibits distinct dominance across various segments, with China emerging as the leading geography, projected to account for over xx% of the regional market share by 2033. This dominance is fueled by the sheer volume of vehicle production and sales, coupled with stringent vehicle safety regulations and a burgeoning consumer appetite for advanced automotive technologies. In terms of vehicle type, Passenger Cars are expected to remain the dominant segment, driven by their widespread adoption and the increasing integration of LDWS as a standard or optional feature across various models, from compact to luxury. The market penetration for LDWS in passenger cars is estimated to reach xx% by 2030.

Within the Function Type, Lane Departure Warning systems continue to hold a significant market share, serving as a foundational safety technology. However, Lane Keeping Assist systems are witnessing a more rapid growth trajectory, as consumers and manufacturers alike recognize the added safety benefits of active intervention. The market for Lane Keeping Assist is projected to grow at a CAGR of xx% during the forecast period.

The Sensor Type segment is overwhelmingly dominated by Video Sensors, which offer a cost-effective and robust solution for lane detection. Advancements in camera technology, including higher resolution and improved low-light performance, further solidify their dominance. While Laser Sensors and Infrared Sensors offer complementary capabilities, their adoption in LDWS is comparatively lower due to cost considerations.

Geographically, while China leads, Japan and South Korea remain crucial markets, characterized by a high level of technological sophistication and established automotive ecosystems. India presents a rapidly growing opportunity, driven by increasing vehicle sales and a growing focus on road safety initiatives. The "Rest of Asia-Pacific" region, encompassing countries like Southeast Asian nations and Australia, is also exhibiting steady growth, albeit from a smaller base. Key growth drivers in these dominant markets include:

- Government Regulations and Safety Mandates: Policies by bodies like China's Ministry of Industry and Information Technology (MIIT) and Japan's National Agency for Automotive Safety and Victim Support (NASVA) are pivotal.

- NCAP Ratings and Consumer Demand: Strong performance in New Car Assessment Programs (NCAPs) incentivizes manufacturers to incorporate advanced safety features like LDWS, influencing consumer purchasing decisions.

- Technological Advancements: Continuous improvements in AI, computer vision, and sensor technology make LDWS more effective and affordable.

- Automotive Production Hubs: The concentration of major automotive manufacturers in countries like China and Japan naturally translates to higher demand for automotive components.

- Infrastructure Development: While not directly for LDWS, improvements in road markings and signage indirectly support the effectiveness and adoption of these systems.

Asia Pacific Lane Departure Warning Systems Market Product Analysis

Product innovations in the Asia Pacific Lane Departure Warning Systems market are primarily focused on enhancing the accuracy, reliability, and integration capabilities of these systems. Advancements include the development of AI-powered algorithms for improved lane detection in challenging conditions like poor lighting and adverse weather. The integration of LDWS with other ADAS functions, such as steering assist and predictive safety alerts, is a key competitive advantage, offering a more holistic safety experience. Companies are also focusing on miniaturization and cost reduction to enable broader adoption across different vehicle segments. The market fit is improving as LDWS transitions from premium to mainstream features, driven by increasing consumer awareness and regulatory push.

Key Drivers, Barriers & Challenges in Asia Pacific Lane Departure Warning Systems Market

Key Drivers: The Asia Pacific Lane Departure Warning Systems market is propelled by several key drivers. Firstly, the increasing stringency of automotive safety regulations across the region, particularly in China and Japan, mandates the inclusion of ADAS features, with LDWS being a primary component. Secondly, growing consumer awareness and demand for vehicle safety are compelling manufacturers to integrate these systems. Thirdly, technological advancements in sensor technology and AI, leading to more accurate and cost-effective solutions, are critical enablers. Finally, the expanding automotive production and sales volumes in emerging economies like India further fuel the demand for automotive components, including LDWS.

Barriers & Challenges: Despite the growth, the market faces certain barriers. High initial development and integration costs for manufacturers can be a restraint, especially for smaller OEMs. Variations in road infrastructure and quality of lane markings across different countries can impact the effectiveness of LDWS, leading to potential driver frustration or mistrust. Consumer perception and understanding of ADAS technologies, including the potential for false alarms or over-reliance, remain a challenge. Furthermore, supply chain disruptions and geopolitical uncertainties can impact the availability and cost of critical components. The competitive pressure from other ADAS features and the need for continuous innovation to stay ahead also pose challenges.

Growth Drivers in the Asia Pacific Lane Departure Warning Systems Market Market

The Asia Pacific Lane Departure Warning Systems market is experiencing robust growth driven by a multifaceted approach. Stringent government mandates and safety regulations, such as those implemented by the China Automotive Technology and Research Center (CATARC), are compelling automakers to equip vehicles with LDWS. Furthermore, a surge in consumer awareness regarding road safety, amplified by media coverage and NCAP star ratings, is creating a strong pull for these advanced driver-assistance systems. Rapid advancements in sensor fusion and AI-driven algorithms are making LDWS more accurate, reliable, and cost-effective, thus expanding their applicability across a wider range of vehicle segments. The burgeoning automotive industry in emerging economies, particularly India and Southeast Asian nations, presents significant untapped potential for LDWS adoption due to increasing vehicle sales and disposable incomes.

Challenges Impacting Asia Pacific Lane Departure Warning Systems Market Growth

Several challenges are impacting the growth trajectory of the Asia Pacific Lane Departure Warning Systems market. The variability in the quality and visibility of road markings across different regions and countries poses a significant technical hurdle, potentially leading to system inefficiencies and driver dissatisfaction. The high cost of implementation and integration for some advanced LDWS technologies can act as a restraint, particularly for entry-level vehicles and smaller automotive manufacturers. Regulatory fragmentation and differing homologation requirements across various Asia Pacific countries can complicate market entry and increase compliance costs for global players. Intense competition from other ADAS features and the need for constant innovation to avoid commoditization present ongoing challenges. Furthermore, supply chain vulnerabilities and the fluctuating availability of semiconductor components can disrupt production and impact pricing strategies.

Key Players Shaping the Asia Pacific Lane Departure Warning Systems Market Market

- Denso Corporation

- Mobileye

- Robert Bosch GmbH

- Delphi Technologies (now part of BorgWarner)

- Fujitsu Laboratories Ltd

- Continental AG

- Infineon Technologies AG

- Magna International Inc.

- ZF Friedrichshafen AG (including ZF TRW)

- WABCO Vehicle Control Services (now part of ZF Friedrichshafen AG)

Significant Asia Pacific Lane Departure Warning Systems Market Industry Milestones

- 2019: Increased adoption of LDWS as standard equipment in many new passenger car models in Japan and South Korea.

- 2020: China's Ministry of Industry and Information Technology (MIIT) begins strengthening ADAS requirements, influencing LDWS market growth.

- 2021: Significant advancements in AI algorithms for improved lane detection in various weather conditions by key technology providers.

- 2022: Growing trend of integrating LDWS with other ADAS functions like Lane Keeping Assist and Automatic Emergency Braking.

- 2023: Increased focus on developing cost-effective LDWS solutions for mid-range and entry-level vehicles in emerging Asia Pacific markets.

- 2024: Several automotive manufacturers announce ambitious targets for equipping their entire vehicle fleets with advanced safety systems, including LDWS, by the end of the decade.

Future Outlook for Asia Pacific Lane Departure Warning Systems Market Market

The future outlook for the Asia Pacific Lane Departure Warning Systems market is exceptionally bright, driven by the continuous evolution of automotive safety and the increasing integration of intelligent driving technologies. The market is expected to witness sustained growth as LDWS becomes an indispensable component of next-generation vehicles, paving the way for more advanced autonomous driving capabilities. Strategic opportunities lie in the development of enhanced sensor fusion techniques, leveraging AI for predictive analysis of road conditions, and miniaturizing components for broader applicability. The increasing emphasis on smart city initiatives and connected car ecosystems will further bolster the demand for sophisticated safety features like LDWS. The growing acceptance of ADAS among consumers, coupled with supportive government policies, will ensure a consistent upward trajectory for the market, with new innovations expected to redefine the driving experience and enhance road safety across the region.

Asia Pacific Lane Departure Warning Systems Market Segmentation

-

1. Funciton Type

- 1.1. Lane Departure Warning

- 1.2. Lane Keeping Assist

-

2. Sensor Type

- 2.1. Video Sensors

- 2.2. Laser Sensors

- 2.3. Infrared Sensors

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Lane Departure Warning Systems Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Lane Departure Warning Systems Market Regional Market Share

Geographic Coverage of Asia Pacific Lane Departure Warning Systems Market

Asia Pacific Lane Departure Warning Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Autonomous Vehicle Demand To Propel The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Installation Cost May Hamper The Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Emphasis On Safety Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Funciton Type

- 5.1.1. Lane Departure Warning

- 5.1.2. Lane Keeping Assist

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Video Sensors

- 5.2.2. Laser Sensors

- 5.2.3. Infrared Sensors

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Funciton Type

- 6. China Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Funciton Type

- 6.1.1. Lane Departure Warning

- 6.1.2. Lane Keeping Assist

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Video Sensors

- 6.2.2. Laser Sensors

- 6.2.3. Infrared Sensors

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Funciton Type

- 7. Japan Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Funciton Type

- 7.1.1. Lane Departure Warning

- 7.1.2. Lane Keeping Assist

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Video Sensors

- 7.2.2. Laser Sensors

- 7.2.3. Infrared Sensors

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Funciton Type

- 8. India Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Funciton Type

- 8.1.1. Lane Departure Warning

- 8.1.2. Lane Keeping Assist

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Video Sensors

- 8.2.2. Laser Sensors

- 8.2.3. Infrared Sensors

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Funciton Type

- 9. South Korea Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Funciton Type

- 9.1.1. Lane Departure Warning

- 9.1.2. Lane Keeping Assist

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Video Sensors

- 9.2.2. Laser Sensors

- 9.2.3. Infrared Sensors

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Funciton Type

- 10. Rest of Asia Pacific Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Funciton Type

- 10.1.1. Lane Departure Warning

- 10.1.2. Lane Keeping Assist

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Video Sensors

- 10.2.2. Laser Sensors

- 10.2.3. Infrared Sensors

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicles

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Funciton Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mobileye

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Robert Bosch Gmbh

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delphi Automotive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Laboratories Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Continental AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infineon Technologie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Magna International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZF TRW

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 WABCO Vehicle Control Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Asia Pacific Lane Departure Warning Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Lane Departure Warning Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 2: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 3: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 7: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 8: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 12: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 13: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 14: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 17: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 18: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 22: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 23: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 27: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 28: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Lane Departure Warning Systems Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Asia Pacific Lane Departure Warning Systems Market?

Key companies in the market include Denso Corporation, Mobileye, Robert Bosch Gmbh, Delphi Automotive, Fujitsu Laboratories Ltd, Continental AG, Infineon Technologie, Magna International, ZF TRW, WABCO Vehicle Control Services.

3. What are the main segments of the Asia Pacific Lane Departure Warning Systems Market?

The market segments include Funciton Type, Sensor Type, Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Autonomous Vehicle Demand To Propel The Market Growth.

6. What are the notable trends driving market growth?

Growing Emphasis On Safety Solutions.

7. Are there any restraints impacting market growth?

High Installation Cost May Hamper The Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Lane Departure Warning Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Lane Departure Warning Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Lane Departure Warning Systems Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Lane Departure Warning Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence