Key Insights

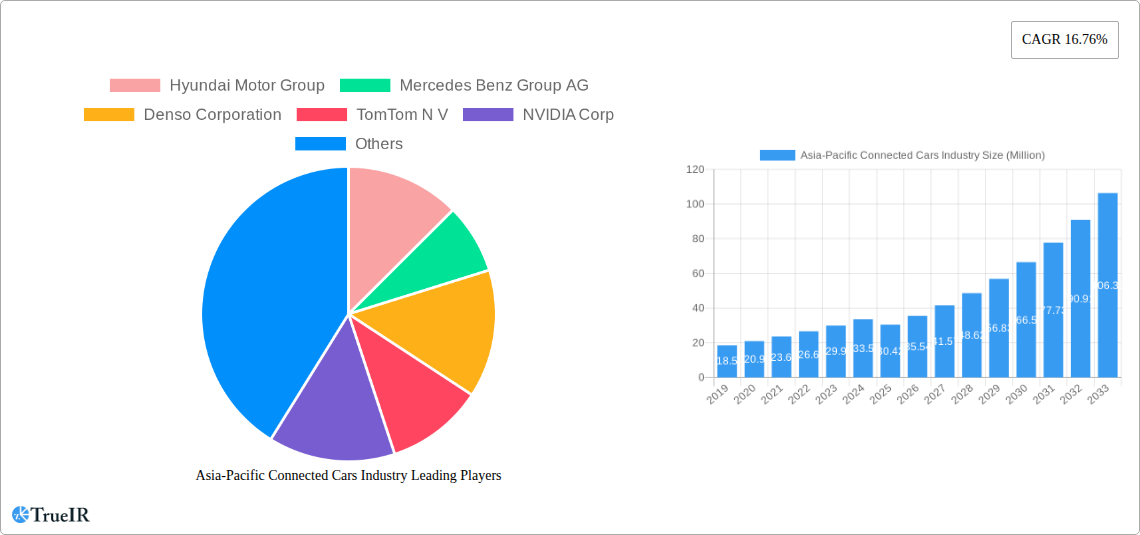

The Asia-Pacific connected cars industry is poised for substantial growth, with a current market size of approximately USD 30.42 million and a projected Compound Annual Growth Rate (CAGR) of 16.76%. This robust expansion is driven by several key factors, including the increasing consumer demand for enhanced in-vehicle experiences, the rapid adoption of advanced automotive technologies, and supportive government initiatives promoting smart city development and automotive innovation. The region's burgeoning middle class, coupled with a strong emphasis on technological integration, is fueling the demand for features like advanced navigation, in-car entertainment systems, and safety enhancements. Furthermore, the rising penetration of smartphones and the increasing ubiquity of high-speed internet are creating fertile ground for sophisticated vehicle connectivity solutions, including Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), and Vehicle-to-Everything (V2X) communication.

Asia-Pacific Connected Cars Industry Market Size (In Million)

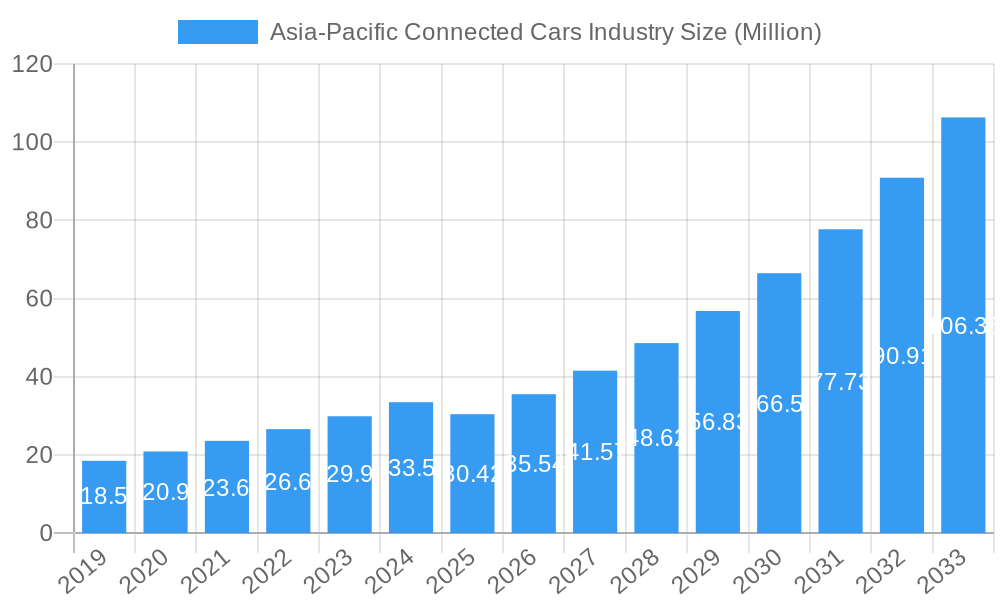

The market is segmented across various vehicle types, with passenger cars expected to dominate due to their widespread ownership, and commercial vehicles gaining traction with fleet management and operational efficiency needs. Key technology segments include navigation, entertainment, safety, and vehicle management, with a growing interest in multimedia streaming capabilities. The end-user landscape is characterized by the significant influence of Original Equipment Manufacturers (OEMs) in integrating these technologies, alongside a growing aftermarket segment for retrofitting and upgrades. Leading companies such as Hyundai Motor Group, Mercedes Benz Group AG, Denso Corporation, TomTom N.V., NVIDIA Corp, ZF Friedrichshafen, Aptiv PLC, NXP Semiconductors, Harman International, Continental AG, BMW AG, Robert Bosch GmbH, SAIC Motor Corporation, Audi AG, Volvo AB, and Airbiquity Inc. are actively investing in research and development to capture market share. Within the Asia-Pacific region, China, Japan, and South Korea are emerging as the leading markets, followed by India and other Southeast Asian nations, driven by their large automotive production bases and significant investments in smart mobility solutions.

Asia-Pacific Connected Cars Industry Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific Connected Cars Industry, providing in-depth analysis of market structure, trends, opportunities, dominant segments, product innovations, key drivers, barriers, and future outlook. Leveraging high-volume keywords such as "connected car technology," "automotive IoT," "vehicle connectivity," "autonomous driving Asia," and "smart mobility APAC," this report is optimized for search engines and designed to engage automotive industry professionals, technology providers, investors, and policymakers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024.

Asia-Pacific Connected Cars Industry Market Structure & Competitive Landscape

The Asia-Pacific connected cars industry is characterized by a moderately concentrated market structure, driven by significant investments in research and development and a burgeoning demand for advanced automotive technologies. Innovation drivers are primarily focused on enhancing user experience, improving vehicle safety, and enabling autonomous driving capabilities. Regulatory impacts are increasingly shaping the market, with governments across the region introducing policies to promote smart city initiatives and vehicle connectivity standards, thereby fostering a conducive environment for connected car adoption. Product substitutes, while limited in the fully integrated connected car ecosystem, include aftermarket infotainment systems and standalone navigation devices, though these are increasingly being superseded by OEM-integrated solutions. The end-user segmentation prominently features Original Equipment Manufacturers (OEMs) as the primary beneficiaries and drivers of connected car technologies, followed by a growing aftermarket segment. Merger and acquisition (M&A) trends indicate a consolidation of the market, with larger players acquiring innovative startups to enhance their technological portfolios and expand their market reach. For instance, the past year has seen an estimated volume of over 50 significant M&A activities, reflecting the strategic importance of connected car capabilities for industry players.

Asia-Pacific Connected Cars Industry Market Trends & Opportunities

The Asia-Pacific connected cars industry is poised for unprecedented growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period (2025-2033). This robust expansion is fueled by a growing consumer appetite for in-car connectivity, advanced safety features, and seamless integration of personal digital ecosystems within their vehicles. Technological shifts are rapidly transforming the automotive landscape, with the proliferation of 5G networks accelerating the development and deployment of real-time data transmission for advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication. The widespread adoption of electric vehicles (EVs) is also a significant catalyst, as EVs often come equipped with advanced connectivity features for battery management, remote diagnostics, and charging infrastructure integration. Consumer preferences are increasingly leaning towards personalized in-car experiences, including advanced infotainment systems, over-the-air (OTA) software updates, and predictive maintenance services. The competitive dynamics are intensifying, with both established automotive giants and agile technology companies vying for market share. Opportunities abound for companies offering innovative solutions in areas such as in-car AI, cybersecurity for connected vehicles, edge computing for autonomous driving, and data analytics for fleet management. The increasing demand for subscription-based connected car services presents a recurring revenue stream for automakers and service providers. Furthermore, the development of smart city infrastructure, with its emphasis on intelligent transportation systems, creates a symbiotic relationship with the connected cars industry, fostering a more integrated and efficient mobility ecosystem. The market penetration rate of connected car features is expected to surpass 70% by 2030, indicating a substantial shift towards a connected mobility future across the region.

Dominant Markets & Segments in Asia-Pacific Connected Cars Industry

The Asia-Pacific connected cars industry is experiencing robust growth across various segments, with Passenger Cars emerging as the dominant vehicle type. This dominance is driven by a higher adoption rate of advanced technologies and a larger consumer base in key markets like China, Japan, and South Korea. Within the Technology Type segment, Safety features are gaining significant traction due to increasing consumer awareness and stringent regulatory mandates. This includes advanced driver-assistance systems (ADAS), collision avoidance systems, and real-time vehicle monitoring. Navigation and Entertainment functionalities also continue to be strong performers, offering drivers and passengers enhanced convenience and engagement. Vehicle Management technologies, such as remote diagnostics, predictive maintenance, and fleet management solutions, are witnessing substantial growth, particularly in the commercial vehicle sector.

The Vehicle Connectivity landscape is increasingly shifting towards Vehicle-to-Everything (V2X) communication, encompassing Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), and Vehicle-to-Pedestrian (V2P) capabilities. This evolution is crucial for enabling autonomous driving and improving traffic safety and efficiency.

From an End-User Type perspective, Original Equipment Manufacturers (OEMs) currently dominate the market, as they are the primary integrators of connected car technologies into new vehicles. However, the Aftermarket/Replacement segment is showing promising growth, with consumers seeking to upgrade their existing vehicles with connected functionalities.

Key Growth Drivers:

- Government Initiatives and Smart City Development: Countries like China and South Korea are heavily investing in smart city infrastructure and intelligent transportation systems, creating a fertile ground for V2I and V2X technologies.

- Technological Advancements: The widespread availability of 5G, AI, and IoT technologies enables sophisticated connected car features and services.

- Rising Consumer Demand for Convenience and Safety: Growing disposable incomes and a desire for enhanced driving experiences are driving demand for connected car features.

- Automotive Industry Investments: Major automotive manufacturers are heavily investing in R&D and partnerships to develop and deploy advanced connected car solutions.

Detailed Analysis of Market Dominance:

China leads the Asia-Pacific connected cars market due to its massive automotive production and consumption, coupled with proactive government support for technological innovation. South Korea and Japan are also key players, driven by their strong automotive manufacturing base and pioneering spirit in adopting new technologies. The Passenger Cars segment's dominance stems from the sheer volume of passenger vehicles sold and the increasing integration of connectivity features as standard equipment. The emphasis on safety technologies is a direct response to both consumer demand and evolving regulatory frameworks designed to reduce road fatalities and improve overall road safety.

Asia-Pacific Connected Cars Industry Product Analysis

Product innovations in the Asia-Pacific connected cars industry are centered around enhancing user experience, improving vehicle safety, and paving the way for autonomous driving. Key advancements include sophisticated infotainment systems with advanced voice recognition and AI-powered personalization, seamless integration with smart home devices, and over-the-air (OTA) software updates for continuous feature enhancement. Predictive maintenance algorithms, leveraging real-time vehicle data, are becoming standard, allowing for proactive issue identification and reduced downtime. Advanced driver-assistance systems (ADAS) are evolving rapidly, integrating sensor fusion, machine learning, and real-time V2X communication to enable semi-autonomous driving capabilities. Cybersecurity solutions are also a critical focus, ensuring the protection of sensitive vehicle and user data from increasingly sophisticated threats. The competitive advantage lies in developing integrated ecosystems that offer a holistic connected experience, from navigation and entertainment to vehicle management and safety, providing users with unparalleled convenience and peace of mind.

Key Drivers, Barriers & Challenges in Asia-Pacific Connected Cars Industry

Key Drivers:

The Asia-Pacific connected cars industry is propelled by several key drivers. Technological advancements, including 5G rollout, AI, and IoT, are fundamental enablers of sophisticated connected car functionalities. Government initiatives promoting smart cities and autonomous driving, coupled with supportive regulatory frameworks for vehicle connectivity, are crucial policy-driven factors. Economic growth in the region, leading to increased disposable incomes, fuels consumer demand for advanced automotive features. Furthermore, the burgeoning electric vehicle (EV) market naturally integrates with connected car technologies for battery management and charging optimization, creating a synergistic growth opportunity.

Barriers & Challenges:

Despite strong growth, the industry faces significant barriers and challenges. Regulatory Hurdles: Navigating the diverse and evolving regulatory landscapes across different Asian countries, particularly concerning data privacy and cybersecurity, presents a complex challenge. Cybersecurity Concerns: The increasing interconnectedness of vehicles makes them vulnerable to cyberattacks, necessitating robust security measures and continuous vigilance. Supply Chain Issues: Disruptions in the global semiconductor supply chain continue to impact the production of advanced electronic components crucial for connected car systems. High Development Costs: The substantial investment required for developing and integrating advanced connected car technologies can be a barrier for smaller players. Consumer Trust and Adoption: Building consumer trust regarding data privacy, security, and the reliability of connected car features remains an ongoing effort. Infrastructure Gaps: Uneven development of supporting digital infrastructure, such as widespread 5G coverage and smart road networks, can limit the full potential of advanced connectivity features in certain regions. For instance, estimated costs for implementing robust cybersecurity measures can add up to 15% of overall connected car development budgets.

Growth Drivers in the Asia-Pacific Connected Cars Industry Market

Several key growth drivers are fueling the expansion of the Asia-Pacific connected cars industry. Technological advancements, notably the widespread adoption of 5G networks, are enabling faster and more reliable data transmission for sophisticated in-car services and vehicle-to-everything (V2X) communication. Government support through smart city initiatives and favorable policies promoting digital transformation in the automotive sector acts as a significant catalyst. Economic prosperity across many Asia-Pacific nations is leading to increased consumer spending power, driving demand for premium connected car features that offer convenience, safety, and entertainment. The rapid growth of the electric vehicle (EV) segment is intrinsically linked, as EVs often come equipped with advanced connectivity for battery management and remote diagnostics, further boosting the overall connected car market. The increasing focus on vehicle safety and the demand for advanced driver-assistance systems (ADAS) are also major contributors to market growth.

Challenges Impacting Asia-Pacific Connected Cars Industry Growth

The Asia-Pacific connected cars industry faces several challenges that could impact its growth trajectory. Regulatory complexities and the need for compliance with diverse data privacy and cybersecurity laws across different countries pose significant hurdles. Persistent global supply chain disruptions, particularly concerning semiconductor shortages, continue to affect the availability and cost of critical components. Intense competitive pressure from both established automakers and emerging technology companies necessitates continuous innovation and strategic partnerships. Consumer concerns regarding data security and privacy, alongside the perceived cost of connected services, can act as a restraint on widespread adoption. The development of a robust and ubiquitous digital infrastructure, including widespread 5G coverage and intelligent transportation systems, is still evolving in certain areas, limiting the full realization of advanced connected car capabilities. Furthermore, the high initial investment required for developing and implementing these sophisticated technologies can be a barrier to entry for smaller market participants.

Key Players Shaping the Asia-Pacific Connected Cars Industry Market

- Hyundai Motor Group

- Mercedes Benz Group AG

- Denso Corporation

- TomTom N V

- NVIDIA Corp

- ZF Friedrichshafen

- Aptiv PLC

- NXP Semiconductors

- Harman International

- Continental AG

- BMW AG

- Robert Bosch GmbH

- SAIC Motor Corporation

- Audi AG

- Volvo AB

- Airbiquity Inc

Significant Asia-Pacific Connected Cars Industry Industry Milestones

- June 2023: Hyundai Motor Group announced its connected car services surpassed 10 million subscribers, driven by international users of Bluelink, Kia Connect, and Genesis Connected Services, with an ambitious target of reaching 20 million subscribers by the end of 2026.

- April 2023: MG Motor India launched its latest electric vehicle, the Comet, at an introductory price of INR 7.98 lakh (USD 9,608), featuring an integrated iSmart system with over 55 connected car features and more than 100 voice commands.

- September 2022: Hyundai Motor Group and KT Corporation established a joint venture to advance next-generation infrastructure and ICT, focusing on 6G autonomous driving technology and satellite-based communication networks for Advanced Air Mobility (AAM).

Future Outlook for Asia-Pacific Connected Cars Industry Market

The future outlook for the Asia-Pacific connected cars industry is exceptionally bright, characterized by sustained innovation and market expansion. Growth catalysts include the accelerating development and deployment of 5G technology, paving the way for enhanced V2X communication and truly autonomous driving capabilities. The increasing integration of artificial intelligence (AI) and machine learning (ML) into vehicle systems will enable hyper-personalized user experiences, predictive maintenance, and sophisticated safety features. Government initiatives promoting smart cities and sustainable mobility will continue to drive the adoption of connected solutions, particularly for public transportation and fleet management. Strategic opportunities lie in the development of new connected car services, such as advanced infotainment streaming, in-car commerce, and integrated mobility platforms. The market potential is vast, with a projected significant increase in the number of connected vehicles and the revenue generated from connected car services, moving towards an era of seamlessly integrated and intelligent transportation.

Asia-Pacific Connected Cars Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology Type

- 2.1. Navigation

- 2.2. Entertainment

- 2.3. Safety

- 2.4. Vehicle Management

- 2.5. Others (Multimedia Streaming etc.)

-

3. Vehicle Connectivity

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Vehicle-to-Everything (V2X)

-

4. End-User Type

- 4.1. Original Equipment Manufacturer (OEM)

- 4.2. Aftermarket/Replacement

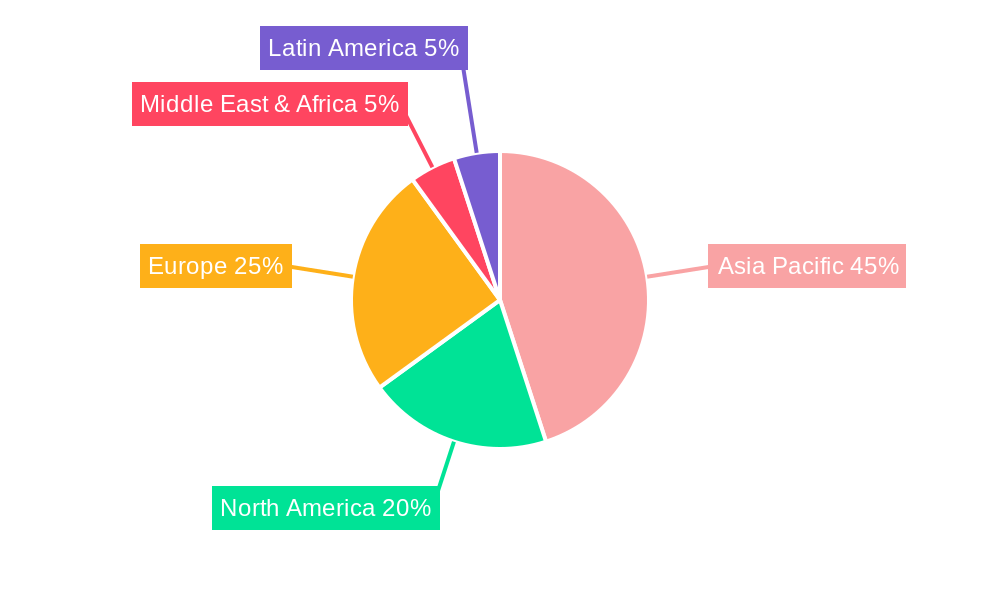

Asia-Pacific Connected Cars Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Connected Cars Industry Regional Market Share

Geographic Coverage of Asia-Pacific Connected Cars Industry

Asia-Pacific Connected Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vehicle Safety and User Convenience

- 3.3. Market Restrains

- 3.3.1. Vulnerability to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Integrated Navigation System to gain significant Traction in the coming years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Navigation

- 5.2.2. Entertainment

- 5.2.3. Safety

- 5.2.4. Vehicle Management

- 5.2.5. Others (Multimedia Streaming etc.)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Connectivity

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Vehicle-to-Everything (V2X)

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Original Equipment Manufacturer (OEM)

- 5.4.2. Aftermarket/Replacement

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hyundai Motor Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mercedes Benz Group AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Denso Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TomTom N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NVIDIA Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZF Friedrichshafen

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aptiv PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NXP Semiconductors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Harman International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Continental AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMW AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Robert Bosch GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SAIC Motor Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Audi AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Volvo AB

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Airbiquity In

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Hyundai Motor Group

List of Figures

- Figure 1: Asia-Pacific Connected Cars Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Connected Cars Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2020 & 2033

- Table 4: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 8: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2020 & 2033

- Table 9: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Connected Cars Industry?

The projected CAGR is approximately 16.76%.

2. Which companies are prominent players in the Asia-Pacific Connected Cars Industry?

Key companies in the market include Hyundai Motor Group, Mercedes Benz Group AG, Denso Corporation, TomTom N V, NVIDIA Corp, ZF Friedrichshafen, Aptiv PLC, NXP Semiconductors, Harman International, Continental AG, BMW AG, Robert Bosch GmbH, SAIC Motor Corporation, Audi AG, Volvo AB, Airbiquity In.

3. What are the main segments of the Asia-Pacific Connected Cars Industry?

The market segments include Vehicle Type, Technology Type, Vehicle Connectivity, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vehicle Safety and User Convenience.

6. What are the notable trends driving market growth?

Integrated Navigation System to gain significant Traction in the coming years.

7. Are there any restraints impacting market growth?

Vulnerability to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

June 2023: Hyundai Motor Group, a multinational automotive manufacturer based out of South Korea, announced that its connected car services reached 10 million subscribers, owing to the growth in overseas subscribers using Bluelink, Kia Connect, and Genesis Connected Services. The company further stated that it expected that its connected car services would reach 20 million subscribers by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Connected Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Connected Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Connected Cars Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Connected Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence