Key Insights

The German used car market, a key component of the European automotive sector, is exhibiting strong expansion. Factors driving this growth include the increasing adoption of electric vehicles (EVs) within a market still primarily comprised of petrol and diesel cars. Economic sentiment, influenced by fuel price volatility, directly affects consumer demand. The proliferation of online sales channels, mirroring global trends, enhances transparency and convenience, posing a challenge to traditional dealerships. This digital shift requires both organized and unorganized vendors to adapt by utilizing technology for operational efficiency and market reach. Intense competition from established entities like AUTO1 Group and mobile.de, alongside new online marketplaces, emphasizes the critical need for strategic pricing and inventory optimization. A wide range of vehicle body types, from hatchbacks to SUVs, caters to diverse consumer needs, further segmenting the market. Governmental emissions and vehicle standards also significantly influence the demand for specific vehicle types.

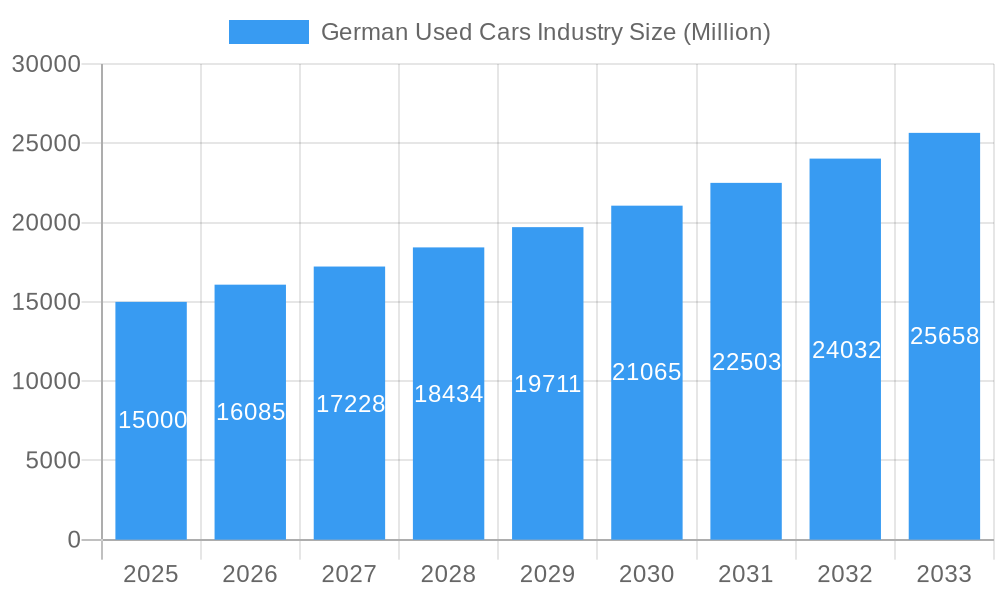

German Used Cars Industry Market Size (In Billion)

The German used car market is projected for significant growth, driven by an expanding vehicle fleet and a growing preference for pre-owned vehicles among cost-conscious consumers. The market is expected to reach $725.3 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 4.6% from 2025 to 2033. Key drivers include ongoing fleet expansion and increasing consumer inclination towards budget-friendly pre-owned options. However, potential economic downturns and rapid technological advancements present ongoing challenges. To capitalize on this evolving landscape, market participants must adapt to shifting consumer preferences, invest in innovative technologies, and strengthen their online presence to secure a larger share of the digital market. Germany's prominent position within the European automotive market offers substantial opportunities, but also exposes it to potential market volatility.

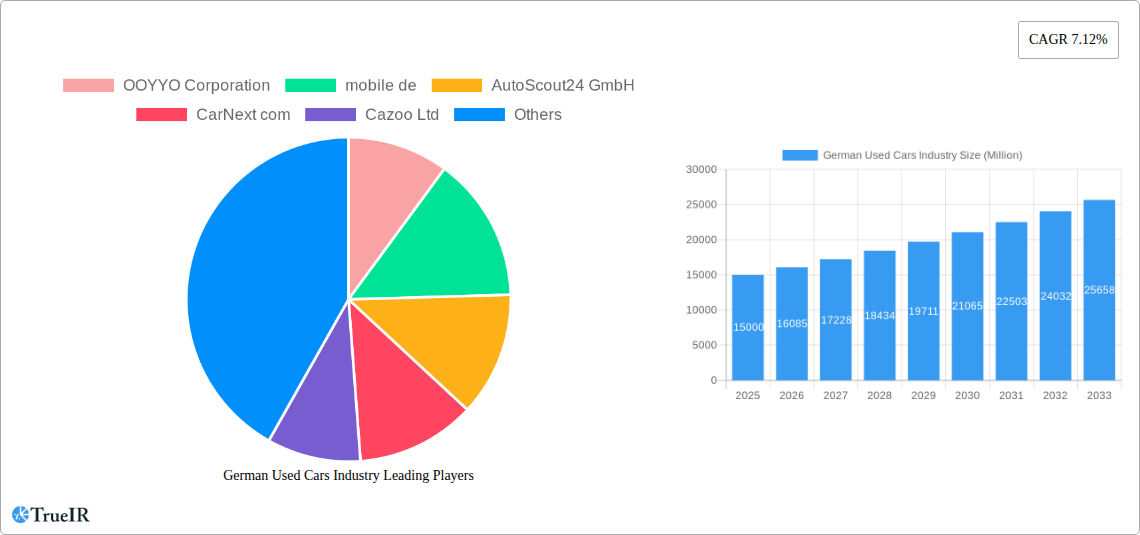

German Used Cars Industry Company Market Share

German Used Cars Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the German used car market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a focus on market trends, competitive dynamics, and future growth potential, this study covers the period from 2019 to 2033, utilizing data from 2019-2024 (historical period), with the base and estimated year set at 2025 and a forecast period spanning 2025-2033. The report analyzes a market valued at €xx Million in 2025, projected to reach €xx Million by 2033, showcasing significant growth opportunities.

German Used Cars Industry Market Structure & Competitive Landscape

The German used car market exhibits a complex structure with a mix of organized and unorganized players. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. Key players like AUTO1 Group, mobile.de, and AutoScout24 GmbH dominate the online segment. However, numerous smaller, independent dealers contribute significantly to the overall market volume.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements such as online platforms, AI-powered valuation tools, and improved vehicle inspection technologies are key innovation drivers.

- Regulatory Impacts: Emissions regulations (e.g., Euro standards) and data privacy laws significantly influence market dynamics.

- Product Substitutes: The rise of car-sharing services and public transportation presents some level of substitution for used car purchases.

- End-User Segmentation: The market caters to diverse segments, including private buyers, businesses, and fleet operators, each with unique needs and purchasing behaviors.

- M&A Trends: The past five years have witnessed a moderate level of M&A activity, with xx major transactions reported, driven by consolidation efforts among online marketplaces and larger dealerships. This trend is projected to continue, further shaping the competitive landscape.

German Used Cars Industry Market Trends & Opportunities

The German used car market is characterized by consistent growth, driven by several factors. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological shifts, such as the increasing adoption of online sales platforms and digital inspection tools, are transforming the customer experience and boosting market efficiency.

Consumer preferences are shifting towards specific vehicle types, with a growing demand for SUVs and MPVs, while the preference for fuel types is evolving, with increasing adoption of electric and hybrid vehicles. The competitive landscape is dynamic, with established players focusing on enhancing their online presence and improving service offerings, while new entrants utilize innovative technologies and business models. Market penetration of online sales channels is growing steadily, exceeding xx% in 2025, demonstrating the increasing preference for digital purchasing.

Dominant Markets & Segments in German Used Cars Industry

The German used car market shows strong performance across the country, with no single region significantly outperforming others. However, certain segments demonstrate higher growth rates.

- Vendor Type: Organized vendors, such as large dealerships and online marketplaces, are experiencing faster growth due to their efficiency and reach.

- Fuel Type: Petrol remains the dominant fuel type, though diesel's share is declining steadily, while electric vehicles (EVs) are showing significant growth, with an xx% market share by 2025.

- Body Type: SUVs and MPVs are exhibiting robust growth due to increasing family size and consumer preference for higher seating capacity.

- Sales Channel: Online sales channels show rapid growth, driven by convenience and accessibility.

Key Growth Drivers:

- Expanding online marketplaces and improved digital infrastructure.

- Increasing consumer preference for used vehicles due to affordability.

- Government initiatives promoting sustainable transportation.

German Used Cars Industry Product Analysis

The German used car market displays a wide range of vehicle types and models, reflecting evolving consumer preferences. Technological advancements, such as advanced driver-assistance systems (ADAS) and connected car features, are becoming increasingly prominent in used car offerings. Competition is fierce, with players differentiating themselves through quality assurance programs, extended warranties, and financing options. The integration of data analytics to improve pricing strategies and customer targeting is also gaining traction.

Key Drivers, Barriers & Challenges in German Used Cars Industry

Key Drivers: Rising demand for affordable vehicles, technological advancements enabling seamless online transactions, and government incentives for environmentally friendly used cars are key growth drivers.

Challenges: Supply chain disruptions due to global events, stringent emission regulations impacting older vehicles, and intense competition among various vendors create challenges. These factors can lead to price fluctuations and reduced profit margins for some players, affecting market growth rates by xx% in unfavorable years.

Growth Drivers in the German Used Cars Industry Market

Technological advancements, increasing affordability of used vehicles, and government initiatives promoting environmentally friendly options are crucial drivers. The rise of online marketplaces enhances accessibility and transparency, while the growing used EV market adds to the overall demand.

Challenges Impacting German Used Cars Industry Growth

Stringent emission regulations limiting the lifespan of older vehicles, along with supply chain vulnerabilities and economic downturns that can influence consumer spending, pose significant challenges. These factors can impact market growth by reducing sales volume and increasing operational costs.

Key Players Shaping the German Used Cars Industry Market

- OOYYO Corporation

- mobile.de

- AutoScout24 GmbH

- CarNext.com

- Cazoo Ltd

- Driverama Germany GmbH

- 12Gebrauchtwagen.de

- Cinch Cars Limited

- pkw.de Autobörse GmbH

- AUTO1.com GmbH

Significant German Used Cars Industry Industry Milestones

- February 2022: Driverama Germany GmbH launched its online used car sales platform, expanding its services beyond car buying. This significantly increased competition in the online used car market.

Future Outlook for German Used Cars Industry Market

The German used car market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing importance of sustainable mobility. Opportunities exist in expanding online platforms, offering innovative financing options, and catering to the growing demand for EVs and hybrid vehicles. The market is expected to experience steady growth, driven by robust consumer demand and the ongoing digital transformation of the industry.

German Used Cars Industry Segmentation

-

1. Vendor Type

- 1.1. Organized

- 1.2. Unorganized

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Electric

- 2.4. Others

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. SUVs and MPVs

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

German Used Cars Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

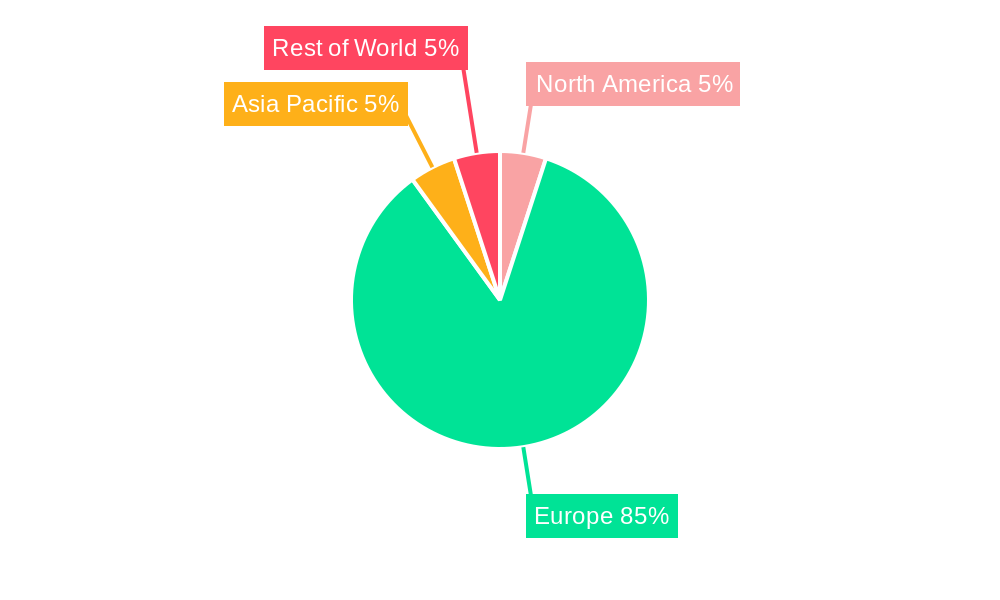

German Used Cars Industry Regional Market Share

Geographic Coverage of German Used Cars Industry

German Used Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Gasoline and Diesel Vehicle are Expected to Hold the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 5.1.1. Organized

- 5.1.2. Unorganized

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. SUVs and MPVs

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6. North America German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6.1.1. Organized

- 6.1.2. Unorganized

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Petrol

- 6.2.2. Diesel

- 6.2.3. Electric

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Body Type

- 6.3.1. Hatchback

- 6.3.2. Sedan

- 6.3.3. SUVs and MPVs

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. Online

- 6.4.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Vendor Type

- 7. South America German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vendor Type

- 7.1.1. Organized

- 7.1.2. Unorganized

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Petrol

- 7.2.2. Diesel

- 7.2.3. Electric

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Body Type

- 7.3.1. Hatchback

- 7.3.2. Sedan

- 7.3.3. SUVs and MPVs

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. Online

- 7.4.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Vendor Type

- 8. Europe German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vendor Type

- 8.1.1. Organized

- 8.1.2. Unorganized

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Petrol

- 8.2.2. Diesel

- 8.2.3. Electric

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Body Type

- 8.3.1. Hatchback

- 8.3.2. Sedan

- 8.3.3. SUVs and MPVs

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. Online

- 8.4.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Vendor Type

- 9. Middle East & Africa German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vendor Type

- 9.1.1. Organized

- 9.1.2. Unorganized

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Petrol

- 9.2.2. Diesel

- 9.2.3. Electric

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Body Type

- 9.3.1. Hatchback

- 9.3.2. Sedan

- 9.3.3. SUVs and MPVs

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. Online

- 9.4.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Vendor Type

- 10. Asia Pacific German Used Cars Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vendor Type

- 10.1.1. Organized

- 10.1.2. Unorganized

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Petrol

- 10.2.2. Diesel

- 10.2.3. Electric

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Body Type

- 10.3.1. Hatchback

- 10.3.2. Sedan

- 10.3.3. SUVs and MPVs

- 10.4. Market Analysis, Insights and Forecast - by Sales Channel

- 10.4.1. Online

- 10.4.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Vendor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 OOYYO Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 mobile de

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AutoScout24 GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CarNext com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cazoo Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Driverama Germany GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 12Gebrauchtwagen de

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cinch Cars Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 pkw de Autoborse Gmb

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AUTO1 com GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OOYYO Corporation

List of Figures

- Figure 1: Global German Used Cars Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America German Used Cars Industry Revenue (billion), by Vendor Type 2025 & 2033

- Figure 3: North America German Used Cars Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 4: North America German Used Cars Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 5: North America German Used Cars Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America German Used Cars Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 7: North America German Used Cars Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 8: North America German Used Cars Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 9: North America German Used Cars Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 10: North America German Used Cars Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America German Used Cars Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America German Used Cars Industry Revenue (billion), by Vendor Type 2025 & 2033

- Figure 13: South America German Used Cars Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 14: South America German Used Cars Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 15: South America German Used Cars Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: South America German Used Cars Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 17: South America German Used Cars Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 18: South America German Used Cars Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 19: South America German Used Cars Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 20: South America German Used Cars Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: South America German Used Cars Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe German Used Cars Industry Revenue (billion), by Vendor Type 2025 & 2033

- Figure 23: Europe German Used Cars Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 24: Europe German Used Cars Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 25: Europe German Used Cars Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 26: Europe German Used Cars Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 27: Europe German Used Cars Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 28: Europe German Used Cars Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 29: Europe German Used Cars Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Europe German Used Cars Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe German Used Cars Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa German Used Cars Industry Revenue (billion), by Vendor Type 2025 & 2033

- Figure 33: Middle East & Africa German Used Cars Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 34: Middle East & Africa German Used Cars Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 35: Middle East & Africa German Used Cars Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 36: Middle East & Africa German Used Cars Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 37: Middle East & Africa German Used Cars Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 38: Middle East & Africa German Used Cars Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 39: Middle East & Africa German Used Cars Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 40: Middle East & Africa German Used Cars Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa German Used Cars Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific German Used Cars Industry Revenue (billion), by Vendor Type 2025 & 2033

- Figure 43: Asia Pacific German Used Cars Industry Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 44: Asia Pacific German Used Cars Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 45: Asia Pacific German Used Cars Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 46: Asia Pacific German Used Cars Industry Revenue (billion), by Body Type 2025 & 2033

- Figure 47: Asia Pacific German Used Cars Industry Revenue Share (%), by Body Type 2025 & 2033

- Figure 48: Asia Pacific German Used Cars Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 49: Asia Pacific German Used Cars Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 50: Asia Pacific German Used Cars Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific German Used Cars Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 2: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 4: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 5: Global German Used Cars Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 7: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 9: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 10: Global German Used Cars Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 15: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 16: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 17: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 18: Global German Used Cars Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 23: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 24: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 25: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 26: Global German Used Cars Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 37: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 38: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 39: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 40: Global German Used Cars Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global German Used Cars Industry Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 48: Global German Used Cars Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 49: Global German Used Cars Industry Revenue billion Forecast, by Body Type 2020 & 2033

- Table 50: Global German Used Cars Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 51: Global German Used Cars Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific German Used Cars Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the German Used Cars Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the German Used Cars Industry?

Key companies in the market include OOYYO Corporation, mobile de, AutoScout24 GmbH, CarNext com, Cazoo Ltd, Driverama Germany GmbH, 12Gebrauchtwagen de, Cinch Cars Limited, pkw de Autoborse Gmb, AUTO1 com GmbH.

3. What are the main segments of the German Used Cars Industry?

The market segments include Vendor Type, Fuel Type, Body Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 725.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Gasoline and Diesel Vehicle are Expected to Hold the Significant Market Share.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In February 2022, Driverama Germany GmbH began selling used cars online in Germany a year after launching a car buying service in the country. Driverama's new service allows buyers to compare popular models, makes, prices, and financing options across more than 1,000 fully inspected cars with an average age of four years. Each vehicle comes with a full-service history, an ownership report, and a professional clean.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "German Used Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the German Used Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the German Used Cars Industry?

To stay informed about further developments, trends, and reports in the German Used Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence